Warren Buffett is not only an exceptional CEO and money manager, but also an exceptional human being!

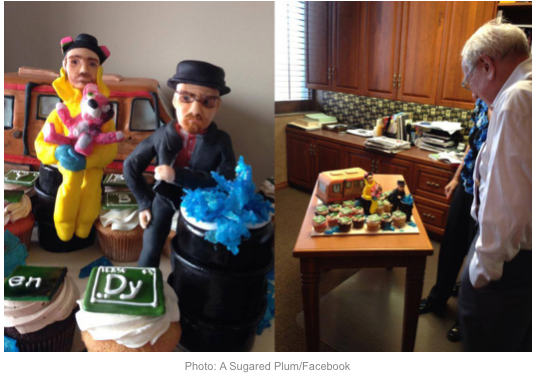

Warren Buffett, the venerable Oracle of Omaha is 84 years old today (as I write this on August 30th). [See his birthday cake in the Footnotes![1]]

“Happy Birthday, Mr. Buffett! May you be blessed with countless more birthdays and even more interesting, profitable investment opportunities!!”

Although we all know that Mr. Buffett’s name appears in the headlines (especially as a “teaser” to get folks to read a business or investment story) on an extremely regular basis, there is much more than the usual reasons to highlight him this month. Here is a quick preview of what we will be highlighting for you below:

1) His Berkshire Hathaway Class A (BRK.A) shares crossed over the (never before seen in the U.S. stock market history) vaunted $200,000/share price threshold on August 14th

2) BRK.A reported earnings on August 1st that beat analysts’ estimates! The company pulled in the highest quarterly net income in its storied history — $6.4 billion. That amounted to no less than a 41% increase on a YOY (year over year) basis!

3) The name sake for the much ballyhooed (but not yet legislated into law) “Buffett Rule” provided $3 billion in financing to help 3G Capital engineer a proposed buyout by Burger King Worldwide (BKW) of Canadian coffee store giant, Tim Hortons (THI). For many observers, it seemed discordantly ironic that the “poster boy” for Barack Obama’s minimum 30% tax on the wealthy was financing a corporate “Tax Inversion” transaction (within which BKW would move its tax home from Miami to the tax-friendly confines of Canada, that sports a mere 15% corporate tax).

That’s a lot of excitement for an 84-year old man in just one month! But by all reports, he is holding up much better than most 65-year olds!

That’s a lot of excitement for an 84-year old man in just one month! But by all reports, he is holding up much better than most 65-year olds!

Let’s start with the amazing milestone reached by BRK.A: $200,000/share! The natural question is: “Why didn’t Buffett ever split the shares (as Apple Inc (AAPL) did in June[2]) to make them more affordable for the average investor?”

Well, quite frankly, Buffett never gave a hoot about the company’s stock being “affordable”!! His focus has always been (and will always be) on managing the company and its assets to the best of his ability in maximizing shareholder value!

When you combine that with the fact that he has always eschewed paying dividends, and that he has managed Berkshire’s assets so magnificently that he is widely considered to be the premier money manager of the 20th Century[3], it is no wonder that BRK-A has reached the pinnacle it has!

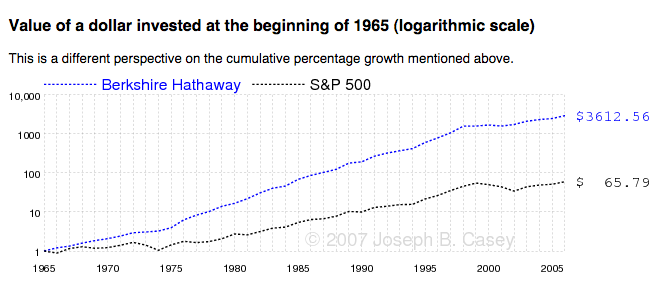

Take a look at this graph of Berkshire vs the S&P 500 Index (broken line) (the value of $1 invested in each) between 1965 and 2006:

If you had invested $1 in Berkshire and the S&P 500 back in 1965, the above graph shows the total investment value 41 years later!

On a regular basis, Buffett has reiterated one of his operating premises in managing Berkshire, namely: the high price of the Class-A shares has contributed mightily to his ability to manage the company without the distraction of dealing with speculators and those trying to profit off of Berkshire without any thought to the company or shareholders![4] Put simply, Buffett was convinced that keeping Class A shares priced as they were helped to make those persons who actually held shares feel and act more like fellow “owners” of the company – and take a long-term perspective on the stock!

