CSX Corp's most recent trend suggests a bullish bias. One trading opportunity on CSX Corp is a Bull Put Spread using a strike $49.00 short put and a strike $44.00 long put offers a potential 9.65% return on risk over the next 30 calendar days. Maximum profit would be generated if the Bull Put Spread were to expire worthless, which would occur if the stock were above $49.00 by expiration. The full premium credit of $0.44 would be kept by the premium seller. The risk of $4.56 would be incurred if the stock dropped below the $44.00 long put strike price.

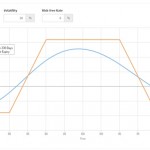

The 5-day moving average is moving down which suggests that the short-term momentum for CSX Corp is bearish and the probability of a decline in share price is higher if the stock starts trending.

The 20-day moving average is moving up which suggests that the medium-term momentum for CSX Corp is bullish.

The RSI indicator is at 72.05 level which suggests that the stock is neither overbought nor oversold at this time.

To learn how to execute such a strategy while accounting for risk and reward in the context of smart portfolio management, and see how to trade live with a successful professional trader, view more here

LATEST NEWS for CSX Corp

Why CSX’s Overall Freight Volumes Declined in Week 36

Mon, 18 Sep 2017 22:06:06 +0000

In the week ended September 9, 2017, CSX registered a 4.2% fall in railcar volumes.

Norfolk Southern: Commodities Leading Shipment Rise in Week 36

Mon, 18 Sep 2017 20:36:18 +0000

Norfolk Southern (NSC) recorded a 6.8% rise in freight railcars in the week ended September 9, 2017.

Adobe, FedEx To Report; 5 Logistics Stocks To Watch: Investing Action Plan

Mon, 18 Sep 2017 20:10:08 +0000

FedEx's quarterly results may call to attention other transportation and logistics stocks that are near key thresholds.

Industrials To Buy Ahead Of A Sector Rally

Mon, 18 Sep 2017 18:27:00 +0000

The S&P 500 hit another new high last week, it’s 34 for the year, as did the FTSE All-World Index, and while investors might be worrying if the rally can continue, MKM Partners’ Jonathan Krinsky writes that trends remain “firmly bullish” in the U.S. and abroad. As for specific sectors, he writes that investors should buy industrials, as they could be poised for a breakout. From his note: The S&P 500 Industrial sector is in a strong uptrend, and looks poised to breakout of its recent multi-month trading range to the upside.

What Analysts Recommend for US Railroads

Mon, 18 Sep 2017 14:37:25 +0000

Union Pacific (UNP) has a consensus analyst rating of 2.3, indicating a “buy.”

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why JetBlue Stock Was Tanking This Week

Why JetBlue Stock Was Tanking This Week