Here is a thought-provoker for you:

What price do you think is appropriate for a company that matches the following description. [Note: the bullet points below have all emerged since January 1st of this year]:

1) Third Quarter Revenue (reported last month) missed analyst projections…

2) In fact, this company “missing” such projections has occurred more often than not during the past year and a half;

3) Gross Margins were compressed … falling 40 basis points;

4) Management has “pulled back” on its previously well-articulated profit objectives for 2016… objectives repeatedly echoed during the past two years… until now, that is;

5) Company executives indicate that corporate review, reflection, and refocusing, involving both the Board and Management, is proceeding in order to clarify direction for the future;

6) Recent dividend hikes have outpaced growth in Earnings Per Share (EPS), bringing the company’s “Payout Ratio” to heights not seen for many years.

Given the above, how would you expect this stock’s price to have performed Year to Date (YTD)?

Well, take a look at the following price chart, within which the S&P 500 Index is contrasted with this particular stock (in Blue):

In recent months, this "mystery stock" has zoomed to over $70/share, far exceeding the S&P 500 Index in red.

As you can see, while the S&P has edged up over 5% YTD, this particular stock has zoomed up as high as 32%, currently (as of 7/14) up about 25%!

Is that your astounded gasp that I hear? At a minimum, this is surely a head scratcher!!

Here is another irony. Between April of 2009 and April of 2013, analyst opinion on this stock ranged between unfavorable and mildly favorable – while the stock ranged between the mid-20’s and the mid-40’s. [See the chart below.] But now that the stock has climbed to over $70/share, analysts are trumpeting it as promising!! Go figure! [It would appear that precious few of such analysts have fully integrated Buffett’s investment philosophy![1]]

Can you guess why this stock captured the attention and capital of so many investors this year?

Why of course!! What else could it be than the current Hot Investment Theme Du Jour: “Tax Inversion”!

These days, it seems as though wherever we look, there is financial news related to Tax Inversion. Oversimplifying the concept, Inversion involves re-incorporating a company overseas in order to reduce the tax burden on company income earned abroad.[2]

During the past thirty years, well over 50 companies have undertaken Tax Inversion. In fact, some significant Inversions occurred in 2013, including:

Perrigo Company acquired Elan Corporation;

Endo Health Solutions acquired Paladin Labs;

Eaton/ Corporation plc acquired Cooper Industries[3];

Omnicom Group (OMC) (announced a merger with Publicis Groupe (PUB)[4]… but by May of this year (2014) it was called off, with Maurice Levy (Publicis CEO) characterizing the effort as a “train wreck”!

On the left is Publicis Groupe CEO, Maurice Levy, with John Wren (Omnicom Group CEO). If the men were not smiling, you might think they were struggling. Evidently, a lot of that took place as the two ad giants tried to complete their promising merger. The merger fell apart!

Transactions to date (in 2014) that involved an Inversion have included:

Applied Materials Incorporated merged with Toyko Electron Limited (to form Eteris[5]);

Horizon Pharma acquired Vidara Therapeutics (see https://www.markettamer.com/blog/the-story-of-how-horizon-pharma-creatively-scaled )

And of the course, the biggest attempted Inversion about which you have read, but never came to pass, was the attempt by Pfizer Inc. (PFE) attempt to buy out AstraZeneca (AZN). AZN held out by claiming it was worth more than offered. [See the Appendix for a “bonus” takeaway that reveals why the Pfizer bid was not primarily related to taxes!]

