With the S&P 500 Index up about 25% over the prior twelve-month period, a number of investors are searching for sensible ways to diversify, without entering new positions in an over-baked “high flier” (eg. Tesla (TSLA)) or one of the more unfamiliar markets (such as some of the “Frontier Markets”: Qatar, Bangladesh, Bahrain, Oman, Tunisia, etc.). I think I have a very viable investment option to outline for you – one that may even surprise some (or many) of you!

Take a good look at this chart:

The blue color represents the S&P 500 Index. We know the S&P has had a fabulous run. But my proposed “option to consider” (in red) has “left the S&P in its dust”!! No, as I promised, this stock is not TSLA, Solar City (SCTY), or even Netflix (NFLX). It is the ETF of a nation that has, since 2008, been unflatteringly (and unfairly) lumped in with the southern European countries whose profligate spending (more accurately, borrowing) has provided a nearly infinite amount of “news material” for the financial press since the financial crisis began![1] Of course, I am referring to the now infamous acronym “PIIGS”.

The southern Europe members of the “PIIGS” are Portugal, Italy, Greece (the “grand daddy” of unaffordable sovereign debt), and Spain. The “lumped in” component of this often-maligned group is the little island nation just west of England: The Republic of Ireland (obviously, the second “I”).

Very quietly (because that is fine with them), Ireland has been lifting itself out of the hole precipitated by the U.S. Financial Crash and the extraordinarily severe contraction in credit that accompanied it.

Just what damage did the U.S.-induced financial crisis wreak on Ireland?[2] Consider the following:

Just what damage did the U.S.-induced financial crisis wreak on Ireland?[2] Consider the following:

1) Between 1995 and 2007, Ireland posted the highest growth rates in Europe;[3]

2) In the financial press, Ireland became known as the “Celtic Tiger” (“Tiger” references the typical descriptive word used to refer to a number of smaller, fast growing Asian economies of that period.[4])

3) A 2005 study by The Economist identified Ireland as offering the best quality of life in the world!

4) According to the World Bank’s “Ease of Doing Business Index”, Ireland ranks 15th.

a. Prior to the Financial Crisis, it ranked 7th.

b. An index created by the Wall Street Journal and the Heritage Foundation[5]had (in the past) ranked Ireland in 3rd place.

However, by 2007, there were some fundamental imbalances “flying under the radar” within the (up to then) high-flying Irish economy. It started with an already robust economy that then had a “new ingredient” added to its mix. When the Eurozone moved beyond economic and political union to actual “financial union”, borrowing rates in Ireland fell. Consequently, it became much easier, and seemingly advantageous, to borrow.[6]

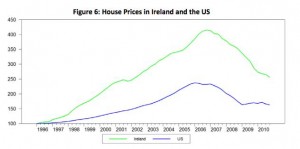

This (relative) “flood” of money started to seek potentially profitable avenues of investment – with the most appealing seeming to be property/real estate.[7] Any student of economics knows what happens when “easy money chases a limited supply of goods/property.” During the ten years ending 2007, property prices accelerated upward faster than in any other developed country in the world![8] As a very significant consequence of the ten-year “boom” in real estate, the Irish economy became heavily tilted toward the construction business – with capital flowing into that space and immigrants moving to Ireland (in droves) to fill construction jobs.

This (relative) “flood” of money started to seek potentially profitable avenues of investment – with the most appealing seeming to be property/real estate.[7] Any student of economics knows what happens when “easy money chases a limited supply of goods/property.” During the ten years ending 2007, property prices accelerated upward faster than in any other developed country in the world![8] As a very significant consequence of the ten-year “boom” in real estate, the Irish economy became heavily tilted toward the construction business – with capital flowing into that space and immigrants moving to Ireland (in droves) to fill construction jobs.

Then 2008 came, and with it came serious economic dislocation. After 24 years of continuous economic growth (on an annual level), Ireland entered into a recession – the first of the Euro nations to do so! Unfortunately, it was a recession “with a vengeance”. As money dried up (inter-bank lending collapsed) and the real estate bubble “burst”, unemployment rose sharply.

