In Part I we placed a spotlight upon the NASDAQ Index, whose performance has been outstripping the S&P 500 and Dow Jones Industrial Indices for at least 3.5 months, and has been leaving the RUT Index (Russell 2000) far behind (and in its “dust”).

We also provided (in narrative and graph format) a brief history of the NASDAQ – an index that still has not yet fully recovered from the traumatizing devastation of the “Dot.com Bubble” between 1998-2000!

Given the fact that the mainline media (and public) places much more attention on the S&P 500 Index and the Dow (and perhaps even upon the Emerging Market Index (iShares MSCI Emerging Markets ETF (EEM) – which commands 40% more daily trading volume than the QQQ), I thought you might benefit from learning more about NASDAQ-related investment options.

We have already covered, in some detail, the basics of NASDAQ, as well as the most important facts and metrics related to the PowerShares QQQ ETF (QQQ). We also identified QQQ’s leveraged cousins:

BULLISH:

QLD ProShares Ultra QQQ (ETF) [2X Bullish]

TQQQ ProShares UltraPro QQQ (ETF) [3X Bullish]

BEARISH:

QID ProShares UltraShort QQQ [2X Bearish]

SQQQ ProShares UltraPro Short QQQ [3X Bearish]

We provided you with a 14-year chart of price action (S&P 500 Index vs NASDAQ), as well as more recent performance metrics that have established the NASDAQ Index as the U.S. Equity Asset Class that has been trending most strongly – with QQQ, QLD, and TQQQ demonstrating among the strongest ETF performances during the past 90 days!

You’ll recall that I provided you with a price chart from March 2000 through the third week of this month (August) – showing that since its all time high in 2000, the NASDAQ has only managed to crawl back up to 20% below “break even”. Meanwhile, the S&P is up over 25% since March of 2000!

However, take a look at this chart:

Isn’t this chart fascinating? If you had bought the NASDAQ in March of 1999 and still held it today, you would be up by 100% (not much of a return over 15 years… but a complete contrast to the 14 year chart!). Since 1999 (excluding dividends) the NASDAQ has doubled the performance of the S&P!! Let me hasten to add that you would have had to be a “Rip Van Winkle” investor to have held the NASDAQ through both the Dot.com Crash and the later “Financial Crisis”… but this graph does add another dimension to just how out of control the “Dot.com” era was within the investing world!

After providing all this information on the NASDAQ Index, the QQQ, and its leveraged cousins, I must confess that I sank to a new low. I actually offered a “teaser” intended to motivate our readers to look for Part II of this two-part series.[1] That teaser was the fact that another high-flying ETF during the past 90 days has been:

QQXT FirstTrust NASDAQ Ex-Technology Sector Index Fund

Since the NASDAQ itself is very tech-centric, it seems unusual that an “Ex-Technology” variation on the NASDAQ could be a top performer… until, that is, you are “let in” on the “secret sauce” of QQXT—

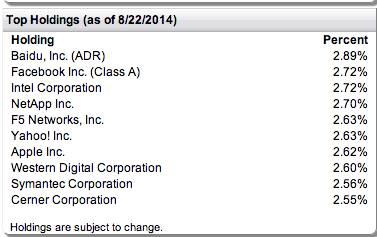

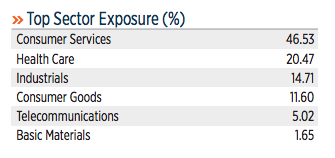

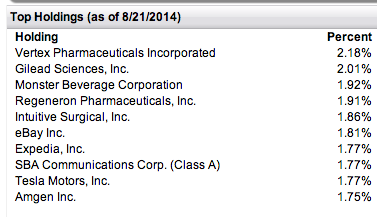

1) Take a look at the “Top Holdings” of QQXT, keeping in mind that (after a down draft earlier this year) HealthCare and Biotech stocks have been “hot”:

2) In particular, a number of Biotech issues are among the “Top Holdings”:

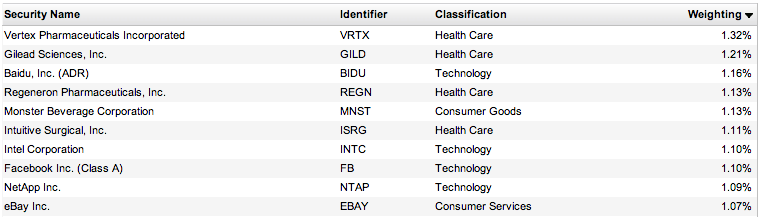

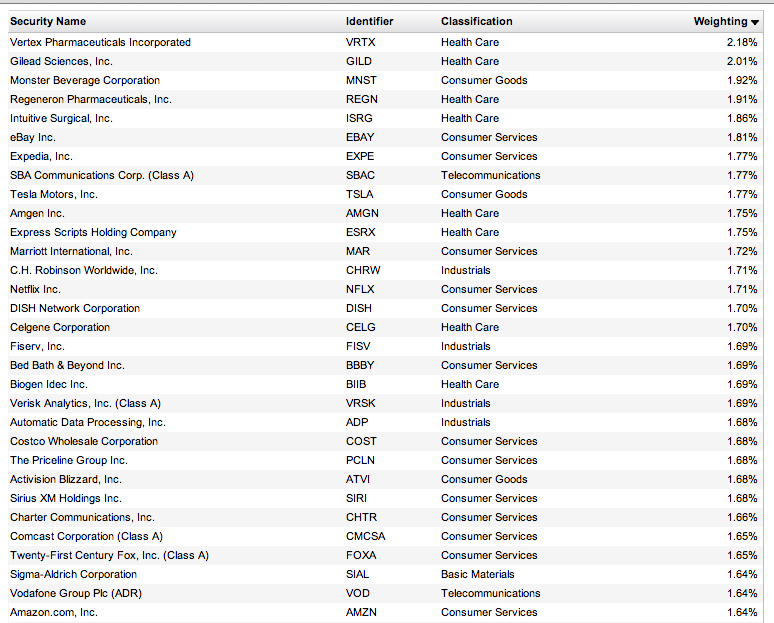

3) Like it or not, the definition of “Ex Tech” for QQXT does not exclude “Internet Stocks” from inclusion within the ETF! Therefore, the actual composition of QQXT is at least a bit different than what you might otherwise have expected from its name!

It would not be unfair for you to have considered such stocks as these within the “Technology” category:

Amazon (AMZN), Priceline (PCLN), Automatic Data Processing (ADP), Fiserv (FISV), Netflix (NFLX), Expedia (EXPE), eBAY (EBAY), and Tesla (TSLA).

However, each one of them is included within QQXT!

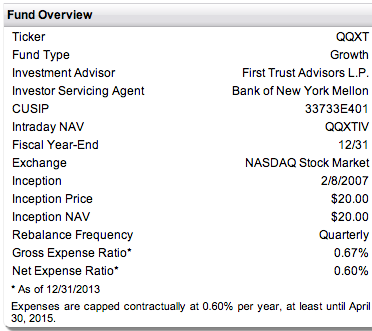

Here are some other germane facts about QQXT:

1) Currently there are 63 holdings;

2) It is an equal-weighted index (unlike the QQQ, which uses a modified market cap weighting methodology);

3) QQXT’s weight in “Consumer Discretionary” stocks (46.35%) is about twice the weighting of that category within QQQ itself!

a) However, TSLA, EBAY, EXPE, NFLX, PCLN (for example) are all included in the “Consumer” category for QQXT!!

4) Here are some key points tied to the ETF:

Just as there is symmetry within the everyday world, there is symmetry with ETFs as well! To balance the existence of QQXT, we also have:

QTEC First Trust NASDAQ 100 Technology Sector Index Fund

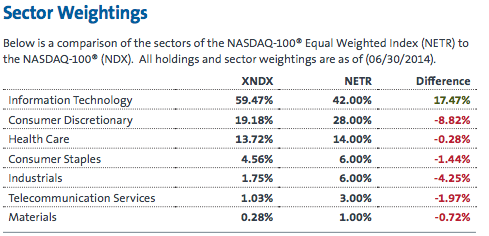

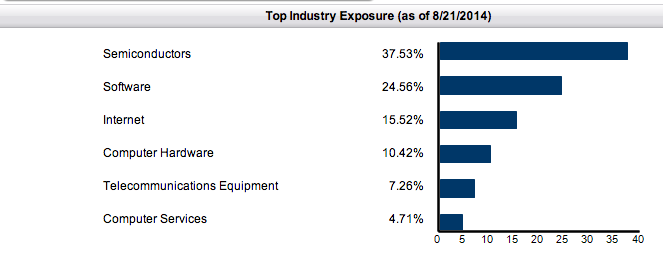

If you evaluate ETFs by name only, this would seem to be the “opposite” of QQXT. But of course, overly simplistic analysis within the investment sphere rarely pays dividends. This is a sector-weighted split out of QTEC:

The top holdings within QTEC include:

Unlike QQQ, but exactly as with QQXT, QTEC is an equal-weighted ETF (the differences in the allocations above are strictly the result of price movement since the most recent quarterly rebalancing! QTEC currently carries just 41 holdings!

