What is the most important news story regarding Google (GOOGL) during the final week of May?

CLUES:

1) It wasn’t a new product.

2) It wasn’t a big acquisition of a company.

3) It wasn’t a huge spike up in price (far from it).

It was the first week for a new CFO/Senior V.P., replacing Patrick Pichette, who has served as GOOGL CFO for nearly seven years, and (simultaneously) held responsibility for the Human Resources Department over the past four years.

Just as importantly, the new CFO was not just a run-of-the-mill selection!! Nope, GOOGL plucked the new CFO straight out of the Morgan Stanley (MS) Executive Suite!! Her name is Ruth Porat… and as you can see below, Ms. Porat has hobnobbed with the “Big and Bold” from the hallowed corridors of Wall Street!

Ruth Porat is the new CFO at Google (GOOGL)... coming over from financial powerhouse Morgan Stanley (MS). Notice the company she keeps! (B. Bernanke in the background.)

Right about now you must be wondering WHY the arrival of a new CFO at GOOGL is worthy of attention? I will grant that, generally speaking, the arrival of a new CFO is not particularly earth-shaking unless the prior CFO was found to have been guilty of fraud, negligence, or improper behavior.

However, this CFO is clearly stepping into a company that, despite its countless past successes and technological innovations, is moving through a significant transition! One powerful illustration of that transition is the announcement (in the same SEC filing that announced her selection as CFO) of a significant reformulation of compensation policy for Senior Vice Presidents. Previously, those officers were paid a bonus on an annual basis. That will no longer be the case beginning next year! Instead, those officers will be granted stock grants that vest over two years.

That compensation policy change reflects similar trends in other publicly traded companies because it accomplishes two things simultaneously:

1) The fact that it is paid in stock “aligns” officer self-interest with shareholder’s best interests (ie. maximizing stock value); and

2) Because each separate grant vests over two years, it incentivizes executives to remain with the company longer (instead of jumping at the first alternative job offer).[1]

What may have pushed the GOOGL board to shake things up?

1) The firms 1Q 2015 Quarterly Financial Report was dismal:

a) Earnings missed analysts’ estimates on a number of metrics

b) The stock tumbled after the report was released by almost 6%

2) That worsened the already obvious underperformance of GOOGL vis-à-vis the S&P 500 over the prior seven months (from Oct. 15, 2014):

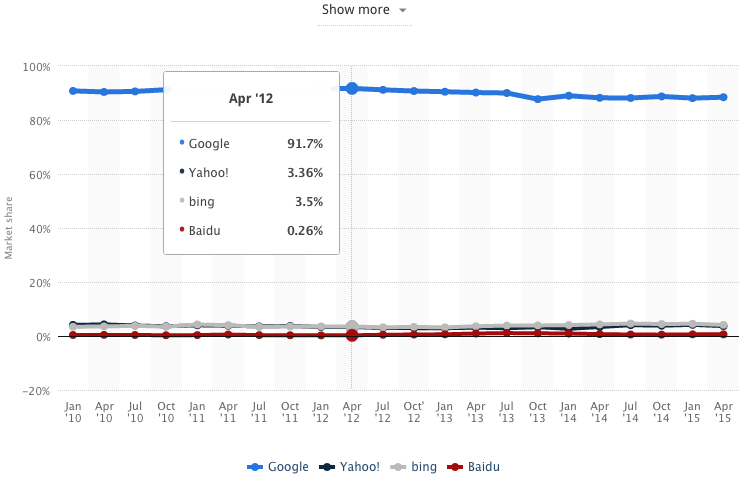

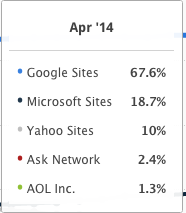

3) We know that GOOGL is (by far) the dominant force in the global “Search Engine” space, and that is the very core of its business (and its primary revenue generator). It is therefore worth reviewing its dominance over time.

As you can see, GOOGL still exerts a strange hold on Global Search… but it has lost 3.6% share in just less than three years. That may not sound like much of a difference… but on a global scale, it can mean the loss of a lot of revenue.

Complicating matters even further, the monetization of “Search” is undergoing a transformation as the world continues to migrate toward “Mobile” (see https://www.markettamer.com/blog/get-smart-understanding-the-mobile-revolution) … a user shift requires a significantly different approach regarding both the design of search screens and ads and the “per click” fee that advertisers are willing to pay!

Within that 1Q 2015 report, it was revealed that “costs per click” declined by 2%. In addition, although analysts were looking for a 23% increase in “paid clicks”… GOOGL only delivered 17% growth.

