Back in the “glory” years before the “Lost Decade” (2000-2010)[1]… … and before anyone had ever heard of terms such as “Flash Crash”, “Quantitative Easing”, “Mortgage Crisis”, “Fiscal Cliff”, “U.S. Bond Credit Downgrade”, “Grexit”, “Brexit”, “HFT”, or “Dark Pools”… United States’ investors enjoyed an era during which “Super Stars” managed key U.S. mutual funds to impressive returns.

No fund “Super Star” was bigger (or more touted) than Peter Lynch.

This short excerpt from Wikipedia.org[2] summarizes it well:

“As the manager of the Magellan Fund at Fidelity Investments between 1977 and 1990, Lynch averaged a 29.2% annual return,[2] consistently more than doubling the S&P 500 market index and making it the best performing mutual fund in the world.[3][4] During his tenure, assets under management increased from $18 million to $14 billion.”

As much the result of Peter Lynch’s unprecedented success as anything else, the Fidelity Investments family of funds grew into the largest U.S. fund family – and prospered for many, many years.

As much the result of Peter Lynch’s unprecedented success as anything else, the Fidelity Investments family of funds grew into the largest U.S. fund family – and prospered for many, many years.

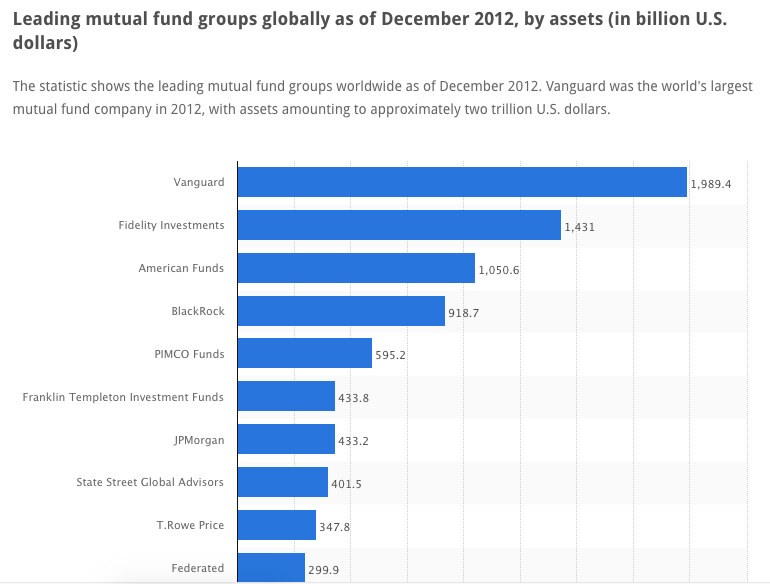

It wasn’t until the end of July of 2010 that any other U.S. mutual fund family seriously rivaled “the House that Lynch built”[3]. As announced in this headline from “ThinkAdvisor.com”, during the sixteen months that followed the disastrous tanking of the S&P 500 in March of 2009, Vanguard Group managed to eke out a narrow lead in Assets Under Management (AUM) over Fidelity ($1.3 Trillion to $1.24 Trillion).

There were countless reasons for that turnabout… but the biggest reason was this:

Following the twin shocks of the “Dot.com” bust and the even bigger/broader bust caused by the global “Financial Crisis”… investors turned sour on the equity markets … and in particular, on funds managed by “Star Managers” that (thereby) charged a higher annual management fee.

This cartoon of the investor stranded on an island during the Financial Crisis illustrates one reason why asset management has changed during the past 45 years.

As a consequence, “Star Managers” began (not so slowly) losing their cache. Lynch was already long gone as a manager before the “Lost Decade” even started… and as so often happens, one by one the “Star Managers” were shown to be vulnerable to periods of subpar performance. Accelerating the pace of “lost luster” were the startling “falls” of two primary “Stars”:

Bill Miller famously managed Legg Mason Capital Management Value Trust (LMVTX) to 15 straight years of outperformance vis-à-vis the S&P 500 Index. However, by 2011, his fund had underperformed the market in five of the prior six years. His downfall was primarily holding over one-third of his portfolio in financial stocks just as the Financial Crisis was about to detonate.

Needless to say, Miller stepped down as CIO at Legg Mason and handed management of LMVTX to his associate portfolio manager. [Miller has resurfaced in the news more recently as a co-manager of Legg Mason Opportunity Trust (LMOPX).

Then, still well within our collective memory, came the seeming implosion of William Gross (formerly the “Bond King”) during 2014… culminating in his departure from Pimco Funds (the firm he had co-founded) in September 2014 to take over the management of Janus Contrarian Fund (JUCDX). As we point out later, Gross had nurtured Pimco Total Return Fund (PTTRX) into a mammoth, internationally renowned mutual fund prior to 2014… but the chaos that beset him and Pimco during that year decimated Pimco’s assets. Gross has a respectable record at JUCDX … outperforming his old fund as seen below.

But Gross has underperformed Jeffrey Gundlach as seen below. In fact, Gross’ title of “Bond King” has been passed on (by the media) to Gundlach.

