It is “Trivia Time” again!

Since July 20th of 2015 through the 18th of February, 2016, which Sector within the S&P 500 Index has posted the poorest performance?

As I (virtually) scan the faces of our many readers, I see facial expressions that suggest that you are thinking:

“Everybody knows that!! What do you take us for – idiots? The poorest performing sector has been Energy!”

I do not blame you for feeling nearly 100% certain that Energy was the worst performing sector during that period. Since the market as a whole has so frequently turned south because of the ongoing deterioration in the price of Oil… and we have been hearing so many negative stories about poor earnings and looming bankruptcies within the oil patch… it is natural that our perception is that Energy has been the worst sector.

However, there is another area that has experienced something of a “Ninja Fall” since last July. Consider the chart below:

S&P 500 INDEX SECTORS (Total Returns)

Between 7/20/15 and 2/18/16

|

SECTOR |

PERFORMANCE |

| UTILITIES | +10.0% |

| TELECOM SERVICES | + 7.6% |

| CONSUMER STAPLES | + 2.5% |

| INDUSTRIALS | – 4.4% |

| INFORMATION TECHNOLOGY | – 7.6% |

| CONSUMER DISCRETIONARY | – 7.6% |

| MATERIALS | -11.4% |

| HEALTH CARE | -13.8% |

| ENERGY | -16.5% |

| FINANCIALS | -16.6% |

This poor performance by the Financials has been a drag on the S&P 500 Index since mid-2013… but not nearly as much of a drag as has been the case during the past 8 months. [Note: Up until mid-2013, the Financials had been outperforming the S&P 500 Index. It has not outperformed over an extended period since then.] Note that through the rest of this article, I will be using the Financial Select Sector SPDR ETF (XLF) as a proxy for Financial Sector performance.

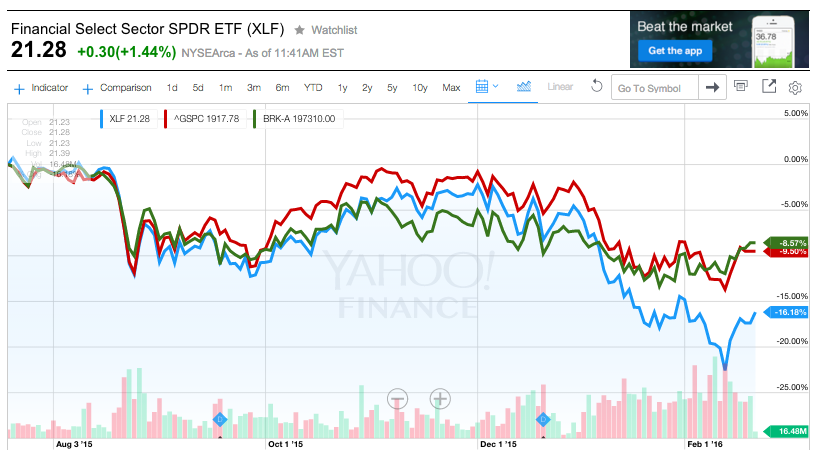

Between July 20th and February 18th, BRK.A declined by just 8.57%, the S&P 50 Index fell by 9.50%, but the XLF dropped by 17.37%!

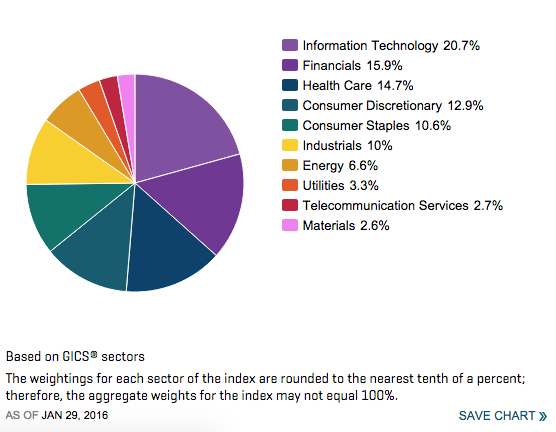

As many of you know, the Financial Sector is the second most heavily weighted group within the S&P 500 Index. In sharp contrast, Energy only constitutes 6.6% of the Index.

