Duke Energy's most recent trend suggests a bearish bias. One trading opportunity on Duke Energy is a Bear Call Spread using a strike $70.00 short call and a strike $75.00 long call offers a potential 5.26% return on risk over the next 8 calendar days. Maximum profit would be generated if the Bear Call Spread were to expire worthless, which would occur if the stock were below $70.00 by expiration. The full premium credit of $0.25 would be kept by the premium seller. The risk of $4.75 would be incurred if the stock rose above the $75.00 long call strike price.

The 5-day moving average is moving down which suggests that the short-term momentum for Duke Energy is bearish and the probability of a decline in share price is higher if the stock starts trending.

The 20-day moving average is moving down which suggests that the medium-term momentum for Duke Energy is bearish.

The RSI indicator is at 22.36 level which suggests that the stock is neither overbought nor oversold at this time.

To learn how to execute such a strategy while accounting for risk and reward in the context of smart portfolio management, and see how to trade live with a successful professional trader, view more here

LATEST NEWS for Duke Energy

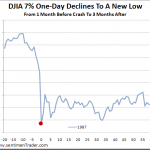

3 Sectors That Could Help You Ride Out a Stock Market Crash

Thu, 10 Sep 2015 10:26:00 GMT

Duke Energy Renewables more than doubles its North Carolina solar portfolio

Wed, 09 Sep 2015 13:35:08 GMT

noodls – CHARLOTTE, N.C. – Duke Energy Renewables today announced it has completed four solar power projects in Eastern North Carolina, adding 30 megawatts (MW) of solar in the state. The projects are located in …

8:32 am Duke Energy Renewables more than doubles its North Carolina solar portfolio

Wed, 09 Sep 2015 12:32:00 GMT

Duke Energy Renewables more than doubles its North Carolina solar portfolio

Wed, 09 Sep 2015 12:30:00 GMT

PR Newswire – CHARLOTTE, N.C., Sept. 9, 2015 /PRNewswire/ — Duke Energy Renewables today announced it has completed four solar power projects in Eastern North Carolina, adding 30 megawatts (MW) of solar in the state. …

Creating The Utility Employee Of The Future

Fri, 04 Sep 2015 16:10:00 GMT

Forbes – The electric power industry is paying well for skilled technicians from Richmond Community College. Graduates can make up to $100,000 within three years.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why Taiwan Semiconductor Manufacturing Stock Was Climbing Today

Why Taiwan Semiconductor Manufacturing Stock Was Climbing Today