Today we are going to take a detailed look at an ETF that is as fresh, current, and relevant as it can be:

1) It is “fresh” because it was just rolled out on November 11th of this year;

2) It is “current” because its focus is upon an investment space tied to one of the most strongly trending news stories since November (the hacking of Sony Pictures’[1] servers and the resultant melodrama regarding the “censorship” of the movie “The Interview” … which led to much embarrassment, many political sound bites, an international incident, etc.[2]);

3) It is (and will continue to be) “relevant” because the FBI and technology experts agree that “Cyber Crime” (surely the fastest growing current criminal activity) is sure to continue to increase and expand its growth – especially now that North Korea has been so open with regard to its own cybercrime activities.[3]

Investing in an ETF whose profile has been considerably raised by news stories does have its pluses and minuses. Such an ETF does garner a lot more media attention and investor focus, which can jack up assets under management and increase both buying demand and transaction liquidity, all of which are very positive consequences. As evidence regarding that point, take a look at a graph of this ETF since inception:

This graph shows an amazing return of almost 9% between November 11 and December 26 … compared with the S&P 500 Index’s return of just 2.41%. Of course, the likely downside of an ETF that is “fresh, current, and relevant” is higher volatility and greater risk!

As the above graph shows, the identity of this ETF is the PureFunds ISE Cyber Security ETF (HACK). As you will find at http://www.pureetfs.com/materials.html, HACK is the just the second ETF from “Pure Funds”:

In a fairly uncommon article that appeared in ETF.COM on November 17th, [4] Cinthia Murphy reported on her interview with an ETF industry consultant (Christian Magoon) who helped an index provider (ISE) design the benchmark for HACK.

The designated field of potential investments for the HACK portfolio includes either software or hardware companies from around the globe that focus on cyber security – ie. products and/or services that are designed to protect computer hardware, software, networks and/or data from unauthorized access/attack of any kind.

In the interview, Magoon pointed out that most indices related to the Technology space are classified on the basis of the “product” that a company produces. In contrast, HACK focuses upon a service – cyber security solutions – whether provided by companies primarily involved in hardware, software, or consulting/analyst services.

Not surprisingly, the majority of companies incorporated within HACK are involved within the systems software area (almost 65%). However, there is sufficient diversification within the portfolio to prevent it from being overly risky. The portfolio includes some communication equipment producers (almost 16.71%), IT Services (5.62%), and an aerospace and defense component.

As a brief illustration of the relevance of companies within the HACK portfolio, here is an image showing U.S. Navy sailors monitoring breaches of security within the daily operation of its naval and sea forces:

Each U.S. Defense Department branch carries out similar operational monitoring on a daily basis.

And as an illustration of the intrusion of cybercrime upon our own individual lives, one interesting story that leaps to mind is the hacking on this past Christmas Day of the servers for Sony's (SNE) PlayStation and Microsoft's (MSFT) X-Box… thereby denying untold heavy-duty gamers the fulfillment of how they intended to spend a good deal of their Christmas Day!

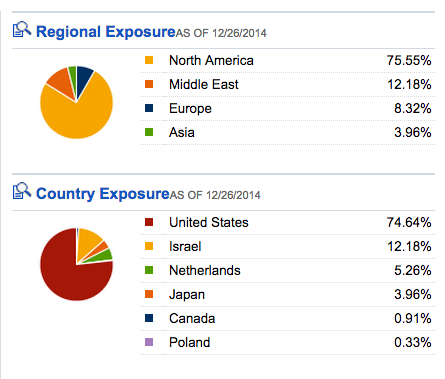

Although the companies included in the HACK portfolio are heavily tilted toward the United States, there is a measure of geographic diversification provided through the inclusion of companies from outside the U.S. (Israel, Japan, and the Netherlands)!

Magoon also pointed out a few of the more obvious pluses of holding HACK within one’s portfolio, including:

Magoon also pointed out a few of the more obvious pluses of holding HACK within one’s portfolio, including:

1) Price Waterhouse published a report on cybercrime that shows that the annual year-over-year growth of cyber attacks since 2009 is a frightening 66%!!

2) The portfolios of other well-known technology space ETFs do not significantly overlap (less than 5%) with HACK portfolio components:

PowerShares QQQ (QQQ)

Technology Select Sector SPDR Fund (XLK)

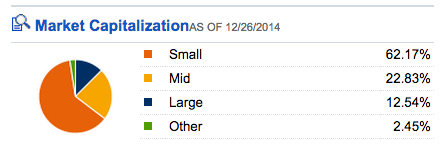

3) There are quite a few of the companies within the HACK portfolio that can be classified as “undiscovered small market cap” (less than $1 billion) stocks — which lends them the potential for outsized gains as they make their mark within the space (but also bear a greater risk of failure vis-à-vis an established large cap firm!).

4) If one owns a significant number of tech stocks, HACK can be held as a hedge against a particularly virulent negative security breach that harms (in the short-term or intermediate term) the brand of one of those firms!

