In order to understand Russia (and therefore inherent risks related to investment in that country) an investor needs to delve a bit into Russian history. If Russia feels like a “puzzle” to you, there are hundreds of years of history that make it abundantly clear that Russia has always seemed to be a bit of a “misfit” when looked at by those who live in Europe or the United States.

First of all, the vast expanse of Russia straddles both Europe and Asia – so it is not fully either “European” or “Asian”.

Secondly (as you’ll see in a moment) Russia was “late to the game” with regard to the unfolding development of “Western” culture, industry, and government.

And third, between the centuries of Tsarist Rule (until 1917) and the firm grip of the Communist Party on Russia and its surrounding “satellite” nations (composing the U.S.S.R.[1]) from 1917 until August of 1991… the Russian people became accustomed to autocratic rule from “the top down”. Despite the fiction that Russia is now democratic (holding regular elections), it is clear to all informed observers that Russia is still run from “the top down” – with former Communist and KGB-bred Vladimir Putin holding forth since December 31, 1999 upon the resignation of President Boris Yeltsin.

Illustrating the fiction of democracy, Russia had a constitutional limit on consecutive presidential terms. Therefore, after winning the 2000 and 2004 presidential elections, Putin recruited a pawn, Dmitry Medvedev, to run for president in 2008, with Medvedev conveniently naming Putin Prime Minister so Dmitry would know what to do.

By the time of the 2012 election, the constitutional length of a presidential term had been extended to six years, and Putin stepped forward to run once again. There is no question that for the foreseeable future (Putin is just 62), Putin, in league with industrial oligarchs (for which Russia is famous) and an extremely powerful strain of organized crime, runs Russia “from the top down”.

Therefore, in that sense, Russia is a “stable” nation politically (as long as one doesn’t look too far under the surface). However, 2014 was a year of contrast for Russia in terms of its international image.

On the positive side, the first part of February witnessed the spectacle of the Winter Olympics in Sochi (along the Black Sea) … the first Olympics in Russia since the 1991 dissolution of the U.S.S.R.

But then Putin proceeded to engage in bold territorial moves that squandered any good will garnered through the games and puzzled millions around the world.

However, that is where history comes in. Students of Russian history might have been put off by Putin’s actions – but they would not have been surprised or puzzled. The fact is that Putin’s actions were merely ongoing variations of “themes” played out over hundreds of years. Allow me to offer just a couple of examples:

1) In the 17th and 18th Centuries, Russia’s Peter I (“Peter the Great”) recognized that Russia was isolatedfrom the progressive Western countries of Europe, who viewed Russia with some suspicion as backward and more than a bit mysterious.

a) Therefore, Peter undertook a grand tour of Western Europe – seeking allies and a “first hand understanding” of what Russia needed to do to “catch up” with Europe.

i) Peter’s tour led to a number of revelations for Peter… some superficial and some quite substantive.

ii) Peter outlawed beards and levied a “beard tax” to motivate compliance (superficial).

iii) He discovered the Potato and ordered Russian farmers to plant them.

a) Once farm families figured out what part of the plant to eat (many were poisoned by eating the plant above the ground rather than the root) the Potato became a key staple in the Russian diet.

b) Ukraine, known as a “bread basket” for the former USSR, is the world’s fourth largest producer… remarkable for its size!

2) Peter recognized Russia’s absolute need for a warm water seaport.

a) After one unsuccessful try to secure a port in the Crimea through a land war with Turkey, Peter built a navy and defeated Turkey in April of 1696 (the Battle of Azov), securing his southern warm water port.

