Imagine that you are a modern-day Rip Van Winkle who mysteriously fell asleep back in early 2011, when Bill Gross and various other pundits appearing on business television were forecasting an increase in the U.S. Federal Funds Rate – which had been holding steady at a record-low of 0.25% since December of 2008. (You would also have heard predictions that Greece would either be kicked out of the Eurozone or leave it by its own volition).

Imagine that you are a modern-day Rip Van Winkle who mysteriously fell asleep back in early 2011, when Bill Gross and various other pundits appearing on business television were forecasting an increase in the U.S. Federal Funds Rate – which had been holding steady at a record-low of 0.25% since December of 2008. (You would also have heard predictions that Greece would either be kicked out of the Eurozone or leave it by its own volition).

Now imagine that you have recently been awakened … in November of 2015… and then you tune into your favorite business television station. Clearly, you would be utterly amazed that rates have not yet been raised! (And perhaps even more so, you would be stunned that Greece is still a part of the Eurozone!)

As you know, according to most reports we hear (and according to last week’s Congressional testimony by Fed Chair, Janet Yellen) the Fed will announce its first rate increase following the December meeting. This raises the obvious question: “How will the investment markets react to that increase?”

The intent of this article is to provide some background on “Rates” and the “Markets”, and then pose various ways of analyzing the relationship between rates, stock prices, and bond prices.

Let’s start by considering the standard textbook narrative regarding the effect of an interest rate increase as taught decades ago to many of us within the “Baby Boomer” generation:

When the Fed increases the Federal Funds rate, it doesn’t have immediate, direct impact upon the stock market. Why? Because there is really only one direct effect — it becomes more expensive for banks to borrow money from the Fed.

However, that change exerts considerable “Ripple” effects – as the higher cost of funds for banks impacts individuals (higher auto loan rates, mortgage rates, student loan rates, etc.); impacts businesses (higher “Prime Rate”, leasing rates, “Receivable Loan” rates, etc.); and investors (margin rates, return on newly purchased fixed income securities, CD rates, etc.).

As suggested above, these “indirect effects” of a Fed rate increase will inevitably impact consumer spending and saving (for example, less spending on discretionary items); folks will spend less on DISCRETIONARY items.

Naturally, that will impact (lower) corporate sales and earnings; and in addition, businesses will have less motivation to borrow (corporate borrowing has ballooned in recent years because of historically low rates).

Such economic adjustments as those suggested above will soon become reflected within stock and bond prices – as a new equilibrium is sought within the “Supply/Demand” dynamics surrounding money.

Folks, you do not need me to tell you that the above definition of the impact of a Fed Funds Rate increase has, in 2015, become seriously antiquated for at least the following reasons:

1) The financial markets have become utterly global. Money can be moved from country to country in seconds via “Electronic Transfer” in ways that were unknown in decades gone by.

a) This is the result of an evolution within banking related to technological progress, international treaties, more sophisticated and elaborate banking systems, and (of course) the consolidation and expansion of banks across national borders (eg. Deutsche Bank, UBS, Barclays, BMO, etc. operate within the U.S. and U.S. banks operate branches overseas.

2) The evolution of high-speed computing beyond anything imagined in former decades… resulting in extremely sophisticated and detailed “financial models” based on algorithms that (supposedly) project the consequences of multiple variables within the economic environment – including actions by Central Banks!

As a result, with greater confidence that the “future” can be predicted, market participants have become convinced that their objective is to invest for the “investment environment” that lies at least six months ahead. So when the Federal Reserve warns of a rate increase… the bond market (and stock market) do not wait for the results of a rate increase to become fully manifest. Instead, they start adjusting maturities, durations, allocations, etc. immediately!!

As we will see below… one formerly time-tested “rule” is that bond prices and stock prices tend to move in opposite directions[1]. In theory, that makes perfect sense in light of the role that the (theoretical) “Risk-Free Rate” plays within the Capital Asset Pricing Model… and its many related “Valuation” and “Risk Management” analytical formulae. (See below)

However, consider the fact that we have reached (at least nearly) the end of one of the longest “Bond Bull Markets” in history[2] — and yet during many years within that long secular bond “bull market”, stocks were simultaneously enjoying their own secular bull market.

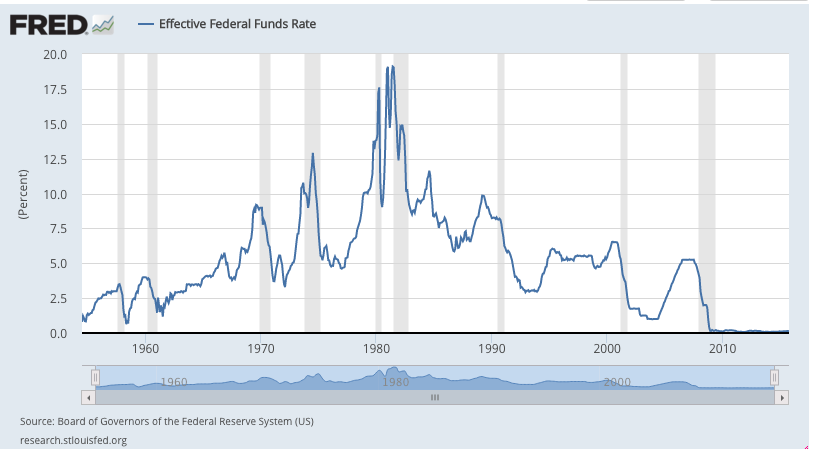

This graph from the St. Louis Federal Reserve Bank offers a telling image of the long term secular downward trend of interest rates since 1980. That trend accounts for the 34 year secular bull market in bonds.

So (as will be illustrated later by reference to a child’s toy)… investors must always remember that the variables that impact rates and stock prices are so numerous, and their movement at any given time is so unpredictable, that it is impossible to make an omniscient forecast of where bond or stock prices are headed next.

Rate Dynamics

The ostensible (“published”) objective of central bank authorities (such as the Fed) is to foster economic growth, enable “full” employment, and temper inflation through the management of that central banks official “lending rate” (within the U.S., it is the Federal Funds Rate).[3]

Raising that rate brings into play the classic systemic effects of “Supply/Demand” taught in Economics 101 – namely, when the cost of something (money) is increased, then demand decreases… leading to an (eventual) rebalancing of “supply” (money) that matches “demand” (borrowing). To simplify, as the Fed raises its basic lending rate, the nation’s money supply (in theory) is reduced.

