Here is an article that is intended to be as much fun and entertaining as informative or insightful. Let’s take a comparative look at two stocks that have become very well-known and (recently) much in the news:

Tesla Motors, Inc. (TSLA)

This is the one of the “faces” of Tesla – Its Sportster vehicle… way out of my price range!

I confess that I was taken back when I looked at a website description of Apple this past week and read the following: [Apple designs and manufactures] “mobile communication and media devices, portable digital music players, and personal computing products worldwide. Its products and services include iPhone, a handheld product that combines a mobile phone, an iPod, and an Internet communications device; and iPad, a multi-purpose mobile device…”

Why did that set me back? Due to the fact that I witnessed Apple’s birth, it will always be (for me) a computer company that diversified into mobile devices and digital music – not the other way around!

At any rate, during the past few months, I believe that TSLA has taken on some of the mystique and cache that used to be the province of AAPL! To illustrate this, let’s compare a 2-year chart of TSLA with a 3-year chart of AAPL (up through just before AAPL fell out of favor).

Both charts reflect a fairly continuous price pattern from lower left to upper right, with AAPL showing an especially sharp incline between November 2001 and April 2012[1], while TSLA shows an “upward burst” in May of this year — when it announced GAAP earnings of $11 million, its very first profit in its ten year history. In the TSLA chart, you can easily see the “rocket launch like” upward move in price in May. Obviously, the fact that TSLA showed a profit (however small) caught Wall Street by surprise!

However, this May profit only moved TSLA from the $50 range up to and over $80 (initially). What propelled the price further upward over the $100 price level? I suggest the following factors:

1) Momentum: The “May surprise” captured Wall Street’s attention. On Wall Street, momentum from big positive “surprises” can have a “carry through” impact based on momentum;

2) “Darling Stock”: Wall Street loves to be able to tout a “darling stock”… one with an easily “sold” story. It doesn’t really matter how misleading the presentation of the story might be… all that matters is that brokers/commentators can hint to investors: “the sky is the limit”!

a. Remember when AAPL was Wall Street’s “darling”?

i. Steve Jobs was a bloody genius — he could do no wrong![2]

ii. Countless “experts” suggested: “Everybody loves AAPL products. They will continue to dominate their markets.”

iii. Those same folks suggested: “the iPhone is matchless.”

iv. Many folks who appeared sane repeatedly said: “AAPL is headed to over $1,000/share!”

b. Don’t you agree that these are the types of things we are hearing now about TSLA?

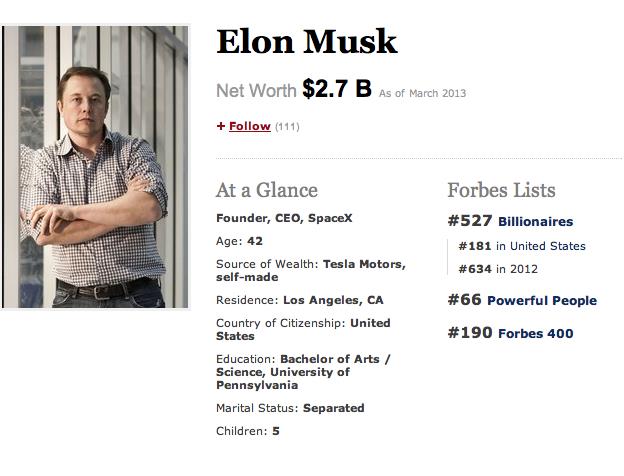

3) “Larger than life” founder: Apart from the uniqueness of his name, TSLA’s Elon Musk has a swagger and charisma that virtually commands attention. He made a fortune through his integral involvement in Zip2, PayPal, and SpaceX. For these reasons (and more) Musk has become a media darling, and practically anything he says (no matter how impractical) gets big play in the press.[3]

4) “Coalition of avid supporters”: talk about being in the “right place at the right time”! Musk has benefited from being in California (an avid conservation-loving government and populace; filled with Hollywood types who have cache and unlimited money, and who buy and talk up Musk’s cars) and ramping up production under a federal administration that loves to throw money at solar projects and electric cars! The devotion of various groups (conservationists, state politicians looking “for points”, federal agencies looking for “success stories”, Hollywood types who love “cache”, and the average person who is angry about high gas prices and US energy dependence[4]) often moves to extraordinary levels.