Those who are business news junkies have also been following, for weeks now, the ongoing drama of the dogged pursuit by Abbvie (ABBV) of Shire plc (SHPG), just now coming to a head. We’ll be focusing on that drama in a separate article.[6]

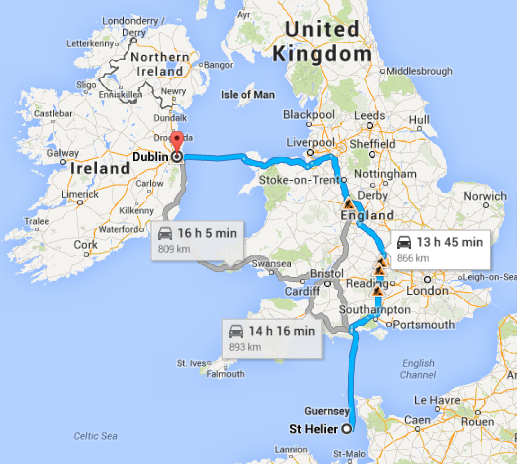

Shire Laboratories started in England, developed staff offices and plants in the U.S., and a few years ago domiciled itself in Ireland via a corporate charter in St. Helier, Jersey (Channel Islands). Are you confused yet?! (See Footnote 6.)

I imagine that each one of our readers has read about one or more of these corporate mergers. After viewing or reading the related business/investment story, you may have thought that you had a solid grasp on the issues that motivated that corporate activity! Unfortunately, I must warn you that, most likely, you do not! The quality of business reporting with regard to Tax Inversion has tended to be far too simplistic, with more than a hint of negativity, and a few pinches of wounded national pride thrown in for good measure. Making matters worse, there tends to be some “herding instinct” on these stories, wherein one publication’s take on the story becomes the outline and tone for the stories that follow (even when the first story “got it wrong”!)

Perfectly illustrating the complicated nature of corporate mergers and Tax Inversion – let me draw your attention to the news this past week that pharmaceutical giant and stalwart, Chicago-based Abbott Laboratories (ABT) is selling its specialty and branded generic pharmaceutical business within developed markets to Pennsylvania-based generic drug behemoth, Mylan Laboratories (MYL). On the surface, this all-stock transaction (estimated value of $5.3 billion) seems pretty straightforward and innocuous, correct?

- This is the logo for ABT

Wrong! The key to this transaction is in the details! ABT will be transferring a therapeutic portfolio of about one hundred of its products to a new public company domiciled in the Netherlands (Holland). In return for that transfer, ABT will receive a 20% stake in MYL!! Meanwhile, MYL will merge itself with a wholly owned united of the new company, thereby making its official tax address in Holland!

Just how cool is that?![7]

Miles White is the much heralded CEO of ABT, pictured here with former Chicago Mayor -- Richard Daley (who retired).

ABT CEO, Miles White[8] has indicated that ABT does not intend to hold its MYL stake over the long-term. ABT has not yet decided what to do with the proceeds of any future sale of that stake; however, Miles highlighted that since that MYL stake is now based in Holland, bringing any sale proceeds back into the U.S. will trigger an extra layer of income tax!

Which brings us full circle back to Tax Inversion! How can companies like ABT maximize shareholder value by deploying its worldwide cash in ways that deliver the highest Return on Investment (ROI) without exposing that cash to a second layer of taxes (it has already been taxed in the country within which it was earned). Since the U.S. assesses one of the highest corporate tax rates in the world, U.S. based companies with a global reach are put at a competitive advantage vis-à-vis other companies that are not required to move cash through double taxation!

On this very point, White was quick to emphasize that no one should be expecting ABT to be engineering a Tax Inversion for itself anytime soon!: “I don’t look at (inversion) as a strategic imperative for us, or a must-do. I wouldn’t rule out a lot of things – I wouldn’t rule out anything, really – but I can’t say you should be waiting for a foot to drop here!”

White, sensing that he had the attention of the financial press during a “teaching moment”, then went on to offer his opinion that the legion of recent deals that have included elements of Inversion have been significantly misunderstood. The primary rationale for Inversion is not any immediate reduction in income tax, but rather the enablement of companies and their shareholders to secure smoother access to overseas cash.

Commenting on such transactions, Miles opined: “They make a lot of sense for a lot of companies. And I don’t think anyone needs to apologize” for making use of perfectly legal processes for shifting one’s corporate tax base.

