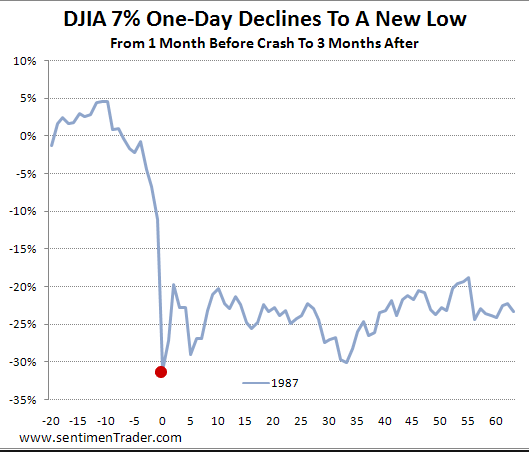

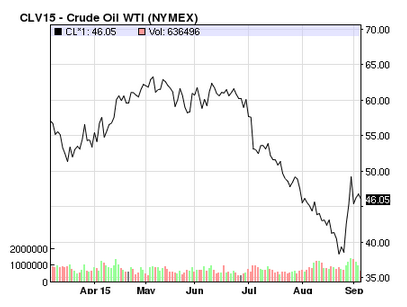

Although there was plenty of Storm and Stress in the U.S. Stock Market on August 24th (2015)... "Black Monday" was much worse in October of 1987, as this chart illustrates!

COULD GOETHE AND SCHILLER HAVE IMAGINED BLACK MONDAY?

Two historical figures who would be very much at home within the current market environment (August 11 through September 3) are Johann Wolfgang (von) Goethe and Johann Christoph Friedrich von Schiller — two great German minds from the 18th Century who were leaders within the “Sturm und Drang” literary movement[1].

For me, about the only consolation that came from the chaos and carnage in the financial markets during the second half of August was (finally) being able to draw upon at least some of what I learned during six years of class time and grueling homework as a student of the German language (during high school and college). Wow, a real life application for all those (misspent) hours!

“Sturm und Drang” means “Storm and Stress”, and refers to a movement that sought to overthrow the “cult of rationalism” that dominated the Enlightenment. In juxtaposition to “rationalism”, Goethe and Schiller exalted human individualism (subjectivity), feeling, and nature…. which often trends toward a bit of chaos rather than dependable order, and brings with it “storm and stress”.

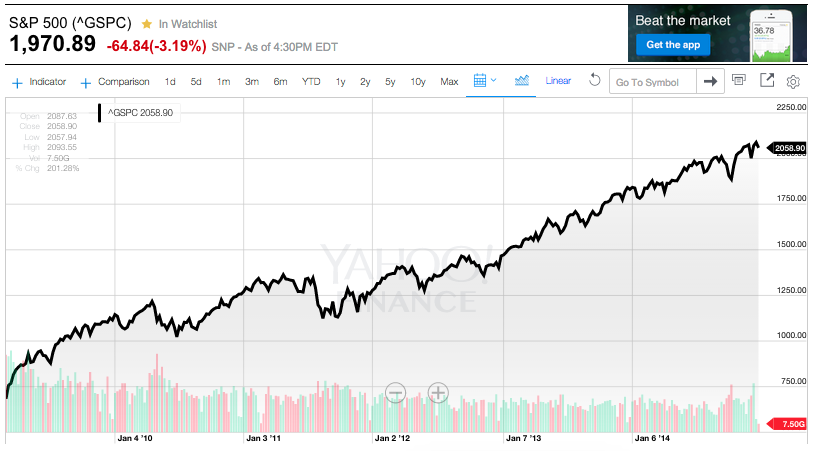

Between 8/11 and 9/3, we can surely see market storm and stress! The S&P 500 Index (the lower line) moved downward as far as 11.6% (the biggest drop coming on “Black Monday”, 8/24) and ended up down about 7.3% for the period. Meanwhile, iShares 20+ Year Treasury Bond ETF (TLT) tailed off by almost 2.7%.[2]

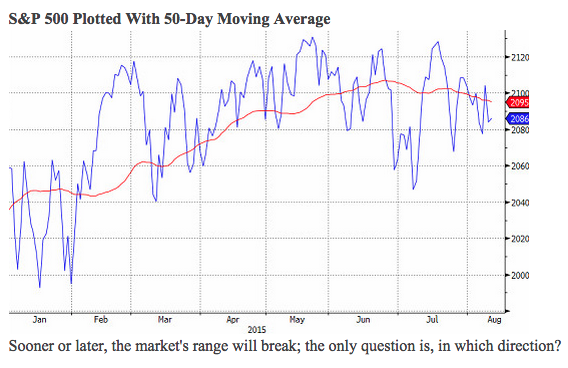

Even before “Black Monday”, the market looked quite dark and stormy:

1) On August 13, Bloomberg noted that the S&P 500 Index had been acting indecisively … with a record number of “crossings” (up and down) of its 50-day moving average. As you can see in the caption for the image, that observation was prescient:

2) Also evident were a number of significant divergences, such as:

a) While the indices were moving upward or plateauing, the Advance/Decline Line indicated market weakness.

b) Several of the best-known, high profile large cap growth stocks demonstrated strength (such as Amazon (AMZN) and Netflix (NFLX)), but the market itself was feeling “heavy”.[3]

c) While the S&P 500 (2.2%) and Nasdaq Index (2.5%) were up between July 8 and August 14, the “riskier” iShares Russell 2000 Index (ETF) (IWM) was down 1.7%.

3) As the very next week played out (August 17-21) the Dow Jones Industrial Average (DJIA) endured three-consecutive triple-digit drops… and ended up with its worst week since 2011 (down 5.8%). The S&P 500 Index was down 5.8% as well; while the NASDAQ dropped by a deeper 6.8%. Significantly, the S&P broke decisively below its 200-day moving average on 8/20.

4) The DJIA’s drop on 8/21 was a jaw-dropping 531 points (3.1% — the deepest drop since August of 2011).

5) Even the (usual) “darling of Wall Street” – Apple Inc. (AAPL) – dropped 6.1% on that Friday…. and 8.9% for the week.

6) The CBOE Volatility Index (VIX) produced its biggest weekly jump up in history – more than doubling in value.

All of the above offers a sketch of the market environment that led into the morning of August 24th… which has been dubbed “Black Monday”[4]. Here is a list of many of the “low lights” related to that stormy, stressful day:

- The Dow Jones Industrial Average opened down by more than 1,000 points;

- Since U.S. markets have a policy that calls for “Circuit Breakers” to kick into place whenever Dow, S&P 500, or Nasdaq100 futures prices tumble 5% or more, the market day “opened” with an extra level of “Sturm und Drang”.

- Making matters (much) worse, it was obvious that countless individual stocks and ETFs were down by 10% or more[5]… which triggered the invocation of the infrequently seen “Rule 48”[6], which was created by the SEC in December of 2007. Very simply expressed, that rule relaxes normal “opening” trading rules, with the intention that its triggering will ensure a smoother commencement of active trading. Alas, in this instance, the rule served only to amplify the chaotic storm.

- Then the Dow began rallying back…

- But ultimately, the Dow rolled over once more and ended the day down by 587 points (3.6%).

- The huge price swings of the Dow on “Black Monday” resulted in the setting of a new record—the Dow’s largest one-day point decline ever, on an intraday basis!

- The S&P 500 and the NASDAQ ended the day down by about 4%.

- The equity storm was global:

- Japan’s Nikkei Index fell by 4.6%

- Hong Kong’s Hang Seng Index slumped by 5.2%

- The (pan-European) Stoxx Europe 600 Index closed down 5.3% (the biggest one-day decline since the end of 2008).

- Germany’s DAX plummeted by 4.7% — which means that since an April top, it has fallen by more than 20%… putting it into “Bear Market” regions.

- But the prize for precipitous collapse went to the Chinese mainland’s Shanghai Composite Index, which plummeted 8.5%!

- In addition, the price of crude oil fell as low as $37/barrel.

Black Monday was definitely the peak of this market-based Sturm und Drang! One of the most compelling descriptive phrases I ran across regarding the two weeks between August 17th and August 28th was this:

[the Market was] “at a crossroads here stuck between Fear and Bigger Fear!” It may be noteworthy that the report from the American Association of Individual Investors (AAII) Sentiment Survey disclosed that only 26.8% of those surveyed identified themselves as “bullish” (a 3.6% decrease from the week before).”