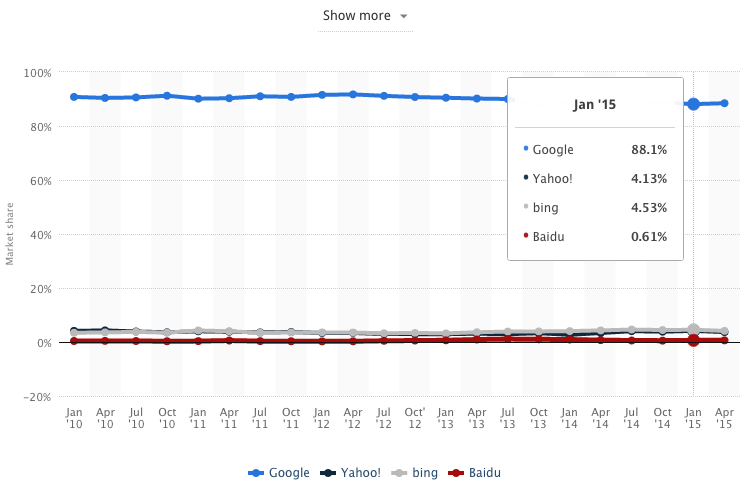

The U.S. market has also reflected adjustments in “Search Share”:

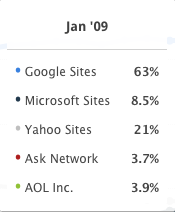

Once again, the 3.4% loss in U.S. market share may not seem alarming… but take a look at the growth of “Microsoft (MSFT) Sites” (largely BING) from 8.5% in 2009 to over 20% now. Also of note is the 8.3% loss by Yahoo (YHOO) since 2009… although it has grown by 2.7% since April 2014.

It is particularly worth noting that a part of YHOO’s growth in share has come through the decision last fall by Mozilla (provider of the browser, Firefox) to discontinue depending upon GOOGL to drive search within its browser. Without digressing into the details regarding that decision, it may interest you to see the web announcement of that change (from Mozilla):

Two things jump out at us: 1) Yahoo will be the “default” search engine for Firefox; 2) Yahoo will support “Do Not Track” (DNT) within Firefox. Of course, anyone who chooses may switch the “default engine” to a different provider.

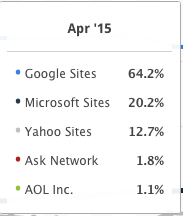

It is also worth noting what the current browser space market share looks like (as of April 2015):

You can see that MSFT (Explorer) holds a commanding 55.8% share, while GOOGL (Chrome) has 25.7%, Firefox 11.7%, and Apple (AAP)L (Safari) just 5.1%!

Speaking of AAPL! Do you remember those heady days of yore (Late Summer/Early Fall of 2012) when the favorite pastime of commentators and investors was to compare GOOGL and AAPL?

1) Which company would you rather own?

2) Which stock price would be the first to reach $1,000/share?

Of course, the “darling” of Wall Street, and first in the hearts of most investors, was AAPL! At the time, it seemed (to many) to be a “shoe-in” to reach $1,000/share! [2]

Well, to shamelessly modify the title of a famous Broadway play… a “Funny Thing Happened on AAPL’s way to $1,000!”

