Here is a potentially intriguing question for you:

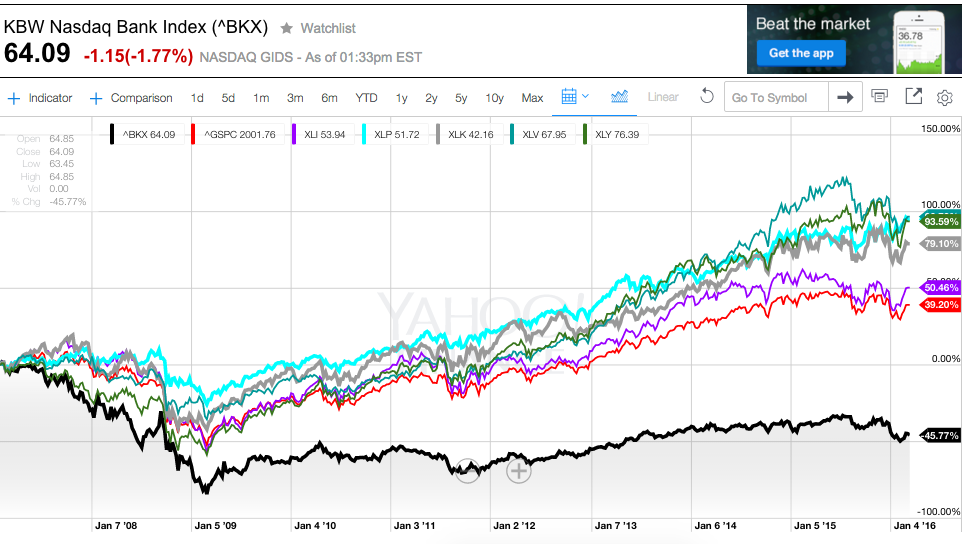

If I assure you that the top (Red) line in the graph below is the S&P 500 Index, from February 1 of 2007 (before the onset of the Financial Crisis) through Monday, March 7, 2016 (it is up 39.20% since 2/1/07)… what sector do you think the Black & Blue lines represents – a sector which has declined by more than 40% since 2/1/07??

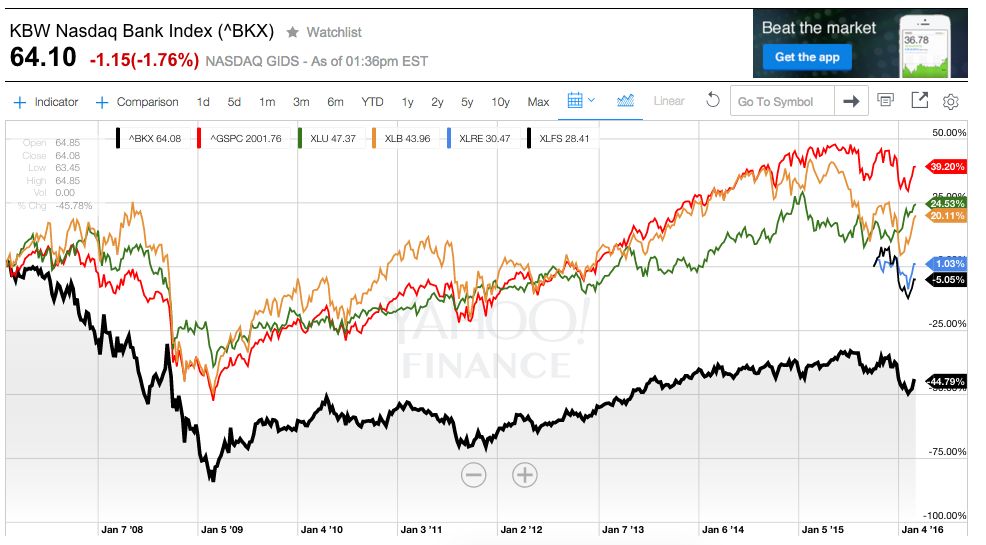

Since July of 2007, the S&P 500 Index (Red) has far outperformed the sector ETF's shown in Black & Blue!

I think we’d all agree that any sector that has underperformed the S&P by almost 80% since 2/1/07 can be labeled as “beaten up” (therefore “black and blue”)!!

The beaten up sector shown in the graph is the “Financial” sector… with particular emphasis on the “Banks”.

Since 2/1/07, the KBW NASDAQ Bank Index (^BKX) has fallen by 44.79%, while the Financial Select Sector SPDR ETF (XLF) has dropped a slightly less 40.09%!

In extremely sharp contrast, five sectors have outperformed the S&P 500 Index since 2007:

Here are the specifics:

XLV Health Care 96.73

XLP Consumer Staples 95.02%

XLY Consumer Discretionary 93.59%

XLK Technology 79.10%

XLI Industrials 50.46%

Meanwhile, three other sectors for which SPDR has provided an ETF during the whole period under review have underperformed the S&P 500 Index… but far outperformed the banks and financials in ^BKX and XLF. Note that Real Estate Select Sector SPDR (XLRE) and Financial Services Select sector SPDR (XLFS) did not start trading until October of 2015. XLFS has roughly tracked the fall and rise of other financial-related stocks… but not fallen quite as deeply.

