"Asimo" the Robot is real... but there is no such thing as "ROBO the Financial Advisor"! Instead, we are seeing a variety of "Digital Investment Managers" and "Digital Wealth Managers" emerging within the financial advisor space.

For those who enjoy discovering (or learning about) key turning points in economics, business, industry, medicine, social connectivity, politics, etc., there is no doubt that we live an era of abundant, accelerating change. Let me try to illustrate:

During my own lifetime, we have experienced all of these transitions (and more) within the “Home Entertainment” industry:

During the 1930's and World War II, President F.D. Roosevelt demonstrated mastery of the only direct access he had to U.S. voters: national network radio. FDR's "Fireside Chats" are legendary!

Age of Network Radio: Until 1943, there were four major national radio networks: two owned by NBC, one owned by CBS and one owned by Mutual Broadcasting System.[1]

The "Golden Age" of network radio included dramatic and comedic programs such as "The Life of Riley" (William Bendix portrayed Riley). Many of the old radio shows were carried over into TV!

National Network Radio also highlighted great singing artists, such as Frank Sinatra (who also appeared in on the air dramas).

Age of Network Television: After 1950, the new technology of black-and-white television became increasingly affordable, leading to rapid penetration of TV sets within homes across the U.S. I remember five channels (three national networks, one local network (WGN), and a PBS network. [Reminder to anyone younger than the “Baby Boomer” era, no such thing as a “remote control” existed, screen size was very small, and screen resolution was (relative to today) appalling.

Color Television: Although the very first national TV broadcast in color occurred on January 1, 1954 (Rose Bowl Parade), because of the high expense of color TV tubes and paucity of color TV programing, color television did not “take off until the early 1960’s. To that very point, the first color broadcast of a national college football game did not occur until the January 1, 1962 Rose Bowl.[2] In fact, it wasn’t until the autumn of three years later (1965) that over half of national prime-time TV shows were broadcast in color.

Here is a sample of the "original" TV recording technology -- Betamax (Beta). It all too soon became out-marketed by VHS technology.

TV Recording Technology: Betamax (aka “Beta”) technology was introduced in May of 1975 by Sony). Its competitor (VHS) was introduced almost 1.5 years later (by JVC). Although many considered Beta a superior technology, VHS soon dominated the market… to the point that Beta (over time) died out.

Cable/Satellite TV: Although the first cable system emerged in the 1940’s and the first commercial cable television system was started in 1950, the rapid rise of free broadcast television dampened interest in developing cable TV on a widespread basis. The primary use for cable was to deliver existing over-the-commercial TV programming to remote areas of the country. That changed in late 1972 when the Home Box Office (HBO) was launched – the first American premium cable/satellite TV network.[3]

Ted Turner revolutionized TV network news. If you think we have too much "news" on TV these days (ie. 24/7), you might even blame Turner for it!

Cable News TV: 1976 became another transformational moment when the colorful and outspoken Ted Turner launched the first “basic” cable network via satellite. That network evolved into the first national 24/7-news channel that (for better or worse) revolutionized TV news reporting and delivery.

High Definition TV (aka HDTV): HDTV was introduced in the U.S. during 1998. As the commercial cost of HD slid downward, the technology spread. By January of 2013, Nielsen Media Research reported that 75% of U.S. homes included at least one television with HD technology.[4]

Digital Streaming Video: From the 1990’s into the first decade of this century, advances in digital streaming accelerated – with more contributions along the way than I could absorb.[5] As our readers know, there is a plethora of providers enabling consumers to access streaming video through a computer, tablet, or smartphone (as well as TV). But the best-known provider most commonly associated with “TV” is Netflix – who pioneered in this space by producing its own first-run programming two years ago and won an Emmy for “House of Cards”.[6]

”]

Note the accelerating pace of transformative change above! And this covers change in just one field – there are similar patterns throughout the full spectrum of industry, technology, and society.