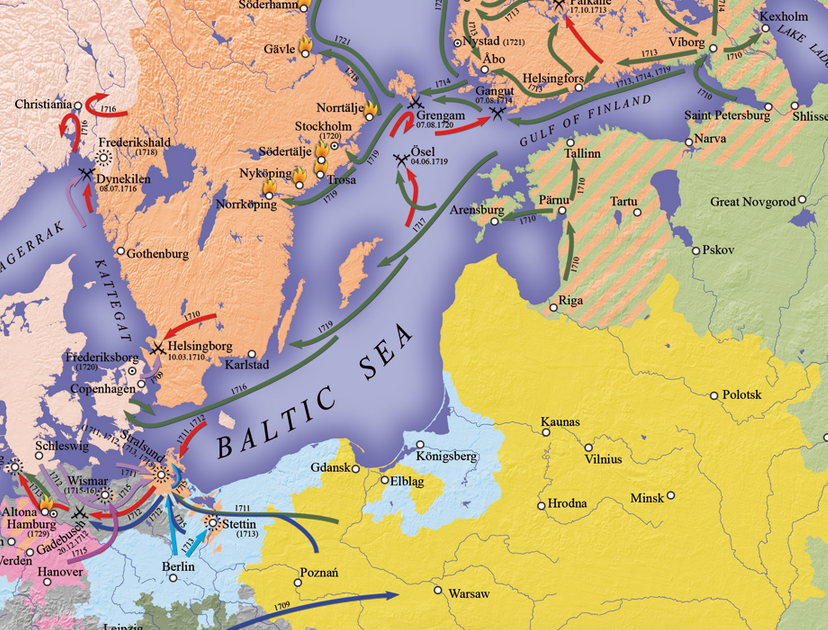

b) Within 25 years, Peter succeeded in defeating his biggest rival to the north, Sweden (Treaty of Nystad in 1721) securing thereby a great deal of territory along the Baltic Sea. That conquest provided Russia with control of the Baltic, made it the strongest power in Northern Europe, and provided Peter with his long coveted “Window to the West” (and another working sea port).

The land captured by Peter is designated here by green with diagonal salmon lines running through it -- Peter's long coveted "Window to the West".

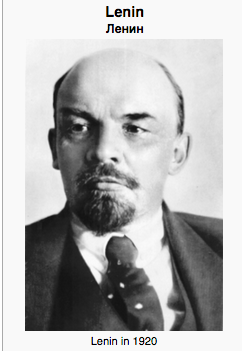

3) Then there is the fascinating struggle between Vladimir Lenin and Joseph Stalin in the early 1920’s regarding how best to integrate their conquered regions into a nation.

a) Stalin wanted to make Ukraine part of “Russia”.

b) Lenin wanted to keep Ukraine as a distinct entity within the “republics” of the Soviet Union.

c) Lenin was “in charge” during the early 20’s, so Stalin complied.

i) The result was that when the USSR disbanded, Ukraine became “independent”.

d) Meanwhile, Stalin’s heritage within the Ukraine has been infamously detested and decried by Ukrainians (5 to 7 million Ukrainians died in the 1931-33 Famine… without Stalin lifting even one little finger of support; and between 1937 and 1938, Stalin ordered mass executions of Ukrainian political leaders and intellectuals!).

i) And yet by the end of World War II, Stalin had enlarged Ukraine by adding to it land (gained as war “spoils”) from Poland and Czechoslovakia, as well as by deciding to attach the Crimea (which was largely populated by ethnic Russians) to Ukraine.[2]

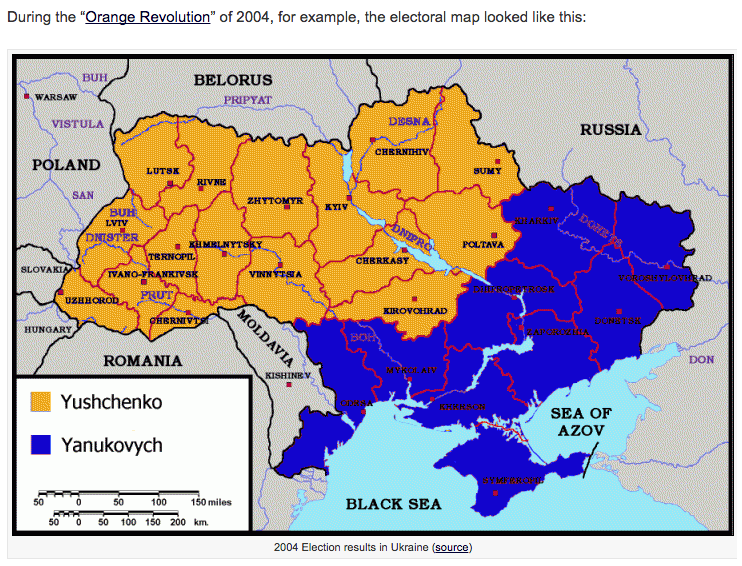

e) The patch work nature of Ukraine nation-building, however, has left it divided and polarized between those who lean toward Western Europe and those whose ties (and allegiance) are intricately bound to Russia. See this telling map below reflecting the sharp division in the election of 2004 in Ukraine (following the “Orange Revolution”):

The orange represents those voting for the Ukraine-centric candidate (favoring European ties) and the purple represents those voting for the Russia-centric candidate.

f) These “pieces of history”, along with hundreds of others, have served as a “crucible” through which the nation and people we know today as “Ukraine” have been shaped and formed.