In the face of these “headline” examples of “Star Managers” who have fallen from grace” … about the only “active manager” who has maintained his international “luster” as a master equity manager through all the carnage experienced since 2000 has been Warren Buffett. [Let it be noted that Buffett is not without critics… consider his huge investments in IBM (IBM) and American Express (AXP) as just two examples of choices for which he has been “taken to the woodshed” by detractors).

About the only two equity managers whose “Star” status has not seriously been questioned are Peter Lynch and the “Oracle of Omaha”, Warren Buffett.

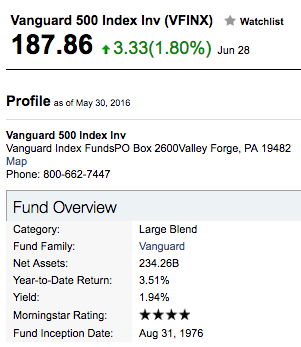

Within the current investment management environment, highlighted by ongoing “fee wars” among the major asset managers (efforts to out compete one another through marketing “lowest cost offerings”)… the groundwork for the impressive success of Vanguard since 2010 was actually laid back in 1975-76, when Vanguard Group founder John Bogle took a risk that other major asset managers were unwilling to make – he launched the very first “Index” fund! (See inset)

That was a foundational strategic decision that set the course for Vanguard to become the prototypical “Index Manager”.

Let me hasten to add that Vanguard offered (and still offers) a number of above average actively managed funds. But I dare say that the name recognition of Vanguard’s managers pales in comparison to that of the bygone days when Fidelity touted its stable of superior managers… from Lynch to (in more recent decades) the likes of Robert Stansky, Jeff Vinik, William Danoff, and Joel Tillinghast.

SO WHAT HAS CHANGED?

As a result of a number of dynamics, including Fidelity’s continued emphasis upon actively managed funds and (until recently) its reluctance to move into the ETF space, Fidelity has continued to fall behind Vanguard in AUM. In fact, less than two years after Vanguard toppled it from the Number One position, Fidelity had fallen behind Vanguard by over $558 billion.

Please take special note of the fact that the American Funds Group was (at that point) almost $400 billion behind Fidelity in AUM… and still engaged in an ongoing struggle to get investors and financial advisers excited about its stable of actively managed funds.[4]

Now, according to the latest “Funds Flow” report from Morningstar (for the period ended April 30, 2016) formerly struggling American Funds is shown to have overtaken Fidelity… to become the second largest fund family! Here is some commentary from Morningstar research analyst, Alina Lamy:

“Consistent inflows for American Funds and outflows for Fidelity prompted a reversal in the top 10 this month, with American Funds climbing to the second spot and Fidelity dropping to the third.”

The fact is that, during the past several years, Vanguard has quite consistently (but not for every period) been listed among the list of assert managers with the highest funds inflows. Well evidently, April was no exception… and American Funds joined Vanguard during April as having the only “sizable inflows” (Lamy’s adjective) into active funds.

Interestingly, the largest flows into passive funds were reported by Vanguard, iShares, Dimensional Fund Advisers (DFA), and Fidelity. It is noteworthy that Fidelity (having seen “the writing on the wall”) has been intentionally growing its stable of passive funds, and has even ventured into the ETF space!

This table (from April) hints at the magnitude of asset flows on a monthly and yearly basis

| APRIL 2016 FUND FLOWS | NET FLOWS |

| VANGUARD GROUP | +$3.4 Billion |

| AMERICAN FUNDS | +$1.5 Billion |

| FIDELITY INVESTMENTS | – $3.7 Billion |

| ANNUAL FUND FLOWS (5/1/15 to 4/30/16) | NET FLOWS |

| VANGUARD GROUP | +$15.0 Billion |

| AMERICAN FUNDS | +$ 5.2 Billion |

| FIDELITY INVESTMENTS | – $28.5 Billion |

Lamy went on to offer additional observations regarding American Funds’ rather impressive resurgence:

“Although recent inflows are still nowhere near its pre-crisis glory days, American Funds has made a skillful comeback, all the more impressive because it’s happening at a time when most active funds (especially equity ones) are in a world of pain.”

Although few funds truly compete with Vanguard’s “low cost structure”, Lamy hypothesizes that American Funds has been growing its AUM by a combination of relatively low cost funds and funds reporting better than average performance:

“Eighty-two percent of its funds are in the low or below-average fee level, meaning least expensive (in the bottom two quintiles in terms of cost).”

“And in terms of performance, American Funds American Balanced (ABALX), which appears on the top-flowing list this month, beat out 97% of its peers in the allocation 50%-70% equity Morningstar category in the past year.”

Another surprising change at American Funds (historically dominated by great equity funds) has been the emergence its bond funds. For example, two such funds[5] attracted inflows during April that totalled $335 million and $213 million., respectively.

There are a couple of other metrics of interest within the April Morningstar report, including:

During April, investors pulled $24 billion out of active U.S. and international equity funds … and poured almost $13 billion into passive domestic and international equity funds. Those flows continue the trend referred to earlier – going for lower cost passively managed choices.

