I spend hours on the weekend just deciding on what I'll focus on for the, typically longer, Monday Seasonal Forecaster newsletter. As I was going through, trying to narrow down which stocks I wanted to focus on, an email came in.

It was from MarketTamer (I like receiving email from those guys). Gareth had produced a Market Outlook video:

Mon May 27 – Executive Summary – Market Outlook Video

What caught my attention was “…with a potential opportunity in Apple (AAPL)”.

Something about Apple caught my attention earlier this weekend. After listening to Gareth's video, I thought I'd contribute some additional details and insights.

Gareth mentioned that AAPL “has generally moved by 30, 40, 50 points, over the course of a month or so”.

I ran the numbers on AAPL, and came up with pretty much the same results. APPL does indeed cycle about every month, on average, and averages out to 10% to 14% moves.

One thing I noticed was the length of AAPL up-moves seemed to be averaging a little longer than 14.8 trading days in recent years. I re-ran the above analysis, starting from 2007, which seemed to be the start of a change in character in AAPL stock. The iPod was becoming a hit, and investors were starting to think of Apple differently. So the numbers from 2007 do show a lengthening of the up-cycles, as AAPL was turning into a ‘darling' stock:

Gareth didn't predict an ultimate direction, but he covered a straddle trade, which would benefit from a move in either direction, as long as it was of typical time and distance.

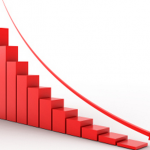

Certainly, AAPL has been cycling up and down within a longer-term down-trend, and it may have broken out of the down-trend recently:

At this point, I start wondering if there is any ‘seasonal' worth taking into consideration, a track record of the stock moving in previous years. AAPL does not have a strong bias, either up or down, over the next several weeks. But heading into late summer, early fall, AAPL tends to move upward. Seasonal charts like this, lacking a strong bias one way or the other, are what I look for with cyclical trades, or trades within trading ranges.

One thing I've learned about charts and technical analysis is to always take a second look, from a different angle or viewpoint.

As Gareth pointed out, AAPL has been cycling up and down. It has recently traded within a range, with one brief exception. You can trade the likelihood that AAPL has recently come off a cycle low, or you can wait for AAPL to get near the bottom of the trading range, around 410 to 420, enter a bullish trade, and trade a move up to the top of the range.

But the chart was trying to tell me something more, and once I looked at volume, it hit me. In March, AAPL set a short-term low. In April, AAPL fell on low volume at first, but logged high volume as it formed a short-term, lower cycle low. Coming off that low there was strong volume on the up-close days. In May, AAPL returned to the same low as March (within 10 cents). This volume was not as strong setting this low, the selling quickly dried up and buying came in. Overall, if you take out the volume spikes on the days AAPL set short-term lows, the volume on up-close days has been noticeably higher than on down-close days.

Now, what chart pattern fits this pattern of lows, the retracement highs, and volume patterns? Yes, an inverted head and shoulders.

Gareth's approach is ideal for trading the up and downs. But if AAPL takes off and penetrates that ‘neckline' around 465, I'd loosen up on the reigns and let it run, perhaps converting to a more directional trade strategy. If this turns out to be a head and shoulders pattern, the depth of it, 80 points, added to the neckline of 465 would suggest a possible target of 545, which happens to be the pivot point on January 2nd from which AAPL started its current five month decline.

Of course, there's much more you need to know and many more stocks you can capitalize upon each and every day. To find out more, type in www.markettamer.com/seasonal-forecaster

By Gregg Harris, MarketTamer Chief Technical Strategist

Copyright (C) 2013 Stock & Options Training LLC

Unless indicated otherwise, at the time of this writing, the author has no positions in any of the above-mentioned securities.

Gregg Harris is the Chief Technical Strategist at MarketTamer.com with extensive experience in the financial sector.

Gregg started out as an Engineer and brings a rigorous thinking to his financial research. Gregg's passion for finance resulted in the creation of a real-time quote system and his work has been featured nationally in publications, such as the Investment Guide magazine.

As an avid researcher, Gregg concentrates on leveraging what institutional and big money players are doing to move the market and create seasonal trend patterns. Using custom research tools, Gregg identifies stocks that are optimal for stock and options traders to exploit these trends and find the tailwinds that can propel stocks to levels that are hidden to the average trader.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Nvidia Stock Investors Can Expect Revenue and Profit to Rise Further

Nvidia Stock Investors Can Expect Revenue and Profit to Rise Further