Here is a quiz for our Market Tamer readers:

“What is one of the primary reasons that many traders prefer to trade an ETF than a single stock?”

Ah, I see nods of recognition among our most faithful readers. Those good folks are offering answers such as:

“Diversification reduces risk”

“No need to worry about a single bad earnings report”

“Much less chance of experiencing a serious gap against our position”

“Lower likelihood of ‘event risk’!”

Each one of those answers is an excellent one!

Now take a look at what happened to one of my favorite ETFs (The Guggenheim Solar ETF (TAN) on Wednesday, May 20th[1].

After reaching a high above $50 on April 23rd, then plateauing around $48.50 through May 18th… there seems to have been some “insider activity” from 9:30 AM on May 19th through the “Close” — with price moving down to as low as $47.13 (an over 1.3% loss in 5.5 hours… and about a 2% loss on the day).

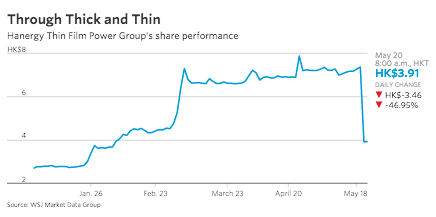

Why do I suggest “insider activity” was in play on that day? Simple! Those who were “in the know” got out of TANbefore the opening 2.25 hours of trading on May 20st – which took TANdown almost 10%!!! WOW! A total of a nearly 12% drop in just two days within a non-leveraged ETF!!!

In case you have not yet taken the few moments necessary to research why/how a generally stable ETF (TAN)… which during the first four months of 2015 enjoyed a stable daily Average True Range (ATR) (per ThinkorSwim) between 0.72 and about 1.0 … then read on. You will find the details fascinating!!

Let me offer my own summary of the facts and interpretation regarding “how this happened.” Trust me, folks, if you don’t already know the story, you will almost surely accuse me of plagiarizing a purloined copy of the script for the next movie iteration of “The Wolf of Wall Street” (or if you prefer, “Wall Street III: WEIQI”).

So take a deep breath, friends. Sit back and imagine this scenario:[2]

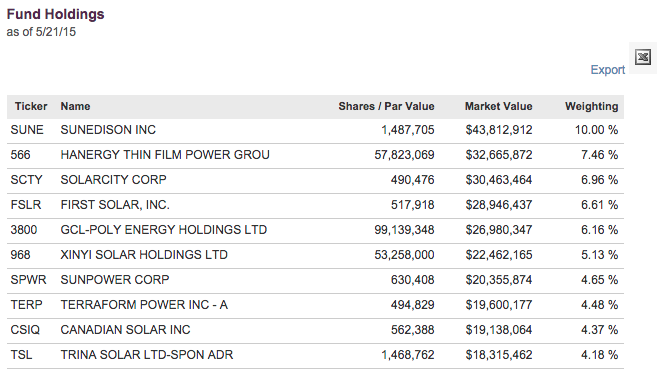

1) A $5.5 billion asset U.S.-based ETF (TAN) holds over 11% of its portfolio in what I would call a “Penny Stock” from China (the Hong Kong Exchange “stock code” for Hanergy Thin Film Power Group Limited is 00566.HK… but since U.S. investors are not accustomed to identifying stocks by numbers, I will refer to Hanergy Thin Film Power Group throughout this article by a “ticker” I found referred to in several recent articles … HKG). HKG is headquartered in Hong Kong.

a) I call HKG a “Penny Stock” because it stood on May 20th at about 4 Hong Kong Dollars… or roughly $0.52!

2) HKG is a subsidiary of a much bigger, older company (1994) – Hanergy Holding Group. According to its website:

“Hanergy Holding Group Ltd. is a multinational clean energy company as well as the world’s leading thin-film solar power company, committed to changing the world by clean power.”

That parent company is closely held, so it has no stock ticker (or code). And more importantly, it is not bound by even the (relatively) loose corporate reporting requirements of China (much less the more stringent requirements that bind U.S. traded stocks).

Hanergy Holding is run by a 48-year old CEO in Beijing [Li Hejun (李河君) – a man Forbes reported in April was worth $32.7 billion.

The February “Hurun Report”

(a Chinese monthly magazine published by Rupert Hoogewerf) listed the Hanergy Holding CEO [note that he is Chairman of HKG, but not CEO] as the richest man in China and 28th richest in the world.

