Last night I watched the original version of the movie classic, “The Terminator”. I was struck by how much younger Arnold Schwarzenegger looked back then, as well as by how many portions of the movie I had forgotten. However, what interested me most was the ways in which the lead character brought to mind the recent history of Sears Holdings Corporation (SHLD), within which the most recent chapter developed earlier this month — when SHLD announced its fifth CEO in just seven years (most often the sign of a very troubled company).

The story of Sears holds within it a mini-history lesson of social and economic trends within the United States. The origin of Sears stretches back to the publication of its first product catalogue in 1888. Because of its budding reputation for quality products and excellent service, its fortunes grew rapidly; and by 1895, the catalogue had ballooned to 532 pages – including an incredible range of products from palm sized items to sewing machines, bicycles, a car, and even a ready to assemble home kit! http://en.wikipedia.org/wiki/Sears_Catalog_Home

By 1906, the industry began to refer to the huge Sears catalogue as “the Consumer’s Bible”. As its reach spread across the nation and “Sears” became a household name, it can be argued that Sears became the modern equivalent of today’s “Google” and “Amazon” — rolled into one. Hundreds of thousands of people depended upon Sears as an ideal starting point through which to search for products and discover various product “price points”. Sears’ enormous pricing, inventory and shipping capabilities positioned it (compared with local retail competitors) as the closest thing in those days to Amazon.com.

Surprisingly, the first Sears retail store did not appear until 1925 (in Chicago); but over the next few decades, it expanded into an absolute retail giant—boasting approximately 1,000 full-sized retail stores, as well as buying huge swatches of land on which to develop malls. It became expansive laterally as well – getting into insurance (Allstate), credit cards (at one point, it was said to be the most widely held card in the U.S.), and financial services (developed the Discover Card and joined broker Dean Witter Reynolds with that for a time). Finally, two of its most enduring legacies have been Chicago’s mega-skyscraper, the Sears Tower (now the “Willis Tower”) and its many iconic brands, including DieHard, Craftsman, and Kenmore.

However, as the formerly “little” Arkansas retailer called “Wal-Mart” began its own explosive growth throughout the nation in the 1980’s and 1990’s, ever increasing its competitive pressure on Sears and other older retail chains. The “old ways” didn’t work as well for Sears, while Wal-Mart’s physical and technological infrastructure was newer and much more adaptable to consumer.

By 2004, Sears management realized that they were nowhere close to finding “the formula” to compete successfully within the 21st century retail environment against the likes of Wal-Mart and Target, so they had to broaden their strategic options. Independently, an east coast hedge fund manager named Edward Lampert, whose ESL Investments Inc. had bought Kmart Holding Corp out of bankruptcy in 2003, approached Sears regarding a merger of Sears and Kmart Holdings – a deal that was completed in March of 2005.

It was clear from the start that Eddie Lampert “held all the cards”. He cut his teeth in finance through the merger arbitration desk at Goldman Sachs Group, Inc., working under the tutelage of Robert Rubin (later President Clinton’s Treasury Secretary). Therefore, Lampert’s strengths were creating “deals” and then selling off assets. As events have unfolded since 2005, Lampert’s management “pedigree” foreshadowed the fate of what was once America’s premier retail company.

The first Sears Holding Corporation (SHLD)CEO was Alan Lacy (who had spent his formative years at Kraft Inc.). Just six months into his tenure at SHLD, Lampert replaced Lacy with Aylwin Lewis (who had his best years in the restaurant industry). A short 27 months later, Lampert ousted Lewis, divided the company into five units, and named W. Bruce Johnson as “Interim CEO”. Quite ironically, the “interim” lasted longer than either Lacy or Lewis (about 36 months). In February of 2011, Lampert named Lou D’Ambrosio, whose professional resume included 16 years at IBM followed by an 8.5 year stint at Avaya Inc. (a telecom company) – including 4.5 years as President and CEO.

Now that D’Ambrosio has announced his imminent departure (reportedly for family reasons) and Lampert has seen fit to name himself as official CEO, experts, analysts, and shareholders remain puzzled that Lampert has never chosen to place an experienced retail leader at the helm of SHLD. However, rather than a reason to be puzzled, perhaps that consistent theme within the annals of SHLD management serves as a telling beacon that points in the direction of Lampert’sultimate intention from the beginning—that is, he never intended to ensure that Sears survived and thrived as a retail giant.

To support this case, consider objective metrics of business “success” that are irrefutable. Despite impressive rhetoric each year regarding a grand, ambitious, strategic plan (as well as the standard trumpeting of “success” regarding several cherry-picked performance metrics) the trend lines of SHLD’s “success” have been consistently and undeniably downward.

