The size of student loan debt has become a great burden for millions of graduates. Financial innovators have developed creative ways to help ease that burden.

Since the heydays of “leverage” in the 2004-2008, United States residents have significantly lightened up on debt within their balance sheet – with one glaring exception. During the past two-three years, an increasing number of socio-economists have expressed sentiment ranging between concern and alarm regarding the continuing growth in “Student Debt” and the challenge that debt places on those who must repay it.

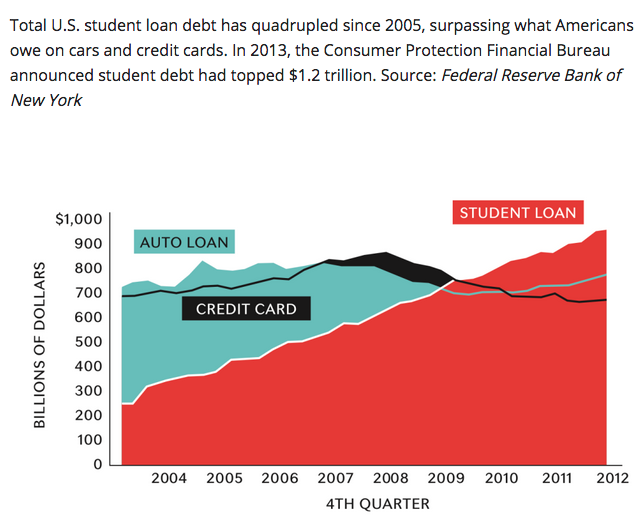

Consider the following charts, which dramatically demonstrate the breadth and depth of this problem[1]. There are many ways to illustrate how Student Debt has been growing disproportionately within the U.S., but this chart (from NEATODAY) does as good a job as any:

At the current level of aggregate Student Debt reported by the N.Y. Federal Reserve Bank — $1.3 Trillion – loan debt has far surpassed both auto loan and credit card debt within the average U.S. resident’s balance sheet.

At the current level of aggregate Student Debt reported by the N.Y. Federal Reserve Bank — $1.3 Trillion – loan debt has far surpassed both auto loan and credit card debt within the average U.S. resident’s balance sheet.

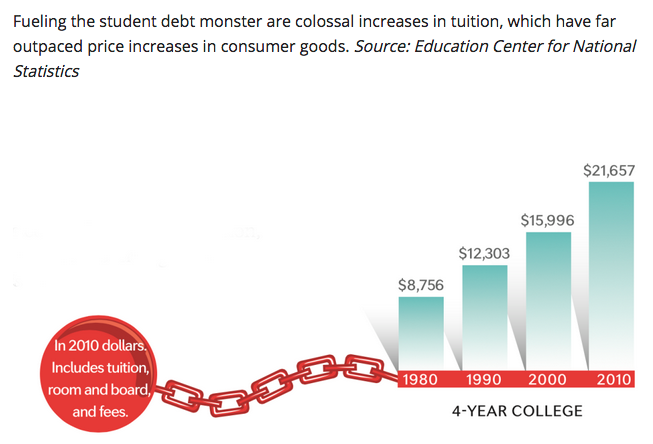

A core contributor to the growth of this debt has been the disproportionate escalation within the cost of higher education. Here is another elemental chart from NEATODAY:[2]