Here are the specifics of those under-performing sectors:

XLU Utilities 24.53%

XLB Materials 20.11%

XLE Energy 6.85%

XLRE Real Estate 1.03%

XLFS Financial Services – 5.05%

As you know, a basic tenet of investing is that (all other things being equal) price tends to “revert to the mean”. Seeing the graphs and tables above, an all too eager investor might presume that banks and financials have been “oversold” and are “ripe for a huge comeback”. Or if that “go get ‘em” investor was familiar with “Pairs” trading, she/he might think that placing an order that is long XLF (Financials) and short either XLV (Health Care) or XLK (Technology) might be a promising strategy.

What has this enthusiastic investor overlooked?? Any guesses??

She/he has neglected to consider the important m caveat “All other things being Equal”!!

I think that we would all agree that, at least within the sectors of “Health Care” and “Technology”, all things are definitively not equal.

Since February of 2007, the Health Care space has been radically impacted by the onset of the retirement of the largest single demographic within the U.S. – the “baby boomers”! That trend will continue into the future…. swelling demand for prescription drugs[1], increasing demand for new life saving and/or life enhancing drugs, expanding demand for assisted living and skilled care facilities, etc.

And although it is easy to lose perspective (we tend to think that developments upon which we count each day have been in existence for much longer than they have)… consider the following facts within the Technology space:

1) It wasn’t until the beginning of 2007 that Steve Jobs first introduced the “i-Phone”!

2) The “i-Pad” was not introduced until 2010!

3) The first 3G wireless network in the U.S. began operation in 2003… but four years later (June of 2007) just 200 million subscribers had moved to 3G worldwide – meaning on 6.7% of global subscribers were on 3G).

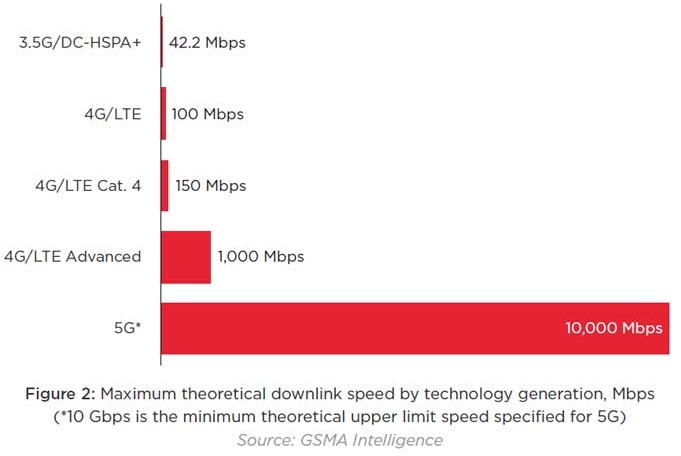

4) Given the above, this image from GSMA Intelligence graphically illustrates why/how “Band Width” and “Data Usage” have become hot topics within the wireless world since 2007!

Anyone who wonders why “Bandwidth” and extra “Data Usage” charges have become hot topics within the “Wireless” space need only review this graphic for an answer!

So what about the “Financial” space? Have things substantially changed since 2007?

You bet your stock portfolio things have changed since then!! Previous articles have catalogued most of the forces of change that have significantly transformed the Financial space during the past nine years[2], but the three biggest factors have been:

1) MISDEEDS OF THE PAST: Misdeeds committed by banks before, during, and after the Financial Crisis helped to propel us into that crisis… and then actually accentuated it. Since that time, countless banks have been fined by U.S. and global regulators for those misdeeds – fines which aggregate well into the tens of billions of dollars.

2) REGULATION: Because of those misdeeds, there has been exponential growth in regulations that impact bank activities and operations, including:

a) much higher Capital Ratios are now required;

b) restrictions have been placed upon what regulators consider “risky activities”, and and

c) tracking and reporting on innumerable new “Compliance” requirements has necessitated the addition of staff (thereby raising the cost of staff in an area that is patently unproductive and a drag on earnings). Among the prime components of these regulatory measures have been:

BASEL III Accord: An internationally recognized code of Capital Requirements for banks (and leverage ratios they are not permitted to exceed)

DODD FRANK ACT: U.S. legislation that mandates increased bank regulation… including the next item–

VOLCKER RULE: a regulation that prohibits banks from conducting certain investment activities with their own accounts. In addition, it limits their ownership of (and relationship with) private equity funds and hedge funds.

3) QUANTITATIVE EASING: this creation of former U.S. Federal Reserve Chair, Benjamin Bernanke, has spread like a virulent virus to central banks around the world, resulting in unprecedented levels of global monetary easing and low interest rates – so low that in some locations, they are actually “negative”!

Therefore, our “eager” investor needs to realize that, at least in the foreseeable future, banks will never be the same businesses or investments that they were in 2007. For the most part, their growth profiles will be much more shallow than they once were, and their appeal will largely come from their ability to generate steady (slightly growing) revenue and (at least in some cases) be “shareholder friendly” by increasing dividends and/or buying back their shares.

Echoing this fundamental change in the banking space, long-time bond expert (and favorite of the media as a source of provocative quotes), Bill Gross (in one of his recent “Outlook” reports) has offered this strong caution about banks:

1) As global yield curves flatten and net interest rate margins narrow, bank profitability will become constrained. Of course, negative yields will have an even more deleterious impact.