Unlike QQQ, but exactly as with QQXT, QTEC is an equal-weighted ETF (the differences in the allocations above are strictly the result of price movement since the most recent quarterly rebalancing! QTEC currently carries just 41 holdings!

How do you suppose these two differently “sliced and diced” ETFs have performed this year?

The QQQ is up Year to Date (YTD) by about 12.5%. But the more concentrated (and equal-weighted) QTEC is up over 15%! Meanwhile, QQXT has trailed them both – appreciating just over 7%! If I now showed you a series of graphs with the price action of all three ETFs over different periods of time, it would inevitably show either QQXT or QTEC out performing the other. However, as far as I can see, there is no dependable way of knowing which ETF will outperform the other – short of suddenly becoming either prescient or omniscient. So your choice between the two will need to depend upon your personal choices regarding the industry weightings within each one!

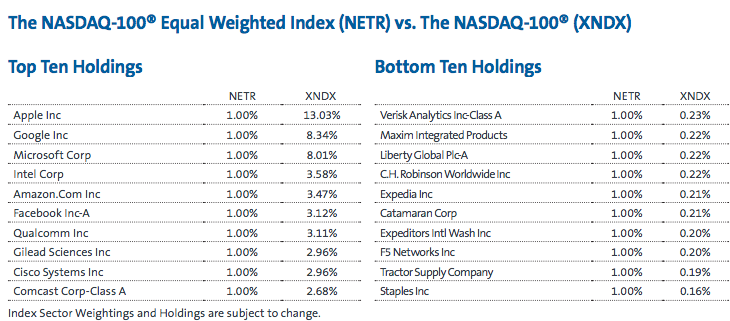

But these ETFs are not all! You’ll recall from our Smart Beta articles that a popular option within that emerging category of indexed ETF is the “Equal Weighted ETF”. As we told you earlier, QQQ is constructed on the basis of a modified capitalization weighting. So ETF providers decided to create alternative ETFs that invest within NASDAQ-100 stocks – but are not weighted by market cap! There are currently two such equal-weighted ETF choices:

QQEW First Trust Nasdaq-100 Equal Weighted Index Fund

QQQE Direxion Nasdaq-100 Equal Weighted Index Shares ETF

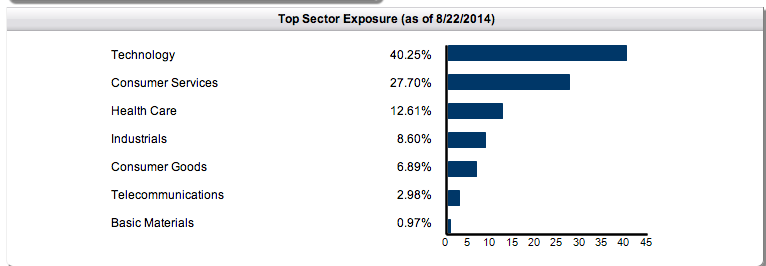

Here are the sector weightings for QQEW:

And here are the top holdings (note that there is nothing startling here… except that the top few stocks have obviously outperformed since the most recent rebalancing):

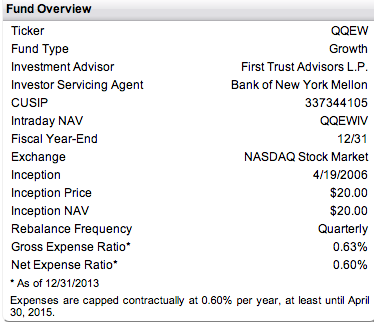

And here are some other basic metrics for QQEW (note the 0.60% Expense Ratio):

And here are some other basic metrics for QQEW (note the 0.60% Expense Ratio):

Moving on to the Direxion ETF (QQQE), note that its website quite helpfully provides both the ETF’s weightings and holdings as well as the comparable metrics from QQQ!

You should note that QQQE has an expense ratio that is 25 basis pointslower than that of QQEW.

You should note that QQQE has an expense ratio that is 25 basis pointslower than that of QQEW.