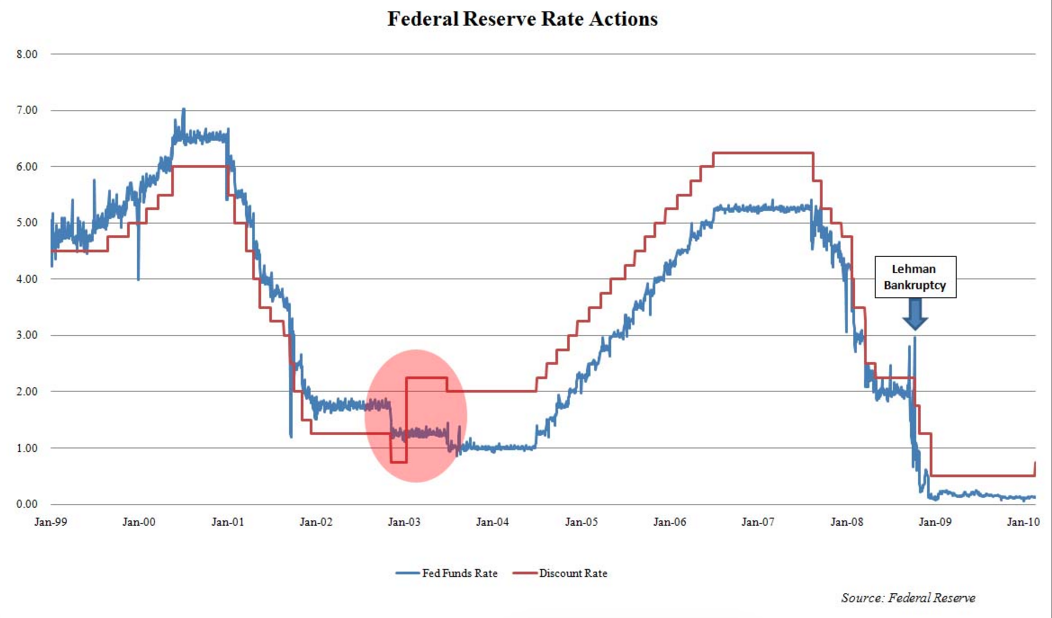

It is important that investors know that the Federal Reserve has (direct) control over just two interest rates: a) the above Federal Funds Rate; and b) the Federal Discount Rate[4]. If you were not aware of that second rate, it is because that rate has become relatively insignificant. The “discount rate system” as it currently operates replaced a much more complicated system[5] in January of 2003. The graph below shows the relationship between the “Fed Funds” and “Federal Discount” rates since 2003 – quite stable except for adjustments during the Financial Crisis.[6]

This graph shows the trend of the Federal Funds Rate vis-a-vis the Federal Discount Rate, which have moved largely in tandem since 2003 (except a couple of adjustments due to the Financial Crisis).

All the other rates that we regularly hear about – “Prime Rate” (set by banks), auto loan rates, 30-year mortgage rate, 15-year mortgage rate, adjustable mortgage rates, etc. – adjust dynamically in accord with the particular supply/demand variables related to the particular economic area related to that rate. So although Fed decisions ultimately “color” and impact other rates in the U.S. – the Fed has direct control over only two rates (and for all practical purposes, only one of those is significant).

ONE ADDITIONAL TOOL

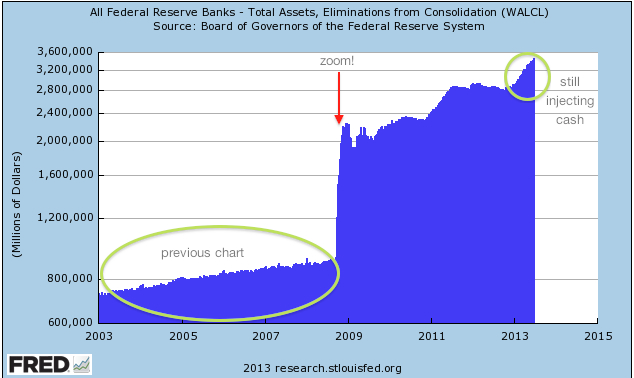

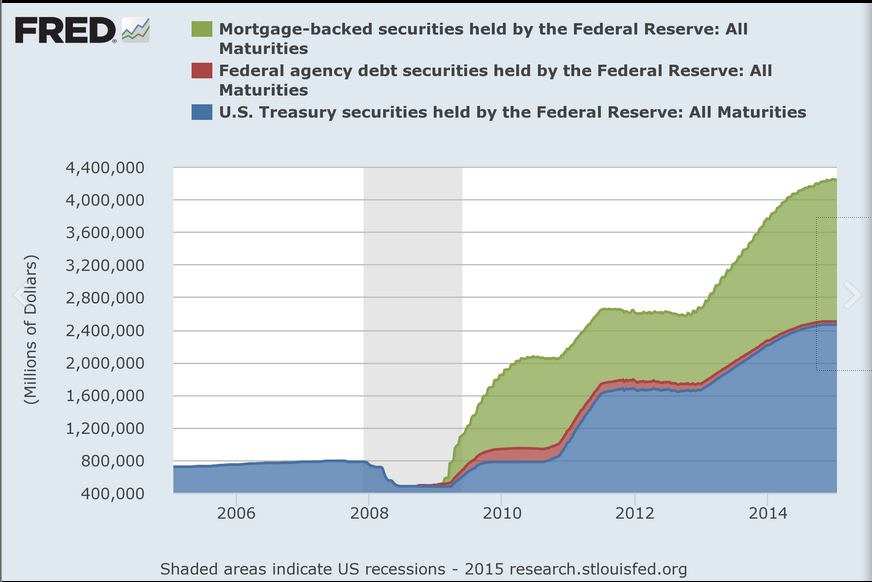

I would be severely remiss if I did not mention the additional “tool” the Federal Reserve has at its disposal in the management of money supply and monetary stimulus[7]. Former Federal Reserve Chairman, Benjamin Bernanke, can be credited with being the midwife[8] of a willingness on the part of Central Banks to utilize a nearly unlimited level of (quasi[9]) governmental assets to buy or sell its nation’s bonds. Since November of 2008, when Bernanke initiated a $600 billion purchase of mortgage-backed securities during the worst portion of the “Mortgage Crisis”… the Federal Reserve ballooned its “Balance Sheet” from about $700-800 billion (before 2008) to its current size of over $4 trillion.

This graph shows the magnitude of the expansion within the Federal Reserve Balance Sheet due to "Quantitative Easing".

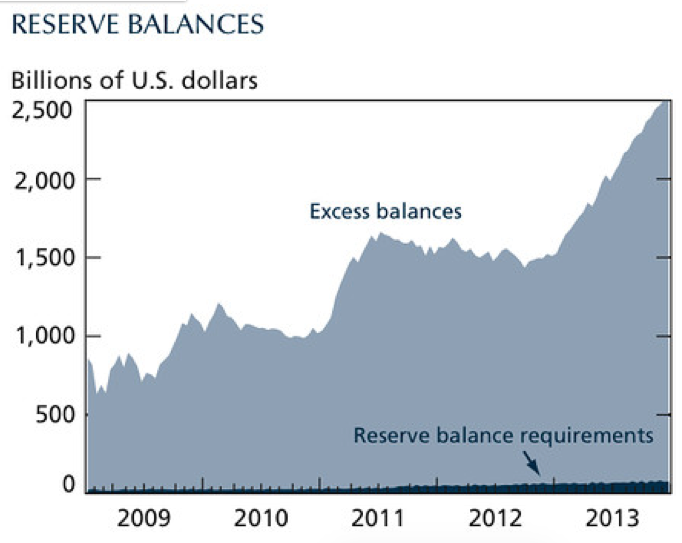

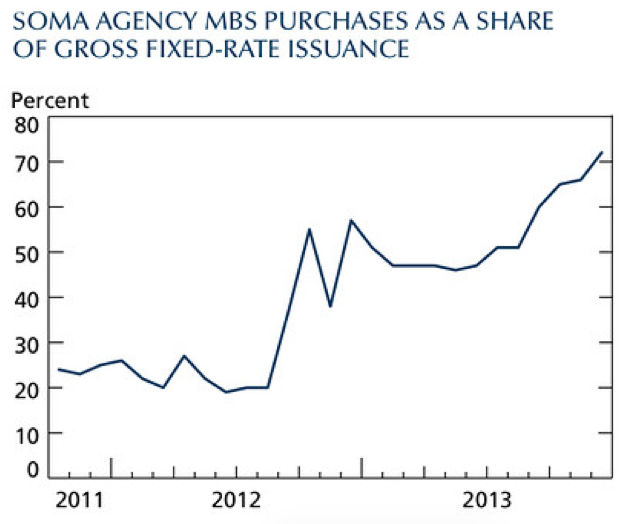

In the event that the above graph does not convey the (formerly) unimaginable degree of “Fed Monetary Stimulus”, consider these graphs that visual for us the degree to which the Federal Reserve has dominated the “demand side” of U.S. Treasury and Mortgage-Backed Security purchases since 2008:

In this graph we see the expansion of Fed Reserves compared with the minuscule "Required Reserves" barely visible at the bottom of the graph.

