Having survived (tattered and torn, but not defeated) the first three trading weeks of June, I began to reflect upon developments in the investment markets since Federal Reserve Chairman, Ben Bernanke, first uttered the now-dreaded “T” word (“tapering”) during Congressional testimony on May 21st. As often happens with me, an image from popular culture sprang to mind: a classic scene from the 1967 movie, “Cool Hand Luke”, when the prison warden (“Captain”) knocks Luke down a hill (as a punishment) and says: “What we’ve got here is failure to communicate. Some men you just can't reach.” [1]

On May 21st, the market was handling Bernanke’s testimony well, until (in response to a question) he made reference to the dreaded “tapering” concept (tapering of QE). That one reference had (to put it mildly) disproportionate consequences both here and around the world – in Japan (where the Nikkei 225 started a tailspin) to Asia (South Korea reached an 11 month low this past week), Europe, and various emerging market countries. Interest rates began to zoom upward, and bond prices tail off. Overall (as the old saying goes) “folks could run, but they could not hide.”

The financial press spent much of the four weeks between May’s testimony and this past week’s Federal Reserve Board meeting anticipating that meeting and the Chairman’s concluding press conference. A number of experts offered predictions regarding Fed action and/or offering counsel to Bernanke regarding what he needed to say on June 19th. Offering thoughts that typified those held by many investment professionals, Mark Spindel (CIO at Potomac River Capital) was quoted in a Bloomberg report. He suggested that Bernanke needed to “step up” and communicate more clearly; he needed to make it very clear that Fed “policy will remain accommodative” even after any bond buying begins to be gently scaled back. After all, “there is a [distinct] difference between the accelerator and the brake!”

Human communication is a tricky and complex process. The Fed minutes and Bernanke’s press conference were a great demonstration of that complexity. As I listened to the minutes and Ben’s personal “messaging”, this is what I “heard”:

1) The economy is improving, but not rapidly;

2) At 7.6%, unemployment remains considerably more elevated than the Fed’s goal of 6.5% (a goal that, with regard to the continuation of the Zero Interest Rate Policy (ZIRP) Bernanke flatly stated might be lowered to 6%!);

3) Fiscal policy continues to constrain economic growth;

4) In accordance with our ongoing monitoring of the Fed’s twin mandates (reaching 6.5% unemployment and not exceeding (on a sustained basis) inflation in excess of 2% annualized), we might begin adjusting the size of asset purchases later this year;

5) However, our resolve to stimulate job creation and economic growth (without creating inflation) is undiminished. We will continue asset purchases and our accommodative monetary stance until we see more progress with our targets;

6) If we ever begin to scale back our asset purchases, we will stand ready to increase them as needed!

7) We will do whatever is necessary to ensure job creation and economic growth!

During the press conference, Bernanke repeatedly spoke of “flexibility” and the Fed’s commitment to adjust to conditions. He even went so far as to emphasize that asset purchases could grow as well as be tapered, and ZIRP is expected to continue as the Fed’s policy for many, many months to come. (That was precisely Spindel’s point – easing up on accelerator is not applying the brake!)

Based on market performance, none of this did any good!

Look at these data points from this past week!

1) The interest rate on the U.S. Treasury 10 Year Note reached a 22 month high (touched 2.51% on Friday!)

2) iShares Barclays 7-10 Year Treasury Bond (IEF) moved down 2%.

3) The S&P 500 Index went on a wild ride, mostly “south”:

a) From Wednesday’s (6/19) High to its Close: Down 1.3%!

b) Thursday morning, it gapped: Down by 1.2%

c) From Thursday’s High to Thursday’s Low: Down 1.7%!

d) From Friday’s High to Friday’s Low: Down 1.3%!

e) From Friday’s Low to Friday’s Close: Up 0.9%

4) From Wednesday’s High (pre Fed statement) to Friday’s Low: Down 4.4%!

On a dispassionate, objective basis, a strictly “fundamental analyst” would watch all this and ask: “Huh! What has changed so dramatically in the economy that this is justified?” A strictly “technical analyst” would see multiple violations of support lines and moving averages, and not be surprised by the direction reversal and momentum change. A strict “money flow analyst” would see tremendous volatility in money flows, recognizing fear when she sees it, and therefore not being surprised that selling begat more selling, which resulted in liquidations and margin calls, that led to tumult and uncertainty.

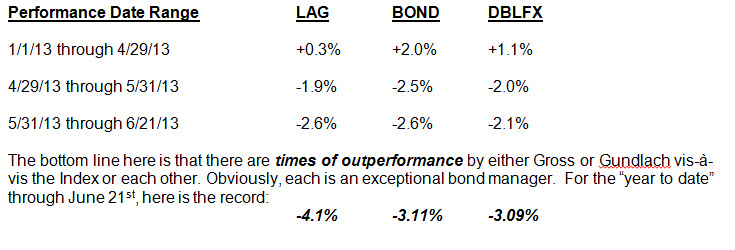

With regard to the overall bond market (beyond the benchmark 10 Year Treasury), the following should help you grasp the radical shift in bonds since the May 21st testimony… and the “damage” done to confidence in bonds. I use three ETF’s as related (but slightly differentiated) “proxies” for the bond market as a whole: a) SPDR Barclay’s Aggregate Bond Index (LAG) (most closely representing the commonly used “bond market index” (which is included in its name); PIMCO Total Return Bond ETF (BOND), managed by the legendary “Bond King” (Bill Gross); and DoubleLine Core Fixed Income Fund (DBLFX), managed by Gross’ newest rival and fellow “guru”, Jeff Gundlach.

