In the February 29th issue of the Seasonal Forecaster newsletter I focused on a ‘basic industry' stock – the type I like to look for when the well-known, often-in-the-news stocks aren't making any progress. The company is Albemarle Corp (ALB). One of Albemarle's top product sectors is Lithium derivatives, increasingly used in electric cars and electronics. Your cell phone has a lithium battery in it. Albemarle may have been the source of it.

In the February 29th issue of the Seasonal Forecaster newsletter I focused on a ‘basic industry' stock – the type I like to look for when the well-known, often-in-the-news stocks aren't making any progress. The company is Albemarle Corp (ALB). One of Albemarle's top product sectors is Lithium derivatives, increasingly used in electric cars and electronics. Your cell phone has a lithium battery in it. Albemarle may have been the source of it.

I covered how the revenue of the company has jumped from $598 million two years ago to $930 million last quarter.

The stock was trading within a tight range. As usual, I covered the ways to increase the probabilities of success in any ALB trade by saying “The best trade entries would be to either trade an upward breakout of the range, or wait until the stock returns to near the bottom of the range and starts to rebound.”

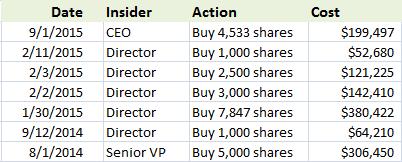

I mentioned a key detail: “One thing that really stood out to me is the amount of stock being bought by insiders. In the past two years, seven key insiders bought new shares. This is pretty unusual for a company where you usually see just selling due to compensation.”

I mentioned a key detail: “One thing that really stood out to me is the amount of stock being bought by insiders. In the past two years, seven key insiders bought new shares. This is pretty unusual for a company where you usually see just selling due to compensation.”

“The number of funds holding the stock has increased 14% over the past 6 months.”

“The number of funds holding the stock has increased 14% over the past 6 months.”

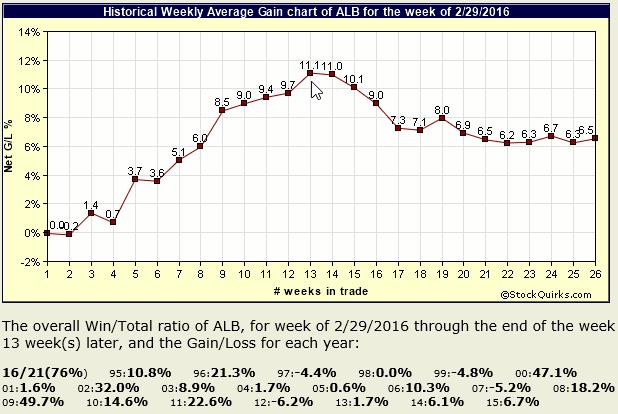

And of course the clincher was the seasonal pattern of the stock:

“ALB's seasonal pattern shows a pretty good track record of gains over the next three months. The 13-week period has averaged an 11.1% return, with gains in 76% of the years. The five losses (or non-gain, as in the case of a net 0.0%), all were relatively small. But the stock has produced some strong gains over that time period, even shortly after the 2008 crash.”

I was going to add the stock to the newsletter portfolio, but to again increase the odds of success, I specified a condition on the trade entry. I didn't have to wait long for ALB to meet my criteria. The next day the stock jumped out of the trading range and my trade entry was triggered.

I was going to add the stock to the newsletter portfolio, but to again increase the odds of success, I specified a condition on the trade entry. I didn't have to wait long for ALB to meet my criteria. The next day the stock jumped out of the trading range and my trade entry was triggered.

Less than two weeks later, the ALB position is showing a 6.5% gain. Even better, the alternative trade using a long call I covered is up 37%.

Less than two weeks later, the ALB position is showing a 6.5% gain. Even better, the alternative trade using a long call I covered is up 37%.

The combination of good fundamentals, waiting for a higher probability technical setup, a strong seasonal pattern, and evidence of increasing institutional participation this year has once again led to a good trade. In this morning's newsletter I am raising the trailing stop so the worst I can now do in this trade is break-even.