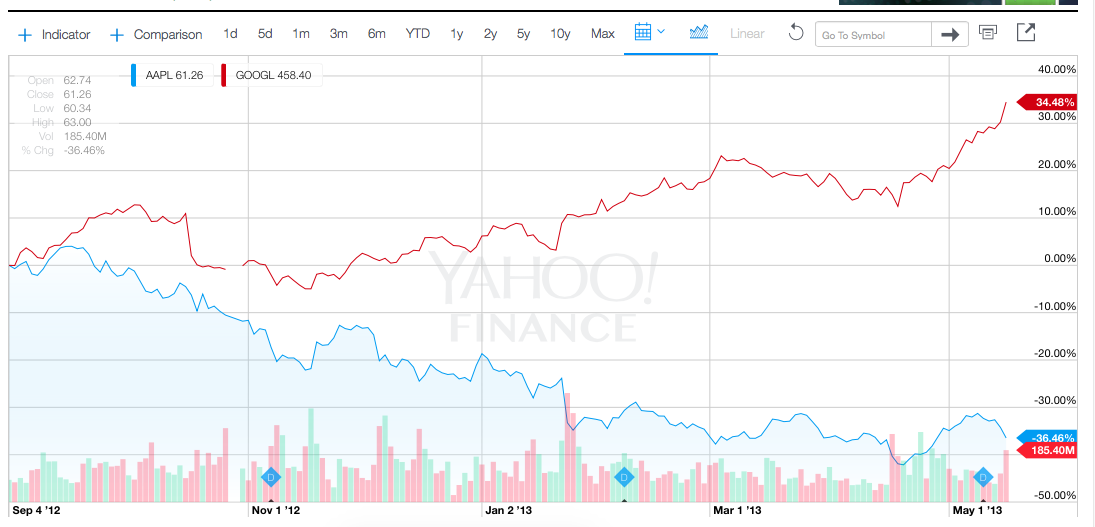

It collapsed from over $700/share (September 2012) to below $400/share (April, 2013). Meanwhile, GOOGL trended upward with very few detours.

Between 9/4/2012 and 5/15/2013, GOOGL “smoked” AAPL … 34.5% to -36.5%… nearly mirror images of one another!!

Between 2012 and 2013, while Apple was moving downward, Google was trending upward in almost mirror-like fashion.

Readers… keep this in mind in the months ahead as you listen to the “expert” commentary on CNBC, Fox Business, and Bloomberg!

While AAPL was taking a “siesta”, Priceline (PCLN) acted like a “lower profile” horse in the Kentucky Derby and captured the “$1,000/share Derby” during September of 2013… followed by GOOGL on October 18, 2013!! They both (figuratively) “left AAPL in their dust”!

Since then, the “stock price derby” has shifted to the “Trillion Dollar Market Capitalization” metric. Let’s provide some perspective regarding that metric:

1) Only one company has ever exceeded $1 Trillion in Market Cap:

PetroChina (PTR). However, that milestone was extremely short-lived!

a) The IPO of PTR occurred on 11/5/2007.

b) That day saw the price nearly triple!

c) Alas, that price level was not sustainable!

d) Within just six months, PTR’s market cap had shriveled to less than $250 billion!!

2) A more helpful level through which to grasp the challenge of exceeding $1 Trillion in Market Cap is the $500 billion level (“half Trillion Dollar level”):

a) The 23rd highest global GDP in 2012 was that of Norway… approximately $500 billion.

b) Just six U.S, corporations have ever exceeded $500 billion in Market Cap:

Apple (AAPL) $750.5 B

Cisco Systems (CSCO) $149 B

ExxonMobil (XOM) $356 B

General Electric (GE) $275 B

Intel (INTC) $163.5 B

Microsoft (MSFT) $379 B

c) Three of the above exceeded the $500 billion level during the “Dot.com Bubble”—CSCO, INTC, and MSFT. In fact, during the first part of the first decade of the 21st Century… even GE topped $500 billion in Market Cap.

d) More often than not in those heady days, MSFT was the biggest of the lot… at one point exceeding $600 billion.

e) However, once the “Dot.com Bubble” burst, GE was left alone in the vanguard

f) XOM exceeded the $500 ceiling in 2007, when oil prices were climbing.

g) As you likely have guessed, AAPL exceeded $500 billion during 2012… but fell sharply thereafter.

3) The growth of AAPL and GOOGL during the first twelve years of the 21st Century was remarkable.

a) From its 2004 market cap of $13 billion, AAPL’s vault over $500 billion was generated by a Compound Annual Growth Rate (CAGR) of 45%

b) For its part, GOOGL grew its own market cap 11-fold in order to become the giant it is today.

4) Highlighting the magnitude of the barrier to a $1 Trillion Market Cap is the fact that (as of 2012) there were only fifteen countries around the globe with an economy that exceeded $1 Trillion in GDP!

a) Therefore, any U.S. company exceeding $1 Trillion in market cap would be (economically) bigger than such nations as Indonesia, Turkey, Saudi Arabia, Switzerland, and the Netherlands.

Where do we stand now?

