Back in 1990, David Swensen had only managed the Yale Endowment Fund for five years, but had already established himself as a remarkable investment manager.

Liquidity may generally seem to be an appealing characteristic.

However (and with a nod to magicians, who remind us regularly that appearances are often deceiving)… considerable recent research has discovered that il-liquidity may be even more desirable.

Before we proceed further, let’s define “liquidity”. The classic definition of “liquidity” is:

“the degree to which an investment security can be quickly bought or sold in the marketplace without adversely impacting its price.”

Let’s illustrate the importance of liquidity with an easily understood example:

Let’s say that the parents of a student entering college at the end of August (2015) have $50,000 invested in a 529 Plan[1]. As August approaches and the parents know that a $35,000 bill from that college will be due, the parents are obviously counting on $35,000 being available for withdrawal from the 529 Plan to pay the bill… and they are depending upon their withdrawal to not negatively impact the ongoing performance of their account’s remaining assets!!

With that in mind, imagine this scenario playing out during this past August … in the aftermath of “Black Monday” (when the Dow gapped down at the open by 1,000 points!)!! Market Tamer published several articles detailing the systemic liquidity problems that surfaced that day will be helpful to you if you have not yet read them:  [https://www.markettamer.com/blog/could-goethe-and-schiller-have-imagined-black-monday ; https://www.markettamer.com/blog/could-goethe-and-schiller-have-imagined-black-monday-part-ii ; https://www.markettamer.com/blog/etfs-and-the-sec-sledgehammer-on-black-Monday]

[https://www.markettamer.com/blog/could-goethe-and-schiller-have-imagined-black-monday ; https://www.markettamer.com/blog/could-goethe-and-schiller-have-imagined-black-monday-part-ii ; https://www.markettamer.com/blog/etfs-and-the-sec-sledgehammer-on-black-Monday]

As for the 529 Plan upon which these parents were depending… the parents suffered the epitome of “bad timing”!

Therefore, the average investor (such as you and I) who invests with a particular goal in mind naturally places a high value on liquidity!!

In sharp contrast, those who enjoy the freedom to invest with a strictly “long-term” view have considerably more flexibility. Those investors can afford to explore a wider range of investment considerations before deciding upon portfolio choices.

In light of the above, take a good look at the following premise and decide if you agree with it!

“If all else is equal, a rational investor will prefer to hold liquid investments vis-à-vis illiquid investments!”

I see almost every head nodding “yes”… so it appears that this premise makes sense to most of you!

However, research now shows that “all else is not equal!”

Now I can see that many of you have that “Huh?!!” look in your eyes.

Why on earth is “all else not equal?”

A number of recent research studies indicate that the prospective returns of highly liquid investments are actually (believe it or not) diminished in comparison with illiquid securities. Expressed slightly differently, many illiquid investments have a higher expected return than those investments that are more liquid.

Why would this be?

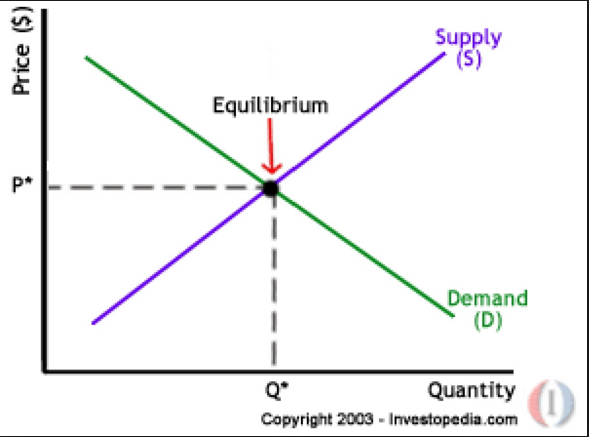

For the answer, we turn to some tried and true principles from Economics 101. Simply put, the demand for liquid instruments is so high[2] … that, by comparison, illiquid investment securities often (actually, most often) carry an “excess return” premium.

In accord with the standard "Supply/Demand Curve"... when demand for "liquid" securities is very high, while the demand for less liquid securities is low, the latter securities gain a "pricing advantage" (cost slides down the price scale).

What is the significance of this discovery?[3]

Well, one particular long-term, noted (and celebrated) investment manager is among those who, many years ago, recognized this “illiquidity premium” and has regularly availed himself of the outsized returns available through them.