Just as the old world of investing (a very wirehouse-centric, open outcry system[7] … with buying/selling of securities in increments of 1/8ths of a dollar and large bid/ask spreads) … has been transformed into a “decimal system” (with spreads as low as “penny wide”) that can be accessed through a widely differentiated spectrum of brokers (full service to discount to deep discount) and/or a plethora of online trading platforms[8] (accessible from computer, tablet, or smartphone)… so too has the world of professional financial services been transformed!

In former days there was a range of financial advisors – stock brokers, insurance agents, real estate brokers, bankers, accountants, lawyers – each of whom would provide clients with professional expertise regarding a portion of their financial needs. There were also professionals who represented themselves as “generalists” – financial advisers or planners able to help with a several separate financial needs of a client (either alone or through a team). As a general rule, while lawyers and accountants charged by the hour or a specified “fee”, the others were compensated through the commissions generated when a client purchased a stock, option, annuity, insurance policy, house or property, etc.

Think for a moment about a commission-based system for the delivery of financial advice. I don’t want you to think about any particular company, broker, or advisor – just consider the concept abstractly, being as objective as you can! What is the greatest vulnerability of the commission-based system?

Well, back in the early 1980’s, a group of financial professionals decided they were tired of working within that (existing) vulnerable[9] system. Those financial planners met in Atlanta in 1982, without full clarity about the direction in which their common concerns should lead them. However, they did know that accepting a commission for the sale of financial products to clients bore the risk of putting the planner in direct conflict with the interest of their client[10]. Because planner compensation varied by the quantity of “products” sold to a client, how could the planner (much less the client) be sure that the quality of financial advice was not impacted by the lure of commission income?

At that initial gathering in 1982, these professional financial planners[11] exchanged ideas regarding how to provide top quality financial planning guidance that would best serve the long-term interest of clients. They strategized ways to ensure access to a wide range of investment and insurance products through which to provide for client needs … but without the complications of a commission-based compensation structure.

NAPFA was the creation of financial advisors who wanted to ensure that all financial advice springs purely from the best interests of the CLIENT!

By February of 1983, a few of those planners distributed a general invitation to planners across the nation … seeking those interested in creating a “Fee-Only” financial practice to join them in Atlanta. Over 125 professionals attended that meeting, giving birth to the National Association of Personal Financial Advisors (NAPFA).

To the average person, 125 professionals meeting in Atlanta to form a national group of “fee-only” financial advisor is hardly earthshaking. It certainly doesn’t carry the snappy cache or attention-getting appeal of the current “Robo-Advisor” craze. However, in the face of wide spread criticism (often vitriolic criticism at that), ridicule, and opposition, those 125 pioneered a professional (and regulatory) debate regarding the most appropriate way for financial professionals to be compensated.

The emergence of NAPFA occurred within a broader context of investor awareness of the cost efficiencies of “No-Load” mutual funds.[12] However, fund companies wanted to maintain multiple distribution channels (ie. promoted/purchased through advisers, offered as an option within employer-sponsored defined contribution plans (eg. a 401(k)), as well as purchased by investors (on their own) through direct marketing). Two of those channels depended upon a financial incentive to ensure strong, steady sales… so “No-Load” providers received approval (in 1980) from the U.S. Securities and Exchange Commission to assess a “12b-1 Fee”[13] on its funds. 12b-1 fees are used for a variety of purposes by fund companies – including the payment of a small (but annually recurring) commission to the financial adviser selling the fund, covering the cost of shareholder servicing, and/or paying for marketing material.[14]

It is worth noting that these changes (thus far) were not driven by technology… but by changes in investor preference, industry trends, and governmental regulation. You may find it especially interesting that the SEC[15] authorized and enabled fund companies to advertise a fund as “No Load” even though it assesses (12b-1 fee) an annual charge (over and above a typical administrative expense) each year an investor holds it. Yes, it is a very small “load”, but it is an annual cost to shareholders.[16]

