Consider the intersection of these various and sundry themes:

Consider the intersection of these various and sundry themes:

1) An investment vehicle that started as a smartphone app;

2) The phone app turned into an investment Index;

3) The investment Index became a publicly available ETF;

4) The original phone app has just been upgraded (to 2.0);[1]

5) These developments were initiated … not by some Wall Street hotshot… but rather by a Latin American entrepreneur, Raul Moreno of Ecuador.

Of course, I am referring to the iBillionaire.me company based in New York (but with an office in Buenos Aires).

This start-up was the joint dream of serial entrepreneur, Moreno (educated at the Stern School of Business in New York) and co-founder, Alejandro Estrada (deeply involved with DineroMail and a Fintech founder; educated at the London School of Business) and was funded by angel investors that included Alec Oxenford and Fabrice Grinda.

By the time the ETF came along, French-based Newfund Management gave it a big boost by adding it to its portfolio.

Currently, the day-to-day operation of iBillionaire is directed by COO, Jack Nguyen (whose resume includes Goldman Sachs (GS) and UBS Wealth Management (UBS); educated at New York University).

This enterprise was kicked off in April of 2013 with the introduction of its iBillionaire mobile app… designed to provide users with current, user-friendly information on the investment news made by top “Billionaire” fund managers and investors.

By August of 2013 the firm introduced its web platform… with greatly expanded news, information, and data on Billionaire investors. Then three months later, it introduced its investment Index – the iBillionaire Index – which Moreno explained at the time had always been a part of its long-term plan.

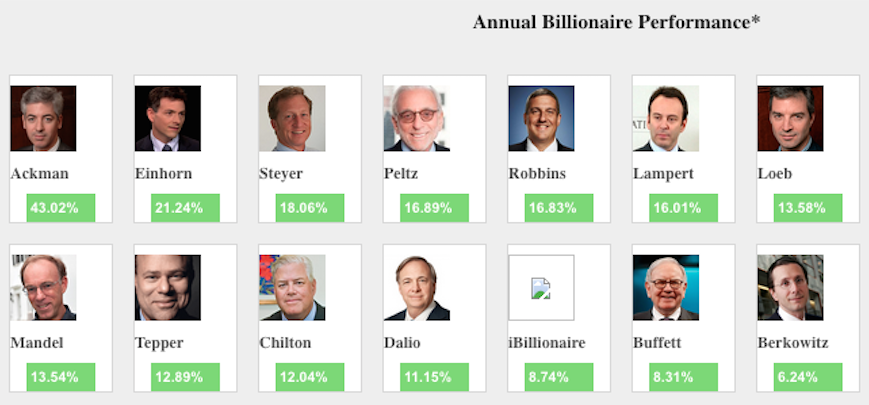

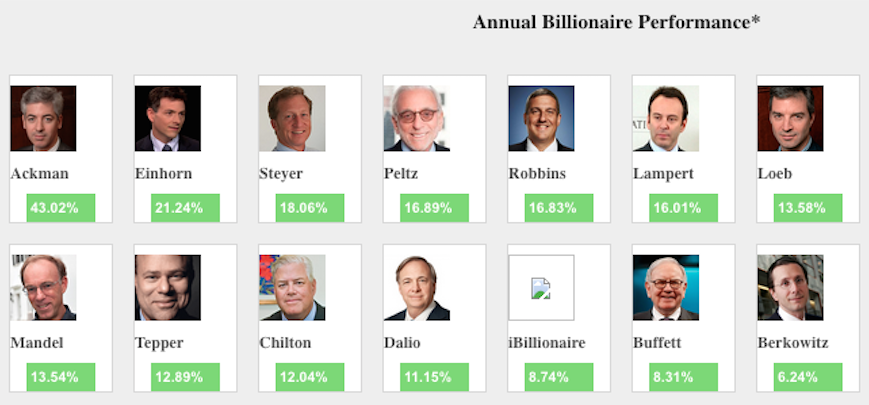

iBillionaire’s driving force is its proprietary methodology of compiling and analysing investment data related to the most successful billionaire managers and investors – who are required to submit publicly-disclosed SEC 13F filings of their positions on a quarterly basis. That methodology tracks bllionaire positions (through the 13F filings) and discerns which of their S&P 500 Index stocks have generated the highest returns over the course of a three-year rolling average. From that data, iBillionaire selects the “Top Ten” billionaires as its focus for the creation of the Index – which is described as the thirty S&P 500 Index components that reflect the “highest conviction” among those ten top-ranked billionaires.

