The Marshawn Lynch run play that was not called in the final seconds of the February, 2015 Super Bowl may never be forgotten!

In our previous article (https://www.markettamer.com/blog/putting-fed-liftoff-in-context ) we offered a detailed context within which to analyze and interpret the U.S. Federal Reserve’s decision on December 16th to raise the Federal Funds rate[1] by 0.25%. We wrapped up that article with these thoughts:

“… I cannot guess the direction of interest rates in the months ahead. No matter what you might hear on TV, hear on the radio, or read in periodicals — it is impossible to forecast rates with certainty.

“All of that being said, it remains clear that the U.S. economy still struggles (with only modest incremental improvements in positive economic data) and the Fed has promised that it will become more “accommodative” on monetary policy during the months ahead if and when the need arises. Therefore, it is fair to suggest that rates may go higher in a few months, or (alternatively) that rates may not go any higher for many months to come. The health of the economy will (we are assured) dictate what the Fed chooses to do.”

Compared to some of the more opinionated articles written about the Federal Reserve and its “Liftoff”, the above commentary was well balanced and “tame”. But that is for the simple reason that within the “Pantheon” of acclaimed market experts and analysts, I can (at best) be considered worthy of handling a “Swifter” — with which to keep the most treasured market icons (and the display of their best work) free of dust and clutter. Within that pantheon, I certainly do not[2] qualify for a position of honor.[3]

Jeffrey Gundlach, founder of DoubleLine Capital and currently referred to by the press as "the Bond King".

With that in mind, this past week I reviewed what currently comes as close as anything to a “Financial Pantheon” – the “Morningstar Hall of Fame”[4]. At the same time, several recent analytical insights from the vaunted, widely quoted, and top-performing Jeffrey Gundlach caught my attention an d absorbed quite a bit of my research time. Gundlach, of course, is a premier bond fund manager whom the financial press has dubbed “the Bond King”[5].

Gundlach first vaulted into the above referenced virtual “Pantheon” in 2006 – when Morningstar named him “Fixed Income Manager of the Year”. In those days, Gundlach toiled for TCW Funds, managing its “Total Return Bond” fund. In 2009, he was fired from TCW Funds – the circumstances being complicated, messy, and the subject of a fascinating knock down, drag out court battle.[6] Gundlach immediately founded “Doubleline Capital”

… an investment management firm that, as of March of 2015, boasted over $73 billion in Assets Under Management (AUM). Through July of this year, Doubleline enjoyed 17 straight months of positive investment cash flows – a relative rarity in these days of volatility, investor angst, and chronic shifts in market sentiment.

If Mr. Gundlach was asked to review my article, he would undoubtedly critique it harshly for being far too tepid. Gundlach would see no need for my usual “balanced” analysis and might even be dumbfounded that I didn’t just come out and say (point blank) that the Federal Reserve’s December decision to raise the Federal Funds Rate by 0.25% rivals the Seattle Seahawks’ disastrous Super Bowl XLIX blunder (on February 1st of 2015) – when (with just 24 seconds to go and Seattle facing 2nd Down and Goal, merely feet away from the winning touchdown) head coach Pete Carroll eschewed calling a Marshawn Lynch run for the score. Instead, Russell Wilson’s short pass attempt was intercepted and the game ended – with a Seattle loss that will live forever in infamy (in the hearts of Seahawks fans[7]).

The above may sound overblown or overly dramatic – but it certainly earned Gundlach lots of headlines when he spoke at the “ETF.com Fixed Income Conference” (Nov. 4-5thin Newport Beach, CA.) and (looking ahead) described a Fed “Liftoff” in December in just those terms. Adding insult to injury, Gundlach flashed side-by-side photos of Pete Carroll and (Fed Chair) Janet Yellen on the huge conference room screen – commenting that the two leaders “even look alike”.

Gundlach may be a bit “visually challenged” (any resemblance between Carroll and Yellen is (at best) faint)… but he does know the bond market! During the past several months, he has opined regarding the many misperceptions that reside in the minds of millions of market participants… including the following misunderstanding:

A Fed “Liftoff” is bad for 30-Year U.S. Treasury Bonds.

Gundlach points out (emphatically) that nothing could be further from the truth. The fact is that (as he said at a recent conference):

“The long bond wants the Fed to tighten. And I know that a lot of people have a hard time with that notion, but it’s difficult to look at the market data objectively and come to a different conclusion.

“People are far too committed to the idea that interest rates are about to explode higher. That’s been the wrong idea for years. And we’ve jumped to the wrong conclusion that the Fed tightening is somehow a disaster for long-term bonds. It’s exactly the opposite.”