Putin knows how to spark antipathy among the people of Ukraine. This view of the Moscow skyline highlights the MOSCOW TOWER, the tallest of the buildings.

In the midst of the Ukraine Crisis, some protesters painted the very top of the Moscow Tower with the colors of Ukraine... as you see above!!

With that background, the political/military machinations of during 2014 should not be a surprise. In fact, as far back as April of 2008, during a NATO meeting in Bucharest, Putin boldly revealed his unyielding view regarding Ukraine while conversing with former U.S. President George W. Bush:

“You don't understand, George, that Ukraine is not even a state. What is Ukraine? Part of its territories is Eastern Europe, but the greater part is a gift from us.”

In case anyone missed that crystal clear comment from Putin, he made another parallel public revelation during a May of 2009 ceremony – while laying a wreath at the Moscow grave of Anton Deniken, a 20th century leader now considered a Russian patriot.[3] Reporting on that memorial event, Russian news services wrote (referring to Putin):

“He has a discussion there about Big Russia and Little Russia — Ukraine… He says that no one should be allowed to interfere in relations between us; they have always been the business of Russia itself.”

If you want to understand Putin… then consider the following:

1) A portrait of Peter the Great is prominently displayed in Putin’s office;

2) The term “Little Russia” was used in the days of the Russian Empire to describe the parts of modern day Ukraine that were under the rule of the Czar

3) Putin has masterfully taken a page out of the “Adolf Hitler Playbook” by counting on European leaders being unwilling to challenge him (ala the “appeasement policy” of Britain’s Neville Chamberlain between 1937 and 1939) and President Barack Obama’s most dependable characteristic being avoiding true confrontation.

i) I am not sure if it is a “record”, but Russia succeeded in annexing the Crimea in less than 20 days…. without firing a shot (although Russian ethnics with guns did hold control of the Crimean Parliament building while a rump session of that body voted to dismiss the existing government, replace its Prime Minister, and authorize a referendum regarding the autonomy of Crimea.)

Let’s now move beyond Russian history and how it continues to be actively reflected within the current affairs of Russia under Vladimir Putin.

It is no secret to anyone that Russian equities took a huge hit during 2014.

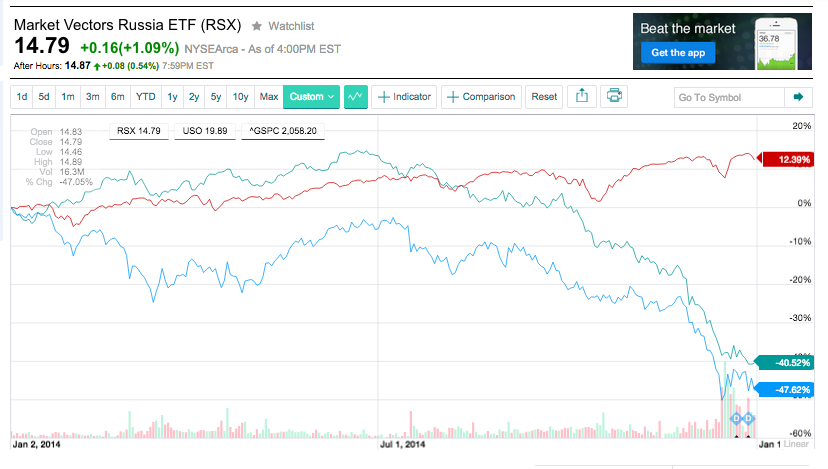

Here is the 2014 chart we provided you in our prior article on “Bottom Fishing” [https://www.markettamer.com/blog/how-to-bottom-fish ]. This chart compares the 12.4% return of the S&P 500 Index with the 40.5% decline in the price of the United States Oil Fund LP (USO) and the 47.6% loss in the Market Vector Russia ETF Trust (RSX)…. which is largest and most liquid of all the available ETFs specializing in Russian equities.

As we can see in the chart, the political/military adventures of Putin (from February into the spring) cost RSX about 20% in value (compared with the 1/1/14 price). Then RSX almost recovered its bearings in full by the end of June… from which time it began a steady swoon that (largely) reflected a relentless descent in the price of oil.

