In Part I, we provided you with a thumbnail history of the restaurant chain, Darden Restaurants, Inc. (DRI). We also detailed some ways in which DRI has become an exceptional company. However, the two chains that have been the foundational anchors for DRI from the beginning (Red Lobster and Olive Garden) have seen their growth slow to a crawl… and even retreat a bit. And we summarized for you why Wall Street feels that this “slow growth” is a very significant issue that needs to be addressed and remedied soon. In this part, we will offer you a look at the plans being proposed to rejuvenate DRI stock!

In October of this year, Barington Capital Group, LP, released a letter it sent to DRI management on September 23rd, alerting the board that it held shares representing about 2% of the DRI stock float, and outlining the steps it felt DRI management needed to initiate in order to maximize shareholder value.

Just three months later (on 12/22), Starboard Value LP significantly increased the heat being brought to bear upon DRI management by announcing a 5.6% stake in the company and echoing the essential “shareholder value” plan announced by Barington earlier.

As it happens, the Starboard announcement came just one day after DRI announced its own “shareholder value” plan. So let’s compare and contrast these two plans![1]

THE DRI PLAN: DRI recognizes that Red Lobster has become a problem. It also recognizes that Red Lobster can most quickly and effectively turn current trends around if it is given the opportunity to offer laser focus upon its own unique market niche, cost pressures, and marketing needs. DRI also recognizes that the company needs to slow down its capital expenditures in order to improve its financial strength and avoid the need to pare its dividend. This latter point came in response to the action by the Standard & Poor’s credit agency – which placed DRI on “credit watch”.[2]

Therefore, the board and management of DRI announced that, by spring or summer of 2014, it plans to:

1) Sell Red Lobster or spin it off to shareholders (in a tax-free exchange);

2) Step up efforts to control costs;

3) Cease (at least temporarily) the expansion of Olive Garden and reduce current plans to create new Longhorn Steakhouse locations – thereby reducing capital expenditures by $100 million each year.

DRI believes that these efforts will result in additional value to shareholders (the Red Lobster sale or spin-off) and have the effect of increasing the valuation on the remaining DRI – since the fast growing chains will suddenly have a greater impact on the bottom line.[3] Here are excerpts from the CEO’s statement:

“Under industry conditions that remained weaker than we had hoped, LongHorn once again delivered competitively strong same-restaurant sales results and we had continued progress at Olive Garden on both an absolute basis and relative to casual dining benchmarks. Our Specialty Restaurant Group remained firmly on track as well. However, Red Lobster's results were well below our expectations. More importantly, it is increasingly clear that Red Lobster's competitive position and priorities have diverged in very significant ways from those of the rest of our business. The separation of Red Lobster and other changes we announced earlier today will better enable both Red Lobster and Darden excluding Red Lobster to take advantage of their distinct competitive circumstances and value creation opportunities. These are exciting steps forward that enhance our ability to create compelling long-term value for our shareholders.”

Assuming DRI can actually sell Red Lobster – how much could it realize from that sale? First, it is worth noting that experts appear to agree that, at almost $7 billion in market cap, a buyer for the entire DRI operation is unlikely. However, according to Stephen Anderson (a Miller Tabak analyst), Red Lobster is about the right size for a private equity (PE) firm purchase! In general, restaurant companies the size of Red Lobster command a price ranging between 0.5 and 1.5 times the trailing 12-month revenue figure. Any accompanying cash or debt prompts an adjustment to that price. Assuming that a PE firm would pay the revenue multiple of 1.0 – the sale price of Red Lobster would be approximately $2.6 billion. According to Anderson: “Private equity might come in to make some changes to the brand, look for increased efficiencies and close some unprofitable locations.”

Other experts say that DRI needs to revive the brand, stabilize sales/revenue, and reshape consumer perceptions of Red Lobster (ie. get consumers more energized about Red Lobster) before it sells the chain![4] As it is now, DRI would be selling an obviously depreciating asset and receive a significantly lower price than is justified by the strength of the chain’s brand identity and level of name recognition.