To oversimplify – picture those “Top Ten” billionaires in a room, discussing which thirty stocks should be included in a joint portfolio. Of course, that would never work out well because the same strong “ego” that drives each billionaire to investment success would also tend to make it nearly impossible for them to agree on just thirty stock names.

That’s the genius behind the iBillionaire process – it removes competing “egos” from the picture by depending upon its computer-based algorithm generate the Index components. The Index is adjusted quarterly, to keep it up-to-date on portfolio changes among the billionaires – in accordance with the quarterly 13F filings!

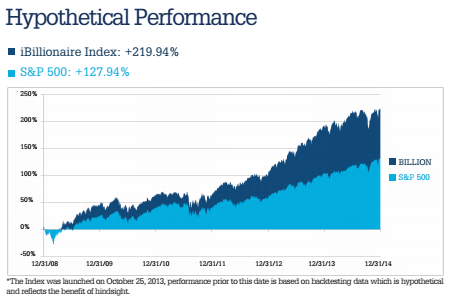

Before I show you the backtested performance data on this Index – let me remind you of the many limitations of backtested data:

1) Because it is not a report from an actually traded portfolio, it is primarily of theoretical value.

2) As always, past performance is never an assurance of future results.

3) The six-year backtested performance shown below is particularly limited by the fact that these years have been extraordinarily unusual (actually unprecedented) because of rampant Quantitative Easing by global central banks.

4) All of that being said, the Index itself significantly outperformed the S&P 500 Index from 12/31/2008 through the end of 2014, as shown in the graph below.

The biggest news related to Raul Moreno’s company came in August of 2014, when the folks at Direxion Investments rolled out an ETF based on the iBillionaire Index (which they licensed from iBillionaire). The Direxion iBillionaire Index ETF (IBLN) provides investors with the highest conviction ideas from the top-ranked billionaires who are required to file quarterly 13F reports with the SEC regarding their portfolio portfolios.