2) From Gross’s newsletter:

“The recent collapse in worldwide bank stock prices can be explained not so much by potential defaults in the energy/commodity complex, as by investor recognition that banks are now not only being more tightly regulated, but that future Return On Equity's will be much akin to a utility stock.”

3) Gross even posed the “bank sector investment question” much as I have already done above… writing:

“Banking/finance seems to be either a screaming sector ready to be bought or a permanently damaged victim of write-offs, tighter regulation and significantly lower future margins. I'll vote for the latter.”

4) Expanding the scope of his commentary, Gross suggested in a TV interview that any financial institution that engages in the creation of credit will face headwinds. Therefore, many non-bank finance stocks will also become increasingly unattractive as an investment.

5) Building on that thought, he said:

“The credit generation, which has powered the US and the global economy for decades, is sort of losing its oomph.

“All finance models, including banks, insurance companies, pension funds, and yes, investment management companies, will be hampered going forward by low interest rates, flatter than historic yield curves, and their ability to earn historic levels of return on equity and return on assets.”

Beyond the insights offered by market veterans such as Mr. Gross, there are various observable trends that impact business (and profits) within the financial sector. Two that impact banks and financial companies in a negative way include:

1) According to Standard & Poor’s, the U.S. “Distress Ratio” [a measure of risk anticipated by the Market within the bond sector] began 2016 at the highest level seen since 2009, when we were in the midst of the financial crisis.

2) During the past few years, analysts within the high interest debt space continually touted the fact that the default rate on those bonds was historically low (between 1.5 and 2.2%). However, based on the ravages of the collapse in oil prices and recessionary growth levels in many nations around the world, Moody’s Investors Service expects that default rate to actually hit 4.2% within the coming year. Defaults are bad news for both bondholders and lenders.

On the other hand, here are two recent news items that portend positive things for bank stocks:

1) S&P Global indicates that analysts expect profits within the financial sector to continue recovering – growing by 5.7% during 2016. Some analysts have even opined that the “average” financial stock will be 31% higher within 18 months.[3]

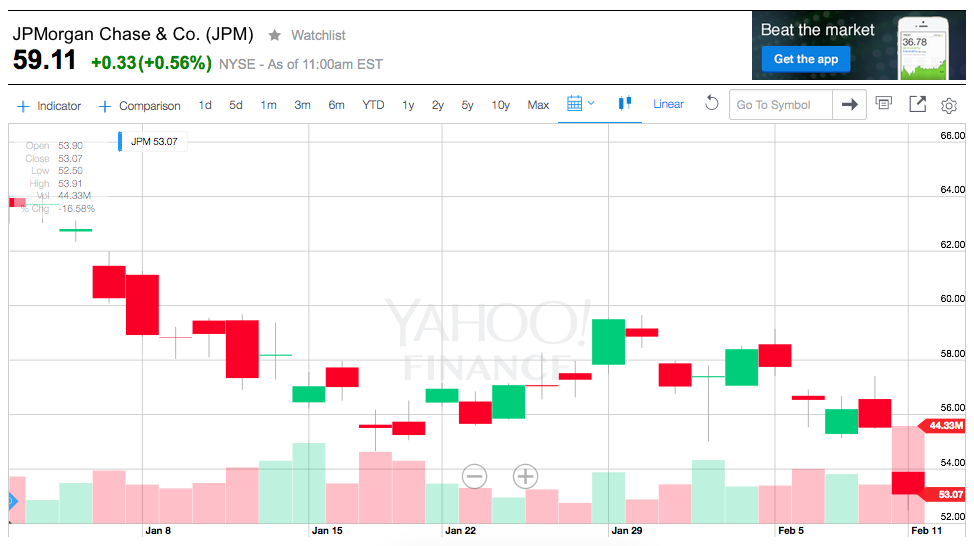

2) In February, Deutsche Bank (DB) announced that it will buy back $5.4 billion in debt (lowering its leverage ratio)[4]; and J.P. Morgan Chase CEO, Jamie Dimon, made certain that the world noticed his own personal “vote of confidence” for U.S. banking (and Chase in particular) – as he purchased 500,000 shares of J.P. Morgan Chase (JPM) stock![5]

You can call Mr. Dimon quite a number of things[6], but one thing you can’t call him is a naïve or foolish investor. He saw JPM tumble by 19.7% between January 1 and February 11th and therefore decided to pick up what he considered “a bargain”:

This is the context within which investors must place banks and financial companies when considering new trades or investments. And it is the context within which we need to interpret recent stock analyst opinions that focus upon the virtues of one or more investments with this sector.

I note that virtually every positive analysis of bank/financial stocks alludes to “Relative Value” … a point already detailed in this article from its beginning. It is undeniable that in mid-February, many major world banks (example: Deutsche Bank (DB) and Credit Suisse (CS)) were sitting at prices that were actually lower than they were during the height of the Financial Crisis! [However, don’t forget that “all things are not equal.]

In particular, analysts at RBC have noted that it has been five years since bank valuations have been as appealing as they are currently. The report also noted other positive factors, including: loan growth; a healthier U.S. economy; stronger credit quality; an increase in mergers and acquisitions (“M&A Activity”).

