I am writing this on February 1st, the “official” start of the “Yellen Fed”.[1] A couple of random thoughts came to mind:

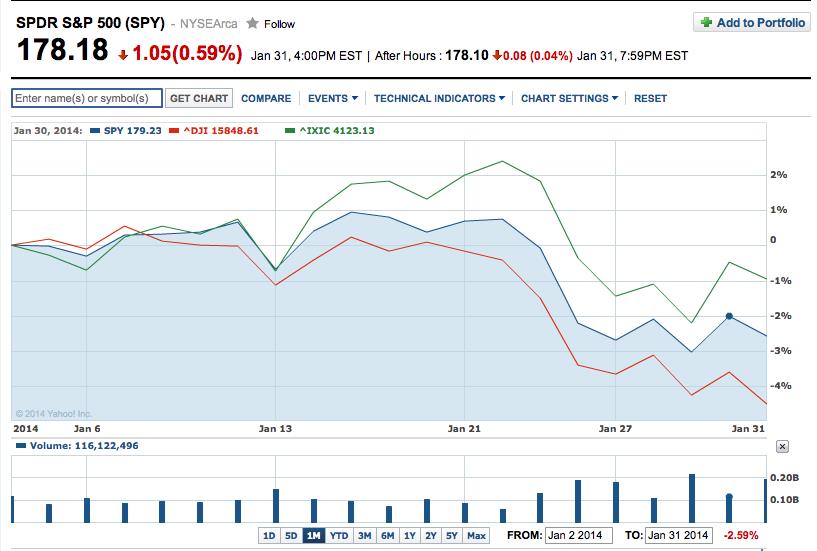

1) Will the performance of U.S. equities in January [S&P 500 down about 2.5%, Dow Jones Industrials down about 4.5%, and the NASDAQ down (just) 1%] be attributed to Yellen or Bernanke?[2]

2) How do the central bankers in the rest of the world feel about the announcement from the Fed (last week) that it will be focusing on U.S. metrics to guide the development of Fed policy going forward;[3]

3) If someone granted me a choice between receiving the Nobel Prize for economics or being named Chair of the Federal Reserve, which one would I choose?

a. The Nobel Prize would provide me the ultimate in professional recognition, and a “crowning note” for my (eventual) eulogy. In return, all I would need to do (in response) is ensure that my future work never casts shame upon the Nobel Prize or myself!

b. On the other hand, becoming Fed Chair would infuse me with nearly unparalleled power in shaping monetary policy and economic wellbeing… with worldwide markets and world leaders regularly attending to the wording of all of my speeches, public statements, and published writings.[4]

i. The “price” I would pay for holding that position would be the personal pressure of knowing that my decisions (and my spoken and written words) will have a profound impact (for good or ill) upon millions of people.

ii. In addition, I would immediately become the object of chronic daily critique and criticism within every “circle” that concerns itself with the Fed and/or the economy (from CNBC to academia and from the financial press to the nightly sound bites from politicians).

Quite frankly, friends, my initial answer to question three was – “It’s obvious. I’d rather be Fed Chair!”

However, I then took a moment to re-consider that choice. Was I truly prepared to sit in the chair of Volcker/Greenspan, Bernanke (and now Yellen)? My imagination took into a world that made me feel as though I was living in some form of “hybrid” between a “fish bowl” and a “pressure cooker”.

Guess what?! I changed my mind and decided I would prefer to be a Nobel Prize recipient!

