This article is a lot different than our “standard” article for this space. So let me do my “Disclosure” upfront:

1) In order to glean anything positive from this article, you’ll need to actually believe that (at least figuratively) “a picture is worth a thousand words”.

2) You’ll need to enter into it with a very open spirit, free from particular expectations… and focus upon being imaginative (even a bit playful).

3) Trust that in sharing this, I am not intentionally attempting to convey any particular market outlook… and I am not motivated by any material self-interest.

4) Well, OK… let’s amend #3 just a bit. I realize now that this article may be inspired by my subconscious awareness that, in the midst of a whole lot of bullish commentary currently flowing through the financial media regarding the stock market (at least through the rest of 2014), I need to remind myself of the need to maintain balance and to remain conscious each trading day of the imperative to “manage risk”.

a) When you wake up on November 21st with positions that you feared were far too bullish and yet you discover that the Dow Jones Index was already (before the open) up over 150 points … pushing your “P/L Day” total higher than it has been in months – it is frighteningly easy to become complacent!

b) Somewhere deep inside, you realize that someone needs to give you a good swift kick in the back end (because your risk management has experienced a serious case of “lagging (way) behind”!!).

So here we go, folks. And remember… “remain open”, “expectation free”, imaginative, and playful!

I) SENTIMENT: as you know, this is a contra indicator… ie. the more bullish investors and/or financial advisors become… the more risky (at least based upon historical patterns) the market becomes.

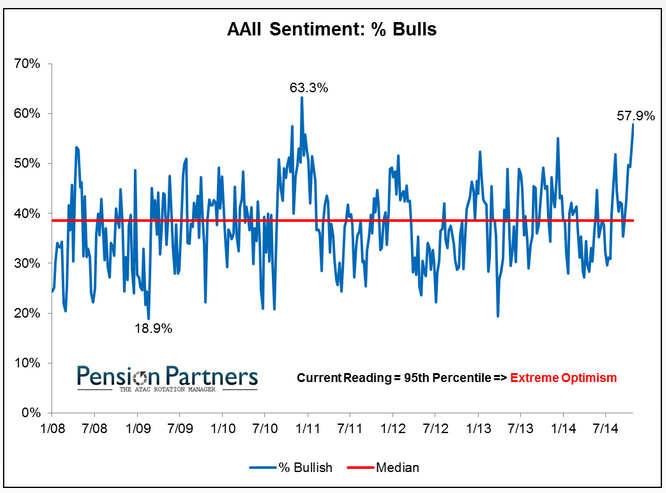

A. Here is the well-known AAII Investor Sentiment Index [this iteration of the graph can be found at http://pensionpartners.com/blog/?cat=11 ]:

As you study this chart, concentrate on where investor sentiment is right now (relative to past market cycles). Investor Sentiment is a longstanding and widely accepted contra indicator (meaning that when investor bullishness crests, it is not a bullish sign!).

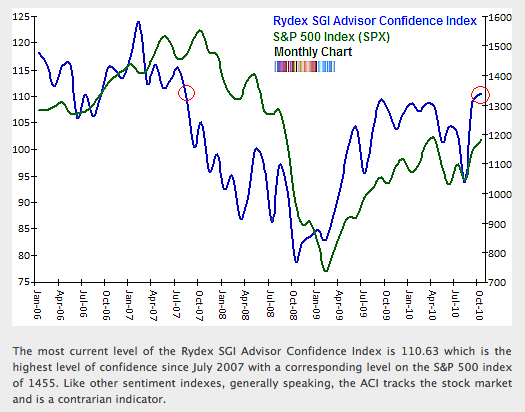

B. Here is the Rydex SGI Advisor Confidence Index (in blue) compared with the S&P 500 Index (in green) [found at http://www.tradersnarrative.com/financial-advisor-sentiment-rises-to-3-year-high-4981.html ]:

- This Advisor Confidence Index functions very much like the Investor Sentiment Index. [One takeaway here is that advisors aren't necessarily any more insightful about the near term prospects of the market than the average investor.]

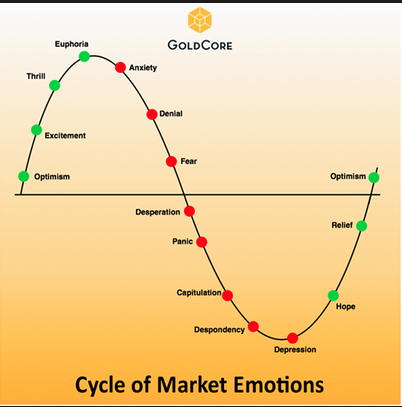

II) MARKET EMOTION CYCLES: speaking of “sentiment”, it behooves us to be alert to the unpredictable vagaries of market moods. We all know the feeling that comes upon us when the market has been hitting on all cylinders… but then suddenly, out of the blue, reverses direction on a dime and descends as though falling from a third floor window – leaving is to say to ourselves “What the _____?” and wondering if it is a “Flash Crash”, the “HFTs” at work, or some development about which we will be the last to know!

Here is a helpful image reminding us that every market moves (generally not nearly as smoothly) along a curved spectrum of emotions… emotions that often defy logic, with their precise cause beyond our ability to empirically ascertain[1].

III) REWARD/RISK: There are many investment experts who have offered helpful insights for us regarding the intimate relationship between “reward” and “risk”.

IV) DARK CLOUDS DO HAVE A “SILVER LINING”: The most famous of these insights comes from “Baron Rothschild”:

IV) DARK CLOUDS DO HAVE A “SILVER LINING”: The most famous of these insights comes from “Baron Rothschild”:

V) MARKETS CAN BE (ARE) MANIPULATED: sometimes, such manipulation is criminal (examples: the “Libor Scandal”, the “Gold Price Fixing Scandal”, many of the bank shenanigans from 2006-2010 for which major banks have been paying major fines, etc.) and sometimes (especially recently) that manipulation is draped in the blanket of civil authority[2].

”]

VI) THE NEED FOR CAUTION… AND VIGILANCE: you can read this as “risk control”, which comes in all shapes and sizes.

VII) SUMMING IT UP: (Remember, friends, you are supposed to have a playful spirit here!!!):

INVESTOR TAKEAWAY:

I suspect this article will function much like a Rorschach Test. Each reader will read within its images those thoughts, insights, and “truths” that emerge most powerfully (and uniquely) for her/him!

So if you care to share what thoughts emerged for you as you read it, I’d be interested in hearing about them!

DISCLOSURE:

The author is not a Rothschild (but wouldn’t it be fascinating to be genetically and financially tied to them!), a Bogle, or a Buffett. However, the author does feel a remarkable kinship with the sentiments of Mark Twain, as conveyed in that final slide![3]

FOOTNOTES:

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Investing $60,000 in These 3 Funds Could Generate Annual Income of Over $6,500

Investing $60,000 in These 3 Funds Could Generate Annual Income of Over $6,500