Those accustomed to reading these articles are well aware of my consistent warning regarding the importance of Risk Management. I suspect that, within a classroom setting, we would all agree that we must each be alert at all times to trades that bear the potential of losing more money than we want to lose on any one trade.

However, when the markets are open, it often feels as though some stocks have a power similar to that of the “Sirens” of Greek mythology (Parthenope, Ligea, and Leucosia)[1] to lure us into a trade despite our better judgment or any warnings that Market Tamer coaches or analysts may have offered in the past. The “allure” of these stocks (and the hype they so often receive within the press) feels just too compelling and we succumb.[2]

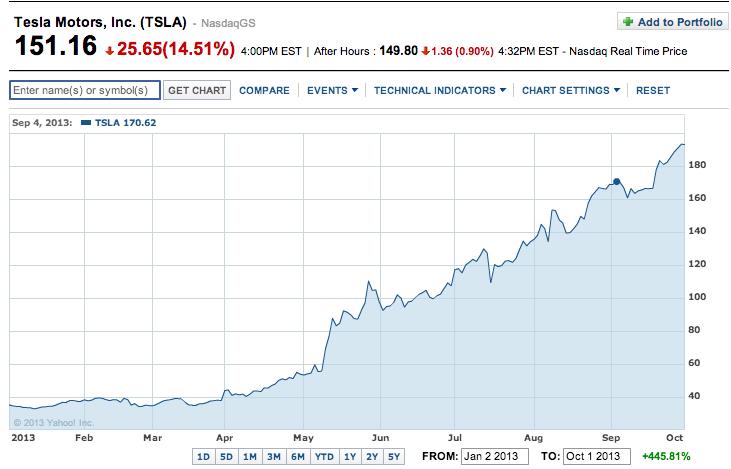

Such a stock is the now internationally well-known electric carmaker, Tesla (TSLA). The chart of TSLA (below) through October 1st (when it reached its closing high of $193/share) should provide you with a powerful demonstration of its irresistible allure:

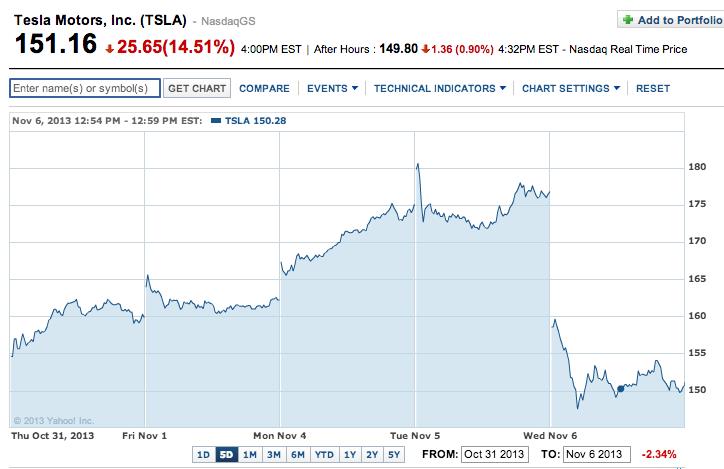

As we now know (it is Wednesday, November 6th as I compose this, the morning after TSLA reported its earnings)) “straight up” is not the only direction in which TSLA can move.

As we now know (it is Wednesday, November 6th as I compose this, the morning after TSLA reported its earnings)) “straight up” is not the only direction in which TSLA can move.

Before we move on to Wednesday’s action, let’s review what took place on Monday (11/4) – because it might provide us some background on the “pre-earnings” dynamics of which we need to be aware.

Not surprisingly, TSLA has been one of the most talked about (and hotly debated) stocks since the beginning of the year. The chart has been extraordinary and is sufficient explanation, in and of itself, for the high level of attention lavished on this company. Countless numbers of investment experts and analysts have been quite vociferous in their (seemingly) undying support for the stock[3], while another group of experts/analysts look at the chart and immediately pronounce (some unequivocally) that TSLA is a “bubble ripe for bursting”. During the month of October, the best one could say for TSLA’s price performance is that “it got tired” – falling about 17%! In fact, ValueWalk’s Michelle Jones offered a fascinating data point about October’s loss. TSLA lost more in market cap during October ($4.1 billion) than the level at which TSLA’s entire market cap was valued on December 31, 2012!!