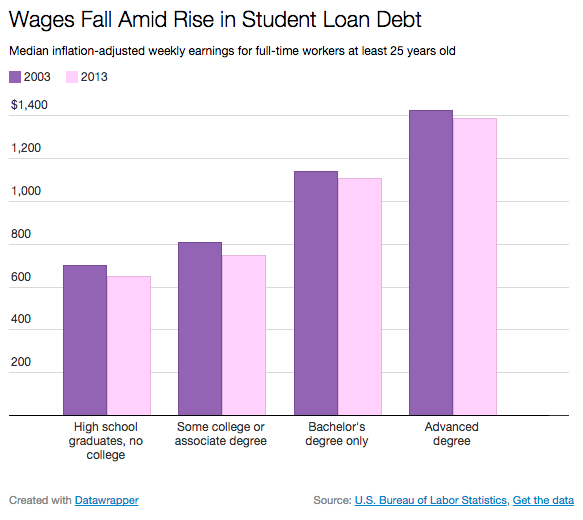

Once today’s average higher education student graduates, she/he faces the challenging task of repaying the total student debt accumulated. That task is seriously complicated by the fact that, on an inflation-adjusted basis, graduates are making less income than grads did years ago (this graph from 2014 as published in Huffington Post[3]):

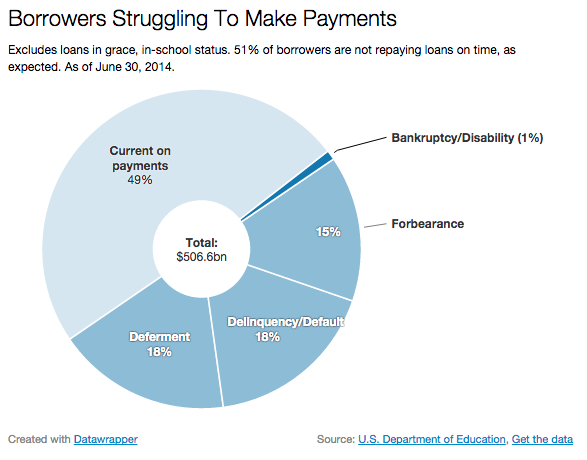

A fifth grader could quickly deduct what the inevitable result of these trends has been:

A fifth grader could quickly deduct what the inevitable result of these trends has been:

1) More difficulty keeping current on loan payments;

2) More folks suffering financial hardship from loans;

3) More delinquencies and defaults.

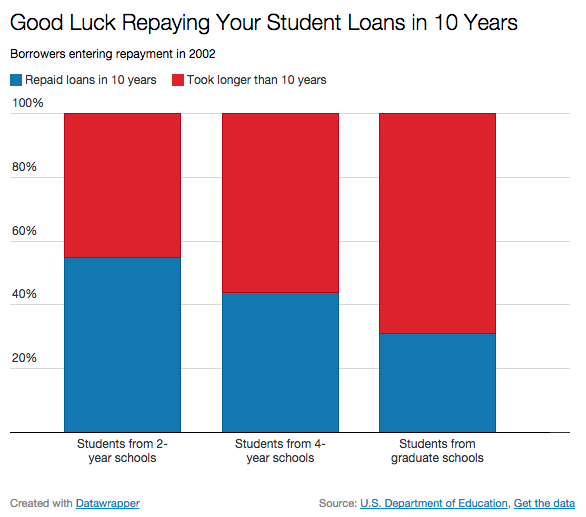

As you can see above, it takes over 10 years for 70% of the students from graduate schools to payoff their loans … making them feel more like a house payment.

Perhaps more to the point, over 50% of student loans are currently in a repayment status that ranges between deferment and bankruptcy!

Given the above, only the most obtuse observer would disagree that U.S. student loan debt is a significant problem worthy of a “solution”. In this light, I offer you the following (true) anecdote:

Recently, a 31-year old MBA graduate from Northwestern University (employed as a professional money manager) carried a $45,000 student loan balance. The interest rate on this debt was 6.55%; therefore, in addition to principal repayment, he was shelling out almost $3,000 each year in interest payments.

He received an offer to refinance his student loan debt – an offer than included a rate reduction so good it felt like it was sent from heaven. His new 2.69% rate reduced annual interest payments to just over $1,200. This refinancing enabled him to pay off the debt three years “early” – with a total savings well exceeding $9,000![4]

To say this graduate was grateful and enthused would be an understatement: “I really should have done this a lot sooner,” he admitted.

