The collar trade is the foundation of many sophisticated investors portfolios and is well worth understanding, particularly in these volatile times.

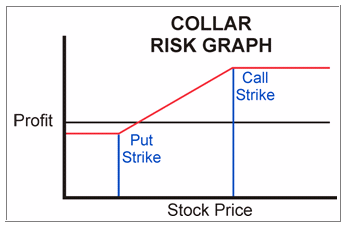

The collar trade can be thought of as simply a combination of the Covered Call and Married Put strategies. Now why is this useful to know? Because the married put component of the collar trade ensures that your stock has an insurance policy on it, allowing you to sell the stock at higher prices, even if the stock plummets to much lower prices.

But that’s not where the benefits end. Think about an insurance policy that you might buy, whether car, health, home insurance, in each case you have to take money out of your pocket to pay for the insurance. But with the collar trade, that’s not the case. You can enjoy the benefits of the insurance without paying full cost for the insurance. The reason for this is that the covered call component of the collar trade puts premium in your pocket which you can then use to offset the cost of the insurance.

The collar trade is a particularly useful strategy to use when you are considering heading away on vacation and when you don’t want to monitor your portfolio extensively. The collar trade is also very valuable when you are looking to buttress your portfolio from the wild swings in the market.

Regardless of whether you are simply looking to reduce portfolio beta, or to head away on vacation and not think about your portfolio a whole lot it is well worth investing the time and energy in knowing how to apply the collar trade successfully in any market condition.

To learn more about the Collar Trade and how to use it, please visit us at www.MarketTamer.com

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why Dollar Tree Stock Surged More Than 8% Higher Today

Why Dollar Tree Stock Surged More Than 8% Higher Today