September 18th, 2013, will be “writ” a bit larger in the annals of Wall Street than other days in recent financial history! That was the day that, according to most of the financial press, and many pundits, the Federal Reserve Board “pulled a fast one” because it didn’t actually “do” what “everyone” knew the Fed had said they were going to do!

Of course, I refer to the “September asset purchase Taper” that was first broached during Fed Chair, Ben Bernanke’s, May Congressional testimony (when that way too familiar term[1] first crossed his lips) and grew in grave weightiness and frequency of media focus from the June Fed meeting onward into September – reaching a fever pitch by mid-month.

Because of a family obligation to which I was firmly committed on the 18th, between early afternoon and late evening I was stuck driving from South Florida to Alabama. So as you would expect, even though I normally avoid CNBC and Bloomberg, my satellite radio was laser-focused on those stations for the entire time. What follows is my attempt to make sense of the events and reactions of that day!

As I searched for an overriding framework through which to tie things together – I kept circling back to Act I of William Shakespeare’s immortal play, “Hamlet” – with particular reference to Scenes II and IV[2]. In that play, and in those scenes, “appearance” and “reality” become extremely muddled – an uncle suddenly becomes a father in order to become the king, even though (in accord with the mores of that day) it was forbidden for him to marry the queen; the son (prince) is thoroughly depressed because so many of the things he counted on to be true now seem to have been an illusion; and a ghost appears (the biological father of said prince) raising all sorts of issues regarding how one lifts a ghost out of purgatory; etc.! [I could go on, but you get the point.] It is when the ghost beckons to Hamlet in a grim way, while his friends are looking on, that Marcellus delivers today’s apropos summary: “Something is rotten in the state of Denmark!”

On September 18th, a seemingly preponderant portion of the financial press, and a whole lot of savvy investors, were caught “short”[3]. Such was the “spirit” of that day and that event that Reuters led off its lead story about the Fed meeting with this bold characterization: “The U.S. Federal Reserve defied investor expectations on Wednesday by postponing the start of the wind down of its massive monetary stimulus.” Feel the “heat” of that description: “defied!” That quickly gripped my attention because I was not aware that the Fed’s charter required it to comply with investor expectation! Imagine the chaotic economy we would have if that was (actually) the case.

According to a Reuters poll in early September, 13 out of 18 of Wall Street’s “primary bond dealers” (the folks who should know the Fed the best) expected the Fed to begin tapering its asset purchases during September! That is almost three-quarters of them! Adding to the general shock/frustration of the Fed decision, hundreds of pundits and commentators had been on record as strongly expecting some level (however small) of Fed “tapering”. In fact, one of our most often quoted investment personalities, Pimco Chief Executive Mohamed El-Erian, was quoted Monday on CNBC that he expected the Fed would reduce asset purchases by $10 to 15 billion, adding that the forward guidance it provided would afford it “quite a bit of wiggle room” in future months.[4]

Of course, as we now know, the Fed decided to maintain its current pace of monthly purchases – buying $40 billion of U.S. mortgage-backed securities and $45 billion of longer-term Treasury securities. After Chair Bernanke completed the Fed’s statement, he was questioned for quite some time by what sounded (to me) as much like a pack of hungry wolves desirous of a piece of his backside as anything else. Quite frankly, I was surprised by how impertinent so many of the questions were, many of them suggesting that the Fed deliberately misled investors. My favorite reply by Mr. Bernanke went something like this: “I don’t recall ever announcing that we would taper asset purchases in September, or any particular month, for that matter!” And Bernanke was absolutely correct!

In fact, in June and thereafter, Bernanke repeatedly took great pains to emphasize how firmly the Fed remained committed to being extremely accommodative for an extended period into the future – even hinting (on more than one occasion) that way too many people were underestimating the liquidity impact of the Fed’s commitment to a historically low Fed Funds rate for the long haul. He also provided fairly clear parameters regarding the key metrics being monitored relative to future asset purchase plans – namely, solid progress toward unemployment moving (sustainably) to 6.5% and inflation not exceeding 2.0 to 2.5%.

So what went wrong? There were two primary factors:

1) The “data” did not yet justify a change in Fed policy;

2) The “investment world” fell victim to a basic (and terribly common) flaw intrinsic in human communication.

On the first point, if you recall the articles I have written since the May “taper” incident, virtually all but one of those pieces have been quite skeptical regarding the strength of our current recovery. On more than one occasion, I have highlighted the underlying weaknesses inherent in the employment data over the past year – including the decline in “job participation levels” and the high percentage of lower-paying, part-time jobs[5]. In fact, I have never been convinced that the economy is sustainably strong enough to justify asset purchase reductions. “The data” just wasn’t there to justify a change! In fact, I held on to all my income-sensitive positions because I was confident the markets would “re-set” following Bernanke’s statement (and I reaped the benefit!).

The question you should ask me now is: “OK, hotshot. During the ‘Market Outlook’ webinar the night prior to the Fed announcement, why didn’t you publically share your conviction by typing all that into the “chat” – like you must have been burning to do?!”

