If you have kids, or aren’t afraid to be one, you know about those teacup rides at various amusement parks. You spin around and go in circles, but you end up right where you started. If I ever get around to writing a book on high probability trade setups, this coming week probably won’t end up as a featured example. But, if I write one on teacup rides, it just may make the cover.

The sequester is due to kick in by the end of the week. Comments are being made about the likely effects that sound very similar to the Ghostbusters dialog with the Mayor in the movie of that name:

Dr. Peter Venkman: This city is headed for a disaster of biblical proportions.

Mayor: What do you mean, “biblical”?

Dr Ray Stantz: What he means is Old Testament, Mr. Mayor, real wrath of God type stuff.

Dr. Peter Venkman: Exactly.

Dr Ray Stantz: Fire and brimstone coming down from the skies! Rivers and seas boiling!

Dr. Egon Spengler: Forty years of darkness! Earthquakes, volcanoes…

Winston Zeddemore: The dead rising from the grave!

Dr. Peter Venkman: Human sacrifice, dogs and cats living together… mass hysteria!

Mayor: All right, all right! I get the point!

(Sarcasm warning) As we know, it didn’t really turn out that bad, especially if you like marshmallows.

So, pick a market direction and ask yourself if, right now, this is a high probability setup to trade in that direction.

It so happens many stocks are forming what may turn out to be high probability setups. If the sequester gets delayed or otherwise dealt with, these stocks could take off. The key point here is that a prudent trader or investor would patiently hold off on any new positions and watch for and identify high probability setups if and when they form. Then, when the external disruptions disappear, he or she would pick the best trades that match his or her goals and money management rules, and implement and manage the trades appropriately.

What would be a good example of a high probability setup?

Pick a sector that has been showing recent strength. It would especially help if there was a ‘seasonal’ aspect to that sector, a track record of gains in most past years. Then look at the top stocks in that sector. Pullbacks on declining volume to 50-day moving averages or previous support, followed by reversal days to the upside on increased volume, make high probability setups that professional traders look for.

For instance, the Oil stocks have been strong recently. Looking at the NYSE Arca Oil & Gas Index we see a nice 20% gain since last summer.

The XOI has pulled back recently. The above chart shows XOI has fallen from the top of its Bollinger Bands to the bottom, and is just above the 50-day MA (not shown). Past drops to the bottom of the bands have produced a reaction back to the top, or at least middle, of the bands. The Stochastics are also falling. If the signal line (the blue line above) falls below the 20 level, crosses the moving average (the brown line), rebounds above 20 and volume increases on the rebound, then you would have a bullish trade possibility offering higher probability.

Does this sector have a seasonality to it, to essentially give us a ‘tailwind’ on any trade we take?

Let’s consider the underlying commodity, the Crude Oil Futures contracts. Over the past 29 years, from late February through late September, crude futures have risen 12% on average. That has typically helped oil stocks.

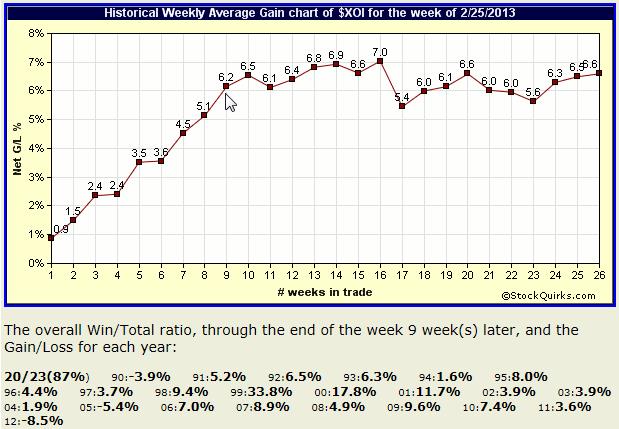

What about the XOI itself? Over the next 9 weeks, the XOI has produced an average 6.2% gain, with gains in 20 out of the past 23 years:

To trade a setup like this, if it forms, you should look at the top component stocks of the XOI. They currently are APC, BP, COP, CVX, HES, MRO, OXY, PBR, PSX, TOT, VLO, and XOM.

Investigate each one. Look for a high probability setup being formed, check the stock’s fundamentals, and look over past data and get a feel for any seasonality (how the stock has done over the next several weeks in past years). If you find something you like, a stop-loss just below the pivot low that is formed may offer a very high reward-to-risk trade.

Of course, there's much more you need to know and many more stocks you can capitalize upon each and every day. To find out more, type in www.markettamer.com/seasonal-forecaster

By Gregg Harris, Market Tamer Chief Technical Strategist

Copyright (C) 2013 Stock & Options Training LLC

Unless indicated otherwise, at the time of this writing, the author has no positions in any of the above-mentioned securities.

Gregg Harris is the Chief Technical Strategist at MarketTamer.com with extensive experience in the financial sector.

Gregg started out as an Engineer and brings a rigorous thinking to his financial research. Gregg's passion for finance resulted in the creation of a real-time quote system and his work has been featured nationally in publications, such as the Investment Guide magazine.

As an avid researcher, Gregg concentrates on leveraging what institutional and big money players are doing to move the market and create seasonal trend patterns. Using custom research tools, Gregg identifies stocks that are optimal for stock and options traders to exploit these trends and find the tailwinds that can propel stocks to levels that are hidden to the average trader.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why EHang Stock Is Gaining Altitude Today

Why EHang Stock Is Gaining Altitude Today