One of the characteristics of Buffett that makes him an extraordinary person and corporate leader is that, once he is convinced of an operating principle that will serve both Berkshire and shareholders well, he is able to move ahead without being worried and intimidated by media opinion or a few disgruntled shareholders (no matter how “big” they might be!). The result of his steadfastness regarding the management of Class A shares has been that – unfettered by speculators, the need to pay out dividends[5], or the need to produce “short-term” results, Buffett has grown Berkshire into the fifth largest corporation in the world — based upon market capitalization!

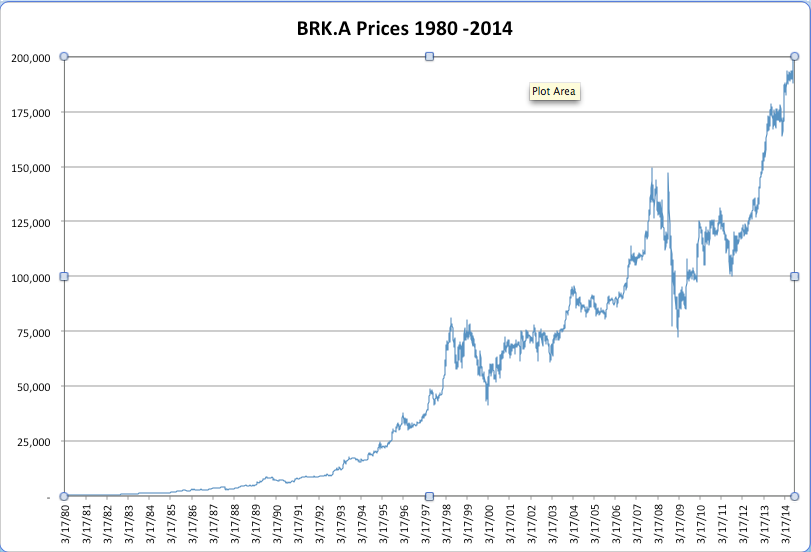

So let’s take a look at how BRK.A became the highest priced shares in the market, and reach its current milestone:

This is a graph of the dates on which Berkshire crossed basic pricing milestones. (Thomas R. Petty, C.F.P.)

To highlight key milestone dates — BRK.A reached (on a closing basis):

$ 25,000 on August 1, 1995

$ 50,000 on January 21, 1998 (Almost 18 months later)

$ 100,000 on October 23, 2006 (8 years, 9 months later)

$ 200,000 on August 14, 2014 (7 years, 10 months later)

Here is a different look at BRK.A’s achievement – using a more normal graph created from YahooFinance.com price data (that only goes back to the spring of 1980):

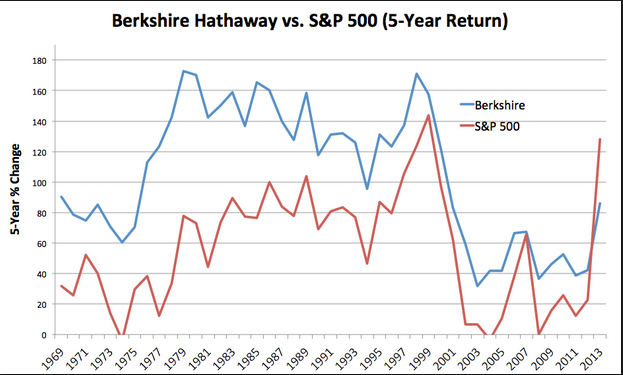

As we saw earlier, Buffett managed to handily outperform the S&P 500 Index during his first 40+ years! One of the measures typically used to illustrate that outperformance has been a graph of BRK.A’s five year rolling average return versus the comparable five year rolling return of the S&P 500. His legendary long-term outlook, plus his total confidence in the long-term vibrancy of the U.S. capitalistic economy, empowered him to thrive through “thick and thin”. In fact, Buffett especially demonstrated his investment genius during the roughest periods, including:

Black Monday (October 1987): outperforming the Dow by 18% (comparing the one day loss of BRK.A vs. the Dow’s one day loss) ;