Now, friends… I want you to consider that same choice! Which choice would you make?[5]

The reason that choice came to mind is because Janet Yellen is married to George Akerlof (their image appears to the left[6]). Akerloff was awarded the Nobel Prize for Economics in 2001, and (as we’ve noted) Yellen has ascended to the very top of the most powerful financial organization within the world. As a consequence, Yellen and Akerlof represent (within one married couple) all of the elements involved within any comparison between “Power” and “Prize”. Let’s take a closer look at each one of these individuals![7]

The reason that choice came to mind is because Janet Yellen is married to George Akerlof (their image appears to the left[6]). Akerloff was awarded the Nobel Prize for Economics in 2001, and (as we’ve noted) Yellen has ascended to the very top of the most powerful financial organization within the world. As a consequence, Yellen and Akerlof represent (within one married couple) all of the elements involved within any comparison between “Power” and “Prize”. Let’s take a closer look at each one of these individuals![7]

Dr. Akerlof’s father was a college professor, so Akerlof became accustomed to the academic world from the start of his life. After earning his B.A. from Yale University and his PhD from MIT, Akerlof has devoted most of his career to serving as a professor (he is currently the Koshland Professor of Economics at the University of California (Berkeley). Akerlof’s widespread fame is the result of his published works, which have touched on a wide range of fascinating topics, including:

1) The economic impact of asymmetrical information. His published work (“The Market for Lemons: Quality Uncertainty and the Market Mechanism” later won him the Nobel Memorial Prize for Economics in 2001!

2) Various optimum models regarding “Wages”. The book he co-authored with wife, Janet [Efficiency Wage Models of the Labor Market] details an “efficiency wage hypothesis” … within which employers pay above the “market-clearing” wage… thereby contradicting standard conclusions drawn from neoclassical economics.

2) Various optimum models regarding “Wages”. The book he co-authored with wife, Janet [Efficiency Wage Models of the Labor Market] details an “efficiency wage hypothesis” … within which employers pay above the “market-clearing” wage… thereby contradicting standard conclusions drawn from neoclassical economics.

3) “Social Identity Economics” is a topic he co-developed with Dr. Rachel Kranton of Duke University. The work’s premise is that individual purchase decisions are not just determined by preferences regarding different goods and services ….. but are also determined by the “norms” and tastes of their social group.[8] Interestingly, their work has been adapted to questions regarding reproductive decisions and the related economic impacts (see: http://en.wikipedia.org/wiki/Identity_economics ).

4) Personally, I was most intrigued by his work on “Looting: The Economic Underworld of Bankruptcy for Profit” (published in 1993 — Paul Romer was his co-author). This work describes how (under specified circumstances) corporation owners might decide it is more (personally) profitable to “loot” the company and “extract value” from it rather than try to turn it around and help it grow.[9]

5) However, the work that seems to have been attracting the most attention during the ascendancy (within the Federal Reserve hierarchy) of Akerlof’s spouse, Yellen, is the book that Akerlof co-authored with his best known “disciple” – Robert Schiller.

The book’s title (Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism) is eye-catching. I would be willing to wager, however, that very few folks could identify that to which the book refers.[10]

The book’s title (Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism) is eye-catching. I would be willing to wager, however, that very few folks could identify that to which the book refers.[10]

One of the most challenging aspects of writing for Market Tamer is that I regularly embark on a topic that takes me into territory that draws my attention to references that are even more absorbing than my original topic… veering me off into multiple time-consuming websites.

Needless to say, there will soon be an article focused on “Animal Spirits”… leading to a look at the impact of Keynes on Akerlof, Yellen, and the world economy.

There is no doubt that Akerlof (older than Yellen by six years) has had a formidable impact on Yellen’s view of the economy and the world. Of course, Yellen has had at least as profound an impact on Akerlof (he has made a practice of following wherever her career trajectory has taken her) and his views. We can sense some of the dynamics at work within the Yellen/Akerlof relationship as we read observations about their interactions.

You already know that Yellen co-authored the book about labor market efficiency. They have also collaborated in writing about the underlying causes of unemployment, the reunification of Germany, and even the growth of childbirth out-of-wedlock! In light of this frequent collaboration, consider this quote from Akerlof in 2001 (after wining the Nobel Prize) regarding the professional synergy at work between them: “Not only did our personalities mesh perfectly, but we have also always been in all but perfect agreement about macroeconomics.”