3) Following an exit from HKG stock by key insiders who liquidated their shares once the initial “lockup” period expired, this Mr. Li[3] gobbled up a massive amount of the shares, reaching an ownership level of almost 80% of all shares!!

4) Since January of this year, HKG skyrocketed by 157% (from about 2.50 HK$ to almost 8 HK$).

5) As it happens, HKG stock is a key component of the MAC GlobalSolar Energy Index that is followed by TAN. Therefore, TAN was required to hold it. (The other liquid Solar ETF [Market Vectors Solar Energy (KWT)] also includes HKG as a major component (about 19% of the portfolio).

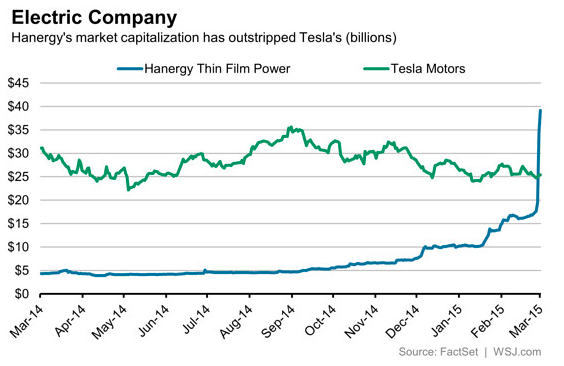

6) Until May 19th/20th, holding HKG was a phenomenal blessing for TAN – half of its 2015 jump upward of nearly 40% was accounted for by HKG!

So what went wrong?

Lately, the biggest issues at hand in HKG have been:

1) Questionable business arrangements between the (unlisted) parent and HKG

2) Much less than transparent accounting and reporting

3) Industry-related news events

At the beginning of March (3/5), the Wall Street Journal published an article that included this:

“[HKG] reported late Monday that its 2014 revenue nearly tripled, and net profit rose 64%. As common as those numbers might start to look, though, they are still strange.

Then on March 31st, the Journal built upon the above theme as follows [bold highlighting added by me for emphasis]:

“Hanergy makes equipment to build niche kinds of solar panels that are either so inefficient that they have been abandoned by peers, or so new that the economics are untested. How this business commands a $36 billion market capitalization [more than Tesla (TSLA) at that point] raises doubts.[4]

“A closer look at Hanergy’s 2014 results keeps raising doubts, too.

“Out of $1.2 billion of revenue in 2014, 62% comes from selling equipment to its closely held parent, Hanergy Holding Group, who then builds solar panels. But much of what goes to the parent seems to come back, since between 2015 and 2017, the parent plans to sell panels back to listed Hanergy worth as much as $6.1 billion, according to separate filings in February.

“Most of the remaining revenue last year came from selling solar power-station assets to an investment fund called Beijing Hongsheng Photovoltaic Industry.

“Yet there are some doubts about Beijing Hongsheng’s status. The legal representative of the ultimate shareholder of Hongsheng appears to be the wife of a former independent Hanergy director, according to documents reviewed by The Wall Street Journal.

“Hanergy has denied that the asset disposals were connected-party transactions.”[5]

Here is another opportunity for you to use your imagination:

Imagine a U.S. company named “Apple Tree”… picture a large cap, but privately-held company. Apple Tree has a subsidiary (Apple Fruit) that is publicly-traded.

Apple Tree is run by its CEO, J. Appleseed, the 28th richest man in the world… who owns 80% of Apple Fruit… thereby giving him virtual control of “terms” Apple Fruit accepts from Apple Tree.

Apple Tree sells component parts for electronics equipment to Apple Fruit… but at semi-bargain prices. Apple Fruit then sells electronic equipment back to Apple Tree for sale/distribution.

However, Apple Tree takes “forever and a day” to actually pay Apple Fruit invoices for product/services delivered!

Given the rather unique, symbiotic (nepotistic?) relationship between the two companies… Mr. Appleseed[6] can engineer rapidly growing financial metrics in whichever direction he wishes. And given the non-public nature of Apple Tree and the intricacies of the Tree/Fruit relationship, the publicly-traded stock could appear quite attractive.[7]

Are you beginning to catch on to the complications inherent in this situation! I willingly admit that I have painted the details of this “case study” in a fashion that is both over-simplistic and slanted toward suspicion! But even with that admission, I think that you’ll agree that “something has been rotten in Beijing”!