This graph shows how dominant the Federal Reserve became within the Mortgage-Backed Securities market in its attempt to shore up the mortgage market.

And here is a parallel graph demonstrating that the Fed was the dominant buyer of U.S. Treasury Bonds in 2011, 2012, and 2013.

Is it any wonder that investment managers, analysts, pundits, and the CEOs at major financial firms all spend extraordinary amounts of time pouring through what would otherwise be totally boring reports from the Federal Reserve?

Because Bernanke and his successor, Janet Yellen, have demonstrated little restraint in the exercise of the full-range of Federal Reserve monetary authority, the “Balance Sheet” of the U.S. Federal Reserve has become a powerful visual aid to help investors more clearly understand the degree to which we have experienced an era of “Monetary Easing” (ie. high liquidity).

Looking at the chart below, we can easily see that (if reason were the sole determinate of investment decision-making) a prospective 0.25 point increase in the Federal Reserve Funds rate could be reasonably viewed as a minor “blip” within the bigger picture of our current “easy money” macro investment environment.

Here is a different view of the mammoth Federal Reserve Balance Sheet, identifying particular categories within the total assets held by the Fed.

Why is that? Because a 0.25 point rise in that Fed Funds rate will hardly make a dent in the vast expansion of the money supply accumulated since 2008 – particularly because other major developed economies still continue their own iterations of “Quantitative Easing” (ie. monetary expansion). Therefore, the possibility exists that a good share of the “easy money” generated in Europe, Japan, China, etc. will be directed to stock and bond opportunities within the U.S.!

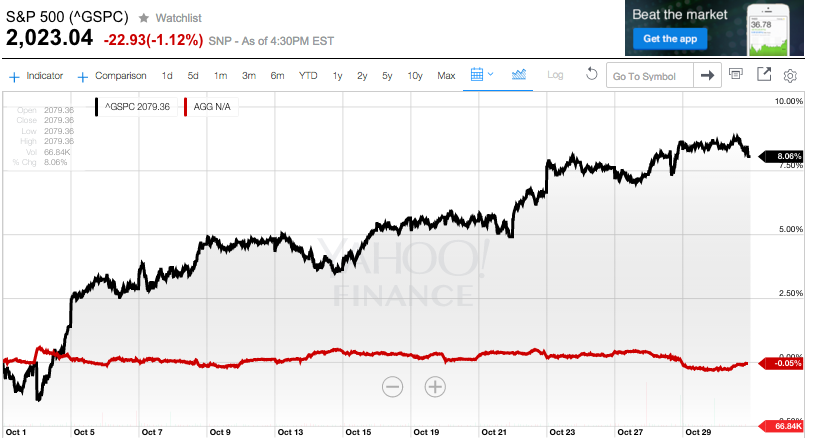

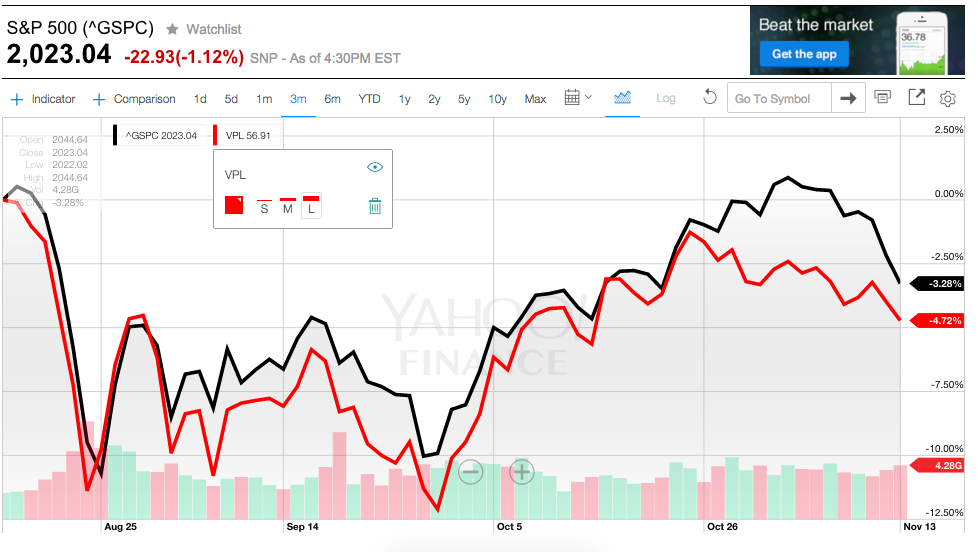

There are surely those who will attribute the 3.2% fall in the S&P 500 Index during the week of November 9-13 [while the iShares Core US Aggregate Bond (AGG) [reflecting the basic U.S. Bond Aggregate Index] rose almost 0.5%, as the result of the prospective Fed Funds rate increase. However, that logic ignores the fact that the month of October witnessed an outsized (and largely unexpected) move upward of just over 8% in the S&P 500 Index, while the AGG fell by 0.05% during the same period.

The S&P 500 Index experienced a strong rally in October. Meanwhile, the U.S. Bond "Aggregate" Index declined.

And allow me to add to this evaluative equation [regard the impact of rates on equity prices] the fact that between the Federal Reserve statement that followed its late October meeting and November 3rd, the S&P 500 Index went up a bit further (from 8.0% t0 8.12%), while the AGG decreased in value a bit more (to 0.88% from 0.5%).

Even after the Fed statement in late October (hinting at an increased chance of a rate hike in December), the S&P 500 Index moved up further while AGG declined a bit more.

If one was forced to “explain” the downward price action in U.S, equities during the second full week of November, positing that equities could not gather enough upward momentum to break through overhead resistance (the previous all-time highs) would be just as cogent an explanation as any reference to interest rates.

It is also quite reasonable to offer the observation that, on a relative attractiveness basis, investors have not been flocking to either Europe:

”] Nor have investors perceived Asia as more attractive than U.S. stocks:

Nor have investors perceived Asia as more attractive than U.S. stocks:

Therefore, one could reasonably posit that if/when the Fed raises rates (which will likely have the effect of strengthening the U.S. Dollar) the unequalled liquidity of the U.S. equity market and the unequalled perceived “safety” and liquidity of the U.S. bond market will continue to offer an attractive return relative to other alternatives within a world still “awash” in monetary supply.