THE OUTSIDER PLAN: Not surprisingly, neither Barington nor Starboard Value considers the management plan to be either sufficient or appropriate. In the words of Barington CEO, James Mitarotonda: “We view the plan Darden announced today as incomplete and inadequate. The plan fails to address significant additional opportunities to enhance long-term shareholder value.”

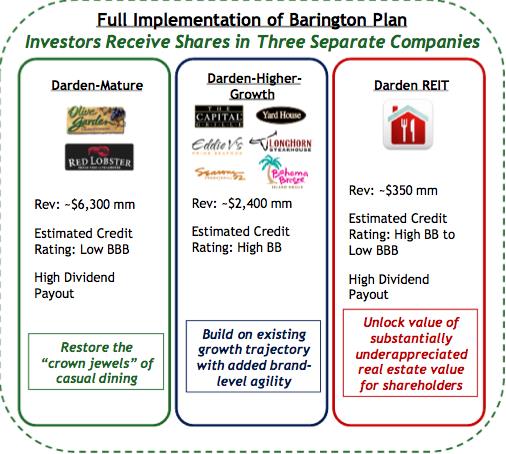

Mitarotunda and his team published a lengthy presentation regarding the details and rationale of its own plan for maximizing share value for all DRI stockholders.[5] The 84-page presentation makes Barington’s vision of an optimum future for DRI very clear. It says that the existing DRI (image to the left), should be restructured into three entities (image below):

Mitarotunda and his team published a lengthy presentation regarding the details and rationale of its own plan for maximizing share value for all DRI stockholders.[5] The 84-page presentation makes Barington’s vision of an optimum future for DRI very clear. It says that the existing DRI (image to the left), should be restructured into three entities (image below):

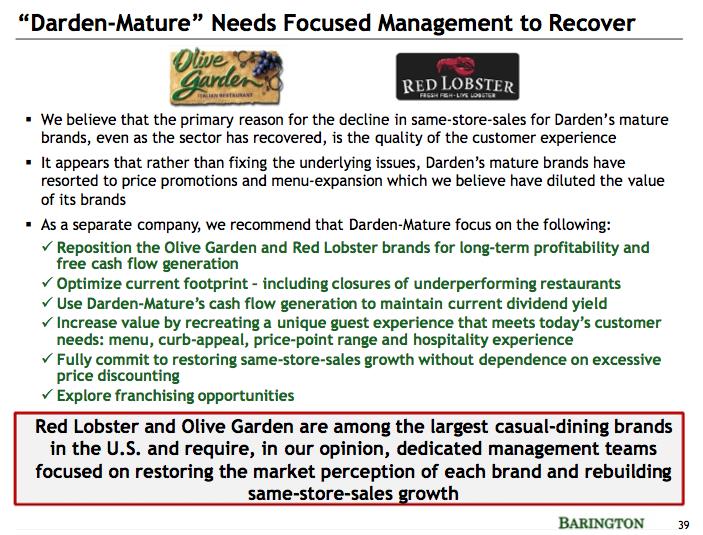

a) “Darden Mature”: Olive Garden and Red Lobster (about 72% of current restaurant revenue). [6]

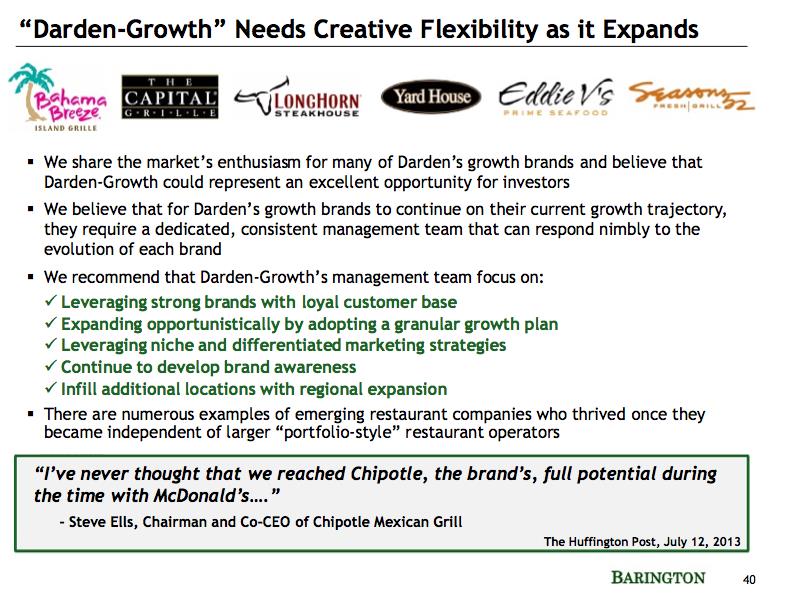

b) “Darden Higher Growth”: All the other chains, including Longhorn Steakhouse (altogether, those six brands account for about 28% of current restaurant revenue).