This is an example of a legitimate, timely “solution” to a growing socio-economic issue within the United States! Guess which of our well-known financial institutions managed to create such an impressive “solution”: J.P. Morgan Chase (JPM), Bank of America (BAC), Wells Fargo Bank (WFC), BMO (BMO), or perhaps even Goldman Sachs (GS)?

None of the above internationally known financial brands was the customer-centric refinancing vendor for this student!

Instead, this offer came from a small organization that has likely escaped the notice of most U.S. residents[5]:

The refinancing offer came from Social Finance, Inc. (commonly referred to as So-Fi), a 2011 start-up company that sprang from the seemingly endless well of start-ups that has emerged over the years from the Stanford Graduate School of Business.[6]

In May of 2015, CNBC named So-Fi as “Number 25” on its list of current “Disruptors”[7]. The story behind So-Fi is as follows:

Four executives (from big banks) met at the Stanford grad school and discovered they shared a vision that the time had come for a nonbank “alternative” – leading them to found So-Fi in 2011. Those four included Mike Cagney, Dan Macklin, Jim Finnigan, Andy Carra. Here is the description of that development by current CEO, Mike Cagney:

“As a reformed banker, I knew there was a better way for financial services to work. Fortunately, I met some great co-founders while at Stanford's GSB who shared the same vision and passion.”

Keep Cagney’s self-description (“reformed banker”[8]) uppermost in your mind. Then listen to this brief (well under 2 minutes) interview with Cagney (access the top video hotlink when you open the hyperlink):

http://www.cnbc.com/id/102623794

What struck me most about this interview were these “impressions”:

1) Cagney is the “anti-Dimon”[9]. He does not look slick; he isn’t even impressive in appearance[10]. He pairs a So-Fi t-shirt with a suit coat.

2) He speaks the “truth”: banks often do not serve their customers well these days.

3) So-Fi places emphasis on product and delivery… utilizing innovative technology.

In just four years, So-Fi has moved from “start-up” phase to one of the premier “non-bank alternatives” available today. Illustrating the powerful thrust of its “product and delivery” within the student loan arena – it has become the largest provider of student loan refinancing (over $2 billion funded). It has also branched into mortgages and personal loans. For example, within the mortgage area, Cagney says: “We're one of the few lenders that will do 10 percent down payment mortgages in major metropolitan areas like Los Angeles or San Francisco,”

Among countless things that differentiate So-Fi from a JPM or BAC are:

1) no application or origination fees for its student-loan refinancing,

2) no prepayment penalties, and

3) interest rates start as low as 3.5 % — well under the average 4.6 percent interest rate of government-issued student loans.

So-Fi states that its underwriting approach, proprietary technology and word-of-mouth referral rate (currently 30% of its volume) is what sets it apart from banks and other lending institutions. Try to fully grasp that last metric – 30% of its volume comes through word-of-mouth referral!!! There are company CEO’s all across the USA who would think she/he had died and gone to heaven if they could boast a referral rate nearly that high!

One of the most impressive things about So-Fi (in my opinion) has been how quickly it has emerged as a force within loan securitization – a bailiwick I almost exclusively associate with “big banks”. Specifically, So-Fi recently closed on a new offering of Student Loan Asset Backed Securities (SLABS) that totaled over $400 million. In the process, So-Fi has garnered so much credibility that major credit rating agencies have not been standing in the way — both Moody’s and Standard & Poor’s have rewarded So-Fi with an “investment grade” rating on its securities.[11]

With all of those factors moving in Cagney’s favor, it hardly sounds like a boast when he projects a loan volume this coming year of $4 billion. Cagney has also publicly stated that he expects an IPO within the coming year.[12]

As you’d expect, So-Fi is not the only entrant within the “non-bank alternative” apace.

Another key player is CommonBond, led by co-founder and CEO: David Klein.

