Ever since we entered the era of “24/7” coverage of financial and investment news on television and the Internet, there has been a discernible pattern: news channels and media commentators tend to focus upon certain “hot button” topics ad infinitum. In my opinion, the result has been the dilution and diminishment of the quality and reliability of any particular news story or analytical commentary.

The first 24/7 cable news network was founded in 1980 by (former Brown University student) Ted Turner!

During the past couple of years, two glaring cases-in-point of this pattern have been:

1) A prospective “Greek Exit from the Eurozone” (aka “Grexit”)

2) When the Federal Reserve will “push the button for ‘Liftoff’” [“Liftoff referring, not to the launching of a rocket, but to the first increase in the Federal Funds Rate in almost ten years).

As we all know, the pattern has been to trot out this or that “expert” on the topic at hand and have them hold forth for anywhere from a few minutes to a more extended interview on the issue. As I was traveling in July, I was subjected to nearly “wall to wall” coverage of the latest iteration of the “Greek Debt Crisis” (on June 30th, Greece defaulted upon a 1.6 billion Euro payment related to a loan from the International Monetary Fund (IMF)) … so a number of “authoritative experts” were trotted up to the microphone to posit (usually with an extremely confident tone in their voice) that Greece was absolutely headed toward either an imminent voluntary exit from the Euro… or they would be “pushed out” by the other Euro members. As an example of that overly confident “tone” from this past July, here is an excerpt from a July 1st article published in Forbes[1]:

“…the country was marked up at 7/4 to leave the Eurozone within six months by online bookmaker Betway…a provider of sports betting.

“While it’s currently 2/5 that Greece will still be in the Eurozone by the end of the year, the odds of a Greek exit are shortening all the time [according to Alan Alger, Betway’s London spokesman]. (Note: Odds of 7/4 mean that a successful bet of £4 (c.US$6.30) on an exit outcome would return £7 (c.US$11) plus the original stake – i.e. £11 (c.US$17.35)).

“Elsewhere, Paddy Power, Ireland’s biggest betting firm, has had the odds on Greece remaining in the Eurozone in 2015 at 4/9 – i.e. a successfully placed £90.00 (c.US$142) bet would scoop £40.00 (c.US$63) – yielding a total of £130 (c.US$205). Ladbrokes meanwhile recently rated the Greeks backing the forthcoming referendum at 4/7 versus a rejection chalked up at 5/4.”

How was I feeling after hearing all that confident commentary? My mind told me that these commentators didn’t have any clearer a “crystal ball” than anyone else, and my mind reminded me that German banks have far too much at stake to let Greece totally “bail” on all that sovereign debt! Alas, I didn’t have the courage of my conviction and “played it safe”. Therefore I did not profit, even though I was absolutely correct!

Moving on to the Federal Reserve, I cannot begin to count the number of times the “listening public” has been prepared by the media for what was almost certain to be a “Fed Funds increase” – starting years ago.[2] To paraphrase an old (sarcastic) saying about errant market “prophets” – media pundits have predicted 9 of the past one Federal Funds Rate increases!”

In fact, the cynic in me has come to believe that a veritable “cottage industry” has spring up during the past 5-6 years – within which often self-proclaimed “experts” make themselves available to appear on TV or radio (or be interviewed for attribution and publication… all in return for an honorarium) regarding any credible, topic – particularly the “Grexit” and/or the “Federal Reserve’s next rate hike”. Meanwhile, they regularly practice honing their “air of confidence and authority” as a major emphasis in their professional growth.

Well, thank heavens the growing (almost unbearable) tension regarding the Fed’s rate hike has now been dissipated. The December 16th announcement of a modest 0.25% increase in the Federal Funds Rate is (as mentioned earlier) the first increase in that rate since mid-2006. That is why this event has been referred to as “Liftoff” – the expectation being that additional rate increases will be coming in the months ahead.

All I can say is “Ugh!” This “Liftoff” now means that we will undoubtedly continue to be tortured whenever we approach a future Federal Reserve Bank Open Market Committee meeting. Making it even worse is the reality that we will not just be besieged and beset by “experts” holding forth on if the Fed will increase rates, but even (heaven help us) whether the Fed might actually lower rates!

