I have bought my share of investment books over the years – I have quite a collection. I still buy them, although I have little time nowadays and resort to just scanning and remembering the key points from each new one.

Amazon has me figured out. They regularly send me teasers, which are recommendations for books I haven't bought yet on topics I've associated myself with in the past. Of course, books on trading are frequently mentioned.

Last night they teased me with a new book on trading that peaked my curiosity. I went to the Amazon page and read both the publisher's description of the book as well as the reviews. Today's article immediately began writing itself.

I have to admit I haven't heard of any of the authors of the Editorial Reviews of this particular book. The reviews stated “.. His process of combining technical analysis with fundamental factors such as insider buying is truly unique.” and “…it not only tells the story of how [the author] made millions in the stock market but shows readers an innovative trading process that could give them a chance to make enough money to dramatically change their lives.”

But what really caught my attention was:

“[The author] is an unconventional stock trading cowboy. During his career, he has had short-term account drawdowns of 61%, 64%, 65%, 75%, 100%, 100%, and 106%. In spite of his drawdowns, in non-overlapping periods during his career, he has had short-term (less than 1 year) personal portfolio gains of 111%, 117%, 156%, 264%, 273%, 275%, 300%, 371%, 1,010%, 1,026% and 1,244% (these last two in the same period- 7 months and 11 months, respectively).”

This time I want to hear from someone in the back of the class. What is wrong with the above declaration? Maybe this sentence?

“During his career, he has had short-term account drawdowns of 61%, 64%, 65%, 75%, 100%, 100%, and 106%.”

Yes, the gains are pretty impressive. But should anyone who is trying to be a consistently successful trader pay attention to someone who has had at least 7 drawdowns of 60% or more?

In the mid 80's, I met Larry Williams. Those of you who were active traders back then probably remember the name. Larry, who was one of the early researchers into seasonal patterns, gained fame from a certain trading championship he participated in. He wrote a book on it, and I just found my copy hiding in the dark corners of my bookshelf. Larry's book was titled “How I Made One Million Dollars…Last Year…Trading Commodities”. If I remember correctly, Larry started with $10,000 and turned it into $1,000,000 in one year from trading commodities.

What makes Larry's story more interesting is, as I recall, he gave the million back to the market the next year from a series of negative trades. Then, he did it again – turning $10,000 into another million in a subsequent year. And I recall hearing he gave a lot of that back afterwards.

This isn't a game – it's your money. It wasn't a game making the money you are using to trade, so why take it any less seriously now? Do the really-high profits mean anything if you just give them back?

Let's look at a totally theoretical example. Suppose you had a $30,000 starting account balance. You have this great trading system that has been advertised similar to the book above. Say you decide to implement a money-management rule of allocating only 33% of your account balance to each trade. You do 10 trades, and the results are:

The overall win/loss trade ratio is 60% – not bad for an active trading system. And look at those gains: 30%, 22%, 15%, 68%, 40%, and 21%.

But after all that, the four losses had enough of an effect where the net account gain was only 6%. Notice that the worst drawdown was 33,757 to 26,309, or 22.1%. How well would you have slept after a 106% drawdown (he was obviously using margin or had to add new funds), or even ‘just' a 61% drawdown?

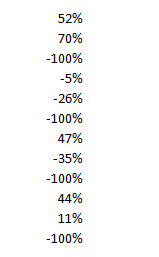

Think my example isn't representative of reality? Here is a 2-month section of the trade results, published on their web site, from one highly-promoted option recommendation service.

Yes, they had a net gain from the 15 months of results. But would you have slept well trading these recommendations?

Now suppose you take another $30,000 starting balance, and this time concentrate on identifying high probability trades. They may not return as much as the winners in the first example. But there are more winners, and the losses are restrained:

You're not going to impress anyone at the next dinner party with these gains, but you ended up with an account gain of 22% and a worst drawdown of only 2.6%, all from a series of mostly small gains.

If you want to buy a book on higher probability trading, may I suggest the following, written by two William O'Neil (of Investor's Business Daily fame) traders – Trade Like an O'Neil Disciple (Gil Morales & Dr. Chris Kacher, 2010). They basically apply the IBD trade-selection-and-management methodology, with some of their own interpretations. They quickly cut non-performers, and ride the stocks proving themselves, regularly adding to existing postiions, taking profits when the trend weakens, and so forth.

I wrote an article for MarketTamer last year based on the approach in this book: Trading High Price Stocks And New Highs

Don't go for the high returns if the drawdowns will kill you. You'll end up a lot better off, and you will sleep better, with a high probability/low drawdown approach to trade analysis and management. You'll eventually be able to write your own book, maybe calling it ‘Trade Like a Pro'.

Of course, there's much more you need to know and many more stocks you can capitalize upon each and every day. To find out more, including the answer to the above question, type in www.markettamer.com/seasonal-forecaster

By Gregg Harris, MarketTamer Chief Technical Strategist

Copyright (C) 2014 Stock & Options Training LLC

Unless indicated otherwise, at the time of this writing, the author has no positions in any of the above-mentioned securities.

Gregg Harris is the Chief Technical Strategist at MarketTamer.com with extensive experience in the financial sector.

Gregg started out as an Engineer and brings a rigorous thinking to his financial research. Gregg's passion for finance resulted in the creation of a real-time quote system and his work has been featured nationally in publications, such as the Investment Guide magazine.

As an avid researcher, Gregg concentrates on leveraging what institutional and big money players are doing to move the market and create seasonal trend patterns. Using custom research tools, Gregg identifies stocks that are optimal for stock and options traders to exploit these trends and find the tailwinds that can propel stocks to levels that are hidden to the average trader.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why MicroStrategy Stock Rocketed 24.7% Higher This Week

Why MicroStrategy Stock Rocketed 24.7% Higher This Week