Here is an interesting twist on the concept of “economic moat”[1]. Government privatization actions usually lead to some form of “de jure monopoly”[2], and that is what resulted from a major transition in Mexican airport management that started in 1965. Until then, a Mexican bureaucracy had been in charge of the administration, operation, and maintenance of Mexico’s airports (the Dirección General de Aeronáutica Civil (DGAC))!

In 1965, Mexico created a federal government-owned corporation whose mission was to design, build, and operate airport infrastructure (a responsibility constitutionally delegated to the State). This government-owned entity was named the Aeropuertos y Servicios Auxiliares (ASA, “Airports and Auxiliary Services”) and had its own equity capital and legal identity as it went about fulfilling its task to manage all the airports previously managed by the DGAC.

This change was entered into in recognition of the fact (proven repeatedly through the centuries) that private companies are more efficient than any government bureaucracy.[3] This “experiment” proved to be so successful that, by the 1990’s, ASA and Mexican leaders agreed to open the airport system to private investment. Legislation in 1995 created parameters within which new entities could be granted a time-defined operating monopoly to manage designated airports in a particular region of Mexico.

The first such business was incorporated in 1998 in Guadalajara – to manage airports in the Pacific (western) region of Mexico. This company, named Grupo Aeroportuario del Pacifico S.A.B. de CV (NYSE: PAC), was granted a 50-year long license to operate (and grow) the airports in that region. It is this intriguing company that is the focus for today’s investment article!

[Note: If/when you research this company on your own, you will usually find it referred to by the acronym “GAP” (which also happens to be its Mexican market ticker). However, in these articles, we universally refer to companies by their New York Stock Exchange (NYSE) ticker symbol, which for this company is PAC. Therefore, you will find the company referred to below as PAC.]

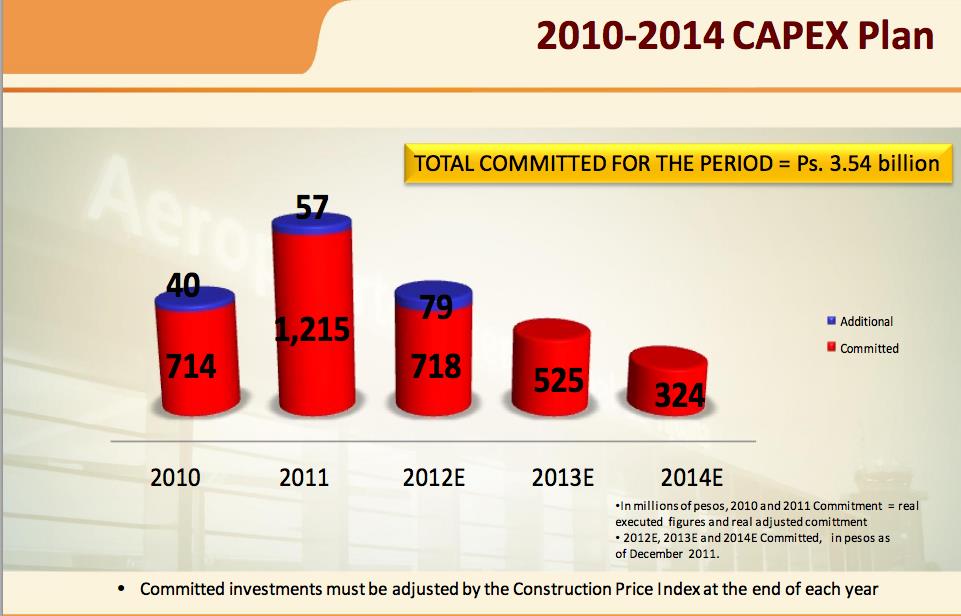

PAC states its objectives succinctly as: “to fund the appropriate levels of infrastructure at their airports; to provide the technology, management methods, and modern operational tools to elevate levels of efficiency and operation; to meet international efficiency standards; and, finally, to maintain the present levels of security.” PAC derives its income through passenger traffic and the marketing (ie. maximization) of its considerable commercial spaces, which it aims to expand and continually improve/modernize. The best example of the scope of PAC’s strategy is the “Development Master Plan 2010-2014” – with a budget over 2,770 million pesos. Below is a chart capital spending related to this ambitious plan:

This company became publically traded in February of 2006 (NYSE: PAC; Blosa Mexicana de Valores: GAP). As of April 15, 2013, it operates 12 airports. Locations include these major Mexican airports: Guadalajara – the nation’s third largest; Tijuana – the fifth largest; Los Cabos – the sixth largest (popular tourist destination); Puerto Vallarta – seventh biggest airport (also a high number of tourists); Hermosillo – eighth largest facility.

This company became publically traded in February of 2006 (NYSE: PAC; Blosa Mexicana de Valores: GAP). As of April 15, 2013, it operates 12 airports. Locations include these major Mexican airports: Guadalajara – the nation’s third largest; Tijuana – the fifth largest; Los Cabos – the sixth largest (popular tourist destination); Puerto Vallarta – seventh biggest airport (also a high number of tourists); Hermosillo – eighth largest facility.

The list is rounded out by La Paz (another big tourist spot), Manzanillo, Guanajuato, Morelia, Aguascalientes, Mexicali, and Los Mochis.

Here is a map of the PAC airport network (red dots… on the Pacific side):

So you will know, Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. (OMA) was founded in June of 2000 and manages one airport hotel and 13 airports (yellow dots) (plus one hotel);

Grupo Aeroportuario del Sureste, S.A.B. de C.V. (ASUR) was started in December of 2008, based at the Cancun Airport and operating nine airports in southern Mexico (white dots).