The answer is one part of today’s “Investor Takeaway”. I kept quiet because: 1) I don’t handle being “publically wrong” very well; 2) After all, what were the odds that I would be correct while ¾’s of “primary dealers”, Mohamed El-Erian, and most CNBC talking heads would be wrong?… after all, most of them have their Wall Street B.S. degree!![6]

The “takeaway” here of course, is that it is not necessarily true that the B.S. degrees held by the “experts” will help them to “see things more clearly” than you or I do! At least some of the time, if you stay observant and focused, you can be at least be as “on target” as they are!

Regarding point two, recall several times when your spouse, child, parent, friend, or employee “absorbed” the words you spoke to them, but did not truly “hear” the message you were striving to covey to them. One specific example that springs to mind is public speaking. Years ago, I spoke publically at least twice a week – and it was a constant source of amazement to me to discover (hours or days later) what those present were convinced I had said, when in actual fact, I had shared a message quite different from that. That are countless ways to analyze the “why” or “how” of that phenomenon – but it comes down to how we each process and filter what we experience.

This really is not rocket science. Consider witnesses at an accident. Invariably, each witness “sees” that accident’s details differently – and therefore offers a slightly different account. That’s why we need courts of law. That is also why, if you listen to a news report regarding one event from several different news outlets, those reports may not always sound as though they actually refer to the same event!

Quite frankly, friends, the news folks sometimes just can’t help themselves. They get so worked up about a story and become so convinced that certain assumptions are “facts” that (in their own mind) they have surely identified “reality”.

As happened in this instance, when the news folks discover that supposed “reality” is merely “mis-perception”, the whole situation becomes as convoluted, confused, and complicated as the story of Hamlet. Making it worse, countless media players then begin (as they did on Thursday) blaming the whole matter on Bernanke and the Fed – with nary a finger pointed at themselves.[7]

Let’s look at the data since May’s first whisper of “taper”. First, there is the benchmark U.S. interest rate – the U.S. Treasury 10-year Bond Rate, so central for mortgage rates, consumer loans, prime rate lending, etc. We all know the Fed wants to foster a healthy housing market (hence “Operation Twist” and the current $40 billion in mortgage security monthly “buys”). Therefore, it should be no surprise to any objective observer that the following graph prompted concern within the Fed Board of Governors:

Between May 1st (1.61% rate midday) and the beginning of September (briefly moved about 3%) that key 10 year rate zoomed upward. That increase reflected an extraordinarily high rate of acceleration! As you can see, the rate almost doubled (about 83% higher) in just four months!

The impact of that rate escalation was felt (literally) throughout the U.S. economy and around the world:

1) Mortgage rates began edging higher;

2) Metrics on new housing permits and housing starts, which had been on something of a tear, began slowing;

3) Many interest sensitive stocks began tailing off (my portfolio began looking like the “Red River”);

4) Longer term fixed income funds and ETFs experienced price declines not seen since 1992, and (of course) weathered large fund outflows;

5) As Bernanke offered in some detail, Emerging Markets suffered mightily (when the U.S. suffers the sniffles, Emerging Markets can become racked by a serious cold):

a) iShares MSCI Emerging Markets ETF (EEM): was down almost 20% between January 2nd and June 24th, then recovered a bit before tanking again by August;

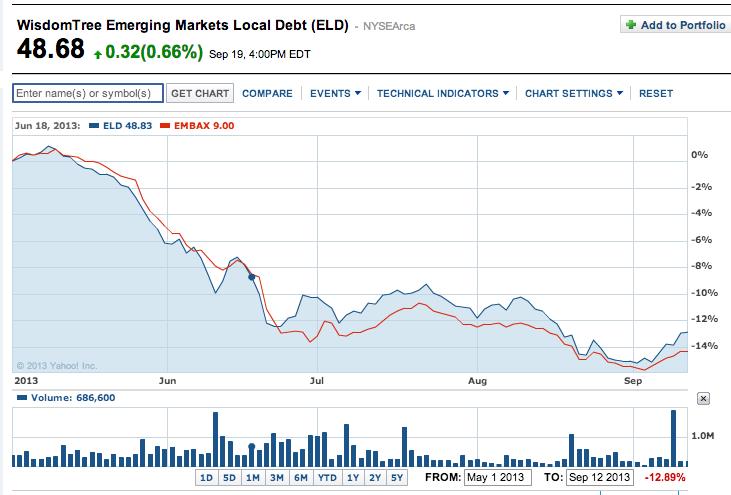

b) Emerging Market fixed income securities were particularly damaged by the interest rate stress in the United States. Each of the following Emerging Market bond ETF funds fell by over 16% in about four short months — WisdomTree Emerging Markets Local Debt Fund (ELD) and Van Eck Unconstrained Emerging Markets Bond Fund (EMBAX)

c) During this period of overall stress and strain, the iShares MSCI Brazil Capped ETF (EWZ) collapsed by over 28% in just about five and one-half months:

Finally, the Indian economy and its currency, the Rupee, were so rocked by developments in the U.S. (aggravating internal Indian economics) that the Rupee hit a new, historic low. Take a look:

Combine these significant concerns with the (self-evident) continuing weakness in U.S. employment growth, and then add the following:

Combine these significant concerns with the (self-evident) continuing weakness in U.S. employment growth, and then add the following:

1) A letter from the International Monetary Fund (IMF) expressing serious concern about the possible impact within the U.S. and other world economies if the Fed begins reducing asset purchases too soon or in too large a quantity;

2) The virtually inevitable damage that dysfunctional politics in Washington, D.C. will foist upon the U.S. economy in October (and thereafter) as politicians dig their heels in like truculent kindergarten children fighting over sandbox toys, rather than like the competent statespersons that used to roam the halls of Congress and the White House.[8]

- Perhaps we should force our politicians to retake Kindergarten Class!