Like Cagney, Klein does not bear much resemblance to the slick, polished leaders of Wall Street. Although Klein did not develop professionally within the banking space, per se… Klein’s professional skills and experience have been honed within the larger U.S. financial space (American Express (AXP) and McKinsey & Company). The seeds of CommonBond can be found in Klein’s personal experience as a MBA student at Wharton School at the University of Pennsylvania:

Like Cagney, Klein does not bear much resemblance to the slick, polished leaders of Wall Street. Although Klein did not develop professionally within the banking space, per se… Klein’s professional skills and experience have been honed within the larger U.S. financial space (American Express (AXP) and McKinsey & Company). The seeds of CommonBond can be found in Klein’s personal experience as a MBA student at Wharton School at the University of Pennsylvania:

Trying to get a loan, Klein found that “banks were providing fixed rates that frankly were just too high.”

Although there are many similarities between So-Fi and CommonBond, there are also differences. So-Fi was spawned within the ecosystem of Stanford, while CommonBond was given birth (on the East Coast) within the (virtual) womb of the Wharton School. Somewhat uniquely, its first funding round (2012) was focused within the larger Wharton Alumni community—and had a limited focus with regard to eligible student loan applicants (its first round of loans went to 40 Wharton MBA students and graduates).

I suspect that its small, “tight” beginning was the seed of CommonBond’s ongoing commitment to proactively enable a higher degree of personalization within student lending. In its first days, it could link donor alumni with recipient students, forging the possibility of mentoring and the building of “community”. Despite its considerable growth since then in size and scope, Klein’s firm still maintains the possibility, when desired, of providing links between student loan applicants and funding sources. Note the inclusion of “community” within its “What We Do” statement:

As just stated, CommonBond has grown significantly since its start … particularly since it received $150 million in new funding from Nelnet (NNI) in February of this year:

CommonBond has expanded the number of graduate programs it serves from 109 to more than 700 (a 7-fold increase). What was once limited to graduates from 50 schools in (variously) MBA, MD, JD and engineering programs … is now open to graduates from about 200 schools in nursing, pharmacy, real estate and veterinary programs.

As with most “large cap” companies and big banks who, as a matter of course, regularly claim to operate with an eye on “Core Values” and an impressive “Mission Statement”, CommonBond posts an eye-catching statement on its website:

What appears to be distinctive about CommonBond (as one learns more and more about the firm) is that Klein and his cohorts actually believe in, and operate in accordance with, that statement! Here are some key quotes from Klein:

“There’s a lot of talk about how banks are bad and we gotta find a new way…

Finance is changing in fundamental ways, Not to be overly dramatic, but I think we’re going through an evolution in finance right now that we haven’t seen since 1500s Venice.”[13]

Now that is an entrepreneur with a vision! But even more impressive (in my opinion) is the commitment CommonBond has demonstrated to enlarge the circle of educational opportunity within today’s world:

For every degree that is fully financed on the platform, CommonBond promises to finance the education of one student for a year at the African School for Excellence in South Africa.[14]

Like Cagney, Klein brims with confidence regarding the future:

“We’ll continue to grow like this as we continue to prove to investors that our approach to underwriting is very effective in maintaining a strong loan portfolio.”

INVESTOR TAKEAWAY:

Let me remind you of Mike Cagney’s self-description:

“As a reformed banker, I knew there was a better way for financial services to work.”

And just a few paragraphs ago, we quoted David Klein being quite direct:

“There’s a lot of talk about how banks are bad and we gotta find a new way…

Finance is changing in fundamental ways, Not to be overly dramatic, but I think we’re going through an evolution in finance right now that we haven’t seen since 1500s Venice.”

In my opinion, 2015 is a “kairos moment” for reformed banking! Consider the news from May of this year:

British and U.S. regulators fined six major global banks for what amounts to “organized crime” to rig the $5.3 trillion/day (volume) foreign exchange (Forex) market. Although a detailed breakdown of the various component fines assessed by regulators becomes complex – the total amount of the aggregated fines was nearly $6 billion!