Here is a summary of some Mexican airport related data, also illustrating the relative size of the PAC operation:

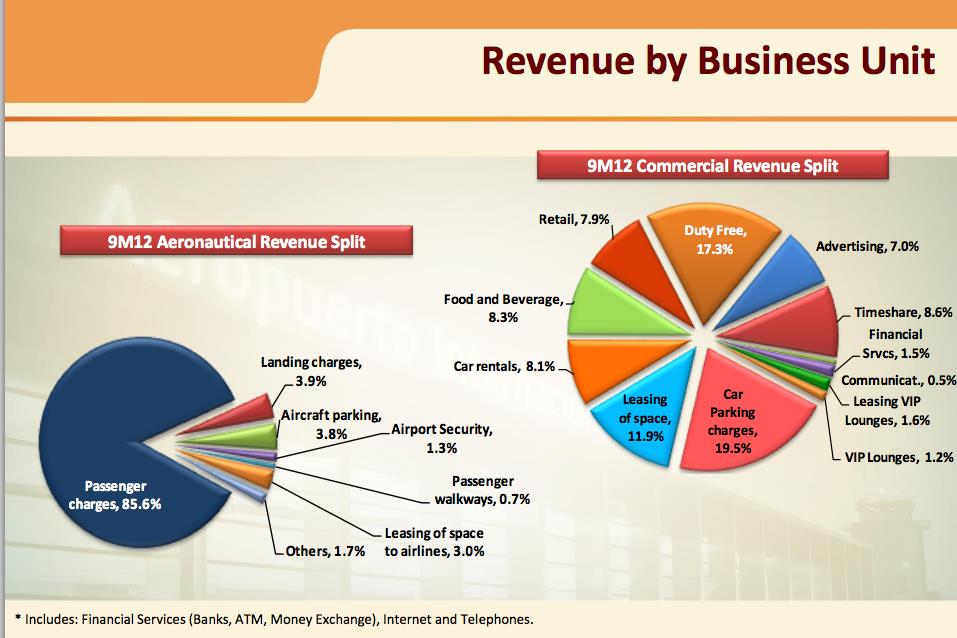

To illustrate the variety and range of income sources for PAC, it leases space to restaurants, retailers, advertisers, and banks. In addition, it manages airport arrangements with operators of duty-free stores, vendors for food and beverages, providers of financial services, car rentals, telecommunications, travel services, promotion services, VIP lounge services, and even developers of timeshares.

In our “Green Age” (with many dedicated to SRI and ESG) many of you will be interested to know that PAC places particular emphasis on environmentally friendly policies and practices. PAC has created (and monitors) standards by which to measure adherence to the fulfillment of environmental goals – summarized too simply as “reduce as much as possible all environmental impacts that are potentially associated with airport infrastructure development.” In recognition of these efforts, the company has received the “Environmental Certificate” granted by the Federal Office for Environ Protection.

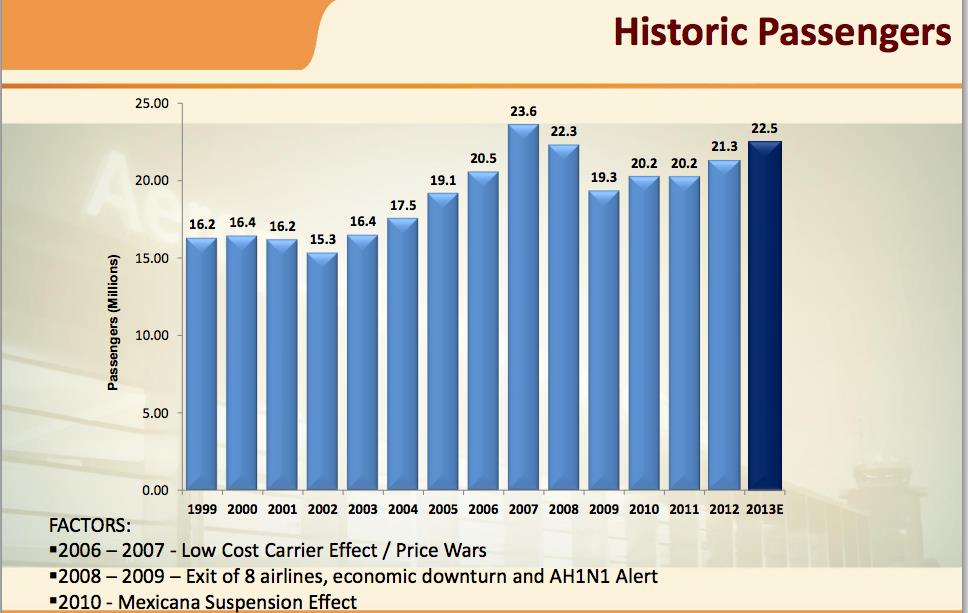

It is quite noteworthy that air travel to/from/within Mexico has proven very resilient. One could rationally have expected a significant drop off in air travel in the early years of the current financial crisis. However, as the following chart demonstrates, passenger traffic remained steady in 2011, after trailing off in 2009 and increasing by 1 million in 2010! Notably, it has resumed an uptrend in 2012 and 2013!

It is quite noteworthy that air travel to/from/within Mexico has proven very resilient. One could rationally have expected a significant drop off in air travel in the early years of the current financial crisis. However, as the following chart demonstrates, passenger traffic remained steady in 2011, after trailing off in 2009 and increasing by 1 million in 2010! Notably, it has resumed an uptrend in 2012 and 2013!

