For anyone who wonders what I want for Christmas[1], the answer is simple. I want a 100% Guaranteed, sure to be on target, prediction of what the stock and bond markets will do during 2015! Surely that is not an unreasonable Holiday Wish… in fact, I’ll bet that many of you would add that to your list if you didn’t fear that you’d be laughed at!

What I’d covet knowing above all else is whether the great Market Bull is on his knees…

or whether the Bull is charged up for the holidays and thereafter:

Of course, this is the time of year when “experts” crawl out of the woodwork to speculate about this very topic. Therefore, credible “2015 Predictions” are extremely easy to come by. The problem is that none of those experts is willing to offer a “Money Back Guarantee” if their prediction proves to be off target!

Of course, this is the time of year when “experts” crawl out of the woodwork to speculate about this very topic. Therefore, credible “2015 Predictions” are extremely easy to come by. The problem is that none of those experts is willing to offer a “Money Back Guarantee” if their prediction proves to be off target!

One source of credible predictions is Business Insider. Its website recently shared 2015 predictions from numerous market veterans. It should be no surprise that very few of those experts are targeting a double-digit gain for equities in 2015! The reason is simple – since March 9, 2009, we have witnessed an absolutely amazing movement from the lower left of the trading screen toward the upper right of the screen. The normal “correction cycles” for which everyone has been looking just have not materialized… with an outstanding case in point being the September/October descent:

One source of credible predictions is Business Insider. Its website recently shared 2015 predictions from numerous market veterans. It should be no surprise that very few of those experts are targeting a double-digit gain for equities in 2015! The reason is simple – since March 9, 2009, we have witnessed an absolutely amazing movement from the lower left of the trading screen toward the upper right of the screen. The normal “correction cycles” for which everyone has been looking just have not materialized… with an outstanding case in point being the September/October descent:

When the downward slope from a swing high on September 18th steepened with ugly candles on October 9th and 10th, everyone (and her brother) was expecting the downward sweep to become the long awaited “Correction”! Alas, everyone (and her brother) was caught off guard when the market action on October 15-17 proved to set the stage for an amazing “V” formation back up!

So here we stand, amazed at a market that “should” have corrected, but just wouldn’t let itself be corrected. The result of all of this has been demoralizing of “bears” and many hedge fund and active mutual fund managers who have been left scratching their heads – trying to explain to shareholders why their holdings have not kept pace with the major indices.

One of the more interesting (and sobering) of the recent market commentaries by which we are surrounded each week has come from Dana Lyons (of J. Lyons Fund Management).

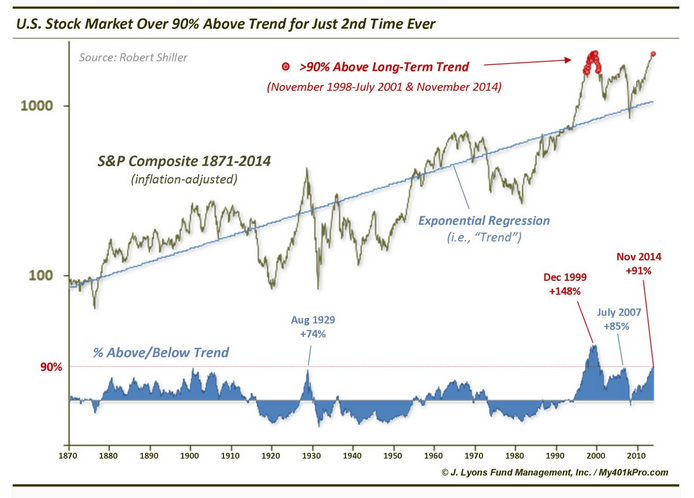

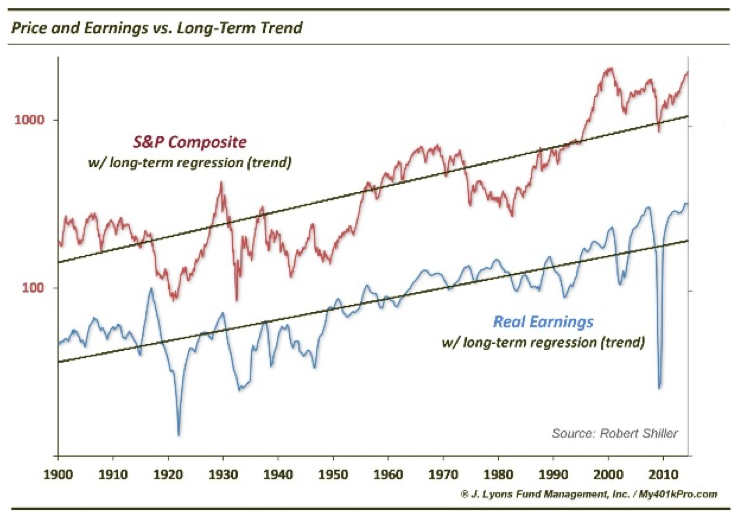

Lyons compared the current inflation-adjusted S&P Composite level[2] with records of its long-term monthly trend – reaching back 134 years (1871 is the oldest date for which records exist).