Therefore, the weak Financials have had a more substantial impact in restraining the Index since last July.

Why is this significant and why am I focusing on this right now?

I want to draw your attention to the countless articles and business news sound bites during the second half of 2015 that focused upon some variation of the following:

“What stocks/funds will benefit from rising interest rates?”

Of course, these articles were inspired by the market’s chronic focus on exactly when the seemingly inevitable U.S. Federal Reserve rate hike would take place. As you recall, many experts were “confident” the Fed was going to raise rates in September… and the Financials had a little “bump up” in early September (until the experts were proven wrong).

I have read numerous such articles… and almost universally, the “experts” made it sound as though banks would be a “sure fire winner” following a rate increase. The rationale for that view centered primarily upon these premises:

Banks will be slow to raise the interest rate they pay on deposits.

Banks will be able to immediately charge a higher rate on new loans.

Therefore “Cost of Funds” for banks would remain steady, while their loan interest revenue would increase.

The implication was that only poor bank management could possibly screw up an otherwise inevitable improvement in the margins and earnings of banks.

These articles then went on to identify specific banks and/or ETFs/Funds (those that focus upon Financials) that the author felt might deliver especially good returns.

I suspect many, many average investors were impressed by those articles. The rationale offered was, in each case, very easy to understand. Prospects for an imminent rate increase seemed fairly strong (after all, almost all the experts were harping its inevitability). So let’s assume that, at least by December, at least 1,000 investors purchased one or more of those banks or financial sector ETFs (or mutual funds). So how did investors who followed that “expert” advice fare in the real, live Market since the rate hike?

Between Dec. 15th and mid-February, BRK.A dipped by only 3.18%. Meanwhile, the S&P 500 Index fell by 7.49% and XLF tumbled by 12.93%!

Oooops!! Between December 15, 2015 (the day before the Fed Rate Hike) and the 19th of February – the Financials lost almost 13%. Worse, the Financials underperformed the S&P 500 Index itself by almost 5.5%! And adding insult to injury for these innocent “investors”… the Financials underperformed Warren Buffett’s Berkshire Hathaway Inc. (BRK.A) by nearly 10%!!

Why do I say: “Adding insult to injury”? The reason is simple. The preponderance of articles on Warren Buffett or BRK.A during the past 6 months have focused upon those BRK.A portfolio stocks that have performed weakly during the past two years.

Therefore, the fact that the Financial Sector performed more poorly than BRK.A since July 20, 2015 is saying quite a bit! After all, based upon the tone of countless commentators who have taken Buffett to task, one might think that nothing performed quite as badly as Buffett’s portfolio!

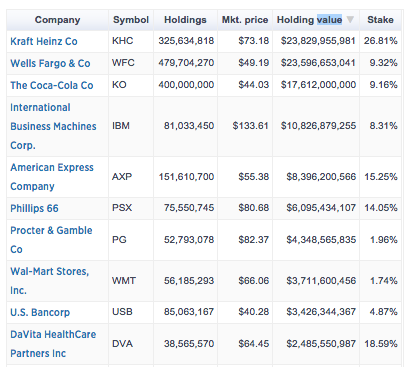

As of December 31, 2015, here were BRK.A’s top positions:

When commentators critique (or even flat out question) Warren Buffet’s portfolio management acumen, they don’t have many kind things to say. Here is my paraphrase of the typical such commentary:

[Note: Kraft Heinz Co. has been a brilliant stroke by Buffett. Not many articles trumpet him as much as he deserves for that effort.]

