Imagine, readers, what would happen if that headline appeared in an Associated Press Tweet on Tuesday morning around 10 AM! Combine three words that, on their own, would not necessarily grab the world’s attention and splash them all over the internet during U.S trading hours, and then watch tens of thousands of traders (including me) panic and scramble. What a study in human behavior that would be!

Well, that is the story I will present to you here – except it isn’t in the form of an AP Tweet (thank goodness). To provide a context for this story, I ask you to recall (or review) the post within which I offered a detailed analysis of Apple Corporation’s (AAPL) newest innovation: the $17 billion “i-BOND” series announced late April and released in early May “Apple's New Product Innovation (Part I)” and “Apple's New Product Innovation (Part II)” As you read, a key element of this i-Bond strategy is that it accomplished the following:

1) Returns $100 billion of cash to shareholders between now and 2015 through an increased in the dividend and share buybacks;

2) It accomplishes this while simultaneously maintaining Apple’s full access to its $45 million U.S.-based cash balance ;

3) Saves Apple $9 billion in taxes by sparing Apple the need to repatriate some of its reported $102.3 billion (as of 3/30/2013) of cash held overseas.

As I warned in my article, repatriation was a hot topic in Washington, D.C. this past week. According to the Merriam-Webster Dictionary (Merriam-webster.com), the word “repatriate” has its roots in the Latin word repatriare – meaning “to go home”. The English word therefore means “to restore or return to the country of origin”. This term normally refers to persons (being restored to their country of birth). However, we all know that our U.S. Congress cares much more about money than it does people – so the hearings this week focused strictly upon the repatriation of money earned overseas by U.S. corporations.

Specifically, the Senate Permanent Subcommittee on Investigations held hearings this week, before which they called AAPL CEO, Tim Cook, to appear on Tuesday. Think about that for a minute, folks! In this era of terrorist bombings, IRS harassment and “targeting” of particular groups applying for tax-exempt status, and the wiretapping of journalists’ conversations and email exchanges with everyone (including parents) this Senate investigating group is grilling the CEO of the U.S. company that, in the most recent year, paid more income taxes than any other U.S. company (and possibly, more than any other company in the world!).

Mr. Cook, accompanied by his CFO and the head of AAPL tax operations, was offered the courtesy of offering an opening statement. Perhaps Cook should have anticipated all of the senators’ questions and included his answers within his opening statement, because during the actual questioning, Cook was frequently cut-off by senators more anxious to get their own pointed sound-bites “on the record” than to hear Cook’s answers.

With regard to “how Washington works”, it may be illuminating to note that the subcommittee had scheduled a special “warm up” period just prior to Cook’s scheduled testimony. The “warm up” was a period of questions and answers with a panel of tax experts — during which senators grilled the panel about U.S. corporation tax issues. In particular, the senators appeared to glory in bringing up various rumored tax practices engaged in by AAPL – including the alleged use of Irish subsidiaries to avoid U.S. taxes. Freed from any semblance of responsibility to be fair or open-minded, a number of the senators peppered their exchanges with the tax experts by referring to AAPL using phrases such as “tax freeloaders” and “unfair advantage.”

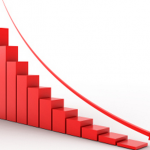

The fact is that this repatriation issue has become a key issue for countless U.S. companies, which hold more than $1.5 trillion (some say it is over $1.7 trillion) in overseas cash. To put that in perspective, this $1.5 trillion is bigger than the Gross Domestic Product (GDP) of all but 12 of the world’s nations!! Very significantly, most of the U.S. companies holding a share of that huge pool of cash are committed to keeping it overseas as long as the long (and deep) shadow of the 35% U.S. corporate tax rate hangs over any attempt to bring that cash “back home”.

GRAPH: to illustrate the significance of the size of U.S. corporate cash overseas, there are only 12 countries with a GDP (2012) higher than this estimated store of cash. The graph to the left includes all twelve of the nations with GDP higher than $1.5 trillion. (Source: Wikipedia.com).