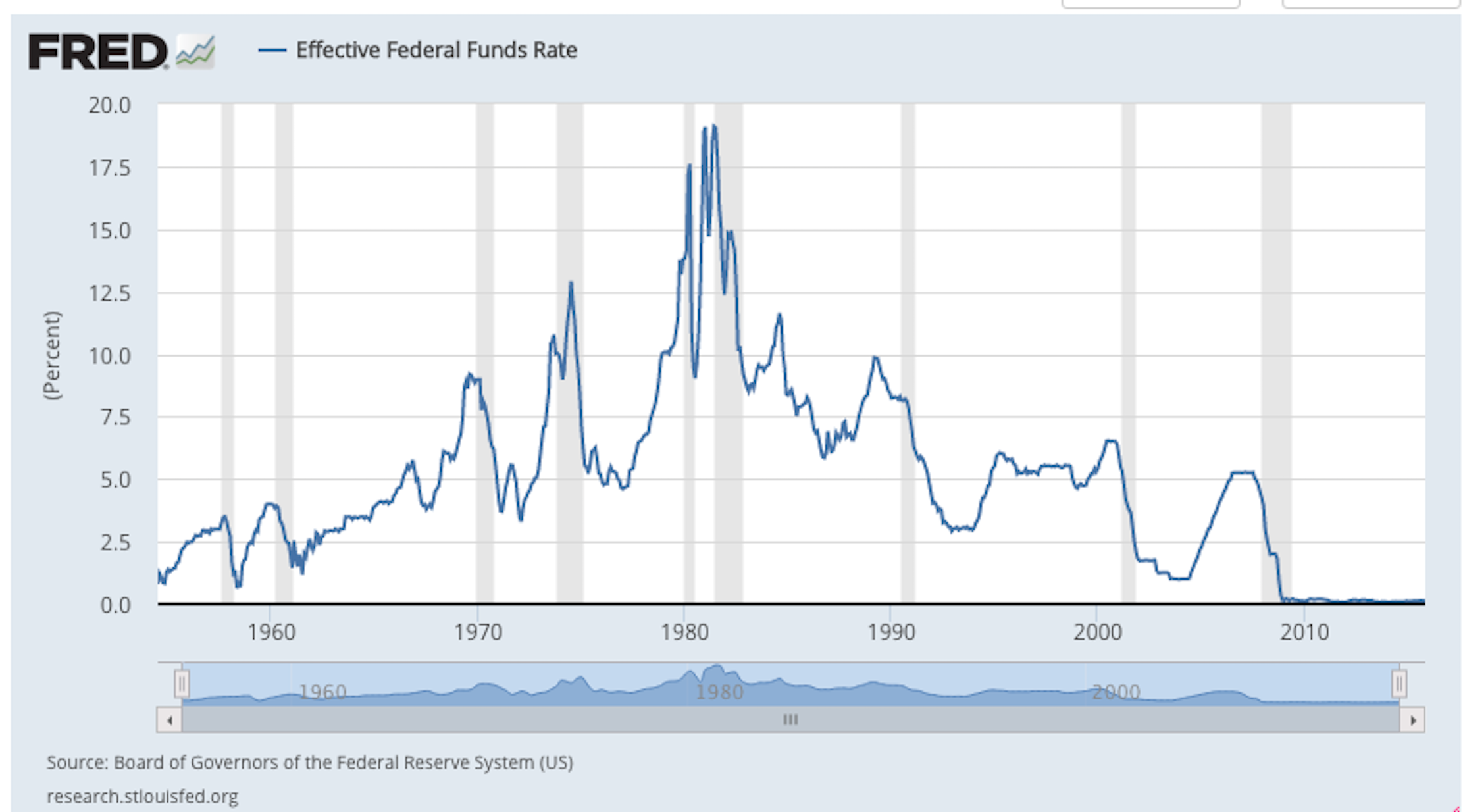

Since 2006 (the most recent prior rate cut) was a long time ago[3], it is extremely easy to lose our perspective on both the importance of interest rates and the powerful dynamic at work between the financial markets and interest rates.

For that reason, I have prepared a number of tables and graphs that should help each of us to gain even more perspective (and therefore clarity) regarding why this latest rate increase holds particular significance.[4]

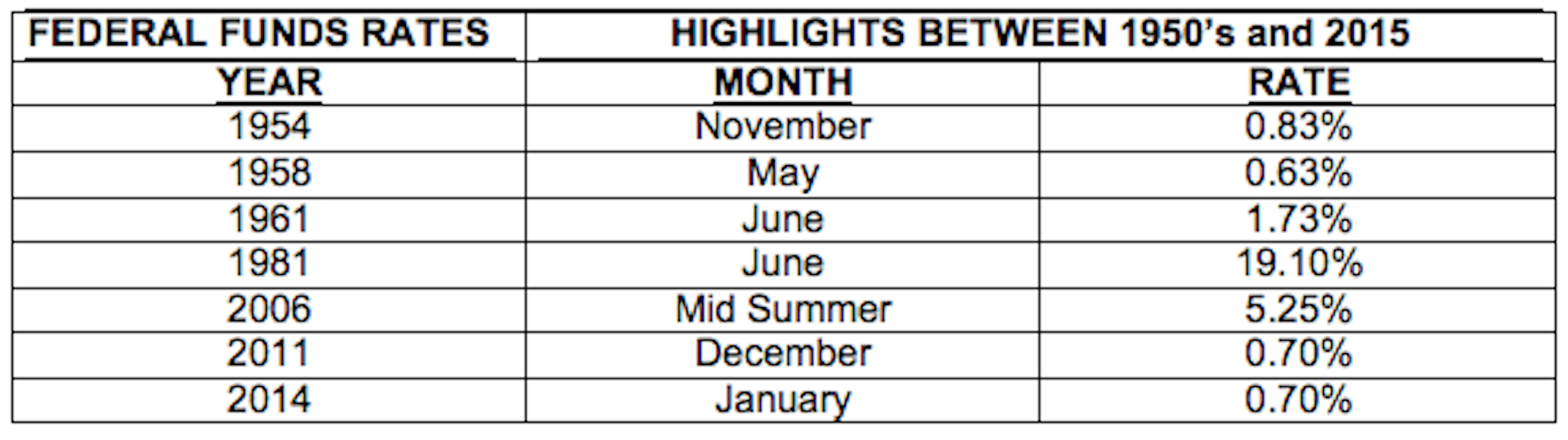

Here is a chart of the Fed Funds Rate since 1952. This makes it very clear that (during the past 9.5 years) we have not only enjoyed historically low rates… but have enjoyed them for an unprecedentedly long period of time!