If you accept the fundamental RBC investment thesis, there are a few U.S. financial firms that may be worth further exploration and research:

1) PNC Financial Services (PNC) is one of the top “super regional” bank companies. It engages in a diversified range of services, including: both retail and business banking; specialized services for both corporate and government entities[7]; residential mortgages; asset and wealth management. PNC is in the midst of implementing an ambitious plan to trim costs and enhance efficiency, and it is known for laudable credit/risk management.

PNC also offers the advantage (in contrast to “money center” banks) of only limited exposure to areas related to the capital markets. And not unrelated, PNC holds a high quality Basel III common equity tier 1 ratio of 10% (as of the fourth quarter of 2015). What that means is that PNC could be considered a “conservative” bank that has demonstrated its ability to consistently generate earnings growth. Based on the March 8th price, PNC offers a 2.34% yield and trades at approximately a 11.5 P/E (“ttm”: for the trailing twelve month period).

2) U.S. Bancorp (USB) is another “super regional” bank. Operating within 25 states, USB offers the commonly expected range of services (banking, mortgage, investment, trust, and payment) to consumers, businesses, and institutions. Unlike the average “money center” bank, fee income generates almost half of USB revenue (45%)…. and it has almost no exposure to the capital markets. Warren Buffett likes the company – which composed 2.75% of the equity portfolio held by Berkshire Hathaway (BRK.B) as of 12/31/15.

Analysts who cover USB highlight its reputation as having one of the best credit/risk management profiles in banking and they project an overall loan growth in the 4-6% year-over-year range. Based on March 8th data, USB offers a yield of 2.49% and sells at a P/E of 12.56 (ttm).

3) Wells Fargo (WFC): speaking of Warren Buffett, within the past year he added to his ownership of WFC – which at the end of 2015 composed almost 20% of the BRK.A equity portfolio! WFC holds $1.8 trillion in assets and operates 8,700 locations around the U.S. In addition to being one of the largest mortgage lenders in the country, WFC offers services ranging from standard banking to consumer and commercial lending… in addition to the many wealth management services offered through Wells Fargo Advisors. It may sound startling, but in one way or another, WFC serves one of every three households within the U.S. [It even operates offices in 36 countries to support customers engaged in global commerce or travel.]

As one might expect within a firm that Buffett covets, WFC management is considered shareholder-friendly. As of March 8th, it offers a yield of 2.99% and sells at a P/E of 11.83 (ttm).

Separately, analysts at BMO Capital Markets believe that Capital One (COF) will outperform the market moving forward… largely because the market still perceives COF as a credit card lender and therefore “prices” it as such:

“Capital One is a fast- growing regional bank that remains valued as if it were still a specialty mono-line credit card lender….”

In that same vein, the ratings team at TheStreet.com wrote the following last August:

“We rate CAPITAL ONE FINANCIAL CORP (COF) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, largely solid financial position with reasonable debt levels by most measures, good cash flow from operations and increase in stock price during the past year. We feel its strengths outweigh the fact that the company has had sub par growth in net income.”

At March 8th, COF offers a yield of 2.3% and sells at a P/E of 9.67 (ttm) – which echoes the “undervalued” theme as highlighted earlier by BMO!

On a side note, the corporation of COF is so new that its co-founder, Richard Fairbank, still looks relatively youthful (founded in 1988).

Given the nature of the market’s misperception (and undervaluation) of COF be the “fault” of its famous spokesman, Samuel L. Jackson (“What’s In Your Wallet?”),

who happens to be 3 years older than CEO Fairbank. In any event, I feel bound to be gender neutral on COF commercial spokespersons, so here is a shot of Jennifer Garner:

Finally, BMO also thinks that Morgan Stanley (MS) can outperform moving forward. Of course BMO offered that opinion long before the MS earnings report for the 3rd Quarter of 2015. That report revealed that revenue from its bond trading business collapsed by 42% — while in sharp contrast, revenue generated by its wealth unit fell by just 3.5%.

To make matters (much) worse for MS… it was announced on February 11th of this year that MS needs to pay a $3.2 billion fine to settle its involvement within the 2008 Mortgage Crisis.

The result was disastrous to the stock price, which tumbled from its most recent high around $41 (last July) … all the way down to an intraday low on 2/11/16 at $21.16. That amounts to a steep 48% fall in just over seven months. By March 8th MS had recovered slightly – so between last July and March 8th, it lost a slightly less drastic 37% (meanwhile, the S&P 500 Index slipped by just 4.7%).

It is natural to ask why I would highlight a stock (such as MS) that has been so severely beaten up by the market?

The reason is simple. After reading quite a bit of analysis about MS, I believe there is a “story behind the story” that is worth exploring.

Unlike so many companies that experience turbulence, the leadership at MS actually seems willing to initiate significant changes. But to understand these changes, we need to go back to 2007-09, when so much of the landscape that then composed the U.S. financial space began to become dramatically changed.

It was in January of 2009 that MS purchased 51% of the iconic Smith Barney retail brokerage house from Citigroup (C)[8]. MS then linked its own Wealth Management Unit with Smith Barney to create “Morgan Stanley/Smith Barney”.