For those who are skeptical, Gundlach offers the example of 2013/14:

Back in 2013, market participants and market “experts” widely expected the Fed to tighten rates[8]. So columnists and advisors began counseling investors to shorten maturities (and even lighten up on bonds). What was the result? Long-term Treasury yields fell throughout the year 2014. The 30-Year Treasury ended 2014 at a yield of 2.70%, over 31% lower than the yield it carried in January – thereby generating a total gain of approximately 30% (bond prices move inversely to rates). In (sharp) contrast, the benchmark S&P 500 Index was up by only 11.4%.[9]

For the record, Gundlach was among those few “experts” who made the correct call on interest rates in 2014. He prophesied that interest rates would head downward because of a mixture of demographic trends (an aging population), the lack of inflationary pressures, and a few technical factors.

Gundlach has also opined why so many current financial professionals have difficulty understanding the real dynamics (and cross currents) at work within the bond market during periods in which rates are expected to rise or remain stable:

“Two-thirds of today’s money managers have never experienced a single Fed rate hike.”

At the mid-November “Charles Schwab Impact Conference” (in Boston), Gundlach presented a laundry list of reasons why he believed the Fed should delay any decision to raise rates.

1) The first reason is now a bit dated, since it refers to the October BLS Non-Farm Employment Report… but still offers a salient point:

a) Practically all of the 271,000 jobs gained in October can be accounted for within the age group: “Workers 55 and Older”. Not exactly a scintillating sign of economic vibrancy and growth.

2) With other major Central Banks still holding a heavy foot on the Monetary Easing pedal… any rate increase by the Fed will only serve to lend more strength to the U.S. Dollar – an economic headwind for major U.S. corporations with overseas sales.

Beyond that, a rising interest rate cycle in the U.S. is likely to cause strong headwinds for overseas economies – particularly in more vulnerable nations. Gundlach suggests that this impact might be the most frightening prospect of “Liftoff”. In particular, he has pointed to China and Brazil:

a) The Shanghai Composite “looks really bad, a lot like the Nasdaq in the year 2000.”

b) Gundlach points to Brazil’s falling GDP (-4.5%) and suggests that the apt descriptor for its economy is “depression”.

3) Subdued Inflation. Gundlach points to the Fed’s favorite indicator of inflation “Core PCE” (Personal Consumption Expenditures)… which on a Year Over Year (YOY) basis is up a mere 1.3%. More surprisingly (and tellingly) he points out that if the U.S. government calculated inflation the same way that Europe does, U.S. price trends would actually fall into the “Deflation” category.

4) Modest Growth. When adjusted for inflation, U.S. economic growth falls into the 2% bracket (YOY). Countless commentators have been pointing out that, in the past, a standard Federal Funds “Liftoff” hasn’t been initiated until growth and or inflation are significantly higher than they are at the present.

Adding to Gundlach’s pique regarding the Fed’s December decision is this:

Gundlach finds it curious that Europe’s growth comes in at about 1.5% — which ECB President Mario Draghi considers sufficiently weak to prompt a serious consideration of additional monetary stimulus. So in the estimation of Gundlach, it is nearly inconceivable that the U.S. Fed, with a slim 0.5% advantage over Europe vis-a-vis economic growth, feels compelled to raise rates.

5) The Bond Market has already adjusted on it’s own. As Gundlach highlights, interest rates have already moved upward through the free market dynamics of the bond market:

a) The rate on the benchmark 10-Year Treasury Bond has trended upward over the past two years;

b) The Junk Bond Index rate has increased significantly… driving prices downward to a 4-year low.

i) The Junk Bond Index is a “great leading indicator of financial conditions,” and sits around a four-year low.

ii) Junk bonds are trading at levels below those seen during 2012, and price weakness has not been caused strictly by the energy sector.

iii) “Junk bonds are signaling with clarion bells, “do not raise interest rates” … [therefore] high-yield securities “should be sold on strength.”

iv) High-yield spreads over Treasuries are significantly higher now than they have been leading up to any Federal Funds “Liftoff” during previous cycles.

v) Those who think the oil market is fishing for a bottom could be in for a rude surprise. Gundlach has opined that many of the oil companies which hedged against lower oil prices (several years ago) are running out of time on those hedges… and that could lead to future disappointments within the junk bond market.

6) (For what it is worth) The “Goldman Sachs Financial Conditions Index”[10] which rises as conditions worsen, is much higher than it was in 2012. “

a) Therefore Gundlach asks: ”Why raise interest rates now?”

