Seemingly at the perfect moment, an amazingly telling story emerged from the Eurozone at approximately the same time as United Kingdom “Brexiteers”[1]. The story was simple in its content… but offers implications galore regarding current trends within the European Union… trends that have exerted a profound impact upon member nations and their economies.

Here is my recounting of this illustrative news story:

A member of the European Parliament from Luxembourg named Mady Delvaux has written and released a draft report offering legislative recommendations to the Commission on Civil Law Rules on Robotics.

This fascinating report is Delvaux’s attempt to address the problem of robots stealing human jobs and disrupting society. Here is an excerpt from the report:

“Within the space of a few decades [artificial intelligence] could surpass human intellectual capacity in a manner which, if not prepared for, could pose a challenge to humanity's capacity to control its own creation and … the survival of the species.”

A central part of the recommendations made to address this issue is that robots should be required to pay taxes and contribute toward the social security of European citizens.

From a related report that appeared through Yahoo.com comes this:

“Europe’s growing army of robot workers could be classed as ‘electronic persons' and their owners liable to paying social security for them if the European Union adopts a draft plan to address the realities of a new industrial revolution.

“Robots are being deployed in ever-greater numbers in factories and also taking on tasks such as personal care or surgery, raising fears over unemployment, wealth inequality and alienation.

“Their growing intelligence, pervasiveness and autonomy requires rethinking everything from taxation to legal liability.”

As one delves into more detail, one discovers that the report distinguishes between very simple, single-task robots and more sophisticated ones. Therefore, the report suggests that the Commission keep in mind:

‘that at least the most sophisticated autonomous robots could be established as having the status of electronic persons with specific rights and obligations.'

The report then proceeds to suggest the creation of a register for smart autonomous robots, which would link each one to funds established to cover its legal liabilities.

Obviously, the report attempts to address the prospect of legal and ethical challenges that it foresees emerging as Automation and Artificial Intelligence continues to grow and expand in scope.

As I considered the report, I began to wonder…

Is Ms. Delvaux trying to “solve” the terrifying problems we have seen unfold right before us on the big screen?

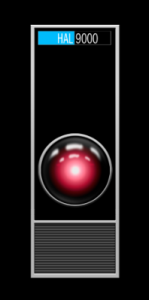

1) The soft spoken HAL 9000 computer in “2001: A Space Odyssey” that sabotages an interplanetary space mission and kills all the crew (except “Dave”)

This cover image for the “2001: A Space Odyssey” DVD shows a mesmerized “Dave”… who had to overcome the HAL 9000 as well as the dangers of space travel!

2) The horror of an all-encompassing “SkyNet” machine that takes control of the world in “Terminator III: The Rise of the Machines”?

3) The havoc reeked by a rogue “AI” robot named “Sonny” in “I, Robot”?

Then I tried to convince myself: “C’mon Petty. Serious legislators don’t try to resolve science fiction movie problems… no matter how indelibly their plot twists and mind numbing images are implanted in our memory!”

However, at that point my attention was drawn to this section of the report:

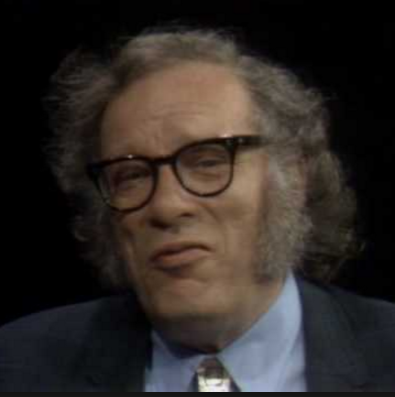

The report suggests that the moral code outlined by science fiction writer Isaac Asimov should be adopted by the EU. Asimov’s code stipulates that a robot absolutely must always obey its creator and is forbidden to ever harm a human being!

Wow! Isaac Asimov could become (indirectly) a European Legislator!

INVESTOR TAKEAWAY:

For all the benefits provided to Eurozone nations by the “Single Market”, there are also significant costs! One of the most significant of those costs is [as pointed out in our original “Brexit” article at: https://www.markettamer.com/blog/to-be-part-of-the-eu-or-not-to-be-part-of-the-eu-that-is-the-question ]:

The ongoing burden of EU regulations… regulations determined by unelected officials in Brussels who would likely be at a loss to pass a standard MBA exam on “Cost Benefit Analysis”[2].