Based on Lyons’ analysis of these two data series… his conclusion is stark:

During the long stretch of this 134-year period, stock prices have been this extended only once before – between November of 1998 and July of 2001.

Yikes! We remember how miserably that turned out! (The “Dot.com Crash”)

Knitting together several of Lyons’ quotes, we have the following:

“Outside of that period, stocks have never been this far above their long-term trend… As it turns out, outside of the afore mentioned 1998-2001 period, November of 2014 marks the first month in its entire history that the S&P Composite is 90 percent above its long-term trend….” (Underlining added by me.)

Lyons’ continues: “Suffice it to say the stock market is extended. Can it stay extended? The past few years prove that it can…. I will only leave you with this: it likely is not the best time to commit a lot of long-term capital to the U.S. stock market.”

Mr. Lyons is hardly alone in his caution with regard to the market. I remember that in the heady days (the mid-1980’s) of the long-lived “Wall Street Week” television show (it ran for 32 years) host Louis Rukeyser[3] had a list of bearish market observers upon whom he could call to garner a interview that might dampen bullish enthusiasm among investors. That list of perennial “bears” included James Grant, with his signature bow tie and glasses.

Grant’s Interest Rate Observer has always been an articulate and erudite source of market insight and data – first as a newsletter and currently as a newsletter and website.

There is an additional reason you might want to seek out Grant’s website! He has an exceptional sense of humor. At that website[4] one can find archives of cartoons that have been used in past newsletters… many of which are hilarious. I can’t reprint any of them here without paying a high license fee… but here is just a taste of that humor:

1) From 2008, the cartoon image is of a psychotherapist in a chair and an investor on the couch, with the therapist asking: “So why do you think your stocks hate you?

2) From this year, an image of a mock front page from the “New York Post” that includes the gleaming face of Fed Chair, Janet Yellen, and the headline: “FED Cures Ebola: ZIRP zaps bug”.

3) And the one I find the most hilarious of all…. The façade of the U.S. Federal Reserve Building with these words suspended above it (similar to a cartoon “bubble”): “Oh well, what the Hell, let’s try it!”

In a November interview on CNBC [http://www.grantspub.com/resources/video.cfm]

Grant evangelizes his long held view that the U.S. Federal Reserve has (for quite some time) overstepped its bounds – leading to “this virus of radical monetary intervention” will inevitably lead to an unpleasant market crisis.[5]

Carrying on in the Grant tradition (but totally unrelated to and independent from Grant) is Dr. John Hussman – 16 years younger but sharing many of Grant’s opinions about the Fed and the market.

Dr. John Hussman, a prolific economist and market expert whose data intensive analysis of the economy and the markets is always worth reviewing.

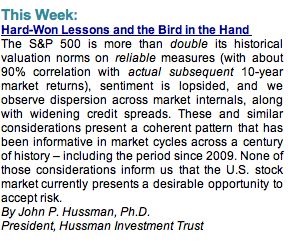

Like Grant, Hussman is articulate, erudite, and churns out a considerable flow of impressive data-intensive analysis. In his latest commentary[6], this is what Hussman says about the current market:

“The S&P 500 is more than double its historical valuations norms… sentiment is lopsided…. None of those considerations inform us that the U.S. stock market currently presents a desirable opportunity to accept risk.”

In a different report, Hussman projects nominal total returns of less than 1.4% annually for the S&P 500 over the coming decade, with negative total returns over the next 8 years. And of course, in line with quite a number of other market observers, Hussman suspects the Fed will need to extend its dovish monetary policy for many years to come.[7] He wrote: “While QE might conceivably hold valuations at a higher plateau, we would still expect volatility – if more muted than in normal cycles – around it. My actual expectation is that the S&P 500 will lose half of its value over the completion of this cycle, but even if stocks have reached a ‘permanently high plateau’ it will likely include tradable departures from a diagonal line.”