7) U.S. Corporate Profit Margins Narrowing. Gundlach observes that S&P 500 company profit margins are on the decline. Some commentators have described this as a “profits recession”. However, Gundlach notes that these margins are falling from historically high levels[11] … and the last time this occurred was in 2007.

a) Gundlach adds the footnote that the most recent period during which corporate margins fell by 60 basis points without triggering a recession was in 1985.

8) Finally, this December “Liftoff” has now modified the public discourse regarding rates.

a) Throughout 2016 and beyond, that discourse will focus upon “the next rate increase”[12]

So what has Gundlach been doing to protect investors within the funds he manages (or co-manages) from the worst consequences of Central Bank “blunders”?

When Gundlach describes his investment process, he starts by pointing toward two fundamental categories within the bond market:

1) Bonds that have a backing of a government “guarantee” and

2) Bonds that do not offer said “guarantee”.

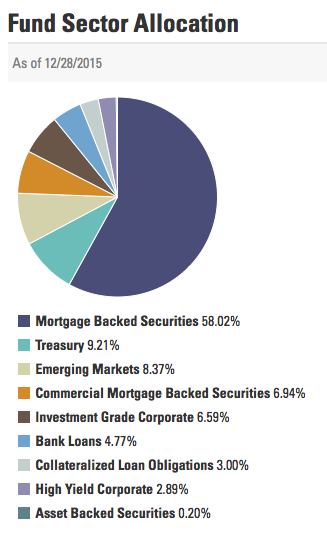

He goes on to identify eight separate bond sub-categories:

1) Treasury Securities

2) Mortgage-Backed Securities

3) Investment-Grade Corporate Bonds

4) Below Investment Grade Corporate Bonds

5) Bank Loans

6) Commercial Mortgage-Backed Securities

7) Developed Market Bonds

8) Emerging Market Bonds

From there, Gundlach and his team begin making strategic and tactical decisions… such as:

1) What fraction of the portfolio should be in government-guaranteed bonds,

2) What part of the portfolio should be in bonds subject to corporate default risk or securitized default risk.

Of course, those decisions are made with a focused view upon the team’s analysis of global economic conditions and inflation:

1) The lower the inflation rate and weaker the economy, the higher allocation one will want in government bonds.

2) Conversely, the stronger inflation trends and economic growth appear, the more desirable a higher allocation to corporate bonds will be (because they are “safer”).

Another indispensable factor within the allocation decision is relative valuation! In fact, valuation can (and has) lead to modifications of the “general allocation” principles identified above. For example, in 2009, the global economy was extremely weak, but (due to a “flight to quality”) government bonds were extraordinarily pricey. So wise managers made adjustments based upon a rigorous balance between relative valuation and an assessment of risk.

INVESTOR TAKEAWAY:

No one will ever accuse Jeffrey Gundlach of being a “shrinking violet”. Quite to the contrary, he is extremely confident, extraordinarily opinionated, and not particularly concerned with “political correctness” within the fund industry or with regard to government institutions (such as the U.S. Federal Reserve).

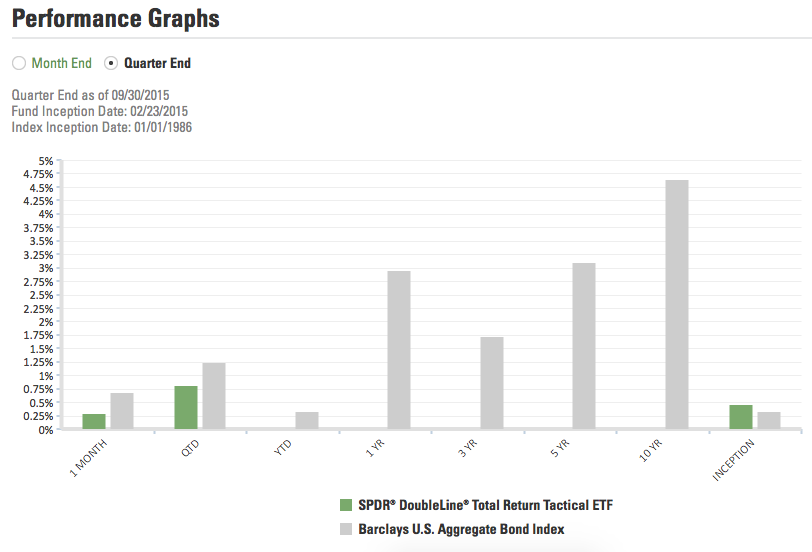

If you are interested in learning more regarding Gundlach’s philosophy and approach to investment management, a great place to go to find resources that will enlighten you is the website for his (relatively) new ETF [rolled out on February 23 of 2015] — The SPDR DoubleLine Total Return Tactical ETF (TOTL):