Finally (perhaps hoping to catch the attention of Washington DC), Miles told the reporters that this issue (above all else) casts a high-intensity spotlight on current U.S. tax structures and regulations. Miles hopes that the public will pressure Congress to address this issue in a manner that will ensure that “every company domiciled in the U.S.” will have a “level playing field in terms of access to capital overseas.”[9]

So, getting back to the beginning of our article and our “mystery” stock. Surely by now, with all this talk about drug companies and Tax Inversion and overseas tax domiciles… you have correctly deduced that our “mystery” company is none other than Walgreens (WAG).

At this point I must confess that I know far too much about WAG. My greatest risk is that I would share far too much of what I know, thereby swamping you, our blessed reader, with TMI (too much information). So please offer me your grace as I edit heavily on the fly!

WAG is the second largest drug retailing chain in the United States.[10] At the beginning of this year, it operated almost 8,700 stores in all fifty states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, and Guam. Like so many of our country’s greatest companies, it was founded in Chicago – in 1901. The guiding force behind WAG from its start was founder, Charles R. Walgreen, a native of Galesburg, IL. The company’s growth started slowly – there were only 4 stores by 1913. However, it was soon fortuitously aided by social developments!

One of WAG’s biggest “breaks” was the 1920’s passage of a nationwide Constitutional ban on the importation, production, transportation, and sale of alcoholic beverages – a ban that remained in effect until 1933!

Now wait a minute, friends. Don’t you dare give me that look – a look that says: “Are you nuts??!! How on earth did Prohibition help WAG?!!”

You see, friends – this is one of the beauties of history. It tends to repeat itself! Just take a moment to imagine a “Medical Marijuana” shop in California (or 22 other states in the U.S.). The equivalent back in 1920 was your local Walgreens store – since “Prescription Whiskey” was available at, and sold by, Walgreens! [What a sweetheart deal that must have felt like!]

By the mid-1920’s, there were 44 stores, scattered around Illinois, Minnesota, Missouri, and Wisconsin, raking in annual sales in excess of $1.2 million! Then, by 1930, WAG boasted almost 400 stores, with annual sales in excess of $4 million! Needless to say, with the extra “kicker” of whiskey, WAG managed to pull through the Stock Market Crash and Depression with little ill effect. In fact, by 1934, WAG was operating in 30 states with over 600 stores!

WAG has practically become a national institution. If you are interested in how management was able to grow the company into the 21st Century, read the book From Good to Great by Jim Collins. One of the book’s most memorable case studies is based on WAG – including the factors that have led to WAG being at almost every important street corner.[11]

By this point, you should be wondering why/how WAG, a domestic drug retailer, is being touted as a candidate for Tax Inversion? Great point!! And good thinking!

There is one reason (and one reason alone) why WAG has become tied to the expectation of a Tax Inversion. In the grand tradition of Charles R. Walgreen, WAG management is willing to think “big” – including beyond the shores of the United States! That is why, over two years ago (June of 2012), WAG announced the purchase a major stake (45%) stake in Europe-based Alliance Boots. This was structured as just the initial step within a three-year buyout plan.

WAG committed itself to a price of $6.7 billion for that initial ownership stake. And it promised to pay an additional $9.5 billion for total control of Alliance Boots. The bottom line result by process end would be the establishment of the world's largest health and beauty retail group – including over 11,000 stores worldwide.

I can’t help but admit that, back in 2012, when I first heard about an Alliance Boots purchase by WAG, my first thought was: “Why on earth is WAG getting into footwear?”

Well obviously, they aren’t! Alliance Boots GmbH (the acronym is German (Gesellschaft mit beschränkter Haftung) and means “Company with limited liability”)) is the product of a huge merger in 2006 between the England’s “high street” pharmacist, Boots Group, and the more pan-European Alliance UniChem, a wholesale and retail pharmacy group. At first, the newly formed Alliance Boots was a London-listed British plc; however, by the very next year it became the target of a private equity transaction by AB Acquisitions Limited (counseled and supported by Kohlberg Kravis Roberts).[12]

By 2012, the business could boast the following:

1) Boots UK was the top pharmacy/health/beauty retailer within the United Kingdom;

2) Alliance Boots was the biggest pharmacy wholesaler within the U.K.;

3) Alliance Boots employed well over 100,000 persons and operates over 3,000 retail pharmacies.