c) Darden REIT: an aggregation of all of the property held by DRI that houses the restaurant locations.

According to Barington, this restructuring (with spin-offs) would result in greatly improved operational performance because each company would be more narrowly focused. In particular, the separate real estate investment trust (REIT) would “unlock” the value of DRI’s properties, properties that it projects could be as valuable as $4 billion.

What is the bottom line of this plan in terms of shareholder value? In the opinion of Barington, this restructuring could lead to an increase in total shareholder value to a level approximating $80/share!

What is the bottom line of this plan in terms of shareholder value? In the opinion of Barington, this restructuring could lead to an increase in total shareholder value to a level approximating $80/share!

Here is a bit more of the key detail from Barington’s presentation:

Barington’s slide show goes to some pains to explain and justify the REIT portion of its plan, using comparable data from other situations. Barington then outlines why it thinks the properties held by DRI are worth as much as $4 billion. As you know, the REIT structure has been rather popular among a number of companies as a tool to “unlock” value. Barington provides a rationale for how the REIT option can unlock value by offering current examples of other companies that have utilized it. Specifically, Barington’s presentation includes one slide highlighting the example of Penn National (a gaming and racetrack company) and a separate slide for the case of Loblaw Companies (a Canadian supermarket chain) and Canadian Tire (a retail company). It is both curious and well worth noting the following:

Barington’s slide show goes to some pains to explain and justify the REIT portion of its plan, using comparable data from other situations. Barington then outlines why it thinks the properties held by DRI are worth as much as $4 billion. As you know, the REIT structure has been rather popular among a number of companies as a tool to “unlock” value. Barington provides a rationale for how the REIT option can unlock value by offering current examples of other companies that have utilized it. Specifically, Barington’s presentation includes one slide highlighting the example of Penn National (a gaming and racetrack company) and a separate slide for the case of Loblaw Companies (a Canadian supermarket chain) and Canadian Tire (a retail company). It is both curious and well worth noting the following:

1) Penn National is in a distinctly different business (gaming, which has long been established to be quite recession resistant) and contrasts with more economically sensitive full service restaurant field;

2) Both of the other companies are domiciled in Canada, and Barington notes (a bit lamely) that Canadian REIT regulations do not apply to DRI.

3) It seems telling to me that Barington can provide no example of a company fully comparable to DRI that has successfully (on at least an intermediate basis) adopted the REIT concept.[7]

Quite frankly, readers, the Barington plan sounds impressive! It even sounds as though it could deliver significant additional value. So why am I not enthusiastic about it? There are several things that give me pause:

1) REIT Plan:

a. As we learned from the Mortgage Crisis, real estate finances are considerably more complicated than slick Wall Street promoters want to admit. Financial giant, Ernst & Young, recently published a great article that outlines some of those complexities. It would be worth your time to read: http://www.globest.com/reforum/68_6/national/reit/The-REIT-Route-for-Non-Core-Real-Estate-334722.html

b. The vulnerability of Barington’s plan is illustrated by the non-comparable examples it extols of successful use of the REIT structure.

c. Would there be one REIT for all DRI locations… or multiple REITS? If I am a buyer of single-use real estate (zoning is obviously in the “restaurant” classification) as opposed to office space (which is usable by a broad spectrum of tenants, I would not want to own the buildings that house the weaker performing Red Lobster (or Olive Garden).

i. If there are multiple REIT offerings, I would be extremely skeptical!

ii. We know what Wall Street did in 2004-2008 as they packaged mortgages – they have been fined for deceptive practices. They “cherry-picked” what various securities contained.

iii. I fear that execution of the details involved within a DRI REIT plan result in something that feels a lot like a “shell game”.

d. Finally (and compellingly) in order to make an REIT offering attractive, pre-ordained annual increases in the triple-net lease monthly rent charges would be required, thereby possibly causing an even greater challenge for the “Mature” DRI chains (remember the “Coverage Ratio” graph in Part I).