One particularly interesting development that has ensued from the SEC’s 12b-1 rule is the evolution of “fund supermarkets” – such as those offered by Charles Schwab, Fidelity, TD Ameritrade, etc. Within such “supermarkets”, investors can buy or sell certain designated (“NTF”[17]) funds without paying a transaction fee. Lest anyone think that these “fund supermarket” brokerage houses offers these NTF funds out of sheer altruism, such is not the case! Generally speaking, each such fund sold through a “supermarket” must pay 0.4% of the value of any shares sold to the broker (annually).[18]

Technology started driving major transitions in the industry when computer speed and memory began to grow exponentially and the Internet transformed the ease and cost of investor access to the securities markets. As broker transaction costs shrank and the sophistication and capacity of online trading platforms grew, securities trading across the globe evolved… including:

1) A move away from open outcry exchange trading (such as Chicago Board of Trade(CBOT)) toward electronic trading;

2) Less broker-assisted trading[19];

3) The development and rapid growth of Exchange Traded Funds (ETFs) – a much different instrument than a mutual fund because;

a) It is traded daily on an exchange (usually with a commission) rather than purchased through a fund company;

b) It has no “front load” and no “12b-1 fee”;

c) It can be bought or sold intraday (for more precise control by the investor of the sale price).

The convergence of all of these trends (and others) has motivated (forced) dramatic shifts in the “revenue model” used by brokers, advisers, fund companies, exchanges… virtually the entire financial industry. Describing this evolution (over the past 25-30 years) as a “sea change” is not overstating the pace and range of change.[20]

I need to add one additional development that has significantly impacted how professionals (and informed investors) think about portfolio construction and the optimization of investment return. This development, referred to as “Modern Portfolio Theory” (MPT), evolved between 1950 and 1980 through the work of Harry Markowitz (and many others).[21] In 1990, Dr. Markowitz was honored with the Noble Prize for Economics and his work gained further credibility and attention.

Obviously, the MPT itself did not require the technology we have available today. However, one outgrowth of MPT is data intensive and has blossomed as the sophistication of PC number crunching accelerated during the past 24 years.

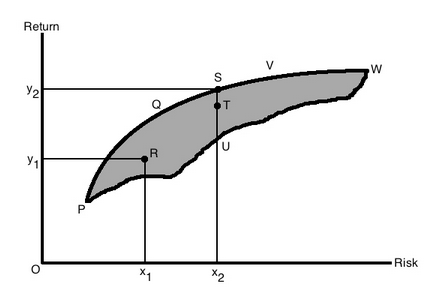

Consider all the possible combinations of asset classes (U.S. large cap stocks, foreign small cap stocks, U.S. corporate bonds, foreign government bonds, real estate, etc.) that one could incorporate within a single portfolio. A graph of the various returns could look like this (assume all of the possible returns fall within the shaded area):

This graph compares investment returns from a large range of potential portfolio asset allocations (in the gray shaded area).

Let’s also assume that, for any given level of risk (horizontal axis) an investor is willing to accept, you want to optimize the return (vertical axis) produced by the portfolio!

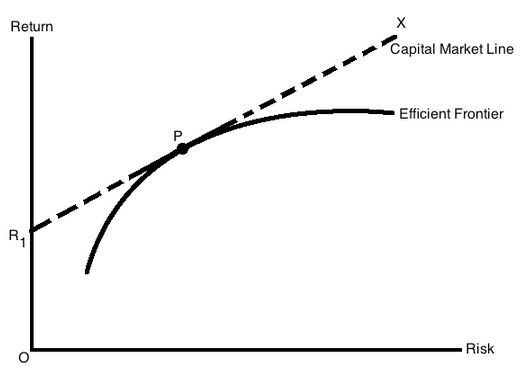

Using the speed and capacity of current computers, it is easy[22] to plot the curve of a range of such optimized portfolios like this:

The curve highlighted in this graph represents the optimized portfolio asset allocation returns for any given level of client investment risk.

The “Efficient Frontier” therefore represents the set of portfolios that are most likely to maximize investment return at any given level of investment risk!