It could accurately be said that Alliance Boots was the “Walgreens of Europe”… plus a bit more (with its larger wholesaling operation).

Now if we remember back to the period between 2010 and 2012, WAG and its whole industry was scurrying to prepare for the Affordable Care Act… with the inevitability of wholesale changes in almost every area of health care being ushered by 2015. Within that context alone, a compelling argument could be made that diversifying beyond the U.S. was a worthy strategic option. At the same time, the key financial players behind the Alliance Boots buyout were ready to “cash out”. So 2012 seems to have been a “kairos” moment for a transaction.

There are also some compelling demographic, economic and global trends going on that makes “scaling up” a logical option for the WAG/Alliance Boots combination. Let’s consider just three of these:

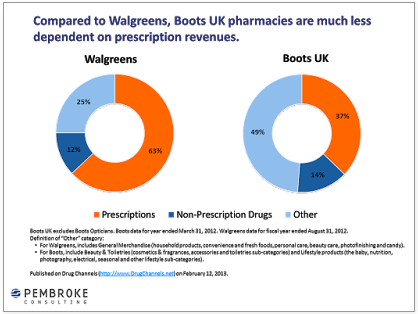

1) In the graph below, you can easily see how dependent WAG is on Prescription Revenue[13]. In contrast, and perhaps helping to provide better “balance” within combined operations, almost 50% of Alliance Boots’ revenue is sourced through non drug sales!

Alliance Boots is less dependent on prescription drug revenue than WAG is... helping to provide better balance in "product mix".

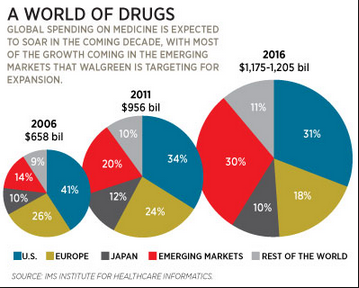

2) The combined operation is looking to expand into the ultra promising “Emerging Markets” – where spending on medicine continues to soar as a percentage of the entire global market!

Looking ahead, WAG hopes to attract a good share of the burgeoning growth in drug sales within Emerging Markets.

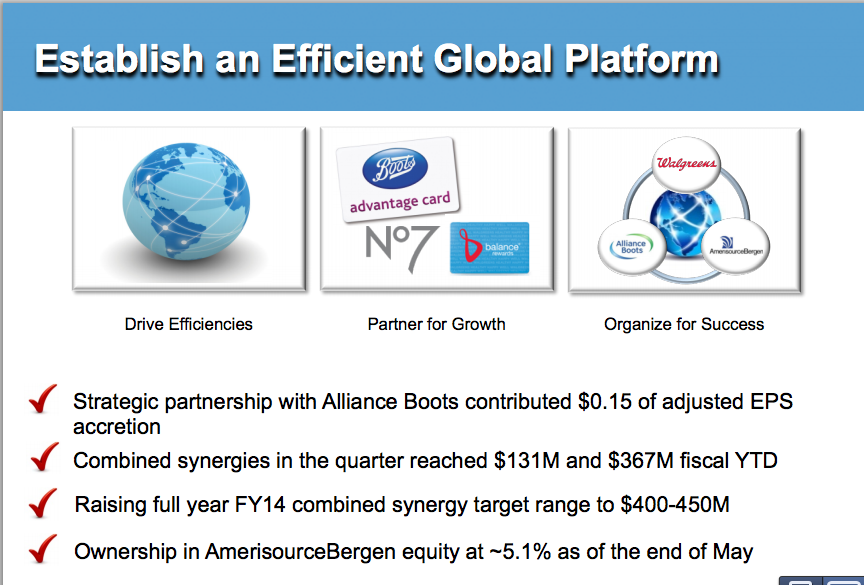

3) Many product, marketing, and cost management synergies will be available. In fact, WAG has already been test marketing some key Alliance Boots branded beauty and personal care products in California. With the greatly expanded market penetration and resources of the combined company (guided by insightful marketing studies), more cross marketing can be done in both directions, as well as new branded products appealing to customers in all markets (and at an affordable price). And, of course, E-commerce operations can be consolidated, expanded, and improved, with tighter security and broader reach. The initial goal set was $1 billion in synergies.