Dot.com Crash: Buffett only invests in businesses he fully understands and trusts; therefore he didn’t invest in “Dot.com” issues… for which he was criticized, until that is, those “Dot.com” stocks crashed and Buffett was (once again) declared a genius;

2007-09 Financial Crisis: While the economy (especially finance companies) were over-leveraged, Buffett’s appreciation for the vital importance of more than adequate “cash on hand” spared him from the worst of that crisis. In fact, it was Buffett’s load of cash (combined with his faith in the U.S.) that enabled him to “step up” and make uniquely advantageous investments within U.S. stalwarts such as General Electric (GE), Goldman Sachs (GS), and Bank of America (BAC) during the Crisis!

However, in the vein of “What have you done for me lately?”… critics have pointed to this graph and started to suggest that Buffett has “lost his touch”!

This 5-year rolling average return chart shows that, lately, the S&P 500 has been "catching up" with BRK.A!

Isn’t it interesting how much delight humans take in disparaging those who have been extraordinarily successful in the past, but finally appear to be slowing down! Such critics forget two things:

1) Buffett has never been “in this” for the short haul; proverbially speaking, he is a “long distance runner”, not a “sprinter”!!;

2) The current Fed-Super-Liquidity driven stock market is not the environment within which Buffett’s long-term value investment style will ever shine. And that is fine with him, because such liquidity cannot last forever!

Which brings us to the next chart, showing the relative performance of BRK.A and the S&P 500 on a YTD basis:

Maybe the old, gray-haired man knows what he is doing!! Certainly a YOY increase in net income of 41%, and a record quarterly haul of income totaling $6.4 billion offers compelling evidence that Buffett has not “lost it”!!

Before we move on from this review of the new milestone reached by BRK.A shares, let me ask a trivia question:

Which stock on U.S. exchanges is the second most expensive on a per share basis?

Put on your thinking caps, folks! The answer may not be on the tip of your tongue, no matter how confident you might think you are!

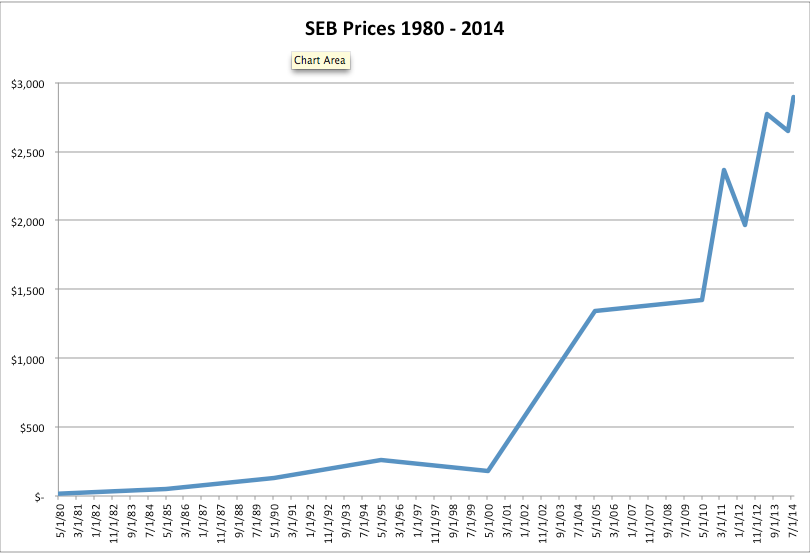

The second most expensive stock today is that of shipping, transportation, agribusiness company named Seaboard Corporation (SEB):

SEB’s price on August 29th was $2,899/share. That means that Buffett’s BRK.A is almost 70 times greater in price than the 2nd priciest stock. Here is a rough view of how SEB reached its status as #2!

Here is a view of how SEB reached its pinnacle of the second priciest stock on a U.S. exchange. (Thomas R. Petty, C.F.P.)

Not surprisingly, BRK.A has outperformed this #2 pricey stock since 1980:

Let’s return for a moment to the fundamental reason that BRK.A shares became so unique with regard to price! Buffett wanted these Class A shares to be pricey because he wanted long-term investors instead of short-term traders or speculators!! That’s why he has neither split Class A shares nor paid dividends!