One simple illustration of almost all of the above can be found in this video of the TSLA “Model X Reveal”. Watch just a bit of the narrator’s introduction, then scroll forward to the “2:25 time mark”, when Governor Jerry Brown touts TSLA (“Governor Moonbeam”), then scroll forward to the “4:00 time mark”, when Musk is introduced as an inspirational leader who regularly touts bits of wisdom worthy of a future book titled “Quotes from Founder Musk”!! The entire video reflects a tone and magnitude similar to the most energetic examples of contemporary evangelical TV! Go to the following link… look for the column of available videos on the far right, and find the “Model X Reveal” icon link to access the video: http://www.teslamotors.com/gallery.

I have to give Mr. Musk his props. He has developed a compelling product. The usual knock on other electric cars can be summed up as: 1) not enough range; 2) not attractive; 3) no pickup. The official “specs” on TSLA vehicles seem to have addressed those complaints. You have already seen what the “Sportster” looks like. Here is a Model S (the car I would likely get if I could afford one):

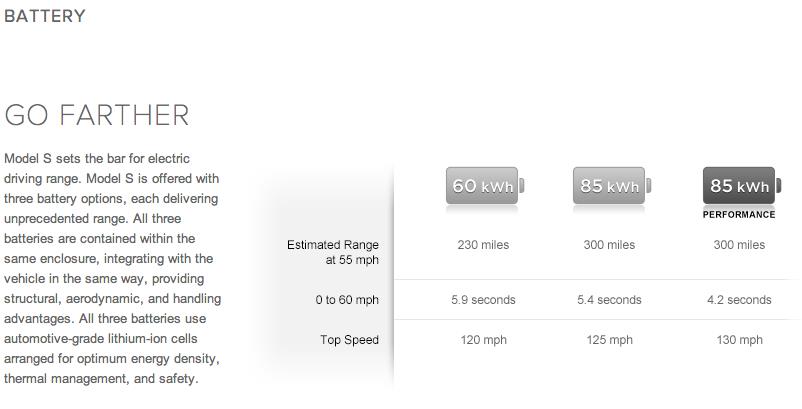

The “base price” is $62,400. (I couldn’t bring myself to write “only $62,400”.) With regard to the “range” of driving before a re-charge, TSLA appears to have addressed that concern by providing three different battery options – offering ranges between 230 and 300 miles, as well as “pickup” (time needed to move from a standing start to sixty mph – between 5.9 seconds to 4.2 seconds).

The “base price” is $62,400. (I couldn’t bring myself to write “only $62,400”.) With regard to the “range” of driving before a re-charge, TSLA appears to have addressed that concern by providing three different battery options – offering ranges between 230 and 300 miles, as well as “pickup” (time needed to move from a standing start to sixty mph – between 5.9 seconds to 4.2 seconds).

In addition, the manufacturing process is impressive. Here is a video of how a TSLA Model S car is produced: http://www.youtube.com/watch?v=8_lfxPI5ObM

One more subtle “testimony” of TSLA’s current standing “on top” of the electric car market can be found in a recent personal experience. On the front page of the Sunday “Auto Section” of the Chicago Tribune, I saw a photo of the new BMW electric sedan. The reviewer was all excited about getting his hands on a genuine BMW version of an electric car! Given BMW’s age-old reputation for top-notch quality, it was “certain” to rival, if not exceed, TSLA’s cars!! Unfortunately, as he moved through the details of the review, it became clear that he was disappointed in the BMW because it did not exceed TSLA! The reviewer hastened to add that there were enough positives in the BMW car to warrant consideration; but he would have to wait a bit for BMW to excel in the electric category and begin to exceed TSLA![5] Also adding significantly to the notoriety of TSLA is a recent Car & Driver review of the Model S – in which it said that the Model S might be the best car it has ever tested!