It is worth pointing out that one of the main virtues of an “Equal Weighted Index” is that it helps avoid the often temporary and disruptive impact of a stock that goes on a run and then collapses[2] – thereby helping to smooth out returns and lower the standard deviation (volatility).[3]

Here are two interesting graphs. The first one shows the equal weighted indices vs QQQ on a YTD basis. QQQ has outperformed by about 2%, but it has not consistently outperformed throughout that period.

The second graph shows two years of prices, with the equal-weighted ETFs outperforming by about 10%.

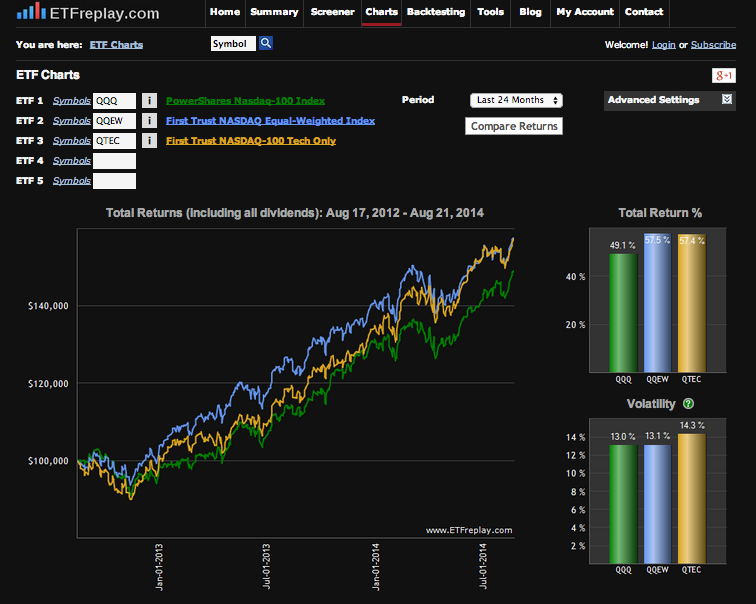

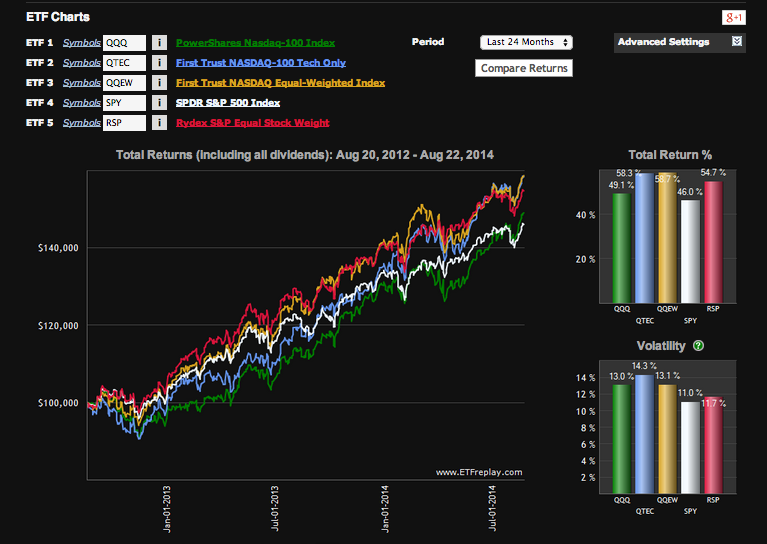

One of the more interesting ETF resources I have discovered can be found at http://www.etfreplay.com/charts.aspx. This site allows you to compare ETFs over various time periods with regard to: 1) Return; and 2) Volatility.

This site provides you with those two metrics for each ETF, from which you can develop at least a rudimentary sense of which ETF offers a risk-adjusted return which will more closely align with your own investment needs and risk tolerance.

For example, this chart compares QQQ with QQEW and QTEC over the past two years:

Over that time period, QTEC provided a return of 58.3% versus the return of QQQ itself at just 49.1%. However, the volatility of QTEC came in at 14.3% vs. the volatility of QQQ at just 13.0%.

With that being said, take a look at the equal-weighted alternative – QQEW! It outperformed both of the other ETFs, with a volatility that was just 1 basis point higher than QQQ… but much lower than the volatility of QTEC![4]

Now here is a fascinating graph comparing the following ETFs over the prior 24 month period:

QQQ

QTEC

QQEW

SPY SPDR S&P 500 Index ETF

RSP Rydex S&P Equal Stock Weight ETF

The top performer over this period has been QQEW, as follows:

QQEW 58.7%

QTEC 58.3%

RSP 54.7%

QQQ 49.1%

SPY 46.0%

Do those metrics surprise any of you? Is that the order of performance you would have guessed if this had been a quiz question?