However, TSLA obviously picked up some steam at the beginning of November, during the lead-in to its November 5th (after market close) earnings report. On Monday, November 4th, TSLA had an incredible day – up 8% on trading volume that was 22% higher than normal! What drove the price action? At least three things: 1) because October performance had been so poor, some were emboldened to think TSLA had found some support and was a solid play to move higher; 2) as often happens with high profile stocks, some influential financial folks began a “whispering” campaign that suggested the possibility of TSLA’s earnings report being much better than expected;[4] and 3) per usual, as the stock moved higher, others “jumped on board”.

However, TSLA obviously picked up some steam at the beginning of November, during the lead-in to its November 5th (after market close) earnings report. On Monday, November 4th, TSLA had an incredible day – up 8% on trading volume that was 22% higher than normal! What drove the price action? At least three things: 1) because October performance had been so poor, some were emboldened to think TSLA had found some support and was a solid play to move higher; 2) as often happens with high profile stocks, some influential financial folks began a “whispering” campaign that suggested the possibility of TSLA’s earnings report being much better than expected;[4] and 3) per usual, as the stock moved higher, others “jumped on board”.

The action was hot and heavy, but (as we know now) it was also treacherously dangerous. If one was composing a book on trading, the November 4-6th price action in TSLA might serve as a worthy “case study” of the dangers inherent in trading on “whispers”! [5] Between Friday, Nov. 1st and Wednesday, Nov 6th, TSLA moved from a high of $180.68 to a low of $146.35… down 19%!

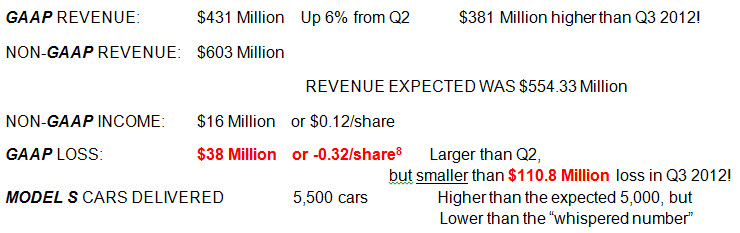

Need I tell you that the actual numbers came in less than the “whisper” numbers?[6] Here is a very brief summary [Note: keep in mind that various news stories on this earnings report offer slightly different figures due to rounding and/or the difference between GAAP[7] numbers and non-GAAP numbers. So focus on magnitude, not precise numbers.]:

To this point, Ben Kallo of R.W. Baird commented: “There are some high whisper numbers out there. Some people on the Street are saying as high as 7,000 cars this quarter.”

CEO Elon Musk reported that there are 19,000 Model S cars on the road, and of the cars delivered in Q3, some 1,000 of them went to Europe! Musk and the TSLA CFO also delivered on expectations of a higher Gross Margin metric – moving it from 14% in Q2 to 21% in Q3. This improvement resulted from an improved supply chain and some significant improvements in manufacturing efficiency!

To the concern expressed by many regarding why more cars are not being sold, Musk reiterated what he said in August: “We have a production constraint, not a demand constraint.” The primary production constraint (by far) is battery cell production (essential for an electric car). It was also announced that TSLA’s first orders for the Model S from China were received during Q3![8]

The bottom line is that TSLA’s numbers could not “beat” the unrealistic “whisper” numbers – but the report held much about which to be positive (at least if you did not own the shares after 4:00 PM EDT on November 5th, that is!). TSLA (as it has been) continues to be what I call a “Rorschach” stock – what is “seen” is as much the result of one’s own preconceptions, experiences, hopes, fears as it is based on any objective reality!

Representing those who still firmly “believe” in TSLA is Cole Wilcox of Longboard Asset Management (Phoenix): “The Street systematically underestimates the demand for the vehicle and the viral nature of sales.”[9]

If you are intrigued by TSLA, or stocks like it, there are safer ways to benefit from any price appreciation it experiences during the months or years ahead! I confess that I have owned options on TSLA in the past. However, I would not have felt comfortable trying to position myself in TSLA on or before November 5th – knowing that the likelihood of wild gyrations to follow were quite high! The stock is (I confess) too volatile for me.