If you’ll recall what I said at the beginning regarding PAC being what I call a variation on a “MOAT” stock, let me elaborate a bit. You’ve already seen that, within the Pacific (western region) of Mexico, PAC has a monopoly on airport management through 2048! PAC also has the Mexican government as an ally with regard to keeping revenues above expenses![4]

Remember that PAC collects airport related fees/tariffs at government-determined levels. Every five years, PAC submits a capital spending plan and passenger projections to regulators, which then provides the empirical basis for determining a new (updated) schedule of fees/tariffs – with a particular focus upon insulating PAC from any anticipated declines in passenger revenue. Because of this built-in system, as long as there is no precipitous drop in passenger travel, PAC is assured of recouping any/all of its infrastructure investments through the normal escalation of tariffs/fees. This also means that, within a fairly broad range of scenarios, PAC’s profitable operation is ensured!

In addition (as I hinted at earlier), fees/tariffs are hardly PAC’s only source of revenue. Here is a chart of revenue sources from a management presentation earlier this year:

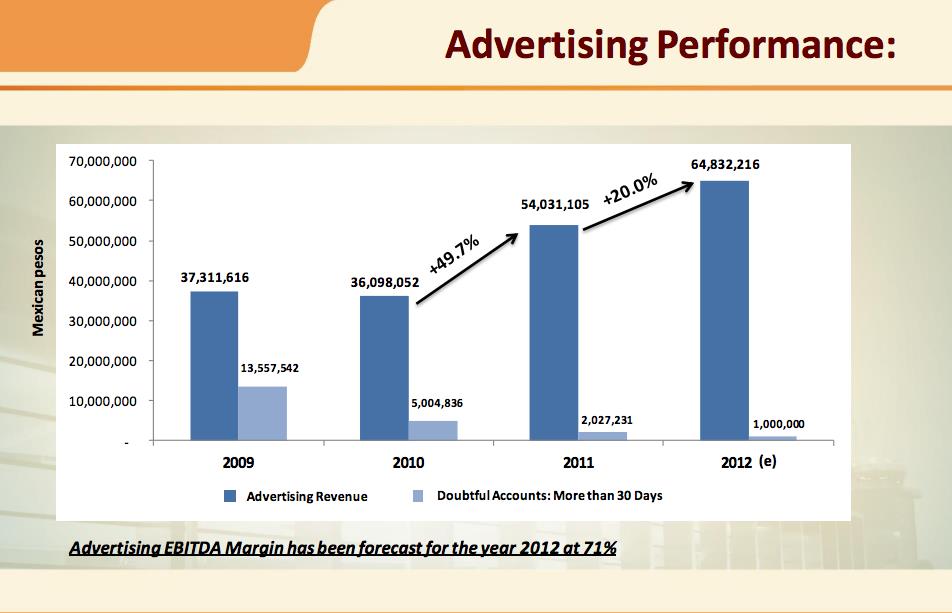

As you can see, the fees/tariffs are the bulk (85.6%) of revenue; but “commercial revenue” is significant and growing! The pie chart (on the right side of that same chart) breaks down those ancillary revenues in detail – with car parking and commercial leasing composing over 30% of such revenue. In addition, as you can see in the chart below, growth within advertising revenue is much stronger than growth on the “regulated” side of operations) (see graph below):