Once again, using the advanced power of computers to crunch mammoth sets of investment data over extended periods of time, studies have established that one’s Asset Allocation (the particular combination of asset classes chosen for any given portfolio) will determine at least 88% of the resulting investment return! Very shortly we will discover how this development has contributed to the emergence of a whole new investment space!

Taking all that we have discussed thus far, let’s consider some of the changes that have been driven within the financial adviser model.

1) In the 1970’s, the commission-only compensation model predominated among both independent and broker-based advisers.

2) Three trends converged in the 1980’s (the SEC 12b-1 Fee in 1980; the emergence of NAPFA in 1983; and the rapid growth in popularity of “No-Load” funds) to motivate the financial adviser world to review/rethink the “commission-only” model.

a) Some moved to a “fee-only” model, while others adopted a hybrid “commission/fee” model.

3) Eventually, one of the most popular models used by brokers and many advisers emerged – called the “Wrap Fee”. That fee is calculated as a specified percentage of AuM.[23] Therefore, the more assets any given adviser aggregates, the greater her/his compensation will be.

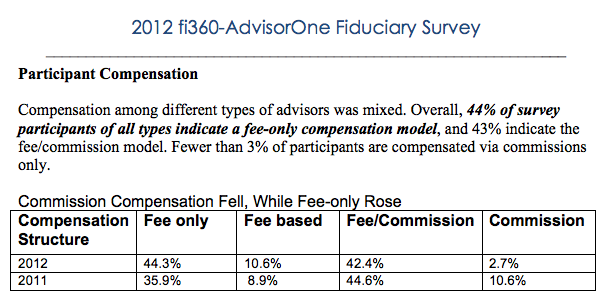

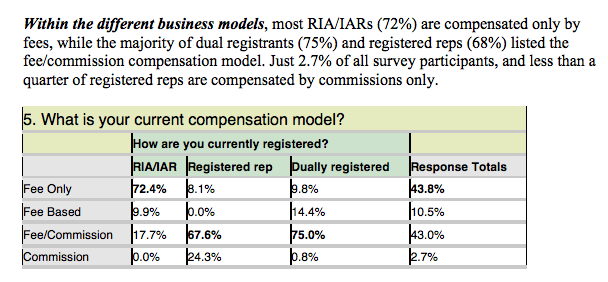

To offer you a picture of the overall change in adviser compensation over these years (remember that before 1980, compensation was virtually “commission-only”), as well as to contrast the difference between the Registered Investment Advisor (RIA)[24] space with the Registered Representative (RR)[25] space, here is a table of compensation models from 2012.

This slide shows the continuing trend away from "commission-based" compensation and toward "fee based" compensation among financial advisors!

This slide indicates that RIA's are primarily "fee-only" advisers, while those who are strictly RR's or are both a RR and RIA are primarily "commission based" financial professionals.

So why did I lead you along this winding journey through time? My point was to give you an overview of why/how the “RoboAdvisor” industry has emerged.

As we’ve seen above, the revenue model of the financial adviser industry has largely been based upon the degree of investment activity of any given client. In fact, even the “fee only model” tends to be based upon a percentage of AuM. This has had several ramifications:

1) Advisers tend to have a “minimum requirement” for new clients – usually at least over $100,000 of invested assets (very frequently much higher, such as $200,000 to $250,000 (or even more for the most sought after advisers!));

2) Advisers focus heavily upon investment management, often providing ancillary advice/services gratis for existing clients.[26]

3) This has resulted in the demographic profile of an average adviser’s client base ranging between a large number of folks over the age of 45 and a much smaller number of folks in their 20’s and 30’s with a high level of investable assets (the Mark Zuckerberg’s of the world).

a) Most members of the Gen Y, Gen X, and Millennial generations do not meet typical adviser minimums;

b) In addition, those younger folks have watched the portfolios of their parents decimated by the “Dot.com” and “Financial Crisis” meltdowns, so they are skeptical regarding the markets (and often of advisers).

c) Even if they do meet an adviser minimum, many are not be highly motivated to work with an adviser who is their parent’s age (or older) – especially if they have to visit an office and handle things the “old-fashioned way” (as opposed to online).