David Swensen of the Yale University Endowment Fund has demonstrated his investment acumen over the past 20 years by earning Yale an average annual return of 13.9%.[4]

Swensen made a name for himself early on. He earned his PhD at Yale in 1980… and assumed the reins at the Endowment Fund in 1985. In his first five years at the helm, he nearly doubled the size of the Endowment – from $1.3 billion to $2.3 billion. Considering that Yale University took annual distributions from the Fund during that period, that is an amazing performance. As of June of 2014, the endowment fund balance sat at a staggering $23.9 billion![5]

Here is a 1990 photo of the (then) "bright and shining star" within the College Endowment space -- David Swensen. At that point he had managed the Yale Endowment for five years after a six year Wall Street career.

I dare say that the number of Chief Investment Officers within higher education who are celebrated to the extent of getting a campus tower named after her/him can be counted on (at most) one hand. However, last spring it was announced that plans are in place for Dr. Swensen to be thus honored!

Of course, Swensen has regularly amazed endowment officers at other higher education institutions – in part by his considerable use of “Alternative Investments” (back in the 1980’s and 1990’s, they were usually described as “hedge funds”). He demonstrated exceedingly good judgment in his choice of “Alts”… since he never experienced a fund failure.[6]

Swensen’s well-documented acumen aside, it is important to note that he operates with an unassailable advantage that is not available to most of us. Swensen can afford to devote a significant portion of the Yale portfolio to strictly long-term investments.

How is that? An endowment fund, by its nature, is long-term in nature.[7] There are no independent investing “clients” who might, at any given moment, come clamoring to Swensen’s door step insisting upon the redemption of their shares – for which Swensen would need to have built daily liquidity into his portfolio management operations.

The fact is that Swensen has (in essence) just one “client” – Yale University. And I assume that Yale, as is the case for most higher education institutions, only calls upon the endowment fund for a distribution from principle once a year (or at most, quarterly). In addition, depending a school’s official policy[8], the amount of a distribution is calculated through a “rolling average” formula. The parameters of such a formula usually range between 3 to 5 years. Once the rolling average of the endowment balance is calculated per the policy, a set percentage of that average balance determines the distribution for that year.[9]

As you can imagine, the “rolling average” methodology has served to smooth out the countless ups and downs of the market … thereby lessening the likelihood of extremely wide divergences in the amount of annual distributions made to a school’s general operating fund, scholarship fund, capital fund… and/or any other fund designated as the recipient of a distribution.[10]

At any rate, what I am driving at is that Swensen’s staff can, throughout the year, very easily project the timing and amount of their “cash needs”. Believe me, that makes investment management ever so much easier, and therefore Swensen is freed up to (truly) invest most of Yale’s portfolio with a “long-term” view!

In addition, Swensen can lean upon a substantial staff (largely Yale-educated) to handle daily analysis and operations:

including one “Senior Director” (Dean Takahashi), five “Directors”, four “Associate Directors”, one “Senior Portfolio Manager” (she runs cash management and trading), one “Senior Business Analyst”, one Senior Financial Analyst”, five “Financial Analysts”, three legal professionals, and other office staff for a total head count of 30.

And of course, keep in mind that Swensen additional advantages because of his access to:

a) Greater information/data processing resources, which can help him and his staff develop more pinpoint analytics regarding the reward/risk parameters of any given investment under consideration;

b) Lower transaction costs and easier access to more highly desired securities due to the sheer heft of Yale’s portfolio and the volume of its trading activity.

INVESTOR TAKEAWAY:

How does knowing this enhance the knowledge base of an average investor?

Well, it is fascinating to consider how phenomenal Swensen’s performance has been – not just over a one, three, five, or even ten-year period, but over 28 years!! In fact, he could rival Warren Buffett as a candidate for “Most Amazing Investor” – except for the fact that one cannot fairly compare the performance of an endowment portfolio manager with that of a publicly traded conglomerate such as Berkshire Hathaway (BRK.A).

But there are a couple of potentially helpful “take away” points nestled within this story about Dr. Swensen:

1) With the evolution of “Alternative Investments” into more refined, liquid, affordable, and accessible instruments (particularly, through a growing number of publicly traded ETF funds), the success of Swensen may be an incentive to explore, analyze, and consider the use of one or more such instruments within one’s own portfolio.

Of course, as one explores this area, the very first caveat regarding an investment in an illiquid asset is that it is only appropriate for the portion of a portfolio that an investor can truly afford to hold long-term!