Here are the Volatility figures (lowest to highest):

SPY 11.0%

RSP 11.7%

QQQ 13.0%

QQEW 13.1%

QTEC 14.3%

I am sure that each one of us would interpret these figures differently, but I find these results of great interest. In fact, those results have caused me to slightly reshape my opinion about these particular ETFs!

Before I close, I need to add that there has been one more NASDAQ investment option of particular interest (at least to investors such as me). It is a “Closed End Fund” instead of an ETF – but it acts much more like an ETF than a mutual fund, so I consider it appropriate to add to this article. It is the

NASDAQ Premium Income & Growth Fund Inc. (QQQX)

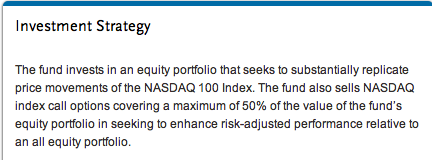

The fund’s investment strategy incorporates the sale of NASDAQ index call options on up to 50% of the value of the fund’s equity portfolio (see below):

A side benefit of that strategy has been a managed distribution currently amounting to a 7% annualized payout from QQQX (quarterly payments). As you would expect with a fund that sells call options, the return from QQQX has not been as eye-catching as QQQ or its “cousins”; however, the options strategy does smooth out volatility and provide some quarterly income!

You may have noticed that I used a “past tense” within my references to QQQX. The reason for that is the announcement by the investment provider (Nuveen Investments) of a restructuring within their Closed-End Funds. You can find the details at http://www.nuveen.com/Home/Documents/Viewer.aspx?fileId=62591

According to the information provided, the existing QQQX will be combined with one other “overwrite” fund to create the “NASDAQ 100 Dynamic Overwrite Fund”.

These changes are expected to take place on or around the period between September 20 and September 30, 2014. Therefore, given the “unknowns” involved, I will personally sell my existing position in QQQX and wait for a few months to reassess the new version of this “overwrite” concept! Obviously, you are free to do as you choose; but I suggest you use caution with regard to QQQX as well!

INVESTOR TAKEAWAY:

I hope you have found this review of the NASDAQ Index from pre-“Dot.com Bubble” to the present to be interesting and informative. Perhaps you have gleaned a new investing idea or two along the way!

There is no doubt that we have a wide range of investing choices if we find the NASDAQ Index of particular interest. Let’s briefly review them before we close

QQQ PowerShares QQQ ETF

QLD ProShares Ultra QQQ (ETF) (Double Bullish ETF)

TQQQ ProShares UltraPro QQQ (ETF) (Triple Bullish ETF)

QID ProShares UltraShort QQQ (Double Inverse ETF)

SQQQ ProShares UltraPro Short QQQ (Triple Inverse ETF)

QTEC First Trust NASDAQ 100 Technology Sector Index Fund

QQXT FirstTrust NASDAQ Ex-Technology Sector Index Fund

QQEW First Trust Nasdaq-100 Equal Weighted Index Fund

QQQE Direxion Nasdaq-100 Equal Weighted Index Shares ETF

It is up to you to discern which one of these options might fit within your particular parameters of risk and return. However, I hope you found that the background information provided above, including the metrics regarding relative Return and Volatility, has provided you with some new insights and perspective.

As for me personally, I think I will shy away from QTEC and QQXT because I have not yet come anywhere close to being prescient with regard to the near-term relative performance of the stocks within each of those “sliced/diced” versions of QQQ.

That said, I am quite intrigued by QQQE because of its slightly lower expense ratio (relative to QQEW) and its risk-adjusted return metrics!

Good luck to you in your investing!

DISCLOSURE: The author does own QQQX and has traded QQQin the past. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] Why do I say I “sank to a new low”? Because I had when the news reporters on TV and radio keep promising you that a “report” you are anxious to hear about will be “next”… but after the following commercial break, they still don’t get to it!!

[2] If ever there was a case for the discipline of an “Equal Weighted Index” … the “Dot.com Bubble” certainly would be a convincing one!

[3] It also helps both promote and maintain the discipline of diversification!

[4] To be fair, if you compare the same ETFs over a 12 month period, relative volatility metrics are parallel, but the return metrics are: QTEC 34.1%; QQQ 32.1%; QQEW 27.5%.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Discover Financial Services: A Stock to Watch Post-Capital One Merger?

Discover Financial Services: A Stock to Watch Post-Capital One Merger?