The average investor looking at this chart might conclude: “Oh, this is simple! RSX is a play on the recovery of oil prices!!”

Not so fast there, friends! Investing is never simple… and RSX is much more complex than a mere “play on recovery in the price of oil”! So let’s take a closer look at what could drive the performance of RSX.

OIL AND NATURAL GAS PRODUCTION/EXPORTS

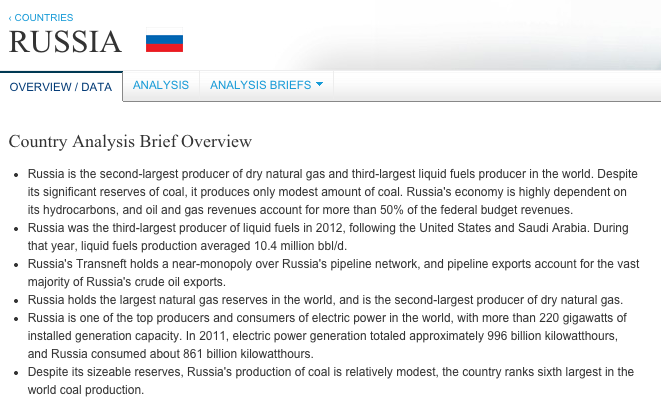

There is no way to deny the outsized importance of carbon-based energy production for the Russian economy. Consider this description of Russia by the U.S. Energy Information Agency (http://www.eia.gov/countries/country-data.cfm?fips=rs ):

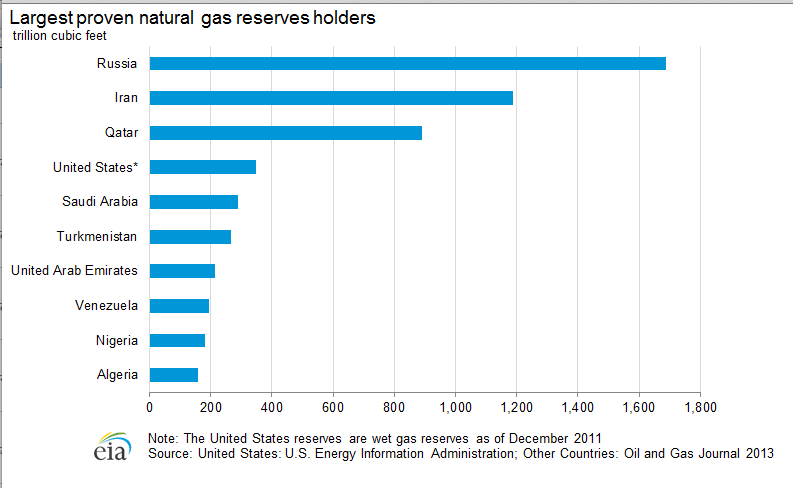

So Russia is the second-largest producer of dry natural gas (and holds the world’s largest natural gas reserves).

So Russia is the second-largest producer of dry natural gas (and holds the world’s largest natural gas reserves).

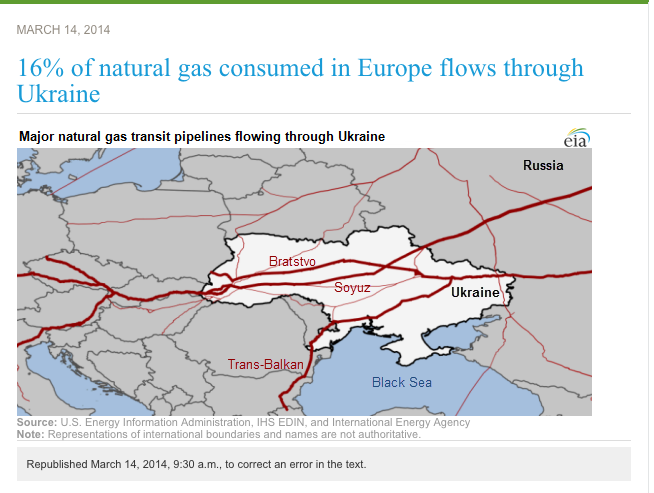

It is also the third largest liquid fuels producer in the world! And it is invested heavily in the pipeline transport of energy products… including two major pipelines that supply Western Europe!!