More revealing (and more interesting) is this observation from Dr. Andrew Rose (another economics professor at the U. of C. Berkeley), who has co-written research with the couple: “George is more loosey-goosey, more casual, with flashes of brilliance…. Janet helps to separate the wheat from the chaff. She’s incredibly sensible and allows you to think very carefully and rigorously about the ideas. Between the two of them, they were a huge pleasure to collaborate with.”[11]

It is totally reasonable to presume that if we joined the Yellen-Akerlofs for an evening meal, we’d be treated to an iengaging conversation about economics and monetary policy. I’d just have to make very sure that I curbed my tongue regarding “Taper”!

YELLEN’S ASCENDANCE

Janet Yellen was born in 1946 in Brooklyn, New York, and raised by a teacher (mother) and a physician (father). She graduated at the top of her high school class (see photo to the left), thereby earning admission to the world’s top university[12], from which she graduated “Summa Cum Laude” in 1967. She then moved on to graduate-level work – receiving a PhD from Yale University in 1971. She secured a position as an assistant professor (in Economics) up Interstate 95[13] at Harvard University, where she remained until 1977[14], when she transitioned to a position as an economist within the Board of Governors of the Federal Reserve System[15]. It was during her time with the Fed that she first met Akerlof.

Janet Yellen was born in 1946 in Brooklyn, New York, and raised by a teacher (mother) and a physician (father). She graduated at the top of her high school class (see photo to the left), thereby earning admission to the world’s top university[12], from which she graduated “Summa Cum Laude” in 1967. She then moved on to graduate-level work – receiving a PhD from Yale University in 1971. She secured a position as an assistant professor (in Economics) up Interstate 95[13] at Harvard University, where she remained until 1977[14], when she transitioned to a position as an economist within the Board of Governors of the Federal Reserve System[15]. It was during her time with the Fed that she first met Akerlof.

To help add dimension to her budding resume, Yellen then moved onto the London School of Economics and Political Science – serving as a lecturer between 1978 and 1980. By 1980, she secured herself some “roots” by becoming an Associate Professor within the Haas School of Business within the University of California at Berkeley (where Akerloff also taught)[16]. She became “tenured” by 1985[17] – and still (in title, at least) is a Professor within that very business school.[18]

It was not too long before her academic career became “trumped” by her professional involvement within governmental service. By 1994, she was appointed as a Member of the Board of Governors of the Federal Reserve… and then her national profile took a prodigious leap in February of 1997, when she was named by President Bill Clinton to serve as the Chair of his Council of Economic Advisers. (In the photo featuring President Clinton, Janet Yellen is at the far left and Treasury Secretary Robert Rubin is in the center!)

It was not too long before her academic career became “trumped” by her professional involvement within governmental service. By 1994, she was appointed as a Member of the Board of Governors of the Federal Reserve… and then her national profile took a prodigious leap in February of 1997, when she was named by President Bill Clinton to serve as the Chair of his Council of Economic Advisers. (In the photo featuring President Clinton, Janet Yellen is at the far left and Treasury Secretary Robert Rubin is in the center!)

In June of 2004, Yellen’s role within the Fed took a big leap upward – as she was named to be the President and CEO of the Federal Reserve Bank of San Francisco. She held that position through 2010. By 2009, Yellen was made a voting member of the Federal Open Market Committee (FOMC) [19]

Although it has been widely reported already, it is worth reiterating that between 2004 and 2008, Yellen expressed significant concerns regarding the enormous boom within residential housing values – wondering aloud what the potential consequences of those dynamics might be. She expressed these thoughts in public speeches and within Fed meetings.

Although it has been widely reported already, it is worth reiterating that between 2004 and 2008, Yellen expressed significant concerns regarding the enormous boom within residential housing values – wondering aloud what the potential consequences of those dynamics might be. She expressed these thoughts in public speeches and within Fed meetings.