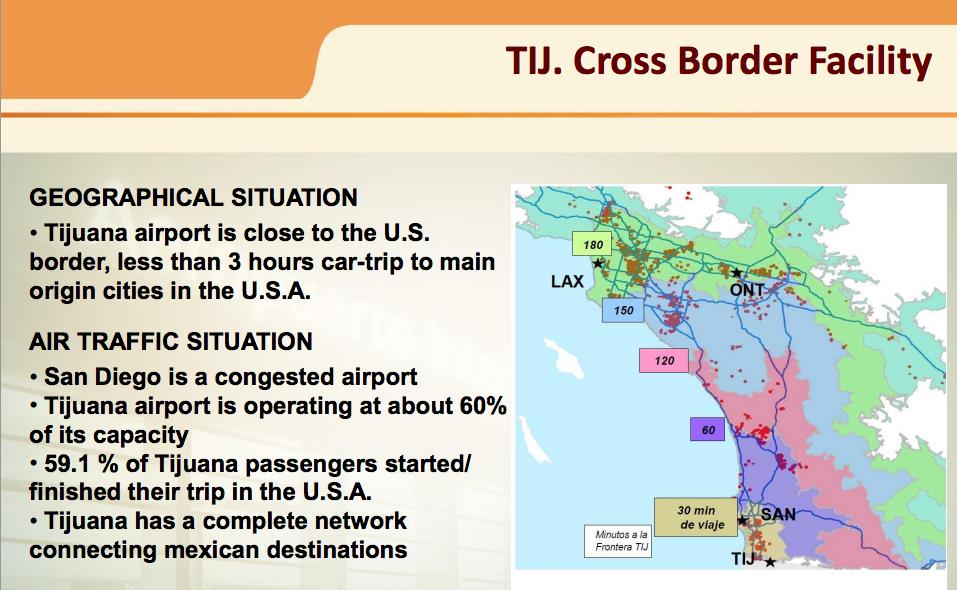

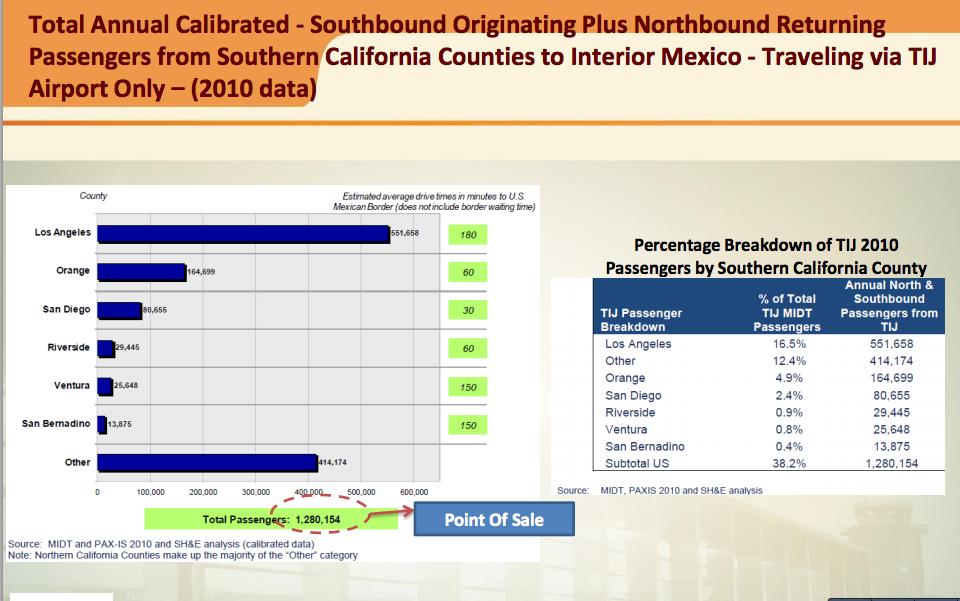

As I roamed through various reports and presentations provided by PAC through its website, I was struck by how thorough management appears to be in thinking through its business operations and strategic planning. It identifies some intriguing “opportunities” available to PAC. For example, consider the strategic location of the Tijuana Airport (TIJ). Management has done a thorough assessment of all data available to it and discerned that a large majority of inbound traffic from outside the country originates in Los Angeles (not exactly rocket science, but believe me, the detail with which management lays out the data is impressive).[5] It also recognizes that overcrowding in the San Diego airport, combined with the US/Mexico cross-border facility, presents a great marketing opportunity for PAC to foster TIJ as a viable alternative for residents of San Diego (where the airport is overcrowded). Load-shifting in that way makes great sense!

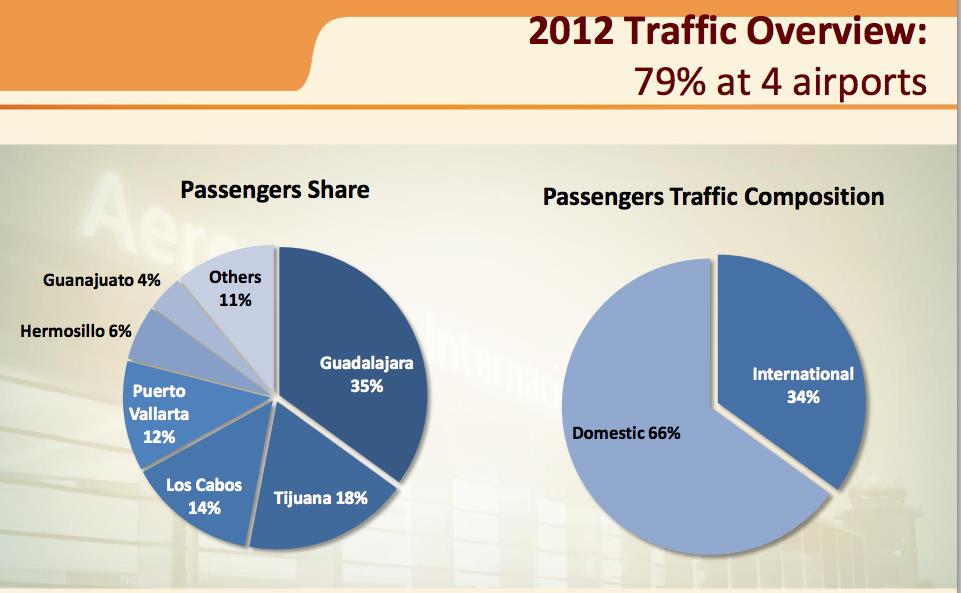

As the world and regional economy improves, PAC enjoys a growing share of international travel. Domestic passenger numbers (66%) still greatly trump those from outside Mexico (34%), but efforts continue along multiple fronts to grow that international business. In the graph below, you can also gain perspective on the relative size of PAC’s airports.

Anyone who considers buying PAC should also know the following:

1) It has a $21.7 billion market capitalization;

2) It is owned by just 7 ETFs (that is neither a negative nor a positive; merely a fact. as part of full disclosure);

3) The company is shareholder-friendly, with a generous dividend policy and a stock buy-back policy (over the past couple of years it has purchased about 5% of its shares);

4) Regarding the dividend, PAC has operated under the following formula: distribute all of its cash (aside from two month’s of operating expense and the amount needed to cover commitments to CAPEX).

a. In recent years, the result has been a distribution to shareholders of about 75% of its earnings.

b. This means the yield is good, but not consistent.

c. YahooFinance.com currently lists the yield as 5.2%; to illustrate one consequence of uneven distributions, ETFChannel.com lists the yield at 10.72%.

