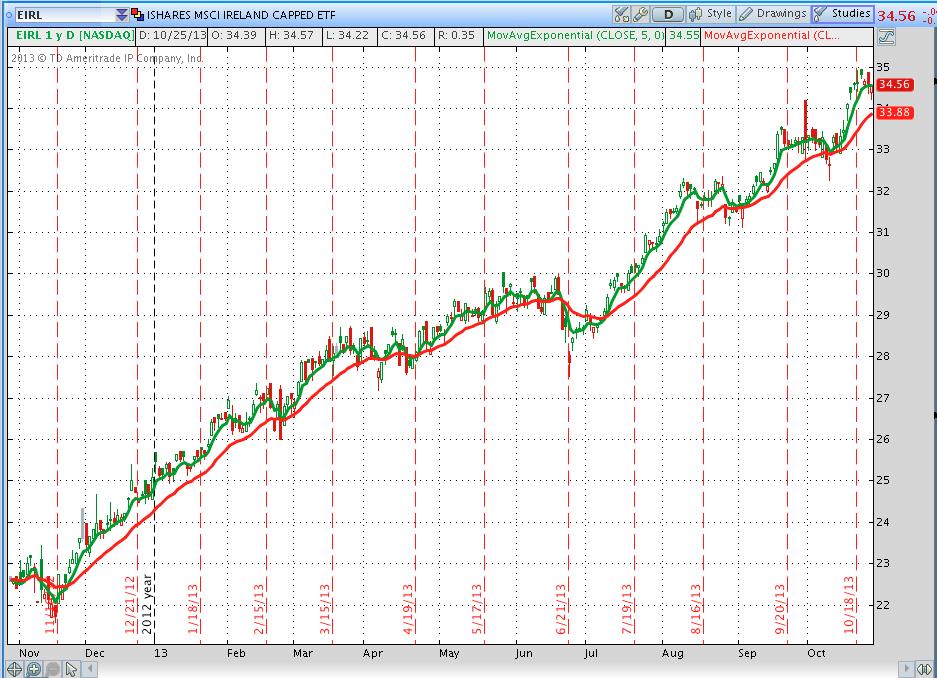

In Part I, we highlighted the chart below, contrasting the past twelve months performance of the S&P 500 Index with that of one particular single-nation ETF:

We know that the S&P has had a great year, so the outperformance seen in this chart (above) is quite impressive! Of course (as those who read Part I know) this particular single-nation ETF is iShares MSCI Ireland Capped Index ETF (EIRL).

Much of Part I provided a very condensed summary of what occurred within the Republic of Ireland during the first decade of the 21st Century that created the environment through which Ireland had to move, and from which a market “baseline” emerged. During the past 12 months, Irish stocks have been rising far above that very low “baseline” – thereby outperforming equities in other major developed markets. If you have not yet read Part I, I urge you to do so now, because what appears below will become much more meaningful!

Why would you want to invest in Ireland? Here in the United States, “turn around stories” have always been investment “darlings”.[1] Such stories tend to capture the imagination (and sometimes the hearts) of the average investor, and (more importantly) the nature of the stock market itself (as an “anticipatory” mechanism) lends itself to investing in companies with an upward trajectory of business, sales, earnings, etc. I can’t imagine anyone disagreeing with this premise.

So, since almost any “turn around” is an attractive investment story, let me ask you a question. Which is more impressive: a turn around within a major corporation or the turn around of a major developed country? As I imagine the answers you might submit in an online “instant poll”, I see that the majority of you indicate that a nation’s turn around is more impressive. I agree. In light of that, consider the following:

Ireland was a “high flyer” between 2000 and early 2007. Its economy was widely admired, and often likened to the little economic “giants” of Asia (Hong Kong, South Korea, Taiwan, and Singapore – the “Asian Tigers”) by being called the “Celtic Tiger”. Then, however, not only did Ireland’s economic engine fairly quickly lose steam, but it began to collapse under the weight of disappearing financial liquidity – which led to steep drops in property values, a crush of non-performing loans/mortgages (developers had become way over leveraged), escalating unemployment, and dangerously under capitalized banks. These forces (and others) combined in a disastrous synergy of economic stress (a true “snowball effect”) that was about as scary a scenario as even a novelist could have created.

