Are you an admirer of Warren Buffett? Would you like to own a portfolio of “Buffettesque” stocks that is reviewed weekly – with well-informed portfolio adjustments quarterly? However:

In the financial world, many leaders are respected, but not beloved. Warren Buffett is both. A large part of that warmth toward Buffett comes from his genuineness and humility.

1) Buffett’s prime shares [Berkshire Hathaway Class A—BRK.A $ 209,782/sh] are priced too high for you;

2) Even with the availability of B shares [Berkshire Hathaway Class B—BRK.B $139.83] you feel Mr. Buffett’s empire and stock is a bit too unfocused for your tastes;

3) You don’t have the time or resources to regularly research, analyze, and manage a portfolio of stocks that reflect the “Buffett Way” – which entails finding quality companies that have a discernible competitive advantage, are well-managed through the efficient use of company financial resources, and consequently generate sustainable profits that amply exceed the company’s cost of capital.

Well then, I have great news for you! You can secure a portfolio of twenty-one such companies that includes all of the following:

1) Excellent market analysis – carried out by a team of professional analysts at least twice each week;

2) A finely tuned re-balancing of your portfolio each quarter… selling those stocks whose competitive advantage or capital efficiency has diminished or whose price has increased enough to decrease its appeal on a relative valuation basis…and replacing those sold stocks with other exceptional corporate competitors that manage capital well, generate impressive, sustainable profits, and are attractively priced;

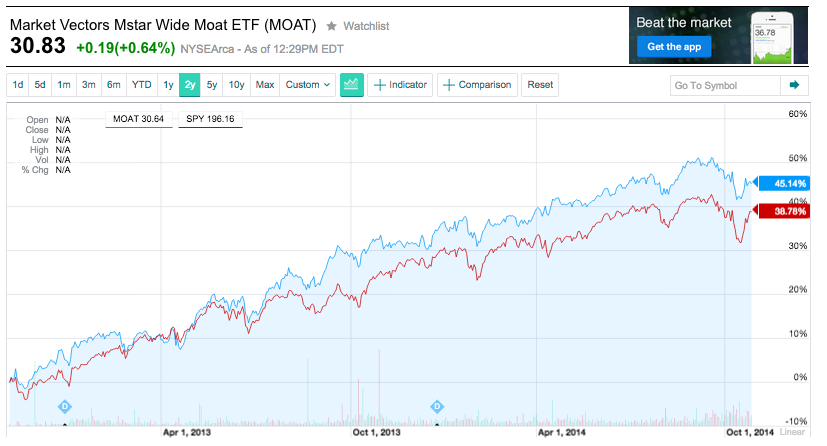

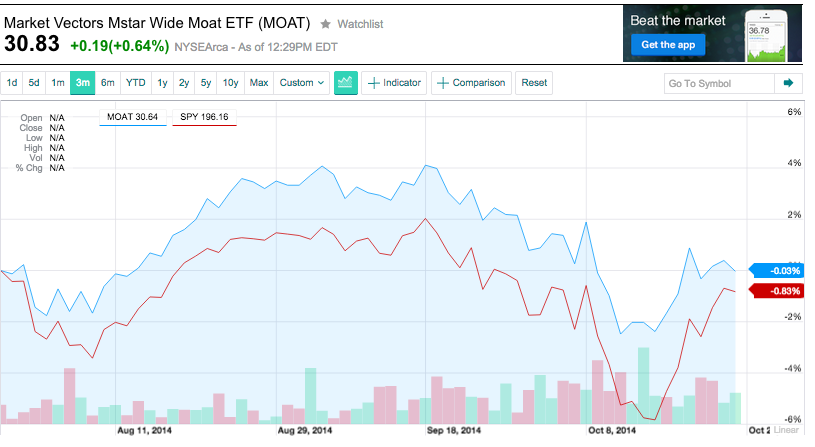

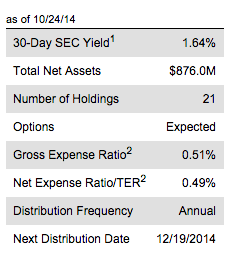

3) Plus you get a current SEC Yield of 1.64% and performance that has been both steady and impressive:

a) It has outperformed the SPDR S&P 500 Index ETF (SPY) by 6.5% over the past two years;

b) Outperformed SPY by 80 basis points during the previous three months:

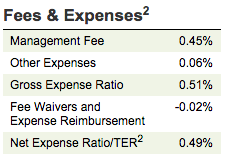

What’s more, you don’t need to pay “Hedge Fund” fees for all of this expert investment management expertise!! In fact, compared with other funds managed this actively, you would pay (on a net basis) a relative pittance – 49 basis points.

Doesn’t that sound like a pretty compelling deal? What amazes me is that this opportunity has not been swooped up by a whole lot more investors! The Assets Under Management (AuM) for this fund total under $900 million – a relatively small amount when compared to many larger portfolios that have not performed nearly as well!

As you’ve already figured out, this fund is an ETF managed in accordance with an Index created and managed by the well-known and esteemed investment team of Morningstar[1]. The ETF’s name is the Market Vectors Wide Moat ETF (MOAT); and its quarterly schedule for rebalancing the portfolio[2] is the middle of March, June, September, and December. [You can find past articles about MOAT at https://www.markettamer.com/blog/moat-is-part-of-the-new-wave-of-indexing, https://www.markettamer.com/blog/how-to-invest-like-buffett-without-doing-the-hard-work.]

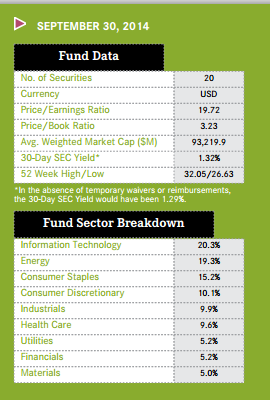

Let’s briefly highlight the criteria used in building the MOAT portfolio:

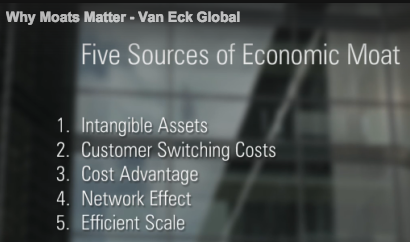

1) Morningstar’s proprietary methodology identifies companies that demonstrate long-term competitive advantages (a “moat”) that allow the company to earn sustainable excess economic profits[3] as measured by its return on invested capital relative to the company’s cost of capital;

2) Morningstar applies a few other fundamental measures of “quality” to ensure portfolio candidates are strong across the board;

3) During their twice-weekly analyst meetings, they dissect corporate economic moats to discern the strength of its moat and the sustainability of such a moat. Here are a few sources of corporate moats.

4) By the time of each quarterly rebalancing date, Morningstar has ranked all the companies within their screened list of strong, sustainable moats, and prioritized those “moats” relative to their current “fair value”.[4]

a) What their methodology is intended to identify is the strongest 21 “moat” companies that are currently moat favorably priced relative to their intrinsic value.

When I first discovered MOAT, I found Morningstar’s videos explaining the concept of “Moat” to be very helpful! Here are two of them (a bit dated, but very helpful):

http://www.vaneck.com/Library/viewpoint-videos/?video=635436973828932957

http://www.vaneck.com/Library/viewpoint-videos/?video=635162322581302950

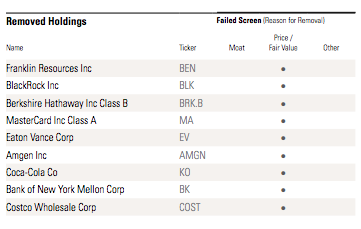

The most recent rebalancing took place on September 17th. Nine stocks were removed from the portfolio, including four that are holdings within Buffett’s Berkshire portfolio … as well as (interestingly) the “mother ship” itself:

Berkshire Hathaway (BRK.B)

Bank of New York (BK)

Costco (COST)

MasterCard (MA)

Coca-Cola (KO)

It is fairly obvious why BK and COST were removed. They were great performers during the quarter – moving up 13.06% and 9.15% respectively. Meanwhile, MA and KO appreciated by a bit under 1.7%.