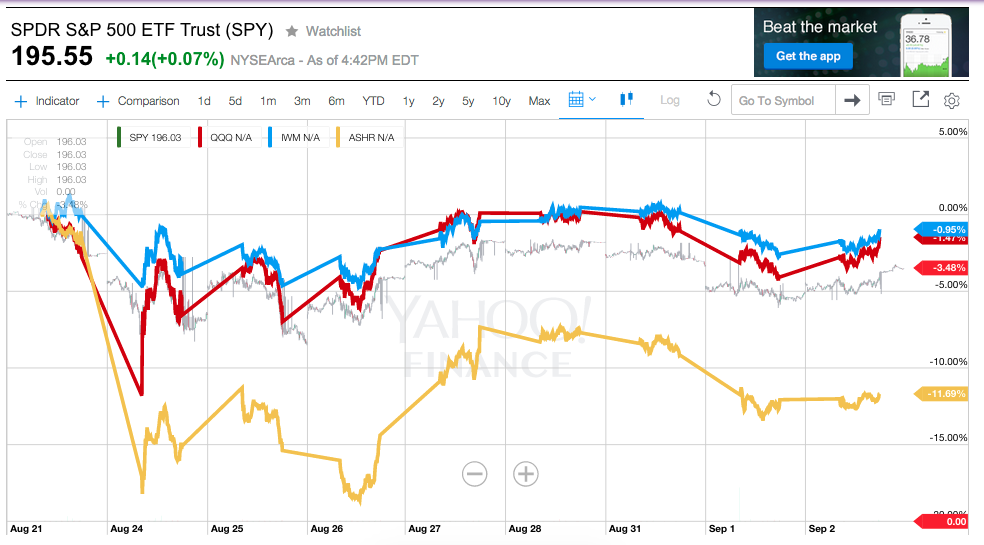

Between August 21 and September 3 (the day before the Nonfarm Payroll Report), here is what the wild ride through global equity markets looked like:

Although ironically, the SPDR S&P 500 ETF Trust (SPY) was up .081% during the week of “Black Monday” (it sure didn’t “feel” like it was up)… consider the performance of various key ETFs during the period between the open on August 21 and the close of trading on September 3: (note that ASHR is representative of Chinese large caps traded in the Mainland market (the so-called “A-Shares)):

SPDR S&P 500 ETF Trust (SPY) -3.48% (think gray line)

iShares Russell 2000 Index (ETF) (IWM) -0.95% (blue line)

PowerShares QQQ Trust, Series 1 (ETF) -1.47% (red line)

Deutsche X-trackers Harvest CSI300 CHN A (ASHR) -11.69% (goldenrod line)

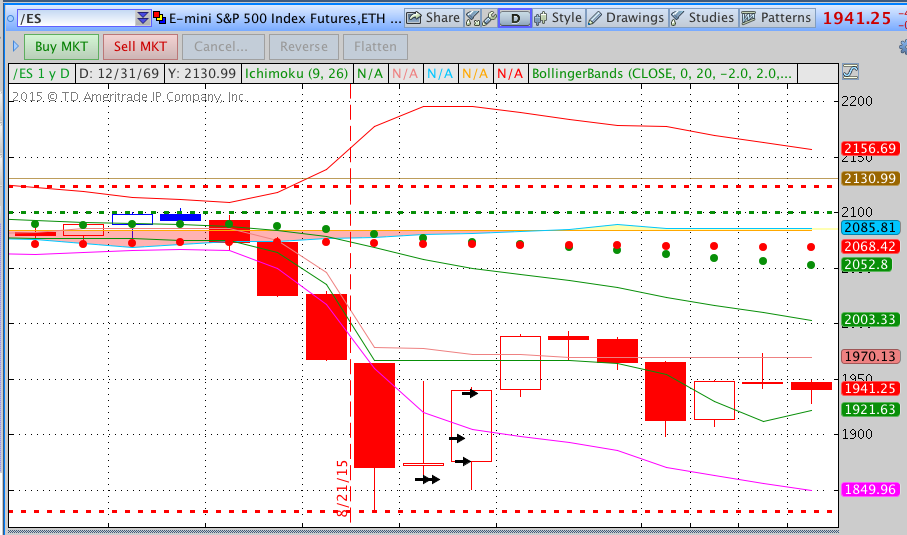

In addition (although market observers will attach greatly varying levels of importance to it), the so-called “Death Cross” (when the 50-day Moving Average dips below the 200-day Moving Average) occurred within the chart of the S&P 500 Index by the close of the week ending August 28 (see the big bold green dots (the 50-day MA) moving below the big bold red dots (the 200-day MA) :

Naturally, in the midst of all this chaotic price movement… this Sturm und Drang… the average investor[7] desperately wanted to know “Why?”! Unfortunately, there must be a fundamental axiom within contemporary journalism schools regarding how to report upon movements within the financial markets… an axiom that might be paraphrased in this fashion:

“Keep it basic… keep it simple. Going into too much detail will discourage viewers/readers from paying attention – thereby lowering Nielsen Ratings and subscription revenue!”