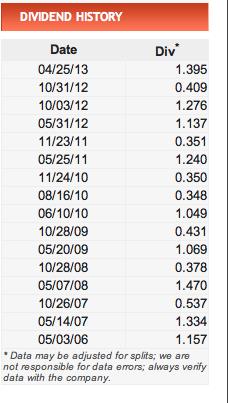

d. See the APPENDIX for a chart from ETFChannel.com listing recent dividend history.

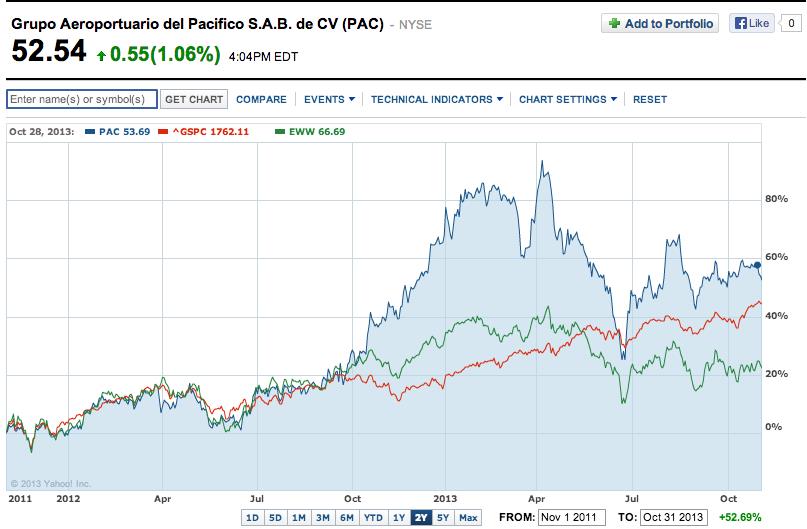

How has the price of PAC performed? Here is a chart covering the past two years. PAC is in blue; the S&P 500 Index in red; iShares MSCI Mexico Capped ETF (EWW) in green. A couple of insights come to mind immediately:

1) PAC outperformed both the index and the ETF over that period;

2) PAC was a lot more volatile, so an investor needs either lots of faith or a strong stomach;

3) The graph suggests that PAC is more sensitive to interest rates than the index.

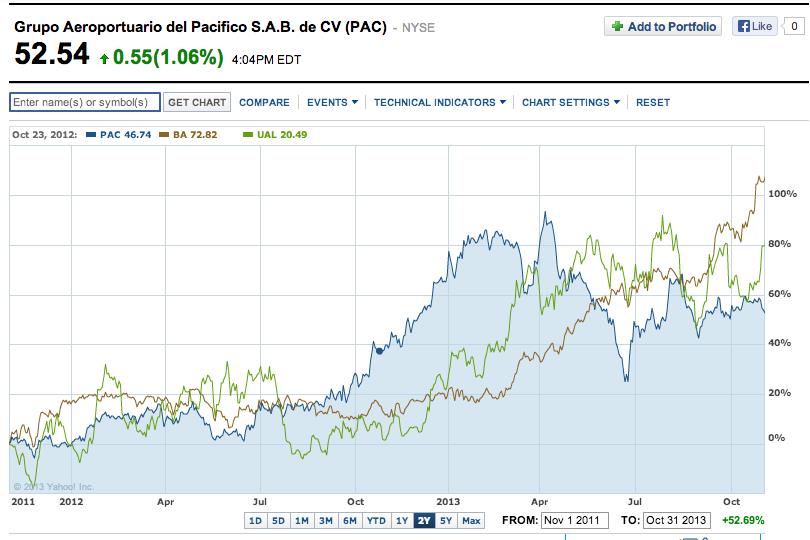

If you want to compare the two-year PAC chart with two small airlines Skywest (SKYW) and ALASKA AIR (ALK), this is what it looks like:

Note that ALK is one of the major sources of international passengers for PAC airports! Through March of 2013, you would have preferred PAC. Since then, ALK has far outperformed. Keep in mind that the price charts do not adjust for dividends paid, so PAC’s total return is higher than it appears!

Then, if you are interested in a “play” on the air travel industry in general, consider this two-year chart of Boeing (BA), United Continental Airlines (UAL), and PAC. You can see how variable UAL and PAC are below. In comparison, BA has been trending upward more smoothly.

What else can we provide you regarding financial performance? Here is a series of PAC management produced slides:

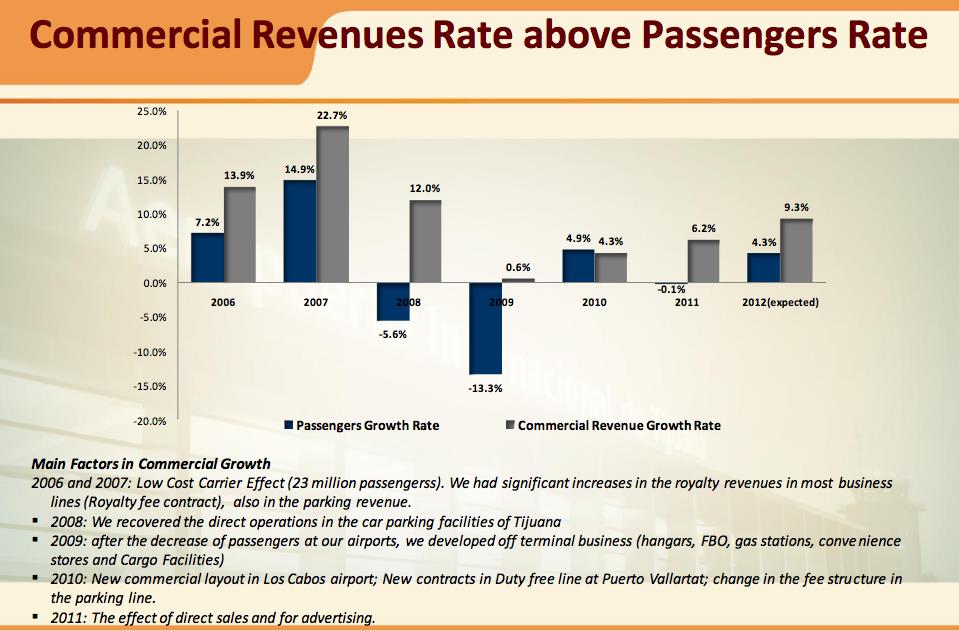

A. COMMERCIAL REVENUE (gray bars) is growing faster than PASSENGER VOLUME (blue bars):

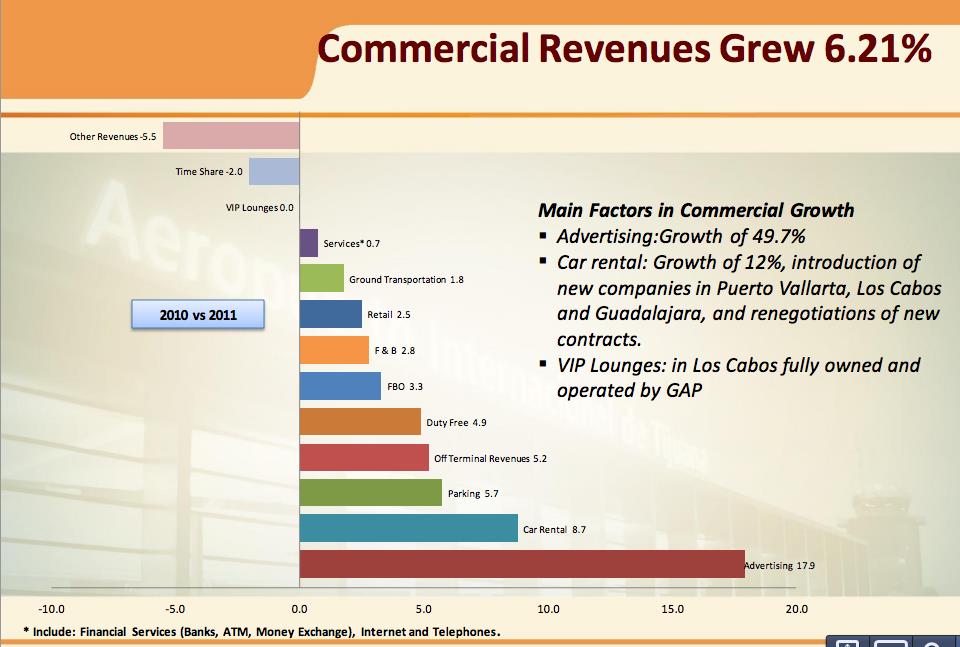

B. A BREAKOUT OF GROWTH RATES within the various COMMERCIAL REVENUE sources:

a. Fastest growth came in advertising (17.9%); car rentals (8.7%); parking (5.7%); off terminal revenue (5.2%).

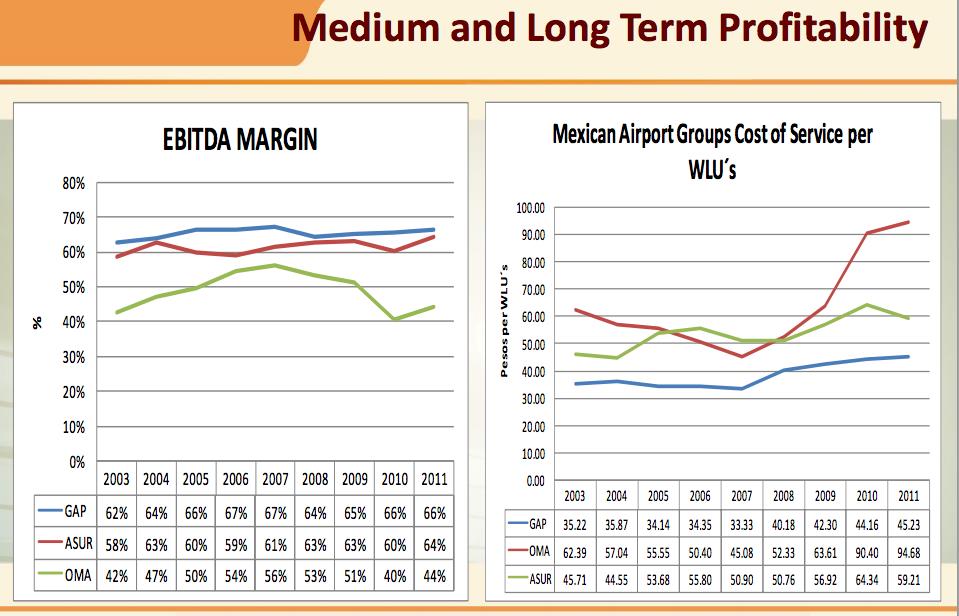

C. PAC OUTPERFORMS its “sister” Mexican airport operators (ASUR and OMA) because it does a better job of controlling the “Cost of Service per WLU”!