Let me now try to weave for you how several streams of these trends have converged during the past few years:

1) The ability to automate portfolio construction based on any given level of risk and investable assets by combining:

a) The increasingly robust ability of computers to process massive amounts of data in defining an Efficient Frontier.

b) Algorithms that can process investor input (the “financial profile” of each investor client) in combination with that Frontier.

c) Gifted software engineers/programmers who create an intricate system through which any given portfolio can be rebalanced, with cash sweeping and tax loss harvesting, every day the market is open.

2) The availability of such a wide range of ETFs (representing virtually the entire spectrum of possible asset classes) that a well-diversified, precisely allocated, professional portfolio can be composed through ETFs alone.

3) Ongoing progress in reducing investment transaction costs (including bid/ask spreads)… so transactions can be executed on behalf of clients at virtually no cost to the client![27]

It is within this context that some exceptionally bright and enterprising individuals have leveraged advanced technology and software programming into a business model that can provide virtually any investor (a “minimum” of only $5,0000[28]) with a professionally designed, diversified portfolio allocated across multiple asset classes and managed daily in accordance with “best investment practices”[29].

Think about this, friends! Here you have an industry (financial advisers) that has historically based its compensation predominantly upon just one aspect of the “financial planning process”[30] now being significantly challenged by a growing number of “low cost providers” who have automated the investment process much as Henry Ford automated the production of automobiles.

Here is a picture of Henry Ford in his original Ford Motors automobile. It didn't need air conditioning.

Thus “Digital Investment Management”[31] has been born!

Although the financial adviser industry largely downplayed this new “competitor” at first, there is no hiding from it now. As we outlined in our prior article: https://www.markettamer.com/blog/could-hal-be-your-new-financial-advisor, the new “Digital Investment Managers” are gathering a growing amount of attention and AuM!

What are the ramifications of the emergence and rapid growth of “Digital Investment Management”? Quite frankly, this area is growing so quickly… in terms of the number of players, the escalation on AuM, and the range of business models… that I find myself unable to conceive of all (or even most) of those ramifications. However, at least a few things seem to have become clear:

I) Professional-level investment management and/or guidance has become available, accessible, and affordable for almost everyone – whether a member of the Gen-Y or Gen-X generations earning $28,000/year or a Medicare eligible widow whose deceased High Net Worth retired corporate executive left her with a need for low-maintenance asset management! As several observers have suggested, investment management is becoming “commoditized”!

II) Do not let yourself ever lump all “Digital Investment Managers” into one category! There are a number of variables that are emerging within that space that serve to differentiate these digital providers!

Perhaps the simplest difference is between those digital providers that actively manage your money for you versus those digital managers who provide you with advice that you must choose to act upon yourself (or procrastinate or ignore). Specifically, Wealthfront (the provider with the largest AuM), Betterment, and FutureAdvisor will manage investment assets for you, while SigFig and JemStep will offer detailed advice on investments that you must follow through with on your own.

In this connection, it is worth noting the following:

1) Wealthfront only requires $5,000 (or more) to start… and for the first $10,000 invested, it charges no fee!

a) Once an account exceeds $10,000, the monthly fee charged on the assets over $10,000 is calculated at an annualized rate of 25 basis points (0.25%). That is dirt cheap for professional management.

b) In addition, the account is not charged commissions on trades made by Wealthfront and there are no custodial fees or exit fees. [However, the portfolio’s total return is impacted by the very small ETF management expense ratio that shareholders of all ETFs bear!]

2) By trolling through the website of various digital providers, one can glean a lot of interesting input/education. For example, SigFig provides a good deal of information for free because its mission specifically targets helping all people (no matter how few assets she/he might have).