This acquisition represented a significant change for MS… whose long-term reputation had been built upon bond and securities underwriting and its proprietary trading business. In fact, the very history of MS is a classic illustration of “Old Wall Street” at work… demonstrating the nearly unmatched power and influence of big money, iconic names, and the “old boys’ network”. Here is a thumbnail sketch:

Back in the 1930’s, the passage by the U.S. Congress of the “Banking Act of 1933”[9] mandated a strict separation between standard “commercial banking” (the kind used by consumers and businesses for deposit activities and loans) and “investment banking” (including underwriting and trading). Before the 1930’s, the prominent “big banks” engaged in what was then considered the “complete range” of bank activities … encompassing both the investment banking and the commercial banking dimensions of financial services. This new “Banking Act” imposed a deadline by which such “big banks” needed to comply with the new federal mandate to fully separate investment banking from commercial banking.

If anyone epitomized “Old Wall Street”, the “Good Old Boy Network”, nearly unlimited power, and unfettered self-aggrandizement (not to mention manipulation) it was John Pierpont Morgan — the founder of J.P. Morgan and Company.

As you might imagine, in those days J.P. Morgan & Co. was a behemoth bank (built by the “larger than life” John Pierpont Morgan on the synergy generated through serving all of its customers’ banking needs… ie.“both sides” of banking, investment and commercial).

In fact, it was a very good thing that patriarch J.P. Morgan died in 1913, because if “J.P.” had still been living in the mid-1930’s (when Congress passed this bill), he would either have suffered total cardiac arrest or heads would have rolled in Washington D.C.

However, in September of 1935, in the absence of the iconic “J.P.”, calmer heads prevailed and proceeded to create a handy “work around”:

Several longtime J.P. Morgan partners, including Henry S. Morgan (a grandson of “J. .P.”)

Here is a photo of Henry S. Morgan — co-founder of Morgan Stanley and a grandson of the iconic J.P. Morgan.

and Harold Stanley, left J.P. Morgan to found “Morgan Stanley” at 2 Wall Street… just up the street from “the House of Morgan” (J.P. Morgan Chase was located at 23 Wall Street). To no one’s surprise, the new bank was a huge success… hinted at by the following:

Within its first year, it achieved 24% market share in total public offerings. In 1938, MS distributed $100 million in newly issued bonds from the United States Steel Corporation, for which it was the lead underwriter. MS also took the lead in handling the huge 1939 financing for U.S. railroads.

Understandably, given its very history, MS did not operate retail-banking facilities in the first decade of the 21st Century. This was quite unlike Citigroup (C), which catered to consumer’s personal banking needs and therefore offered a wide range of consumer banking services. In fact, Smith Barney brokers had grown accustomed to being able to offer their investment clients with virtually any banking product they might need. Being able to offer “full services” like that led Smith Barney brokers to feel that they had a competitive advantage vis-à-vis many of their competitors – boosting their ability to attract and retain clients.

Therefore, once MS took control of Smith Barney, some of the top Smith Barney advisers left the organization between 2009 and 2012[10] because of the new competitive constraints they faced under MS management (because MS only offered very basic consumer banking services).[11]

This brings us up-to-date with regard to how MS CEO, James Gorman, is re-shaping MS. Gorman is insightful enough to understand the challenge he faces in transforming MS into a sustainable company… as well as an attractive investment (given existing market[12] and regulatory constraints[13]).

In fact, as I alluded to earlier, Gorman is currently trying to contain and overcome both the dreadful 3rd Q (2015) earnings report (which included that 42% collapse within its bond trading unit) and the February announcement of its huge $3.2 billion fine. Beyond those devastating pieces of news, Gorman is quite aware that regulators have been, for years now, putting significant pressure on MS to move away from the “feast/famine” cycles inherent within proprietary trading…. and move strictly into more conventional banking.

On that note, let me interject a bit more “history”. If one didn’t know any better, one might naturally assume that MS bought Smith Barney in 2009 because it was uncommonly “cheap” due to Citigroup’s compelling need for an infusion of cash during those traumatic days when fear abounded regarding “systemic illiquidity”. However, the plain fact of the matter is that MS needed Smith Barney more than Citigroup needed cash!

I am willing to bet that if the general public was asked which U.S. bank received the largest amount of “Federal Reserve bailout” funds back in 2008, the majority would offer the wrong answer. History shows that it was MS that needed the largest amount of Fed funds during the Crisis ($107 billion) due to the massive write-offs it had to take against its $1.15 billion in 2009 earnings (the result of huge proprietary trading losses). Things looked so precarious for MS back then that some believed it might have to seek “strategic alternatives”[14] … hence the $107 billion from the Fed.

Why was Smith Barney important within the new strategic plan for MS? Because investment and wealth management generate revenues and profits are immeasurably more dependable and stable than those from the proprietary trading of stocks and bonds.

Before 2008, Morgan Stanley was primarily an investment bank engaged in securities underwriting[15], corporate consultation with regard to such matters as “Mergers & Acquisitions” (M&A), and proprietary trading. The preponderance of investment banking revenue/profits was regularly apparent within the detail reported in quarterly earnings statements.

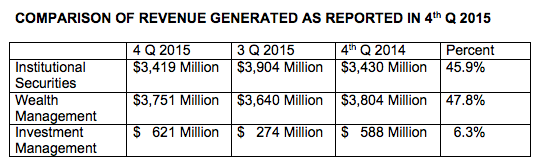

But since then, the financial reports from MS have shown a dramatic shift! Here is a view of MS revenue from its three component business segments for the 4th Q of 2014, 3rd Q of 2015, and 4th Q of 2015:

Here is a summary of Morgan Stanley revenue from its three primary divisions for the 4th Q and 3rd Q (2015) and the 4th Q (2014).