Consider the following charts:

1) SHLD Market Capitalization: From $15.21 billion in January of 2008 to $4.97 billion in January 2013 – a decrease of over 67%

From YCharts.com

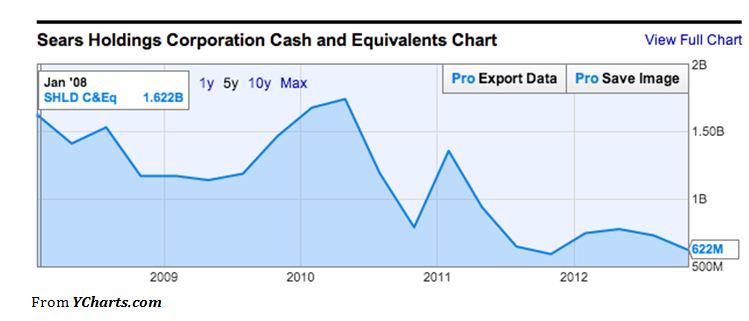

2) SHLD Cash and Cash Equivalents: From $1.62 billion in 2008 to $622 million now;

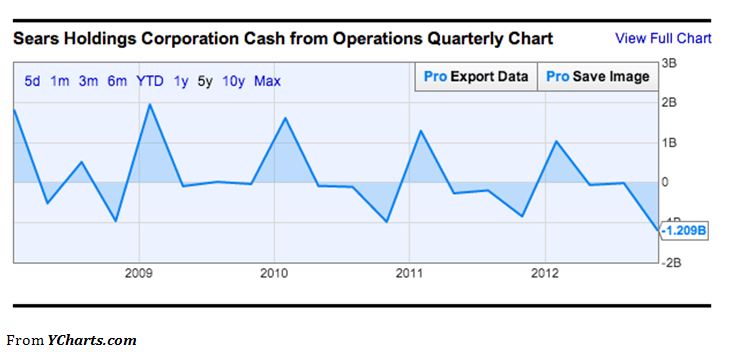

3) SHLD Cash from Operations: a continuing series of lower highs and lower lows – falling to $1.21 billion currently.

4) SHLD Stock price: SHLD’s high was in April of 2007, at $191.93; its nadir was one year ago (January of 2012 at $29.20). It currently sits at $46.66 (January 14, 2013).

a. Since January of 2007, the S&P 500 has remained (net) at approximately the same level, while Target has moved up about 5% and Walmart has risen by over 43% Sears has declined over 70%!

Embellishing this very bleak picture, SHLD has posted over 18 quarters of same-store sales declines. Within the past 24 months, there have been times that it was hemorrhaging so much cash that credit experts wondered if they could survive.

However, it is within the world of “salvage finance” that Lampert shines. Since the forming of SHLD,Lampert has closed over 170 stores, fired more than 40,000 employees, liquidated inventory (at shuttered stores), and diluted the value and quality of its iconic brands by lowering production specs, licensing other retailers to sell its brands, and/or the out right sale of brand rights. It is those expense reductions and asset sales that have kept SHLD afloat.

It is this side of Lampert that is powerfully reminiscent of “The Terminator”. You’ll remember in the first movie how single-minded he was on his mission — to destroy the object of his focus. However, in the process, he steadily lost all that made him appear to be human – from his left eyeball and eye socket, to a large swatch of his face, to the “skin” over various body parts, to the full functioning of one of his legs… until, by the end, he was merely the mechanical outline of a man-sized being.

That is descriptive of the fateful end toward which SHLD seems to be headed – with each successive quarter, it appears less and less to resemble a viable, ongoing retailer. It has a lowCCC+ credit rating from Standard and Poor’s – so borrowing costs are exorbitant! Exemplifying this is a relatively recent auction of notes maturing in October of 2018 – priced at 6.625%, despite our current near historically low interest rates.

All of this has not escaped the notice of respected commentators. Forbes has famously listed Lampert as the 125th wealthiest person in America, as well as the “second worst CEO/Chairman of a large, publicly traded American company.” http://en.wikipedia.org/wiki/Edward_LampertGaryBalter, managing director with Credit Suisse Group AG in New York has characterized the most recent leadership transfer to Lampert in this manner: “We don’t view Sears asa longer-term, successful operating company, so changing players within the operations of the company aren’t going to make it better.” Echoing a similar sentiment, Matt McGinley, managing director at International Strategy and Investment Group in New York, has observed: This is a company where perception for the past handful of years has been that they are a ship without a captain.”

Personally, I beg to differ with Mr. McGinley. SHLD has had a “captain” from the start. However, it has not been a “heroic” captain such as John Paul Jones (Revolutionary War) or Admiral William (Bull) Halsey (World War II). Instead, the SHLD captain most closely resembles Arnold Schwarzenegger’s Terminator – driven, powerful, destructive, obsessed with a narrow focus and willing to do anything in an attempt to get closer to his desired “end”. For the Terminator, that “end” was the death of Sarah Connor. He failed.

For Lampert, I suspect the “end” has always been the profitable dismantling of Sears – maximizing the cash value of its most valuable assets – the brands and the real estate. The financial meltdown of 2007-08, with the massive collateral damage it brought to real estate values, liquidity, and the economy, threw an incredible monkey wrench into Lampert’splans, but those who have watched Lampert operate from his east coast kingdom should not doubt either his will to succeed or his ability to wait for the convergence of an economic recovery and a real estate rebound to enable him to achieve his long sought goal of “maximizing asset values”!

The only possible explanation one can offer for the price of SHLD not approaching zero is the widespread expectation that “asset realization” will come sooner than later. Such investors have now waited for almost eight years for that day to come – while watching the former “giant” waste away. However, it is clear that Lampert has time and value on his side. According to a Bloomberg analysis, Lampert’sadjusted cost basis per share of SHLD is a meager $16.

In other words, no matter how much value he has managed to lose the entire company, as well as millions of shareholders, he is still sitting on a tidy profit!

http://slant.investorplace.com/2013/01/i-still-dont-get-sears/

Submitted by Thomas Petty

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Should Growth Stock Investors Buy Visa Stock Instead of Mastercard Stock?

Should Growth Stock Investors Buy Visa Stock Instead of Mastercard Stock?