At that point, the challenge before the Irish government and its people was more than daunting. The government was forced (by the Euro authorities) to assume the liabilities of the banks. Ireland soon had to request a huge bailout from the EU (European Union) and IMF (International Monetary Fund), international credit rating agencies reduced the nation’s bonds to “junk” status, and its borrowing costs skyrocketed. It would not be hyperbole to suggest that many folks considered Ireland to be “doomed”.

However, anyone who was familiar with the long course of Irish history knows that the Irish people have characteristics that are similar to the legendary “Phoenix”. [2] From its earliest conquest through numerous natural disasters (including the famous 19th Century “Potato Famine”) and economic crises, Ireland has always sprung back to life!

However, anyone who was familiar with the long course of Irish history knows that the Irish people have characteristics that are similar to the legendary “Phoenix”. [2] From its earliest conquest through numerous natural disasters (including the famous 19th Century “Potato Famine”) and economic crises, Ireland has always sprung back to life!

When faced with this 21st Century Crisis – a severely weakened economy, high unemployment, a mountainous national debt load and the need for a wholesale national “belt-tightening”… the Irish people did not bellyache, pontificate, prevaricate, or throw their hands up in despair. In sharp contrast with the other European members of the so-called PIIGS (Portugal, Italy, Greece, and Spain)[3] the Irish set themselves to work, determined to lift themselves out of the crisis. They made regular (and deep) cuts to the national budget and bore with higher taxes, increased fees, and multiple sacrifices. During this period of austerity, Ireland hit every major target (both debt reduction and economic metrics) and demonstrated slow but steady upward progress. The nation worked through salary cuts and tax increases without any civil disobedience. (In contrast with some “Club Med” nations.)

Ponder this description from an October 16th article:[4]

“To the extent that Ireland is recovering, this is because its people are formidably enterprising and have an ultra-open economy with a high enough trade gearing to withstand the combined shock of a fiscal squeeze equal to 19pc of GDP and a double-digit collapse of the money supply.”

As the Republic’s Prime Minister (Enda Kenny) proclaimed at his political party’s recent major gathering: “For our country, it has been a backbreaking time, but it had to be. Because it was clear that only radical action could save us from total ruin.”

Those sacrifices and that “backbreaking” effort are about to show astounding results. By December 15th, it is expected that Ireland’s debt to the EU/IMF will be paid in full! Investors who demonstrated faith in Ireland during the crisis by scooping up Irish debts and properties that had “bargain prices” on them during the 2008-2011 period have been richly rewarded. Prominent among these investors was Franklin Templeton! That firm made a fortune by purchase fully one-tenth of Ireland’s debt during the darkest days of the crisis.

These notable achievements have been recognized by the Standard & Poor’s debt rating agency, which raised its outlook on Ireland from “stable” to “positive”, with the debt rating of BBB+ (investment grade): “The outlook revision reflects our view that Ireland’s general government debt burden is likely to decline more rapidly, as a percentage of GDP, than we had previously expected. Ireland’s economic recovery is under way.”

Finally, one portion within the S&P outlook statement praised Ireland for the “strong consensus” among the country’s largest political parties in support of fiscal consolidation and reform! Does that remind you (by way of contrast) of any other country’s lack of consensus on fiscal matters? I think that Philip O’Sullivan, chief economist at NCB Stockbrokers, expressed the state of things quite well when he opined the following: “When you look at some of the cliff-hangers we have had in the rest of the periphery, Ireland has kept its head down and got on with it, and I think that has been recognized.” [5]

What are some reasons a company (or an investor) would want to commit capital to Ireland?

1) Fiscal Responsibility: the politicians in Ireland recognized the importance of a unified front in order to more quickly lift the country out of the pit created by the Financial Crisis;

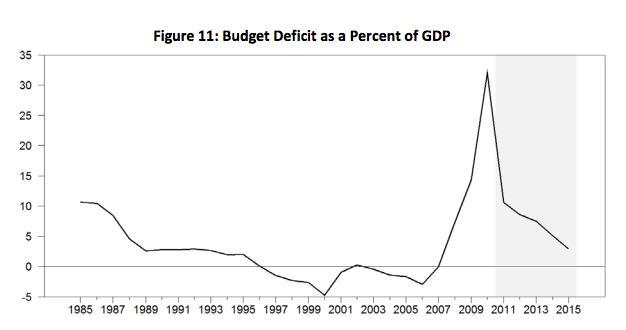

a. The annual budget deficit (that was as high as 33% of GDP in 2010) is now very securely below 7%.[6]

a. The annual budget deficit (that was as high as 33% of GDP in 2010) is now very securely below 7%.[6]