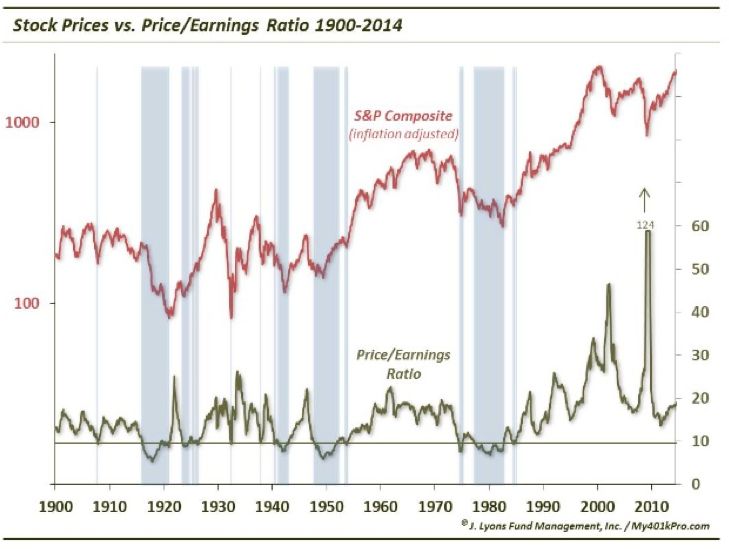

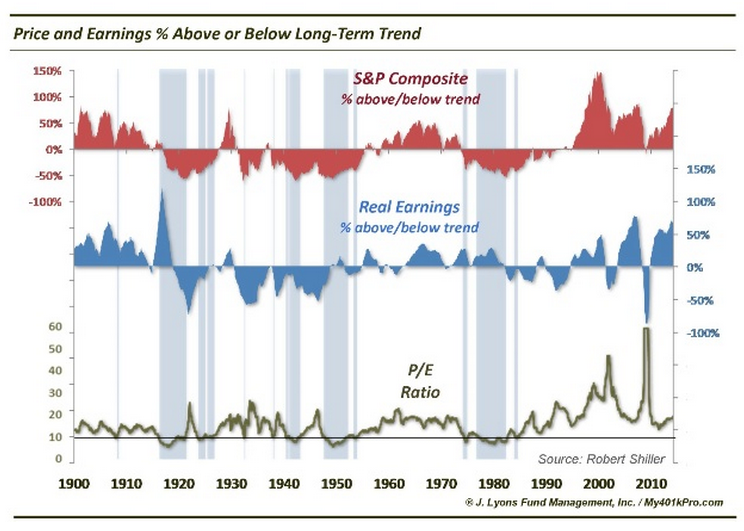

Wrapping up the “Be Careful Out There” perspective on the market, let’s look at some more of Dana Lyons’ recent work.[8] Reflecting his commitment to developing market opinion based on ascertainable data, Lyons took time to dig deeper into the most common “Valuation Metric” accepted within the market: the “Price to Earnings Ratio” (P/E). Instead of analysing the metric as usually presented… Lyons separated the ratio’s components in order to take a look at the essential dynamics within the ratio itself. Namely, Lyons broke out the price data and the earnings data and created graphs that helpfully illustrate the primary reason(s) for a high or low P/E at any given time.

Here is an undifferentiated, standard look at P/E data vis-à-vis S&P 500 pricing:

If one looked at this graph (alone) for clues regarding potentially fruitful market entry points based on “low valuation”… one might think that 1910, 1916, 1932, and 1941 presented solid entries. However, one would only have been “half right”!! Why? Because the valuation dynamics at work within those years were quite different.

If one looked at this graph (alone) for clues regarding potentially fruitful market entry points based on “low valuation”… one might think that 1910, 1916, 1932, and 1941 presented solid entries. However, one would only have been “half right”!! Why? Because the valuation dynamics at work within those years were quite different.

Take a look at this graph:

Above you see that the reason for “attractive valuation” in 1910 and 1916 was solid earnings (above the trend line) relative to the price of equities. In contrast, the driver of valuation in 1932 and 1941 was low equity pricing… not earnings, which indeed were below trend (far below trend in 1931!). As one might suspect then, investors who entered the market in 1910 and 1916 were rewarded (and would have been wise to sell somewhere on the way up), while any who purchased stock in 1932 or 1941 were likely to have been frustrated.

Lyons then went on to create the next graph, breaking out the contribution of “Price” and “Earnings” to stock valuation at any given point in time by illustrating where each component stood relative to “trend”.

Therefore, examining the position of the “red” and the “blue” data above relative to “trend” (the 0% line in each series) could have alerted investors in those years regarding the relative expectancy that an investor could assume with regard to short or intermediate term market profits.

