In our previous article [https://www.markettamer.com/blog/plato-comments-from-the-grave-on-the-current-stock-market], we offered detailed data and graphs that demonstrated the degree to which the U.S. stock market has depended heavily upon corporate buybacks for a surprisingly high proportion of the “fuel” that has driven it higher. In fact, we even referenced a credible authority that claimed that the recovery in stock prices from its nadir in early February to the end of the first quarter (at approximately “break even” for the YTD) was driven almost entirely by buybacks![1]

We ended that article promising to reveal for you an even longer-lived and more pervasive force that has been driving equity markets upward. I would actually be surprised if you cannot easily identify that force. It is an institution that used to operate quietly, yet (largely) effectively in the background of the U.S. economy and politics. Before 2007, the head of that institution was heard from only occasionally (twice a year, when he was required to make a report to the U.S. Congress… and occasionally when he was seen out on a date with a famous and/or glamorous woman[2]). However, since the brewing, bubbling, and then full eruption of the “Financial Crisis”, that institution and its two chairs have received domestic and international press coverage that far exceeds that granted to any other U.S. political or economic figure – excepting of course the U.S. President.

The market moving institution to which I am referring is, of course, the U.S. Federal Reserve.

In mid-March of this year, economist Brian Barnier discussed his macro-market analysis with a number of interviewers. The “headline” from Barnier’s research was as follows:

In late November of 2008, the Federal Reserve announced its plan to buy $600 billion in mortgage-backed securities then and each month thereafter (into the (then) near-term future). As we now know, that step constituted the very beginning of what has become an unprecedented stream of U.S. monetary easing (“Quantitative Easing” I, II, and III (and “Operation Twist”).

Barnier contends that between that fateful decision and the present, the Fed has been responsible for over 93% of the market’s appreciation.

In fact, building upon and amplifying that point, Barnier’s research suggests that the Fed precipitated all of the market’s growth during the first half of 2013.

Of course, most of us accepted long ago the premise that the Fed has been (and remains) a huge force within the market. Just consider a few of the hackneyed tag lines that are regularly bandied about within the financial media as absolute, “given” truth:

“Don’t fight the Fed”;

“Market bulls benefit from the ‘Bernanke (Yellen) Put’ underneath the market”

“All that money flooding the financial system has to find a productive home … so it naturally flows into the equity market.”

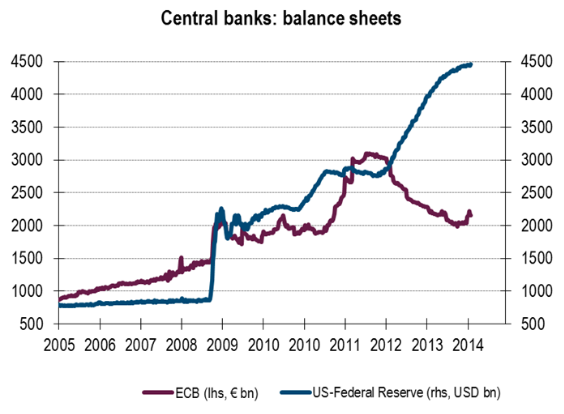

In fact, that later result is exactly one of the objectives (albeit unspoken objectives) the Fed sought to achieve through its QE programs. Visually amplifying this development can be achieved through the use of any user-friendly graph of QE over the past 8 years… such as the graph below that measures the size of the Fed’s “Balance Sheet (B/S)” from 2005 into 2015. This type of graph helps us to more clearly identify (visually) the full “scale” of the magnitude of this monetary tsunami.

To gain maximum benefit from this graph, focus strictly upon the blue line … absorbing the amazing magnitude of the discrepancy between “normal” Fed monetary policy (the line to the left of late 2008) and Fed monetary policy since the start of 2009[3]:

This is a graph of U.S. monetary easing (blue line) versus that of the ECB (red line). I encourage you to focus strictly on the blue line.

Quite unsurprisingly, the 8-year bull market in U.S. equities (since early 2009) reflects quite closely the ballooning of the Fed’s B/S. All of the above being said, it is important to understand that Mr. Barnier is not just some opportunistic market pundit who slaps together some eye-catching charts paired with impressive sounding analysis that merely confirms the essence of the absolute, “given” truth to which I referred earlier!!

Much to the contrary, Mr. Barnier has established a distinguished record as a well-grounded economist, investment analyst, market researcher and observer, and as an expert in strategy, product management, technology, finance, risk and operations. He is a Principal/Member at ValueBridge Advisors, LLC and has an impressive history of top notch analytical books, videos, speeches, etc. (accessible at http://www.brianbarnier.com/writing.html ). In fact, to be completely fair to Mr. Barnier’s experience level and skill, I need to offer this quote from the ValueBridge Advisors, LLC (at which he is a Principal/Member) regarding Barnier’s background:

“[Barnier is] Founder/blogger at Feddashboard.com … a forensic economist/fundamental analyst.”

