Money printing. Nominal price increases. Inflation Creep. Unintended consequences of central banking intervention.

These labels might all be understood, but have they changed your behavior? Have you decided to eat less or drive less?

If not, one reason might be that the price increases in food and energy are to some degree expected. Generations have now come to expect that each year prices will increase slightly. Paying $1 for bottle of Coca Cola this year translate to paying $1.05 next year and $2 for the same bottle in 10 years doesn’t seem too out of line.

But what happens when a discontinuity takes place? To explain what is meant by a discontinuity, first we need to define the opposite: continuity in price increases.

When money is printed and money supply increases, and the cost of goods increase, the aim of central bankers is to do so at a gradual pace. Stability is a core tenet of central banking policy.

Purchasing power is eroded commonly through nominal price increases as well as through inflation creep. When you go to the store and find cereal costs the same this year as last year in nominal terms but you discover the package size has decreased, you are subjected to inflation creep.

Whether you pay for the same amount or the same amount for fewer goods, you are the victim of inflation.

But you’ve come to expect inflation. Maybe the impact of inflation on you is to buy one less bar of chocolate or skip an odd drive in the car. It typically doesn’t create such a monumental shift in behavior that you stop buying chocolate altogether or stop driving altogether.

To create a behavior shift that big, something more significant is required: a discontinuity.

A discontinuity in prices might be described best as paying $1 for a bottle of Coca Cola this year and waking up next year to find the price is almost $8.

It might sound incredulous. And within the borders of the USA, such price shocks are rare. To experience the destruction of the dollar and really feel its effects, let’s transport you to Norway for a moment.

In Norway, finding a bottle of Coca Cola in a restaurant for less than $7 is about as difficult as any Treasure Hunt ever created.

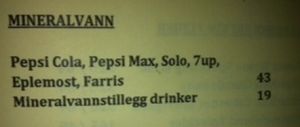

On a menu at a run-of-the-mill restaurant in Oslo, a bottle of Coca Cola costs 43 Norwegian Kroner.

43 Norwegian Kroner at today’s exchange rate translates to $7.51 for a bottle of Coca Cola.

And if you thought that was expensive, how does $10 for a 15 minute bus ride sound? Or $38 for a hamburger? Or $22 for a slice of strawberry cheesecake?

These prices might seem incredulous, but they are very real. They also create a discontinuity in the reality of US consumers who travel to Norway and discover that a dollar might still be a dollar in look and feel, but it doesn’t buy nearly as much as it used to.

When discontinuities in prices take place on this scale, behavioral shifts take place, and purchasing behavior changes drastically. These are the realities of imbalances between strong currency nations and nations heavily indebted with weak currencies.

The trend is firmly established. The challenge is to generate income from savings sufficient to offset the weakening currency and to do so, you should know how to generate and keep your first $1,000 trading.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why Bitcoin, Ethereum, and Dogecoin Are Surging Higher Today

Why Bitcoin, Ethereum, and Dogecoin Are Surging Higher Today