STOCK VALUATION METHODS

Let’s move on to explore a different tact regarding the relationship between interest rates and equity prices. One standard (“classic”) method of valuing a company is Cash Flow Analysis… adding all expected future cash flows and discounting said flow back to the present… with the “discounting factor” being rate-related. One calculates future (theoretical) stock value by dividing expected future cash flow (discounted) by the stock shares outstanding (float):

Cash Flow Analysis: The expected Future Discounted Cash Flow from Company Operations

Divided by

The number of Common Shares Outstanding (“Float”)

In addition, there are valuation methods that are based upon “Relative Value” … which compares a theoretical return from Stocks vis-a-vis a “Risk-Free Rate” (generally the 10-year U.S. Treasury Note). One doesn’t need a college professor to explain why a “Risk Free” rate is important within stock valuation. After all, If an investor can earn a 3% rate without any risk or worry, she/he will not be interested in investing within equities unless it is likely that equities will provide a return that exceeds 3% by enough of a margin to compensate the investor for risk!

As the “Risk-Free Rate” goes up… bonds become more attractive and stocks have a higher “return threshold” to overcome (ie. a “Risk Premium”) in order to become attractive on a relative basis.

Theoretical Value of Stocks = “Risk-Free Rate” plus “Equity Risk Premium”[10]

If these issues of “relative value” and “risk-adjusted” value intrigue you, you can find much more detailed information within these prior articles:

https://www.markettamer.com/blog/market-valuation-watch-for-the-puca

https://www.markettamer.com/blog/sharpen-your-analysis-of-ibb-xbi-and-fbt

https://www.markettamer.com/blog/key-information-ratio-for-deciding-between-fcntx-and-rgaax

A “Contrarian” View:

I appreciate disciplined, reasoned analysts who offer insights that move the investment discussion beyond “conventional thinking” (in other words, analysts who don’t always accept premises that are supported by such nonsensical arguments as “everyone knows”).

Dr. Aswath Damodaran of the Leonard N. Stern School of Business (within New York University) is a great example of such a rigorous, credible analyst.

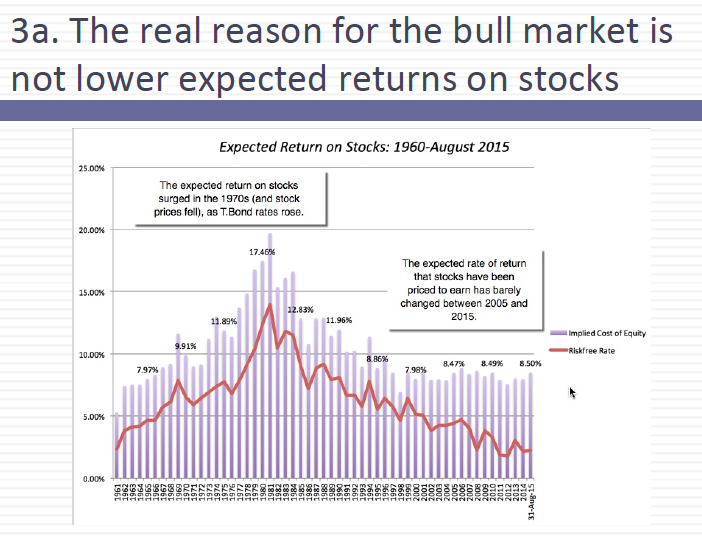

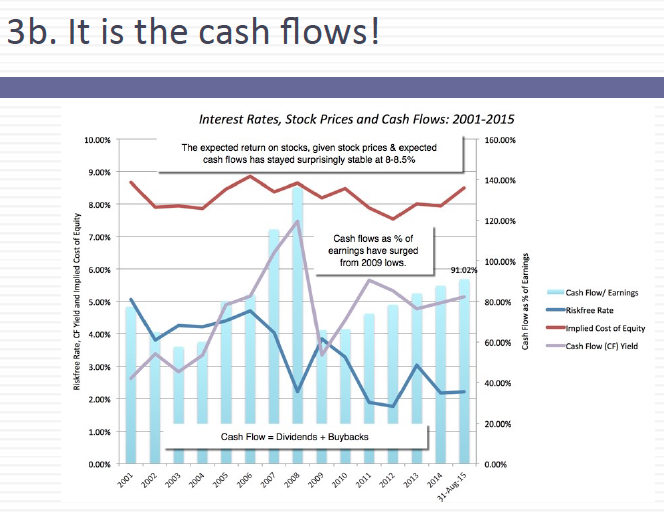

Within a well-documented presentation regarding the Federal Reserve, interest rates, and equity prices, Damodaran suggests that the recent equity bull market (since 2009) has not been the result of low interest rates (and lower “equity risk premium”) as much as it has resulted from extraordinarily high levels of cash distribution from corporations to investors:

Damodaran's unconventional, yet rigorous, analysis confirms my prior thesis regarding the complexity of predicting the impact of a change within any one variable (such as interest rates) … as well as projecting any ultimate “result” within the global financial markets.

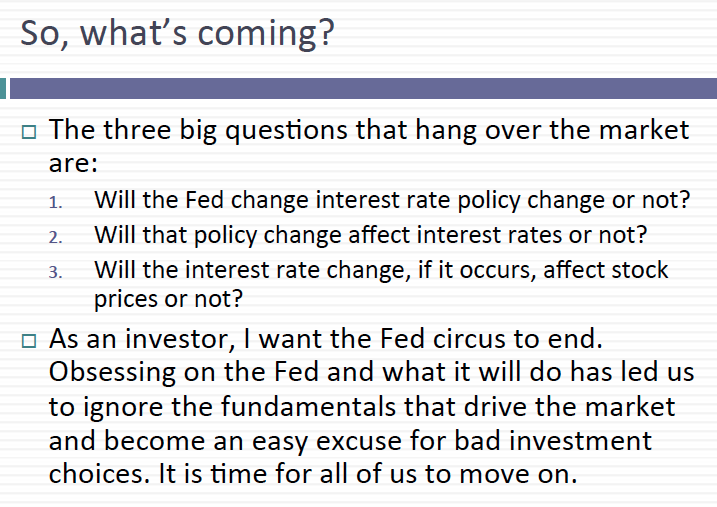

Additionally, one added insight that Damodaran highlights brings me to my final question regarding this issue of the relationship between the Federal Funds Rate and U.S. Equity prices. Here is the slide that provokes that final question:

Damodaran is exactly correct that ending the “mystery” regarding when the Federal Reserve will initiate its first increase in the Fed Funds Rates since June of 2006 will be (at least in the long run) healthy for the economy and the markets.

This virtually unprecedented era of monetary liquidity has had many positive effects, but it has simultaneously lulled businesses and individuals into an “easy money” mindset.

If one accepts the premise that “money supply” serves as an economic “stimulant”, then corporations, investors, and consumers have been on a “stimulant” since 2008 [and even receiving increasing doses of said stimulant since 2010]. It is fair to suggest that we have become “dependent” on that stimulant, and “withdrawal” from it could prove to be tricky. However, remaining on such a stimulant indefinitely will only serve to make the ultimate withdrawal (which classic economics would classify as an ultimate certainty) even more challenging and painful. So Damodaran is correct in his thesis that “it is time for us to move on!”

