This image from the Shanghai Airport could inspire us to ask: 1) How will JD.com fare in the rapidly growing Chinese e-commerce market; and 2) Is the Internet really "free" in China?

One of the many “tools” that the Alibaba Group IPO underwriting team is likely to use between now and August[1] in order to leverage the IPO price upward is to tell the story of the oversubscribed IPO of JD.com (JD) on May 22, 2014. JD.com, as most of you know, is the number two e-commerce company in China, and therefore an Alibaba competitor. As that IPO took shape, estimates of the initial offering price ranged between $16 and $18/share. However, during the standard IPO promotional period, the underwriters managed to coax the price up to $19/share.[2] The IPO is reported to have raised $1.8 billion (per Dealogic) for JD.com. Since the Alibaba IPO is widely projected to come in at a much larger $20 billion, it will be about 11 times the size of the JD.com IPO.

On the day of the IPO, trading opened at $21.75 and increased to as much as $22… before closing at $20.90 for a first day gain of about 10%! The Alibaba IPO underwriting team is sure to make mention of that fact! However, they are unlikely to qualify that first day gain by adding that (according to Dealogic) since 2000, the average first-day performance for U.S. IPOs that have raised more than $1 billion is 14%.

It will be helpful for you to know a bit more about JD.com (formerly known as 360Buy and/or Beijing Jingdong Century Trading Co., Ltd). Its founder is Liu Qiangdong, who has assured himself that no one can “get in his way” by presenting the IPO offering within a two-tier (“dual class”) share structure.

What are the details regarding “dual class” shares? LiuQiangdong has (conveniently) reserved 84% of the “voting power” on all Board decisions. No one can make any decision with which Liu does not agree; and if a proposal comes before the Board in his absence, action is postponed!

It is worth noting that, a few years ago, JD secured $2.2 billion in financial support from Saudi Prince Alwaleed Bin Talal (Kingdom Holding Company) and the Ontario Teachers Pension Plan.

”]

Perhaps the most significant fact that U.S. investors need to know about JD.com is that its fundamental business model is quite distinct from that of Alibaba! As we’ve read in my Alibaba articles, Alibaba serves (primarily) as an online link (broker) between sellers and buyers[3] who are interested in entering into transactions that are sealed via the Internet.[4] For Alibaba, “product inventory” is an irrelevant metric.

In sharp contrast, JD.com operates on a model much more similar to Amazon.com (AMZN) than to Alibaba. JD operates an online-direct sales model. This means that (largely) it buys products[5], inventories and stores them, and then sells those products to customers via the Internet.[6] Here is a sobering fact about that model: despite the fact that JD’s sales since 2009 have ballooned by a factor of 24, the company has failed to become profitable! The better news is that, during 2013, JD narrowed its annual loss from $277 million (2012) to just $8 million!

It is noteworthy that, with the IPO being offered at $19/share, the company was being valued at approximately $26 billion, or approximately 2.261 times its 2013 sales! By way of comparison (to offer perspective) AMZN trades at approximately 1.9 times last year’s sales.

An entirely natural question to ask at this point is: How will JD.com endeavor to gain a competitive edge vis-à-vis Alibaba. The answer is both simple and intriguing. In March, JD announced a major partnership with Asia’s largest Internet concern – Tencent Holdings, Ltd. (TCEHY). What are the terms of this partnership?

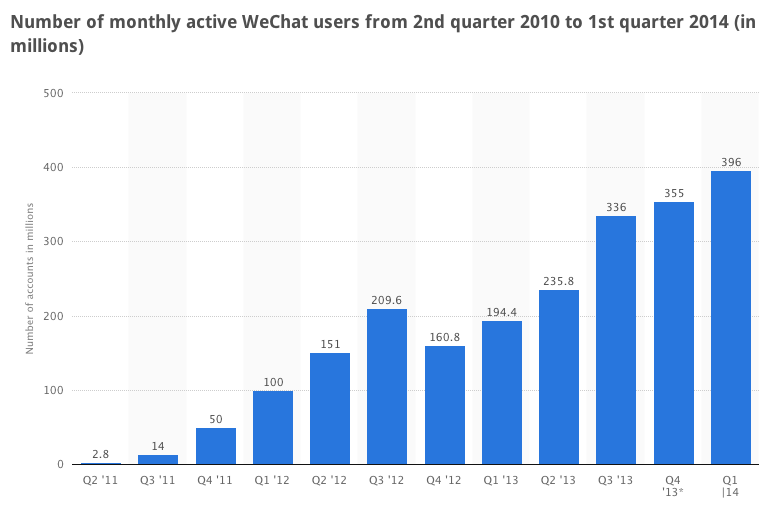

2) TCEHY agreed to integrate JD’s e-commerce sites into its WeChat messaging service – a social media platform that boasts almost 400 million active monthly users (the largest in China!).[8] That is expected to significantly boost traffic to JD’s Internet sites.

A relatively new development in China is the integration of payment systems within social media platforms. This integration makes the online shopping experience much easier and more convenient for those who use social media sites. In addition to this integration of JD sites within WeChat,TCEHY will promote JD e-commerce through its other popular social media site – QQ.

The number of users on WeChat continues to grow impressively. The additional traffic driven to JD.com from WeChat could provide it a huge boost.

