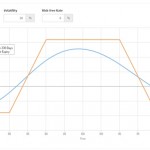

Netflix's most recent trend suggests a bullish bias. One trading opportunity on Netflix is a Bull Put Spread using a strike $175.00 short put and a strike $165.00 long put offers a potential 34.23% return on risk over the next 30 calendar days. Maximum profit would be generated if the Bull Put Spread were to expire worthless, which would occur if the stock were above $175.00 by expiration. The full premium credit of $2.55 would be kept by the premium seller. The risk of $7.45 would be incurred if the stock dropped below the $165.00 long put strike price.

The 5-day moving average is moving up which suggests that the short-term momentum for Netflix is bullish and the probability of a rise in share price is higher if the stock starts trending.

The 20-day moving average is moving up which suggests that the medium-term momentum for Netflix is bullish.

The RSI indicator is above 80 which suggests that the stock is in overbought territory.

To learn how to execute such a strategy while accounting for risk and reward in the context of smart portfolio management, and see how to trade live with a successful professional trader, view more here

LATEST NEWS for Netflix

Where to Watch 4K Content With HDR

Tue, 19 Sep 2017 10:00:03 +0000

There are now lots of 4K TVs that have HDR (high dynamic range) capability, technology that can create brighter, more lifelike images by expanding the set's brightness, contrast, and colors. But …

What's Likely Behind Amazon's Reported Interest in Buying a Slew of TV Channels

Tue, 19 Sep 2017 04:30:00 +0000

The tech giant is said to be in talks to buy independent TV channels, and that could be good news for Amazon Prime members.

Netflix's Tough Loss to Hulu at the Emmys: Why It Matters

Tue, 19 Sep 2017 02:20:00 +0000

Despite a massive promotional campaign, Hulu's ‘The Handmaid's Tale' bests ‘House of Cards,' ‘The Crown' and ‘Stranger Things' for the most prestigious Emmy.

Global Stock Markets Have Lost Their Minds and It's Becoming Pretty Disturbing

Mon, 18 Sep 2017 23:15:00 +0000

Global stock markets have morphed into unstoppable beasts of epic proportions. Investors are ignoring any form of risk in the attempt to chase performance and make a ton of money.

Why Netflix Doesn't Need Hot Shows To Keep Growing

Mon, 18 Sep 2017 21:50:00 +0000

Netflix had arguably its strongest content slate ever last quarter with new seasons of House of Cards, Orange Is the New Black, and Unbreakable Kimmy Schmidt. Momentum from these shows helped the company far surpass Wall Street’s estimates for subscriber growth, but the company could be in for a repeat performance this quarter, despite a less exciting base of new shows. For one, Piper Jaffray’s Michael Olson tracked Google search terms related to popular Netflix shows and concluded from this that there's a good chance the company will beat Wall Street’s subscriber estimates once again.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Want $4,700 in Passive Income? Invest $25,000 in Each of These 3 Midstream Energy Stocks.

Want $4,700 in Passive Income? Invest $25,000 in Each of These 3 Midstream Energy Stocks.