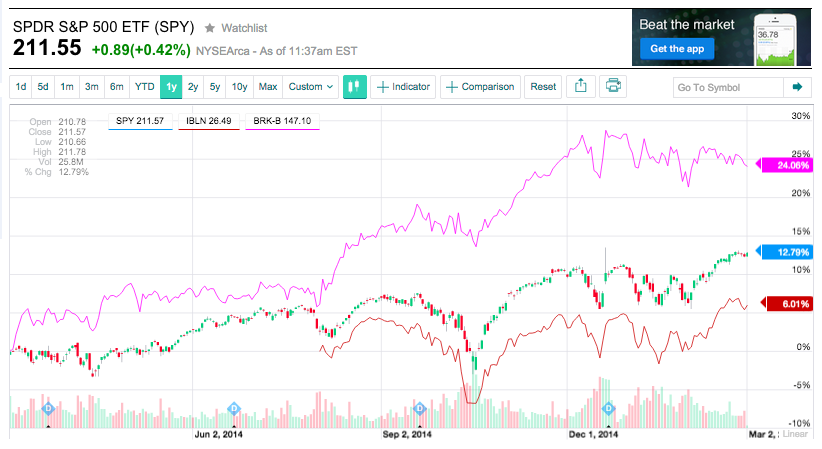

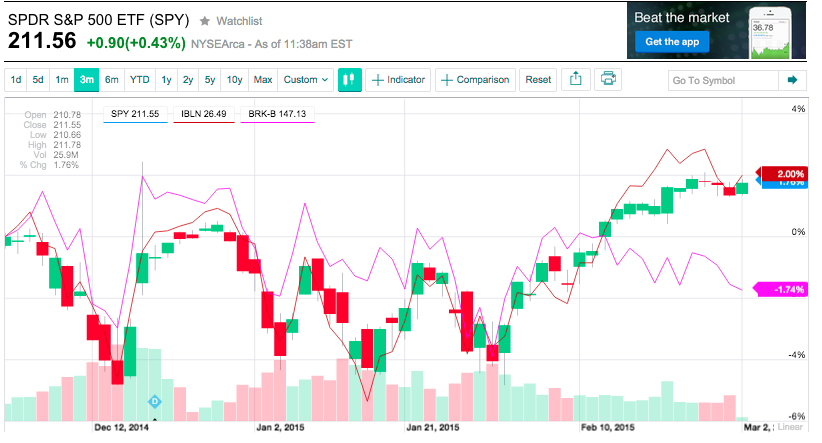

Through IBLN, we now have an actual, market-tested portfolio that can be referred to as a measure of relative performance in real time! Presently, the ETF is 7 months old, and it was just rebalanced in the middle of February, 2015. Let’s take a quick look at relative performance during: 1) the past year; 2) since August 1, 2014; and 3) during the most recent three-month period:

This graph shows that Buffett's Berkshire Hathaway (BRK-B) has smoked both the S&P 500 Index and the IBLN portfolio during the past year.Since its inception in August of 2014, IBLN has underperformed both the S&P 500 Index and BRK-B.

However, during the most recent 3-month period, IBLN has outperformed BRK-B and kept up with or exceeded the S&P 500 Index!

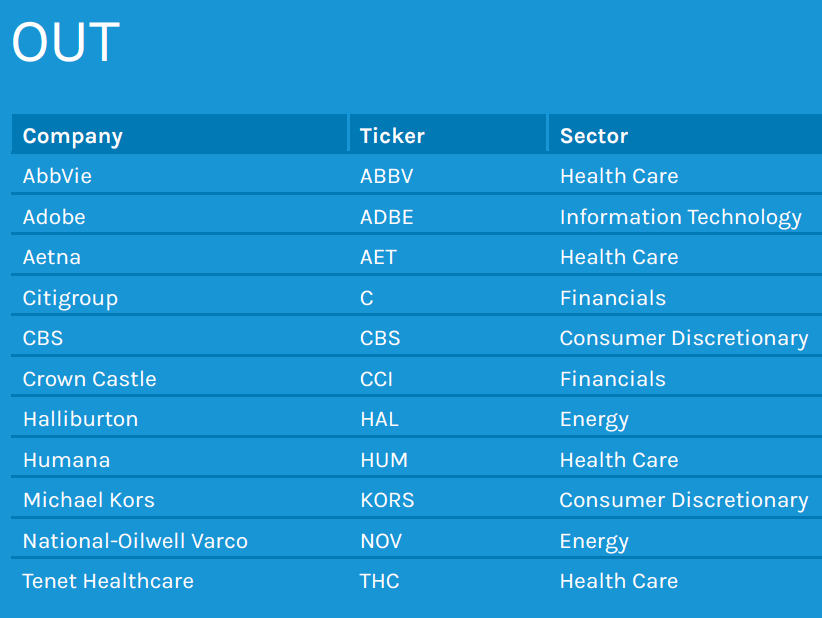

Undoubtedly, you’ll be interested to know which stocks got dropped from the portfolio and which were added.

The advantage of an algorithmic formula that determines the selection of components within an Index and its related ETF portfolio is that it is objective. In addition, in this case when a stock gets dropped from IBLN, it doesn’t mean that something is “wrong” with it… it merely means that other stocks have received greater interest among the coterie of IBLN’s “Top Ten” Billionaire Investors!

Of course, much the same thing could be said with regard to the list of newly added stocks. The addition of these stocks does not necessarily mean that anyone should rush out and buy shares of each of these companies! Instead, what it means is that these are the stocks that have (most recently) captured the attention (and the investment dollars) of key Billionaires followed by the Index. [Note that the full IBLN portfolio is viewable in our Appendix.]

