In Part I, we offered you an overview of the trading history and personal and professional story of someone who has lately been much in the news – Bill Ackman. We discovered that, despite his two recent public “failures” (JC Penney (JCP) and Herbalife (HLF)), Ackman has displayed some legitimate trading “genius”. We also listed some important trading lessons we can glean from the Ackman story and promised to offer you a look at a couple of Ackman’s current stock positions that might potentially be appealing to you!

Let’s start by taking a look at several of Ackman’s largest portfolio positions (as of mid year):

Canadian Pacific Railway Ltd (CP) 26.8%

Proctor & Gamble Co. (PG) 23.9%

Beam (BEAM) 12.0%

Ackman saw a potential turnaround situation within the operation of Canadian Pacific Railway Ltd (CP) and took an initial position in 2010. Reflecting his standard operating procedure once taking a sizable position, Ackman began pushing for change at the top of the company by around late October of 2010.[1] The CP Board stood by then CEO, Fred Green[2], as the leader best capable of guiding CP into a bright future. However, having wearied of the pummeling from Ackman (or else seeing “the writing on the wall”, or both), Green resigned suddenly in May of 2011, just prior to the company’s annual meeting. With Ackman then having “a seat at the table” and Green out of the way, a whirlwind search for a new CEO resulted (by the end of June) with the announcement that Hunter Harrison (see photo to the left) long-time[3] head of the rival (and bigger) railway system, Canadian National Railway (CNI), had been voted in as the new CP CEO. That left CP with a 15-member board dominated by Ackman and seven Pershing-friendly directors![4]

Ackman saw a potential turnaround situation within the operation of Canadian Pacific Railway Ltd (CP) and took an initial position in 2010. Reflecting his standard operating procedure once taking a sizable position, Ackman began pushing for change at the top of the company by around late October of 2010.[1] The CP Board stood by then CEO, Fred Green[2], as the leader best capable of guiding CP into a bright future. However, having wearied of the pummeling from Ackman (or else seeing “the writing on the wall”, or both), Green resigned suddenly in May of 2011, just prior to the company’s annual meeting. With Ackman then having “a seat at the table” and Green out of the way, a whirlwind search for a new CEO resulted (by the end of June) with the announcement that Hunter Harrison (see photo to the left) long-time[3] head of the rival (and bigger) railway system, Canadian National Railway (CNI), had been voted in as the new CP CEO. That left CP with a 15-member board dominated by Ackman and seven Pershing-friendly directors![4]

All who belittle Ackman’s moves related to JCP and HLF should dwell on this chart for a bit (the graph below depicts the price action from Ackman’s May, 2011 victory through this past week):

CP saw its stock soar between the closing low (post May) of $44.92 and the recent high of $137.26 (5/20/13) – a move of over 205%!

Precisely what did Ackman see in CP that drew his “activist investor” interest? He saw a severely underperforming industrial stock struggling within a generally positive industry environment!

Specifically, between July of 2008 and November of 2010, CP stock languished while CNI was surging about 40% (see graph below: CP is in blue; CNI is in red).[5] Ackman determined that the management team (and the board) at CP was not getting the job done, which meant the potential existed for significant operational improvement within the company once the management and board were transformed through a proxy fight. Once Ackman pushed his “foot in the door” and gained control, Ackman identified the person he thought best qualified (“his guy”) to lead CP. That individual was a tough-as-nails executive whose resume included (in years past) transforming the Illinois Central Railway and pushing CNI[6] to the point where it (as seen below) totally trounced CP for years (CP has been, by far, the “number two” Canadian railroad): Hunter Harrison.

In TV interviews, Harrison projects as an easy going “good old boy”. However, the truth is that he is cut from much the same cloth as Ackman – no-nonsense and “straight ahead” (no matter what). In fact, there have been several stories headlining accusations about Harrison having fostered a “culture of fear” within CP.