Barclays is one of the major banks fined this past May by British and U.S. regulators for "rigging" the foreign exchange market.

Nearly as significant is the stark fact that four of these banks caved in to U.S. Justice Department demands to plead guilty to the charge of conspiring to manipulate the currency market. [As most of you know, the most frequent past practice has been for a bank to pay the fine without admission of “guilt”].[15]

This is 23 Wall Street in New York City -- the "House of J. Pierpont Morgan" and headquarters of the old J.P. Morgan and Company. Its current rendition, JP Morgan Chase Bank, is one of the banks that admitted to rigging the Forex market.

That being said, it would have been nearly impossible for these banks to deny guilt, since a treasure trove of condemnatory evidence was uncovered during the investigation that preserved this Forex conspiracy in action. A good number of the foreign exchange traders from these banks regularly exchanged strategies and comments in “chat rooms” (one was named “the Cartel” and another was called “Mafia”). The preserved conversations established that these traders conspired to set exchange rates that (in essence) cheated customers while benefitting all or some of the traders. These traders actually tried to strategize ways to gouge clients without alienating them completely.[16] One particularly cynical trader opined: “If you aint cheating, you aint trying.”

Following on the heels of (and in the spirit of) the huge 2012 “LIBOR Scandal”, as well as the well-chronicled record of Jamie Dimon’s JPM as one of the most highly fined companies in the history of the United States (see https://www.markettamer.com/blog/category/investing-ideas) it should be no wonder that members of the GenX and Millennial generations do not trust “big finance”!!

It is to those millions of consumers (as well as folks like me) that Cagney, Klein, and other non-bank alternative entrepreneurs serve as a beacon of hope within the professional finance space! It is inspiring that honest to goodness, sustainable finance companies can be effective, efficient, and principled!![17]

For current investors, there is regrettably not yet any way for us to invest in either CommonBond or So-Fi. However, as I mentioned earlier, So-Fi is expected to launch an IPO within the next twelve months – so we can keep our eyes peeled for an announcement of that IPO.

On a personal level, I regret not being able to enter into a “pairs trade” today within which I am long So-Fi and short JPM. I am convinced that, as long as there is no “big finance” interference with the current business model, management philosophy, and “mission” of firms such as So-Fi and CommonBond, they have nearly unlimited upside!

And in my more hopeful moments[18], I even envision So-Fi and CommonBond motivating “big finance” toward some positive, constructive, customer-centric reforms! Why do I suggest that? The reason is as elementary as “the profit motive”. Call them what you will, but the “captains” of big finance are not blind to the success of competitors!

In fact, a recent report by Goldman Sachs (GS) projected that as much as $4.7 trillion of future financial service industry business is “jeopardized” by innovative start-ups such as So-Fi, CommonBond, online financial service providers, “Robo-Advisers” (see https://www.markettamer.com/blog/disruptive-technology-investment-management) and the like.

Since $4.7 trillion can be a powerful motivator, one could hope that Wall Street might be moved to acknowledgement (if only to themselves) that customer acquisition requires becoming more attuned to genuine customer needs, developing innovative products that truly address those needs in helpful ways, and delivering those products through multiple channels. Then, as “big finance” admits it needs to learn from innovators like So-Fi and CommonBond, one could even dream that innovators like Cagney and Klein could begin changing the old school (corrupt) “culture” of Wall Street … and reforming at least some of its leaders[19] into actually committing to a mission statement that includes concepts such as:

1) Lowering the cost of financing education

2) Lowering the cost threshold

3) “Paying it forward” by financing the education of a third world student.

Of course, if that is too much to expect, I think the U.S. public, quite tired of big bank scandals, might appreciate a mission statement as simple as: “Do no harm. Be open. Serve customers with integrity.”