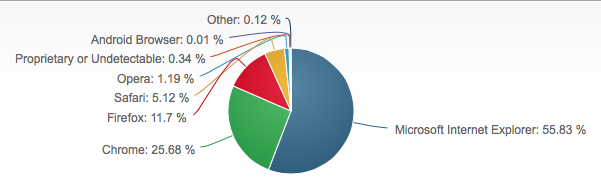

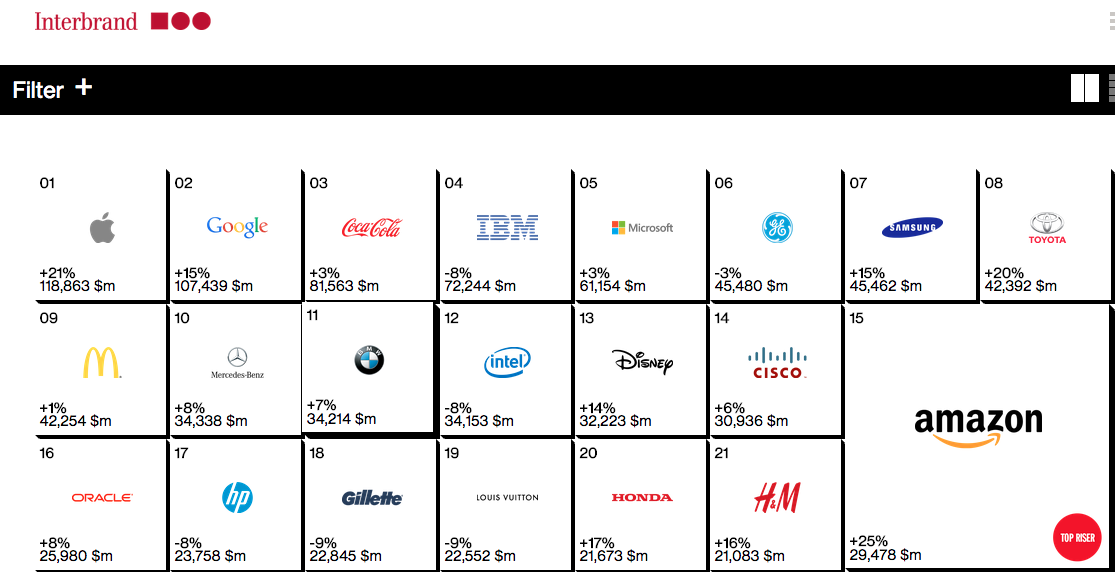

With regard to “global corporate size”, as of 2014, AAPL was considered the largest company and GOOGL the third largest. Of course, greatly contributing to this corporate growth has been the remarkably steady growth of the “brand value” of these two U.S. corporate icons.

Based on the research of Interbrand, take a look at the top four “global brands” in 2014:

And for the “incurably curious” among you, here is the “Top Twenty” list:

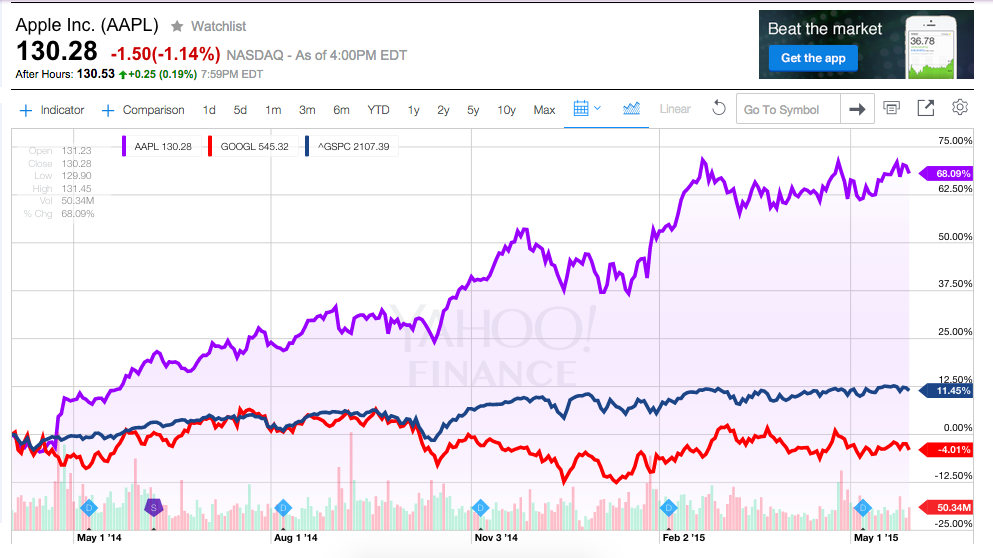

But of perhaps most interest to our beloved readers is the relative performance of GOOGL and AAPL:

1) You’ve already seen how GOOGL smoked AAPL after September of 2012!

2) However, our Market Tamer readers are among the “top of the heap” in “Investor IQ” and surely predicted that such a dramatically one-sided trend was not destined to continue!