It should also be noted that in 2013, WAG/Alliance Boots signed a new 10-year Distribution Agreement with AmerisourceBergen (ABC) (now the world’s 2nd largest drug distributor). This gives the now enlarged/expanded WAG even more leverage to demand from drug wholesalers (including generic manufacturers) the lowest prices possible. As Econ 101 suggests, this will give WAG a competitive advantage vs Caremark LLC (CVS), and should allow it to expand and broaden the drug business in Europe – where generic drugs are significantly under-utilized – as well as in the Emerging Markets (as already mentioned).

All of this does sound irresistibly promising! It is an exciting story! However, I confess to having been a lot more impressed by the WAG of several years ago[14], consistently offering good value for the consumer dollar and offering a stock priced (reasonably) between $30 and $40.

This is the point at which I invite you to keep everything else I say about WAG in the context: “what Tom says might only reflect his own personal experience!” That is not at all an unfair perspective! After all, I have not only been thoroughly unimpressed by the major “remodeling” done in our area stores (particularly the reconfiguration of the pharmacy area), but I have found that it takes longer to get service at the pharmacy counter. My experience with the electronic renewal of prescriptions and notification of pickup availability has been, at a couple of points, abysmal. And I have found that a competitor offers a much better “rewards” program, with better prices on the items I regularly need.[15]

In addition, I can’t help but focus upon this historical parallel:

1) WAG succeeded and grew through the 1920’s with the “tailwind” of “Medicinal Whiskey”;

2) Today, despite the fact that it’s newest advertisement campaign is built around the theme:

“At the corner of HAPPY and HEALTHY!” … WAG continues to sell cigarettes.[16] I will grant that the argument used by WAG to justify the continuation of sales [because they need to serve their customers, a large percentage of whom depend upon WAG to carry them] is economically understandable. However, to me this feels like a “throwback” to the whiskey sales of the 20’s.

After all, in 2014 no one can claim that cigarettes do anything but harm to its users. You’d just have to be completely “Batty” to make any “health benefit” claim for smoking! (See image below)[17]

Putting aside all of the above, however, I was totally astounded by what I considered a completely maladroit management presentation at its late June earnings conference. Here is my summary of the key issues:

1) In 2012, swelling with the energy and excitement of securing the initial leg of the Alliance Boots deal, management saw fit to broadcast very ambitious goals for 2016… fully four years away!

a) What did we learn in Management 101? “Do not set expectations that you do not intend to move heaven and earth to achieve!”

b) WAG management had to admit that, not only were the operational metrics for WAG not on target to meet those objectives, but neither were the operational metrics of Alliance Boots!!

c) What happens when management offers bad guidance to analysts, or the Fed provides faulty guidance to Wall Street? Prices get punished.

d) So a key lesson to remember for the future: Don’t give unrealistic guidance – especially four years in advance!