In the midst of the lights, cameras, and accusatory tone of many of the questions directed at him, Cook maintained his good sense and confident stance that AAPL has not done anything illegal or improper. Among Cook’s statements were these:

“We don’t depend on tax gimmicks… We not only comply with the laws, but we comply with the spirit of the laws…. To our knowledge Apple is the largest corporate taxpayer in America. We paid $6 billion in cash to the U.S. Treasury – that’s $16 million each day. And we expect to pay even more this year.”

GRAPH: Perhaps a better illustration of the size of U.S. corporate cash sitting overseas is the graph to the left, which excludes the GDP numbers from the top four nations. See how the U.S. corporate overseas cash level compares with Germany’s GDP! (Source: Wikipedia.com)

Think about that for a moment — $16 million every day! In a Congress that depends upon vast sums of money streaming into the U.S. Treasury every year to prop up its addiction to spending more money than any of us can imagine, one would think that testimony from a company that pays $6 billion in taxes would be heralded rather than vilified as a “tax freeloader”.

Cook’s testimony offered some additional highlights:

“Apple is a company of strong values. We believe our extraordinary success brings increased responsibilities to the communities where we work…. We enthusiastically embrace the belief, as President Kennedy said: ‘to whom much is given, much is required.’” [1]

“The tax code has not kept up with the digital age.”

That last sentence is the crux and key of Cook’s message to Congress. He strongly suggested that, just as AAPL has thrived by keeping things simple, so Congress should do the same with the tax code. Admitting that his suggestion would most likely lead to higher amounts of AAPL taxes, Cook still implored Congress to eliminate loopholes, reduce overall rates, and make it attractive to bring overseas cash back to the U.S.

Interestingly, Cook has a strong ally with regard to the essence of his Tuesday testimony. The ally is President Barack Obama, who said the following over two years ago in his 2011 State of the Union speech:

“Over the years, a parade of lobbyists has rigged the tax code to benefit particular companies and industries. Those with accountants or lawyers to work the system can end up paying no taxes at all. But all the rest are hit with one of the highest corporate tax rates in the world. It makes no sense, and it has to change.

So tonight, I’m asking Democrats and Republicans to simplify the system. Get rid of the loopholes. Level the playing field. And use the savings to lower the corporate tax rate for the first time in 25 years – without adding to our deficit. It can be done.”[2]

You would think that an alliance between the U.S. President and the country’s second largest company would move Congress to action. However, I offer you three simple realities:

1) Obama’s speech was almost 2.5 years ago, and not only are we no closer to corporate tax reform now than we were then, but Congress can’t even agree on basic budget issues, much less how to simplify the impossible mess that has been made of taxes by prior Congresses.

2) The existing system motivates companies, executives, and board members to donate billions of dollars to politicians in an effort to influence action on special interest legislation (including tax breaks). Members of Congress depend upon those revenue streams; they like things the way they are.

3) To justify the status quo, Congress has a great straw dog upon which to lean. In 2004, Congress passed the “American Jobs Creation Act”, which included provisions intended to create jobs and stimulate the economy (sound familiar?). One of those provisions was a tax break on repatriated corporate funds – taxing them at a deeply-discounted rate of 5.25%. The common wisdom in Washington was (and probably still is) that this so-called “repatriation tax holiday” was a failure with regard to job creation.

Obviously, legislation could be designed that provided for a significant tax break on corporate cash repatriated to the United States and tests and safeguards (ie. potential penalties) to ensure that such cash was put to uses that are helpful to create jobs and stimulate the economy. However, I am sorry to say that it is my opinion that, within the current political climate, all of the realities I have outlined above ensure the continuation of a U.S. corporate tax policy that both Obama and Cook agree is overly complex, unfair, and economically irrational. One of the many unfortunate consequences of Congressional inaction will be that over $1.5 trillion in U.S. corporate cash will continue to be exiled from our quite lackluster domestic economy.

Submitted by Thomas Petty

[1] Kennedy ‘s famous quote is lifted from a verse in the Gospel of Luke, Chapter 12 ,from the Bible.

[2] italics added for emphasis

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why Verve Therapeutics Is Skyrocketing Today

Why Verve Therapeutics Is Skyrocketing Today