In addition, any “excess return premium” will only be worthwhile pursuing if the foundation of any given illiquid security reflects an otherwise sound, credible investment option. This is obviously a much more nuanced point… but it is vital to keep in mind, since owning a patently bad investment that is also illiquid utterly defeats any attempt to enhance investment return. It will also continue to frustrate and haunt an investor over a long period of time, since she/he is locked into that security until it can be sold at a “fair value” price.

2) With reference to point 1) above, let me alert you to some of the dangers that lurk within illiquid instruments:

a) When a seemingly sound illiquid investment goes “sour”, what usually happens is that the interests of the person managing said investment are no longer aligned with the interests of the related investors! This has occurred in the past with regard to several hedge funds, certain life insurance and annuity products, and very recently, with regard to the widely decried closing of “Third Avenue Focused Credit” (see the December, 2015 story at Barrons.com).

b) It has also happened to certain “Non-traded Real Estate Trusts”. If you enjoy “investment drama”… then “Google” any of these search terms and start yourself on an extremely dramatic (and sobering) journey of a real estate wheeler and dealer whose empire collapsed upon him:

Nicholas S. Schorsch;

AR Capital (formerly American Realty Capital);

Realty Capital Securities (a related entity accused of faking shareholder proxy votes for a special September shareholder meeting);

Non-Traded Real Estate Investment Trusts.

An article from the New York Times described Schorsch as being “in the center of a maelstrom”. I think that is a significant under-statement.

c) In light of the above, it behooves every investor to be extra cautious whenever a salesperson presents a seemingly appetizing investment possibility for which you are not provided a detailed, vetted, prospectus. It should be no surprise that when the sponsor/provider of a less liquid security moves toward the “roll out and distribution” phase… those who directly sell the security to investors tend to receive significantly more compensation than usual… thereby strongly incentivizing said sales people to be particularly “persuasive”.

That is a perfect example of when a potential “misalignment of interests” looms large!

Here is a classic photo of the infamous U.S. mega-banker -- J. Pierpont Morgan. He was notorious for always putting his own interests first and foremost, then trying to convince the client (or the country) that he was helping them. That is "misalignment of interests".

In fact, recent (and regular) headlines within the financial press regarding an impending “Fiduciary Standard” [a regulation being developed by both the U.S. Department of Labor (DOL) and the U.S. Securities and Exchange Commission (SEC)] has been prompted by countless instances in past decades of well-compensated sales folk peddling less liquid securities which, for years thereafter, saddle the buyers of said securities with a financial burden because of the absence of a viable secondary market.

Any governmental “Fiduciary Standard” that holds sales people accountable for ensuring that the legitimate long-term interests of investors are at the heart of every security sale should help increase the “alignment” of the interests of investors with the professional responsibility of advisers/brokers! (It certainly is unlikely to make things any worse).

Here is an old photo of a 19th Century Corporate Board of Directors. It is worth noting that board members are obligated to act as "Fiduciaries" who make decisions based upon the best interests of shareholders. Let's just say that we are still working on ensuring that this "Fiduciary Standard" is realized in every corporation!

Before moving on, I cannot resist offering a famous quote from J.P. Morgan:

“Well, I don't know as I want a lawyer to tell me what I cannot do. I hire him to tell how to do what I want to do.”

That is hardly a sterling example of a CEO who is intent upon always doing what is right, just, ethical, and legal! Alas, some news stories hint at the possibility that the “spirit” of J.P. Morgan lives within the actions of major corporations today

3) It is certainly possible for an investment manager with the acumen of Dr. Swensen to serve as an intermediary within a publicly traded instrument (such as an ETF) to help “capture” some of the “illiquidity premium” which we have described above. With the guiding hand of an able and trustworthy manager, this sort of “Alternative Investment” ETF would provide investors (those with a longer-term perspective) with the ability to enhance the diversification of their portfolio!!

a) The research to which I referred earlier has demonstrated that this “illiquidity premium” is both significant and stable. In fact, this has become so well-documented that the experts at Ibbotson Associates recently suggested that this “Illiquidity Premium” should be developed into a separate, identifiable asset “class”… much as there are now “Smart Beta” ETFs that tilt its portfolio toward such characteristics as “Minimum Volatility”, “Value” , or “Momentum”!