Demonstrating the massive drawing power of Vanguard, during April alone, its Total Bond Market Index Fund and its Total Stock Market Index Fund each drew in roughly $2.8 billion in funds!

Finally, it is worth mentioning that Vanguard’s ascension within the mutual fund space has propelled it into the “top five” list of international asset managers[6]. Here is a summary of the largest asset managers as of the end of 2015:

| FIRM | Assets Under Management | |

| BLACKROCK (BLK) | $4.5 Trillion | Manages iShares ETFs |

| VANGUARD GROUP | $3.3 Trillion | |

| STATE ST GLOBAL ADVISORS | $2.3 Trillion | Manages SPDR ETFs |

| FIDELITY INVESTMENTS | $2.1 Trillion | |

| ALLIANZ | $2.0 Trillion | Hurt by Bill Gross’ Fund[7] |

INVESTOR TAKEAWAY:

Even active traders use mutual funds and ETFs. The “Fund Industry” has been revolutionized by the amazing emergence of ETFs… as well as the continuing “Fee Wars” – with Schwab, Vanguard, Fidelity, State Street Global and Blackrock each (at various points) trying to outdo the others with regard to low management fees.

Topics of interest in this space are nearly limitless – from how the synergy of advancing technology and cheap, easily tradable ETFs has blossomed into the “Robo Adviser” industry… to how professional asset managers have incorporated ETFs into their overall management strategies.

However, the biggest, most elemental change that continues to unfold within the funds space itself is the ongoing shift of investor assets from “actively managed” funds to “passively managed” funds. Within this secular shift, Vanguard has proven to be a prime beneficiary.

Hence, as we have seen in detail above, there has been a marked shift in market share – a shift that toppled Fidelity[8] from the top of the heap… to be replaced by Vanguard… and now even by American Funds.[9]

Finally, allow me two additional thoughts:

1) The shift toward Index Funds was not precipitated by Warren Buffett… but it certainly was reinforced when, on page 20 of his Annual Letter to Shareholders (dated March 2014) he offered this advice:

“What I advise here is essentially identical to certain instructions I’ve laid out in my will. One bequest provides that cash will be delivered to a trustee for my wife’s benefit. (I have to use cash for individual bequests, because all of my Berkshire shares will be fully distributed to certain philanthropic organizations over the ten years following the closing of my estate.) My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.”

I find it ironic that the greatest active investment manager of our time should be the most outspoken proponent of Index Investing.

2) It is a testament to the insight and courage of John Bogle that Vanguard has risen to “the top” in the fund world. Yes, it is easy to look back at 1975 from the vantage point of our present era, within which index investing is not only accepted, but is (indeed) taken for granted and even touted by “greats” such as Buffett.

But that does not do justice to Bogle’s business acumen and fortitude. In those days, “indexing” was simply not done. Proper investing required human judgment, a sure hand at the helm, some form of “active management”.

Mr. Bogle has written in detail regarding how he had to persuade his board to go along with what was (then) definitely a very unorthodox idea! The fact that he pushed for it until he received approval… and then stuck with it through all those decades during which “star managers” were “the thing” in the industry… should impress upon all of us what true “leadership” is about. Now Vanguard is reaping the “fruit” from the seeds planted (with great effort) by Bogle over 40 long years ago!

DISCLOSURE:

The author has accounts at Fidelity and at Vanguard… as well as ETFs from State Street Advisors and BlackRock. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] “Lost Decade” refers to those ten years that witnessed the “Dot.com Crash” and the “Mortgage Crisis Crash”. As a consequence, the S&P 500 Index (not including dividends) essentially treaded water during the decade.

[2] https://en.wikipedia.org/wiki/Peter_Lynch

[3] To borrow the imagery used for countless decades to describe the original “Yankee Stadium” as “the house that [Babe] Ruth built”. In historic fact, the Edward C. Johnson, 2nd family “built” Fidelity… and his son (Ned) and (currently) granddaughter Abigail carried on following his death.

[4] Much more than with Vanguard or Fidelity, American Funds sales are driven by financial advisers – who have historically been compensated for linking investors with those funds.

[5] The Bond Fund of America (ABNDX) and Intermediate Bond Fund of America (AIBAX)

[6] “Asset Management” includes all forms of investment management carried out by a firm… from funds to ETFs to Unit Investment Trusts to pension funds, insurance funds, etc.

[7] Pimco Total Return Bond Fund (PTTRX) was the world’s largest actively managed fund until 2014, when Bill Gross’ management began to be seriously questioned…leading to his departure to Janus Funds. At one point it managed nearly $300 Billion. However, by August of 2015, that had fallen to less than $100 Billion for the first time since 2007. In fact, just in December of 2015 alone, investors pulled another $19.4 billion out of the fund (13.5% of its assets).

[8] “The House that Lynch Built”… and its other “Star Managers”

[9] Which has managed to rejuvenate itself through the addition of solid bond funds, continuing great performance… but especially a very supportive core of financial advisors who continue to serve as primary distributors of American Funds products!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Is IonQ Stock a Buy?

Is IonQ Stock a Buy?