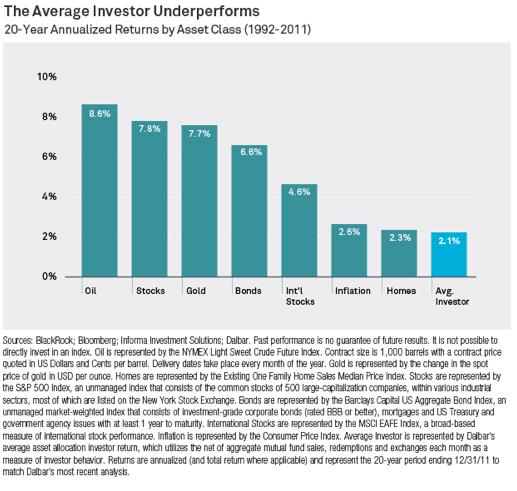

After writing a piece on investor fear and market volatility, I ran across the most interesting chart provided through Dalbar and Blackrock – a chart showing “average investment returns” over the past twenty year period (ended 12/31/2011). Why did I find this so fascinating? It’s simple – looking at that 20-year period made trading look so easy!!

Some of you are asking: “Are you crazy?! Investing is ‘E A S Y??’ No way! Not based on my portfolio return!”

That’s so puzzling! Just look at these average returns from that long period of time:

1) Stocks: returned an average of 7.8%;

2) Bonds: returned an average of 6.6%;

3) For those with a global outlook, international stocks returned 4.6%;

4) And for those who ensured they were “well-balanced”… dabbling into oil (8.6% return) or gold (7.7%) proved to be “accretive”[1] to portfolio returns!!

5) It is true that homes only appreciated by 2.3% (surprises you, doesn’t it!). However, that really isn’t a part of one’s true investment portfolio.

So based upon the above, all we would have needed to do is stick with some variation on an asset allocation plan such as the following (the average annual portfolio return calculation I provide for you is extremely crude):

TRADITIONAL BALANCED PORTFOLIO (60% US Stocks/40% bonds): 7.32%

MORE BROADLY DIVERSIFIED PORTFOLIO

(40% US Stocks; 15% Int’l Stocks; 7.5% Gold; 7.5% Oil; 30% Bonds): 7.0125%

MORE AGGRESSIVE PORTFOLIO

(45% US Stocks; 10% Int’l Stocks; 15% Gold; 15% Oil; 15% Bonds): 7.405%

Wouldn’t you agree that investing during this period appears to have been as easy as “shooting fish in a barrel”? After all, inflation averaged just 2.6% per year, so any of these asset allocation choices would have outperformed inflation by at least 4.5%! What could be easier?!

I’ll bet you’d like to see that cool chart I referred to at the beginning! Here it is:

What’s that you say? Ahhh, I see. You want to know what the data point at the far right side of the graph represents – the one colored “aqua”.

What’s that you say? Ahhh, I see. You want to know what the data point at the far right side of the graph represents – the one colored “aqua”.

Well, quite frankly, I was hoping you wouldn’t notice! That 2.1% data bar represents the average annual return of the “average investor” during that 20-year period. But don’t worry! That statistic doesn’t apply to us!!

Why do I say that? Well, we’ve just seen that all we needed to do during those 20 years was stick to a basic, balanced, asset allocation – and our return was guaranteed to exceed inflation! In fact, the only way our portfolio could end up with a cumulative investment return that was less than inflation would be if our investment decisions had been so irregular and inconsistent that we resembled a “nervous Nellie”. We must have “zigged” when the market “zagged” or turned “left” when the market turned “right”.

This is the precise point at which the most recent article that I posted in this space becomes extremely relevant – the one within which I reviewed three major studies of investor sentiment. Based upon those studies, it is clear that fear can be an overwhelming force in the average investor.

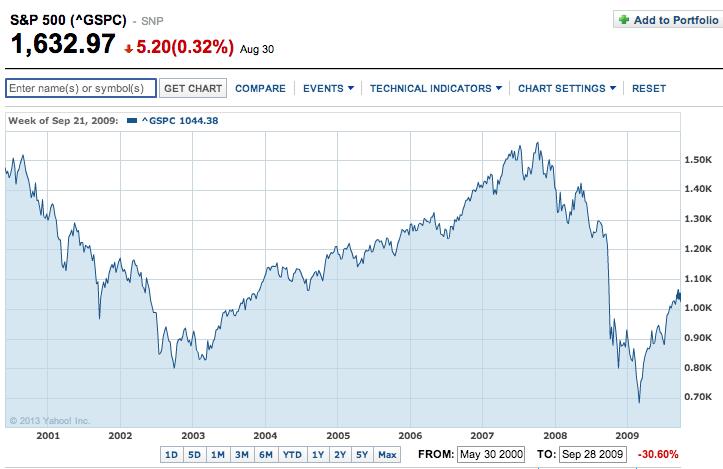

It is worthwhile asking if such investor fear is “reality-based”? That is a complex question.[2] On the one hand, here is the chart that has inspired a majority of the fear that haunts the average investor:

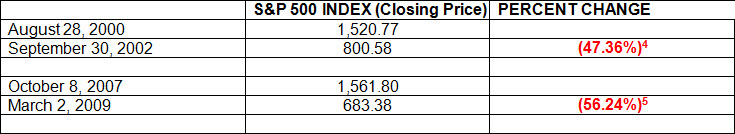

The chart above covers the period between May 2000 and September 2009 – encompassing two major “crashes”[3]. And here is the key data from those two bouts with volatility:

I’ll bet you remember how you felt as the market kept pushing further and further downward in 2002 and 2009! None of us works hard and saves conscientiously – only to watch precious gains turn into losses! The graph and table above… combined with events such as the “Flash Crash” and the recent “Flash Freeze” … are powerful illustrations of why the average investor has grown so fearful of volatility and loss. In fact, as the Nationwide Financial survey established (see earlier article), investors fear the stock market more than either dying or losing their job, and they fear another financial crisis more than almost anything else!