However, to be fair, Buffett has not been entirely immune to pressure with regard to making Berkshire more accessible and shareholder-friendly. Most notably, he issued “B-shares”[6] on May 9, 1996, at a value 1/30th that of Class-A shares.[7] The opening price was $1,180. This decision was not fully a bow to “accessibility” for shareholders, but was (in reality) driven by Buffett’s determination to spare the stock from what he considered predatory “unit trusts” (which were on the cusp of aggregating shares in order to market lower priced Berkshire “lookalikes”).

I find it interesting that, despite Buffett’s firmly entrenched views on “shareholder friendly” strategies such as dividends and stock splits, he is (by necessity and nature) an astutely pragmatic businessman! In 2010, as he negotiated one of his best known purchases, the Burlington Northern/Sante Fe railroad, he put his aversion to stock-splits aside and authorized a 50-1 stock split of Class-B shares for one reason (and one reason alone) – it enabled holders of BNSF stock to convert more of their shares into Berkshire shares, thereby reducing tax costs!!

It is Buffett’s utter pragmatism and focus on delivering long-term value that is his most enduring strength! He is devoted to fulfilling his primary mandate as a corporate CEO (and investment manager) – the maximization of shareholder value!! That responsibility does not include popularity contests or ideological crusades! It is my contention that it has been Buffett’s utter pragmatism and devotion to maximizing value that has led to the latest “Buffett BrouHaHa”[8].

It is Buffett’s utter pragmatism and focus on delivering long-term value that is his most enduring strength! He is devoted to fulfilling his primary mandate as a corporate CEO (and investment manager) – the maximization of shareholder value!! That responsibility does not include popularity contests or ideological crusades! It is my contention that it has been Buffett’s utter pragmatism and devotion to maximizing value that has led to the latest “Buffett BrouHaHa”[8].

Perhaps you’ve recently seen or heard media headlines such as: “Is Buffett a hypocrite?” You might have been caught off guard by the implication, but don’t worry, folks!! I assure you that Warren Buffett’s integrity is still fully intact. The problem is that most of the mainline media does not truly understand the principles under which Warren Buffett lives!

Allow me to elaborate briefly. As I have read about and observed Mr. Buffett through many years, I perceive the following:

As a U.S. citizen, Buffett follows the following principles:

1) Obey all applicable laws;

2) Live responsibly;

3) Give back (as moved or inspired) to help others.

As the CEO of a major U.S. corporation, Buffett focuses on these principles:

1) Obey all applicable laws;

2) Within the bounds of 1) above, maximize shareholder value!

Those principles appear to be very much at work within Buffett’s private and business life!

Late in 2012, 3G Capital’s CEO, Jorge Paulo Lemann, contacted Buffett, a long-time friend (and fellow former member of the Gillette Co. Board) to offer him the opportunity to partner with 3G in purchasing the venerable U.S. brand, H.J. Heinz Co. Days later, Buffett met with the Heinz CEO, William Johnson, for lunch in Omaha.[9]

As reported in the footnote below, the Heinz CEO discussed some of the best known brands of his company with Buffett over their lunch meeting!

By February, 3G and Berkshire announced a joint acquisition of Heinz (for an estimated value at $23 billion). Berkshire put up half the common equity ($4 billion from each) needed for the deal, and in addition, purchased $8 billion in preferred stock that pays 9%/year ($7.0 million yearly). Each company holds 50% ownership, but 3G Capital is charged with daily management of Heinz.

I will grant that Buffett is not renowned for “shared deals”. That being said, however, this deal was “classic” Buffett! The purchase of ownership in an established, profitable U.S. brand, operating in an industry Buffett thoroughly understands. In this case, the “kicker” was working with someone within whom Buffett has complete confidence (Lemann) so Berkshire did not need to front all the risk capital… and get a sizable chunk of dependable cash flow (the 9% preferred) to boot! At the time of the announcement, few if any questioned the wisdom of Buffett’s decision to make the deal.[10]

Move the calendar ahead just a bit more than 1.5 years. The trusted Lemann contacted Buffett again (who was awash in cash looking for a home) and asked if Buffett would be interested in helping 3G Capital finance a new deal, blending two more established consumer “brands”: Burger King (BKW) and Tim Hortons (THI)! Making the offer perhaps more irresistible was the fact that Berkshire was only asked to put up $3 billion for preferred equity paying (you guessed it) 9%. Berkshire did not need to put up any “risk capital”, and would not need to worry about managing another company. [For more about BKW, see: https://www.markettamer.com/blog/what-60-year-old-company-has-surged-higher-over-the-last-2-years ]

Why would Buffett say “No”?? After all, he publically shared his positive feelings about Lemann and 3G Capital at the February Berkshire shareholder meeting, calling 3G:

“marvelous partners … They're very smart, they're very focused. They're very determined. They're never satisfied. And as I said earlier, when you make a deal with them, you make a deal with them … We welcome the chance to work with them again.”