Finally, although we cannot yet invest in So-Fi or CommonBond, we can utilize them as our non-bank alternative for loans – and spread the word about them to others. The best way to reform banking is to help demonstrate that reformed banking works!

DISCLOSURE:

The author does not directly own the stock of any major U.S. bank. Since the innovators described above are not yet publicly traded, he has no financial interest in them either. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] A problem some commentators have labeled a “Time Bomb”

[2] Having served a post-graduate school as CFO for over a decade. I could offer chapter and verse regarding “why” education costs have increased at a greater rate than the CPI. However, it boils down to the “business model” of competition within the higher ed market today—highlighted by expensive building projects, professor salaries (personnel accounts for over 50% of costs), and the way schools handle scholarships (“tuition discounting” has become an enigmatic puzzle for college shoppers).

[4] The student used part of the savings to buy his female friend an engagement ring. The finance company threw in a free bottle of artisan olive oil!!

[5] In fact, when I looked within “Creative Commons” for a publishable image for the firm, there were none to be found.

[6] From the So-Fi Wikipedia.org entry: Social Finance, Inc. (commonly known as SoFi) is a marketplace lender that provides student loan refinancing, mortgages and other types of loans, such as parent and personal loans. The company is a non-bank alternative focused on offering loans at lower rates than traditional lenders. SoFi’s primary customers are early stage professionals.

[7] The term “Disruptor” does not refer to someone at a speech or public event that causes a ruckus that distracts everyone and disrupts the goings-on! Instead, it refers to start-up companies that are so innovative that they “disrupt” the status quo within their industry group and upgrade the evolution of that business to a new (higher) level.

[8] I can’t help but compare the expression to these parallel expressions: “reformed criminal”; “reformed extortionist”; “reformed bully”; “reformed cigarette smoker”; “reformed drug addict”.

[9] Referring to JP Morgan Chase CEO, Jamie Dimon – impeccably dressed and groomed, distinguished gray hair, and fond of wearing cuff links with the “U.S. Presidential Seal” on them.

[10] I might actually be in better shape, and if you knew me, you’d know that is a sad statement.

[11] It should go without saying that So-Fi (and others in the space) have been immensely enable and empowered in their efforts by the Federal Reserve’s Zero Interest Rate Policy (ZIRP) has empowered these start-ups to borrow the money they need for their business model at historically low interest rates.

[12] It should be fascinating to watch who they chose as underwriting partners!

[13] Klein’s reference to 1500s Venice may pass way over the head of non-historians. That is the era often credited with developing the beginnings of what has become the modern system of credit.

[14] Obviously, CommonBond’s efforts are similar to those of Warby Parker (an eye wear company) and Toms Shoes.

[15] NY University School of Law Professor (and former antitrust regulator) Harry First opined that although the demand that banks plead “guilty” is a great step because it shows “the Justice Department has become far more serious in its criminal prosecutions than it has in the past” … if the Justice Dept. is “really serious about deterrence”, it will need to prosecute individuals!

[16] If one dissects that thought at it depth, it comes close to the ultimate in cynicism and fraud.

[17] I wanted to write “and have a soul”, but I knew there would be “blowback”.

[18] Granted, those moments may be “flights of fancy”

[19] Whenever I get to that point in “my dream”, I suddenly wake up and realize that I am more of a realist than a dreamer. Based on the (sad) record of history, I reluctantly suspect that it is more likely that Wall Street’s abiding interest in this area is to suppress true competition and design ways to enhance its own future business growth and profits

Related Posts

Also on Market Tamer…

Follow Us on Facebook

We're About to Find Out the Answer to Warren Buffett's Pointed Question About Trump's Tariffs. Here Are 3 Stocks to Buy Depending on What That Answer Is.

We're About to Find Out the Answer to Warren Buffett's Pointed Question About Trump's Tariffs. Here Are 3 Stocks to Buy Depending on What That Answer Is.