https://www.spdrs.com/library-content/public/ETF-TOTL_20150930.pdf

and/or the DoubleLine Funds website:

http://doublelinefunds.com/index.html

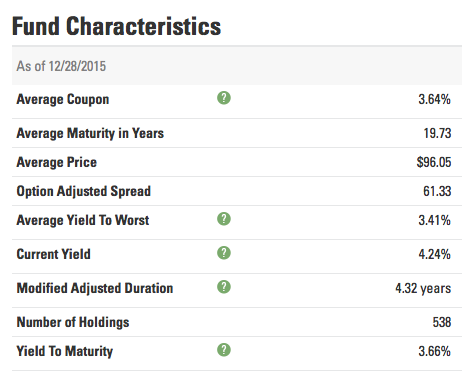

Here are some key metrics and enlightening information regarding TOTL:

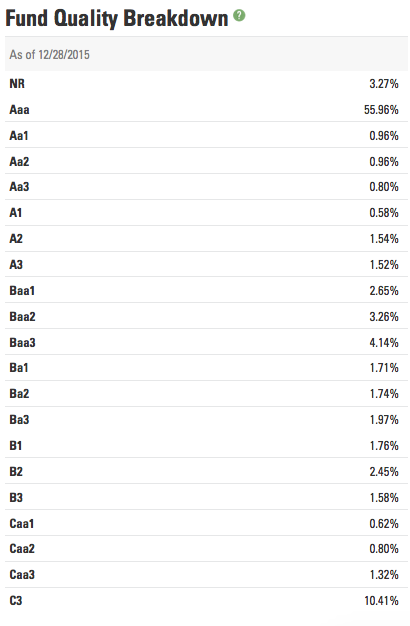

This is a detailed list of ratings on the bonds within TOTL. Note that it holds almost 10.5% in "C3" rated bonds!

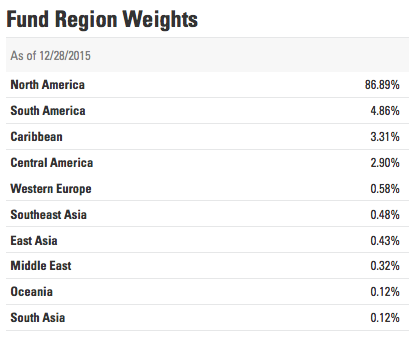

Here is the detailed list of bond maturities held within TOTL as of the end of December (2015). Note that TOTL holds a much higher allocation to long bonds than does its related index.

The author has followed Jeffrey Gundlach for years, particularly as William Gross fell from grace and lost his media crown as “Bond King” to Gundlach. The author currently does not own shares of TOTL or any of the Doubleline mutual funds. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] Fed Funds is the most basic tool used by the Fed to manage U.S. Monetary Policy.

[2] Not yet, at least.

[3] Just to reassure you, there is not actually any “Pantheon” dedicated to acclaimed Investment Managers, Analysts, or Experts. It is merely a personal flight of fancy to indicate how revered certain financial figures become as portrayed within the financial press… akin to “Super Stars”. For example, the financial industry equivalents of sports icons such as Michael Jordan, Walter Payton, Mike Ditka (“da Coach”)… or for non-Chicagoans, such stars as Steph Curry or LeBron James… would be folks such as Peter Lynch, Warren Buffett, Benjamin Graham, Bill Gross, John Bogle, etc…

[4] “Investment Manager of the Year” in each major asset class back to 1987 (see http://corporate.morningstar.com/US/asp/subject.aspx?xmlfile=174.xml&filter=PR5303 )

[5] Of course, the press had to first strip that title from the once revered Bill Gross when things “blew up” at PIMCO…

[6] From Forbes in 2011: “Star bond investor Jeffrey Gundlach was awarded $66.7 million by a jury over his messy divorce from money management firm Trust Company of the West, in one of the ugliest battles ever to grip the multi trillion-dollar bond-fund world.”

[7] And anyone who was unlucky enough to have bet on the Seahawks.

[8] An expectation (or anxiety) largely triggered by (then) Fed Chair, Ben Bernanke’s, May press conference when he uttered the “Taper” word regarding “Quantitative Easing”.

[9] If you are curious, the 10-Year Treasuries were also up on the year, with rates moving down from 3% to just over 2.2%!

[10] An Index that moves higher as conditions deteriorate.

[11] “Historically High” here means — “the highest levels in history”.

[12] A fate that seems reminiscent to me of “Chinese Water Torture”.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Ryman Hospitality: The King of Convention Real Estate

Ryman Hospitality: The King of Convention Real Estate