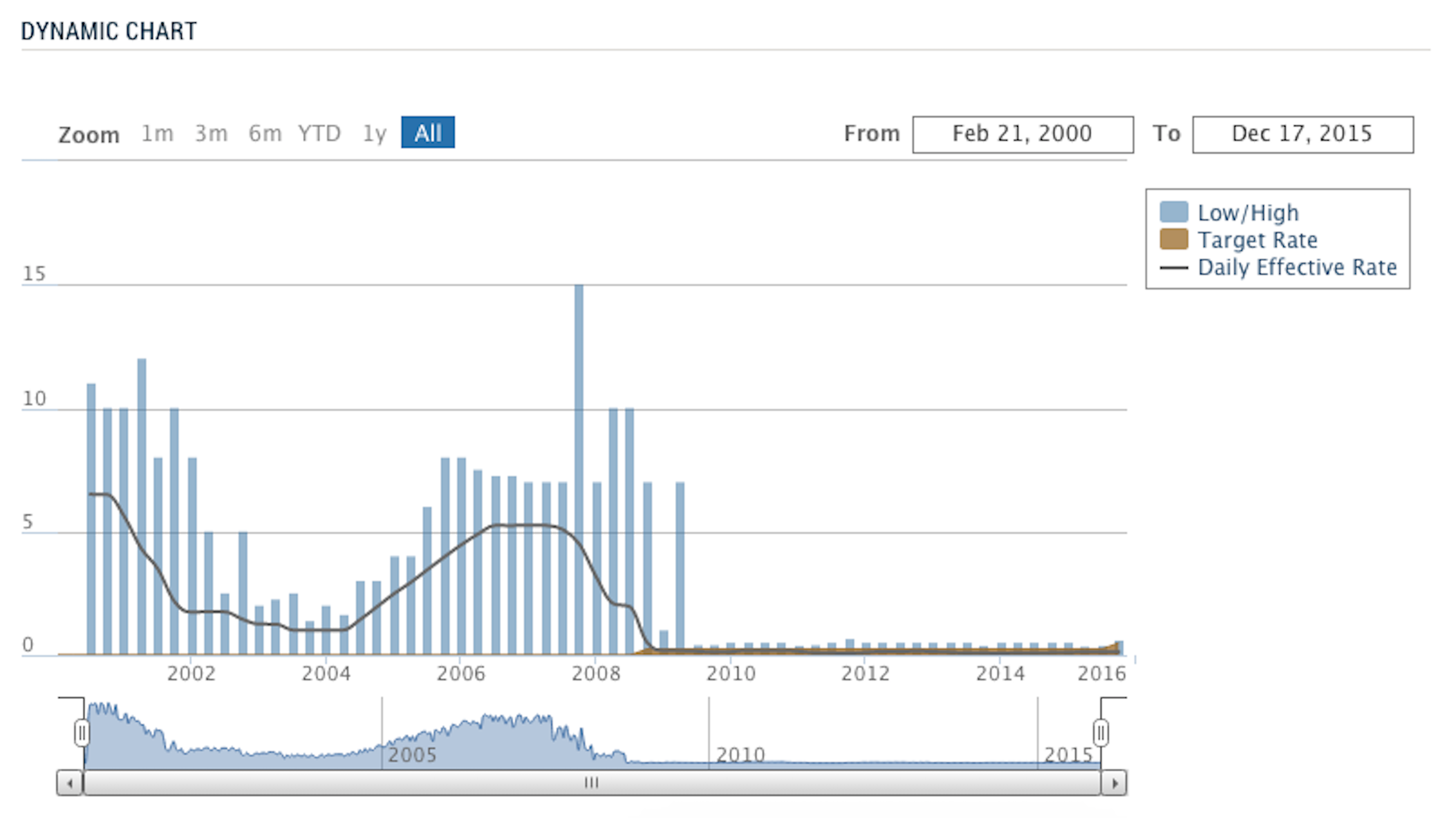

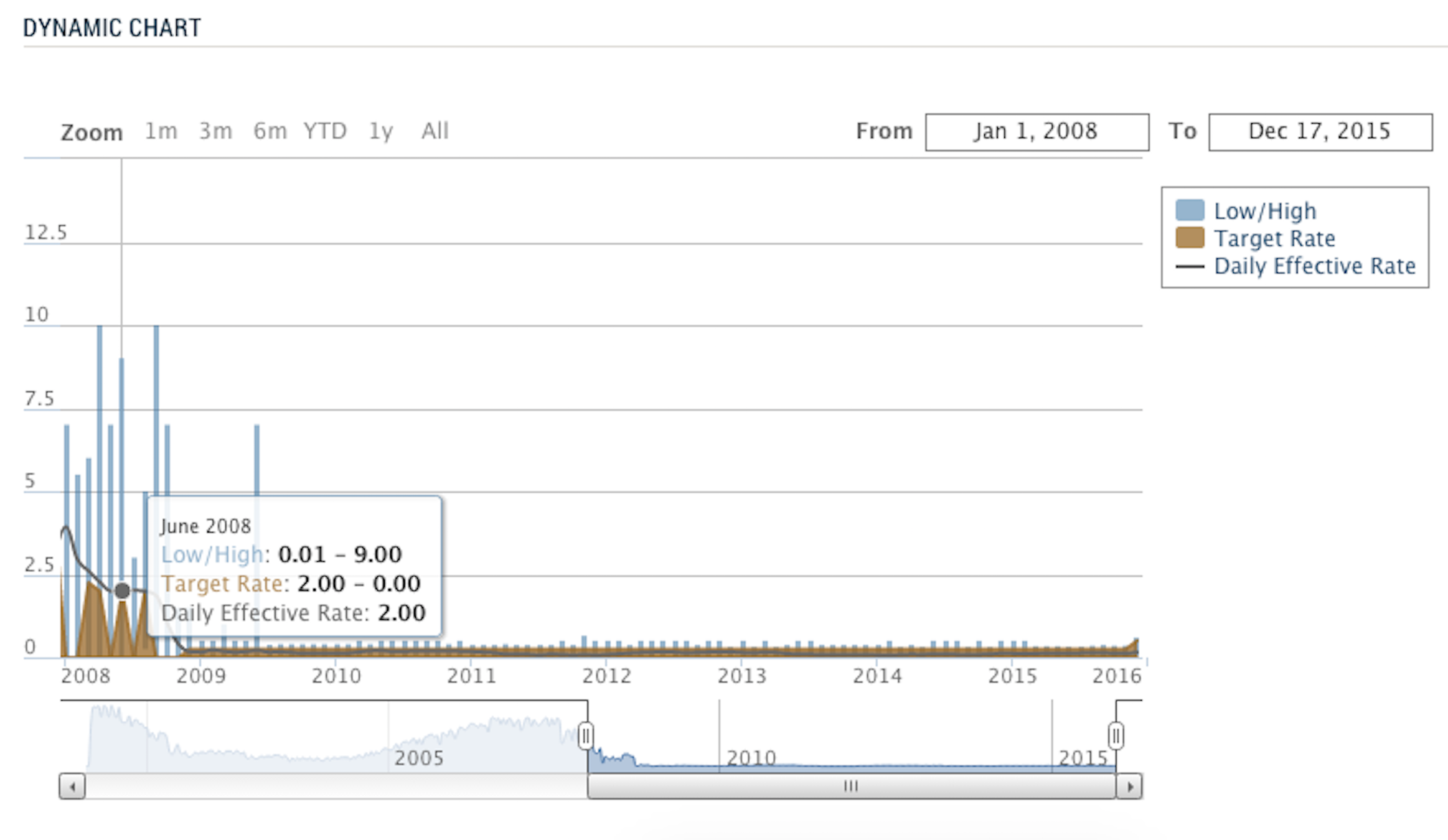

Those of us who don’t dabble in managing a nation’s money supply don’t often think much about the difference between the Fed’s “Target Rate” and the “High and Low” rates that are actually experienced within the financial system. Here is a chart of the “Target Rate” versus the actual “Highs” and “Lows” since the year 2000. Once again, what is startling is just how very low we have been since the Financial Crisis.

Here is the same chart – but for the period between 2008 and today. We can see that the Target Range in June of 2008 was between 0% and 2.0% (but it reached as high as 9%).

And since the detail within the big chart from “FRED” that we reviewed earlier is hard to decipher, here are some “high points” within the path that the Fed Funds Rate has taken since 1952. Note in particular that the 2006 mid-summer rate increase to 5.25% was the last time that rates were increased prior to the increase we just witnessed on December 16th!

Note that throughout 2014 and 2015 (until December 2015), the Fed Funds Rate varied between 0.07% and 0.12%.

Of course, we need to keep in mind that managing interest rates is not nearly as easy as the Federal Reserve Chair sitting before a press conference announcing the “big decision” made by the Fed’s “Open Market Committee” (FOMC). There are many operational mechanisms through which the Federal Reserve buys or sells Treasury Securities[5], thereby managing the “Supply/Demand” dynamics within the financial markets and impacting interest rates and money supply.