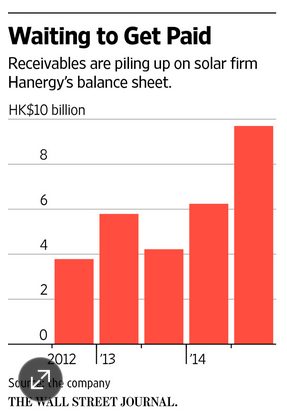

Those unpaid “Receivables” held by HKG are of considerable size. By the end of 2014, balance sheet receivables totaled twice the amount of one year earlier. In fact, that metric was so large that it exceeded total 2014 Revenue (granted, by only 1%… but it did exceed the year’s revenue). Complicating deeper analysis was the absence of a Cash Flow Statement within the Financial Statements.[8]

According to the Australian Business Review (based on a Wall Street Journal report):

“Hanergy has a high level of receivables, nearly all due from the parent, as of June last year.”

Another financial metric that should have been a red flag before May 20th was “Profitability”. The second half of 2014 showed a profit margin of just under 25%… versus a margin of 54% during the first six months of 2014… and of 69% during 2013.

That being said, another red flag could have been the comparison of HKG profit margins (final six months of 2014) with those of FLSR (15%) or fellow Chinese Solar firm, GCL-Poly Energy Holdings Ltd. (5.3%)

There have been at least six major factors that have contributed to the rapid rise of HKG stock… factors that created a “Prefect Storm” for HKG:

1) Optimism regarding U.S. demand for solar panels: The U.S. solar business has one of the best performing segments within the solar market space.

Feeding that optimism was “buzz” resulting from the February 2015 deal announced between FSLR and AAPL[9]…

In addition, there was a separate agreement announced during February in which Google (GOOG) committed $300 million of investment funds to a major initiative by Solar City (SCTY)[10].

2) The release of the (now famous) Chinese video: “Under the Dome” (穹顶之下)

This

video has been viewed far more than 200 million times.

The film was released just days before the start of China’s most public annual political events (meetings of the national legislature and a government advisory body) in hopes of pressuring for change.

http://www.oregonlive.com/movies/2015/03/watch_under_the_dome_the_seari.html

Be patient with the video. Trust me, it will be worth it. At a minimum, watch the first 3 minutes… during which a poised young woman gives compelling witness to the threat of Chinese pollution to babies. Then move forward to about the 45 minute mark and watch the segment covering what I would describe as systemic chaos within China regarding environmental law enforcement!

3) The impact of “YieldCo”… a novel financing approach originated by First Solar and Sun Power … through which solar firms remove huge solar project overhead costs off their Balance Sheet … while still maintaining ownership/control of the projects.

The strategy pools solar projects into a publicly traded entity that offers shareholders high payouts (dividends).

“Yieldcos” operate power plants and sell electricity, using that revenue to fund dividends to investors.

The promise of this strategy to maximize shareholder value moving forward has contributed to higher investor demand for solar companies.

4) Recovery in the price of Crude Oil. Solar stock prices were decimated between July and December of 2014 when oil prices crashed. Ironically, recent solar earnings reports have confirmed that the profitability of solar companies is not directly related to the fate of oil. Baird analyst Ben Kalio was recently quoted by MarketWatch : “That’s one of the major drivers [of solar stock prices] – the decoupling with oil!”

5) The November 2014 opening of the Shanghai-Hong Kong Stock Connect… that links the (limited access) Shanghai Market with the open, (more) transparent Hong Kong Exchange.

Chinese investors, buying through the above link, have been very attracted to HKG…. Making it one of the highest volume stocks traded through “Stock Connect”.

As an anecdotal example, during one day earlier this year, HKG traded 827.6 million HK$ worth of buy and sell orders – about 30 times the amount of the second highest volume stock!

More to the point, net inflows through the stock-connect program have pumped more than 1.2 billion Hong Kong dollars into the stock since January. And (not surprisingly) since November of 2014, the HKG stock price experienced extraordinary appreciation… in significant part because of this increased Chinese “demand”.

6) Of course, any stock that rises exponentially is going to be subject to above average “shorting”. That has been true for HKG as well. And as we know, when a widely shorted stock continues going up, those “shorts” are “squeezed”…. forcing them to buy back shorted shares – thereby putting further upward pressure on the stock price! In fact, demand to “borrow” HKG for purposes of selling short became so strong that the annual rate charged to borrow shares reached 35%!! (At one point during 2015, a total of 120 million shares had been borrowed.)