COUNTER-POINT:

I have already confessed to being impressed by Dr. Damodaran’s analysis, and I have agreed with the point he made regarding the dysfunction of uncertainty regarding “when” the Fed will start raising rates. However, the question still remains: “Should the Fed raise rates in December?” Let me offer a cursory analysis that attempts to suggest an answer to that question:

1) In favor of a December increase:

a) The October Non-Farm Payroll report (seemingly) far exceeded expectations with regard to new jobs created and unemployment reduced;

b) That same report indicated an increase in wages (on average);

c) And of course, “everyone knows” that the United States has been (on balance) experiencing a steady (albeit modest and slow) economic recovery.

d) Some (many) would suggest that if the Fed continues to postpone the inevitable rate increase, it will risk losing credibility (an issue made immeasurably worse by the language change in the November Fed statement, as well as by Yellen’s testimony before Congress – both of which have suggested an increased receptivity within the Fed’s “Open Market Committee” to increase rates as soon as December.

2) In favor of waiting until 2016 to raise rates:

a) That “remarkable” Non-Farm Payroll report from October is considerably less than remarkable when one dissects the data. For example, consider this data point:

84% of the “new jobs” were given to folks in the 55-69 year old age group. Yes, 84%!!

Much, much worse:

Those in the demographic between 25 and 54 years old lost (in the aggregate) 35,000 jobs… with males in that group losing 119,000 jobs!!

How depressing is that? (And I am in the 55-69 year old demographic!)

b) The bad news does not stop there. Yes, the October Payroll report indicated an increase in wages. However, illustrating the complexity of economic analysis, the monthly “Index Report” from the New York Federal Reserve (released on November 9th) suggests a different conclusion. Consider these metrics:

“According to a Survey of Consumer Expectations report Monday by the Federal Reserve Bank of New York said, one-year ahead expected inflation ticked up to 2.82% from 2.73% the prior month. But three-year ahead expected inflation ticked down to 2.78% from 2.84% in September, with October's reading resting at its lowest level in a survey that goes back to June 2013.

“The bank also said the public's expectations of future income took a big hit. Median household income expectations fell to a 2.3% rise, from September's 2.8%. The New York Fed noted this was the biggest one-month drop in the history of the survey and that it was spread across demographic groups.”[11]

c) Global economic malaise[12] continues to be a significant issue. Consider these metrics from Michael Snyder’s blog “The End of the American Dream”:

i) HSBC (the western world’s largest bank) has reported that the world is already in a “dollar recession“. Global GDP expressed in U.S. dollars is down 3.4 percent so far in 2015, and total global trade has fallen 8.4 percent.

ii) Recent reports from China indicates that exports were down by 3.7% year over year (YoY); imports were down an eye-popping 20.4% (YoY) ; demand for Chinese steel is down 8.9% (YoY); China’s rail freight volume is down 10.1% (YoY).

iii) During October, South Korean exports were reported as down 15.8% (YoY).

iv) The Netherlands government index indicates that, one year ago, the global primary commodity trade was sitting at a level of 150. However, now it is reported to be resting at 114 (a fall of 24%).

v) U.S. exports are down 11% (one could presume the significant rise in the U.S. Dollar accounts for a good deal (if not most) of that decrease.)

d) In the category of “Everybody Knows that Consumer Spending is the largest single component of U.S. economic activity”… consider these thoughts:

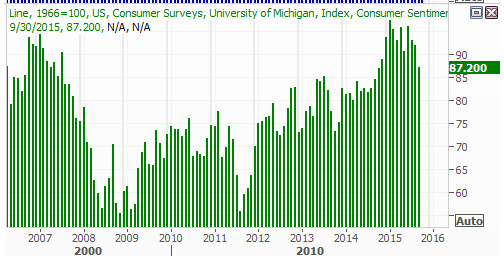

i) The October “Michigan Sentiment Index” fell to a multi-month low, confirming a downtrend:

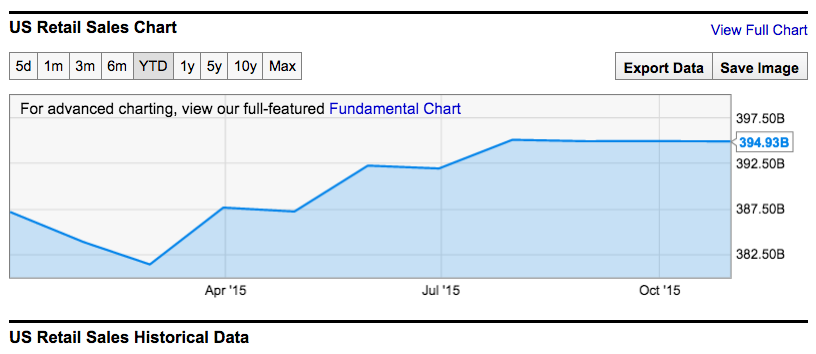

ii) U.S. Retail Sales data shows a very lackluster trend during 2015…

so lackluster that a 2015 Gallup poll indicated the following:

Consumer spending growth in the United States seems to have plateaued, with last December’s spending being roughly in line with December-2013’s level of per-consumer spending. Further, consumption during each month of 2014 was comparable to the same month in 2013. Finally, consumption during 2015 has been modestly weaker overall than 2014’s levels.