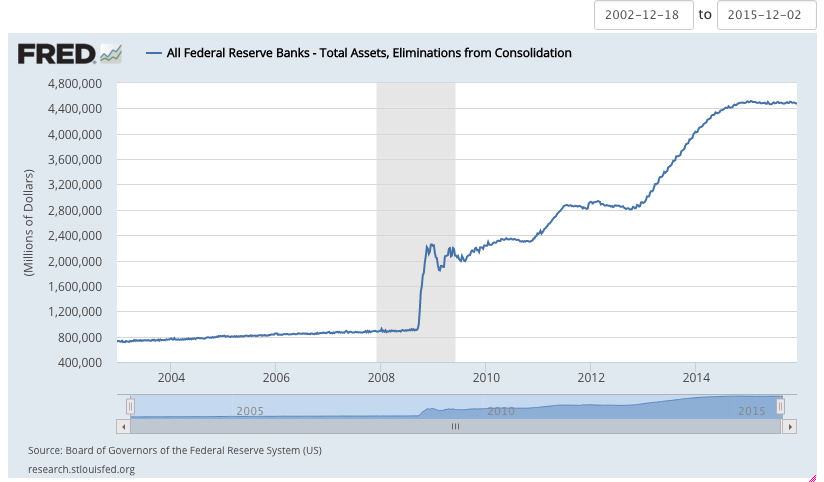

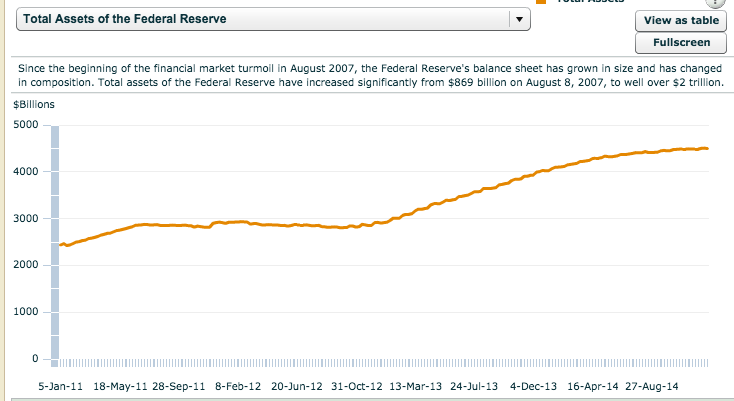

We’ve already seen the huge tilt that (then) Fed Chair Benjamin Bernanke gave toward low rates during the dark days of the Financial Crisis. This began the era of the now famous “Zero Interest Rate Policy” (ZIRP). Below we will see the mammoth tilt that Bernanke and the Fed gave toward an unprecedented level of U.S. monetary liquidity… ballooning the Federal Reserve’s “Balance Sheet” from under $800 billion to (almost) $5 trillion.

Let’s look at the progression of these rate changes within the extended evolution of “Quantitative Easing” (QE) in stages:

Between July of 2008 and late 2010, the Balance Sheet ballooned by a factor of just 3 ($0.8 to 2.4 trillion).

Then, between 2011 and 2015, the Fed nearly doubled its “Balance Sheet” (from $2.4 to over 4.8 trillion).

I often find financial news as entertaining as it is informative. A great case in point is one of the experts trotted out onto the airwaves regarding the topic of the Federal Reserve, “Liftoff”, and what would likely happen going forward. Obviously, this expert felt some sort of obligation to serve as a “defender” of the Fed and its “QE”. Specifically, the expert was asked about the severely bloated Fed Balance Sheet and the potential dangers that it holds for the U.S. economy going forward.