Combine this trust with the fact that 3G’s forte is quite similar to one of Buffett’s favorite investment areas… namely, strong brands in the food and beverage space… and you have a great “match”. In a sense, Buffett’s recent experience working with 3G is akin to 3G serving as an adjunct “due diligence investment development office” (3G has initiated both deals, invited Buffett to participate, and offered to manage the acquisitions after deal completion).

So what is the big brouhaha all about? Well, one openly announced aspect of the Burger King/Tim Hortons deal is a so-called Tax Inversion – with BKW moving its tax home to Canada to secure the benefits of its 15% corporate tax rate (and the absence of “double taxation”, as in the U.S.). [For more on Tax Inversion, see: https://www.markettamer.com/blog/tax-evasion-or-inversion-a-short-history-case-study and https://www.markettamer.com/blog/would-you-invert-a-view-from-the-ceos-chair ]

As we know, the press loves to grab headlines, as well as any opportunity to criticize the Oracle of Omaha. The media saw an ideal moment to accomplish both objectives! Buffett therefore has been (variously) accused of at least the following:

1) A lack of patriotism.

a) U.S. Treasury Secretary Jack Lew has accused companies involved a Tax Inversion of being “unpatriotic”.

b) President Obama has echoed Lew’s characterization, and has even taken it one step further, saying: “my attitude is I don’t care if it’s legal, it’s wrong!”[11]

2) Outright hypocrisy.

a) Back in 2011, the White House made a big deal of the fact that Warren Buffett publically agreed that existing tax law that has permitted individuals such as him to owe taxes at a lower effective rate than someone like his secretary is not truly “fair”.

b) The White House proposed a new tax law that would apply a minimum tax rate of 30% upon persons who report total taxable income greater than $1 million.

c) The White House and/or the media dubbed that measure the “Buffett Rule”… a misleading misnomer if ever there was one, since Buffett himself did not inspire it, create it, propose it, or codify it. He merely stated that he understood the premise underlying it.

d) The most important fact at work here should be that the proposed legislation was never approved… and therefore, in accordance with U.S. government practice, is not current, effective, or applicable law!!

In response to this media brouhaha, I say: “Bologna Sausage!” Warren Buffett has done more for the United States and the vibrancy of its economy and wellbeing than anyone in Washington, D.C. Through his shareholder letters, quotes, and actions (especially at times of great difficulty) Buffett has done more to inspire faith and trust in U.S. businesses than anyone within the media. He is a patriot, and he continues (as always) to obey all applicable laws!

If the 2011 tax proposal had been duly approved and made the “law of the land”, Buffett would willingly have paid what he owed. However, the law did not pass, so Buffett continues to pay the Treasury what the law says is due from him.

The fact is that Mr. Buffett is a very bright man, and he realizes that any money “given back” to society over and above the annual payment of taxes (in accordance with tax regulations) is best channeled through his favorite charities![12] (Buffett is exceptional in his charitable endeavors.)

Buffett also obeys all applicable corporate laws! As currently constituted (the U.S. Congress published the applicable law in 2004) corporate acquisitions that adhere to certain clearly defined parameters are permitted to include “re-domiciling” as a provision within the acquisition! Therefore, “Tax Inversion” is legal. Anyone who truly believes in the U.S. governmental system as it has operated for over 200 years will understand that operating within the bounds of U.S. law is, in fact, patriotic — political commentary and/or ideology aside!

Therefore, with regard to the $3 billion investment Buffett made to purchase preferred stock within the blended Burger King/Tim Hortons entity, it was a legal investment that will help contribute to the maximization of Berkshire’s shareholder value!