I know that you can recall the typical 2015 headline that has led off the average Bloomberg Radio news update (or a CNBC “tease” leading into a commercial break):

“Stocks down because Greek debt relief talks are stalled.”

“Stocks tumble because of a poor PMI Index number from China.”

“Stocks soar because of Yellen’s dovish comments at her press conference.”

“Bond yields move up because Richard Fisher (a Fed voting member) indicated it is time to raise the Fed Funds Rate (during a speech earlier in the day).”

Really? Are they serious? How can anybody (with a straight face) honestly believe that the “Market” moves up or down on any given day because of one single solitary reason?

Let’s pause for a moment and consider an analogy. Imagine that when you saw your best friend this morning, you said “Hello, how are you?”, and he proceeded to punch you in the nose. You stand there, in considerable pain, bleeding, and wondering what just happened. All you know is that you said “Hello” and then you got punched straight away. Are we to therefore conclude the following: “Best friend gets his nose broken because he said ‘Hello!’?”

Of course not! If we were privy to a much larger set of facts, we might discover some (key) recent developments in your best friend’s life, such as:

1) His beloved dog and companion got run over by a car;

2) He was summarily fired from work for refusing to sell a poor performing fund to a client, despite pressure from his boss to help the office’s monthly sales metrics look better;

3) His 2010 Honda CRV was side swiped by a truck whose driver had been driving beyond the “safe driving” limit for consecutive hours without rest. The body shop estimate for the repair was just below his $1,000 insurance deductible;

4) His dentist just informed him he has five cavities that need to be filled, and will likely need a root canal, too;

5) His aging mother, for whom he handles all of her financial affairs and troubleshoots most of her daily problems, just told him that he is “The worst son with whom God has ever cursed a mother!”

Hmmm? Considering how much pain, frustration, and hopelessness was coursing through your friend… you might actually offer thanks that he didn’t just rip your head off! A bloody nose is much easier to handle than reattaching your head!

My point is that very few things in life are as simple as either journalists or human beings would like to imagine they are!!

In this connection, a new book about Warren Buffett’s long-time business partner, Charlie Munger, includes this amazingly insightful observation from Munger about genuine wisdom:

“What is elementary, worldly wisdom? Well, the first rule is that you can’t really know anything if you just remember isolated facts and try and bang ‘em back. If the facts don’t hang together on a latticework of theory, you don’t have them in a usable form. You’ve got to have models in your head. And you’ve got to array your experience ‑ both vicarious and direct ‑ on this latticework of models.”

In other words, individual, isolated facts are neither terribly helpful nor ultimately meaningful. Instead, each of us needs a framework (a “model”) through which to organize all those individual facts into a constructive, functional understanding of reality.

Applying Munger’s “wisdom” to the practice within the financial media of focusing strictly on one or two facts demonstrates how misleading the exposure to any given information provider can be – particularly regarding anything as complex as global finance!

Personally, I know that whenever I travel long distances by car (and I must therefore depend upon the radio for market information) I become confused (and very frustrated) when I hear different stations characterizing that day’s “Market” action with what I consider widely different adjectives, ranging from: “slipping”, “descending”, “falling”, and “tumbling”… to “plummeting”. I swear there are days when I walk away wondering if a few of those stations were actually reporting on a market from a parallel universe. And of course, the wider the fluctuations in market price on any given day… the broader is the range of different interpretations that will be offered regarding the answer to the question “Why?”

So let’s move on to my own best efforts attempt to offer a “Why?” that is more inclusive than the typical report from the CNBC, Fox Business, WBBM (a Chicago news radio station), or the Chicago Tribune:[8]

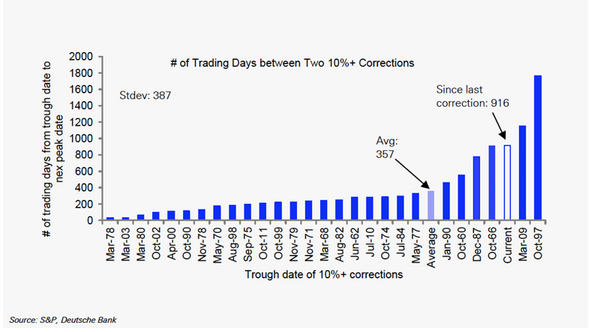

1) We were “overdue” for a “Correction”.

a) Markets never go straight upward. According to a recent Deutsche Bank study[9], the average rally period without a correction is 357 trading days.

b) Prior to August (2015) we had moved up by 220% since March of 2009 … without such a correction.