That is not to say that there are not intriguing and worthwhile “stories” that accompany each stock that has been added to the Index — stories that might sway investor interest.

For example, let’s take a look at just five of these newly added stocks… as viewed by three separate Billionaires:

DAVID TEPPER of Appaloosa Management

(New Jersey based) has high conviction in GOOGLE (both GOOGL and GOOG) and Goodyear Tire & Rubber (GT) – both of which are newly added to IBLN. Of course, GOOGL continues expanding into nearly everything (not necessarily generating high margins in its newest endeavors… but definitely generating lots of energy and news clippings).[2] In fact, GOOGLE is Tepper’s second largest position – behind only General Motors (GM) in its portfolio weight at Appaloosa. Tepper’s market opinion about GM likely helps shape his conviction in GT, another of the newly added stocks in IBLN. Tepper owns 3.7% of GT – which was recently trading at 13.5 times earnings and just 0.4 times sales!

Before we move on from David Tepper, there is one key insight that can be clearly illustrated through Tepper: these Billionaire investment managers often carry divergent views regarding the market and particular stocks. Consider this kernel of empirical fact from “GuruFocus.com”:

“David Tepper , founder of Appaloosa Management, was listed by Forbes as the highest-earning among the top 40 hedge fund managers and traders for 2012. With a personal income of $2.2 billion last year, the alpha investor beat out other top earning Gurus for the top slot, including Carl Icahn, Steven Cohen, James Simons, George Soros, Ken Griffin, Ray Dalio, David Shaw, Leon Cooperman and Daniel Loeb. According to GuruFocus Real Time Picks, David Tepper made major tweaks to his portfolio with 30 trades in the second quarter, either reducing or selling out. While 14 billionaire investors added or bought new holdings in Apple, David Tepper is one of four Gurus reducing their AAPL positions in the second quarter of 2013.”[3]

JORGE LEMANN at 3G Capital

is, hands down, the most intriguing of the Billionaires (Bloomberg has even dubbed Lemann with that title – although they word it, “most interesting billionaire in the world” as a play on the infamous Dos Equis commercials).[4]Lemann is the wealthiest man in Brazil and ranked by Forbes as the 34th richest in the world.[5] His heritage spans Brazil and Switzerland (within which he splits his time during the year)… he is a five-time national tennis champion… and he was part of the recent collaboration with Warren Buffett on the transformation of Burger King.

is, hands down, the most intriguing of the Billionaires (Bloomberg has even dubbed Lemann with that title – although they word it, “most interesting billionaire in the world” as a play on the infamous Dos Equis commercials).[4]Lemann is the wealthiest man in Brazil and ranked by Forbes as the 34th richest in the world.[5] His heritage spans Brazil and Switzerland (within which he splits his time during the year)… he is a five-time national tennis champion… and he was part of the recent collaboration with Warren Buffett on the transformation of Burger King.

Lemann’s recent high conviction play is Mohawk Industries, Inc. (MHK) – a flooring manufacturer, which just this past week reached a 52-week high! MHK is also one of the newest additions within the IBLN portfolio.

DAVID EINHORN

of Greenlight Capital

has high conviction in a media company, Time Warner (TWX) – which is recently his sixth largest holding.[6] TWX leaves me cold (however, it must be noted that I am most definitively not a Billionaire) – but besides the boring parts (magazines) TWX also owns HBO, Cinemax, CNN, TBS and TNT, and recently rolled out HBO GO (for mobile) as a standalone product.