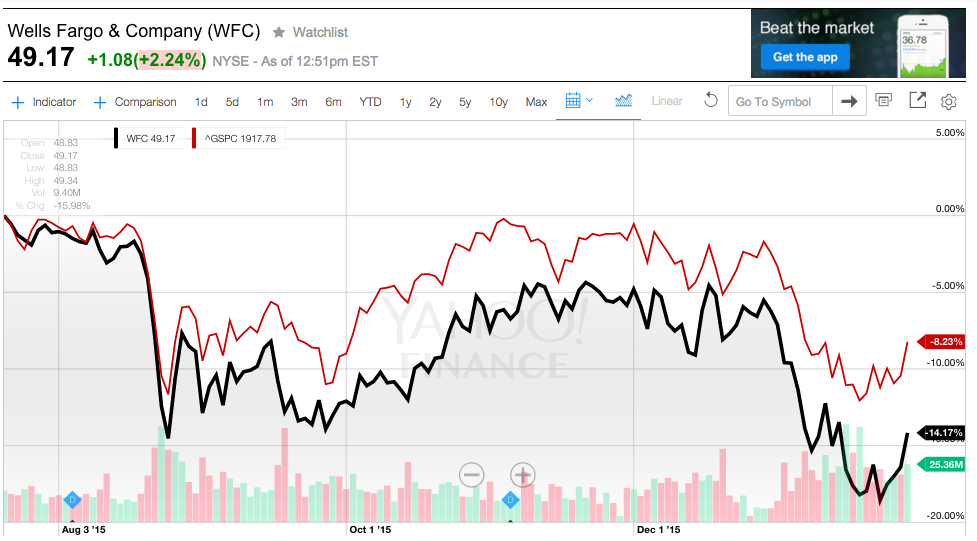

1) Since July 23 of 2015 through January, Wells Fargo (WFB) has lost 14.17% while the S&P 500 has lost just 8.23%. Warren Buffett is the largest shareholder and keeps holding on.

2) The Coca-Cola Co. (KO) has been the subject of a number of articles criticizing Buffett for its underperformance (vis-à-vis the S&P 500 Index) over the past five years. In addition, critics often complain about how “boring” KO has been. However, the reality is that, over the past two years, KO has outperformed the S&P 500 Index… and pays out a 3.2% dividend. I’ll personally take a “boring stock” like KO any day!

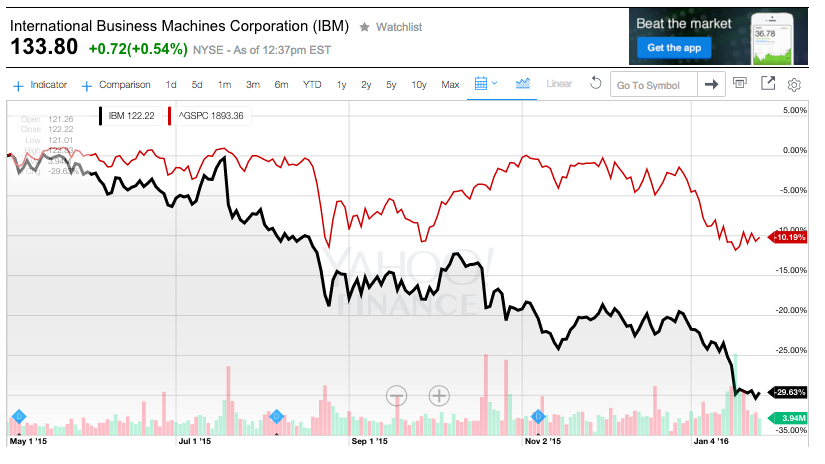

3) Since April 30, 2015 (through the end of January) IBM has fallen by almost 30% … while the S&P 500 Index lost only a bit more than 10%. Warren Buffett is the biggest shareholder… and he keeps buying more. How foolish can he be?