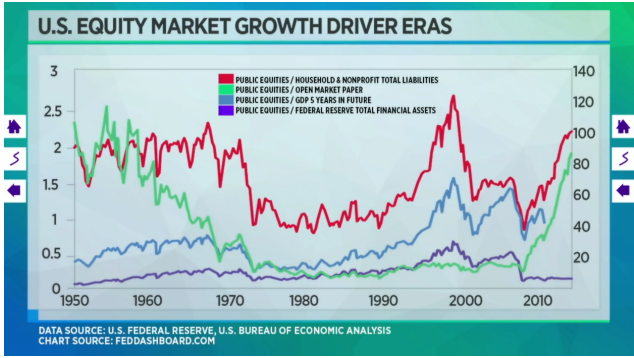

Mr. Barnier compiled data on the total value of publicly-traded U.S. stocks since 1950. He then sought to discover significant correlations between key economic factors and market action by calculating the corresponding ratio between market value and each studied economic factor (stock value divided by an economic factor’s corresponding metric). He then graphed those ratios and studied the result.

The operating premise of this methodology is that if any given chart shows a horizontal line stretching over long periods of time (meaning that stock values and the selected economic data are moving at approximately the same rate)… a correlation between those two variables is indicated.

After scouring graphs of hundreds of such factors, Barnier narrowed his focus down to four primary economic factors of greatest significance:

1) GDP data five years into the future;

2) Household and nonprofit liabilities (note that this factor played the chief role during two of the periods detailed below);

3) Open Market Paper;

4) The size of the Federal Reserve’s Assets (ie. B/S).

This is a graph of Barnier's work in identifying key economic factors that exerted an outsized influence upon the direction of U.S. Equity Markets.

Using the “correlation graph” technique referred to earlier, Barnier then isolated distinct time periods (“Eras”) during which one of those factors was seemingly the primary “driver” of equity returns. He then tested (to confirm the presumed result) each correlation hypothesis through regression analyses.

This is the resulting graph of Barnier’s study:

In this graph we can see what Barnier views as four primary “Eras”… described as follows:

1) 1950 into the mid 1970’s:

The primary economic driver during this era was future GDP outlook – which seemed to account for some 90% of movement in the stock market.

This makes sense when one considers the overriding economic trend of that era, which witnessed the U.S. transition from a “wartime economic machine” into a peacetime economy and “super power”. That transition which was often rocky. In fact, economic growth was a primary political issue during those years, usually paired with national security (related to the fear of rapidly advancing nuclear missile technology). I remember clearly that the Eisenhower/Stevenson presidential contest and the Kennedy/Nixon contest both dwelled heavily on those points.

2) Early 1970’s into the early 1990’s:

As the notable growth of credit cards and the steady rise of consumer debt took hold in the early 1970’s, “Household Liabilities” emerged as the key economic factor impacting equity price movement.

Besides credit card debt, the growth within (aggregate) home mortgage loans was the most significant sub factor within the metric for this economic factor… obviously dropping off during the early 1990’s, when real estate prices experienced a “mini crash”[4]

According to Barnier, household debt helped to explain about 95% of equity price moves during that era.

3) Mid-1990’s into 2000:

No one who lived through it will ever forget the “Dot.com Bubble”.

This is a graphic illustration of the “Dot.comBubble” period. It is telling that the NASDAQ did not recover the “high point” of the “Dot.com” period until April of 2015!

We all read stories about visionary tech companies with infinite potential… which were generally accompanied (as P/E ratios grew to the upside … way beyond realistic sustainability) by reassurances from smooth-talking market pundits that “This time is different”. That characterization was meant to convince investors that as we moved into the 21st Century… old measures of equity valuation were no longer relevant – at least in relationship to all of the newest (exciting, visionary) tech companies “of the future”. These pundits regularly suggested that these innovators (and disruptors) would generate exponential growth in economic productivity (and eventual company profits).

Alas, those “promises” proved quit illusory and very damaging for portfolio values around the country!

During this time, the great “underbelly” of the tech boom was hyperactivity within the commercial paper market (which Barnier refers to as “open market paper”). That was the funding mechanism largely relied upon by tech start-ups (between the mid-1990’s and the bursting of the tech “Bubble”) to support their ongoing operational costs.

The regression analysis applied by Barnier suggests that growth in commercial paper accounted for as much as 97% of the market’s growth into the heights of the “Dot.com Bubble”.