Of course, all of the above factors were “positive” for HKG. However, on May 19th there was a highly visible announcement that surely contributed toward nervousness regarding solar stocks in general, and Chinese solar stocks in particular:

On Tuesday, May 19th, the stock of the world’s second largest solar manufacturer [Yingli Green Energy (YGE) ranked second per 2014 shipments[11]] plunged 37% following YGE’s disclosure (through a securities filing) that: “there is substantial doubt as to our ability to continue as a going concern.” Analysts offered the obvious observation that YGE had recently expanded quite a bit… largely through debt; therefore its debt obligations were (relatively) substantial. Of course, the following day (May 20th) its CEO, Liansheng Miao, issued a clarifying statement that comforted shareholders and analysts. In effect, the clarification indicated:

CEO Miao believes the company will meet its debt repayment obligations. The company feels that some media sources took the filing statement out of context…. and the company believes that it has been transparent regarding its opportunities and its risks.

The bottom line is this:

Despite the many advantages of an ETF (as listed earlier), on May 19th and 20th, one solitary Chinese solar stock (one that most Americans would not be able to identify[12]…even within a multiple choice question) was the cause of TAN suffering a downturn of nearly 12%.

Keep reading to review what the significance of this development might be.

INVESTOR TAKEAWAY:

Making an “Assumption” is one of the most dangerous things an investor can do!

I have no idea how many of those who invested in TAN “assumed” it was a reasonably tame investment that would not dive by 12% in two days… however, I think it is safe to assume the “answer” would be “most investors”.

So what can a TAN investor do moving forward to be better prepared and more confident? Let me suggest the following:

1) Never assume an ETF is “diversified” in the same way that financial advisors generally think of diversification!

a) First, an ETF is (by definition) focused on a subset of the investment universe.

b) “Solar Stocks” will inevitably reflect the “Solar Space” and only that space.

i) That means it is non-diversified, no matter how many different solar stocks it contains.

ii) More particularly, because the two largest solar stocks are Chinese, the solar space will be greatly impacted by the Chinese economy, Chinese politics, and Chinese business regulation (or lack thereof).

2) Whenever an ETF outperforms “the Market” by a wide margin (as TAN has in 2015), it is very important to not be blindly complacent… but rather to research “why” it has outperformed.

a) If you discover that “outperformance” has been largely due to one stock in the portfolio (as with HKG)… it is incumbent to discover why that stock has outperformed.

b) If analysts cannot adequately account for that outperformance… it may be time to get out of the ETF!

c) More pointedly, if that stock has demonstrated any “red flags” (such as those tied to HKG) – it may be a firmer sign that the time has come to get out of the ETF, or at least sell a call to “cover” your position.

As I have indicated above, one overarching issue at work within TAN (and solar stocks in general) is the outsized influence that China has on the industry. In that regard, I find it perpetually ironic that our U.S. markets tend to respond strongly to events in both one of the most insignificant economic regions in the world (Greece, with a GDP equivalent to (only) the Dallas/Fort Worth area) and the second largest global economy (China, with the world’s largest populace).

For any American to truly understand China, one would need to take the time to learn Chinese, study its culture and history, and actually live or do business in China. It is truly a world unto itself… and radically different from life or business in the U.S.

It may sound ludicrous, but one simple, relatively accessible route toward more clearly understanding Chinese business would be to learn (and master) Chinese games. Yes, you read it correctly. I said “games”.

Take for example, one of the most sophisticated and challenging of Chinese games – Weiqi (pronounced “way-chi”).[13] The name of that game can (quite roughly) be translated as “the game of encirclement”. Weiqi is reputed to have been invented some 4,000 years ago.

A prominent Chinese scholar, David Lai (U.S. War College –research professor of Asian security studies), has documented the similarities between Weiqi and the basic principles of The Art of War (the Chinese classic by Sun Tzu).

What were the most important strategies described by Sun Tzu?

The use of deception

Emphasis on flexibility

The impact of sudden, unexpected moves

Patience that, combined with the above, will gradually achieve one’s objectives.

Now think about what you have read regarding “all things Hanergy” – from the non-traded parent company to the publicly traded HKG and their common leader (Li Hejun).

Allow me to add this not insignificant head scratcher.

Bloomberg and the Financial Times reported on May 20th that Li Hejun failed to appear for the annual shareholder meeting set for that date! Fortunately for the company, the CEO and Finance Director did manage to grace the meeting with their presence!

When a company spokesperson was asked for an explanation of Hejun’s absence, the best that person could offer was:

“Chairman Li did not attend the AGM. He had something to do!” No further comment was offered.