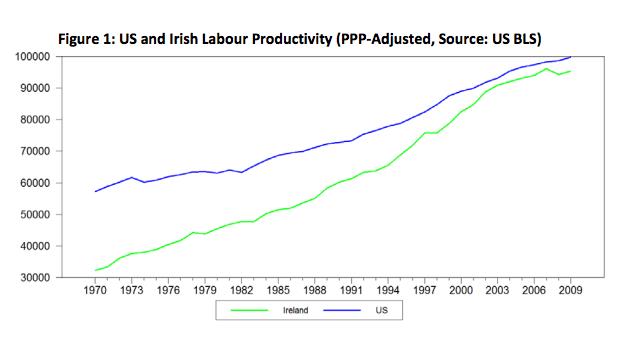

2) Labor Productivity:

a. Recently the CEO of Titan International, Inc. (headquartered in Quincy, IL) caused an international fuss when he described French laborers in very negative terms: (headline) “Titan CEO Scoffs at France’s Work Ethic and Its ‘So-Called Workers’”.[7]

b. There is no such problem in Ireland; take a look at the following graph of labor productivity:

i) In recent years, Ireland has been rapidly catching up with U.S. productivity (U.S. in blue; Ireland in lime green)

3) Business Climate

a. As we saw in Part I, Ireland is regularly rated as one of the most “business-friendly” economies in the world!

b. You’ll also recall that Ireland has a very “friendly” corporate tax rate (12.5%);[8]

c. You undoubtedly heard some “brouhaha” out of Washington, D.C. in recent months involving Ireland.

i. In exchange for international companies bringing plants or operations into Ireland and providing Irish folks with jobs – Ireland has had the temerity to grant said corporations very enticing tax breaks!

ii. Senators and Representatives in Congress were incensed at such boldness, and expressed their ire as often as they could find a microphone and camera – upset that U.S. corporations would do the economically sensible thing (and fulfill its fiduciary duty to shareholders) by building plants in Ireland for higher net profit.

d. Yes, Ireland is extremely business-friendly because it wants to provide jobs for its people![9]

e. In fact, according to Tax Notes, of all the world’s countries, Ireland is the most profitable country for U.S. corporations!

4) Strong Export Economy:

a. Even through the economic “crunch”, Ireland has benefited from an export economy more vibrant (relative to the national economy) than Portugal, Italy, Greece, or Spain.

i. An October 16th online article from the Telegraph Media Group Limited[10] offers an interesting statistical comparison of Irish export vitality:

1. Ireland’s exports of goods and services amount to 108% of GDP;

2. Comparable figures for PIGS are (descending order): Portugal 39% GDP; Spain 32% GDP; Italy 30% GDP; Greece 27% GDP.

b. Ireland has a “current account” surplus (2.3% of GDP).

c. That strength in exports is due largely to the efforts of Irish leaders 20-30 years ago to incentivize, enable, and push an expansion in the IT, pharmaceutical, and financial services spaces!

i. And that leads us to…

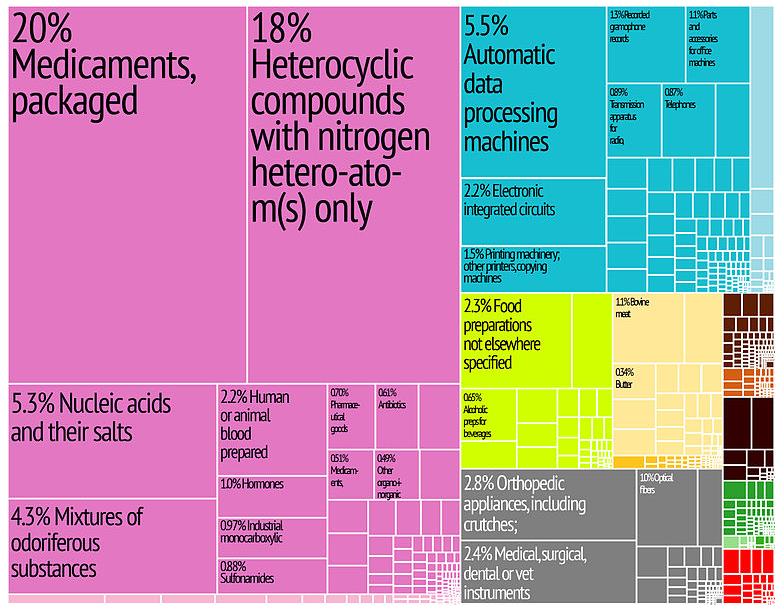

5) An Enticing Mix of Economic Activity and Strengths (see the graphic depiction of Irish industry below):

IMAGE (above): The biggest industry spaces are designated by the following shades:

IMAGE (above): The biggest industry spaces are designated by the following shades:

1) PURPLE: Medical Pharma, Fluids, and/or Substances;

2) TOURQUISE: IT

3) GRAY: Medical Equipment, Instruments, Devices.