2) Spin-off of the “Growth Chains

a. It does not take a rocket scientist to recognize the outsized growth prospects of the smaller chains within DRI. Just compare these two charts, showing Longhorn Steakhouse sales vis-à-vis the smaller chains.

b. Notice that Longhorn holds 72% of the restaurants shown, but only produced 55% of the sales!

c. More clearly, the average per unit sales of the smaller chains is way over twice as high as unit sales at Longhorn!

d. All things being equal, I’d love to own a piece of the “Specialty Restaurant Group”… which of course is the whole point of developing some sort of restructuring or spin-off plan. The question I do not think has yet been answered is: “What is the plan that will optimize the assets of DRI in the most productive and sustainable manner!!

3) Debt/Credit Rating

a. As we have already alerted you, S&P has already placed DRI on “Credit Watch”.

b. DRI has a significant amount of public debt… rated Baa3 (Moody’s) and BBB- (S&P and Fitch). That is not much higher than “Junk” status.

c. The ratio of consolidated earnings to fixed expense stood at 5.4 in May of 2011.

i. It fell to 4.4 in 2012

ii. It now stands at 2.7!!

iii. That does not bode well for DRI credit!!

d. How would debt be allocated among the three “shells” proposed by Barington?

i. Depending upon the answer to that question, “something will have to give” if none of the parts of DRI want to receive a “Junk Bond” rating.

e. The one thing that is clear, obvious, compelling, and undeniable is that “Operating Expense” must be reduced!!

4) Dividend

a. Obviously, this issue is closely related to point 3)!!

b. The DRI dividend has been an extremely attractive feature of the company – especially since it has been paid since the beginning… and has been regularly increasing! Shareholders expect it.

c. Unfortunately, during the past ten years, the “Payout Ratio” has grown from 5.9% to 72.8%. Anything over 50% is cause for annual review; anything close to or above 100% is totally unsustainable and would be a neon sign that reads “Sell”!!

5) Do Barington and Starboard “have what it takes”?

a. Do these activist have sufficient leverage to motivate the DRI board and management to initiate a restructuring as ambitious and comprehensive as those two activist investors insist is necessary?

a. Do these activist have sufficient leverage to motivate the DRI board and management to initiate a restructuring as ambitious and comprehensive as those two activist investors insist is necessary?

b. Barington holds about 2.8% of DRI; Starboard holds about 5.6%.

c. It is interesting to note that board members own a remarkably modest amount of DRI stock.

d. If you study the “Major Holders” data in YahooFinance.com, you’ll find that these are the major holders of DRI stock:

As I point out at the bottom of the worksheet, this means that the various subsidiaries of Capital [8]control over 25% of DRI, while Blackrock controls almost 6%!

What this means is that neither Barington nor Starboard are likely to get very far unless/until Capital or Blackrock (or a new major hedge fund player) joins forces with them! We’ll just have to wait and see.

Meanwhile, one idea that is referred to within the Barington plan but is not strongly emphasized is the option to begin offering franchise opportunities!! As we mentioned in the Ruby Tuesday article and the article regarding the Restaurant/Entertainment ETF, several restaurant companies have been stepping up the utilization of the franchise model as a means to reduce capital and operating costs while increasing future cash flows. Although not a sufficient remedy in and of itself, it does sound like an extremely promising elixir for what ails DRI!