Imagine being gripped by that level of anxiety about stocks and a financial crisis. Then imagine looking at a relatively non-descript price chart, such as this one:

“Fear” can make any given investor, within certain contexts, assume that the next market move will look like this:

Such circumstances could include any one or more of the “headlines” with which we have become all too familiar: Sequester, Fiscal Cliff, Debt Limit Debate, Fed Taper, City Bankruptcy, etc.

Such circumstances could include any one or more of the “headlines” with which we have become all too familiar: Sequester, Fiscal Cliff, Debt Limit Debate, Fed Taper, City Bankruptcy, etc.

It is this type of fear that lures us (or pushes us) into less than fruitful investment decisions. I could overwhelm you with data that demonstrates investor “flight to safety” (aka “flight from stocks”), but that would be counter-productive. Instead, let me lift up just one statistic that I ran across this past week:

Since 2000, investors have thrown $980 billion into bond funds and pulled $388 billion out of stocks.

That is just one symptom of a generalized aversion to equities that has kept such a large percentage of retirement plan investors over allocated to bonds, target date funds, and money market accounts – especially since the depths of the market in 2008-09. That is how/why so many “average” investors are said to have “missed out” on U.S. stocks’ steady move upward since the market’s nadir in early 2009!

In light of the above, it is not all that surprising that so many “average” investors underperform “the market” over time. When fear drives behavior, investors can become satisfied with almost any return that is not a loss.

So our challenge is to help investors develop a disciplined approach that reduces the ill effects of fear. Here is where I insert the “on the other hand answer” to the question: “is investor fear ‘reality-based’?”

Study after study after study has established that a reasoned, established, consistently applied investment approach will (over time) outperform the “average investor”. Sample workable strategies include:

1) Buy a stock when its 50-day moving average crosses above its 200-day moving average;[4]

2) Buy or sell a stock or ETF whenever the respective “trigger level” is hit within a Market Tamer “Algo Pick”;

3) Buy the SPY ETF whenever the MMTI is bullish;

4) Buy a stock or ETF when the price has moved over the 5 and 20-day EMA’s and the RSI and Stochastics are signaling bullish conditions.

None of these strategies are complicated. None of them are beyond the ability of the “average” investor to carry to fruition. And in the unlikely event that you are unwilling to exert even that much effort, another strategy that can “outperform” over the long-term[5] is choosing a reasonable, well-diversified asset allocation plan, such as one of those I highlighted at the beginning of this article.

Any of the above is far, far superior to any of these common traps into which investors fall:

1) “Market-timing”: if veteran Wall Street pros can’t get “market timing” right, the “little guy” has virtually no chance at all;

2) “Performance-chasing”: placing your money in those funds that have most recently “led the pack” is a perilous venture – sometimes you’ll do well and at other times you’ll “strike-out”[6];

3) Commission-based advisor: your optimum performance is not enhanced by investing your assets through an advisor who is strictly commission-based and has “carte blanche” regarding how to invest your assets.[7]

INVESTOR TAKEAWAY: Investing is one of the areas of life that is most characterized by dichotomy. As I have described in some detail above, the dichotomy of investing is that it can be (sometimes simultaneously) extremely simple or exceptionally challenging. As long as you can maintain investment discipline and then trust that discipline through the (sometimes) emotionally wrenching ups and downs of the daily news[8], you will outperform that “average investor”. In fact, you will also outperform inflation, and over shorter periods of time, you will (hopefully) outperform several other assets classes, as well!

The bottom line on this matter is that no one else can “make this happen” for you! It is true that someone else can provide you with a trading strategy or discipline, but there is only one person who can ensure that you trust that discipline and hang in there through “thick and thin”. That person is you!

Disclosure: Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

Submitted by Thomas Petty MBA CFP

[1] That term has been a more recent addition to the lexicon of investment professionals. I’ve been listening to them rationalize poor performance or exult about great performance for decades. Twenty years ago, the phrase “improved performance” was sufficient. However, that got too boring, so they went to “additive” to performance. Now of course, it is “accretive to performance”.

[2] I am cursed with a propensity to invariably see multiple sides of almost any issue.

[3] The “Dot.com” bubble and the “Mortgage Crisis” meltdown.

[4] And the corollary – sell when the stock’s 50-day moving average crosses below the 200-day moving average.

[5] As long as the investor does not deviate from the plan, that is!

[6] Why is this? Simply because the standard warning is absolutely true: “Past Performance is No Guarantee of Future Results!”

[7] If you must hire someone else to manage assets, have their compensation be based on your investment return (success), not commissions! Then your interest and the interest of your advisor become identical!

[8] Investment discipline can be particularly tested by the bravado, hyperbole, and misinformation that seems to be a daily staple on the business channels (CNBC, Fox Business, Bloomberg News, etc.).

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Is IonQ Stock a Buy?

Is IonQ Stock a Buy?