Considering the following, that is not surprising:

1) During 2012, Harrison announced “Phase 1” of the CP management plan, including –

a. 4,500 jobs cuts[7];

b. The largest (proportional) share of cuts would be made at the HQ office;

i. The existing rented office space in Calgary would be vacated;

ii. The HQ office would be moved to new quarters located within a CP rail yard just outside of Calgary.

c. Reduction of the company’s fleet by more than 30%;

d. The closing of some CP rail yards;

e. Possibly the sale of some under-used CP assets;

2) Phase II includes two prongs:

a. A streamlining of operations and system-wide train scheduling – including reducing the number of trains while increasing the number of cars per train;

b. The inauguration of system-wide meetings between the CEO and employees[8]—

i. Harrison intends to use said meetings to lay out his “plan” and to inform staff of his expectations for them going forward;

ii. In Harrison’s own words: “I don’t want to lose good people; there are not enough of them to go around.”[9]

“Culture of fear” or not, Harrison’s plan is premised upon what he might call a central railroad axiom: “The success or failure of a railroad is not based on the economy. It’s based on how you control the costs!” Therefore, from the start, Harrison made a bold promise: CP’s operating ratio would come close to matching the industry leader [CNI] by 2016!

Why was that a “bold” promise? Consider this statistic: during 2011, CP spent about $81 for every $100 it earned in revenue, producing an operating ratio of 81%. For that same year, CNI’s ratio was just 63.5%!! If you have ever tried to move an elephant – you can appreciate the magnitude of Harrison’s challenge. Moving a railroad and an elephant are somewhat comparable. However, the central point in all of this is that Harrison’s plan is “vintage Ackman”: aggressive and unrelenting. And that is precisely why the stock has climbed 160% since September of 2011! (See below, with CP in blue and CNI in red.)

Moving on to BEAM Inc. (BEAM), the story is short and sweet. Ackman became active within Fortune Brands several years ago, and persuaded the company that the “sum of the parts was greater than the whole”. By December of 2010, Fortune sold off its golf business ($1.23 billion) and announced plans for the division of remaining assets between Fortune Brands Home and Security (FBHS) and BEAM.[10]

A quick glance at the stock charts for each of these companies makes it clear that Ackman was prescient (and profitable):

FHBS (Blue) has trounced the S&P 500 Index since it started trading in September of 2011.

Meanwhile, BEAM has also performed admirably since its debut in October of 2011, as often as not outreaching the S&P 500 Index (below):

As an added “kicker”, BEAM currently pays out a 1.3% dividend.

Turning to consumer products behemoth Proctor & Gamble (PG)[11], Ackman started his activist strategies around mid-year of 2012. He was extremely critical of then CEO, Robert McDonald, whom Ackman felt had dropped the ball by letting spending get out of hand while simultaneously letting market share slip. Ackman began pushing for cost-cutting and operational efficiencies.

The over-simplified version of the PG story is as follows:

1) PG has (historically) emphasized quality and tended toward the “upper range” on price points;

2) PG currently garners over 60% of its revenues from developed markets, within which it had been losing share due to the interaction between a poor economy and relatively high pricing;

3) By the end of fiscal year 2012, PG had committed to lowering prices and improving packaging in an effort to regain market share;

4) More importantly for future growth, it placed greater emphasis on sales within its developing markets, which grew by 7% in Q4, and over the prior twelve years had grown at a compounded annual rate of 12%;

5) It projects growth between 8-9% in emerging markets during the next FY;

6) It has been starting up new plants in emerging markets and strengthening its supply chain and sales channels within those markets;

7) Special emphasis is being placed on growth within the “baby care” and “health care” segments, since those areas are booming in developing markets;

8) Ackman got his wish earlier this year when McDonald departed and retired CEO, A.G. Lafley, was brought back to run the company.

Here is a snapshot (above) of PG stock prices since Ackman became “active” with the company (PG in blue; S&P 500 Index in red). Not a bad performance, but clearly, the PG investment is (at best) “a work in progress”. It is worth noting that PG currently sports a 3.2% dividend yield, and interestingly, Warren Buffett holds almost twice as many shares of PG as Ackman does!

Finally, we come to the newest “Ackman project” – Air Products and Chemicals (APD). Ackman owns 9.8% of APD, which is actually considerably less than he had intended to invest. However, this past July, APD made a splash in the press with this notice: [the board] “has observed unusual and substantial activity in the Company's shares.” (That is code for “Oh my gosh, somebody is after us!”) To its credit, the board took swift action[12], adopting a “shareholder rights plan” – also known as “a poison pill” – that triggers once any single shareholder’s ownership reaches the 10% (or more) level.