3) Well, readers, congratulations! You were correct. Since April 1st of 2014, AAPL has smoked both the S&P 500 and GOOGL…

AAPL Up 68%

S&P 500 Up just 11.5%

GOOGL Down -4%

So, given all of the above, which company would you rather buy here: AAPL or GOOGL? Just to clarify, there is no “correct” answer – it will depend upon your assessment of their relative value. [See Valuation: https://www.markettamer.com/blog/market-valuation-watch-for-the-puca .]

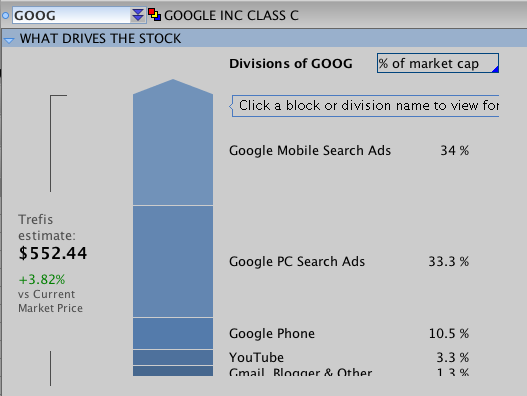

First, it cannot de emphasized enough that these two powerhouses are predicated upon a core business model that are distinctly different:

GOOGL: is largely an Internet Service/Search/Ads provider.

Over 70% of its Revenue is generated by online ads, YouTube, Gmail ads, etc.

Just over 10% of Revenue comes from the “Google Phone”.

AAPL: in sharp contrast, AAPL is predominantly an electronics product manufacturer/merchant, with nearly 80% of its Revenue coming from said products (iPhone leading the way by far (59.3%):

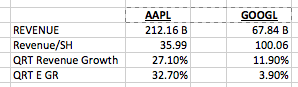

To help you discern your choice between the two, consider these metrics:

Clearly, GOOGL is no match for AAPL on either Total Revenue or Quarterly Revenue Growth. AAPL generates triple the revenue of GOOGL… and grows it at a rate about 2.3 times greater than GOOGL.

It is worth noting, however, that on a per share basis, GOOGL’s revenue metric is triple that of AAPL (because of a lower share float than AAPL).

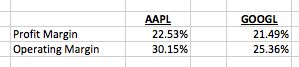

In regard to Profit and Operating Margins… GOOGL and AAPL are in the same general range… quite positive.

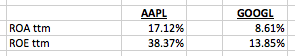

However, within the sphere of Return on Assets and Equity… AAPL once again demonstrates its mettle! It generates twice the return on assets and three times the return on equity.[3]

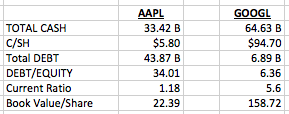

In the area of Cash, you may or may not be surprised that GOOGL far outmatches AAPL … despite regular references through the years to AAPL’s “cash hoard”. In particular, take a long look at Cash/Share! When you see GOOGL’s, your response may likely be: “Geez… I didn’t know it was that high!”

And a quick look at the Debt related metrics highlights that to which I referred in Footnote 3. AAPL has assumed a boatload of debt in the execution of its strategy to “return value to shareholders” – through share buybacks and dividend payouts! That program explains the lowered cash level, and raised levels of debt and debt/equity. (As well as a weaker Current Ratio).

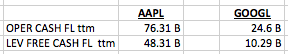

Finally, note the tremendous amounts of cash generated by each firm (annually… trailing twelve months (ttm)). This “cash machine” is what drives AAPL’s shareholder value strategy… and enables it to be able to afford buybacks and dividends. In fact, many of the big “tech” names have become “cash machines” – enabling those companies to pay out a dividend and/or engineer stock buybacks!

Of course, our readers know that this “Maximize Shareholder Value” strategy has been building for years now. As we proceed further, I will try to sidestep the issue of the “wisdom” of that strategy… and stick with the available ascertainable data.

During April of this year, large companies executed a new monthly record of $141 billion in buybacks (according to Birinyi Associates). Birinyi further observed that already pre-announced buybacks among U.S. companies constitutes the strongest start ever in that area. In the event that the current pace continues, Birinyi projects that total buybacks by S&P 500 firms during 2015 will approach $1.2 trillion!! That would break the prior record set in 2007[4] of $863 billion! For recent perspective, the buyback total in 2014 was just under $680 billion.