As you can see above, Wealth Management is the largest generator of revenue for MS. It is also evident that, relevant to the variability of total revenue, Wealth Management is much more consistent – with much less variability than either Institutional Securities (which includes trading) or Investment Management (which, although small in size, generates higher profit margins).[16]

Mr. Gorman and his team have come to appreciate the ways in which the Wealth Management operation (Morgan Stanley/Smith Barney) brings much more stability to the financial health of the company. MS can now boast the largest single wealth management entity in the world – encompassing over 16,000 brokers. As it has witnessed that segment of corporate operations become the most reliable for its bottom line… it has recommitted to maximizing the Wealth Management business in every way possible.

Here is a rough summary of what one finds when one takes a “deep dive” into the existing operational metrics of the Wealth Management business:

· Morgan Stanley serves 3.5 million wealth management clients

· Within that huge client base, only 1% use MS retail banking products (which until now have only included checking accounts and credit cards)

· The company’s bank deposits total just $139 billion.

· Overall, MS deposits sit at just $147 billion.

· In the “big picture”, what this means is that total MS “deposits” equal just 18% of its total assets!!!

Why is that of particular significance? Because, in sharp contrast:

· Deposits at JP Morgan Chase (JPM) and Bank of American (BAC) equal more than 50% of total assets.

Also, MS has discovered that:

* Clients who actively use MS banking products hold an average of 7% more assets at MS than clients who do not. Since (at least for the present) the annual customer fees are based on a percentage of total assets held at MS – increasing the asset base will generate more income and strengthen the financial base of the company.[17]

I think that even Mr. Gorman would concede that it doesn’t take a genius to “put the dots together” and decide to rollout a package of new, additional bank products, including:

· Savings accounts

· Certificate of Deposit

· Online Banking

· Mobile banking

According to the president of the Wealth Management operation (Greg Fleming) the reason this has not already been in place for years is that MS needed to ensure that it got its banking technology fully up to “Best Practices” standards:

“We’ve been gearing up for this over the last few years and building out our technology, which is why this is more of a 2016 initiative.”

[Author’s Note: I urge you to take a minute to look at the Appendix, which captures in graphs and basic bank consumer data how vital current, state of the industry technology is for the future of banks. Banks have been “behind the curve” on this, and banks such as MS are still trying to “catch up”]

This initiative should go a long way toward expanding the pre-tax margin within the Wealth Management business – which last quarter reached 23% … at the lower end of management’s long-term objective… but about on par with the margin reported by rival BAC’s wealth unit. Management hopes this initiative will boost total bank deposits (over time) from the current $139 billion to its objective of $200 billion. Crucial within the full promise of this initiative is the fact that the 16,000 brokers that stand at the front line of the Wealth Management business will be the “channels” through which these bank products will be advertised, promoted, explained, and sold – sparing MS from any need to build even one “retail banking” facility!

Another significant plus for MS is its relatively benign exposure to energy. David Konrad, the head of U.S. bank research at Macquarrie, recently offered this opinion

“We like [MS because it has] lower than peer energy exposure.”

This fact has two repercussions for MS:

1) MS holds less relative risk to a resumption of oil price declines than do its financial rivals such as JPM, BAC, C, etc.

2) MS also enjoys the benefit of needing a relatively smaller capital “reserve” against bad oil loans than is the case for those rivals.

It is also worth noting that Macquarie analysts hypothesize that if MS were to decide to totally exit or unwind its fixed income and commodities trading business, MS stock would be worth $40 per share. I personally don’t think that is a decision Gorman is anywhere near ready to make, and I suggest that Macquarie is far too optimistic regarding the ensuing stock price if Gorman actually did move in that direction.

Finally, I have one more reason (although it is admittedly really lame) for esteeming MS as a company. It employs and stands by its amazingly candid and humble “Chief U.S. Equity Analyst”, Adam Parker.

Before I begin sharing the recent remarkable candidness of Mr. Parker, let me highlight three facts that will help put Parker in proper context:

1) First of all, Parker is not a “newbie”. He has an established and distinguished performance record:

“He has been named to Institutional Investor's All-America Team multiple times, in both portfolio strategy and quantitative research, most recently in 2012.”[18]

2) For thirteen years I was the chief administrator that oversaw large endowment funds for two separate non-profits. That required me (among many other things) to sit through quarterly portfolio review committee meetings during which the investment consultant/manager would do what I called the “investment professional dance” – she/he would blame poor performance on market anomalies, but then attribute good to great performance to the genius of their team.

3) The simple fact is that within the world of “Wall Street”, no one needs Helium because all egos are already fully pumped and riding sky high. In that ego-powered environment, the admission of a “mistake” usually comes only at the end of a Justice Department probe or a SEC investigation.

So enjoy these recent observations and remarks from Mr. Parker:

1) On February 14th, Parker publicly admitted that, at that point in 2016, his clients would have been better off doing the opposite of some of his team's recommendations.