What is the industry “space” occupied by APD? It is a global supplier[13] of gases (atmospheric, process, and specialty gases), performance materials, equipment, and services. Its customers range from companies within the food and beverage space, as well as the health and personal care industry, to companies involved with energy, transportation, and semiconductors!

What is the industry “space” occupied by APD? It is a global supplier[13] of gases (atmospheric, process, and specialty gases), performance materials, equipment, and services. Its customers range from companies within the food and beverage space, as well as the health and personal care industry, to companies involved with energy, transportation, and semiconductors!

APD was founded in 1940 and is based in Allentown, PA. Globally, it employs over 20,000 folks. It website[14] focuses on its ability to help customers become more efficient, plus its many awards for “sustainability”. It also includes an interesting chart regarding its “brand”.

APD was founded in 1940 and is based in Allentown, PA. Globally, it employs over 20,000 folks. It website[14] focuses on its ability to help customers become more efficient, plus its many awards for “sustainability”. It also includes an interesting chart regarding its “brand”.

Ackman hasn’t yet outlined his aspirations for APD, but he has described the APD business as: “simple, predictable, and free-cash-flow-generative, and enjoys high barriers to entry, high customer switching costs and substantial pricing power.” Ackman’s description includes most (not all) of the qualities used to discern which companies have “wide moats”.[15]

How does the valuation of APD stand up vis-à-vis competitors? The P/E of APD is 22.6, while the P/E ratios for the others are (in descending order): Airgas (ARG) 25.09; Praxair (PX) 21.68; and Linde (LIN.DE) 20.60.[16] Therefore, Ackman must not have relied upon simple valuation in his analysis.

Taking a look at relative stock price performance, here is the relevant graph covering the prior ten-year period (note that I do not include Linde, since it was not been tradable here until 2012):

As you can see, APD has significantly underperformed both Airgas (ARG) and Praxair (PX) during this period. This metric therefore demonstrates “room for improvement.”

However, if we review dividend yield, we see that APD’s yield of 2.7% significantly tops those of PX (2%) and ARG (1.8%). Since the payout ratio for APD is already a sizable 60%, there doesn’t seem much promise in tweaking that area.

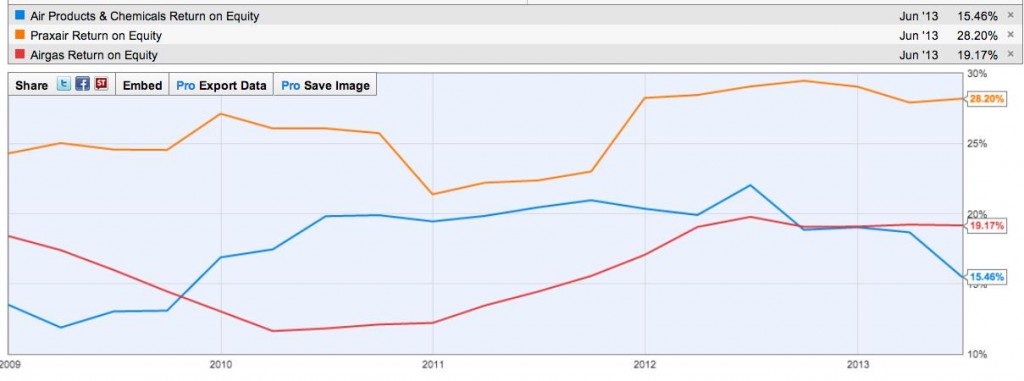

If we move on to financial performance, we do discover an obvious and telling area that could be improved – Return on Equity (ROE). From YCharts.com, we have these 5-year metrics comparing the three competitors:

APD currently lags both rivals on this measure, but it reflects a much wider and more prolonged shortfall compared to PX (which almost doubles the APD ROE). The same relative performance appears within the Return on Invested Capital (ROIC) metric.

What could be done to maximize the value of this company then[17]? If one studies each company’s balance sheet, it becomes clear that APD is operating with significantly less leverage than the other two companies. For example, the debt-to-equity ratio for APD is almost half that of either competitor. Therefore, flexibility exists within this realm for some form of recapitalization strategy.