To wrap up, assuming you agree with me that there was “Failure to Communicate”, was that “failure” due to the inabilities of Ben Bernanke to “message” effectively? A number of my colleagues joined me in noticing several more subtle communication cues (“vibes”, if you will) that Bernanke (unintentionally, I think) projected on Wednesday afternoon. I believe those “vibes” interfered with an effective “hearing” of his message:

1) He seemed more detached than normal (he wasn’t as effusive; appeared to be at a “low energy level”);

2) He refused to address two issues on investors’ minds:

a. His prospective absence at the upcoming Jackson Hole Conference in Wyoming (an annual meeting of some of the world’s best minds, one he has not missed previously);

b. His hopes/plans regarding the approach of the end of his term as Fed Chair (in January).

3) Combined with President Obama’s casual answer to Charlie Rose in a June interview regarding a possible reappointment of Bernanke as Fed Chairman (Obama: “… he’s already stayed a lot longer than he wanted or he was supposed to…”), Bernanke’s refusal to address either issue caused uneasiness on Wall Street and made it harder for folks to hear, grasp, trust, and integrate his intended message! (That is the message I outlined in bullet point fashion much earlier).

4) The fact is Wall Street hates uncertainty, and the emotions of anxiety or uneasiness that uncertainty can breed definitely interfere with the “listening process”

Whether “failure” was due to Bernanke or not, the result was clearly a month-long spate of traders who “sell first and think later”. The volatility such a mindset causes surely casts a pall on economic matters, and makes government policy setting more challenging.

William Dudley (the president of the New York Fed) was prophetic when he said one month ago: “There is some risk that market participants could overreach even before normalization begins, when the pace of purchases is adjusted but the level of accommodation is still increasing month by month. Not only could such responses threaten financial stability, but also might make it harder to calibrate monetary policy appropriately to the economic situation.”

When I first read that a month ago, my initial response was a sarcastic: “Duh! You think?” Unfortunately, Dudley’s concern has proven even more tellingly on target than I had feared. His term “overreach” is more than a bit understated! (“Overdone” is more to the point.) The only factors that I can deduce which could justify the market reaction that we have seen are:

1) The market was looking for an excuse to “correct”, and Bernanke was the excuse; or

2) (More diabolically) the markets have grown so dependent upon Quantitative Easing that it has become (in some “collective” sense) like a drug addict so needy for the QE “drug” that fear of losing any bit of it at any point overwhelms it with visions and fears of withdrawal and the financial version of “DT’s”.

In either case (and with apologies to our woman readers) I refer you back to the Cool Hand Luke quote from the start (“…Some men you just can't reach…”). I believe the markets’ inability to “listen” to Bernanke’s message clearly enough resulted in an over-reaction! I don’t see any economic Nirvana surfacing in the U.S. anytime soon; in fact, I have real difficulty imagining the unemployment rate getting down to 6.5% by this time next year! (Unless the BLS manages to keep doctoring its formula in ways that lower the denominator more and more – ie. the U.S. workforce number.) We will soon enough discover where the markets head from here.

Action plan: If you include bonds in your overall portfolio (despite numerous dire warnings from “experts” why that is not a wise idea), a few paragraphs earlier we presented you with real, solid, “tested” performance metrics from an extremely volatile period in the bond market! Nothing is as reliable as actual results!

Gross’ BOND and Gundlach’s DBLFX managed to end up in a “virtual tie” for YTD performance through 6/21. In addition, please note that neither BOND nor DBLFX, despite extreme bond volatility this past week, lost nearly as much between Wednesday and Friday as the 4.4% loss on the S&P 500! In fact, neither BOND nor DBLFX lost that much during the volatile month-long period between May 21st and June 21st!!

So if you decide that a general bond fund has a place in your overall portfolio allocation as both a way to generate income and provide a “buffer” for the volatility of equities, either BOND (an ETF) or DBLFX (a mutual fund available through DoubleLine itself, or through major brokerages) would be a great choice! In that spirit, here is a graph comparing these two funds with the S&P 500 during the May 21st to June 21st period:

DISCLOSURE: The author owns BOND and SPY (an ETF that mimics the S&P500 Index), as well as EEM.

Submitted by Thomas Petty MBA CFP

[1] The American Film Institute identifies this quote as the 11th best quote in American film history!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Pros and Cons of Rolling Over Your 401(k) to an IRA

Pros and Cons of Rolling Over Your 401(k) to an IRA