How does Lyons interpret our current valuation based on this work? Here is what he wrote in conclusion (I have not nearly done justice to his whole article; if you find this of interest, you should go to the link I provide in the footnote[9] and read the piece in its entirety):

“Does that mean that we think the stock market is destined for new lows below those set in 2009? That is not our expectation. Remember, our definition of a durable secular market low is one that supports a sustainable secular advance. That means that prices need only revert back to the secular bear market range established between 2000 and 2013 to render the current rally “unsustainable”. In the S&P 500, that would mean a return to the 1500’s area that marked the tops in 2000 and 2007. This, we believe, is not out of the question. Nor is it unprecedented. Similar temporary new highs have occurred during prior secular bears in the 1910’s and in the early 1980’s.” [Bold emphasis added by T. Petty.]

INVESTOR TAKEAWAY:

As we all know, the “Wild Card” in any analysis of the current stock market is the U.S. Federal Reserve and the (as James Grant calls it) “virus of monetary intervention” (ie. flooding the world with liquidity) that it has introduced into world markets (via the Central Banks of Japan, Europe, China, etc.). The Fed’s Balance Sheet is still over four times the size that it was in 2007, and even with the current upbeat news on the Non-Farm Payroll front, it is unlikely to descend toward normal levels anytime soon.

Add to this massive liquidity the fact that the world’s perception (right or wrong) is that the U.S. markets are the best and safest place within which to invest the surplus of money with which the Central Banks have flooded us. Also, even Hussman, Grant, and Lyons admit that the rarefied level at which the U.S. equity indices currently stand (at least the S&P 500, the NASDAQ, and the Dow Jones Industrials) could become even more rarefied for an indefinite period going forward (ie. equity prices could move even higher).

Finally we have the dynamic of lower oil prices, a development that some experts project will remain intact for a significant period. If that turns out to be true, market dynamics will be[10] further impacted by higher levels of consumer discretionary net income. And of course multiple business sectors will be blessed by lower costs[11].

Where does this lead us, the “average” investor[12]? It should (in my opinion) lead us to become more cautious, vigilant, and aware at all times that “this time is not different”. By this I mean that, someday, somehow, in some way (and probably when we least expect it) the market will incur a painful correction. The stock market has never (and will never) merely “continued going up” in the fashion that it has since March of 2009.

Warning lights are visible and “red flags” have been raised by any number of experienced, astute investment professionals — including the ones referred to above. What that should mean for us might include at least the following:

1) Put “Risk Management” at the forefront of your thinking

a) Pay attention to position sizing and never go “overboard” on any given position.

2) Consider some “Portfolio Protection” along the lines of strategies that have been taught by Market Tamer coaches (especially Ron) – such as the “Plunge Protection Trade” or “Collar Trades”.

3) Lean on objective sources of stocks and ETFs that offer a higher level of “Expectancy” with regard to profits:

a) A prime example of such an objective source is the Market Tamer Algos (the original “Algo” and the newer (longer-term) “Algo II”)

Finally, never underestimate the power of the Federal Reserve and/or Seasonal and Historical Trends to move markets within the short and intermediate terms. In fact, that will be the focus of our next article!

What would you say if I told you that one of the best-known perennial “Bears” has recently come out with a pretty wildly bullish outlook for the period between December and the spring of 2015! Well, it is true, and I’ll outline that thesis for you very soon. Keep your eye out for it! [Hint: the expert to whom I refer is British by birth. He co-founded an investment firm whose headquarters is in Boston, Massachusetts.]

DISCLOSURE:

Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] Trust me, that select group can be numbered on the fingers of one hand![2] Lyons used the data provided by Noble Prize winning economist, Robert Schiller

[3] One of the most amusing things one can find in the biography of Rukeyser is that People magazine once dubbed him: the only sex symbol within the “dismal science” of economics. If you are puzzled by that “award”… consider the alternatives – particularly those who have won the Noble Prize for Economics. Needless to say, Rukeyser competed for that award against a rather unexciting pool of cndidates.

[5] A crisis that Grant notes not even the Fed will be able to stem.

[6] Available at http://hussmanfunds.com/wmc/wmc141201.htm

[7] I wrote this article on December 5th, just after the huge Non-Farm Payroll Report of 321,000 “new jobs” – the most since 2012. So that report is not reflected in Hussman’s thinking. However, I suspect that Hussman would not be significantly dissuaded from his view by one report.

[8] This analysis can be found at: http://www.seeitmarket.com/market-masters-durable-secular-pe-lows-combination-p-e-13870/

[10] (At least according to economic theory)

[11] The “Transportation” sector being the most

[12] I refer to “us” very generically, because as you know, Market Tamer investors are “above average”!!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Saving for Retirement? Here's the Number You Should Be Aiming for, and How to Get Your Portfolio There.

Saving for Retirement? Here's the Number You Should Be Aiming for, and How to Get Your Portfolio There.