For now, this stock is a keeper. On April 1st, this position will pay a dividend of $0.305 a share. Did I mention Albemarle has increased dividends for 19 consecutive years, and the dividend has been growing at a 15% rate? I made sure to mention in the newsletter that this stock was a good candidate for dividend reinvestment.

To find out more, please click on the following link: www.markettamer.com/seasonal

By Gregg Harris, MarketTamer Chief Technical Strategist

Copyright (C) 2016 Stock & Options Training LLC

Gregg Harris is the Chief Technical Strategist at MarketTamer.com.

MarketTamer is not an investment advisor and is not registered with the U.S. Securities and Exchange Commission or the Financial Industry Regulatory Authority. Further, owners, employees, agents or representatives of MarketTamer are not acting as investment advisors and might not be registered with the U.S. Securities and Exchange Commission or the Financial Industry Regulatory.

The sender of this email makes no representations or warranties concerning the products, practices or procedures of any company or entity mentioned or recommended in this email, and makes no representations or warranties concerning said company or entity’s compliance with applicable laws and regulations, including, but not limited to, regulations promulgated by the SEC or the CFTC. The sender of this email may receive a portion of the proceeds from the sale of any products or services offered by a company or entity mentioned or recommended in this email. The recipient of this email assumes responsibility for conducting its own due diligence on the aforementioned company or entity and assumes full responsibility, and releases the sender from liability, for any purchase or order made from any company or entity mentioned or recommended in this email.

The content on any of MarketTamer websites, products or communication is for educational purposes only. Nothing in its products, services, or communications shall be construed as a solicitation and/or recommendation to buy or sell a security. Trading stocks, options and other securities involves risk. The risk of loss in trading securities can be substantial. The risk involved with trading stocks, options and other securities is not suitable for all investors. Prior to buying or selling an option, an investor must evaluate his/her own personal financial situation and consider all relevant risk factors. See: Characteristics and Risks of Standardized Options (http://www.optionsclearing.com/about/publications/character-risks.jsp). The www.MarketTamer.com educational training program and software services are provided to improve financial understanding.

The information presented in this site is not intended to be used as the sole basis of any investment decisions, nor should it be construed as advice designed to meet the investment needs of any particular investor. Nothing in our research constitutes legal, accounting or tax advice or individually tailored investment advice. Our research is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive or obtain access to it. Our research is based on sources that we believe to be reliable. However, we do not make any representation or warranty, expressed or implied, as to the accuracy of our research, the completeness, or correctness or make any guarantee or other promise as to any results that may be obtained from using our research. To the maximum extent permitted by law, neither we, any of our affiliates, nor any other person, shall have any liability whatsoever to any person for any loss or expense, whether direct, indirect, consequential, incidental or otherwise, arising from or relating in any way to any use of or reliance on our research or the information contained therein. Some discussions contain forward looking statements which are based on current expectations and differences can be expected. All of our research, including the estimates, opinions and information contained therein, reflects our judgment as of the publication or other dissemination date of the research and is subject to change without notice.

Further, we expressly disclaim any responsibility to update such research. Investing involves substantial risk. Past performance is not a guarantee of future results, and a loss of original capital may occur. No one receiving or accessing our research should make any investment decision without first consulting his or her own personal financial advisor and conducting his or her own research and due diligence, including carefully reviewing any applicable prospectuses, press releases, reports and other public filings of the issuer of any securities being considered. None of the information presented should be construed as an offer to sell or buy any particular security. As always, use your best judgment when investing.

Past performance is no guarantee of future performance. This product is for educational purposes only. Practical application of the products herein are at your own risk and MarketTamer.com, its partners, representatives and employees assume no responsibility or liability for any use or mis-use of the product. Please contact your financial advisor for specific financial advice tailored to your personal circumstances. Any trades shown are hypothetical example and do not represent actual trades. Actual results may differ. Nothing here in constitutes a recommendation respecting the particular security illustrated.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why JetBlue Stock Was Tanking This Week

Why JetBlue Stock Was Tanking This Week