INVESTOR TAKEAWAY: Here are the primary takeaways from all that appears above—

1) No company can long survive without being supremely alert and flexible!

a. History is littered with companies that were fabulously successful for a time, but neglected to maintain a laser focus on its market – intense enough to stay in touch with customer preferences and expectations and make appropriate adjustments (menu, price, customer service, marketing) as new trends develop and evolve.

b. DRI management can legitimately be criticized for not attending to changes in the markets served by Red Lobster and Olive Garden soon enough!

i. It is only recently that Olive Garden is adding a “burger” (albeit Italian) to its menu, even though the “Low Carb” diet has been growing in popularity for quite some time.

ii. Its promotional efforts on behalf of these two biggest chains have not been nearly as effective as needed – and management is only now admitting that this area is one that needs significant refocus!

iii. All of the above speaks to the point made by activist investors, analysts, critics, and now even Darden management — namely, that greater focus is sorely required in each of the unique market niches served by the individual DRI chains.

c. Another way to say this is that DRI management may currently be too centralized and/or too big!

2) You now know the metric used within the restaurant industry to determine the market value of a restaurant company (0.5 to 1.5 times the prior 12 months of revenue). You may want to file that formula away for future reference as you perform your own “valuation” projections.

3) When it comes to the proposals/plans of an activist investor – Beware!!

a. Obviously, the primary (sole) interest of the activist investor is to secure a profit for that investor. (Ignore any language that claims her/his interest is solely in helping company management fulfill its fiduciary responsibility or help the company become “all it can be”… activist investors are after a profit – the quicker the better!)

b. For that reason, the execution of any such plan may or may not result in a sustainable maximization of value!

c. One thing we can count on from an activist plan –

i. It will make certain assumptions very advantageous to the appeal of its plan;

ii. It will be overstated (after all, it is at heart a “sales presentation”!).

4) Remember that any activist with less than 10% ownership must secure support from much bigger shareholders in order to have its plan move toward adoption;

5) Regarding the current value of DRI stock:

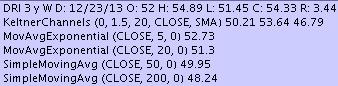

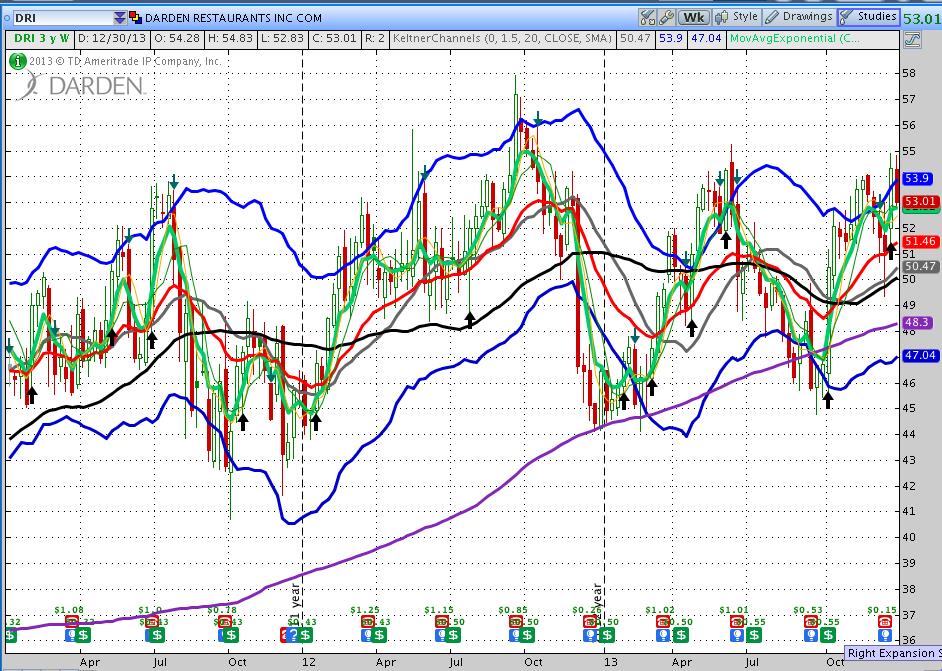

a. Note on the weekly price graph below (from ThinkorSwim) these several things:

i. The “activist buzz” in December pushed the price up to the top of its Keltner Channel.

ii. Here are the moving average figures (as of 1/3/14):

iii. Since the beginning of 2012, the $44-46 range has provided strong support!

iii. Since the beginning of 2012, the $44-46 range has provided strong support!

b. Therefore, if one was determined to trade DRI (I do not make recommendations; just observations!) one might agree that buying the stock outright, or purchasing calls on the stock, may not be a prudent strategy, unless or until DRI breaks above $55.25 on a closing basis (the high from June of 2013). In the interim, put credit spreads could be a more prudent alternative.