With a straight face, the expert pointed out that, of course, that Balance Sheet would be expected to increase over the years due to inflation, so that factor accounts (in part) for Fed Assets growing in size.

Hmmmm! “Inflation”??? Incredulous, I felt obligated to do some fact checking.

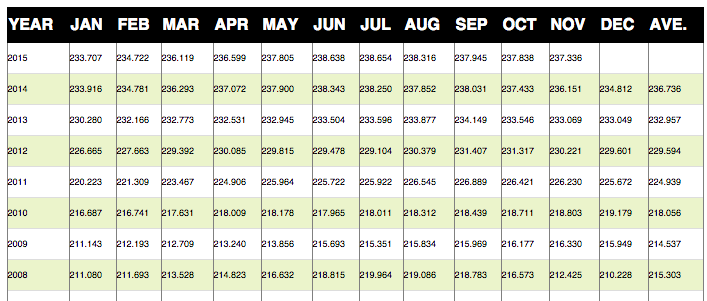

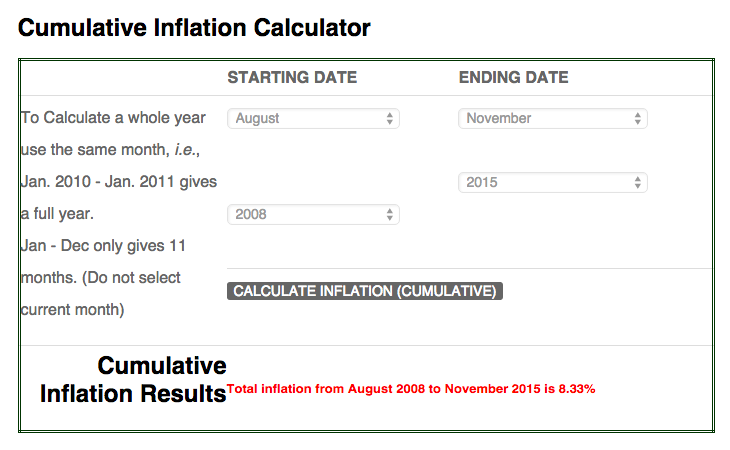

Here is the handy "Inflation Table" through which one can find the "factor" through which one can calculate inflation during any given period.

I found this table on the Inflationdata.com website[6]. Using basic math, I calculated that inflation between 2008 and 2015 amounted to a total (over that period) of just 8.78%. Then I happened across the site’s handy dandy “Inflation Calculator”[7]:

According to this “Calculator”, the cumulative U.S. inflation (using the CPI-U formula) during the period was 8.33%.

In August of 2008, the Fed Balance Sheet stood at $909,982 billion. Since I am inclined to be charitable to Dr. Bernanke and Dr. Yellen, let’s give them the benefit of the doubt and apply the higher cumulative inflation rate above. That would mean that, if inflation alone were the cause of the Fed Balance Sheet expanding, current Fed Assets would total $989,855 (not even $1 trillion of the nearly $5 trillion that the Fed currently holds!).

So much for inflation explaining much about Fed Balance Sheet expansion! Let’s just say that Bernanke/Yellen and Company “threw all the chips on the table” in a bold bid to ignite the economy and move the U.S. far above levels that could be labeled “Recessionary” or “Ultra Slow Growth”[8]. I’ll leave it to you to decide just how successful they have been.

Now that we have thoroughly reviewed the history of the Fed Funds Rate and the expansion of the Fed Balance Sheet… let’s move on to U.S. Treasury rates!