As Randy Bateman (CIO at Huntington Asset Advisors) notes, within a low-growth economy reflecting a lower than normal recovery of consumer and business buying activity following a recessionary period:

“Buybacks are something corporations can take control of and at low borrowing costs, they’re a viable option.” (This means that companies (like AAPL) can borrow money at low rates to repurchase shares)

The fact is that this option has become so appealing (and prevalent) that the current level of cash flow that CEO/CFO’s allocate (on average) to stock buybacks is over 30% — nearly double the cash flow percentage allocated back in 2002 (based on Barclays data). Of course, mathematics dictates that such increased cash flow to buybacks must come from somewhere. Part of this increased flow to buybacks has been taken from capital spending – which in 2002 consumed more than 50% of cash flow, but now receives about 40%.

This strategy is appealing for a number of reasons[5]. David Lafferty of Natixis Global Management has offered one of these reasons:

“Buybacks have become sort of the low-risk medicine in the C suite. The reality is capital expenditure comes with risk, significant amount of risk, especially in a slow-growth world. Buybacks offer a lot of flexibility.”

Besides making investors “happy”, buybacks reduce the number of stock shares outstanding… immediately improving all the “per share” financial metrics of a company! With one stroke of the pen (ordering a share buyback) a CEO can help her company’s financial health look better!![6]

Just so I do not open myself up to accusations of being a “Pollyanna” about buybacks… I should remind readers that nothing good in life (or in business) comes without some cost or downside. Those who want to be reminded of four basic drawbacks of buybacks can read the footnote that follows.[7] [Remember I promised to not talk down the dividend/buyback strategy! Hence those points are relegated to a footnote!]

At this point you might be wondering whether I have forgotten that this article is about GOOGL… not “buybacks”. You are correct… and your observation offers a great segue into the basic purpose of all of the above!!

Readers, what is the most obvious thing (besides the iPhone) that AAPL has and GOOGL does not have?

A share buyback program and a dividend!!!

Yes, unlike so many of its mega-sized tech counterparts, GOOGL has no dividend and no share buyback program!!

There is one overriding reason that (as of now) no high-profile hedge-fund activist has yet glommed onto a 9-10% share of the company’s shares and started a public (and corporate) campaign pushing for a commitment to share buybacks and/or a dividend! That reason can be found as easily and quickly as the second paragraph of the Wikipedia.org article on GOOGL:

“Google was founded by Larry Page and Sergey Brin while they were PhD students at Stanford University. Together they own about 14% of its shares but control 56% of the stockholder voting power through super-voting stock (untraded).”[8]

Therefore, it is not likely that even the boldest hedge fund icon would engage the GOOGL board in a high profile struggle over buybacks/dividends. But, despite the fact that GOOGL won’t have a Carl Icahn-like “knight-in-shining-armor”[9] to unlock the cash hoard for shareholders as he did for AAPL shareholders… there are pressures that can be brought to bear on management to see the rationale behind such a strategy.

Let’s see if we can put together a quick bullet point list of reasons why a buyback plan would be justified:

1) If you agree with me that AAPL has a compelling reason to keep spending on R&D to keep its products ahead of the rapidly moving “tech curve”… consider that it spent about 3% of its trailing twelve month revenue on R&D this past year!

a) In rather sharp contrast, GOOGL allocated more than $10 billion to R&D during the past four quarters… about 15% of its revenue!!!!

b) It can be argued that a number of the millions/billions spent by GOOGL in past years on acquisitions can be questioned from a “return on investment” perspective.[10]

i) One well-known major acquisition that comes to mind in the category of “winner” is YouTube… adding positively to revenue and profit; and DoubleClick is exemplary of an acquisition that leverages GOOGL’s bread and butter “Search” business.

ii) One acquisition that (on balance) was a “loser” both figuratively and literally (they just sold it for a huge loss) was “Motorola Mobility”.

iii) Most of the other acquisitions have not been (for most folks at least) “top of mind” in terms of size, success, or profitability.

iv)Therefore going forward, the funds spent on R&D related to those concerns within GOOGL may not have a current or near-term profitable “payback”.

c) One of the things at which GOOGL excels is “headline making”

i) In recent years, recall these “splashes” in the news:

Google Driverless Car

Google Wallet

Google Glass

Google Watch

Google TV

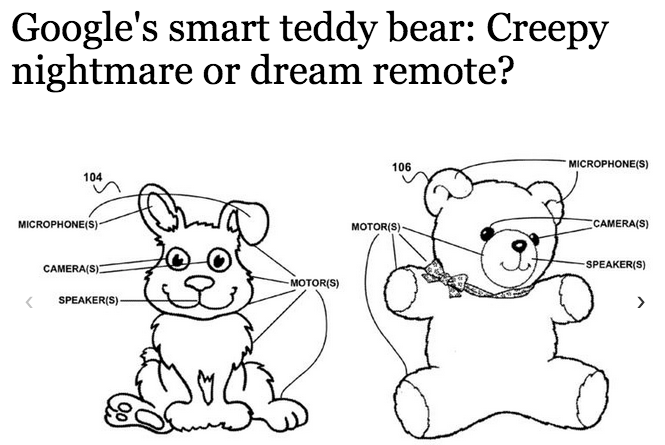

ii) Just this past week, this was big news:

d) There is no doubt that “innovation” is crucial within U.S. business.