Now that I have disclosed a large number of positives regarding TSLA, let’s take a look at the stock price! As an ongoing company, would you rather own TSLA or AAPL? Let’s take a peek “under the hood” of each company from the point of view of an investor performing due diligence:

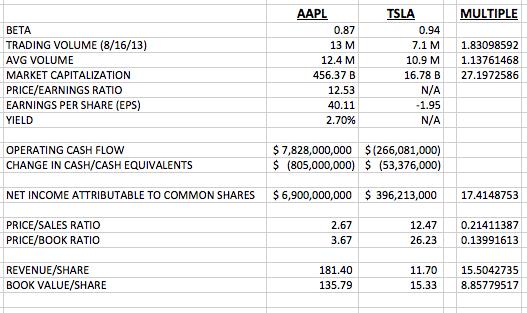

These figures come from YahooFinance.com. The one column that could be confusing for you would be the “MULTIPLE” column, which is a mathematical calculation provided to show a numerical comparison between AAPL and TSLA. For example, AAPL’s “average trading volume” is almost 1.14 times TSLA’s – which I find remarkable given the relative size of the two companies!! Do you see that AAPL’s market cap is over 27 times larger than that of TSLA?? The net income related to the common shares of AAPL is almost 17.5 times that of TSLA. These figures suggest to me what you and I already knew before we looked – namely, TSLA has become a truly super-hyped, widely touted, much discussed, and therefore highly traded security!!

On any valuation basis you prefer, AAPL is much, much “cheaper” than TSLA. There is no comparison. So a Ben Graham, Michael Price, or Warren Buffett disciple would not touch TSLA with a ten-foot pole.[6] In fact, I will be so bold as to suggest that TSLA has taken on the “cache” that AAPL had earlier in its history (before it became transformed from a growth stock to a shareholder-friendly “dividend” stock). Today, it is TSLA that is “being sold” to investors as a “sure thing”, “dynamic”, “the wave of the future”, and “the sky is the limit”. Investors/traders are making presumptions regarding future sales growth, production efficiencies, profit margin expansion, etc. that justify a stock price above current levels.

I confess that I do not know the future!! TSLA might actually become all that current commentators and enthusiasts suggest it will become.[7] It is possible! But tell that to all the poor folks who believed the “AAPL to $1,000/share” story last year and purchased AAPL at $700! It was heart breaking for them to watch it fall all the way below $400/share earlier this year!

As most of you know, TSLA did take another apparently giant step toward its future just this month. In another flashy new story, TSLA blew away Wall Street expectation by announcing Q2 revenue of $405 million and profits of $26 million! Very impressive!!

However, “looking under the hood”, here are some salient facts that are worth noting:

1) In June of 2009, TSLA received promises from the U.S. Department of Energy that it would receive $465 million in low-interest government loan funds!

2) In January of 2010, as it was developing the Model S vehicle, TSLA received said funds; [8]

3) The Panasonic lithium-ion batteries upon which every TSLA vehicle depends for power were developed as a result of millions of dollars of subsidy from the government of Japan;

4) TSLA was able to show a Q1 profit of $11 million only because it sold $68 million of its “zero-emission vehicle” (ZEV) credits[9] to less environmentally friendly car companies.

5) During Q2, TSLA sold another $51 million in ZEV credits – once again showing a profit only because of government tax breaks;

6) Consideration must also be given to the $7,500 federal tax break for each purchaser of an electric car – lowering the base price of a Model by 12%!!

I am in no way denying the worth or utility of state and federal tax breaks. I am, however, trying to bring “transparent light” upon the financial results (to date) of TSLA. I am confident that many, many staunch supporters of TSLA resent the government bailouts of GM and Chrysler, while largely turning a blind eye to the parallel government subsidies from which TSLA still benefits!