2) This is his candid explanation:

“Our portfolio advice has been pretty horrendous lately …

“For those who follow our portfolio, we did quite well over the five years from 2011-2015. But, our portfolio just had its worst month in 61 months in January, and things have not improved in February.

“The market is down more than we thought it would be. Our biggest sector bet has been financials (particularly credit cards).

“[We feel much like the …] investor [who] recently said to us at a conference, ‘I am doing a lot of things, just nothing with confidence.’”

3) Demonstrating that he has a sense of humor, Parker riffed on a parallel between the current market environment and the (old, old) Superman comic planet: Bizarro World (aka “htraE” … where everything turns out the opposite of what is expected.

Once again from Parker:

“Are we on a cube-shaped planet? Should ‘Us do opposite of all Earthly things?’ Everything seems backwards. Sell winners, buy losers, own staples in both up and down markets. Just do the opposite of what makes sense. ‘Bizzaro World.’”

4) Finally, Parker then brought home his candid humility:

“Doing the opposite of what we recommended would have been better. Bizarro World.”

My prediction is that at the end of this year, countless top strategists who made public forecasts before January 1st should be proven significantly wrong regarding their predictions. In fact, S&P/Dow Jones reports that just six weeks into the year, many of those strategists had already cut their estimates. Come year-end, I doubt that any of those strategist will fashion nearly as humble and entertaining a “mea cupla” as Parker has already offered in February!!

Five stars to Parker and his MS team!

Finally, to wrap up this narrative regarding MS and provide you data points comparable to the ones offered earlier on PNC, WFC, USB, and COF

At March 8th, MS offered a yield of 2.3% and sold at a P/E of 8.5 (ttm).

INVESTOR TAKEAWAY:

In case you haven’t yet been converted to what seems to be the “common sense mantra” regarding how to invest (or trade) within our current market environment… consider this thought:

When it comes to almost any single, non-diversified stock in 2016, do not let your self “fall in love” with one stock. Generally speaking, in our increasingly volatile market environment, unless an individual stock is exhibiting a particularly strong trend (and that trend is buttressed by strong support (for bullish trades) or strong resistance (for bearish ones)) it is more profitable to utilize strategies such as buying a stock when it moves toward the bottom of its trading range and selling it when it moves close to the top of its range.

Alternatively, consideration can be given to selling a calling below strong resistance or selling a put above strong support.

In the current environment, although simply buying and holding any given stock will definitely cut down on one’s transaction costs, that practice will not necessarily maximize your net trading profits during the months ahead!

Therefore, although I did report (above) on several financial stocks that might prove to be worth consideration, I strongly caution you to evaluate those stocks within the context of the observations and strategy options that I have offered in the previous few paragraphs!

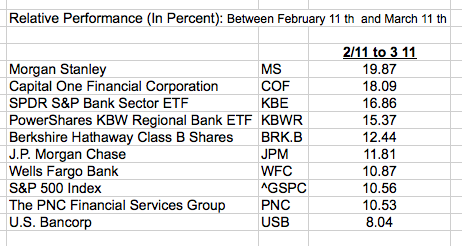

[AUTHOR NOTE: I have prepared two tables in the APPENDIX that rank relative performance of stocks referred to in this article during two periods:

a) Year To Date through March 11

b) Between February 11 (the recent low for most financial stocks) and March 11

I suggest that you review those tables to glean your own insights.]

However, if short to intermediate trading is not your preference, and you feel drawn to bank/financial stocks as a longer term play on a valuation basis, I definitely suggest that you consider investing within a diversified portfolio of such stocks rather than just one financial company itself!

With that thought in mind, you might consider such choices as:

XLF or KBW

For that matter, you might even consider Berkshire Hathaway (BRK.B) — considered by the folks at XLF to be within the “Financial” sector and including (as alluded to above) significant allocations to such well known financial stocks as: WFC, USB, New York Mellon Bank (BK), American Express (AXP), and Bank of America (BAC). In addition of course, one of the core operating segments within BRK.B is its huge insurance business…. also a part of the vast range of U.S. financial service stocks.

DISCLOSURE:

The author utilizes a number of banks for his personal funds. However, he does not currently own any bank outside of an ETF or mutual fund. The author does not currently own XLF, KBW, or BRK.B. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

APPENDIX:

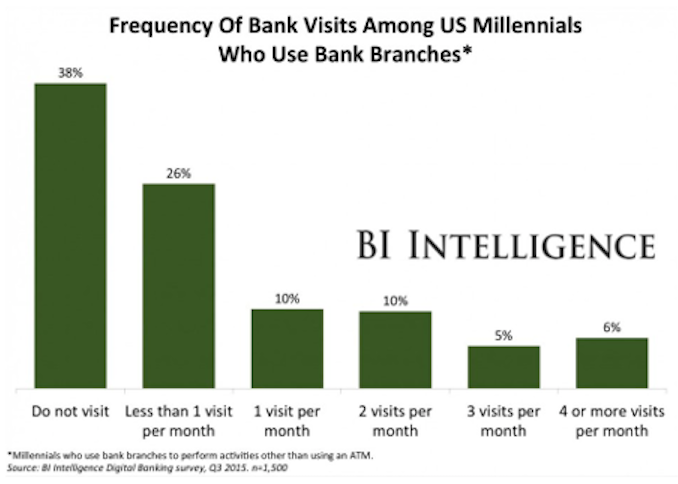

The “Millennial” generation is pushing long-lived brick and mortar financial service companies to reshape how services are delivered – be it account access, depositing, investment advice, portfolio management, etc.