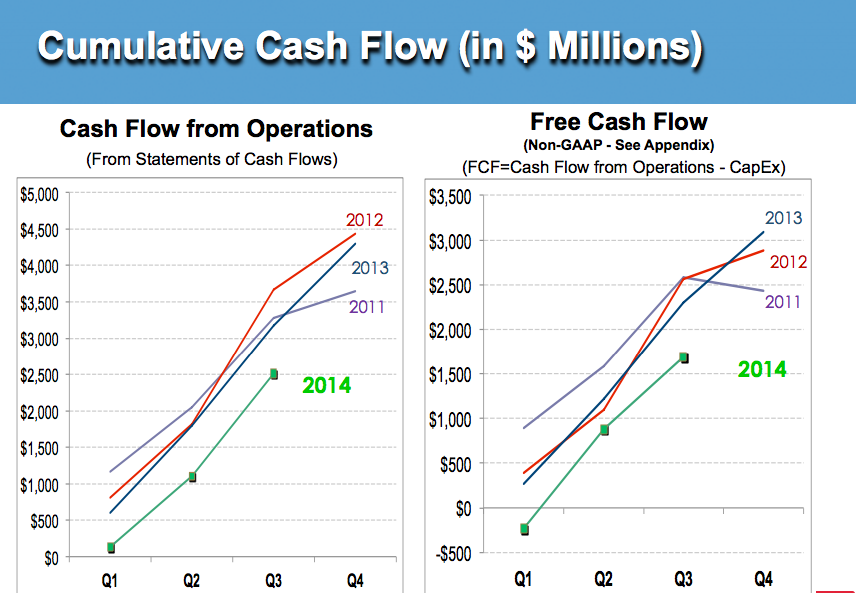

e) This chart from the WAG investor presentation suggests simple visual evidence of WAG’s recent financial challenges. Cash Flow and Free Cash Flow from 2014 is in Green… and at the bottom of the graph!

2) Back in 2012, it might have appeared to the novice that a pretty clear and solid path had been laid out for WAG to complete the Alliance Boots acquisition process by 2016. However (alas) at the June earnings conference, management had to admit that discussions to complete that acquisition have been tougher than anticipated.

a) In the words of WAG CEO, Greg Wasson: “We are working through complex issues in planning for step two, and we are taking the appropriate time to come to the right resolution for the combined enterprise.”

b) More specifically, the Board indicates that some of the “sticking points” have Included topics such as a deal structure, cost-savings initiatives and potential capital structures.

c) I find it astounding that, even with two years to be diligently working on these issues, all of which should have been clear and in focus from the day the ink was dry from the first step in the acquisition in 2012, these crucial, essential, pivotal issues are not much, much closer to resolution!!

3) Management promises that, by late July or early August, an additional update on the timing and structure of the “proposed second step of the Alliance Boots transaction will be announced.

a) This strategy of “kicking the can down the road” is much more reminiscent of the management principles demonstrated in Washington DC than in Chicago, Illinois.

b) Chicago Mayor Rahm Emmanuel is internationally known as a no-nonsense negotiator who “gets results”.

Chicago Mayor Rahm "Dead Fish" Emanuel is on the left, and WAG CEO, Greg Wasson, is on the right. Perhaps Wasson should have asked Rahm to handle negotiations with Alliance Boots on the final step of the acquisition, because Rahm is known as a "results-getting" negotiator!

c) As detailed earlier, Abbott CEO Miles White managed to shepherd a transaction to completion that, in many ways, was at least as complicated as this one. More to the point, White “managed it” so effectively that no one (analysts, press, or critics) batted an eye!

d) These reflections cause me to wonder aloud if Mr. Wasson and his team are really “ready for prime time” within the world of global pharmaceutical corporate management!

INVESTOR TAKEAWAY

Remember that I never give buy or sell recommendations! (Ever!)

With that said, were I to be teaching you an academic course on relative valuation, this is what I would say:

1) If you absolutely had to buy a pharmaceutical-related company right now, and your choices were limited to WAG, CVS, and ABT (poor you!!)… consider these points:

a) Price (WAG price in blue; S&P 500 Index in red)

i) As you can see below, around the time of the initial step in the acquisition of Alliance Boots, WAG was priced at less than half its current price!

Ii) That price stayed largely in “a range” until mid-2013, even though the 2016 “Objectives” had been posted and trumpeted for some time; and any sharp analyst could have created an appealing financial “model” for the melding of WAG, Alliance Boots, and AmerisourceBergen, (including Tax Inversion – which is in no way a “new” concept!).

iii) It has only been since the Tax Inversion theme has become Wall Street’s investment theme “de rigueur” (at least in connection with pharmacy stocks!) that WAG stock has skyrocketed.

iv) An objective observer could suspect we were witnessing an “Inversion Bubble”.

b) Relative Metrics

I) CVS and WAG are comparable in size (without counting Europe)

ii) In terms of these two metrics especially important to me, CVS is superior:

5 Year Dividend Growth CVS 28.39% vs WAG 23.46% Payout Ratio 24.14% vs 42.9%

Note that, as a consequence, the CVS dividend is much safer!