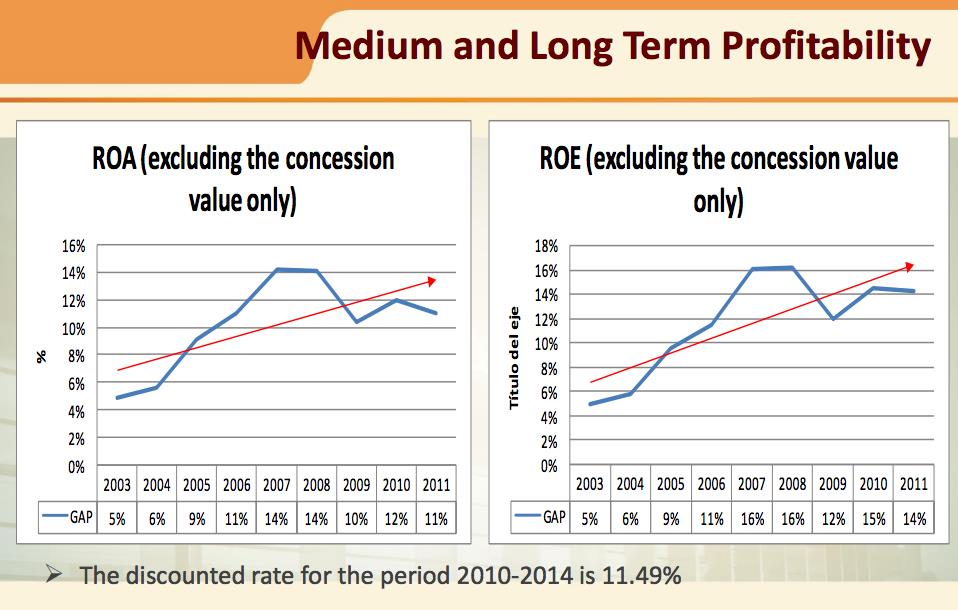

D. The RETURN ON ASSETS (ROA) and RETURN ON EQUITY (ROE) graphs are not as pretty as one might prefer, but an argument can be made that they have an upward trend:

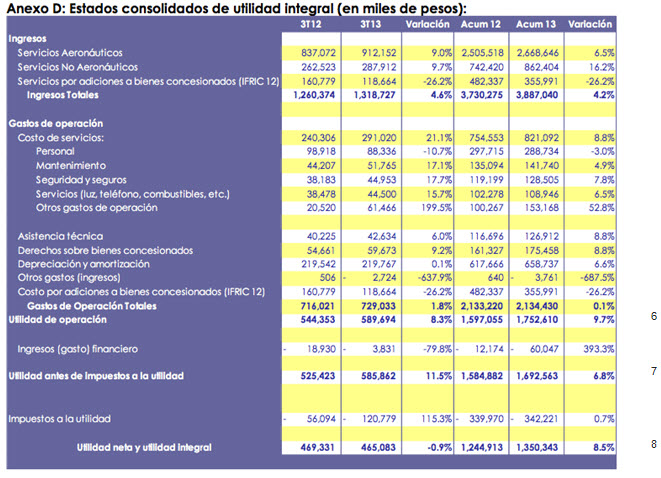

E. HERE IS THE MOST RECENT EARNINGS REPORT (October 2013):

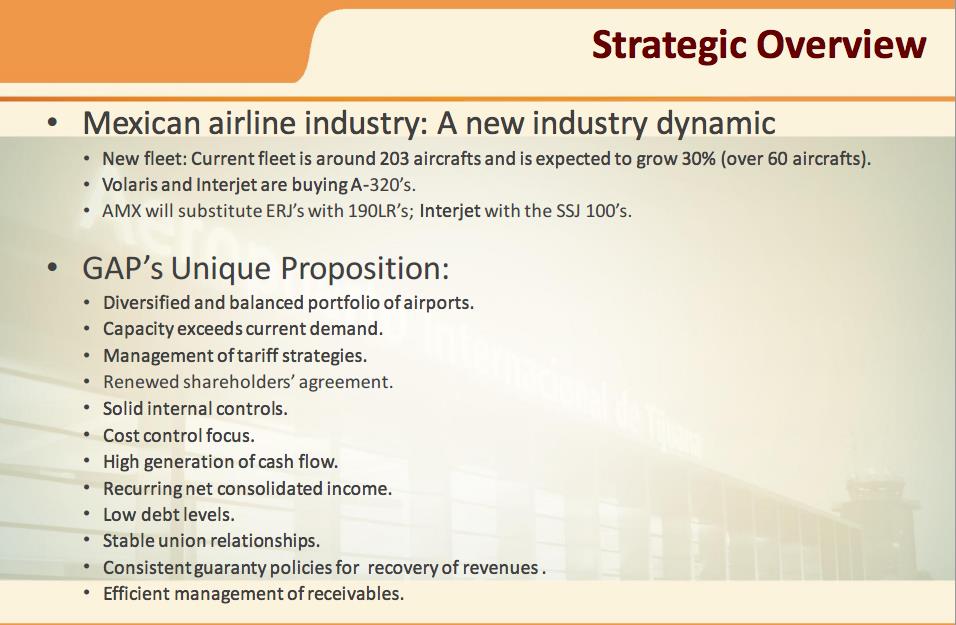

Based upon my acquired understanding of PAC, I believe the management team has created a very fair assessment of what is appealing about the company (Remember that “GAP” in its literature refers to our PAC):

Quite impressively, management also admits to risks related to the company:

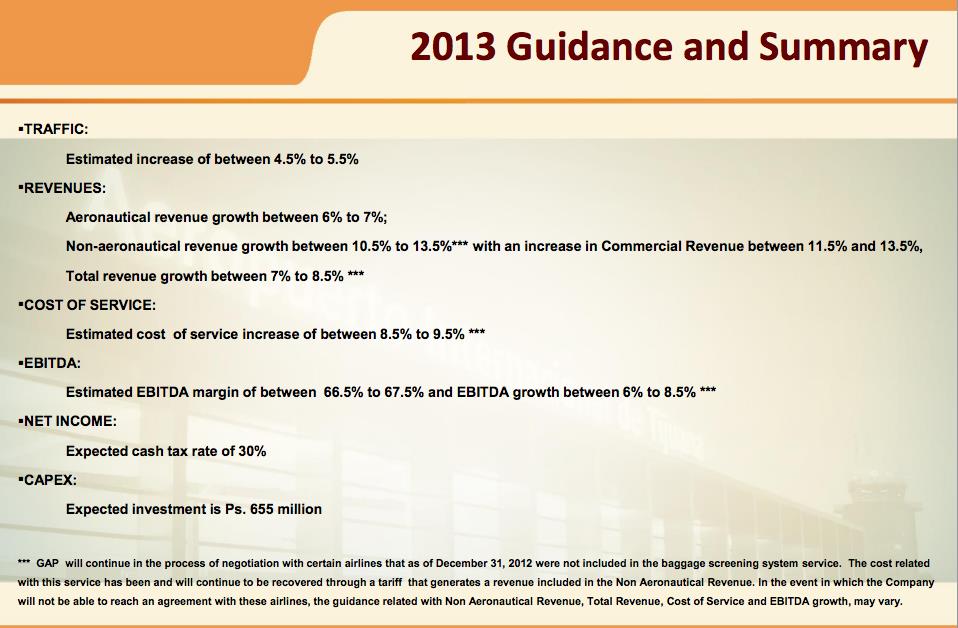

Finally, since Wall Street absolutely loves every company’s proffered “Guidance”, here is the report presented by PAC:

INVESTOR TAKEAWAY: I personally think it is vital for us who are investors/traders to perpetually stretch the boundaries of our knowledge. Obviously, we are “most at home” with U.S. companies and securities. However, companies from around the world are (in the aggregate) growing faster than we are. Wall Street no longer “rules the investment world”, and we all need some level of diversification beyond the borders of the U.S.! My research on PAC (specially requested by someone else) has certainly stretched me!

The history behind PAC’s origin and the business structure of PAC are very “foreign” to me.[9] I will not explain this graph beyond saying that “Shareholders” such as you and I own a portion of 85% of the company. A government-formulated entity with firm Mexican roots owns the other 15% [it is much, much more complicated than that!].

The central, and most intriguing (for me), part of this story is how very much PAC sounds, looks, and feels like a “MOAT” stock… intentionally created and buttressed by the government (MOAT with a “twist”!),

The central, and most intriguing (for me), part of this story is how very much PAC sounds, looks, and feels like a “MOAT” stock… intentionally created and buttressed by the government (MOAT with a “twist”!),

It is worthy of consideration as a trading instrument, and/or as an investment. But anyone investing in it needs to be prepared for volatility!

In addition, to the list of “risks” the management team enumerated (see above) I would add the risk that, to one extent or another, interests, actions, and/or money from Mexican drug cartels will inevitably impact PAC. That sounds scary, I know. However, it should be no scarier than the reality of Al Capone in Chicago during the 1920-30’s, as well as the reality of organized crime within the United States for decades on end.[10]

All of this said, I have been impressed by what I have seen of management’s acumen, and I am definitely impressed by the company’s extremely shareholder-friendly practices!

Finally, the presentation slides can be found at http://www.aeropuertosgap.com.mx/files/presentaciones/GAP%20-%20Corporate%20Presentation%20Jan2013.pdf.

DISCLOSURE: I do not own PAC, or any of the other “sister” companies. However, I am most definitely intrigued by it for countless reasons. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

Importantly, I have taken 6 years of German; I have learned key expressions in Korean, Gaelic, and Spanish. However, I have no acumen with regard to regarding Spanish – particularly “financial statement” Spanish. I have used internet-tools to translate whatever I needed to translate. As you can imagine, I do not, in any conceivable way, stipulate that I have translated such sentences or phrases accurately!

Submitted by Thomas Petty MBA CFP

[1] See these past articles about the ETF MOAT.https://www.markettamer.com/blog/how-to-find-stocks-with-economic-moats https://www.markettamer.com/blog/why-was-facebook-kicked-out-of-moat They provide detailed explanations regarding the concept.

[2] Otherwise called government monopoly or coercive monopoly. See http://en.wikipedia.org/wiki/Government-granted_monopoly for a more detailed explication.

[3] Might this (perchance) bring to mind the U.S. Dept. of Health and Human Services?

[4] No matter how you feel about government regulation, if you are a shareholder of PAC, having the government back you up on price increases is extremely appealing.

[5] See the “Total Annual Calibrated” southbound passenger data chart in the APPENDIX at the end.

[6] [Rough translation] Income from operations, up 9.7%

[7] [Rough translation] PAC income before taxes, up 6.8%

[8] [Rough translation] Comprehensive net income, up 8.5%

This report and other 3rd Q data at http://www.aeropuertosgap.com.mx/images/files/reportes_financieros/3q13%20gap%20spa_final.pdf

[9] Pun is intended

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Should Dividend Stock Investors Buy Coca-Cola Stock Instead of PepsiCo?

Should Dividend Stock Investors Buy Coca-Cola Stock Instead of PepsiCo?