In retrospect, the biggest systemic issue impacting the economy was the banking system. As is so often the case in times of crisis, bank executives began to more closely resemble an ostrich than an effective leader! As liquidity disappeared in the Republic, unemployment rose (decreasing demand for real estate), and property developers saw their balance sheets collapse[9]. What did bankers do? They did all they could to delay admitting the truth! Irish banks had extremely substantial exposure to domestic real estate. The tragic irony is that the bankers had, during the prior ten years, enabled the excessive boom in real estate. It was the “open credit lines” from banks that enabled property developers to engage in property speculation – an economic activity that escalated far beyond objective measures of value.[10]

In retrospect, the biggest systemic issue impacting the economy was the banking system. As is so often the case in times of crisis, bank executives began to more closely resemble an ostrich than an effective leader! As liquidity disappeared in the Republic, unemployment rose (decreasing demand for real estate), and property developers saw their balance sheets collapse[9]. What did bankers do? They did all they could to delay admitting the truth! Irish banks had extremely substantial exposure to domestic real estate. The tragic irony is that the bankers had, during the prior ten years, enabled the excessive boom in real estate. It was the “open credit lines” from banks that enabled property developers to engage in property speculation – an economic activity that escalated far beyond objective measures of value.[10]

As a simple example, by 2007, agricultural land in Ireland posted an average value of 23,600 Euros ($32,000) per acre – several multiples above values for equivalent land elsewhere in Europe! Lending to builders and developers amounted to some 28% of all bank lending. According to Dr. Morgan Kelly of University College Dublin, this was[11]: “the approximate value of all public deposits with retail banks. Effectively, the Irish banking system has taken all its shareholders’ equity, with a substantial chunk of its depositors’ cash on top, and handed it over to builders and property speculators… By comparison, just before the Japanese bubble burst in late 1989, construction and property development had grown to a little over 25% of bank lending.”

As a simple example, by 2007, agricultural land in Ireland posted an average value of 23,600 Euros ($32,000) per acre – several multiples above values for equivalent land elsewhere in Europe! Lending to builders and developers amounted to some 28% of all bank lending. According to Dr. Morgan Kelly of University College Dublin, this was[11]: “the approximate value of all public deposits with retail banks. Effectively, the Irish banking system has taken all its shareholders’ equity, with a substantial chunk of its depositors’ cash on top, and handed it over to builders and property speculators… By comparison, just before the Japanese bubble burst in late 1989, construction and property development had grown to a little over 25% of bank lending.”

How did these bankers “avoid” facing reality? They utilized two major sources of “escape” from disaster and doom: 1) they continued to “enable” property developers by delaying the “calling in” of delinquent loans[12]and they (in many cases) loaned said developers the funds needed to remain “current” on the loans[13]; 2) In September (2008), the government declared a sovereign guarantee of all deposits, in hopes of preventing public panic and a “run on the banks.”

That gives you a very condensed view of “what happened and why” in Ireland during 2008. To flesh out the broad outline of what followed, here is a summary:

1) In 2009, unemployment reached the highest levels since records began. In addition, the following occurred:

a. The nation worked through salary cuts and tax increases without civil disobedience;

b. The Irish Stock Exchange hit a 14 year low;

c. The government nationalized Anglo Irish Bank, which by then had a market capitalization of less than 2% the peak it reached in 2007![14]

d. The government injected billions of Euros into Irish banks to prevent collapse.[15]

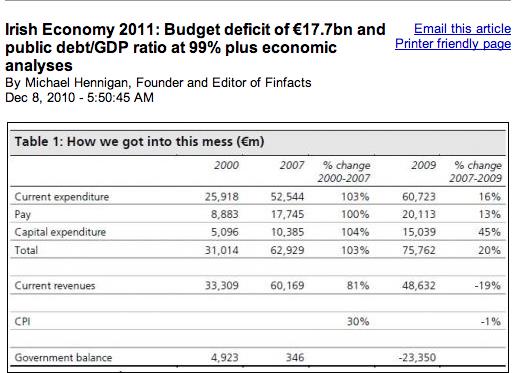

e. By the end of 2009, all doubt was erased about this being a temporary or short-lived crisis (consider the numbers in the following chart from Michael Hennigan at Finfacts. Note the drastic dislocations between expenditures and revenues by the end of 2009!):

2) In 2010, the crisis deepened:

2) In 2010, the crisis deepened:

a. The Irish Government pumped more funds into the ailing banks;

b. The Irish Government made an official request to the European Union (EU) for financial assistance.

c. A package of 85 billion Euros was granted, but conditioned on Ireland allowing its budget to be closely monitored by the Troika (the Euro Commission, ECB, and IMF) on a regular basis to ensure “financial conditions are met”.[16]

3) In 2011, Ireland’s debt rating was lowered to the “junk” level, and borrowing hikes rose to 15%.

a. In December of 2011, five new regulations and one new directive became officially effective throughout the EU.

b. These measures were designed to strengthen the EU’s “Stability and Growth Pact” (SGP), a pact to coordinate and safeguard national fiscal policies throughout the EU.[17]

c. Someone with a sense of humor persuaded the EU to refer to these measures (collectively) as the “Six-Pack”.[18]

The following point is offered out of chronological order, but it is essential for us to fully appreciate what I would describe as “the load heaped upon the Irish people and its government”! Now that you know the magnitude of the economic and financial crises that have come to Ireland since 2007, here is a real eye-opener (or “kicker”) for you:

At the height of the financial chaos in 2008, the European Central Bank forced the Republic of Ireland to assume 60 billion Euros of financial liabilities being held by five Irish banks. The reason was simple – to insulate the rest of Europe from a “chain reaction”.[19] According to Megan Greene from “Maverick Intelligence”, the more honest and detailed explanation for this requirement was: “German banks would have suffered massive damages if Ireland had done an Iceland and walked away.[20] The decision was a disaster for Ireland and the whole burden fell on the Irish people. There is a moral issue here.”[21]

If you combine proportionally unimaginable debt with economic challenges that seem to continually spiral downward, then you have captured what the Irish must have felt as “their lot” back in 2007-10. It is a condition and a feeling not too far off from describing what it might be like for a nation-state to be “buried alive”.

Despite all of this, the indomitable, indefatigable spirit of the Irish people never waned, never wallowed, never “walked away”. After all, this is the people who persevered through centuries of conquest, natural disaster, and oppression. They couldn’t be “conquered” by a mere mountain of debt, appalling unemployment, and steep economic barriers.[22]

However, their journey was trying! The Republic’s national budget for 2010 amounted to nearly one-third of the nation’s GDP![23] Beyond the woes that led to the nationalization of the Anglo-Irish Bank, the other two largest Irish banks had to weather the value of their common stock tumbling approximately 50% in one day.[24] Pulling the nation out of this intimidating morass would require steep, widespread budget cuts, increased taxes (of all types), and countless sacrifices at all levels – including the quality of the nation’s credit rating (decreased to “junk status”) and the political future of those in charge of the Republic during the Crisis (they were overwhelming defeated in the 2011 election).

Let’s return now to the beginning of this article where I pointed out the stock that has so handily outperformed the S&P 500 Index. After reading all of the above, it would be natural for you to be thinking: “How on earth has EIRL been outperforming anything after its businesses and country were buried under unimaginable economic hardship and debt?”

The answer can be summarized rather simply:

1) According to the BBC (and other sources) Ireland is on track to complete the repayment of its international bailout by December!

a. Republic of Ireland Prime Minister, Enda Kenny, announced the news with these words: “Tonight, I can confirm that Ireland is on track to exit the EU/IMF bailout on December 15th. And we won’t go back!”

b. She continued: “It won’t mean that our financial troubles are over. Yes, there are still fragile times ahead. There’s still a long way to go. But at last, the era of bailout will be no more. The economic emergency will be over.”

2) An important investment tenant that I learned from one advisor who was a “value player” is (to paraphrase) – Remember that a company does not need to solve all of its problems in order to become a good investment. Sometimes, all that is needed is for it to move from “really, really bad” to “less bad.”

Obviously, Ireland is the first Euro country to lift itself out of EU Emergency Aid.[25] As a very positive consequence of this notable feat, the Standard & Poor’s ratings service agency recently upgraded Irish credit from “stable” to “positive” – making credit more affordable and more readily available for the Republic. Global investors have clearly taken note of this good news as well – since the total assets committed to the managers of EIRL has (nearly) doubled since January 1st!

In Part II, I’ll lay out the foundations of a reasonable thesis regarding why investing in Ireland (through EIRL or otherwise) can make a great deal of sense!

INVESTOR TAKEAWAY: Some of you may wonder why I spent so much time and effort reviewing “history” – heaven knows that (in itself) knowing history will not produce trading profits for you! However (and a big “however” it is!) individuals much smarter than I am have pointed out that history is an irreplaceable source of insight. Consider George Santayana’s often misquoted statement: “Those who can not remember the past are condemned to repeat it.”[26]

So, what can we glean from this mini-history of the recent Irish Crisis?

1) A “bubble” is a bubble is a bubble, and it will pop at some point. Never believe the inevitable “hype” at the time a bubble is growing… usually some variation on the theme that “this time, it’s different!”

2) If you ignore that axiom, you can lose a lot of money.

3) A corollary to the above is – stay well balanced.

a. That was certainly a truth ignored by Irish bankers (and U.S. bankers!);

b. We must keep the asset allocation within our investment/trading accounts diversified (balanced) in accordance with whatever plan we have.

c. Being too heavily weighted in financials, technology, emerging markets, bonds, or high-beta stocks (or anything else) can really “hurt” your bottom line.

4) The best measure of a nation’s people (and its “spirit”) is how it handles crisis.

a. By that measure, the Irish have proven their mettle, particularly when compared with the countries often referred to as “Club Med” (because of geography): Greece, Italy, Spain, and Portugal (the“PIGS”).