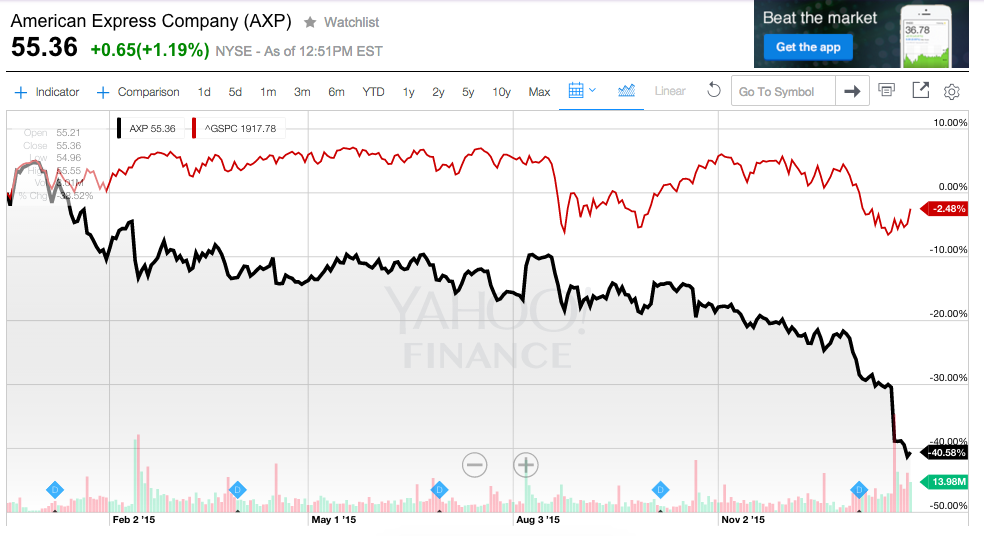

4) Since the middle of December 2014 (through the end of January) American Express (AXP) has lost over 40.5%, while the S&P 500 Index lost just 2.5%.

In addition, it is fascinating to note that Buffett held $3.7 Billion in Exxon Mobil (XOM) stock for a number of years… until selling the entire position by early 2015. During the rapid fall in oil prices over the last half of 2014, Buffett was regularly shellacked for hanging on to XOM. Then when it was announced that he sold it, commentators jumped on him because he waited too long. In their estimation, surely the worst of the oil price collapse was over by then!

News about Buffett having sold XOM broke in early February of 2015. Therefore, review this chart of XOM (compared with the S&P 500 Index) since then:

We clearly see that XOM underperformed the Index by 2.8% (-7.9% vs -5.10%). So Buffett’s decision was additive to BRK.A’s performance during the past year. Has anyone said “Atta Boy, Warren!” Of course not.

Getting back to the Financial Sector. Why have U.S. Financials performed so poorly since mid-2013? If oversimplification was a capital crime, I might be subject to being shot on the spot for this summary. However, in this case “simple” is more effective than “detailed” and “exhaustive”:

A) CAPITAL RESERVES:

The Basel III Accord (preceded of course, by Basel I and II) has resulted (we are assured) in U.S. banks being much more strongly capitalized than they were in 2008 (at the height of the Financial “Meltdown”).

With banks needing to hold greater amounts of capital “in reserve”, they have lower amounts of capital to use for the generation of profits. That means (all other things being equal) a lower profit margin and a deduction in earnings.

B) VOLKER RULE:

This key component within the infamous “Dodd Frank Act” (bank regulation legislation that was created and approved following the 2007-09 Financial Crisis) severely limits investment banks such as Goldman Sachs (GS) and Morgan Stanley (MS) with regard to proprietary trading – an area that was (in former days) extraordinarily lucrative for banks.

There I no doubt that the prime rationale of the Volker Rule – ie. lower the risk profile of big U.S. banks – was laudable. However, the “collateral effect” of that legislation was to reduce the financial capacity of banks to use its trading desks as a way to lift bank profitability – particularly during periods (such as the current environment) when loan profits are down and the yield curve is flat. As a result, the amplitude of potential bank profitability is flattened a bit…. thereby generating less enthusiasm for banks as an investment vis-à-vis alternatives.

One prominent commentator described the Volker Rule as having “neutered” GS and MS![1]

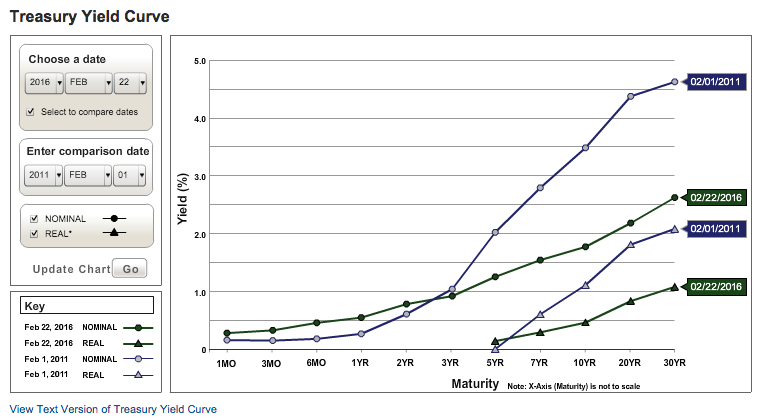

C) FLATTENING YIELD CURVE:

Generally speaking, a flatter yield curve is bad for commercial banks. When long-term yields decline, a bank’s opportunity to achieve strong lending profits is diminished. Below you can see how much flatter the Yield Curve has been in February of 2016 (Green Line) than it was 5 years earlier (Blue Line).

In addition, banks are not just at the mercy of a usually (much) less than omniscient Federal Reserve Board regarding the level of rates. One could argue that, in fact, the Market is a more powerful determinant of rates than the Fed. [See: https://www.markettamer.com/blog/gundlach-on-the-feds-amazing-blunder .]

Consider the direction of the “Benchmark” U.S. interest rate following the “big” December 16th decision by the Fed to “raise rates”:

On 12/16/15, the benchmark U.S. Treasury Ten-Year Security yielded 2.30%. Less than two months later, that yield had fallen all the way down to 1.63%… near a “historically low” level.

So “the Market” (the collective perception of investors, both big and small) is crucial in any determination of actual rate direction, as well as the precise magnitude of any rate increase or decrease.

Finally, with regard to rates, even the remote prospect of “Negative Rates” (which have cropped up in Europe and a few other countries) precipitates nightmares within both bankers and investors in bank stocks!

D) “GREXIT”, EMERGING MARKETS, and GLOBAL BANKING:

We are frequently offered reassurances with regard to the level of exposure that U.S. banks have to the sovereign debt of Greece, Spain, Italy, emerging market nations, etc.

Aside from my innate skepticism with regard to reassurances by bankers or government regulators to the effect that U.S. banks hold only “minimal” or “manageable” exposure to such loans, the simple fact is that the global banking system in 2016 is extremely interwoven … somewhat like the way baskets are woven. That “weaving” is far too complex and opaque for anyone to truly have a strong degree of confidence with regard to what might happen if a major European Bank was to fail[2], or a mid-sized country was to default on its loans.

E) THE OIL PATCH:

It could be posited that we will inevitably see a number of oil companies declare bankruptcy in the months ahead. How that impacts U.S. banks will be determined by the price of oil (will it or will it not move below $27/barrel) and the number and size of the companies that go under.

F) DODD FRANK REGULATORY CHANGES

Whenever the Federal government adds to regulation, the inevitable result is a substantial increase in required reports – the breadth and depth of said required reporting usually being as incoherently described by regulators as are the regulations set by the IRS! The generation of those reports requires additional bank staff persons… which increases bank expenses – but without any commensurate increase in bank earnings.

G) PERIODIC NEWS REPORTS:

Despite repeated statements by the Federal Reserve’s chairperson (be it former Chair, Ben Bernanke, or current chair, Janet Yellen) that clear and transparent messaging by the Fed with regard to the direction and intent of Fed policy… the media revels in publishing stories regarding what this Federal Reserve Board member or that regional Fed bank president thinks about rates, the economy, or bank regulation.

Consider this simple example:

a) On February 23, the President of the Kansas City Federal Reserve Bank, Esther George, was interviewed on Bloomberg TV. She opined that U.S. banks are indeed, much more financially sound than they were in 2008. [In addition, she expressed her hope that Fed Board members will consider a second rate hike in March. Of course, she is a well-known interest rate “hawk”.]

b) In sharp contrast, the relatively new president at the Federal Reserve Bank of Minneapolis, Neel Kashkari, appeared on Bloomberg TV on February 18th. During that interview, Kashkari offered his take on how to make the U.S. banking system safer. I suggest that you read the account of that article at http://www.bloombergview.com/articles/2016-02-18/kashkari-s-big-plan-for-the-banks.