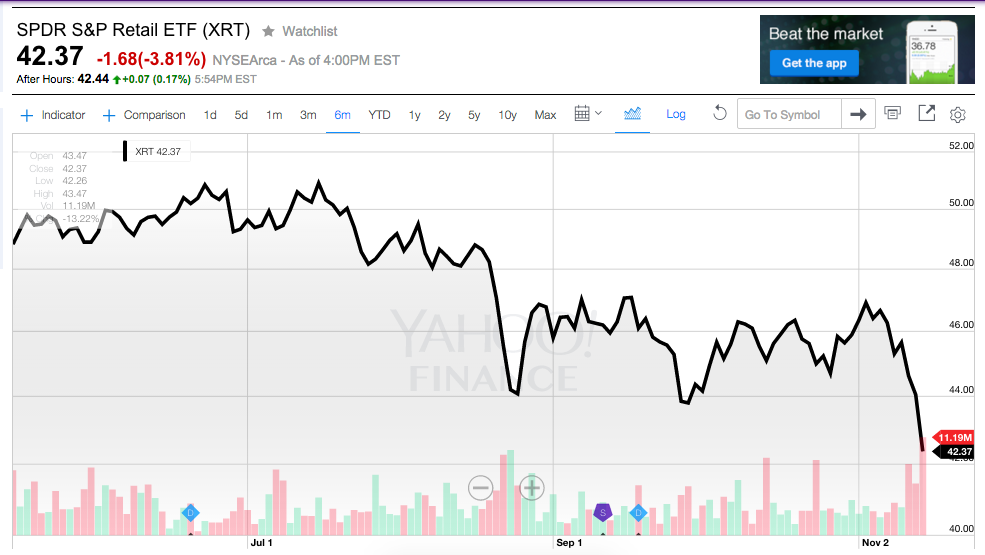

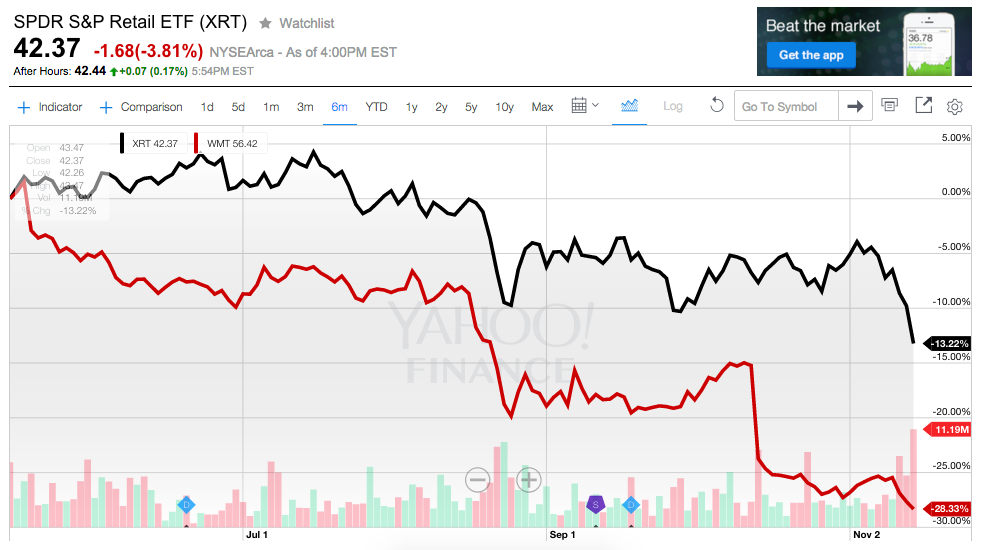

iii) Anyone who has been watching the Market Tamer Monday night coaching calls has been aware of the weak performance of stocks within the retail sector (illustrated by the prior six-month’s performance of the SPDR S&P Retail ETF (XRT):

That being said, any Walmart (WMT) shareholder would quickly trade XRT’s 6-month return of -13.2% for WMT’s abysmal -28.3% fall!!