Einhorn’s other high conviction addition to IBLN is YAHOO (YHOO) – which would be as boring as any stock could possibly be if it were not for (at least) three “hot” components:

1) A nearly $40 billion residual stake in Alibaba (BABA) which it plans to spin-off to shareholders later this year! This spin-off is an intriguing story in and of itself… on multiple levels:

a) Believe it or not, the new company will be called “SpinCo”

b) The spin-off will be “tax-free”… forming an independent, publically traded investment company.

c) This strategy enables YHOO to create real, tangible value for shareholders while simultaneously sparing YHOO a huge corporate tax bill had it held onto to BABA stock for later sale as a source of cash (for corporate use).

d) Accompanying the BABA stock within SpinCo will be YHOO’s existing “Small Business Division” (employing about 100 folks) – which sells tools to help small enterprises set up their businesses online, including the sale of e-commerce tools, domain names, web hosting and local listing services. Existing clients number over 1.5 million and (as reported) generates approximately $50 million in EBITA (“Earnings before Interest, Taxes, Depreciation, and Amortization”).

2) YHOO has lots of cash and current assets:

a) At 12/31/14, almost 43% of YHOO’s total net worth was composed of cash and invested assets.

b) It’s P/E/ Ratio was 5.9

c) Cash/Share was $8.54

d) Current Ratio stood at 2.14

e) Book Value/Share was $41.35

f) Revenue per share was $4.68

3) Marissa Mayer as CEO (enuf said):

It is likely worth noting that (as of 3/3/15) YHOO was down 15% YTD… largely because BABA was down 22% YTD. Obviously, many see YHOO as a less expensive (and less volatile) play on the future of BABA.

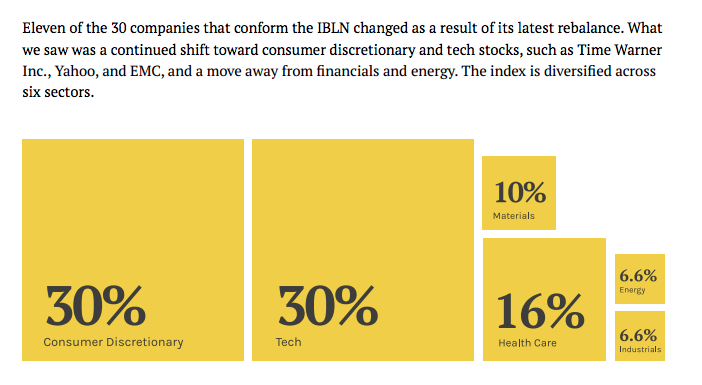

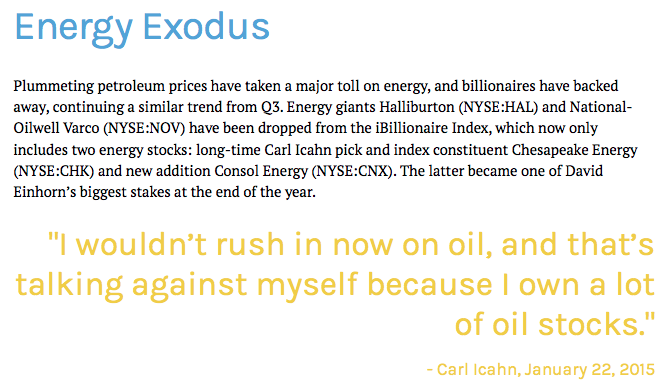

There is one more specific dimension regarding IBLN that could, potentially, be a source of helpful insight for investors on a quarterly basis. Take a look at the change in SECTOR Allocation following each quarterly rebalance!

From the most recent rebalance report from IBLN, take a good look at these thoughts and insights (http://ibln.ibillionaire.me/1Q15.pdf ):

INVESTOR TAKEAWAY:

Why might an investor allocate funds into IBLN? As we all know, that boils down to become a very subjective question. However, let me take a stab at offering an answer.

1) If one has even a modicum of faith in or respect for “back testing”… the outperformance of the Index vis-à-vis the S&P 500 Index since the start of 2009 is astounding. If future performance offers even half that degree of outperformance during the next six years, I’d want “in”.