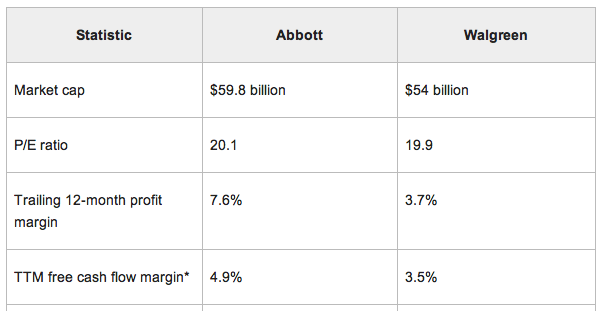

iii) A brief comparison of ABT to WAG (from a January Seeking Alpha, reported these metrics:

I am sure you can sense my preference! As an added “kicker”, yesterday (July 16th) ABT beat analyst expectations on earnings ($0.54 vs $0.51)! One sign of good management is “beating” estimates! This segues perfectly into the final point:

c) Management

i) In my mind, by this standard, CVS and ABT are both at least a step above WAG.

ii) CVS CEO Larry Merlo made an impressive, “stand up” decision to drop cigarettes so that CVS would not perpetually be in the hypocritical position of pushing “health” in the back of the store while peddling “cancer sticks” in the front of the store.

iii) Few CEO’s become recognized as a Barron’s “Top CEO” for six years in a row as Miles White (of ABT) has done! And he secured an incredibly creative and potentially profitable global deal without a hitch! That is impressive!

So my friends:

1) Beware of Wall Street’s de rigueur investment themes… no matter how trumpeted by Fox Business News, Bloomberg, or CNBC.

2) Beware of any kind of “Bubble”.

3) Look behind any “pizzazz” (or current story line) and take the time to look “under the hood” of a potential investment

4) Never, ever underestimate the importance of quality, globally savvy and internationally astute, management.

Even a great, “can’t miss”, “sky is the limit” deal can be screwed up by poor management [18]

DISCLOSURE:

I am currently holding a bear call credit spread on WAG. I do not own CVS or ABT. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

APPENDIX:

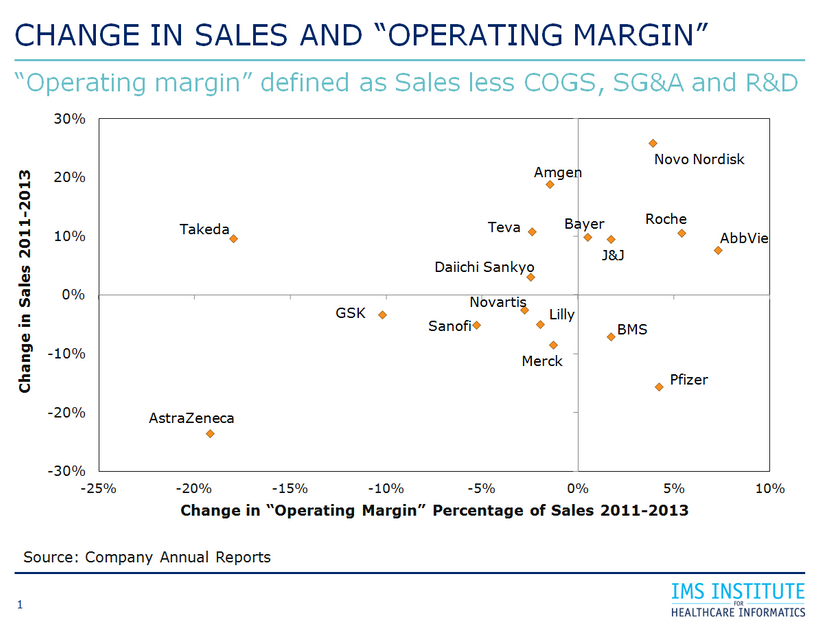

A May article in Forbes proves once again how much more powerful one image can be than a thousand words. Take a look at this chart of pharmacy companies. While the industry as a whole has spent the past three years improving the bottom line by trimming expenses and becoming much more operationally efficient (improving Margins!), it appears that AZN “didn’t get the memo”!!