You have surely realized by now that HACK should be considered a “niche” ETF – to be included in your portfolio only after you accept the following inevitable characteristics of a “niche” product:

1) Liquidity will be lower in HACK than for the shares/options of a major, large cap stock or ETF;

2) It will always be more volatile than a mainline Index ETF (such as SPY, DIA, QQQ, etc.);

3) Options on this ETF will have wider than average spreads between the “Bid” and the “Ask” prices.

With that said, there are many positive reasons to own HACK – depending upon your investment goals, your market outlook, and your ability to move in/out of such a position when you deem it advisable. In fact, some of the reasons to own HACK at any given moment in time are similar to the reasons that a trader (or investor) would own other “niche” ETF’s within the Tech/Internet space, such as:

Robo-Stox Global Robotics and Automation ETF (ROBO)

[See: https://www.markettamer.com/blog/first-robocop-now-robofund ]

Global X Social Media ETF (SOCL)

Related to the above, Mr. Magoon points out that even if the HACK ETF itself does not generate a large daily trading volume[5], the stocks that are held within the HACK portfolio itself are not obscure companies with overly low liquidity. To give you a sense of the size of portfolio holdings, here are some metrics regarding the ETF’s Index (albeit from 11/11/14). Note the “weighted average market cap” of $9.2 billion!

Another factor that offers a plus with regard to the liquidity of HACK is this excerpt from an analysis published by Bloomberg:

“HACK‘s $65 million in assets puts it in the top 15 percent of the 196 new launches. That's especially noteworthy because the ETF comes from a tiny, relatively unknown issuer without a ton of marketing power.” [Author note: I imagine most of our readers had not heard of “Pure Funds” before!]

Regarding the “fundamental story” driving HACK, I could regale you with a load of impressive statistics. However, given the current prevalence of headline stories regarding breaches of cyber security, I suspect that this one metric will be sufficient:

According to Bloomberg Intelligence, corporate and government investment in cyber-security services is projected to jump by (at least) 40% by 2017!

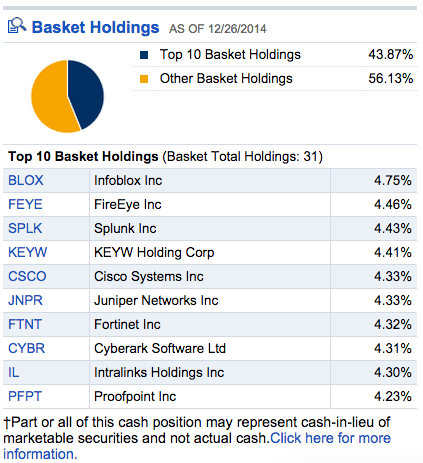

If you are one how prefers to focus on the “Top Ten Holdings” of am ETF/fund, here is that list for HACK:

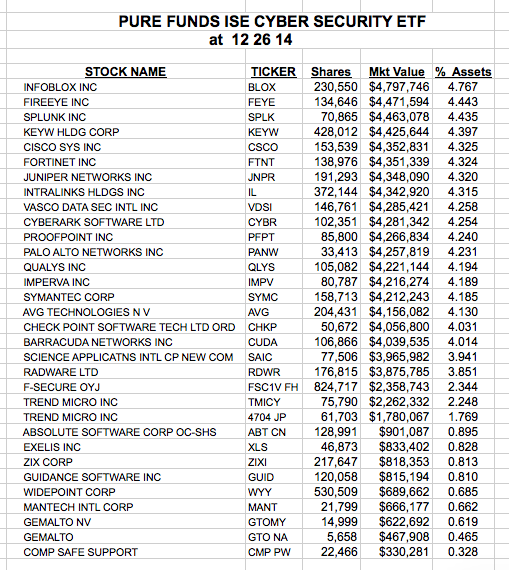

On the other hand, if you are one who prefers a comprehensive look at portfolio components within HACK, here is a downloaded list of all the stocks within the ETF:

INVESTOR TAKEAWAY:

There is much to commend the consideration of HACK as a trading vehicle when it trends in either direction. The challenge within that endeavor is the absence of a long-term chart through which to gauge what “trending” looks like within HACK…. and (obviously) where support and resistance zones can be found.

As we have indicated, using HACK as a “hedge” in conjunction with other tech-related positions that one already holds also makes sense.

In any event, it is well worth keeping an eye (or two) on HACK as it grows in assets, as well as in the development of a “track record” (not to mention how it performs vis-à-vis the latest “headlines” regarding any new breach of a corporate website, credit card company server, confidential customer data, etc.

Just (please) keep in mind that if you choose to trade HACK options, that wide “bid/ask” spread will present a challenge!

DISCLOSURE:

The author does not (yet) own HACK, nor any other security referred to above. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] Subsidiary of Sony Corporation (SNE)

[2] This included an official statement from the North Korean government that referred to the U.S. President through the use of a racial slur!

[3] Sovereign governments have been involved in cyber attacks for a long time. However, unlike North Korea they have (until now) generally tried to be more subtle about it (using “Stealth” strategies and/or not matching the attacks with public statements.

[5] And because it does not generate large daily trade volume, it offers lower than average liquidity.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

The Smartest S&P 500 ETF to Buy With $2,000 Right Now

The Smartest S&P 500 ETF to Buy With $2,000 Right Now