2) It is empirically established that “high conviction” investment choices by top performing Billionaire investors will exceed the investment return of a John Doe investor[7]. In fact, one of the shortcomings of Billionaire portfolios is that “best practices” in the investment industry preclude the billionaires from investing ONLY in their “high conviction” stocks. Such a portfolio would be (practically criminally) “non-diversified”. So it stands to reason that a portfolio of “high conviction” stocks from ten top Billionaires might do quite well.

3) The universe within which IBLN chooses portfolio stocks is the large cap S&P 500 Index – so we are dealing with highly capitalized, well-established companies unlikely to go “belly up” anytime soon. Therefore the IBLN portfolio definitely leans toward “high quality”.

4) For some investors, investing in IBLN can provide a “psychic” benefit – the satisfaction that might come to some investors from knowing they are “investing with the big boys”… “riding the coattails” of likely “insiders”… investing in stocks held by famous investors they read about all the time, or even admire (like Warren Buffett).

5) One analyst has offered this great suggestion:

Think of the IBLN portfolio as being the S&P 500 Index Minus 470 “lower conviction” choices!!

I do want to remind you to review the three performance graphs I shared earlier. Remember that over the course of the prior year, Buffett’s Berkshire Hathaway (BRK-B) far outperformed both IBLN and the S&P 500 Index. The same is true, but to a much lesser degree, regarding the period between the rollout of IBLN (in August of 2014) and the present time. However, during the most recent three-month period, IBLN has clearly kept up with (and exceeded) the performance of the S&P 500 Index… and significantly outperformed BRK-A.

I must note for the record that when an ETF is first rolled out, its initial performance can be a bit erratic and should not be counted on as an indicator of future performance.[8]

Even if you are not interested in an actual investment in IBLN, you should consider accessing the fascinating information and data available through their phone app and website! I personally find Raul Moreno, Alejandro Estrada, Jack Nguyen and their colleagues interesting enough that I will keep my eye on them and follow their continuing evolution within the investment space. That will include, at some point in the future, a close look at the new Index they just introduced in February – the iBillionaire High Divident Index!!

DISCLOSURE:

The author has never owned IBLN. However, he does subscribe to the IBLN website and has owned YHOO. He currently owns a position in AAPL. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

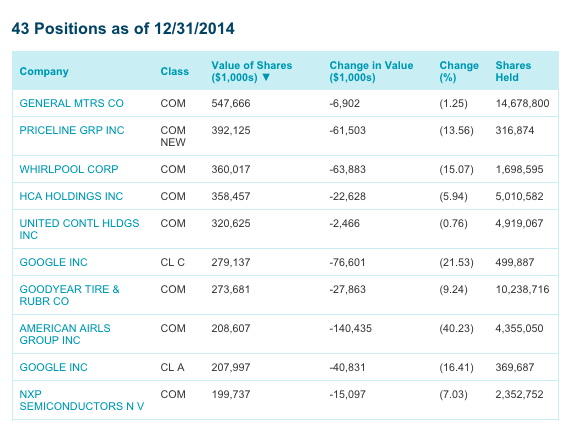

APPENDIX:

FOOTNOTES:

FOOTNOTES:

[1] These folks have also just released a new investment Index to complement the original Index. I promise I will highlight that Index in a future article.

[2] You’d think that a company capable of developing a self driving car could also develop a common sense-based, honest, objective, influence-free politician – in which case they’d get my vote!

[3] http://www.nasdaq.com/article/14-billionaires-buy-as-david-tepper-slices-aapl-second-quarter-update-cm267725

[4] To some folks, Lemann is most closely associated with Anheuser-Busch Inbev SA (BUD) – which (by the way) does not own Dos Equis. Lemann and his colleagues at 3G Capital are prominent players within the BUD board!

[5] Plus he did not play any role in the Petrobas scandal that has rocked Brazil.

[6] Steve Cohen and Leon Cooperman are also big fans of TWX

[7] Or more particularly, a Tom Petty investor.

[8] Think of it as similar to how a foal learns to walk after it emerges from the womb. It wobbles a bit, then increasingly gains stability and agility.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

1 Growth Stock Down 75% to Buy Right Now

1 Growth Stock Down 75% to Buy Right Now