2) Related to point 1) is the fact that (as we have reported at several points in months past — most recently in https://www.markettamer.com/blog/market-valuation-watch-for-the-puca) the market had become overvalued by virtually every measure conceivable[10].

a) In this regard, one of the most frequently referenced “Valuation Metrics” within the financial press is Robert Shiller’s[11] CAPE RATIO. It has been unusually high for an extended period. (See https://www.markettamer.com/blog/how-to-cope-with-cape-fear-a-look-at-valuation-and-volatility )

b) Following the August carnage in the financial markets, one financial publication highlighted Shiller’s work once again. Although Shiller did not offer any particularly new insights (at least no new insights not already illuminated earlier this year) he did make a oblique reference to his own portfolio, which has been “underweighted” in equities this year.

c) Recall my theory regarding the axiom that must be the guiding principle in journalism schools today: “Keep it basic… keep it simple. Going into too much detail will discourage viewers/readers from paying attention!” That seemed very much top of mind for the editor of this recent article about Shiller… because he titled that article:

i) “Shiller Ditches U.S. Stocks, Says It’s a ‘Dangerous Time’”

ii) I actually re-read the article to see if I missed something. I confirmed that I hadn’t. I only found that which I knew already knew weeks ago. The fact is that Shiller had not actually “ditched” U.S. stocks entirely. He was merely exercising caution.

iii) Therefore, I present this article as another “exhibit” in the case that can be made that the financial press is, far too often, extremely misleading… if not downright deceitful.

3) Since July 13th,[12] China has (largely) replaced Greece as the chief focus for global market observers and pundits. As we have noted in several recent articles related to China (https://www.markettamer.com/blog/danger-china-red-alert; https://www.markettamer.com/blog/a-free-market-or-macau-with-margin-part-i ;

https://www.markettamer.com/blog/a-free-market-or-macau-with-margin-part-ii ;

https://www.markettamer.com/blog/ashr-or-fxi-or-perhaps-the-mix-in-cn )

two primary economic/financial fears have crystallized this year within China:

a) A slowdown in the “Economic Growth Engine” that China has provided the world over the past few years.

i) It appears that China is on a path to fall under 7% projected economic growth moving forward.

ii) Compared to the rest of the world, that is still very impressive growth. But the market has been depending upon 7% or higher growth (not lower).

* Lower growth … therefore lower demand… has negatively impacted oil prices and the larger commodity group in general…

* Which has really been hurting “emerging market” economies… most of which are rich in commodity resources and weak in industrial production

b) The severe (downward) volatility within the Chinese equity markets has precipitated fear in other global markets… and in particular, the ineptitude demonstrated by the Beijing government in handling both the financial dynamics and the public relations tied to Chinese exchange trading has made experts pessimistic regarding how the Chinese markets will fare in the months ahead.[13]

c) An entirely new China-related issue reared its ugly head on August 11th when Beijing announced a “one-time” devaluation of its Yuan, which had been on an upward trend for a decade. See the Wall Street Journal’s streaming video for details: http://www.wsj.com/articles/china-moves-to-devalue-the-yuan-1439258401

i) This quite unexpected move caught the markets by surprise.

ii) As we know, the “Market” detests any “surprise”.

iii) Once again, both the competence and the true intentions of Beijing leaders came into question… especially given the reaction of the Peoples Bank of China (PBOC) to the cross currents in Yuan price movement.

iv) The PBOC threw massive support at the currency market in order to prop up (stabilize) the Yuan … while Beijing continued (simultaneously) to take all the steps needed to support (stabilize) the stock market. Fighting such capital intensive battles as those requires liquid assets… and financial experts have deduced rather large-scale reductions in the inventory that China holds of U.S. Treasury Securities!

v) Speculation regarding how this will play out (in the long run) vis-à-vis China’s goal of becoming a major player within the International Monetary Fund and the inclusion of the Yuan as a prominent part within the IMF Reserve Currency “Basket” adds an additional layer of uncertainty to an already volatile mix of current and potential “China worries”.