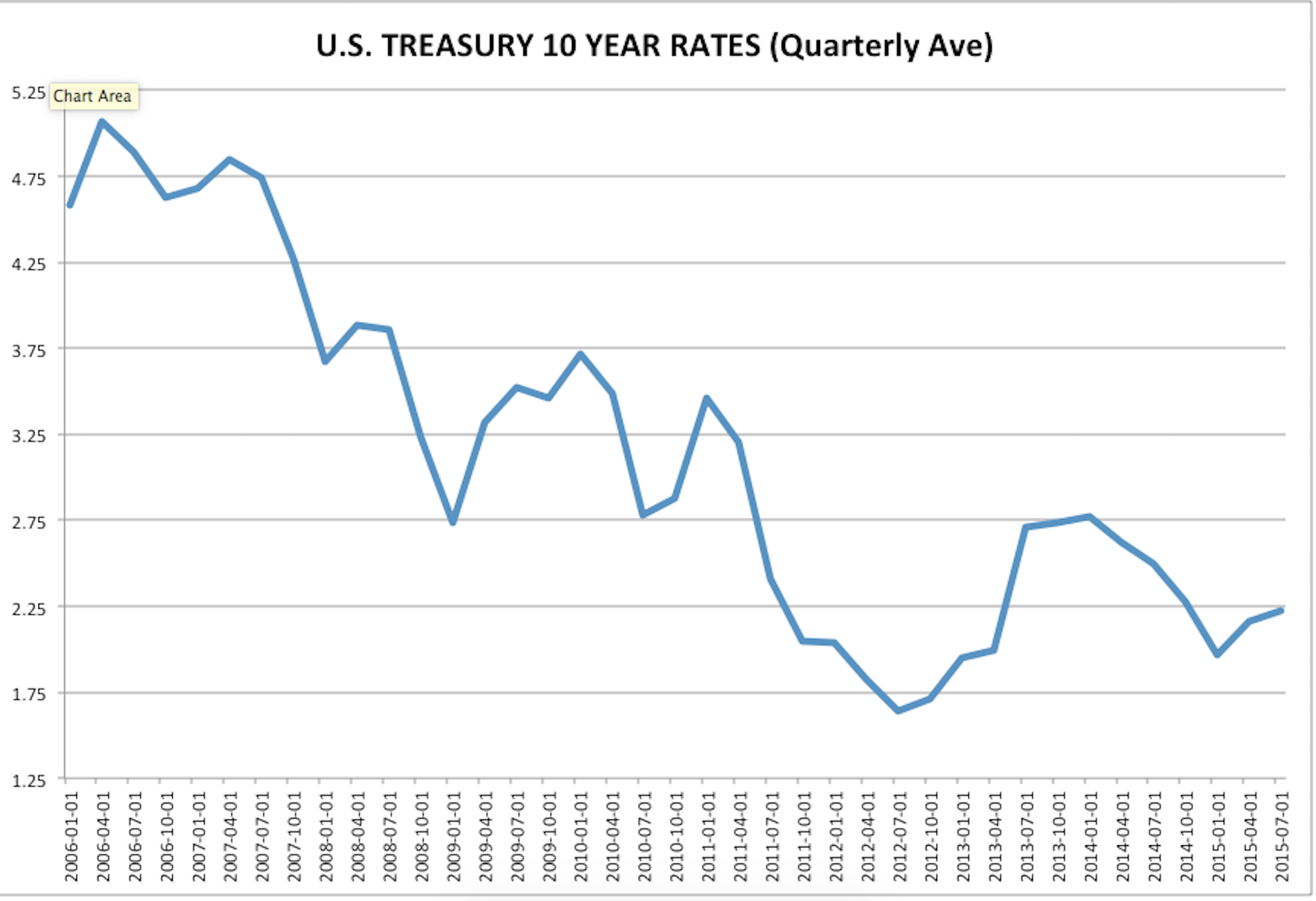

After all, the fact is that none of us actually deals with the “Fed Funds Rate” directly. The rate that most directly impacts us is the U.S. “Benchmark” rate – the U.S. Treasury 10-Year Note. Movement up or down in that rate has a much more direct impact upon the rates that we see when we borrow money (whether to buy a home, purchase an automobile, use our credit card, take out a student loan, or for any other purpose) than does the Fed Funds rate. Obviously, U.S. Treasury Security rates also have an impact upon the rates we receive on our savings and C.D. accounts.

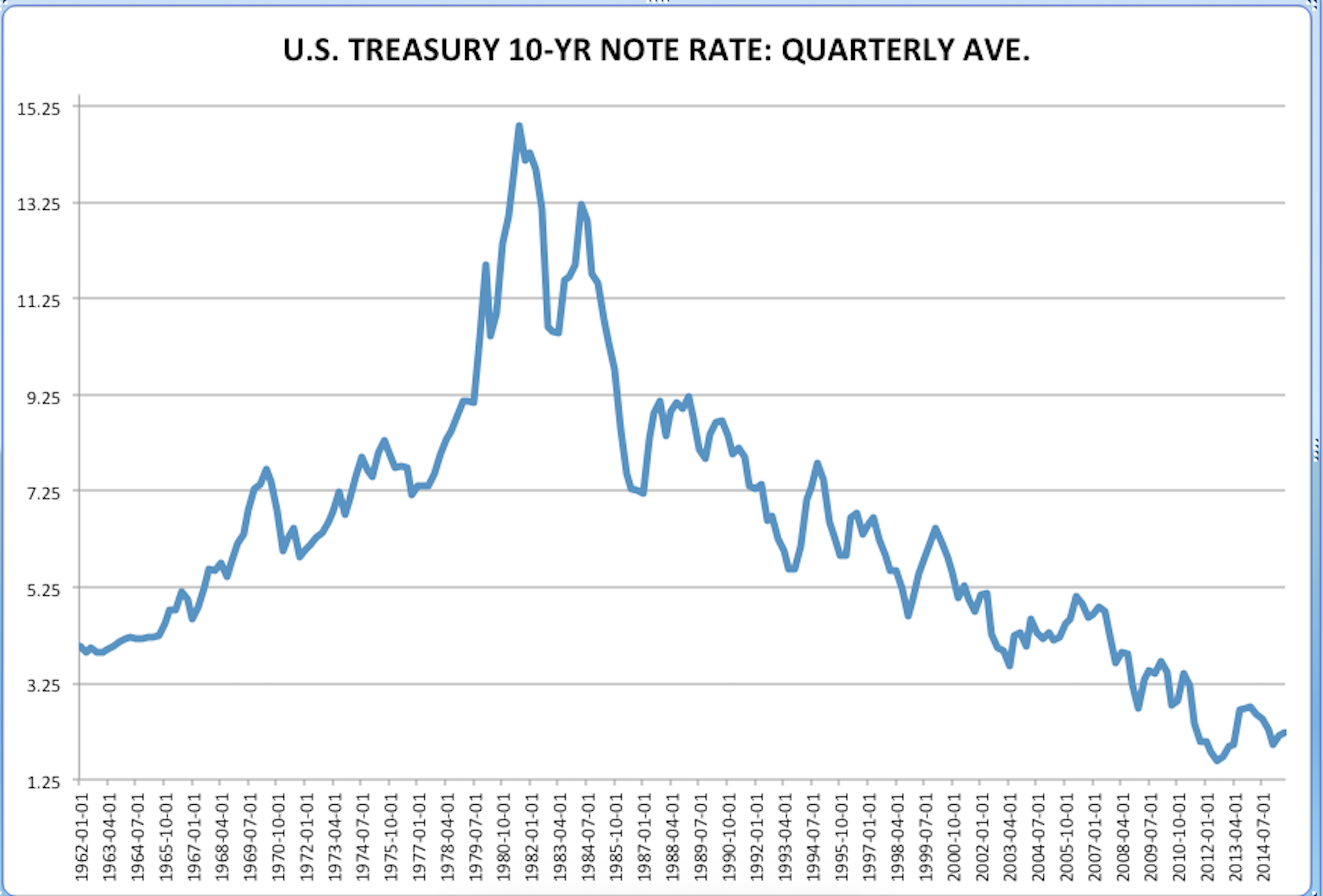

Therefore, let’s supplement our close-up look at Fed policy by reviewing historical data related to the U.S. Treasury 10-Year Note. Reviewing these graphs and charts will help us gain an additional layer of understanding regarding how unusual (actually, it has been unprecedented) this period of low interest rates has been.

