Within the past week, Ron Haydt caught my attention (during a market brief) when he wondered aloud how long the iShares Russell 2000 Index (IWM) had been trending upward. That started me thinking about our very long-lived market move upward from March 8, 2009, a move that I confess caught me very much by surprise (I take comfort in the fact that I am not alone in my surprise!).

Here is a homemade price graph of that move (based on Dow Jones Industrial Index prices from the St. Louis Federal Reserve[1]) from 2009 through July 24th:

Thus far, the move upward from the 2009 low closing price (March 9) to the July 23rd closing high of 15,567, has returned 137.78% (not including dividends).[2]

Before we look at any of the other upward moves since 1970, I need to mention that there are various and multiple ways that analysts and commentators have defined a “market correction”. Among the variations that I ran across in my review, I found metrics ranging between a 10% and 25% drop in market price.

That is why I inserted two arrows into the chart above – marking the move in 2011 (between July 7 and September 22) from 12,719 down to 10,734. That move measured -15.61% — a drop that certainly felt like a “bear market” in my portfolio. However, the general consensus seems to be that we have been in a bull market since March of 2009.

Our current bull market is particularly remarkable when we recall the multiple “doomsday” scenarios that certain pundits and media outlets pushed last fall – warning that an impending triple-threat from “Fiscal Cliff”, “Sequester”, and “Debt Ceiling” could result in a precipitous market decline. As events played out, the market has scooted higher despite Congressional ineptitude, higher tax rates, and arbitrary federal spending cuts (“sequester”), as well as several other obstacles.

It is no “news flash” that the most potent force driving the market has been Federal Reserve (FED) monetary easing (made painfully obvious during the May/June “Taper Tantrum”). However, after Fed Chair Ben Bernanke made a concerted effort to emphasize that low rates and easy money will continue (for as long as it takes to move the U.S. closer to 6.5% unemployment and a more sustainably vibrant economy) the markets have reversed its swoon and moved upward, with some conviction, no less. One of the major “barometers” of investor enthusiasm and commitment has been “fund flows”, and July’s figures have offered a stark testimony to the as yet untapped financial resources that could potentially flow into stocks or bonds:

1) During the first twelve trading days of July, ETFs tied to U.S. equities took in about $24.4 billion (about $2 billion per day).[3]

a.That pace is nearly four times the average rate between January and June!

2) The SPDR S&P500 Index ETF (SPY) alone received $12 billion from investors in the first half of July ($1 billion per trading day).

a. SPY has now moved over the $150 billion level in assets for the first time ever!

3) In a similar vein, Reuters reported that the current asset flow into U.S. equity funds is the most since 2008.

However you look at it, we’ve been in an uptrend for a long time. In fact, through the July 23rd high, it has been 1597 days! Impressive! But how does our current “bull market” compare with other markets within the past 45 years?

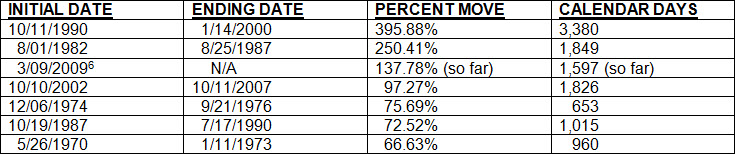

When I gathered and ran the data[4], I was struck by the results. This market falls into third place relative to magnitude of the upward move and fourth place relative to number of days[5]. Here is a chart summary:

I) (1990-2000) THE RISE OF TECH/FALL OF USSR MARKET: At the start of these 3,380 days, we were basking in the excitement of the fall of the Berlin Wall in1989, and watched with rapt attention as we saw witnessed Germany re-unite, the USSR collapse, and the Warsaw Pact be dissolved. It was an amazing moment in history – bringing a sweeping reshaping of global geopolitics. For the remainder of the decade, we looked on as global tech giants emerged (see chart below: Intel (INTC); Cisco (CSCO); and Microsoft (MSFT)) and small, start-up tech companies managed to get Wall Street all too excited. Finally, we experienced something that sounds impossible these days – the President (Clinton) and Republicans managed an agreement that (for a time) produced a balanced budget (yes, it IS possible!). Unfortunately, this market was brought low (very low) by the excessive exuberance that surrounded the “Dot.com” companies – many of which had no earnings but huge prices (trading on dreams and hopes, and the illusion that we had moved into a totally new and different “economic age”. That illusion never works out well!