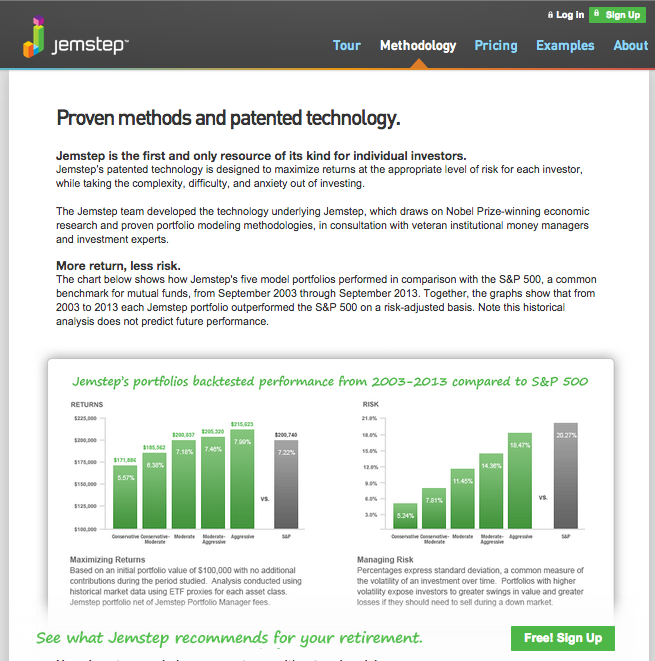

Jemstep offers insights regarding their methodology and past performance:

Jemstep offers insights regarding their methodology and past performance:

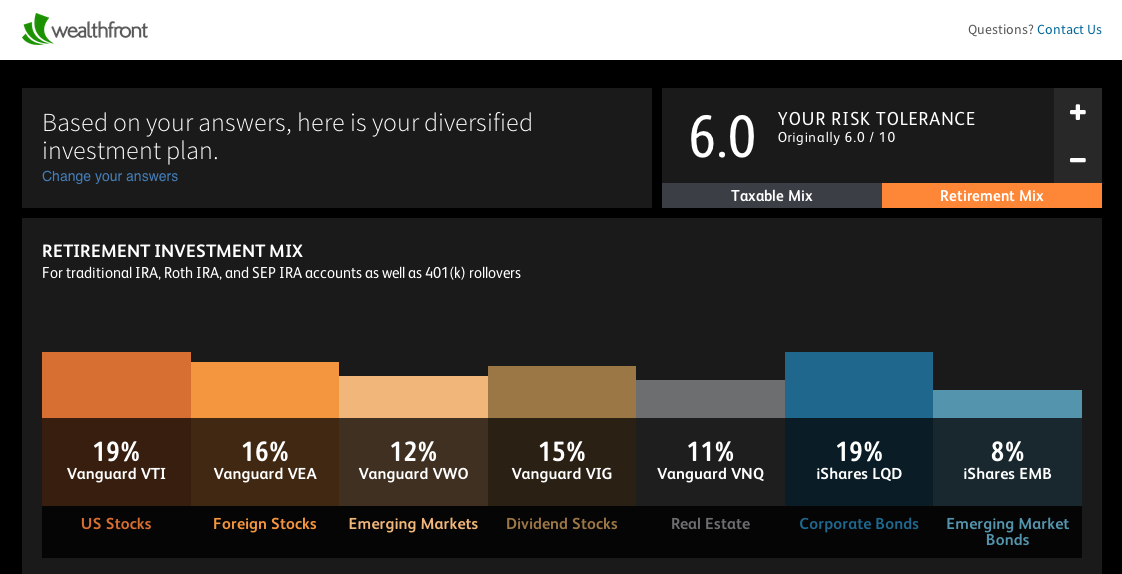

And after I responded to a few questions on their website, Wealthfront laid out separate portfolio allocations for a taxable account and a tax-qualified account (ie. an IRA or Roth IRA account, etc.). Here is the tax-qualified breakdown:

3) Each digital provider secures the individual investor (risk/goals, etc.) profile it needs from you in unique ways… and each provider makes different assumptions about what asset allocation will maximize your return at a given level of risk! [The particulars of Digital Investment Management are unique for each provider!]