What concerns me is that such stories occur every week – grabbing investor’s short-term attention in ways that are often dysfunctional over the long-term. Making this even more dysfunctional is that I discovered the interview when a commentator reported that Kashkari called for a “transformational restructuring” of mega-banks.

That headline prompted me to assume Kashkari was calling for a breakup of mega-banks. However, if you actually read the article, it becomes clear that Kashkari much more strongly prefers to merely “substantially” increase bank capital requirements — something quite different from “breaking them up”.

Of course, Kashkari’s comments fly in the face of all those periodic reassurances we are given that the U.S. banking system is “secure”…. Including Esther George’s comment from the other day. It makes one wonder!

INVESTOR TAKEAWAY:

Now that we know just how poorly the Financial Sector has performed since mid-2013; and in particular, that it was the worst performing sector between July of last year and February 18th of this year, what insights can we glean? I suggest the following:

1) Beware expert opinion when it is built upon a premise that seemingly “everyone” assumes is correct. Just because banks have thrived following previous rate increases, there is no assurance that banks will always thrive following a rate increase!!

Remember: “What everyone ‘knows’ is not necessarily so!” and its corollary:

“Ms. Market regularly revels in fooling as many people as she possibly can!”

2) We have reviewed a number of reasons that account for the poor performance of bank stocks – even following the December rate hike. One overriding factor that impacts banks… and all stocks… is the unprecedented level of global central bank intervention. Nearly universal “monetary easing” has played havoc with many, if not most, of the “standard rules” through which markets have been analyzed and understood through the decades.

It surprises me that so many analysts and commentators still neglect to condition all of their published work with come variation on this caveat:

“The analysis offered herein is applicable within a ‘normal’ market environment. However, the current market continues to be significantly distorted by global central bank monetary easing. Therefore, caution is warranted!”

3) No matter how many columnists, analysts, business news talking heads, etc. take Warren Buffett out to the figurative “Wood Shed” because of IBM, AXP, Bank of America (BOA), or even KO – don’t feel badly for the venerable Mr. Buffett. Just remember that he outperformed the S&P 500 between last July and mid-February… KO has outperformed for two years… and all of Buffett’s critiques suffer from “performance envy”.

The latest trend I have been tracking with regard to the Financial Sector is lots of stories regarding…. can you guess??

No… not an apology from all those “experts” who so confidently recommended this past fall (and especially in December) that investors buy select bank stocks and/or Financial Sector ETFs (or funds)[3].

Instead, I have been noticing numerous articles to the effect of: “Geez, now that financial stocks have deteriorated so much since mid-December, which ones should you buy NOW?”

That is a question I will address in my next article. Keep on the lookout for it.

DISCLOSURE:

The author does not own any Financial Sector ETF or mutual fund. As always, he does own various iterations of the S&P 500 Index. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] If one takes that literally, it is indeed an unpleasant simile.

[2] It is widely understood that European banks have a huge overhang of non-performing loans.

And consider the current fiscal/sovereign debt situation of world oil export nations. Saudi Arabia and OPEC may have intended to drive Shale Oil producers into bankruptcy… but in the process, they have driven the fiscal situations of Saudi Arabia, Russia, Venezuela, and a number of other exporters to crisis levels. Consider this from an October, 2015 report from the International Monetary Fund (IMF):

“The oil price decline has ‘increased the urgency for MENAP oil exporters to adjust their fiscal policies,’ the IMF said, predicting fiscal deficits to be 12.7 percent of GDP in the MENAP oil exporter countries and 7.3 percent of GDP in MENAP oil importer countries in 2015.

For Saudi Arabia, OPEC's largest oil producing member and de facto leader, the IMF predicted a fiscal deficit of 21.6 percent of GDP in 2015. As such, oil exporters needed to adjust their spending…”.

[3] I don’t see many “apologies” from so-called “experts” for earlier proffered advice that lost investors money!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

AMD: Solid Execution and AI Ambitions — but Can It Catch Nvidia?

AMD: Solid Execution and AI Ambitions — but Can It Catch Nvidia?