The other stocks that were removed are: Amgen (AMGN), BlackRock (BLK), Eaton Vance (EV), and Franklin Resources (BEN).

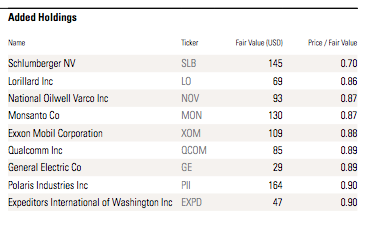

Replacing those nine securities in the portfolio are three that are held by Buffett, including:

National Oilwell Varco Inc. (NOV)

Exxon Mobil Corporation (XOM)

General Electric (GE)

The price of XOM fell 5.21% between 6/17 and 9/16 and GE dropped by 2.23% … so they obviously became a better “value”.

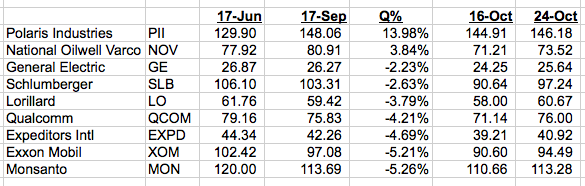

The other six stocks added to MOAT are Schlumberger NV (SLB), Lorillard Inc. (LO), Monsanto (MON), Qualcomm Inc. (QCOM), Polaris Industries (PII), and Expeditors International of Washington Inc. (EXPD). One of the really informative “value adds” of the MOAT database is that (as seen in the chart below) Morningstar reports the calculated “Fair Value” for each stock as well as the percentage of discount to fair value at the time of its addition to MOAT:

Below is a look at the current MOAT portfolio as of the 9/17 rebalancing:

Once again, you can see the calculated fair value for each stock and the percentage of that fair value as of the rebalance date.

I decided I would calculate on my own what the market price of these 18 stocks was on the dates shown within the worksheet below:

REMOVED:

Note the top performers through the past quarter (above). And notice that AMGN and COST have maintained their outperformance since then!

ADDED:

While I do not have even nearly all the data used by Morningstar, I was struck by the “addition” of PII and NOV. Notice that PII had a great quarter (almost 14% higher), so the addition (one presumes) is because of a perceived increase in the value and sustainability of its moat. Obviously, the total “relative value” of NOV improved more than many other potential portfolio stocks during the quarter—despite moving higher by almost 4%.

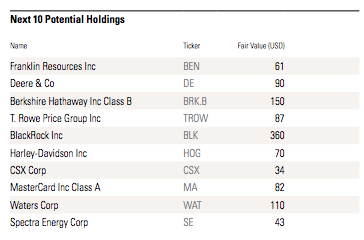

Thus far, you've seen the names (and some metrics) of the stocks added and removed from the MOAT portfolio. Below is what I consider the pièce de résistance of the MOAT website. It is a list of the next 10 most highly rated potential candidates for the MOAT portfolio – including the calculated “Fair Value” of each company.

Imagine the value to the average investor of all of this professionally researched stock data. With this treasure trove of information, one could:

1) Create a “Watch List” of “Moat” stocks;

2) Create a “Watch List” of stocks on the verge of inclusion in MOAT… complete with a “FV” for each stock;

3) Check for available options on these stocks and discern if a put credit spread might offer good expectancy… with a short strike being placed at or below the “FV” for that stock.

4) Or (the simplest use) just buy shares of MOAT outright (it does not yet offer options).