4) Early in the 21st Century… into the Financial Crisis

As we all remember, the first decade of this century saw an amazing upward movement in both residential real estate and mortgage lending. Concurrent with those developments were the ongoing effects of federal housing policy – pushed by such Congressional figures as Barney Franks and approved by President Clinton – to make home ownership more widespread.

This is Congressman Barney Franks, a major force behind the liberalization of mortgage regulations that contributed to the reality of the Financial Crisis.

There is no point in rehashing all of the errors and abuses from that era – they are well-chronicled in actions taken during the past six years by the U.S. Justice Department, U.S. Treasury, and other enforcement agencies against those who violated U.S. regulations and/or law.

With regard to Barnier’s market analysis, mortgages and other forms of debt within the U.S. drove as much as 94% of market movements into the middle part of that first decade.

5) Late 2008 into the Present

As the financial system became stressed, and then (we are told) nearly collapsed during the height of the Financial Crisis, we all remember the many reassurances that came from the U.S Treasury Secretary (Henry Paulson) and the (relatively) new Fed Chair (Ben Shalom Bernanke) that the

Looking back on that very scary period of “Financial System Meltdown”, we have the luxury of imagining what Henry Paulson was really thinking during all those weeks he was trying to reassure the markets! This image might be captioned: “OMG… What will we do?”

Along the same lines, while Bernanke was joining Paulson in desperate efforts to “put out the fires” that were erupting within the financial system… we can playfully imagine that he was thinking: “Goodie! I can create ‘Quantitative Easing' and transform global monetary history!”

government would do everything necessary to prop up the system.

However, the markets did not respond to those reassurances with full conviction until Bernanke (the “Father” of “Quantitative Easing”… and evidently the “step father” of the vast global monetary easing that has emerged since Bernanke first introduced “QE”) announced large-scale government buying of bonds. It was at that point that the market began to find its footing and then start its inexorable march higher.

As I have already pointed out, Barnier contends that the Federal Reserve has been responsible for over 93% of market movement in U.S. equities since the start of “QE”.

Interestingly (and tellingly) Barnier also points out that ever since the Fed stopped buying bonds in late 2014 (the December 29, 2014 S&P 500 Index high was 2093.55), the market has largely traded in an approximate 16% range. Today (April 27, 2016) the S&P 500 closed at 2095.15!! [Case closed.]

From the end of 2014, when the Federal Reserve stopped buying bonds, until the present, the S&P 500 Index has been stuck in a trading range (or a “Box”).

INVESTOR TAKEAWAY:

Obviously, if any of us had been privy in advance to the results from Barnier’s “Era” analysis, we could have “cleaned up” and retired early! Alas, none of us can ever know in advance what will come to pass within the securities markets… at least on an intermediate to longer-term term secular basis.

In that sense, none of the analysis or history offered in this article will be helpful to investors or traders in the “present”.

However, recognizing that Barnier is not just some lightweight financial pundit trying to grab headlines or garner either fame or new clients… but rather an experienced and credible researcher/analyst/forensic economist… Barnier’s work should remind us that one of the fundamental keys to long-term success as an investor lies in focusing upon actual, demonstrable trends within the economy and the markets. Instead of keeping our eyes glued to Bloomberg TV or CNBC (thereby allowing ourselves to become bombard by[5] all of the seemingly expert commentary regarding what will happen today or tomorrow… or the equally distracting list of all the latest factors about which we should be experiencing great angst) we should keep our senses tuned to longer term trends that will most likely drive the greatest portion of any given future market movement!!

Personally, I am anxiously awaiting any insights Barnier might be willing and able to offer regarding which “economic factor” will become the predominant force in market movements that lie ahead of us. At this point, your guess may very well be as good (if not even better) than my guess.

DISCLOSURE:

The author continues to hold positions in ETFs and mutual funds based upon the S&P 500 Index, as well as other key U.S. equity indices, with appropriate allocations to international equities and both domestic and international fixed income funds. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] Fund flow data (among other metrics) showed that the “average” investor was bailing on stocks (and moving into bonds) even as the market was reversing its downward direction.

[2] Of course, I am referring to the erudite but inscrutable Alan Greenspan.

[3] One could characterize it as “Monetary Policy on Steroids”.

[4] I hasten to add that, back at that time, “mini” was not attached as a descriptor of “crash”. But given the relative magnitude of the 1990’s real estate price fall compared with the 2007-09 era, I thought it necessary to qualify “crash” in that way!

[5] And even “drawn into” or “seduced by”….

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Retiring in 2025? 3 Financial Moves to Make as Soon as You Resign From Work

Retiring in 2025? 3 Financial Moves to Make as Soon as You Resign From Work