3) Finally, the agreement grants JD complete control over TCEHY’s own e-commerce operations: Tencent Digital, Tencent E-commerce, Tencent Guangzhou, and Yixun Logistics. It goes without saying that this development gives JD access to a much wider e-Retail market!!

As was pointed out within the article that covers Alibaba valuation, JD and TCEHY have vowed to create a competitive advantage vis-à-vis Alibaba on the basis of: 1) Delivery (promising faster delivery)[9]; and/or 2) Service (promising superior “after sale service”)[10]. As you can guess, competitors have to position themselves vis-à-vis Alibaba on factors other than price, since Alibaba is the low-cost leader.[11]

The breadth of this new partnership between JD and TCEHY sounds dauntingly impressive. It remains to be seen, however, how that partnership will impact the future prospects and market share of Alibaba. After all, Alibaba remains (as I’ve emphasized) the low-cost leader (with, by far, the largest scale). In addition, Alibaba’s insightful leadership has hardly been idle within the social media space. It latched on to a share of Sina’s (SINA) micro-blogging site Weibo (its IPO came in April, and its stock trades under the ticker WB). WB is China’s second largest social media channel… boasting 66.6 million active daily users and 143.8 million monthly active users… bringing more potential customers into the Alibaba sphere of influence. In addition, WB allows Alibaba’s significant core of business clients an additional marketing opportunity. Alibaba integrates with WB’s location-based services and user search criteria, thereby enabling Alibaba merchants to utilize “targeted marketing.”

I am confident that Ma Yun (aka Jack Ma) and his Alibaba management team are quite aware that they will need to adjust and tweak their business model in response to the evolving dynamics of the e-commerce market in China. Obviously, two of the areas within which Alibaba will need to make some form of adjustment are delivery and service.

No matter what your biases might be about the “players” within Chinese e-commerce, it will be fascinating to watch how industry sales volume grows, the extent to which the Mobile channel gains ground vis-a-vis computer-based sales, and how the market share of each e-commerce player grows or ebbs. So grab your favorite beverage and take your own front row seat to witness how the “e-commerce fight” in China progresses. It is sure to be entertaining… and almost as sure to be a lot less predictable than Wall Street promoters would like us to think.[12]

INVESTOR TAKEAWAY:

I admit that, initially, I was skeptical of the efficacy of the new partnership between JD.com (JD) and Tencent (TCEHY). My impression is that the JD.com founder/CEO, Liu Qiangdong, is a self-centered, arrogant, materialist. After all, Forbes already listed him as being worth well over $10 billion earlier this year. Evidently, Qiangdong has more elaborate retirement plans because, in addition to the millions of shares in Jingdong he sold through the May IPO, the company board of directors set aside a “one-off bonus” that was paid through company shares. Following the May IPO, that bonus is now worth a cool $1.78 billion.[13]

However, all of that said, I must admit that the strategy employed by JD and TCEHY within the terms of their agreement makes a great deal of success, and may prove to be the only way to make progress in slowly unseating Alibaba from its extremely comfortable place at the very top of the Chinese e-commerce market! Therefore, it will be well worthwhile to periodically check on the future trends within the business-to-consumer and consumer-to-consumer e-commerce markets in China.

DISCLOSURE: I do not own JD.com stock, nor do I own Alibaba or TCEHY. I have not purchased anything through Taobao.com, TMall.com, or any of JD’s or TCEHY’s e-commerce sites. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] The projected IPO date

[2] If you are surprised, raise your hand. Ah, no one’s hand is raised!

[3] Whether they be businesses or consumers

[4] In that sense, its model is similar to that of eBay (EBAY)

[5] It buys from brands and manufacturers…

[6] Its infrastructure includes 86 warehouses, 1,620 delivery stations, and 214 pickup stations. Its prospectus noted that company costs for shipping, warehouse rent, and compensation jumped up 34% during 2013.

[7] Do the math, my friends. For $215 million, TCEHY received a 15% share of a company now (presumably) worth $26 billion… making that 15% worth $3.9 billion. I only wish JD had challenged me to come up with the $215 million purchase price; I would have found the money by hook or by crook!

[8] One of many frustrating aspects of research on Chinese companies is the frequency of (seeming) discrepancies in data points. For example, an article from Reuters at http://www.reuters.com/article/2014/03/10/us-jd-tencent-hldg-idUSBREA2902T20140310 reports this: “WeChat, known as Weixin in China, had 272 million monthly active users as of September and has quickly grown from a messaging app to a full-fledged platform, letting users play games, book taxis, make online payments and even invest in wealth management products.”

[9] JD has committed lots of capital to this effort, constructing a 16 million feet warehouse and hiring a very large core of scooter drivers trained to delivery goods as quickly as possible.

[10] The JD CEO is quoted in an interview about this: “The most appealing aspect of our company to investors is where we’ve focused our efforts over the last 10 years, on superior customer services. There will be an increasing number of [Chinese] consumers who will put a premium on superior service.”

[11] Competing with Alibaba on price would be as pointless as competing with Walmart (WMT) on price. By the way, Alibaba’s worldwide merchandise volumes lag only WMT!!

[12] Especially the ones who will be pumping the Alibaba between now and August.

[13] Remember that Qiangdong controls 84% of all company voting power, so the board action on the “bonus” must have come at his direction.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Investing $60,000 in These 3 Funds Could Generate Annual Income of Over $6,500

Investing $60,000 in These 3 Funds Could Generate Annual Income of Over $6,500