4) LIME GREEN: Food and Food Prep related.

It is extremely significant to note that Ireland is home to 20 of the world’s top 30 Medical Technology companies!

6) Improving Internal Environment

a) It would be grossly misleading to suggest that “Everything is coming up roses” in Ireland;

b) However, there is no denying that things are getting better!

c) Consumer sentiment is on an upswing.

d) Many other metrics are showing a positive trajectory.

a. The GDP is on track for 3rd consecutive year of growth;

b. Exports forecast to grow by 2.3% in 2013;

c. Inflation is moving at a slower pace than in the rest of the EU… suggesting Ireland continues to become more competitive!

d. Unemployment has been falling for the past year.

e. Look at the following projections from the IMF regarding “Real GDP Growth”:

i. Many of you know that the trend of European securities has turned up this year!

ii. I note with much more that casual interest that the Presidency of the Council of European Union was filled for the first six months of this year by the Irish National Government![11]

iii. The goal for those six months (stated upfront) was: “run an efficient and cost-effective Presidency which would deliver real results.”

iv. The leadership did broker an agreement among Member States to increase European economic stability – dubbed the “Two Pack”.[12]

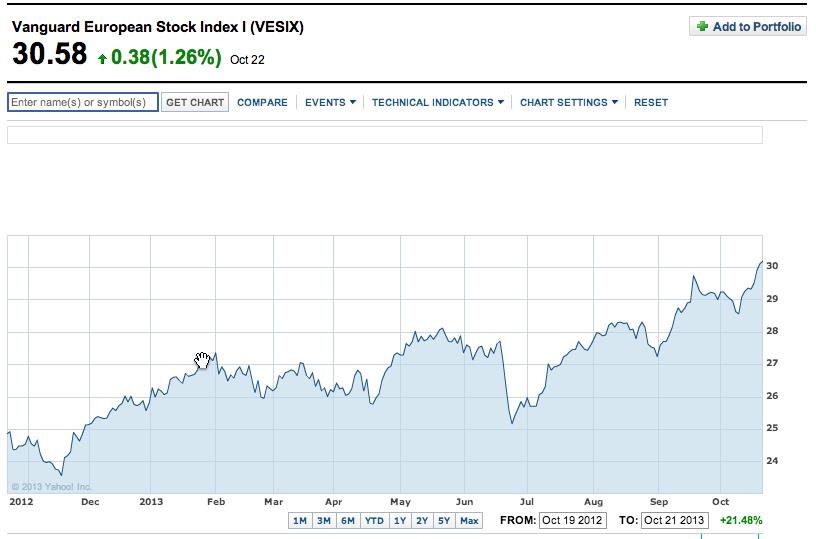

v. Surely the markets recognized that the European Union was under great leadership, which inspired confidence and spurred billions flowing into Euro stocks! (See graph below).

GRAPH (above): the Vanguard European Stock Index (VESIX) provides all the evidence I need to confirm my thesis regarding the power of “Irish Intangibles” to move markets upward!

b. Is there any possibility we can arrange for a six month “Irish/U.S. Exchange Program” – we get Ireland’s Premier and legislative leaders to sort things out here in the U.S., while the Irish pray real hard as President Obama and Congress work their own styles of magic in Ireland![13]

I trust that by now, I have effectively made my case regarding the virtues of Ireland, its people, and its economy. There is no question that Ireland holds the potential to once again become a “Celtic Tiger” – but (this time) without letting the economy become too focused within one economic space.