The need for continually improving technology is self-evident in this graph:

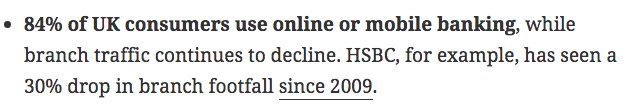

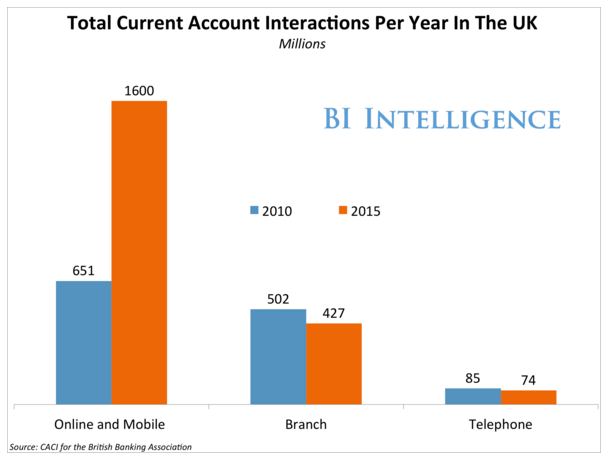

It is very important to note that this trend is not just evident within the United States.

Take a look at these data points from the United Kingdom:

PERFORMANCE RANKINGS

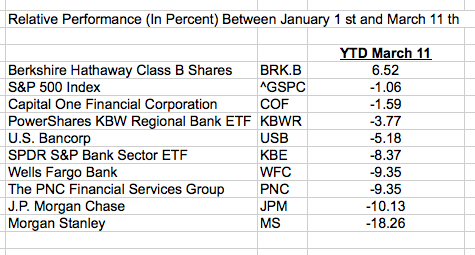

Here are the promised tables ranking relative performance thus far in 2016:

Here is performance data regarding stocks covered in this article … showing the period 1/1/16 through 3/11/16.

FOOTNOTES:

[1] Older patients use steadily more prescriptions than other age groups.

[2] https://www.markettamer.com/blog/coco-the-clown-and-the-markets

[3] If I could invest in a “binary” instrument that would pay me a decent profit is, in 18 months, that “average” financial stock is not 31% higher… I would do it in a heartbeat. I have become extremely skeptical of such “analysts”… and have been known to say that “Analysts’ opinions and $6 will get you a nice cold Venti Light Espresso Frappuccino at Starbucks!”

[4] Two caveats need to be added: 1) as you read last month, DB was under severe pressure from bad news and fearful stockholders about its financial health and future, so it had to respond in ways designed to offer reassurance; and 2) announcing a debt buyback and actually doing it are two different things.

[5] That amounts to a $26.6 million investment! The latest purchase increases his total personal holdings in JPM to 6.7 million shares – or about $360 million.

[6] Which I personally often do…

[7] Such as real estate finance and asset-based lending

[8] MS completed the full acquisition in stages between 2009 and 2013.

[9] Often referred to as the “Glass Steagall Act”

[10] To be fair to MS, every time top advisers are faced with a change in ownership of the company, a significant number of them will leave to go somewhere else… no matter what.

[11] MS did offer checking accounts and credit cards, but that was about it.

[12] Rocked by a-typical and extremely volatile markets, its trading desks have lost lots of money.

[13] As with all banks, MS continues to feel burdened by Dodd Frank and the Volker Rule.

[14] Perhaps similar to how Washington Mutual and Bear Stearns got sold off to other institutions for a ridiculously low price.

[15] MS is a long-time leader in underwriting, touting both top-level human expertise and state of the art technology. It was the lead underwriter for public rollouts of Google, Inc (GOOG), Groupon, Inc. (GRPN), Compaq, Cisco Systems, Inc. (CSCO), Salesforce.com (CRM), etc. and was instrumental within the rollouts of Apple, Inc. (AAPL) and Facebook (FB).

[16] I cannot help but note for the record that Goldman Sachs (GS) has chosen to remain a significant player in proprietary trading and what regulators warn is “risk behavior”. That gives GS a riskier profile than MS… but also the potential for greater profitability in any given period. How does GS justify that strategic decision? A cynic might suggest there are two reasons: a) CEO Lloyd Blankfein is a former currency trader who success is legendary; and 2) GS has “friends in high places.” One third of the sitting U.S. Federal Reserve Bank presidents used to have ties with GS… as do Mark Carney (Bank of England Governor) and Mario Draghi (ECB President).

[17] KEY NOTE: this is an all important banking dynamic to which we must pay attention:

a) More banking products results in more deposit funding

b) During financial crises, depositors are much less likely to flee than are corporate clients

c) When rates rise, deposit funding is almost always cheaper than other forms of borrowing would be for MS.

d) Regulators absolutely adore bank deposits and detest revenue and profits from proprietary trading (which so often lead to disasters such as JPM’s “London Whale”

[18] From the MS website

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Is Palantir a Buy?

Is Palantir a Buy?