- If that is not conceivable, we should at least force them to wear t-shirts emblazoned with the warning: “Runs with Scissors!”

One other factor that a couple of the more insightful commentators offered on Thursday was the focus that Ben Bernanke has always had on preserving the U.S. from deflation.[9] When one reflects upon how much “money” is floating around “out there” – it should be quite astounding that we do not yet see tangible signs of significant inflation.

That brings me to Dallas Federal Reserve President, Richard Fisher, whose outstanding summer speech (“Horseshift”) was the focus of an article in this space just weeks ago. At the end of that speech, Mr. Fisher highlighted the primary reason why we have so much money doing so little (ie. companies are “sitting on it”). There is so much government regulation, so many transitions currently swirling around us, and so many “uncertainties” facing the economy that companies have become extraordinarily wary and cautious. Something, somehow, needs to start changing that.

The other thing Fisher did in his speech was artfully articulate the only compelling reason I have yet read explaining why the Fed will, sooner than later, absolutely need to start reducing its asset purchases (and stabilize its balance sheet). In fact, on Wednesday, Blackrock CEO, Laurence Fink, expressed concern that, with the federal annual deficit shrinking a bit, the U.S. Treasury may start reducing the size of its bond issuance. At that point, the already sizable portion of our own debt that the Fed is buying each month would conceivably begin to approach 100%. That cannot be sustained.

Given all of the above, I do find it rather amazing that so many very bright investment people[10] were caught fully expecting the Fed to do that which just didn’t seem to make sense based on existing economic trends! In fact, the Fed even reduced its own “guidance” for U.S. economic growth during 2014!

Therefore, to paraphrase the words of Marcellus: “Something is rotten on Wall Street”. However, in my estimation, the “rotting” shouldn’t be attributed to Mr. Bernanke or the Fed—but rather to the financial press and Wall Street commentators that got lost in their own speculations! In fact, I think they became so lost that they were lulled into the conviction that what was merely their “perception” was certain to become “reality”.

Alas, as is often the case among humans, when it became clear they were “wrong” (very wrong) – they could neither face it nor accept it. Therefore, as is at the heart of the chaos in “Hamlet”, the characters involved have moved on to a concerted effort to explain how other perceptions are off-base while theirs is the one that is on target. We’ll just have to sit back and watch how that turns out!

INVESTOR TAKEAWAY: Everything we read and hear within the financial press should be received with skepticism. The simple fact is that each speaker has her/his own agenda, as well as limits upon the range and depth of his/her knowledge, experience, perception, understanding, and expertise.

For these reasons, the type of development we experienced on the 18th is not really that unusual. What was unusual is the magnitude of the financial stake tied to that statement and press conference, as well as the number of persons and reporters who were “watching” and reacting. If we approach future such events with a bit less certainty and more skepticism, and we ensure that our own risk management discipline is so firmly in place that whatever ensues from that event does not financially overwhelm us – we will have achieved something very positive, indeed!

Finally, as I pointed out earlier, just because we do not have the credentials or forum(s) enjoyed by the experts and talking heads to whom we expose ourselves regularly through the financial media, we are not therefore inevitably resigned to be wrong in our market view/expectations, while they are correct. In fact, I am sure that many of you were better prepared for September 18th than many of the professionals we hear from so often. Please never forget that!

DISCLOSURE: Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

[1] “Taper”

[2] See especially this insightful interpretation: http://www.shmoop.com/hamlet/act-1-scene-4-summary.html

[3] Figuratively and literally.

[4] “Wiggle room” regarding standing pat, decreasing, or increasing assets purchases in months to come.

[5] Each of these metrics was referred to by Bernanke on Wednesday!

[6] That refers, of course, to “Bachelor of Science in Investing Degree”. I’m not sure what you were thinking of!

[7] Evidently, most of them are incapable of considering the possibility that they “misread the data” or “jumped to conclusions.”

[8] Both the Federal Reserve and world economists continue to observe the importance of the Fed’s accommodative policy as a counterbalance to the “fiscal drags” caused by increased taxes and the Sequester.

[9] He wrote a dissertation on disinflation in the Depression.

[10] Complete with those degrees, don’t forget!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

3 High-Yield Stocks Beating the Market Slump That You Can Still Buy Hand Over Fist

3 High-Yield Stocks Beating the Market Slump That You Can Still Buy Hand Over Fist