5) Perhaps a controversial point (forgive me if you are offended) but this story also illustrates the power of banks in our modern world –

a. The power of banks to bring an economy down (Lehman Brothers, AIG, Anglo-Irish Bank, etc.);

b. The power of banks to exert their own best interests, even when the result holds dire consequences for a nation (Ireland, Cyprus).

c. We witnessed the power of German banks in this story.

d. Heaven knows that U.S. banks exercise their power at least as often.

6) The stock market is (at its best) an anticipatory mechanism.

a. As pointed out above, EIRL has become quite a magnet for money this year, not because Ireland is “out of the woods”, but because of the impressive trajectory of “progress” that Ireland has demonstrated!

b. Ireland’s economy has moved from being “very bad”, to “bad”, to “less bad”… and now, “hopeful”!

DISCLOSURE: The author does not currently own EIRL, but it is on his radar. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

[1] The stock (in red) highlighted in the chart above is the iShares MSCI Ireland Capped Index ETF (EIRL).

[2] The image to the left is that of the Dublin City Center.

[3] It is worth noting that one of the primary drivers of growth was a low corporate tax rate, recently as low as 12.5%.

[4] South Korea, Taiwan, Singapore, Hong Kong.

[5] Entitled “The Index of Economic Freedom”…

[6] Note in the image of the EURO that the Republic of Ireland flag is overlaid as its background.

[7] If only the Irish had known then what we know now!! But just as in trading, we can never allow ourselves to “get stuck” in our natural (inevitable) “If only” regrets about what is past. We must stay focused on what lies ahead!

[8] Dwell on that statistic for a moment. Many folks believed that U.S. real estate “bubbled” during this same period. Irish property prices moved higher/faster!

[9] Some eventually saw those balance sheets flip “upside down” – ie. liabilities far exceeded any reasonable estimate of assets.

[10] A captivating and telling visual of the term “housing bubble” can be found in the graph below – the trajectory of house prices in Ireland up to 2007 (compared with U.S. prices (the purple line).

[11] “Just How Sound is the Irish Banking System”

[12] The bankers feared bankrupting a considerable number of these developers, not to mention provoking increased depositor fear.

[13] Sparing the bank from the requirement of reporting said loans as “bad debt”!

[14] From that point, the bank “wound down” until it merged with the Irish Nationwide Building Society, thereby forming a new entity called the Irish Bank Resolution Corporation. At the time of the merger, the Irish Finance Minister (Michael Noonan) made a public statement explaining the import of the name change, which was intended to remove: “the negative international references associated with the appalling failings of both institutions and their previous managements!”

[15] Further, the National Asset Management Agency (NAMA) was established by the government to assume the role of “banker” for bad property debt.

[16] To be utterly fair to Ireland, it’s real estate issues were in no way unique. Across Europe, an aggregate amount of 4.5 trillion Euros was committed (just between 2008-11) to protect banks from collapse. That amount is equivalent to 37% of the annual GDP for the entire EU!

[17] One could view this as a “complement” to the ESM (European Stability Mechanism) – essentially the collective EU “bailout” fund.

[18] Make mine Guinness Stout, please!

[19] How did THAT work out for you, EU??

[20] Unique among nations, Iceland took a hard look at their financial burdens and how deep a “hole” had opened up in their national balance sheet, then decided to “walk away” and start over. That strategy actually worked out well for them.

[21] There is some truth in the semi-tongue-in-cheek statement sometimes made that German banks succeeded where Adolf Hitler failed – ie. the banks have extended German hegemony (albeit financial) across Europe. No matter how you personally feel about the “moral issue” raised by Ms. Greene, the German banks acted as if their attitude was: “Moral schmoral…. Show us the money!”

[22] Don’t forget that the Irish “saved civilization”! It sure did – just refer to Thomas Cahill’s book: http://www.amazon.com/How-Irish-Saved-Civilization-Irelands/dp/0385418493

[23] For perspective, if that same thing happened within the U.S. federal budget during any one year, the annual deficit for that year would amount to over $5 trillion!!

[24] Imagine if JP Morgan Chase (JPM) ever tumbled over $26 in one day!

[25] I wish I could “make book” on how long it will take the financial press to delete one “I” from the acronym “PIIGS”. The problem is that the press adores catchy acronyms and places much more value on “catchy” than it does on “true”.

[26] From Reason in Common Sense: The Life of Reason, Vol. 1… His statement is often linked with a similar insight from Edmund Burke: “Those who don’t know history are destined to repeat it.”

Related Posts

Also on Market Tamer…

Follow Us on Facebook

It's Official: President Trump Announces 10% Tariffs on Global Imports. 3 Things Investors Need to Know.

It's Official: President Trump Announces 10% Tariffs on Global Imports. 3 Things Investors Need to Know.