However, there is much to be said about “Innovation with Focus”.

i) A number of commentators have referred to GOOGL as the “Thomas Edison” of U.S. industry because of the many technological innovations it has developed (and continues to juggle).

ii) However, Thomas Edison the private inventor was not a publicly traded company. And he tended to “focus” his innovation work (by necessity as much as choice).

iii) Some suggest that GOOGL needs to refine its focus and prioritize asset allocation on the basis of short and intermediate term profitability.

2) Until that is accomplished, I think I’ve made the case above that GOOGL stock itself could use a “shot in the arm”.

a) The quickest “shot” would be a buyback program.

b) It is also the easiest in that it can be a “one-time” program, if management is not yet ready to commit to any annual dividend.

c) The standard “buyback” Wall Street might expect from a company like GOOGL would (normally) be in the 5% of market cap range. With an estimated market cap of $374 billion, that means that Ms. Porat could reasonably be expected to announce an $18.7 billion program, if the management and board agree that a buyback is an appropriate strategy.

d) Can GOOGL “afford” such a strategy? Yes!

i) Recall above that it has Operating Cash Flow of over $24 B.

ii) Analysts are projecting that GOOGL will grow its cash by at least $20 B during 2015 and 2016;

iii) One particular analyst expects that the total cash pile at GOOGL will exceed $100 B by the end of 2016!

iv) As hinted above, given the current historically low levels of interest rates, it would be worth considering a financing strategy similar to that of AAPL … particularly since GOOGL has a relatively negligible level of debt!

That strategy conserves cash and leverages the positive of super low rate debt

3) Why would “now” be an optimal time for GOOGL to initiate a buyback/dividend program?

a) It has a new CFO… and one from investment banking giant MS, no less.

i) Therefore, Pichette’s presumed bias against buybacks is now a matter of the “past”.

ii) And Porat has valuable connections within the investment banking world through which to pull off a very attractive financing strategy for a buyback/dividend program.

b) An announcement regarding such a program could be positively interpreted by Wall Street as demonstration of the willingness (by GOOGL management) to exercise flexibility in cash allocation… depending upon which allocation will deliver “better return” for the investor!

i) We know that Warren Buffett has been struggling to find productive use of the annual influx of cash generated by the coterie of businesses owned by Berkshire-Hathaway (BRK.A).

ii) Well friends, GOOGL’s cash is currently growing at twice the rate of BRK.A.

c) As GOOGL continues to grow and search for top-notch engineers, programmers, and executives, the trajectory of its underlying stock becomes quite important because of the central role that stock options play in the luring and retention of such key employees!

i) In the past few months, even former CFO Pichette admitted that “price matters”:

“I just can reiterate the same message that I give on a regular basis, which is share price does matter. It matters to our board. It matters to all of us. … We do review this issue on a regular basis.”

d) And as a potentially big “bonus”, if GOOGL initiates even a modest dividend … GOOGL would then (suddenly) qualify for purchase by those (many) funds and ETFs whose explicit investment “mandate” is limited to the holding of those instruments that generate dividends.

i) It always helps a stock when its “pool of investors” grows!

INVESTOR TAKEAWAY:

I’d characterize the central takeaways from this article to be (at least) the following:

1) GOOGL has been underperforming “the Market” for quite some time;

2) In this slower than normal economy, with GOOGL’s “growth” prospects no longer toward top of market “growth darlings”, management may be well-advised to recognize that GOOGL is no longer primarily prized as a “high growth” vehicle.

3) Given the incredibly broad range of GOOGL products and the numerous “projects” currently in place, it may be prudent to demonstrate to investors and Wall Street alike that its near-term profit growth and near to intermediate term stock price actually “matter” to both management and the board!

a) One such step would be to prioritize the allocation of cash toward uses that better maximize both stock price and stock value.

4) With a new CFO in place who brings with her investment banking connections and expertise, now could be an opportune time for GOOGL to try what for it would be a “new thing”.