That (as you’ve probably heard) is one of the compelling reasons that Western Europe tolerates Putin’s acts of international aggression – Europe’s dependence upon Russian oil and gas. And take a guess with regard to the geographical route used by the two pipelines to which I referred above??

Yes… straight through the middle of Ukraine!!

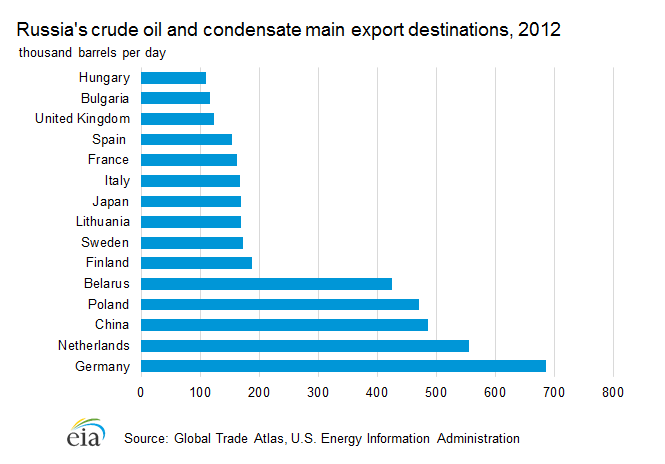

Here is a quick view on how much of Russia’s energy exports go to each nation: (Note especially Germany, Netherlands, and Poland):

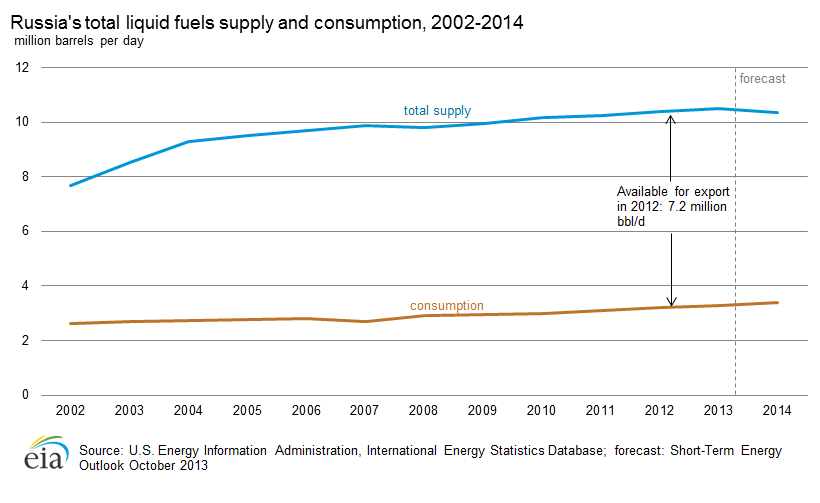

Here is a picture of how/why Russia is able to export so much of the energy products it churns out each year:

Therefore, Russia is one of the world’s largest energy exporters:

Therefore, Russia is one of the world’s largest energy exporters:

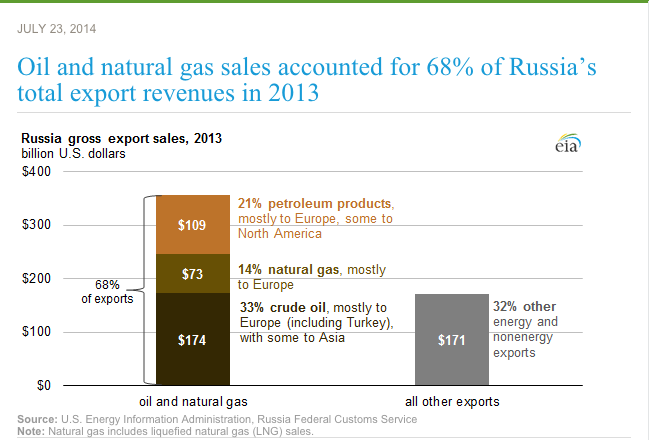

This chart shows that, as of the July 2014 report data, 68% of Russian exports are oil, natural gas, and petroleum products.

As you’ve seen, the collapse of oil prices has caused serious economic stress in Russia. However, that being said, there is a whole lot more going on within Russia that impacts Russian equities!