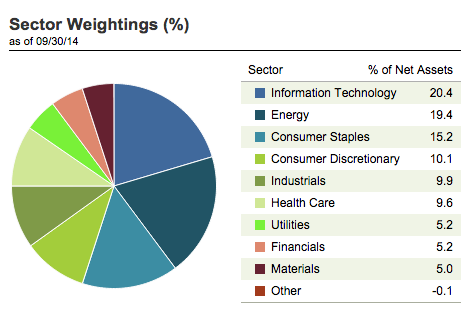

If option 4) appeals to you, here is some more information about MOAT:

Before we wrap up, here is information about two MOAT stocks that you’ll possibly find of special note and interest. It is also a reminder that the MOAT strategy and research methodology is one that has a long-term perspective – without any guarantee of out performance over any shorter-term time span.

Before we wrap up, here is information about two MOAT stocks that you’ll possibly find of special note and interest. It is also a reminder that the MOAT strategy and research methodology is one that has a long-term perspective – without any guarantee of out performance over any shorter-term time span.

As we know, two particular widely traded (and even more widely known) stocks have had a challenging couple of weeks:

Amazon (AMZN)

Here is AMZN CEO, Jeff Bezos with his company's smartphone. It has not being setting the market on "Fire".

IBM (IBM)

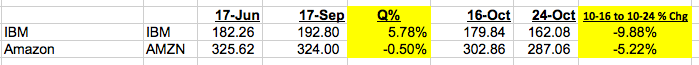

Here is the price performance for those two stocks during the same time periods as reported above:

Here is the price performance for those two stocks during the same time periods as reported above:

The % figure in the far right column is the price change between Oct. 16 (a swing low in the S&P) and Oct 2 4, after earnings were reported.

I imagine there was some “gnashing of teeth” at the Chicago Morningstar headquarters in the hours that followed the most recent earnings reports for AMZN and IBM … but to that I reply: “Welcome folks to the real world in investing! That’s why we stay diversified!!”

INVESTOR TAKEAWAY:

Let me drawn your attention to the detailed article I have written about IBM, an article that will be published very shortly (if it is not already posted … depending upon when you read this).

If you value exceptional company research and analysis, you prefer to not “over pay” for company stock, and you absolutely love “free”, you would do well to bookmark the webpage for MOAT: http://www.vaneck.com/moat/. It will always be there waiting for you to view it (and benefit from it).

In addition, if you find value in the time-tested investment principles of Warren Buffett, but are concerned that BRK.B is a bit too big and its portfolio a bit too sprawling for you, you might find (after your own due diligence) that MOAT is an attractive, smaller, more nimble alternative to BRK.B.

Finally, as you know, I’ve already listed some ways you could make use of the stock specific research, analysis, and metrics available (free) through the MOAT website!

DISCLOSURE:

The author does not currently own stock or options related to MOAT or any of the stocks that were removed from or added to MOAT in September. In addition, he does not

More and more investors are looking at the MOAT ETF.. in part because it is a reflection of how Warren Buffett likes to invest.

own either IBM or AMZN!

FOOTNOTES:

[1] Based, as many of the greatest financial resources are, in the Chicago, Illinois area!

[2] After rebalancing, the portfolio is referred to as “reconstituted”.

[3] I saw your eyebrow arch up and heard you think: “Huh?” “Excess economic profit” is simply a measure of a company’s “return on invested capital” compared with its “cost of capital”. An absurdly simple example would be the aggregate return Apple (AAPL) receives on its iPhones vis-à-vis AAPL’s blended cost of capital – which is extraordinarily low due to its massive cash horde, its cash flow, and its low cost of debt.

[4] This “fair value” is determined through financial analysis and calculations, not by the market.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

3 No-Brainer EV Stocks to Buy With $100 Right Now

3 No-Brainer EV Stocks to Buy With $100 Right Now