[See: https://www.markettamer.com/blog/momo-a-momentum-etf-can-help-your-mojo and https://www.markettamer.com/blog/the-synergy-of-momentum-and-value]

b) In addition, researchers have begun to recognize that the often outsized returns generated by private equity managers (similar to Swensen) that have formerly been attributed to “Alpha” … should actually be attributed to this “Illiquidity Premium”.

c) Therefore, do not be surprised if, at some point in the coming years, you see an ETF or a fund being offered that promises to capture an “Illiquidity Premium”.

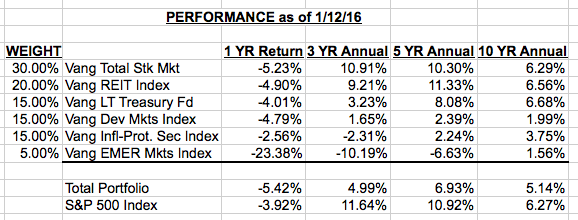

Moving from the “esoteric” to more immediately accessible “teaching points” that we can glean from Dr. Swensen, consider the portfolio shown below… a portfolio published in the past by Dr. Swensen. The portfolio is named “Yale U's Unconventional Portfolio”. It can be found within the MarketWatch.com website as part of its ongoing “Lazy Portfolio” feature:

Obviously, through this portfolio allocation, Dr. Swensen is trying to help the average investor simplify her/his portfolio by using low-cost, reliable, proven Vanguard funds.

Here is a "casual" look at Dr. Swensen, as you might see him around New Haven, Connecticut, where his office is located.

As you review the average annual performance metrics for the past 1-year, 3-year. 5-year, and 10-year periods, you might be asking yourself the question: “Why would I want to use this ‘Yale Portfolio' when it actually returned less than the S&P 500 Index during those respective time periods?”

That is a great point! The answer is both important and a bit complicated! Here are a few basic reasons to consider using the above portfolio rather than depending strictly upon the S&P 500 Index.

1) Diversification: annualized performance figures offer a “one point in time” view of investment return. However, in between those points in time, performance volatility can get quite rocky, as we saw on and around August 24th. I can assure you that the diversified portfolio above offers a smoother (less scary) performance graph.

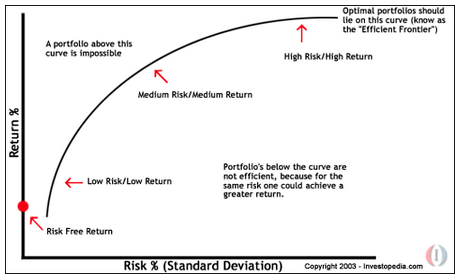

As we have discussed previously, the only way one can create a portfolio that is “optimized” to deliver the best risk/return performance is through diversification… leading your portfolio toward the “Efficient Frontier”. [See https://www.markettamer.com/blog/key-information-ratio-for-deciding-between-fcntx-and-rgaax and https://www.markettamer.com/blog/sharpen-your-analysis-of-ibb-xbi-and-fbt ]

2) There are two proven principles behind Swensen's portfolio that have served the “Robo Adviser” industry very well in driving them to the amazing success they have enjoyed in recent years. The portfolio may “look” far too simplistic, but these proven principles also make the “Robo” portfolios look “simple” as well:

a) The use of inexpensive funds and/or ETF's

b) The use of tested, proven passive index funds.

Finally, here is the most compelling reason to consider a portfolio such as suggested within the “Yale U. Unconventional Portfolio”:

Paul A. Merriman founded Merriman LLC in 1983 and ran that investor education and investment management firm until he retired in 2011 and moved on to related activities through his own website: http://paulmerriman.com/about/paul-merriman/ .

Last year, Merriman compiled impressive data that substantiated his premise that the S&P 500 Index is not the “be all and end all” within the investment world. Merriman strongly objects to the fact that some so-called experts semi-regularly assert that, over time, investors will find it nearly impossible to outperform that benchmark index.

Therefore, Merriman compiled data from 2000 onward. He specifically chose the year of 2000 because at that point, the S&P 500 was the most widely held asset class within U.S. portfolios. This fact was driven by the fact that, between 1980 and 2000, that index produced an average (compounded) annual return of 18%. Even more eye-catching, between 1996 and 2000, it had compounded at an average rate of 28.6%!

Therefore, Merriman compiled return data from 2000 through December 31, 2014 (15 years) on six low-cost Vanguard Index Funds with 15-year records.

