The Dow Jones plunged 216 points. The NASDAQ sank 43 points. The S&P 500 collapsed 22 points.

Question: What held strong? Which sectors showed relative strength on a day when the market was getting pummeled?

Chart Courtesy of StockCharts.com

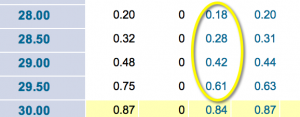

Answer: The Market Vectors Gold Miners (GDX), which declined a whopping $0.09 on the day. That's relative strength. And still some nice premium in the June 14 put options on the bid side for those concerned about another decline and looking to sell premium below market value.

A decline in the GDX below the short put strikes would result in assignment of the options, leading to an obligation to purchase the stock at the strike price. The premium would still be pocketed in such an event. In the chain above, if GDX declined below $29.50, a $0.61 premium would reduce the cost basis following assignment to $28.89. A strike price chosen further out of-the-money would increase the probability of the option expiring worthless and generating maximum reward on the trade while lowering the maximum reward in the process.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

You Don't Need Talent to Succeed: Lessons From Warren Buffett's Lifetime of Investing

You Don't Need Talent to Succeed: Lessons From Warren Buffett's Lifetime of Investing