So let’s take a look at First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN). TSLA has been its fifth largest stock holding (6.65% weight at beginning of November)… a very significant fact because there are not many funds that have as high a percentage of assets invested in TSLA! What did QCLN do as TSLA sank 17% in October? Well, it actually rose by 1.7%!! Pretty cool, eh?

As a “bonus” for any of you who are huge fans of Elon Musk, QCLN also owns a significant amount of SolarCity (SCTY) – another Musk-related company! It is QCLN’s sixth largest holding![10]

Finally, since we always try to maximize your options[11], an alternative to QCLN is MarketVectors Global Alternative Energy ETF (GEX). Until October “happened”, the largest holding in GEX was TSLA. However, after October’s $4.1 billion market cap drop, TSLA fell to the third largest holding within GEX. During October, GEX did not climb as much as QCLN, but it did end the month in positive territory – up 0.15%! Therefore, GEX is a viable alternative for you if you can’t resist the “siren song” of a TSLA!

Here is a price chart for QCLN and GEX YTD (Jan 1, 2013 through November 6, 2013):

INVESTOR TAKEAWAY: As we suggest regularly, Risk Management is a crucial discipline within trading and investing. Being realistic, there will (inevitably) be occasions when we are drawn toward trading stocks that we know may be more volatile than our “normal” risk tolerance would allow. There is no shame in that – it merely demonstrates your humanity.[12]

That being said, I do strongly suggest you consider lower risk ways of benefitting from the performance of volatile stocks. Various option strategies can offer some intriguing alternatives, as can the sale of covered calls (although I remind you that a covered call would have been of little help on November 6th). An additional alternative, as I suggest above, is trading an ETF that holds a significant stake in the stock that you find irresistible! Based on the performance of QCLN and GEX during 2013, especially the “risk management” they provided during TSLA’s October debacle, this is a strategy that might well prove beneficial for you! Please keep it in mind.

DISCLOSURE: The author has owned TSLA options in the past, but holds none currently. Nothing in this article is intended to be a recommendation to buy or sell anything. It is offered for educational purposes only. Please consult your financial advisor before buying or selling anything.

Overnight action on TSLA between Nov. 5th and Nov. 6th.

Submitted by Thomas Petty MBA CFP

[1] See either http://en.wikipedia.org/wiki/Siren (where the Sirens’ names are Peisinoe, Aglaope, and Thelxiepeia) or http://www.greekmythology.com/Myths/Creatures/Sirens/sirens.html

[2] Even the Greek hero, Odysseus, was so irresistibly drawn to the Sirens that he was spared only by being very tightly bound by ropes to his mast!

[3] There is no doubt that founder and CEO, Elon Musk, has delivered a visually appealing, technologically sparkling, electric car at a price that, although high, is not outrageous. And he has done that while Detroit is still seemingly flailing at the same task.

[4] “Whisper Numbers” have become a Wall Street institution. There are even (at least) two websites dedicated to them: http://www.whispernumber.com/; http://www.earningswhispers.com/. See also: http://en.wikipedia.org/wiki/Whisper_number

[5] Those who are familiar with Evanescence or George Michael have known the power and danger of whispers for quite some time! From “Whisper” – “Fallen angels at my feet; Whispered voices at my ear; Death before my eyes; Lying next to me I fear.” And from “Careless Whispers”: “Time can never mend… The careless whispers of a good friend; To the heart and mind… Ignorance is kind; There's no comfort in the truth…Pain is all you'll find.”

[6] Friends, try to contain your shock, please!

[7] GAAP: Generally Accepted Accounting Principles

[8] That is a big deal. If/when TSLA becomes a “car of choice” among the wealthy in China, demand will move even higher.

[9] Fascinating use of the term “viral”, don’t you think?

[10] Is QCLN a rogue “Elon Musk” ETF??

[11] Pun intended

[12] If a mythological hero like Odysseus is nearly helpless in the face of such irresistible temptation, what hope do we have?

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Retiring at 60? 3 Pitfalls to Be Mindful Of.

Retiring at 60? 3 Pitfalls to Be Mindful Of.