RUSSIAN CURRENCY AND FOREIGN EXCHANGE CREDIT POSITION

Wall Street remembers well the 1998 default on Russian debt. That default was prompted by a convergence of circumstances – including the Asian Financial Crisis and the resulting deep fall in demand for oil. That (of course) resulted in falling oil prices. Russia was also still trying to overcome the breakup of the old Soviet Union – which left Russia with the non-geographic assets of the USSR, but also imposed upon it the crushing debt of the U.S.S.R. (the perils of holding exorbitant levels of foreign-denominated debt). Add that to the challenge of holding a “pegged currency” (limiting its monetary sovereignty) and it was no wonder that Russia defaulted.

Consider the internal consequences for Russia in that period:

1) March of 1998, President Boris Yeltsin dismissed his entire Cabinet and Prime Minister Viktor Chernomyrdin… naming 35 year old Sergei Kiriyenko (former Energy Minister) as “acting” prime minister. Kiriyenko’s move to hike the rate on GKO bonds (as high as 150%) failed to save Russia from default – and he resigned by the fall of that year.

2) The government was unable to come up with any coherent plan to move the crisis toward resolution[4]… but perhaps the worst “black eye” in this troubled period was the revelation that as much as $5 billion in international loans provided through the IMF and World Bank had been stolen following the funds’ arrival just before the total meltdown!

All of that aside, the speed with which Russia recovered was astounding. Of course, the recovery had more to do with global grants, bailout funds, and a relatively quick recovery in oil demand than it did to any political/financial savvy on the part of Russian leaders. But it was, indeed, a rapid recovery.

Russia demonstrated increasing financial strength into the 21st Century… until the 2007-09 “Financial Crisis” cracked open in the U.S. and spread around the world. With the global financial infrastructure fractured, the Russian Ruble was collapsing vis-à-vis the U.S. Dollar, the Russian Central Bank was intervening in the foreign exchange market (big time), and interest rates were soaring (but no where near the 150% of 1998). According to a Pravda article by Nathan Lewis in November of 2008, the Central Bank struggled to “get it right” in stabilizing Russian finances. So Lewis detailed a strategy by which the bank could restore order.

In a recent article by Lewis that appeared in Forbes magazine (10/16/14), he observes that by February of 2009, the bank actually followed a strategy parallel to that suggested by Lewis in 2008: the bank used its intervention activities (sale of foreign currency) to shrink their monetary base by 22%! In accord with the principles we all learned in Economics 101, the lower monetary base resulted in a huge rebound in the Ruble… restoring stability!

So Russia has rebounded from two financial crises within the past 17 years. It now has a third crisis on its hands that springs directly from the collapse of oil prices and the resulting weakness in the Ruble:

On January 10th of this year, the Fitch Credit Rating Agency downgraded Russian debt from BBB to BBB-…. just one step above “Junk” status. Of course (as you’d expect), Russian officials are categorizing that rating change as “unfounded” and “politically motivated”.

Long before Fitch’s action, the Economic Development Minister for Russia (Alexei Ulyukayev) warned of such a step and described it as misleading because (at least at that time) Russia’s economic indicators were substantially better than they were in either 1998 or 2008! Therefore, Ulyukayev characterized any such a credit downgrade as just another politically motivated action on the part of Western leaders to chastise Russia. In the same vein, Vladimir Klimanov, who serves as Director of the Institute for Public Finance Reform, indicated to Pravda recently that: “I think that the political factor will act as the defining one in the activities of rating agencies.”

Whether politically motivated or not, Russia can be empirically categorized as much healthier financially today than it was in 1998 or 2008.

What follows is my best effort to accurately paraphrase a characterization by Ulyukayev of Russian finances that was published in October of 2014:

Agency credit ratings should focus upon “long-term solvency“… and on that basis… Russia does not have any problem.

“Solvency” is determined by a country's ability to pay its foreign and domestic debts. (In October) Russia's foreign debt is less than three percent of GDP, and the entire national debt is only eleven percent.

Therefore, Russia can repay its external debt in just one year. The draft budget for 2015-2017 has a meager deficit. In summary, Russia’s macroeconomic and financial structure is stable enough.