These regulations impact an amazingly wide range of issues. One graphic illustration of this reality is the following contrast regarding the seemingly unlimited scope of EU regulatory reach:

The EU regulates everything from the maximum number of hours someone can work (48) to the amount of power in a vacuum cleaner.

Of course, the popular press focuses almost strictly upon the direct transfer of funds from the UK to the EU that constitutes the annual assessment (aka “tax”) for UK participation within the European Union and its “Single Market”. That annual amount (although it varies from year to year) has averaged between 8 and 10 billion pounds (the U.S. dollar equivalent would be $11 billion to $14 billion). Not surprisingly, the UK is the third largest net contributor to EU revenue (after Germany and France).

However, what the media’s focus upon “direct” costs of EU membership totally misses is this:

The existential cost to the British and the UK economy of EU regulations is much, much higher than those “direct” costs!

Although any estimate of actual regulatory costs upon the UK economy is likely to be slanted by political bias… we do have a relatively “neutral” source to which to turn for such an estimate:

Open Europe… described by Wikipedia.org in this manner:

“… a think tank with offices in London and Brussels and an independent partner organisation in Berlin, promoting ideas for economic and political reform of the European Union.”[3]

According to Open Europe, the top 100 most expensive EU regulations cost the UK economy approximately 33.3 billion pounds (about $49 billion)!

Yes, you read that correctly – well over three times the much touted and easily identified annual assessment paid to the EU!

I know that many of our loyal readers consider the U.S. to be overly regulated. However, if you indeed believe that the U.S. far too regulated… reflect upon the statistics I offer below:

At the end of 2015, the compendium of U.S. government regulations totaled approximately 80,260 pages (found in the Federal Registry).

It has been speculated[4] that if the total cost to the U.S. economy of those 80,260 pages of regulations were an actual economy at work on the global stage… it would constitute the world’s ninth largest economy![5]

That sounds startling enough in itself, wouldn’t you agree?

But now wrap your mind around this:

The “Acquis Communautaire” (within which the entire body of rules, directives, and regulations of the EU is recorded) consumes over 170,000 pages!!

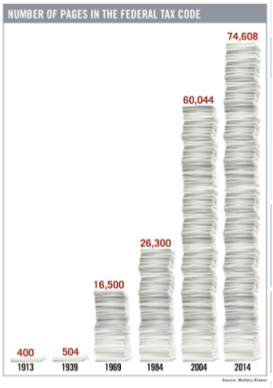

Being a professional tax preparer, I am intimately conversant with the complex, obtuse, bizarre, and frequently indecipherable set of regulations commonly known as the “Federal Tax Code”.

In a perfect world, one might hope that no other set of regulations anywhere else would or could be longer or more dysfunctional than the U.S. tax code.

That being said, it is evidently the case that if anyone needs proof that we do not live in a perfect world, the EU’s “Acquis Communautaire” could be it…

The EU regulations consume well over twice as many pages as the Federal Registry… and nearly two and one half times the pages required to record the Federal Tax Code!

I am not even sure that the folks at “Ripley’s Believe It or Not” would find that statistic credible… at least until they researched the details on its own.

Given the above, now we have Mady Delvaux, however well-intentioned, suggesting that this already mammoth compendium be expanded in order to curtail any possible realization of the horrors we have witnessed on the screen, including:

1) HAL 9000

2) Skynet

3) Sonny (“I, Robot”)

Forgive me for thinking simplistically, but it is hard for me to avoid thinking that the UK voters made the right choice on June 23rd! Now we must see what the UK politicians and their EU counterparts do as a result of that (non-binding[6]) referendum vote.

DISCLOSURE:

The author does not own any UK-specific securities or ETFs… although he does (for reasons of diversification) own international funds/ETFs. The author has no innate bent toward one position or the other, since he is (genetically) a “European mutt”. However, the author does confess to an overriding abhorrence of excessive government regulation. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

[1] “Brexiteer” is a term that describes those UK voters who cast their ballot in favor of leaving the EU!

[2] In my humble opinion, we suffer from quite a number of such politicians in Washington DC, not the least of whom is Senator Elizabeth Warren.

[3] Open Europe was presented with the “International Think Tank of the Year” by Prospect Magazine in 2012.

[4] I suspect with a bit of hyperbole…

[5] Between India and Russia.

[6] No matter the 52% to 48% vote in favor of leaving the EU. That election outcome does not bind the UK Parliament to actually carrying out an departure by the UK from the EU.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

XRP Is Rising Today — Is the Cryptocurrency a Buy?

XRP Is Rising Today — Is the Cryptocurrency a Buy?