This graph shows the average U.S. 10-Year Treasury Note rate during each quarterly period since 1962.

And here is a more focused view of the most recent nine-plus years:

Once again, since the actual rates within these graphs are very hard to decipher, I have provided you “the highlights” in the table below. This table shows the various “high points” of the 10-Year Note rate level during each period shown. Note that, in particular, we have listed the highest rate for each year since 2006 (just before the “Financial Crisis”). [All of these figures are based upon the Quarterly Average Rate.]

|

U.S. TREAS 10-YR NOTES |

HIGHLIGHTS FROM 1962 to 2015 |

|

|

YEAR |

MONTH |

RATE |

| 1979 | October | 10.44% |

| 1981 | July | 14.84% |

| 1990 | July | 8.70% |

| 2000 | January | 6.47% |

| 2006 | 2nd Q Average | 5.07% |

| 2007 | 2nd Q Average | 4.85% |

| 2008 | 2nd Q Average | 3.88% |

| 2009 | 3rd Q Average | 3.52% |

| 2010 | 1st Q Average | 3.72% |

| 2011 | 1st Q Average | 3.46% |

| 2012 | 1st Q Average | 2.04% |

| 2013 | 4th Q Average | 2.74% |

| 2014 | 1st Q Average | 2.77% |

| 2015 | 2nd Q Average | 2.18% |

As I was preparing all this data, it was hard for me to believe that our rates during the past 9 years have stood at just half the 1990 rate… between one-quarter and one-third the rate from 1981… and even (on average) less than half the rate from the year 2000!

As referred to earlier, these ultra low rates have been the direct result of the “Zero-Interest Rate Policy” (or “ZIRP”). This ZIRP policy has brought considerable hardship to “Savers” in the United States – especially Senior Citizens on fixed income budgets (who were counting heavily prior to their retirement on interest and dividend income).

Currently, financial media outlets are chock full of “dueling opinions” regarding whether the Fed was “correct” in lifting rates in December. Many commentators feel that conditions back in September were more favorable for a rate hike than those that were present in December. Those folks believe the Fed decided to act because Fed leaders feared they were losing “credibility”. Then there are other experts who very forthrightly make the case that the Fed will regret announcing a rate hike now. [We’ll get to those thoughts in the next article.]

INVESTOR TAKEAWAY

Only time will tell if the Fed made “the correct” decision or not. That being said, members of the FOMC would be well advised to keep their fingers and toes crossed and carry a lucky rabbit’s foot[9] because the simple fact is that, since the Financial Crisis, every other Central Bank that has raised rates (after lowering them) has (thus far) had to “backtrack” months thereafter in order to stop the economy from an unacceptable slide.

We will be depending upon the wisdom, experience, and insight of Dr. Yellen and her colleagues in the months ahead to decipher (as Yellen refers to it) “the Data” and make fortuitous and timely decisions!

In that regard I found it curious[10] how many of the questions directed at the Fed Chair during Wednesday’s press conference carried with them an air of incredulity – with many addressing Dr. Yellen (albeit with polite manners and words) with an unmistakable tone suggesting that the Fed’s action did not comport with their oft repeated policy statements … as well as the Fed’s own interpretations of its mandate. One broadcast reporter in particular even repeated his question… a question asked with a tone that could reasonably be interpreted as being an attempted “takedown” of the Fed and/or its Chair.[11] Needless to say, the optics of the press corps coming down so hard on a woman who resembles one’s benevolent, kind, old aunt (or even one’s own grandmother) were something to behold!

Obviously, therefore, despite the possibility that the members of the Fed arrived at their (unanimous) December decision in order to ensure “Fed Credibility”, there are clearly a number of folks within the financial media (and I’m sure elsewhere as well) for whom the Fed has precious little credibility these days.

With that said, and at the risk of piling on, there was a little story from back in October that caught my eye as I researched this article. I think you will find it amusing and telling[12]. It involves what can be found in the Federal Reserve’s September Z-1 Release: “Financial Accounts of the United States”

The significance of an accounting change made by the Federal Reserve in September is hinted at within the Fed Minutes from that month:

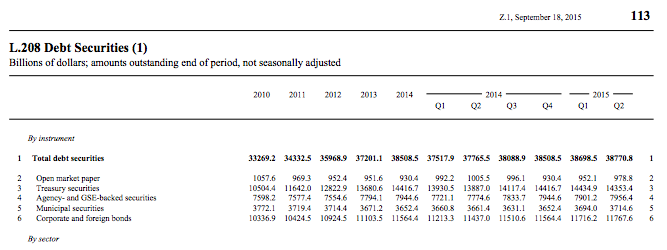

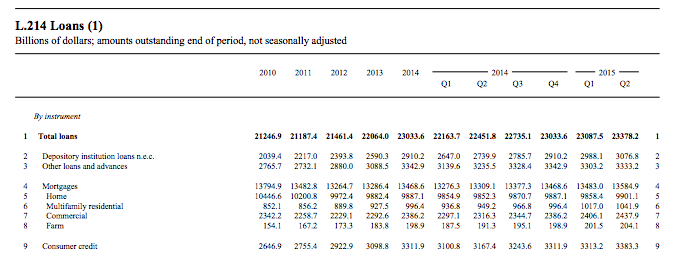

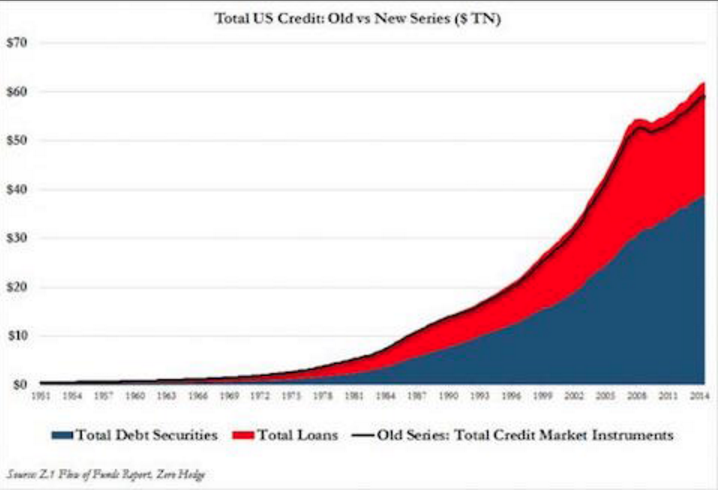

“With the September 18, 2015 Z.1 release, the classic presentation of the instrument category “credit market instruments” has been discontinued and replaced with two new instrument categories, “debt securities” and “loans”. “

Here is the page from the Federal Reserve Report that details the new (segregated) "Debt Securities" category.

Here is the page that details the "Total Loans" category within the September Federal Reserve Bank report.

“While the underlying instrument categories that make up the sum of debt securities and loans are the same as those in old “credit market instruments” concept, changes to a few of these categories make the new sum of debt securities and loans larger than in previous publications.”

Now that is fascinating! The Fed took a formerly consolidated account and split out its component parts… placing each component into a new, separate account! There is nothing out of the ordinary about that, correct?

But wait… the sum of these new accounts is larger than the total of the old account!!

Well, even that shouldn’t be a problem. I served as CFO for two different organizations and I occasionally took similar actions. However, I was always expected to justify any discrepancies and/or “rounding errors” [and our auditor would only accept those explanations so long as they were not “Material”.[13]].

So let’s look for the Fed’s explanation:

“Total debt outstanding was revised upwards due to methodology changes to both Treasury securities and security credit. Total debt outstanding is now the sum of two new instrument categories: debt securities (table L.208) and loans (table L.214). The aggregate of these instrument categories was previously called credit market instruments.”

Ah, a new “Methodology”! [The government is famous for adopting new methodologies. Alas, I was never allowed to do that with our financial statements!]

Now let’s see if we can calculate the difference caused by this new “Methodology”. We merely need to calculate the difference between the sum of the newly created accounts vis-à-vis the total shown within the formerly consolidated account!

Can you guess the difference?

$2.5 trillion!! Yikes!

Now in the defense of Yellen and Company, this change doesn’t look so bad when viewed in the context of a graph:

But I suppose that the cynics among you would suggest that all this means is that the government deals with such large amounts that it is all to easy to “hide” a $2.5 trillion accounting error![14]

The reality is that if someone in a public corporation made a $2.5 trillion error, there would be Congressional hearings, a Justice Department investigation, and the announcement of one or more employment terminations, and lots of media attention. However, within the framework of our national government, $2.5 trillion is just a “rounding error”.

Wrapping up, I cannot guess the direction of interest rates in the months ahead. No matter what you might hear on TV, hear on the radio, or read in periodicals — it is impossible to forecast rates with certainty.

All of that being said, it remains clear that the U.S. economy is still struggling (with only modest incremental improvements in positive economic data) and the Fed has promised that it will become more “accommodative” on monetary policy during the months ahead if and when the need arises. Therefore, it is fair to suggest that rates may go higher in a few months, or (alternatively) that rates may not go any higher for many months to come. The health of the economy will (we are assured) dictate what the Fed chooses to do.

However, one thing is absolutely certain. Senior Citizens and other “Savers” should not get too excited about receiving higher levels of interest income just yet!! The very day that the Fed Funds Rate increase was announced, banks announced an increase in the rates they will charge on loans… but announced no similar increase in rates to be paid on deposits!

DISCLOSURE:

The author is not a banker, nor a present or former member of the Federal Reserve Board. The author cannot predict the direction of interest rates going forward, much less if or when the Federal Reserve might raise rates (or lower rates) in the months to come. Therefore, you will be spared from any news outlet adding me as one more “talking head” about “the Fed this… or the Fed that.” Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] http://www.forbes.com/sites/rogeraitken/2015/07/01/greeces-odds-74-to-exit-eurozone-with-betway-but-are-all-bets-off/

[2] Including “Bond King” Bill Gross’ infamous call early in 2011!

[3] It is a bit startling that many of today’s “experts” weren’t even financial professionals back in 2006! So they haven’t directly experienced a rate hike until December 16th!

[4] Repeatedly, the financial media has been referring to it as “historic”. These graphs and tables show “why” it is “historic”!

[5] And Mortgage Backed Securities

[6] http://inflationdata.com/

[7] Which told me (essentially): “Hey, dufus, you didn’t need to calculate that by yourself! WE do it FOR you!”

[8] And they were particularly intent on keeping the U.S far away from “Deflation” territory!!

[9] And/or lift up prays to their favorite deity.

[10] And a bit startling ….

[11] That particular questioning sounded as though the reporter was saying: “C’mon Madame Chair… you’ve got to be kidding if you expect us to believe this decision is informed by your often stated principles and criteria for rate decisions!”

[12] And perhaps maddening.

[13] In other words, as long as the changes were in a reasonable order of magnitude… ranging between a few dollars to (if the accounts were large enough) one or two hundred dollars.

[14] I, of course, am not a cynic!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

2 Ultra-High-Yield Dividend Stocks That Passive Income Investors Won't Want to Miss

2 Ultra-High-Yield Dividend Stocks That Passive Income Investors Won't Want to Miss