Take a good long look at this list… keeping in mind that the S&P 500 Index returned only 4.1% on an average annualized basis during this period. The only major Vanguard Index fund that under-performed the S&P during that period was the Vanguard Developed Markets Index Fund (which returned only 2.6% annually and doesn’t appear in my table below).

| FUND | TICKER | 15 YEAR RETURN (Annualized) |

| Vanguard REIT Index | VGSIX |

12.5% |

| Vanguard Small Cap Value Index | VISVX |

10.5% |

| Vanguard Small Cap Index | NAESX |

8.3% |

| Vanguard Emerging Mkts Index | VEIEX |

7.1% |

| Vanguard International Value | VTRIX |

4.5% |

| Vanguard 500 Index Fund | VFINX |

4.1% |

To help you more fully appreciate the advantages of diversification… consider these calculations of relative return:

|

IF INVESTOR HAD PUT $10,000 INTO THE FUND ON 1/2/2000 |

||||||

|

Name |

Ticker |

Balance at 12/31/2014 |

Net Gain |

|||

| Vanguard REIT Index |

VGSIX |

$60,098 |

$50,098 |

|||

| Vanguard Small Cap Value Ind |

VISVX |

$44,713 |

$34,713 |

|||

| Vanguard 500 Index Fund |

VFINX |

$18,271 |

$ 8,271 | |||

|

|

||||||

|

All Non-500 Index Vanguard Funds with 15-Year Record |

$27,206 |

$17,206 | ||||

Note that even an equal “blend” of the non-500 Index Vanguard Funds would have generated a net gain that exceeded more than twice the gain generated by the S&P 500!

With reference to this data, Merriman himself suggested the following “lessons” for the average investor:

1) “Recency Bias” (ie. chasing those funds that produced the best returns last year, or over the past several years) is a dysfunctional behavior!! Back in the year 2000, surveys documented that countless investors expected the S&P 500 to grow at a clip between 20% to 30% each year through 2010!! Boy, were they wrong!

2) “Diversification” among portfolio asset classes is the only way to ensure that one does not end up holding just the year’s worst performer

3) Whenever you analyze past returns in order to project future investment prospects, always use the lengthiest performance records you can lay your hands upon! Fifteen years of performance is available through Morningstar… and that is much more relevant and on-target than a record of the past one to three years!!

DISCLOSURE:

The author has no funds being managed by Dr. Swenson.[11] I do have funds invested within a number of Vanguard Funds, including the Emerging Markets fund (VEIEX) and REIT fund (VGSIX) referenced above. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] 529 Plans provide a tax-qualified means of saving for future education expenses.

[2] (and demand for illiquid investments is so low)

[3] Particularly since most of us will still not be willing to invest in an illiquid security?

[4] According to the Yale website, over the past 28 years, the return has been 13.8%

[5] Other details about Swensen include: Prior to joining Yale in 1985, Mr. Swensen worked within “Wall Street” … three years at Lehman Brothers and three years at Salomon Brothers (his work focused on developing new financial technologies). At Salomon Brothers, he structured the first swap, a currency transaction involving IBM and the World Bank. He has authored two books:

Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment and

Unconventional Success: A Fundamental Approach to Personal Investment.

[6] Hedge Funds in those days had, at best, a checkered history and reputation. Quite a number of the turned out to be poor investments… and several “blew up”. For that reason, the members of the board to whom I answered when I managed the operation of a small endowment fund (around $100 million) for a postgraduate theological school refused consider any “Alternative Investments.”

[7] Some insightful experts even suggest that an endowment fund should be managed with the same risk parameters as might be suitable for a “teenager”… since it is, indeed, a long term fund.

[8] Created, approved, and administered by an official board

[9] The commonly used percentage was once as high as 6%… but in the past 10-15 years, that percentage has tended to be lowered in order to account for the more volatile and less steady returns expected from the market.

[10] The vital importance of “smoother” distribution amounts can be illustrated by the period 2008-09, which saw the stock market absolutely tank. If there had not been a “rolling average” at work In calculating a distribution… the school’s scholarship promises or capital project plans would have been severely impaired.

[11] Obviously, being a Yale U. Endowment Fund, I would be prohibited from doing so. But even if there was not a rule against Swensen managing my assets, I suspect he would decline any such opportunity. I am confident that his reason for declining is that he is jealous that I graduated from rival Brown University!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

SPDR Portfolio S&P 1500 Composite Stock Market ETF: What Do You Get When You Buy “Everything”?

SPDR Portfolio S&P 1500 Composite Stock Market ETF: What Do You Get When You Buy “Everything”?