To any member of the media who wishes to press the point further, I would merely point out that the real “Buffett Rule”, rather than the much ballyhooed and misleading “rule” trumpeted about since 2011 is: “Maximize shareholder value within the bounds of the law!”

INVESTOR TAKEAWAY

Leaders are easy targets – particularly leaders who have earned the status of “legendary”! You better believe that, within the judgmental circles of “Wall Street”, anyone who can (essentially) spend his whole career in the relative obscurity of Omaha, Nebraska, and yet be internationally famous and be a virtual lock to be able to secure a luncheon meeting with any U.S. CEO of his choice, deserves the status of “legendary”! He came upon the moniker, “Oracle of Omaha”, the old-fashioned way: he earned it!

But no matter how often Buffett has been “targeted” for criticism or attack, his patience, his common sense, and his good humor have carried him through. More to the point, because of the strength of his convictions and principles and his ability to eschew popularity as he strives to fulfill his responsibilities and duties, Buffett has demonstrated that, through “thick and thin”, through good times and bad, he is perhaps the model by which all U.S. CEO’s should be judged.

So the next time you hear or read some (so-called) journalist trying to take Warren Buffett down a peg or two, just remember that Buffett is among the most virtuous, faithful, patriotic, generous, and effective corporate leaders that these United States have ever seen! The just achieved BRK.A milestone of $200,000/share is just one more accomplishment in an endless stream of accomplishments attributed to the management and leadership of Warren Buffett!

As a final aside, I am regularly amused by headlines in my email to the effect of: “Invest like Buffett”. The easiest answer to that is (duh!): “Buy shares of Berkshire Hathaway!”[13]

DISCLOSURE:

The author owns a put credit spread on BRK.B. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] Buffett is (strangely) a huge BREAKING BAD fan, so Omaha bakery, Sugared Plum, made and delivered an oversized cake for him highlighting the TV show:

[2] On June 9th, AAPL completed a 7-for-1 stock split that reduced the per share price from the mid $650 range to the mid $90 range per share. The general consensus through Wall Street’s history has been that stock splits help broaden share ownership (due to the reduced cost barrier).

[3] That is the reason we keep seeing his name pop up in the press and on TV

[4] This is Buffett’s mannerly way of saying he has kept the “riff raff” away from Berkshire shares! In his 1984 annual letter, Buffett explained: “Were we to split the stock or take other actions focusing on stock price rather than business value, we would attract an entering class of buyers inferior to the existing class of sellers.”

[5] Without being brazenly boastful, Buffett has regularly admitted that he has always been confident in his ability to squeeze a higher investment return from each spare dollar of Berkshire profit than his average shareholder could… so it made more sense for Berkshire to reinvest its available cash than to pay out dividends!

[6] Depending upon your brokerage or platform, either BRK.B , BRK-B, or BRK/B

[7] At day of issuance, Class B shares carried only 1/200th the voting rights of Class A shares. Holders of Class A stock are allowed to convert their stock to Class B, but holders of B cannot convert into A!

[8] From Wikipedia: “A brouhaha, from French brouhaha (possibly from a corruption of Hebrew בָּרוּךְ הַבָּא; barúkh habá, “welcome”, literally “blessed is he who comes”), is a state of social agitation when a minor incident gets out of control, sometimes referred to as an uproar or hubbub.

[9] Johnson later reported that he brought Buffett pins in the shape of pickles and ketchup bottles and: “we talked about Ore-Ida hash brown potatoes, which he likes.”

[10] In fact, many thought it to be a bit of genius…. again.

[11] Innumerable folks are still waiting for the President to say something similar about Lois Lerner and the evidence that the IRS has tilted the administration of certain tax policies on the basis of political affiliation! Anyone who is holding her/his breath until such a statement is made may find that the new health plan does not cover the inevitable consequence!

[12] All of which deliver the dollars donated much more efficiently and effectively than any government could or will!

[13] The easiest option is BRK.B shares: $137.25. You can buy a few shares on a recurring basis (dollar cost averaging), or buy in lots of 100 shares. Or you can choose among: a covered call, a put credit spread, an iron condor.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

20 Words From President Donald Trump That Can Completely Derail the Otherworldly Rally in Artificial Intelligence (AI) Stocks

20 Words From President Donald Trump That Can Completely Derail the Otherworldly Rally in Artificial Intelligence (AI) Stocks