As just one corporate case in point, consider Covidien plc (COV) (“Positive Results for Life”) – a $10 billion global healthcare leader that has its world headquarters in Dublin, Ireland. The metrics on that company are so compelling (a combination of very strong competitive advantages, strong financials, and very positive projections of future growth, with the added bonus of being priced at less than fair value) that the Market Vectors Wide Moat ETF (MOAT) added Covidien to its portfolio during its recent September re-balancing.[14]

So let’s assume you are willing to consider an investment in EIRL. How would you discern an appropriate strategy for entry? That is an intriguing question. The first thing you need to know (and keep in mind) is that EIRL does not have any tradable options! That limits one’s trading alternatives a great deal.

Moving on, we can see from the Weekly Candlestick Graph of EIRL (below) that it has been on a relentless move upward since January:

Indicative of EIRL’s strength, you can see that it has spent a good deal of time moving above the upper Keltner Channel band (in the Daily Candlestick Graph). It just moved back down into the Keltner Channel at the end of this past week.

Finally, taking a look at the EIRL Daily Candlestick Graph (below), with the 5-day Exponential Moving Average (green) and 20-day Exponential Moving Average (red), we see that the ETF has fairly faithfully respected the 20-day EMA as strong support.

Based on the above, what strategies could you consider? Only you can (and should) decide! With that said, a reasonable person could choose any of the following strategies (or some combination thereof):

1) I am staying away from EIRL! Single-country ETFs are not diversified enough for me (and my portfolio). I’ll feel much more comfortable with a multi-national investment;

2) I will wait until the stock trades in between the mid-Keltner Channel line and the lower line; then I will start to build a position;

3) I will wait for the stock to approach the 20-day EMA, then I will start to establish a position. I will simultaneously place a stop order below my purchase price based upon either or both of the following—the price at which I see the next support level; the price at which my loss on the trade would exceed my normal trading rules;

4) I will choose to trade in and out of EIRL — based on Keltner Channel levels and/or moving averages; I am not intent on “building a position”;

Here are a few other thoughts to keep in mind:

1) Given the relatively low cost of commissions, one could choose to “dollar cost average” by buying some relatively low (but identical) number of shares based upon some consistent interval of time;

2) You could do an internet search and find one or more ETFs with attractive Irish stocks included in the portfolio – thereby providing you with a “play” on Ireland and its economy while enjoying greater diversification than available through EIRL.

a. Keep in mind that MOAT itself has 5% of assets invested in Ireland.

b. It is not impossible that some medical (or med tech) ETFs (or mutual funds) include a number of the firms that call Ireland their “home”.

Whatever you decide, I hope you found this look at Ireland and EIRL interesting, thought provoking, and informative! Adapting a thought usually found in much different contexts, I hope we can all agree that the modern, 21st Century Ireland isn’t “Your Great Granddaddy’s Ireland” anymore!

INVESTOR TAKEAWAY: What can we glean from this brief account of the recent Irish Crisis and its impact upon the current Irish economy:

1) A “bubble” is a bubble is a bubble, and it will pop at some point. Never believe the inevitable “hype” at the time a bubble is growing… usually some variation on the theme that “this time, it’s different!”

2) If you ignore that axiom, you can lose a lot of money.

3) A corollary to the above is – stay well balanced.

a. That was certainly a truth ignored by Irish bankers (and U.S. bankers!);

b. We must keep the asset allocation within our investment/trading accounts diversified (balanced) in accordance with whatever plan we have.

c. Being too heavily weighted in financials, technology, emerging markets, bonds, or high-beta stocks (or anything else) can really “hurt” your bottom line.

4) The best measure of a nation’s people (and its “spirit”) is how it handles crisis.

a. By that measure, the Irish have proven their mettle, particularly when compared with the countries often referred to as “Club Med” (because of geography): Greece, Italy, Spain, and Portugal (the“PIGS”).

5) Perhaps a controversial point (forgive me if you are offended) but this story also illustrates the power of banks in our modern world –

a. The power of banks to bring an economy down (Lehman Brothers, AIG, Anglo-Irish Bank, etc.);

b. The power of banks to exert their own best interests, even when the result holds dire consequences for a nation (Ireland, Cyprus).

c. We witnessed the power of German banks in this story.

d. Heaven knows that U.S. banks exercise their power at least as often.

6) The stock market is (at its best) an anticipatory mechanism.

a. As pointed out above, EIRL has become quite a magnet for money this year, not because Ireland is “out of the woods”, but because of the impressive trajectory of “progress” that Ireland has demonstrated!

b. Ireland’s economy has moved from being “very bad”, to “bad”, to “less bad”… and now, “hopeful”! (I would call it “very hopeful”.)