Just imagine, my friends, if any of the following had happened in the U.S.:

1) Warren Buffett did not appear at a Berkshire-Hathaway (BRK.A) shareholder meeting.

2) Tim Cook was AWOL from an AAPL shareholder meeting.

3) Elon Musk missed a TSLA shareholder meeting… or (for that matter) a SCTY meeting (don’t forget he is Chairman!).

Meanwhile, in China, Mr. Li simply “had something to do.”

This, by the way, is the same Mr. Li Hejun who prominently displays corporate “Mottos” on the HKG website… mottos which (supposedly) express the essence of how HKG does business. Here are a few select mottos from the longer list on the site:

“The absence of ethics negates everything.”

“Integrity is essence.”

“Communicate openly and frankly.”

It is within this context that I ask you:

1) Would you play Weiqi with Li Hejun?

2) Do you really trust Mr. Li or his company?

3) Would you agree that Hanergy Holding and HKG have operated without the transparency Mr. Li’s mottos would imply? In fact, in my observation, much of the operation within Hanergy… and the business interactions between Hanergy and HKG… remain shrouded in the following:

The answers to the above questions should play a role in determining whether one should own (or continue holding) TAN (or KWT).[14] I do not mean to imply that your feelings about HKG and Mr. Li should determine whether or not you own TAN. However, if you do own TAN, but have not yet reflected seriously about these issues, then I politely and humbly suggest that you must enjoy investing with some level of resignation and adventure.[15]

DISCLOSURE:

The author owned TAN shares and/or options through most of 2014. He opted out of those as TAN sank as a consequence of the oil price collapse. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

APPENDIX:

Here is a current list of TAN holdings from its website:

FOOTNOTES:

[1] Yes, TAN is one of my favorites. I held it for an extended period of time through much of 2014… then I moved on to other opportunities. However, Market Tamer’s premier coach, Ron Haydt, called TAN to our (my) attention in his “Executive Summary” posted the night of May 20th!!

[2] Please accept my premise that stocks under $5 (U.S.) in price can be categorized a “penny stocks”.

[3] Unlike with U.S. names, the “family” name for Chinese folks appears first… so Li Hejun is “Mr. Li”

[4] Another “Red Flag” : HKG market cap also rose so high that it exceeded the combined market cap of the world’s three largest solar concerns: Solar City (SCTY), Sun Edison (SUNE) and First Solar (FSLR).

[5] Isn’t it amazing how often governments, politicians, and corporate officials are asked to (figuratively) confirm that an animal that looks, waddles, and quacks like a duck in, indeed, a “duck”… and they go ahead and deny it despite of logic and common sense?!

[6] Thank heavens that, as all readers of children’s books know, Johnny Appleseed would never do anything unethical… would never play fast and loose with the rules… and would never deceive!!

[7] As incredibly profitable as the real Apple (AAPL) has been… imagine how much more impressive it would be if its metrics could be managed (manipulated) in similar fashion!

[8] U.S. GAAP Accounting Standards are not perfect… But in comparison with Chinese accounting practices, U.S. standards are remarkably detailed, trustworthy, transparent, and enlightening!

[9] First Solar, Inc. (Nasdaq: FSLR) today announced that Apple has committed $848 million for clean energy from First Solar's California Flats Solar Project in Monterey County, Calif. Apple will receive electricity from 130 megawatts (MW)AC of the solar project under a 25-year power purchase agreement (PPA), the largest agreement in the industry..

[10] The agreement was to finance at least 25,000 residential solar panel installations. Through this agreement, GOOG became a “tax equity” investor – in exchange for funding, GOOG will receive tax breaks tied to the solar panels installed by SCTY (generally yields an annual return between 8% and 10%.

[11] The world’s largest shipper of solar manufacturer per 2014 shipments was Trina Solar (TSL) … another Chinese stock.

[12] Despite it being run by the world’s 28th richest person.

[13] Played on a square grid with 19 intersecting points along each axis, Weiqi involves two players taking turns placing white or black stones (all of equal value) on the grid. The goal is to surround and capture enemy stones (thereby dominating the board). The game is so complex that completing just one game can sometimes take the entire day.

[14] ICLN invests in solar stocks as well… but not exclusively. It includes a broad range of “Alternative Energy” stocks.

[15] I’d be tempted to describe it as “reckless abandon.”

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why EHang Stock Is Gaining Altitude Today

Why EHang Stock Is Gaining Altitude Today