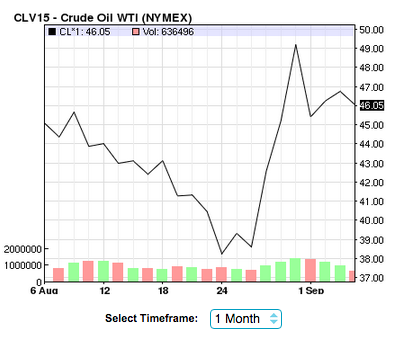

4) As referenced in the points above, the price of Oil, which in the second half of 2014 was widely seen as a net positive for U.S. Consumers (expected to have significantly boosted consumer spending, which it did not)… has become a real drag on the equity market whenever the per barrel price of oil dips below the $40/barrel level.

a) Meanwhile, earnings reports from energy companies have been (obviously) lack luster and prices within the Energy Sector have (by far) underperformed the Market.[14]

b) Some bankruptcies have appeared within the “Oil Patch”… and given the significant presence of oil-related debt within the High Yield Bond space, those ETFs and funds focused on high yield have come under pressure.

c) The price of oil (through Black Monday) was down over 34% since its high earlier this year ($61.43) and is down 62% from last year’s peak.

d) Prior to mid-August, oil’s price had dropped for eight straight weeks (the longest such streak since 1986).

e) Energy stocks currently comprise about 7% of the S&P 500 (it was much higher earlier in the year)… so oil price stability is crucial for stock market stability.

f) Although the current price of West Texas Intermediate Crude is around $45/barrel… we continue seeing volatile price movement.

5) Meanwhile, in the world of Fixed Income securities, one would normally expect some positive movement within bonds during this time of equity market turbulence… as folks seek the (relative) safety of fixed income securities. This would be particularly true within the U.S Treasury Security space… as global investors seek the safety and liquidity of U.S. Dollar assets. However, such normal market interactions and correlations have not been very dependable in recent months. As many experts will tell you, bond portfolio managers have been facing a much more complex challenge during 2015. (See: https://www.markettamer.com/blog/bonds-dying-of-thirst )

a) Consider the example of two tried and true veteran bond managers:

I) Dan Fuss of the Loomis Sayles Bond Fund (LSBRX) … sometimes referred to as “the Buffett of Bonds”.

ii) Bill Gross (formerly the “Bond King”), currently managing the Janus Global Unconstrained Bond Fund (JUCAX)

b) LSBRX was hurt by its exposure to global bonds… particularly bonds denominated in non-U.S. currency (eg. Canada, New Zealand, Australia… all quite negatively impacted by the fall in commodity prices). Year-to-Date (through the end of August) LSBRX was down in value by 4.9%.

c) Meanwhile, Gross had been known to be selling options on volatility prior to mid-August, believing we were stuck in a trading range. Alas, as we now know, volatility exploded, which is about the worst thing anyone selling options could have happen. Consequently, on Black Monday, JUCAX dipped nearly 3%! Fortunately, however, year-to-date through August, JUCAX was down only 2.4%.

d) In sharp contrast, 10-year U.S. Treasuries have been (largely) unchanged for the year-to-date, leaving holders with at least eight months of interest (about a 1.3% return).

e) Add to this mixture of swirling forces impacting the bond market the aforementioned actions by the Peoples Bank of China in supporting its currency.

i) To keep a close track upon the intricate interplay of factors that influence global bond prices, there are analysts who (among other things) tear apart the arcane detail within such scintillating reports as “The Federal Reserve Statistical Release”.

ii) There, in the above report, largely hidden in a footnote that only the most nerdy of financial analysts would notice, was the revelation that “Custody Holdings” of Treasury and U.S. agency securities owned by “foreign and official accounts” (largely non-U.S. central banks) fell by an unusually large $15 billion during that week.

iii) One could posit that a large portion of that dip was due to China selling some of its treasure trove of U.S. Treasury bonds… putting downward pressure on prices…. and thereby accounting for the glaring “lukewarm” reaction within the bond market to the downward storm and stress within the equity market – when normally bonds would soar in response to tumbling stock prices.

f) These details exemplify how difficult the current market dynamics have been … not only because of big currency movements and higher volatility, but also because of the all-important illiquidity issue detailed in the Market Tamer article just referenced (https://www.markettamer.com/blog/bonds-dying-of-thirst.)