7) A nation’s political leaders can, and should, look far beyond partisan politics when its people are confronted by crisis;

a. Irish parties have “buried hatchets” enough during the past few years to significantly enhance a “smoother path” toward Ireland’s emergence from its economic purgatory;

b. “Reality” means that, as the last dime of EU lending is repaid, the parties will feel some level of release (or “relief”) from its more normal style of partisan politics;

c. One wonders if current members of the two parties within the U.S. could actually pass any legislation with any truly effective (and growth oriented) economic impact;

i. It appears to many that the only skill that each party has honed to perfection is appearing before a camera and creating a sound bite.[15]

8) A dynamic partnership between industry and government can foster, over time, an environment within which new businesses (and an abundant stream of jobs) can be attracted, planted, nurtured, and blossom.

a. It is that partnership that has led to the high level of medical-related industry concerns we now see in Ireland, including Covidien;

b. It is that partnership that helps make Ireland the most profitable world country for U.S. corporations;

c. It is that partnership (or the incredible results therefrom) that has leaders in Washington, D.C. fuming – because U.S. leaders recognize the several ways in which Ireland has succeeded while they have (at best) fallen flat.

9) Finally, all hyperbole aside, we should never ever discount the “intangibles” that can be discerned within and among a people – a people such as the Irish.

a. Personally, I’ll take a pass on “Club Med” and entrust my money (instead) to the promise inherent within the future of Ireland.

DISCLOSURE: The author does not currently own EIRL, but it is high on his radar. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

Submitted by Thomas Petty MBA CFP

[1] Of course, the real underlying reason for “turn around” stocks being good performers is that stock brokers can never get enough of such “easily sold” stories, and the financial press regularly latches on to “catchy” tales they can create from such stories because of the innumerable images, upward sloping graphs, and “human interest” stories that emerge and “play well” to viewers/subscribers.

[2] Mythology tells the story of an immortal bird (“Phoenix”) that rises from the ashes of its predecessor. The image provided above comes from www.betterlivingthroughbeowulf.com

[3] I prefer referring to these particular nations as “Club Med” because of geography and the frequent sense one gets from their bellyaching that they feel somehow “entitled” to “skate” regarding their huge debt loads.

[4] http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/10384297/Europes-debt-crisis-credibility-hangs-on-thin-Irish-thread.html

[5] The German Finance Minister, Wolfgang Schaeuble, did not offer anything remotely resembling the flowery praise of O’Sullivan or the S&P folks, but at least he offered an acknowledgement in the form of: “Ireland did what Ireland had to do and now everything is fine.” [“Jetzt ist alles in Ordnung!”]

[6] One of my most recent sources reported that the budget deficit in the new year could fall below the 5.1% target!

[7] http://www.huffingtonpost.com/2013/02/20/titan-ceo-french-workers_n_2723996.html

The CEO reportedly said: “The French workforce gets paid high wages but works only three hours. They get one hour for breaks and lunch, talk for three and work for three. I told this to the French union workers to their faces. They told me that's the French way!”

[8] The 12.5% rate was reported in the U.S. Tax Journal, Tax Notes.

[9] Evidently, Congress believes the world should “play fair” and try to create jobs the same way the White House and Congress likes to do it – by systematically increasing regulations, raising taxes, and siphoning a growing share of national resources from the private sector into government. And don’t forget the brilliant tactic of extending big loans to troubled solar companies, playing the loans up in the press as “job creators”, and then watching said companies go bankrupt, fire everyone, and never pay back the loans!

[10] http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/10384297/Europes-debt-crisis-credibility-hangs-on-thin-Irish-thread.html

[11] See http://en.wikipedia.org/wiki/Presidency_of_the_Council_of_the_European_Union. It sounds bizarre, but it is true. This “Presidency” is not held by an individual, but by a government.

[12] An obvious complement to the “Six Pack” described earlier.

[13] What’s the worse that could happen? Obama already has the Irish moniker; and the Irish have managed to recover from economic disaster. How much trouble could our leaders cause in just 6 months??

[14] I provided full details in this space earlier this month!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

We're About to Find Out the Answer to Warren Buffett's Pointed Question About Trump's Tariffs. Here Are 3 Stocks to Buy Depending on What That Answer Is.

We're About to Find Out the Answer to Warren Buffett's Pointed Question About Trump's Tariffs. Here Are 3 Stocks to Buy Depending on What That Answer Is.