THREAT OF REMOVAL FROM THE MSCI EMERGING MARKET INDEX

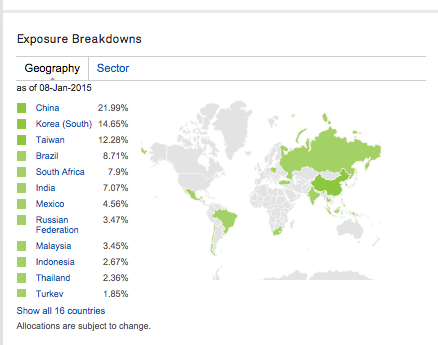

This is a vulnerability that most investors probably haven’t considered. However, the fact is that the arbiters of the MSCI Emerging Market Index (EEM) might feel pressure to remove Russia from its index if conditions deteriorate beyond a certain degree.[5] Here is a recent breakdown of the composition of that Index:

While it is true that Russian equities only comprise 3.5% of the index, the full negative impact upon Russian equities would not be so much a sale of EEM’s stake in Russia… but rather the perceptual fear of imminent calamity that investors would undoubtedly feel in the event that Russian equities were dropped by the MSCI Index!

This may not be an overwhelming risk… but it is definitely a risk of which any investor needs to be aware!

INVESTOR TAKEAWAY:

As Baron Rothschild famously said:

“The time to buy is when there's blood in the streets.”

In much the same spirit, our own 21st Century Oracle (Warren Buffett) has opined as follows:

“The best thing that happens to us is when a great company gets into temporary trouble…We want to buy them when they're on the operating table.” (1999: Businessweek)

“Investors should remember that excitement and expenses are their enemies. And if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful.” (Berkshire Hathaway “2004 Letter to Shareholders”)

When the stock of a company tanks by almost 50% within 12 months, it behooves an investor to study closely why it collapsed and consider the possibility of that company “rising from the ashes” the following year. The same principle applies to an ETF, and that is the very reason we have taken this deep look into Russian equities and the RSX ETF!

What have we discovered?

1) Vladimir Putin, for all of his gutsy Real Politik in an era of “Neville Chamberlain like” Western leaders, poses a risk for Russian equities. As we saw early on in 2014, even without getting Russia into a “hot war”, Putin’s foreign policy exploits can diminish the appeal of Russian equities in the range of 20%.

2) The price of oil and natural gas has an outsized impact on the Russian economy because 68% of its exports have been energy-related.

3) Wall Street becomes especially cautious about Russian finances because of the 1998 and 2008 crises. However, Russia is in a much stronger financial position today than it was prior to either of the earlier crises. If the Central Bank is willing to swim “upstream” vis-à-vis the Fed, ECB, and Bank of Japan[6] by actually shrinking money supply (temporarily)… the Ruble should regain value as it did in early 2009. Meanwhile, foreign debt and foreign reserves are in relatively solid condition.

4) If Russia can avoid “Junk Bond” status and escape being removed (however temporarily) from the MSCI Emerging Market Index, it will thereby sidestep two significant risks to further price deterioration.

So from an existential, trading perspective, what could all of this mean for an investor who gets intrigued by “Bottom Fishing” possibilities?