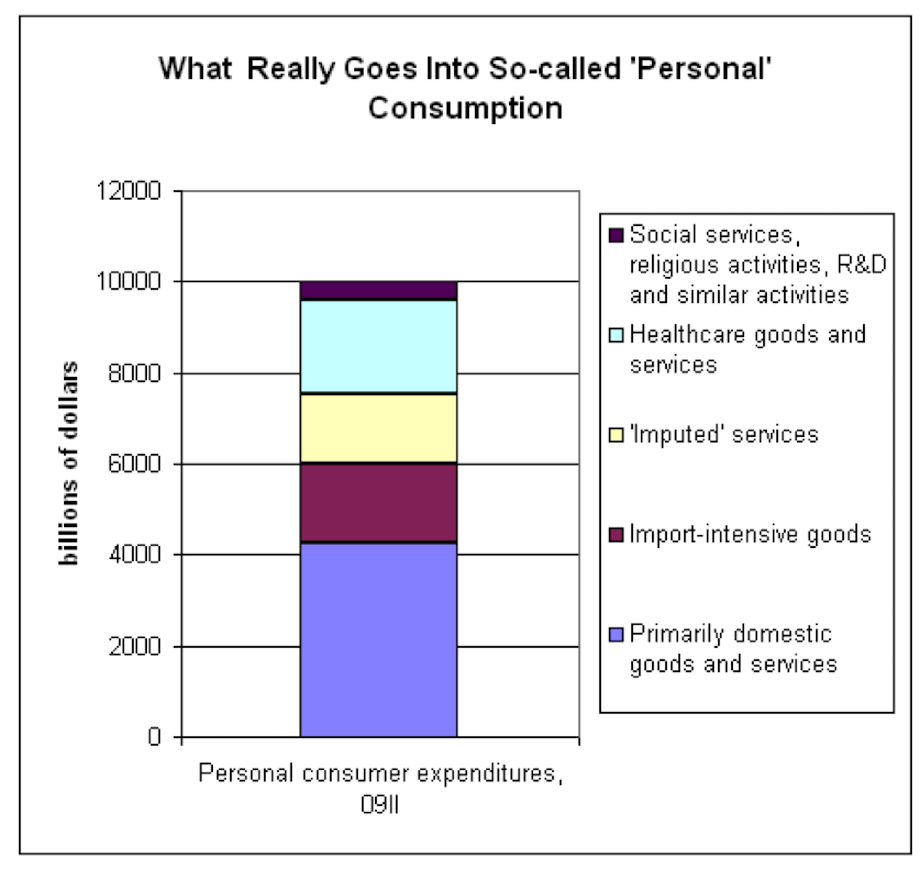

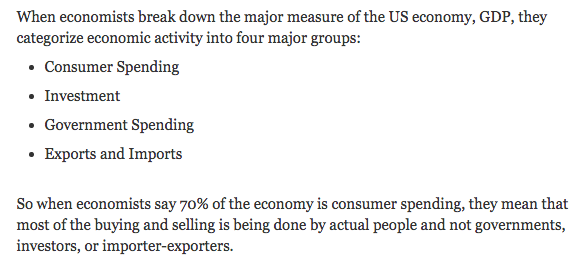

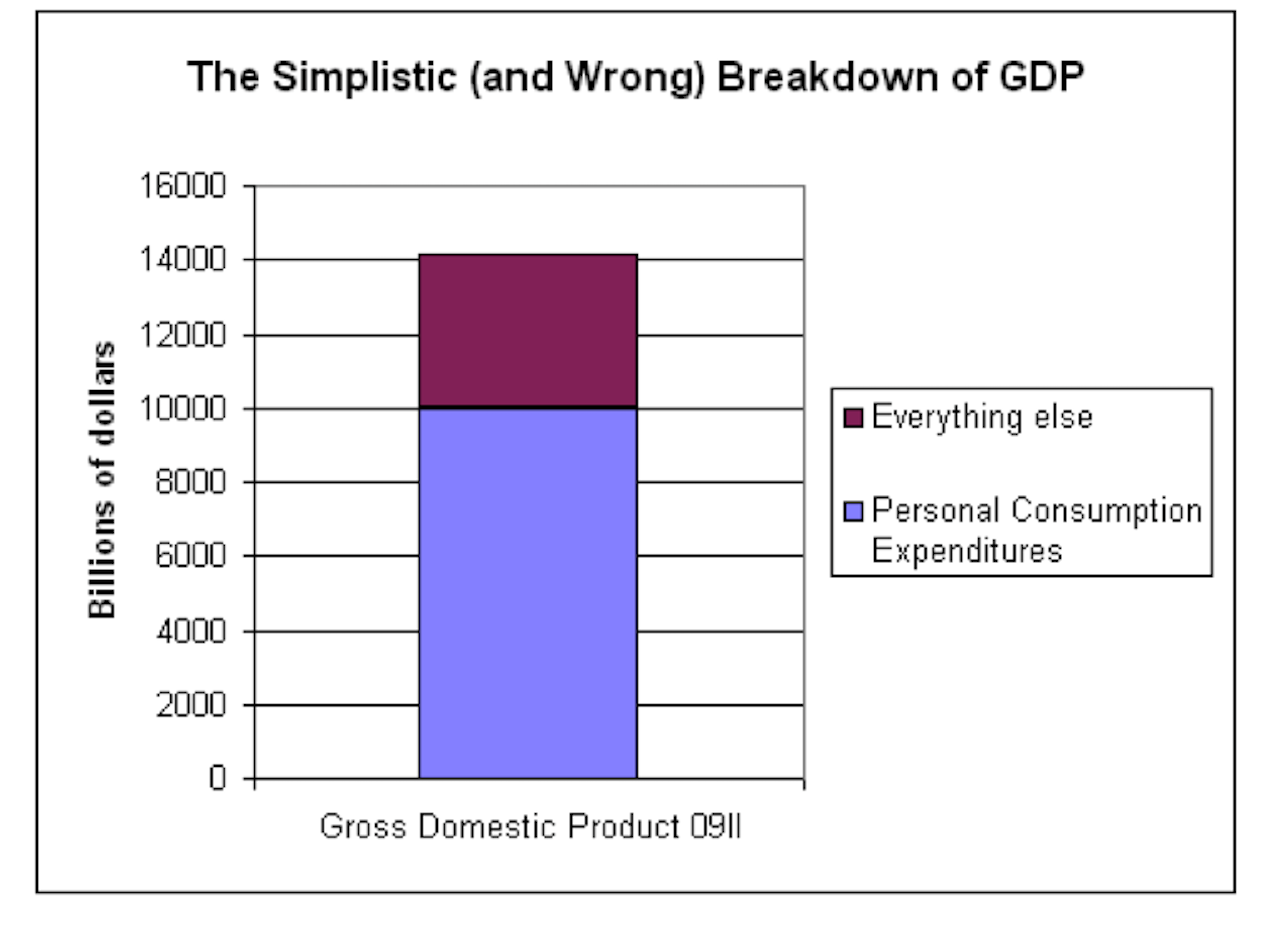

iv) As suggested above, “Everybody Knows….” that Consumer Spending accounts for 70% of the U.S. GDP.[13]

So Consumer Spending is a vital driver of the U.S. Economy… and a primary determinant of future U.S. economic growth.[14] [For your edification, I have shared information from Bloomberg’s Tom Keene regarding whether or “Consumer Spending” legitimately constitutes 70% of the U.S. Economy.

He believes it is actually closer to 40%, due to questionable expenditures included by the government in “Consumer Spending”… such as residential rents and medical bills paid by Medicare and/or health insurance companies.

v) So whether “Consumer Spending” accounts for 70% of the economy or 40%, one could suggest that it would be wise for the Fed to foster a high level of consumption during the extremely important (and highly monitored) November-December Retail Sales period. Widespread talk of a rate increase will not serve to maximize consumer optimism and certainly not result in compelling motivation to “spend” for the holidays!

a) In the event that anyone within the Fed cared about fostering “holiday sales”, it would be prudent to send a couple of the Fed governors out on a speaking tour and casually mention how vital retail sales are at this time of year, and (by the way) that would be a worthy reason to postpone a rate hike.

In the hopes that I have not already “lost” you, let me summarize this section of my article by simply saying:

Whether or not it is a prudent decision for the Federal Reserve to raise the Federal Funds Rate in December is far beyond my “pay grade”, not to mention my level of expertise. I am merely an average investor/consumer, just like my beloved readers are. I am incapable of the type of “higher level” thought engaged in by such vaunted leaders as Janet Yellen (Chair), William Dudley (New York Fed and Vice Chair), Charles Evans (Chicago Fed), Stanley Fischer, Jeffrey Lacker (Richmond Fed), or Dennis Lockhart (and so on).

Only time will tell if whatever decision they make proves to be the optimal choice!

COMPLEX INTERACTIONS:

In a perfect world… “rules” would remain static and dependable!!! Alas, investing is similar to the time honored toddler toys that offer a child “keys”, “buttons”, “colors”, etc. to push down at their whim and whimsy. However, as one button/color/key is pushed…. that action causes something else in the toy to change…. such as (for example) another key within that toy that was formerly depressed suddenly pops UP!! Such a toy reflects a premise that each action results in “counter” or “compensating” action…. which is (of course) similar to Newton’s “Third Law of Motion”: “For every action, there is an equal and opposite reaction!”

This toy teaches a child about the essential, fundamental interactions among different factors/variables within life. As that principle applies to investments, there are literally hundreds of variables that impact global securities within the investment world. Changing one or two of those variables will “play out” in any number of unpredictable ways. Therefore, no one can be utterly confident that the ultimate IMPACT on the market will be one precise, definable result. [Although investment “authorities” will rarely admit to their own lack of omniscience in this regard!]

An additional (and significant) conundrum with regard to an accurate projection of the impact of any interest rate hike on stock prices is the reality that “market participants” are (at best) sketchy regarding what to expect during an initial (and then subsequent) rate hike. One eye-catching statistic I read the other day suggests that two-thirds of today’s financial advisors have never experienced (professionally) a rate hike. Needless to say, since it has been nearly a decade since the most recent hike, all of us are (at best) definitely out of practice with regard to what to expect.

INVESTOR TAKEAWAY

The globalized, highly interconnected economy within which we live today is dramatically different than the economy within which many of our past “tried and true” investment models were first created. For example, although back in the 1950’s and 60’s, it was true that a Federal Reserve hike of the Federal Funds rate did not instantly result in significant moves within the stock market, that principle is no longer true today. In fact, due to the constant streaming of current market data from all over the world, combined with sophisticated algorithmic models (that supposedly project the likely consequence of practically any change in an investment variable) – major market managers make asset allocation moves in advance of actual corporation, central bank, or governmental announcements.

Combine all of this with an expansion of the number of “variables” at work within the current global economy, and the result is a “puzzle” sufficiently complex and perplexing to keep great investment minds around the world fully engaged and rarely satisfied[15].

In an effort to provide actual evidence regarding my premise that the “end game” of a Federal Funds rate hike in December[16] is (at best) enigmatic, let’s take a look at the historical record as detailed earlier this year by two recognized investment authorities: Jason Zweig (of the Wall Street Journal) and Dr. Robert R. Johnson (CEO of the American College of Financial Services). As you read these observations, keep in mind this “big picture” perspective:

Between 1971 and the present, the Federal Funds Rate has averaged about 6% … with a record low of 0.25% set in December of 2008 (and not changed since) and a nearly unbelievable high of 20% in 1980 (no that is not a misprint!).

Back in January of this year, Zweig cited numerous investment firms who have posited that (depending upon how one defines Fed policy and upon which periods are analyzed) stocks do not necessarily suffer during times of rising rates. In particularly, if rates are lifted gradually from very low levels during periods of negligible inflation, stocks have had periods during which they appreciate (on average) 8-10% annually.

The period of 1979-82 is of particular note because during that period of record-breaking rate hikes (up to the aforementioned 20%) stocks far outperformed bonds.[17]

Equally significant is that the Fed is not always dependable relative to the advance “signals” it offers the markets. For example, in December of 1993, the Fed’s Open Market Committee announced that a rate rise had become more likely “at some point, but not necessarily in the very near term.” I guess their definition of “not in the very near term” was different than the definition assumed by the “Market”, because the “Market” was quite taken aback when, just 45 days after that Fed announcement, it began a series of rate increases. During the following year (1994) “Cash” (+4%) outperformed stocks (+1.3%) and far outdid 10-Tear U.S. Treasury Notes (-8%).