Before you begin to hope that she might be some type of a visionary – able to discern trouble ahead – allow me to quickly bring your expectations back to earth! Despite her having the advantage of a “front row seat”[20] to witness the mortgage excesses of Countrywide Financial [21], Yellen was (unfortunately) too sanguine regarding the U.S. economy’s resiliency. She fully expected that the economy would be able to recover from the shock of a bursting within the housing bubble. She actually argued against any policy change that might attempt to deflate that bubble, believing in her own mind that: “arguments against trying to deflate a bubble outweigh those in favor of it”. In any event, Yellen never did explore what authority the San Francisco Fed might have possessed to take unilateral action in California on housing. Besides, based on her reading of U.S. economic history and the “Tech Bubble” crisis from 2000-03, she was operating on the assumption that even if the housing bubble “could be large enough to feel like a good-sized bump in the road… the economy would likely be able to absorb the shock.”[22]

Needless to say, Dr. Yellen proved to be overly optimistic on that score!

By April of 2010, President Barack Obama announced that he was elevating Yellen to the position of Vice-Chair of the Federal Reserve. (Bernanke swore her in during 2010.) That (as we have seen) offered her sufficiently broad visibility to garner her support from many quarters when, less than 40 months later, the President’s top pick to replace Ben Bernanke (Lawrence Summers) became almost immediately the target of opposition from almost all directions.[23] As a result, stakeholders may or may not have been convinced that Yellen was the best choice – but more than enough folks perceived her to be a far superior choice vis-à-vis Summers to turn the momentum toward her candidacy!

By April of 2010, President Barack Obama announced that he was elevating Yellen to the position of Vice-Chair of the Federal Reserve. (Bernanke swore her in during 2010.) That (as we have seen) offered her sufficiently broad visibility to garner her support from many quarters when, less than 40 months later, the President’s top pick to replace Ben Bernanke (Lawrence Summers) became almost immediately the target of opposition from almost all directions.[23] As a result, stakeholders may or may not have been convinced that Yellen was the best choice – but more than enough folks perceived her to be a far superior choice vis-à-vis Summers to turn the momentum toward her candidacy!

I wish I was confident in my understanding of all that Yellen values and how the economic philosophy and policy experience she has accumulated might impact the Fed during the months to come! However, I do not know anyone (yet) who can confidently speculate regarding the ways in which Yellen could shift, or even reshape, the Fed and its current monetary policy!

That being said, I do draw some reassurance from the observation (see earlier) from collaborator, colleague, and friend, Dr. Andrew Rose: “George is more loosey-goosey, more casual, with flashes of brilliance…. Janet helps to separate the wheat from the chaff. She’s incredibly sensible and allows you to think very carefully and rigorously about the ideas. Between the two of them, they were a huge pleasure to collaborate with.”

Hmmm! Obviously, Yellen has been exposed to “loosey-goosey” for (at least) forty years now, and she has (nonetheless) managed to maintain sanity and balance. That means that she is well equipped to handle politics in Washington, D.C. (and the Eurozone) – where “loosey-goosey” is the norm and “steady, disciplined, balanced discernment” is clearly the exception. In addition, being “incredibly sensible” and being able to “separate the wheat from the chaff” are particularly appropriate characteristics for any Fed Chair to be able to draw upon!

Let’s all hope that Chairwoman Janet Yellen does an extraordinarily capable and competent job – one that will result in her “legacy” being characterized years from now as one that ranks with the likes of Dr. Paul Volcker [24]– rather than some of the Fed Chairs whose tenures have been looked upon (in retrospect) with dismay![25]

Let’s all hope that Chairwoman Janet Yellen does an extraordinarily capable and competent job – one that will result in her “legacy” being characterized years from now as one that ranks with the likes of Dr. Paul Volcker [24]– rather than some of the Fed Chairs whose tenures have been looked upon (in retrospect) with dismay![25]