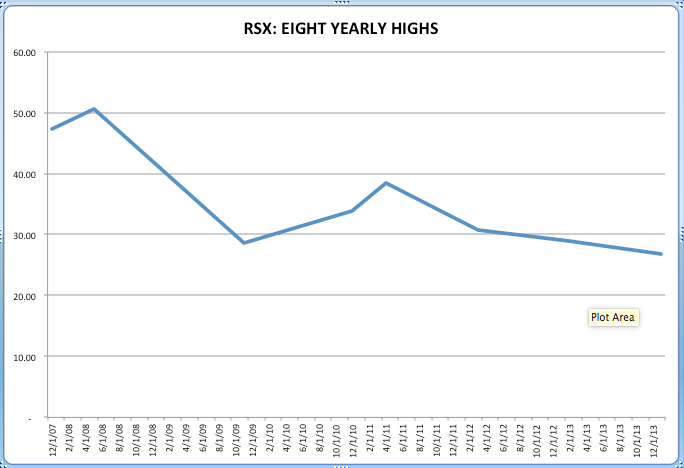

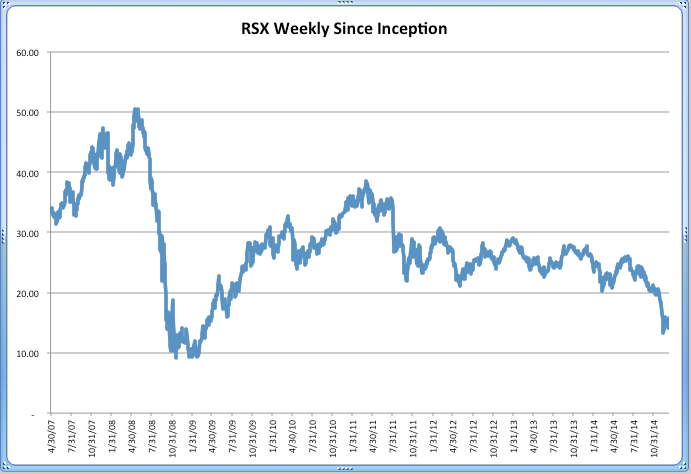

First of all, let me be crystal clear on one basic point. Russian equities and RSX should (in my opinion) never[7] be considered as a “buy and hold” investment! To illustrate this, I downloaded all of the “Adjusted Daily Closing Prices”[8] of RSX since its inception in 2007. Then I downloaded weekly adjusted prices and graphed the result:

There are three powerful points that become obvious from this graph:

1) We are rapidly approaching an area that represents an “all time low”;

2) The recovery from the 2008 crisis was spectacular… a nearly 300% return;

3) Other than that recovery, the “trend line” on RSX has demonstrated a downward slope.

That third point is highlighted by the following graph of the annual highs of RSX since inception:

This is a very simple view of the "big picture" trend in RSX... showing for each year from 2007 to present the highest "Adjusted Closing Price" of that year.

So if one accepts the axiom that any purchase of RSX should be on the basis of a day trade, a swing trade, or a “secular recovery” trade (example, a recovery in oil prices)… then decisions regarding RSX boil down to:

1) When does one think that oil prices have nearly bottomed (there is presumed support around $45/barrel)?

2) What strategy do you prefer: i) stock purchase and/or covered call; ii) option purchase; or iii) debit spread; or d) credit spread.

a) If you asked me (and you shouldn’t) I would opine that an intermediate term stock purchase or coverall call…. or a credit spread… would be preferable because I do not favor risking option premium decay on a security such as RSX.

3) Are you willing to invest in a country run by the sly, ambitious, risk-taking egomaniac that is Vladimir Putin. (At a low enough price, I would be so willing.) It is certainly a fascinating study to watch a short, 21st century politician, stuck in the KGB mold and mindset, applying diplomatic principles learned from Adolf Hitler, in an attempt to recapture the glory that shown through a 17-18th century monarch – Peter the Great, who towered over everyone else of his era with his 6 foot eight inch stature!!

4) Given that the nominal monthly low of RSX in 2008 was around $10/share and the current (as of 1/12/15) swing low (12/16/14) was around $12.50/share… I would be looking for a position that could later be adjusted as needed… such as [NOTE: this is only an example offered for educational purposes… not in any way a trade recommendation]:

a) Buy a RSX covered call, using the March 17 C for a net price per 100 shares of stock of $13.90 (under today’s Bid/Ask spread).

b) Sell a March 14P/12P credit spread for $0.75 credit… over the current Bid/Ask spread.

The former is a significantly more conservative trade, especially since RSX offers (based on current data) a 4.5% dividend yield.[9]

Good luck… and no matter what you decide to do (or not do) I hope you have learned a few things along our “Bottom Fishing” journey.

DISCLOSURE:

The author does not currently own RSX. But I have a mental alert that will trigger at least one trade. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] The Union of Soviet Socialist Republics

[2] The incorporation of the Crimea into Ukraine was not completed during Stalin’s lifetime. Instead, it was completed by Stalin’s successor, Nikita Khrushchev, in 1954… during the 300th Anniversary of the Cossack request for imperial Russia’s protection against the Polish-Lithuanian commonwealth. It is worth noting that Khrushchev was Ukrainian!!

[3] Although strange, it is true that Denikin was a commander in the “White Army” – which battled the Bolsheviks following the 1917 revolution! It is therefore remarkable that he has grown into a current “Russian patriot”… and honored by a former KGB man through and through (Putin)!

[4] Reminds one of the US Congress.

[5] Such as if Russian debt is downgrade to “Junk” status.

[6][6] Who have been hyperactive in flooding their countries with “money supply”.

[7] Never ever ever ever!!!

[8] “Adjusted” for all dividends and stock splits during its existence.

[9] That is more likely to edge (or fall) down than it is to increase or remain the same… at least until oil begins an uptrend.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

3 Magnificent Stocks That Could Double or More by 2030

3 Magnificent Stocks That Could Double or More by 2030