Looking at this chart, I am almost tempted to think that even I could move Operating Margins into one of the right hand boxes – preferably to at least the level of J&J. This must be the big reason PFE is salivating to get control of AZN! In future quarters, improving “comps” could prove to be a breeze!!

This chart illustrates the potential within AZN for improving margins through firmer cost controls and more efficient use of capital.

FOOTNOTES:

[1] Buffett often writes: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

[2] U.S. Companies whose overseas operations pull in millions/billions of cash have a compelling motivation to find a way to rationalize its tax liability – since (without an adequate strategy) said income is taxed both abroad and in the U.S. Obviously, companies pursuing this strategy are likely to select a country that has a lower tax rate and less stringent corporate governance requirements.

[3] Management declared a new corporate name for the combined entity that would never qualify them as possessing an iota of humility; namely: the Premier Global Power Management Company.

[4] At the time of the announcement, this merger was, in the immortal words of V.P. Joseph Biden, “A big f______ deal!”… because it would have created the world’s largest ever advertising firm. One can have some fun by offering conjectures regarding why it didn’t work!

[5] Eteris is said to mean “Eternal Innovation for Society!”

[6] There are lots of juicy details to share, such as: Shire plc was created in Basingstoke (Hampshire) England in 1986, and expanded over time into the U.S. (staff in Cambridge, MA and Wayne, PA; manufacturing in Lexington, MA and San Diego, CA. Then in 2008, in response the Labour Party tax policy in England, up and moved its tax domicile to Ireland via the creation of a new holding company in St. Helier, Jersey, in the Channel Islands!

Huh??!! Absolutely! Go figure. You will not want to miss that article!!!

[7] Imagine the person hours by management and legal teams that must have been invested in creating that tidy little wonder of corporate legerdemain!!

[8] White has been named by Barron’s magazine to its list of “World’s Best CEOs” in 2009, 2010, 2011, 2012, 2013, and 2014. Here is part of its description of White: [under White’s 15 years of leadership…] “Abbott has been the envy of much of the drug industry, with its consistent earnings growth and excellent shareholder returns. To unlock even more value, White got board approval to split the company in two.” [that resulted in the spinoff of Abbvie (ABBV)

[9] I am not holding my breath about Congress doing anything constructive… it’s not covered by the ACA’s prescribed health plans!

[10] This point needs clarification. WAG has more stores (a lot); but CVS has a larger market cap and much greater revenue. You take your choice regarding how to rank them!

[11] When I visit family in the SW Florida area each year, it definitely appears to me that there are far more WAG locations than there are McDonalds (MCD) stores!

[12] It is worth noting that Alliance Boots was the first company on the FTSE 100 Index that was bought out by a private equity firm.

[13] 63% of WAG revenue is from Rx sales, and another 12% from non-prescription drugs. In my humble opinion, that is why the 2011 battle with Express Scripts (ESRX) was ill-advised.

[14] I used to shop at week at least once each week, and secured all my Rx’s from WAG.

[15] I may go into WAG once a month now.

[16] In sharp contrast, CVS has dropped cigarettes. Caremark’s CEO, Larry Merlo said: “We’ve come to the conclusion that cigarettes have no place in a setting where health care is being delivered!”

[17] I am not objective. My dad smoked for over 45 years and lived with the scourge of emphysema for the last ten years of his life.

[18] Just consider the story of Omnicom Group and Publicis Groupe as an example… not to mention anything touched by the folks in Washington DC!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

2 Quantum Computing Stocks That Could Supercharge Your Portfolio

2 Quantum Computing Stocks That Could Supercharge Your Portfolio