III) Existing financial advisers will need to retool their revenue/fee model in a way that reflects these realities:

1) Digital Investment Managers have already successfully disrupted the existing assumptions regarding how much professional management should cost by significantly undercutting current average fee levels and becoming a “low cost provider”.

2) Fees for services that advisers often provide gratis to their investment management clients will need to be “priced” based something akin to an “ala carte” menu… since digital providers (at least currently) are unable to provide estate plans, complicated trusts, detailed advice regarding the tax consequences of bequests or gifts[32].

a) This point has been made by a number of experienced experts within the financial adviser space, including Ron Carson of Carson Wealth Management and Tom Nally, the President of TD Ameritrade Institutional (the portion of Ameritrade that relates to RIA’s).

Tom Nally is the TD Ameritrade executive who most directly (and often) interfaces with financial advisers who are clients of T.D. Ameritrade.

b) Mr. Nally recently offered this intriguing analogy: “Advisors need to step back and go to the drawing board and ask ‘How do we charge?’ If you’re charging 100 basis points for investment management, that’s like [asking clients to] buying the floor mats and getting the car for free.”

INVESTOR TAKEAWAYS:

Television disrupted network radio. Color TV disrupted black and white TV. TV recording (Betamax; VHS) disrupted the TV industry. Cable TV disrupted National Network TV. Streaming Video continues to disrupt TV and the movie industry.

In fashion similar to the above… and similar to Henry Ford’s disruption of the auto manufacturing industry of his day, Walmart’s (WMT) disruption of the retail industry, Amazon’s (AMZN) disruption of “brick and mortar” retail, etc…. Digital Investment Management will continue to disrupt the financial adviser and brokerage industry!

No longer will hardworking, diligent, but asset-poor individuals (whether my adult children or older folks moving through their 40’s, 50’s, 60’s, etc.) need to feel lost or intimidated by the investment world! With as little as $5,000, they can secure “24/7” professional investment management for as low as 25 basis points!

And while they retool their compensation/fee model to fit this technologically transformed investment management space, financial advisers who are enterprising and flexible can leverage technology to become (relatively) freed from the limits of geographical proximity! Put more directly, through Skype, YouTube, Web conferencing, and the very automated (algo-based) “24/7” digital portfolio management that enabled the so-called “Robo Advisors” (have I made it clear that I abhor that misleading term?) to secure, serve, and satisfy clients across the country or around the world! They could even specialize in a few particular portions of the financial planning process and extend the reach of her/his expertise beyond state or national boundaries! And finally, current advisers (if they choose) can rapidly scale up their AuM on a national basis if they market themselves something like this:

“Investors, if you are considering sending your hard earned assets to a ‘Robo Advisor’, please think twice! Imagine how you will feel If you send your funds to a ‘Robo’, and another ‘Dot.com’ bubble or ‘Financial Crisis’ besets us!! You won’t be able to Skype a ‘Robot’ to gain assurance that your investments are doing better than are those of the average investor … or that you will continue to have enough investment income to keep you fed, clothed, housed, and enjoying daily life. But if you let me invest your funds, I will manage your investments for just 5 basis points more than that ‘Robo’ will charge and (more importantly) you will have a real live person with whom to converse during the inevitable ‘rough patches ahead’.”

DISCLOSURE:

The author does not have any relationship with any Digital Wealth Manager (“Robo Advisor”). The author is a C.F.P., but currently offers his “fee-only” services only to persons of limited means. Also, he has never (ever) been compensated by commissions; he is not a RIA or RR. [He agrees with the mission and philosophy of NAPFA but is not a member.] Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[2] Minnesota clobbered UCLA 21-3.

[3] I shudder at the thought of what would have occurred without HBO. Our nation (and the world) might have been deprived of the cultural richness that is The Sopranos, Game of Thrones, and Boardwalk Empire!