6) However, the bond market has not been the only market experiencing a shortage of liquidity. The bank regulatory changes that I highlighted and described in the May Market Tamer article also account for some of the reasons stock trading has experienced bouts of illiquidity as well.

a) Last year, Stephen Schwarzman (co-founder of the Blackstone Group) actually predicted that a “crunch” would result from the higher costs that have resulted from new global bank rules placing serious restrictions on the utilization of bank assets.

b) Alain DeCoster (co-founder of ABS Investment Management in Greenwich, Connecticut) has echoed the concerns raised by Schwarzman: “There’s no doubt that the months ahead are going to be tough ones for the [asset management] industry…. Expect more volatility as markets gap up and down to adjust to the new reality of fewer liquidity providers, and less liquidity in international markets.”

i) The particular regulations referred to here include:

* The Basel III requirements, which are being phased in; and

* The U.S. “Volcker Rule” that restricts proprietary trading by banks.

ii) The week of Black Monday was a perfect case in point… a so-called “Perfect Storm (and Stress)” of illiquidity.

* Here is DeCoster’s take: “Look what happens when you have overwhelming selling and no natural counter parties, fewer market makers, and most of the traders on vacation. Shares of electronically traded funds trade below their net asset values. With all these dark pools and electronic platforms, people are having to look around to find liquidity.”

c) The founder of Seabreeze Partners, Doug Kass, is renown for a mouth that goes where “other mouths fear to tread”. Consider this textbook example of “illiquidity at work” in the marketplace: Kohlberg Kravis Roberts (KKR) opened on Monday at $17.73, then traded down to $8 before bouncing back at $19.50! In response to this currently less liquid stock market… Kass offers this observation:

“This comes from regulatory changes in the banking and investment industry that have reduced the incentives to provide liquidity. The adjustments are occurring at a time when the retail investor has left the market, and when high-frequency trading and leveraged strategies dominate the daily volume as never before. The regulators are asleep.”

d) Of course, there are other issues at work here, as one should expect.

i) There is considerable controversy regarding the merits of Rule 48 and Circuit Breakers.

* Both are well-intentioned, but are they effective or are they dysfunctional?

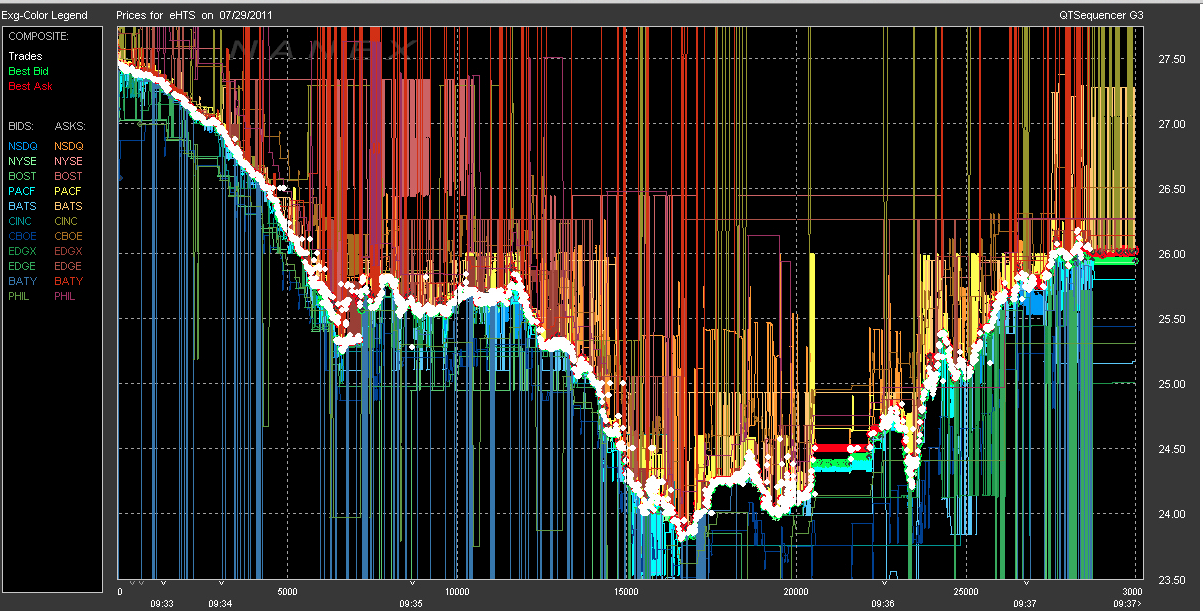

Nanex provide excellent analysis regarding the negative effects of "High Frequency Trading" (HFT). This chart illustrates how computer algorithms engaged in HFT can briefly send stock prices plummeting for a few milliseconds… before recovering. The transactions are executed so fast that individuals can not keep up. The transactions do not necessarily reap high profits taken alone... but on a cumulative basis they generate significant amounts. This chart shows Hatteras Financial (HTS).

ii) It is worth noting that High Frequency Trading was enabled by regulators around the same time as Rule 48.