Robert R. Johnson

Johnson collaborated with Dr. Gerald Jensen (Northern IL University) and Dr. Garcia-Feijoo (Florida Atlantic University) on a book published this past March: Invest With the Fed.

Johnson collaborated with Dr. Gerald Jensen (Northern IL University) and Dr. Garcia-Feijoo (Florida Atlantic University) on a book published this past March: Invest With the Fed.

For what it is worth, this past spring Johnson did not expect the Fed to raise rates until early 2016 because he knows the Fed does not want to jeopardize progress in the economic recovery. That being said, this is how Johnson expects the stock market to react when the first hike does come:

“The market will likely react very negatively in the short-term and continue to perform poorly over the long-term. Some pundits are claiming that the market may view a rate hike as positive for the stock market because it signals that the Fed believes the economy is sound. I disagree.”[18]

Johnson and his colleagues analyzed investment and rate data back to 1966. Here is a thumbnail summary of their results:

1) They categorized rates into three groups:

a) “Expansive” – Fed lowers rates definitively[19];

b) “Indeterminate” – this term applies primarily to the periods prior to 2003… when the Fed Funds rate and Fed Discount rate were not moving in unison.

One could say the Fed was “on the fence”.

c) “Restrictive” – Fed raises rates definitively. (See earlier footnote).

2) They discovered that each of the above conditions relate to approximately one-third of the years between January 1966 and December 2013.

3) During that entire period, the inflation-adjusted average annual return of the S&P 500 Index was about 6% (including dividends).

a) During “Expansive” periods, the S&P 500 generated 12% annually.

b) During “Indeterminate” years, the S&P 500 gained 7% annually.

c) During “Restrictive” periods, the S&P 500 produced an average return of 0.8%.

4) The bottom line, according to Johnson, is this:

While stocks will not get crushed because of an interest rate hike, history has shown that (on average) they will not generate as high of a return as during less restrictive periods of monetary policy. And on a relative basis, even though rising rates have the fundamental effect of lowering bond prices, bonds perform “less badly” than stocks during those “Restrictive” years.[20]

Johnson does offer one additional point that needs to be emphasized:

“None of this means you should bail out of the stock market. But people should condition their expectations and temper their enthusiasm.”

A Caveat

As I have hinted earlier, the environment within which we currently operate – unprecedented global monetary liquidity – is so different from the environment between 1966 to 2013 (much less any other period), that each investor should proceed with caution. Mr. Zweig made it clear that the “investment equation” is far too complex, with an exceedingly large number of variables, for anyone to assume that she/he has “the definitive analysis” regarding what will occur following a Federal Reserve rate hike!

In fact, the only thing I can predict with any confidence is the following:

1) CNBC, Bloomberg, and Fox will continue to consume far too much air time discussing all of the “If”, “when”, “should they”, “shouldn’t they” questions related to the Federal Reserve; and

2) When a rate hike is announced (whenever that is) it will produce a lot of exciting volatility until the markets settle into some sort of new equilibrium.

DISCLOSURE:

As would be expected, the author holds a portfolio that is diversified across several asset classes – including U.S. and foreign equities, corporate bonds, U.S. Treasury securities, and precious metals. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] Hence the centuries-old standard diversified “balanced” portfolio has consisted of 60% stocks/40% bonds (with adjustments to account for changing circumstances).

[2] As interest rates kept falling until they reached historically low levels. The graph from the St. Louis Federal Reserve dramatically shows that rates have fallen from almost 20% (early 1980’s) to historic lows (10-year Treasury Notes below 1.5% at one point) over the past 35 years. As rates fall, bond prices rise.

[3] The rate that banks are charged for borrowing from Federal Reserve Banks… which amounts (in reality) to borrowing from “each other” –since deposits at the regional Fed banks consist of the aggregate deposits of all the banks in that region. The reason the Fed facilitates this lending is to help banks meet their regulatory reserve requirements. By letting banks lend to each other, the Fed facilitates economic optimization by enabling (in a very easy and “safe” way) those banks with a “surplus” to maximize the return they glean on their deposits.

[4] This rate is the rate at which banks can borrow directly from the Federal Reserve, as opposed to borrowing from its Federal Reserve regional bank (as described in the definition of “Federal Funds Rate” above).

[5] The primary forms of credit extended directly from the Federal Reserve before January 2003 included: adjustment credit, extended credit and seasonal credit

[6] When Bear Stearns and Lehman Brothers (and others) became illiquid.

[7] It is vital that every investor understand the meaning of two key economic terms: “Monetary Stimulus” and “Fiscal Stimulus”. “Monetary Stimulus” is initiated by a Central Bank through the lowering of an official Central Bank interest rate (such as the “Federal Funds Rate”) or the injection of government assets into the monetary system through the purchase or sale of bonds (see description of Fed “Treasury Bond Purchases” from earlier). “Fiscal Stimulus” is the result of a government engaging in deficit budgeting in order to stimulate economic activity – such as China’s recent injection of governmental funds in gigantic infrastructure programs throughout the country.

[8] At the risk of being accused of sexism, others have called Bernanke the “father” of this type of monetary policy.

[9] Although legislated by the U.S. Congress and governed by rules promulgated through the 1913 legislation that gave it birth to it, the Federal Reserve is not literally a part of the U.S. government.

[10] Historically, the “Risk” Premium has averaged about 7%. That would mean that, on average, if the 10-Year U.S. Treasury Note (yielding 2.28% on 11/13/15) moves up to 2.53% at the time of a rate increase, investors would expect an equity return (going forward) of at least 9.53%. In my personal opinion, given the remarkable equity bull market since March of 2009, that is unlikely to be realistic. Therefore, if I am on target (in no way is that guaranteed) stock prices would decrease in order to adjust to the revised valuation of equities.

[11] This information comes from ZeroHedge.com: http://www.zerohedge.com/news/2015-11-09/what-rising-wages-fed-itself-just-admitted-household-income-expectations-are-falling

[12] If economies in Europe and Asia, and Emerging Markets, are not at least growing in some fashion, the U.S. economy will suffer as well.

- The “standard” data point regarding the importance of “Consumer Spending” within the U.S. Economy is that it accounts for 70% of GDP.

However, Tom Keene of Bloomberg has drawn attention to a more granular breakdown of which expenses the government categorizes as "Consumer Spending". Once one reviews this detail, it is easy to recognize that "Consumer Spending" as we normally understand it actually consists of something less than 70% -- perhaps a level between 40 and 50%!

[15] At least not totally satisfied.

[16] Likely only a 0.25% hike if one is announced.

[17] Fed Chair Paul Volcker was totally focused on stamping out inflation during that period – hence the 20% ultimate rate. (Yes, the same “Volcker” as in the much more recent “Volcker Rule”)

[18] The quote comes from a May 19, 2015 article in Forbes: http://www.forbes.com/sites/trangho/2015/05/19/how-rising-interest-rates-will-affect-the-stock-market-and-your-investments/

[19] Remember that before 2003, the Fed controlled both the Fed Funds rate and the Fed Discount rate… so “definitively” means they raised both rates.

[20] Which, by the way, is one of the key reasons that bonds are a great diversifier within a portfolio.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

You Don't Need Talent to Succeed: Lessons From Warren Buffett's Lifetime of Investing

You Don't Need Talent to Succeed: Lessons From Warren Buffett's Lifetime of Investing