Recapitalization could come in a couple of different forms, the primary ones being: 1) maximizing shareholder value through a share repurchase plan or an increased (or special) dividend payment; or 2) engineering an acquisition to foster growth.

What could a likely takeover target be? The obvious one is ARG, since the market cap of PX is 50% higher than that of APD, and almost five times bigger than ARG. As a consequence, combining APD and ARG could significantly strengthen the competitive potential of APD[18] – and likely improve the overall profit margin, efficiency, etc.[19]

Here is the “bad news”. APD already tried that strategy in 2010 and eventually gave up. However, that was “then” and this is “now”. It might be possible that Ackman and a few other advocates could create a rationale and a “bid” that is compelling enough for both parties to “sign on”.

Whatever your take on Ackman or on the “gas industry”[20], the possibilities inherent within APD are interesting! In addition, if you agree with the premise that we have moved through the worst of the current economic downturn, and will (sooner or later) begin significant, sustainable growth, then APD stands to gain significant growth in revenue and earnings – with or without a recapitalization. Just imagine, if you will, what could happen if Ackman (et al) could swing a recapitalization plan of some sort and move APD’s ROE up to even 20% (much less to the even higher 28% ROE of PX)? “Enticing” might be an apt description for that scenario!

INVESTOR TAKEAWAY:

Love Bill Ackman or hate Bill Ackman, his recent travails with HLF and JCP are not illustrative of his overall record. Obviously, I wish I had “jumped on board” with him for the CP ride upward, or for the big moves in FBHS and BEAM.

Moving forward, I will definitely pay more attention to what Mr. Ackman is doing, and I will keep my eye on PG and APD, with the intention of maintaining an open mind regarding joining him in the ownership of either one (or both)!

DISCLOSURE: The author does not hold HLF, JCP, CP, CNI, BEAM, FBHS, PG, APD, ARG, PX or any other stock mentioned above. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

[1] That approach is not unique to Ackman. It is the very definition of any “activist” investment manager.

[2] Green had been with CP all of his life and had served as CEO since 2005.

[3] But by 2011, he had been retired from CNI for two years.

[4] An interview with Hunter from June, 2011, is well worth watching, since it touches upon the key dynamics that need optimization within any railroad system: http://www.theglobeandmail.com/report-on-business/video-harrison-why-im-the-man-to-run-cp-part-one/article544089/?from=4418217

[5] To illustrate the “positive environment” for railroads, Warren Buffett took then market leader Burlington Northern/Santa Fe private in 2010 at a 30% premium!

[6] Before Harrison, CNI had been considered a “bloated railroad”.

[7] 80 per cent of the job cuts will reportedly come through retirements and other forms of attrition.

[8] Fondly (or not so fondly) referred to as “Hunter Camps” during his years at CNI.

[9] He then continued: “There are only two things I need them to do. They have to be willing to be cross-trained in another discipline, and willing to relocate if needed. If they don’t want it, they oughtta get their résumés dusted off.”

[10] For the few who don’t know, BEAM is the former liquor division of Fortune Brands… highlighted by the Jim Beam and Maker’s Mark brands. If you don’t like the stock, you might like one of the brands!

[11] For a brief history of PG’s origins, take a look at: https://www.markettamer.com/blog/how-well-do-you-know-the-dow-jones-industrial-average-take-the-quiz-part-i and https://www.markettamer.com/blog/how-well-do-you-know-the-dow-jones-industrial-average-part-ii

[12] Congress might want to take note of what “swift action” means!

[13] Customers in over 50 countries.

[14] http://www.airproducts.com/company/company-overview/at-a-glance.aspx

[15] The so-called “Buffett” investing style. See https://www.markettamer.com/blog/how-to-find-stocks-with-economic-moats

[16] All P/E figures are drawn from YahooFinance.com

[17] With pressure from Ackman and others.

[18] In fact, the current revenues of ARG and APD, if added, would exceed those of PX by 30%.

[19] Once the combined operations are fully integrated and synergies realized.

[20] I am surprised that YahooFinance.com does not list Congress and/or the White House as competitors for APD in the “gas industry”.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

3 Things That Need to Happen for Bitcoin to Reach $200,000

3 Things That Need to Happen for Bitcoin to Reach $200,000