INVESTOR TAKEAWAY: There are times when I become amazed (appalled) by the hubris of (so-called) financial experts who trumpet a confident prediction regarding future market direction and/or the longer-term impact of a financial development. There are those who have claimed to have a solid grasp regarding what a “Yellen Fed” will do and how that will impact the economy and market direction. I am quite skeptical regarding such claims — since the market most frequently acts in ways that “surprise” (confound) the greatest number of market participants! In addition (as Bernanke was fond of reminding us) Fed policy tends to be very “data dependent” – meaning that moves in unemployment and/or inflation (as well as related economic metrics) tend to impact policy decisions one way or the other.

So please do not “fall” for any analyst who claims that her/his prediction regarding Yellen and the Fed can be counted upon to be true.

That being said, there are a few basic premises through which we can better understand Yellen as she leads the Fed:

1) She has been “on board” with Quantitative Easing since the beginning;

2) Within the past few months, Bernanke has publically reiterated that he has kept Yellen fully briefed since even before her formal nomination, and she has been fully supportive of all recent Fed decisions;

3) Those factors have led some observers to oversimplify Yellen’s perspective on interest rate as “dovish”. That is unfortunate, because (as we know) Fed policy is “data dependent”;

a. During the “Greenspan Era”, for example, Yellen supported higher interest rates, even as many others were pushing for lower rates. She is not always “dovish”!

4) Consider all the work Yellen/Akerlof have published on labor! Yellen’s primary concern at present is driving employment (and the labor participation rate) upward.

a. Many analysts are declaring that the abysmal labor participation rate in the U.S. has become “structural/systemic” and will therefore not appreciably improve;

b. Yellen does not agree with that outlook. She is convinced that our current employment malaise will turn around as “demand” moves upward.

i. It is the demand side that the Fed is trying to “kick start” through low rates.

ii. When we publish our prospective article on “Animal Spirits”, we’ll read about “Say’s Law” (related to supply inducing demand) and review its place in 2014.[26]

5) Several Fed Governors are quite concerned about the bloated size of the Fed’s Balance Sheet.

a. Yellen is more concerned about empowering the U.S. economy and job growth.

6) One Bernanke practice[27] that is likely to continue under Yellen is the use of “Forward Guidance”.

a. These are the Fed statements that are forward-looking… such as (to paraphrase) “it is our expectation that the Fed Funds Rate will be kept at the present low level for an extended period of time – at least as long as the end of 2015, and quite possibly beyond the time that unemployment moves below 6.5%.”

b. “Forward Guidance” can be helpful (no doubt); however, when too many observers try to completely dissect and then re-translate Fed statements, such “Guidance” can become more like a Rorshach Test than a clear, helpful guide for the market.[28]

7) I do believe it is fair to state that Yellen is (at heart) a pragmatist… prone to try to ground those around her with “reality” (Just as Dr. Rose described her earlier.)

DISCLOSURE: The author does not currently own any of the books written by George Akerlof or Janet Yellen. Nothing in this article is intended as a recommendation to buy or sell books or securities (or anything). Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

[1] Ben Bernanke’s final Fed meeting came during the last week of January; Janet Yellen officially began her new job on February 1st.

[2] Strictly speaking, we should credit it to Bernanke.

[3] More specifically, some of us thought the Fed might hold off on an added layer of “Taper” because of the currency turmoil in within the emerging markets. Billions have been pulled out of emerging market equities and bonds because of “fear” (the word “contagion” has popped up again). Some may feel that the Fed’s (relative) insularity might be due to the fact that U.S. companies do not have as much “exposure” to EM dynamics as those in Europe. [From Reuters: the percentage of company revenue derived from emerging markets varies… “about 24 percent of revenues overall for firms listed on the MSCI Europe index, versus 15 percent for the MSCI United States index and 14 percent for the MSCI Japan index.”]

[4] Not to mention that sales of my prior books would skyrocket!