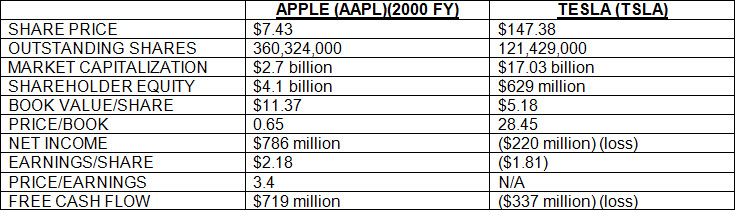

What might a critic of what I have written above say to me? One reasonable critique could be some variation of the following: “Look, Tom, what you have written is true (figures don’t lie). However, you have grossly misled your readers because TSLA is just ten years old, while APPL is a mature company. Of course there is no comparison between them. It would be more reasonable (and helpful) to compare TSLA with a ‘younger’ AAPL, long before the over-hyped cache started to be spun about AAPL being a ‘sure thing’, or a ‘mega stock’… or even ‘AAPL is forever’! Looking at a price chart, how about a comparison of today’s TSLA with the AAPL of the year 2000!?!”

OK, that is reasonable. And after all, I am here to serve our loyal readership! So here is a “look under the hood” that contrasts AAPL of yesterday (as it was in 2000) with the TSLA of today.[10]

Perhaps you find these figures interesting! Personally, I find them even more compelling than the earlier chart I provided you. The final “content” I provide for you appears after the “TAKEAWAY” and “DISCLOSURE” sections below – it is a box from Forbes highlighting Musk’s life and career.[11]

INVESTOR TAKEAWAY: It is not my intention to suggest that you would be foolish to purchase TSLA shares at this level. It is extremely hard for human beings to resist an exciting, compelling “story stock” run by a charismatic and successful leader. We also tend to be strongly influenced by news stories, media features, sales pitches from brokers and commentators, and what we hear from others “within our own circle”. I confess that I got “caught up” in the energy surrounding AAPL during 2012! I became such a “convert” that I was shocked by how far and how fast AAPL fell out of favor!

So the one and only point I am trying to suggest in the article above is this: If you buy TSLA at this level, please do so with your eyes “wide open”… harboring no illusions that any stock is a “sure thing”. You may (or may not) think that the folks running GM, Ford, and Chrysler are “challenged” in one or more ways. Those companies have certainly had a checkered past with regard to technological and sales success. However, it might be the case that, in our free market global economy, one or more of the “major” auto manufacturers[12] will finally “perfect” the electric car concept and develop an e-car that provides strong competition to TSLA. Such a product, combined with the existing (and expansive) sales and marketing infrastructure of such “mainline” auto makers – could quite easily diminish the magnitude of future growth that so many have been projecting for TSLA.

DISCLOSURE: The author does not currently own TSLA. However, around the $100 level, he did own options on that stock in months past. He also does not (currently) own AAPL, GM, F, or any other carmaker. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

Hyundai, etc.

Submitted by Thomas Petty MBA CFP

[1] After declining a bit following April, AAPL moved steadily higher during 2012, until it peaked at just over $700/share in September!

[2] How many corporate CEO’s have a major movie made about them? That is evidence enough of Steve Jobs’ legendary status, “cache”, and selling power. Hollywood presents to you – Steve Jobs (well, OK, it presents Ashton Kutcher portraying

Jobs!)

[3] Witness the attention given to his “hyperloop”!

[4] Not to mention that the “average Tom, Dick, or Harry” loves a “star” like Musk, as well!

[5] http://www.chicagotribune.com/classified/automotive/sns-rt-cbre96s190r00-jpg-20130729,0,2817955.photo

[6] Not even a 20-foot pole!

[7] As the old expression goes, TSLA might become “all that, and a bag of chips!”

[8] Much to TSLA’s credit, earlier this year it paid those loans off (in full) nine years prior to the final due date!!

[9] Related to a California auto emissions mandate.

[10] Figures are prior to TSLA Q2 results. Figures compiled by Ross Givens of Blue Tick Research.

[11] http://www.forbes.com/profile/elon-musk/

[12] Including, of course, BMW, Subaru, Audi, Toyota, Honda, Hyundai, etc.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Stock Market Frenzy: Here's Why This Warren Buffett Quote Is More Important Than Ever

Stock Market Frenzy: Here's Why This Warren Buffett Quote Is More Important Than Ever