DISCLOSURE: The author is an owner of DRI stock and a put credit spread. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

As noted at the start, the author is a died-in-the-wool Olive Garden aficionado. Nothing beats its bottomless salad and Moscato!

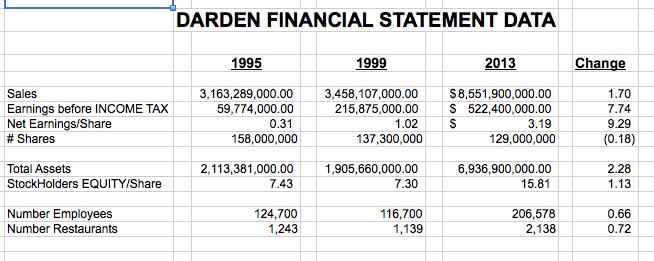

APPENDIX: Here is the financial data worksheet promised earlier (prepared by me by reference to the current financial statements available in the “Investor Relations” portion of the DRI website. That site even includes the 1999 Annual Report, from which I pulled the 1995 and 1999 fiscal years!

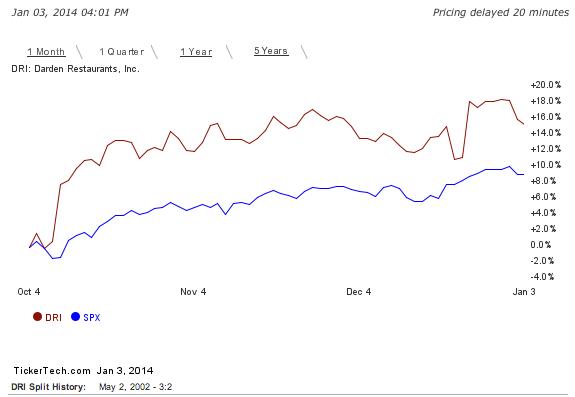

Finally, below is a graph of the prior quarter of DRI price action compared with the S&P 500 Index. DRI has outperformed by a factor of nearly 2!

Submitted by Thomas Petty MBA CFP

[1] There are differences between the Starboard and Barington plans, but they are generally not considered significant enough to be considered separately. Since Barington was the first “shark” and has gone to greater efforts to detail its plan, we will refer to its plan as the “outsider” plan – as a way to contrast that plan with the DRI management plan.

[2] This is understandable, given the financial graphs I presented earlier – especially the “Coverage Ratio” graph!

[3] The DRI CEO believes that the specialty restaurant group brands have: “the potential to deliver 17-19% total sales growth … driven by new restaurant growth.” It is worth adding that the 13 units opening soon in Asia could very well prove to be a valuable addition to DRI’s growing international base.

[4] According to merger arbitrage specialist, Sachin Shah, at Albert Fried: “Step one really should be fixing the business. Right now, Darden needs to be aggressive in innovating and investing in the business and changing the mentality that Red Lobster is a mature, stagnant brand. That's how you create long-term value.”

[5] Find it at: http://www.scribd.com/doc/192140864/Barington-Capital-Presentation-Darden-DRI

[6] The biggest difference between the Barington plan and the Starboard Value plan is that Starboard would be content if Longhorn Steakhouse was grouped with Olive Garden and Red Lobster.

[7] Perhaps more directly to this point, Tom Armistead offers this sage observation in a 12/24/13 Seeking Alpha article: “I've watched a few analogous [REIT] situations deteriorate over the years. TravelCenters of America (TA) was burdened by excessive rents owed to Hospitality Properties (HPT), from which it was spun off. Not pretty. Friendlys Restaurants (a restaurant/ice cream operation) was burdened by huge debt on its real estate, and limped along for years on razor thin margins before being taken private.

[8] You may not know that Capital is the parent company to the absolutely huge family of “American Funds”.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

2 Ultra-High-Yield Dividend Stocks You Can Buy and Hold for a Decade

2 Ultra-High-Yield Dividend Stocks You Can Buy and Hold for a Decade