[4] And all NFL fans who don’t have HD at home migrate to the nearest sports bar to watch the game.

[5] Microsoft (MS WIndows Studio Suite, Connectix QuickCam, Active Movie, Windows Media Player); Apple (QuickTime); Adobe (Flash); YouTube; RealNetworks.

[6] Robin Wright (who was the Princess in “Princess Bride”) is worth the price of admission.

[7] That system was [generally too expensive (commission-wise) for widespread trading by less experienced traders

[8] Discount brokers with online trading platforms have pushed commissions down to a fraction of what they were in the 1980’s and earlier!

[9] And therefore flawed…

[10] That is the vulnerability of a commission-based system!

[11] You could call them “planners with a conscience”

[12] In the early days of mutual funds, those funds that included an upfront sales charge (ranging in rare cases up to 8.5% of the invested funds) had the highest level of Assets Under Management (AuM) because of their motivated/incentivized sales force (advisers, brokers, etc.).

[13] So named because Section 12b-1 of the SEC regulation described and authorized such a fee.

[14] Note that within some 401(k) plans, 12b-1 fees are used to make payments that help cover that plan’s administrative costs.

[15] As well as the industry’s self-regulatory body – the Financial Regulatory Agency (FINRA)

[16] These developments also led to the creation of multiple “classes” within a number of funds – such as “A”, “B”, “C”, etc. The various classes differ primarily based on what kind of load or fee is charged… and whether that charge is “one-time” or on an annual basis. I doubt that anyone can rattle off the differences from memory unless he/she is a broker, adviser, or frequent buyer of such a fund!

[17] “No Transaction Fee”

[18] Such payments amount to $4,000 per million in shares sold (and paid annually for as long as it is held)

[19] Investors didn’t need to place orders through a broker at a wire house because they could enter orders on their own!

[20] You’ve likely noticed the number of “experts” on CNBC, trading educators, or brokerage investor trainers who are “former floor traders”… because the number of CBOT floor traders has dwindled to a mere shadow of its former size (and glory).

[21] Note that, altho MPT has contributed greatly to investment theory… it is by no means universally esteemed! The fact is that, as with all theories, it has its limits.

[22] Using tools such as “Monte Carlo Simulation”

[23] Common “Wrap Fee” levels range between 0.5% and 1.5% (50 basis points to 150 basis points).

[24] Wikipedia.com describes a RIA as: “an investment adviser (IA) registered with the U.S. Securities and Exchange Commission (SEC) or a state’s securities agency.” The Investment Advisers Act of 1940 codified the investment advisor designation. Further, the SEC defines an “IA” as an individual or a firm that is in the business of giving advice about securities.

[25] Wikepedia.com describes a RR as: a “general securities representative, a stockbroker, or an account executive who is licensed to sell securities… in the United States.”

[26] Such as particular questions regarding employer pension plans, rollovers, inheritance, etc.).

[27] This is crucial in the 24/7 digital investment management functions of daily cash sweeping and regular portfolio rebalancing and tax loss harvesting!!

[28] That is Wealthfront’s minimum requirement.

[29] This would include: 1) regular portfolio rebalancing; 2) tax loss harvesting as appropriate; 3) sweeping unneeded account cash (accumulated through dividends or new investor deposits) into the actively invested portfolio.

[30] Albeit the most visible and obvious aspect!

[31] Among those who (like me) abhor the very inaccurate term “Robo Advisor” [after all, clients are never served by a robot… and the entire process/service of these providers has been designed by, implemented by, and administered by human beings knowledgeable about the intersection of investment management and technology] many refer to this space as “Digital Wealth Management”.

[32] I suggest you review tax law on almost anything related to estates and/or inheritance. Your eyes will glaze over.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Nvidia Stock Investors Can Expect Revenue and Profit to Rise Further

Nvidia Stock Investors Can Expect Revenue and Profit to Rise Further