[5] I really do think that this exercise can provide us with a much better perspective on what it means to be Chair of the U.S. Federal Reserve. It might even make us slightly more empathetic with the person who holds that office. (Although that empathy would immediately evaporate as soon as a Fed decision lost us hundreds of dollars in the stock market!!)

[6] From Wikipedia.com

[7] I would love to see the results of a nationwide survey from an experienced pollster (Gallup, Harris, etc) regarding how much the American public knew about Akerlof and Yellen prior to the fall of 2013!

[8] Here is an overly simplistic example. I read last week that 85% of junior high students have a cell phone. If all of their friends have a Samsung (as opposed to an i-Phone), they are likely to much prefer a Samsung.

[9] In my humble opinion, that sounds like Eddie Lampert’s strategy with Sears Holdings (SHLD)

[10] It refers to the 1936 book by John Maynard Keynes, The General Theory of Employment, Interest and Money.

[11] I am guessing that it is a very good thing that Yellen grounds Akerlof in reality!

[12] That school (of course) is Brown University. I matriculated the year she graduated and remain (forever) a member of the Brown University Class of 1971.

[13] Interstate 95 links New Haven, Conn (Yale), Providence, R.I. (Brown), and Boston (Harvard)

[14] She also served as a “Research Fellow” in 1974 at MIT (a neighbor of Harvard’s in Boston).

[15] Within the Division of International Finance, Trade and Financial Studies Section.

[16] She was assigned to teach “Macroeconomics” to both full-time and part-time MBA students, as well as undergraduates. It is worth noting that she was twice recognized as the Haas School's outstanding teacher (an annual award).

[17] She was named the “Eugene E. and Catherine M. Trefethen Professor of Business and Professor of Economics”.

[18] I am confident that the faculty roster is flaunted on a regular basis to impress applicants and donors alike!

[19] This FOMC is the group upon which Wall Street places a microscope of analysis at least once a month (regarding the announcement of any decisions from their monthly meeting, and weeks later, dissection (with a fine tooth comb) of the minutes from the prior meeting!

[20] As President of the San Francisco Fed.

[21] Since then subsumed within Bank of America

[22] October 2005: http://www.frbsf.org/news/speeches/2005/051021.pdf

[23] Dr. Summers has been controversial in most positions he has held. He was the target of especially virulent opposition from liberals during his tenure as President of Harvard. He was not viewed as a consensus builder or someone with the sensitivities needed in 2014 regarding ethnicity and gender.

[24] Fairly or unfairly, Volcker was catapulted into the sphere of “demigod” because of his success remediating the way out of balance economy he inherited from predecessor G. William Miller (under President Jimmy Carter) and setting the course of the U.S. economy in the direction from which the stupendous “Bull Market” that commenced in 1982 took off.

[25] An obvious example of a Fed Chair whose term is remembered with dismay would be Marriner Stoddard Eccles, Fed Chair between 1934-48. It was the Eccles’ Fed that (unintentionally) made the mistake of a monetary policy that was too tight during the Great Depression… a mistake that served to worsen the economic suffering. In a manner of speaking, one could say that Eccles was the inspiration for “Quantitative Easing” – since Ben Bernanke’s one, rock solid, unshakeable vow to himself was that he would not let the Great Depression be repeated in the 21st Century!

[26] One of that law’s premises is: “the supply creates its own demand.” Hmmm, but the market is now flooded with money (supply), and yet demand is still low!

[27] At least at the level to which Bernanke carried this practice, he can be said to have “introduced” it into our expectations about the Fed.

[28] By this I mean that a number of observers/scholars, etc. tend to “read into” Fed comments the economic or political views that she/he hold to be most appropriate and necessary for sustainable growth.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

2 Artificial Intelligence Stocks You Can Buy and Hold for the Next Decade

2 Artificial Intelligence Stocks You Can Buy and Hold for the Next Decade