II) (1982-87) REAGAN/VOLCKER RALLY

III) (2009-2013) THE BERNANKE BOOST

Well, OK, there are lots of descriptions you could use for this market (some of them unprintable). But who can really quibble with the notion that, within a world economy that suffers from below average (anemic) growth, widespread unemployment, and unprecedented sovereign debt, and within which national budget deficits (rather than surpluses) are the “rule” instead of the exception – to what else can we attribute a steady rise in stock market prices (even from atrociously low levels)? Benjamin Bernanke did not invent “monetary easing”, but his several bold “escalations” of easing have lifted the U.S. economy (picture money as though it is water in a lake; as the water level rises, the boats are lifted). These days, when Bernanke speaks, it feels as though the markets are “listening” more intently than when a national head of state speaks. He has also provided immense “political cover” for other central banks (EUB, BOE, BOJ) to engage in mega doses of monetary easing. (See the earlier graph).

There you have your rearview mirror look back at the past 45 years of Dow Jones Industrial Average performance history, and a summary of how our current market “stacks up” relative to the others. There is just one other set of graphs that I want to share with you because one day of market history within this period stands out head and shoulders above all others: October 19, 1987. It is still called “Black Monday”. Take a look (left) at what happened that day:

Graph to the left:[7] the line that resembles falling off a cliff is a one-day 23% collapse in the market. In terms of magnitude, no other one-day decline comes close to October 19th! I share this because so many investors did not live through it, and might still find it hard to imagine.

Trust me, that decline was all too real. Here is an interesting graph summarizing the events leading to that crash: [8]

That crash is the very thing that set up the market for its next up-move (1987-1990), which took sixth place in our ranking.

Feel free to look at the other graphs (below) of several of these market moves.

INVESTOR TAKEAWAY: Never let the ecstasy or agony of the daily moves in the market make you lose your longer-term perspective on the market! Yes, we go down (sometimes way down). However, if we learn (and live by) an investing discipline that depends upon rules and a longer-term plan (instead of emotions) and patience (with some faith thrown in) history demonstrates that we can manage and prosper. In fact, that is a chief reason for the existence of MarketTamer – to help you in your journey toward personal growth and investment success!

Disclosure: the author lived through all 45 years (I started trading while in diapers, of course). He has owned many iterations of Dow Jones Industrial Index funds in the past, as well as INTC, MSFT, MSFT, and AAPL. However, nothing in this report is intended to be a recommendation to buy or sell anything! Finally, the “bull market” graphs (below) were produced by the author, using data downloaded from the St. Louis Fed.

[1] http://research.stlouisfed.org/fred2/series/DJIA/downloaddata

[2] From the March 8th midday low of 6,469.95, the move upward was over 140%.

[3] Funds flow data comes from ConvergEx Group.

[4] Downloading the price data from the St. Louis Federal Reserve website into Excel

[5] The “number of days” is counted in calendar days rather than trading days.

[6] I prefer using the 3/8/09 low of 6,469.95, resulting in a gain of 140.6%; but I bow to the need to be consistent and use “low closing price”

[7] From https://en.wikipedia.org/wiki/Black_Monday_(1987)

[8] From https://en.wikipedia.org/wiki/Black_Monday_(1987)

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Trump's Feud With the Fed: Should Investors Be Worried?

Trump's Feud With the Fed: Should Investors Be Worried?