* Has anyone within the SEC even given brief thought to a rigorous study of whether of not HFT and Rule 48 have been, on balance, either a blessing or a curse?

In our next article (appearing within a day or two), we will wrap up this account of the most basic factors that account for “Why” we have just endured such “Sturm und Drang” in the financial markets. We’ll start that piece with what may be the most intriguing underlying cause for this startling turmoil (hint: it has to do with government intervention), and then we will offer a quite lengthy “Investor Takeaway” section that will try to tie together everything you have read. So keep your eyes on the lookout for it!

DISCLOSURE:

The author does have a considerable portion of his net worth invested in a diversified portfolio of funds, ETFs, and selected stocks – none of which are highlighted in any promotional way in the article above. In addition, the author is not related to either Goethe or Schiller.

Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions

FOOTNOTES:

[1] An illustrative example of this type of literature comes from Reinhard Mey… with which I am certain many traders can relate:

“There was my Sturm und Drang time and I saw a piece of the world

And came home and found half my world was locked

….

How often my turn desperate as often as I stood there speechless

How many times I've seen them until I finally could no longer see

…..

Resistance and contradictions”

[2] As I will suggest later, the fact that TLT did not rally (“flight to quality”) as equities tanked was suggestive itself of two things: 1) assets have become more correlated with each other during times of stress; and 2) the bond market is not in a bullish phase (there is much uncertainty).

[3] Although the fact that he is known as a “perpetual Bear” colors his observation, Societe Generale's Albert Edwards has noted that there is a high probability — 99.7 percent! — that we are already in a bear market. That number is based on the findings of a model that looks at the performance and momentum of high-quality stocks. When investors are aggressively bidding up a narrowing list of good stocks (as they did earlier this year) while ignoring the rest, it typically indicates a period of broad market underperformance.

[4] I need to emphasize that the “first” Black Monday (October 19, 1987… which I witnessed up close and personal) was much worse than August 24th. The Dow plummeted by 22.6% in October, 1987… but a mere 6.6% at its worst level on August 24th.

[5] If the drop occurs during market hours, the 10% drop needs to occur within a 5-minute period for the rule to be triggered. Obviously, if the drop comes before the open, that “5-minute” factor is irrelevant.

[6] From CNBC http://www.cnbc.com/2015/08/24/rule-48-the-arcane-nyse-rule-to-tame-a-wild-market.html : “The goal of Rule 48 is to ensure orderly trading amid financial market turbulence. It's only used in the event that extremely high market volatility is likely to have a floor-wide impact on the ability of designated market makers (DMMs) to disseminate price indications before the bell.

Unlike a circuit breaker that stops stock trading, Rule 48 speeds up the opening by suspending the requirement that stock prices be announced at the market open. Those prices have to be approved by stock market floor managers before trading actually begins. Without that approval, stock trading can begin sooner.

[7] In many cases resembling a “Deer in the headlights”

[8] Remember, I promised a “best efforts” answer… NOT a comprehensive, exhaustive answer!

[9] The study covered stock market action since the 1950’s.

[10] Although I have noticed that “buy side” brokers have a seemingly unlimited capacity to create (seemingly out of thin air) metrics that might suggest we were “under” valued at July levels! Those sort of exercises in salesmanship seem (in my opinion) to be straight out of “Alice in Wonderland”.

[11] Shiller is not a descendant of Johann Christoph Friedrich von Schiiller… but wouldn’t it be cool if he was!!

[13] One small example: Financial journalists in China were told last week not to accentuate the negative in describing the plunge in stocks. Now that takes my journalism school “axiom” and raises the stakes a bunch… moving from “Keep it simple” to “Disregard the facts entirely.”

[14] At one point recently, it was noted that (YTD as of then) the S&P was down by 3%, while the energy sector was down by approximately 20%!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why Bitcoin, Ethereum, and Dogecoin Are Surging Higher Today

Why Bitcoin, Ethereum, and Dogecoin Are Surging Higher Today