5) I believe we have demonstrated that a buyback and/or dividend strategy is well within the financial ability of GOOGL… and would, in fact, demonstrate both a reasonable and achievable way of (very efficiently) enlarging its “investor universe” and maximizing shareholder value!

With regard to trading GOOGL… short of Page/Brin/Porat adding me to their VIP contact list… we have no way of knowing if or when GOOGL might announce a buyback and/or dividend. Since any announcement of such a program would likely cause something of a “bull rush”… the worst trade one could make right now would be to sell a naked bear call (or short the stock).

If one is of the mind that GOOGL has established a reasonably dependable (albeit wide) trading range, she/he could sell bull put spreads at her/his comfort level. And if one was particularly venturesome, he/she could put on an Iron Condor at deltas of less than 20. However, such a position would expose one to a significant gap up if/when GOOGL announced a shareholder value plan!

And of course, if one doesn’t mind tying up lots of capital, one could just buy shares of GOOGL outright… and wait.

Finally, folks, lest any of you began wondering about the “Market Cap” leaders when we touched on that $1 Trillion Market Cap “Race” much earlier… here are some current numbers for perspective:

AAPL $764 B[11]

MSFT $379 B

GOOGL $374 B

XOM $356 B

BRK.A $353 B

Let’s see now… hmmmm… my money is on AAPL!![12]

And just to remind us all that there is a vast difference between high “stock price” and high “market cap”… here are the caps for two current high-priced Wall Street favorites:

PCLN $ 61 B

NFLX $ 38 B

DISCLOSURE

The author has owned positions in GOOGL in the past, but does not do so currently. He does currently hold positions in AAPL. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] No need to feel badly for Porat that she is arriving at just the time that “bonuses” are curtailed!! Her announced package includes: 1) $650,000 salary; and 2) $5 million signing bonus… in addition to $65 million in stock grants that vest over the 2015 through 2019 period. Even I might be able to scrape by with that package!!

[2] I confess to being a skeptic at heart… and I kept snarling at every broker-like “expert” on CNBC that declared, with little equivocation, that AAPL’s next price level (from $700/share) would be $1,000/share!! They ignored my snarling!

[3] Those who understand leverage will immediately recognize the impact on ROE that springs from AAPL’s debt… magnifying ROE.

[4] Another ominous sign of a market peak??

[5] Including getting Carl Icahn off your back!

[6] It doesn’t hurt the odds of the company’s performance for the year meet or exceed standards set by the board – thereby enabling executive bonuses to be paid out!!

[7] Drawbacks:

1) In the first quarter of 2015, cash returned to shareholders exceeded profits for the first time since 2009 (per data from S&P 500 and Bloomberg);

2) The reduction in capital investment funds alluded to earlier has left U.S. companies with the oldest pants and equipment in nearly 60 years;

3) If one excludes 2001 and 2008 (recession years), the share of corporate earnings since 1998 that has been utilized for dividends and buybacks has averaged approximately 85%

4) A “buyback” is an implicit admission by management that that are unable to find a compellingly profitable use for their cash… or at least compelling enough to make a “buyback” the second most appealing use for those funds.

5) Buying stock back at prices that everyone I talk with agrees is near a market cycle top does not seem (on the face of it) a particularly ingenious idea. It runs contrary to the dictum: “Buy low; sell high!”

[8] They incorporated Google as a privately held company on September 4, 1998. The company’s IPO was on August 19, 2004… making GOOGL almost “11 years old.”

[9] I am being utterly sarcastic, my readers. Carl Icahn is closer to a shining corporate parasite that a shining knight! And his recent analysis showing why/how AAPL should be worth $245/share is both laughable and a patently obvious attempt on his part to play up the price so he can start selling his huge hoard of shares at higher prices!! He’s love to “distribute” his shares to you!

[10] During the past three years, GOOGL spent $17.6 billion on acquisitions. Amazingly. But, those transactions required just 50% of the total cash generated during that period!

[11] Do not quote this… because there are countless estimates of this metric out there… But based on the number of shares outstanding as of April of this year… my projection was that the AAPL price would need to exceed $173.60 in order to reach/exceed a $1 Trillion market cap.

[12] You know what a risk-taker I am! A $173.60/share price may not come quickly… but short of some other company developing the next “miracle product” none of us can live without… I’d say AAPL is the frontrunner.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Thinking of Buying Archer Aviation Stock? 3 Things You Should Know

Thinking of Buying Archer Aviation Stock? 3 Things You Should Know