Lately, when assessing daily news stories in general, and financial news in particular, it has become difficult to decide which topic has become more tiresome and irritating:

- The U.S. Federal Reserve and Janet Yellen’s every word[1]; or

- ‘BREXIT” – the referendum within the United Kingdom on June 23rd that will speak to whether the UK stays within the European Union or withdraws.

The life of British PM, Jo Cox (also a wife and mother) was tragically taken in the lead up to the BREXIT vote.

It was actually the assassination of British Member of Parliament (MP) Jo Cox on June 16th that moved me to start exploring more detail about the BREXIT issue… one more example of what I would describe as “politics gone off the rails”[2].

As I delved more deeply into the details of BREXIT, I discovered how very little I actually know about the European Union, and how superficial the general news coverage regarding BREXIT has been.

Therefore, with our focus upon this thorny issue at its peak, I decided to quickly[3] put together an article on BREXIT.

That being said, let me stipulate upfront that this article will not help anyone know how to invest more profitably… nor does it purport to be authoritative… and it definitely offers no pretension that I can accurately predict the outcome of the BREXIT vote [or any other vote, for that matter].

So allow me to offer discourse on a topic I like to imagine was prophesied by Shakespeare centuries ago, as he penned the immortal line (spoken by Hamlet):

“To Be (in the EU) or Not to Be (in the EU)… that is the Question!”

WHAT THE AVERAGE PERSON MIGHT ASSUME BASED UPON GENERAL NEWS COVERAGE OF BREXIT:

Based strictly upon what I have seen and heard through the media, these are some of the assumptions the “average person” outside of the United Kingdom might have developed by now:

- That financial markets are exposed to the risk of a catastrophic reaction that, although unpredictable, could range in scale somewhere between a significant downside correction to something along the scale of the Lehman Brothers collapse in 2008;

- That a U.K. withdrawal from the EU would almost certainly ignite a series of similar efforts by nations (such as France) within which significant portions of the populace are unhappy with the EU;

- That the “hot button” BREXIT issues for those in the UK include (at least the following):

- The loss of strict UK sovereignty over issues impacting UK citizens… with particular emphasis upon immigration and the “cost/benefit” (tax wise) of membership within the EU;

- Economic regulation (some feel that small business within the UK is hindered by EU-mandated regulations);

- The UK would regain some of its lost international “clout” if it had its own (independent) representation within international circles of influence.

- A presumption is made that the UK could negotiate trade agreements with EU nations, and with the rest of the world, that would be at least as advantageous, if not more advantageous, to the UK as it currently enjoys through EU membership

- Most (but not all) of the press coverage surrounding BREXIT serves to leave the viewer/reader with the impression that when the referendum result is reported on June 24th… the markets will resolve themselves one way or the other (to the downside or the upside).

As I explored BREXIT in much more detail on my own, I discovered how misleading the above “impressions” about BREXIT really are. So let me address each one of the above as best I can:

1) CATASTROPHIC FINANCIAL MARKET REACTION

Let me combine this topic with the fourth topic – the fantasy that what we learn on June 24th about the referendum result will somehow lead (within some finite time period) to “resolution” within financial markets.

First of all, the plain (but difficult) fact is that the actual referendum vote itself is unlikely to “resolve” much of anything with regard to the financial markets. Why?

- The UK legislation that established this “EU Referendum” does not include any legal requirement that UK Parliament actually become bound by the referendum’s outcome! This contrasts with the 2011 “Alternative Vote” referendum –which incorporated a legal triggered requiring the government to follow the will of the people!

The truth is that, at some point following the referendum, the 650 members of Parliament would vote upon EU membership matters based upon their own judgment (ie. politics). Experts indicate that these MPs (in the aggregate) include a significant majority who favor EU membership.

- Even if the referendum vote shows that a majority want to “Leave”… and the Parliament actually complies with that vote and initiates a “Withdrawal” process, that will only start the clock on what would surely become a protracted, contentious, possibly chaotic, and most certainly unpredictable period of two years … during which negotiations would take place regarding the precise terms under which the UK would withdraw, In addition, a presumption may be made that (simultaneously) the UK would attempt to negotiate separate trade agreements with non-EU countries (and EU-members willing to talk to them).

For specifics regarding “Withdrawal”, I refer you to the December 13, 2007 “Lisbon Treaty” (initially referred to as the “Reform Treaty”) that dictates the process of any withdrawal from the EU.

Dare I remind us all of how dreadful Europe’s record has been with regard to efficient, rational, and expeditious resolution of complicated matters such as this? We only need recall the torturous and interminable negotiations that have taken place (seemingly forever) with regard to resolution of the “Greek Debt Crisis” and the infamous “GREXIT”.

Christine Lagarde is the Director of the IMF. She offered some pointed warnings to UK voters during the week prior to the BREXIT vote.

With the recent “tough talk”[4] from high-ranking officials regarding the challenges facing the UK if it decides to withdraw from the EU… any “withdrawal” negotiations with EU leaders would certainly be contentious (bordering upon polemical) and would roil the financial markets for many, many months thereafter. Mere common sense dictates that if the EU powers-that-be make it “too easy” for the UK to depart without a steep, steep price, other nations may actually feel incentivized to exit as well.

The plain and simple fact is that, unless the BREXIT vote turns out solidly in favor of remaining within the EU, absolutely no one is able to predict the actual impact upon the financial markets, nor the timeline over which that impact would play itself out.[5] So I regret to suggest that, unless the BREXIT vote is overwhelmingly in favor of the status quo, we will likely (as with “GREXIT”) keep hearing about BREXIT for a long, long time to come – a fate reminiscent of “Chinese water torture”.

2) A BREXIT WILL LEAD THE WAY FOR OTHERS TO DEPART:

Listening to the media coverage, one might develop the impression that the EU is a strong, longstanding, closely-knit, homogenous body that is now suddenly threatened by this rebellious movement from within the UK.

However, history books paint a much different picture… one in which a core group of continental nations still suffering the ravages of World War II join together in an inter-nation federation through which they can achieve mutual economic advantage by lowering trade barriers and expediting business, travel, and cooperation among the member nations.

Then through the course of the following 64 years, that rather loose organization (of just a handful of nations) evolves into something much larger, with a very broad range of responsibility and power, and (perhaps most significantly) much more institutionally complex, with an extremely large base of staff, bureaucrats, officials, and (alas) politicians who are deadest upon preserving their position and power.

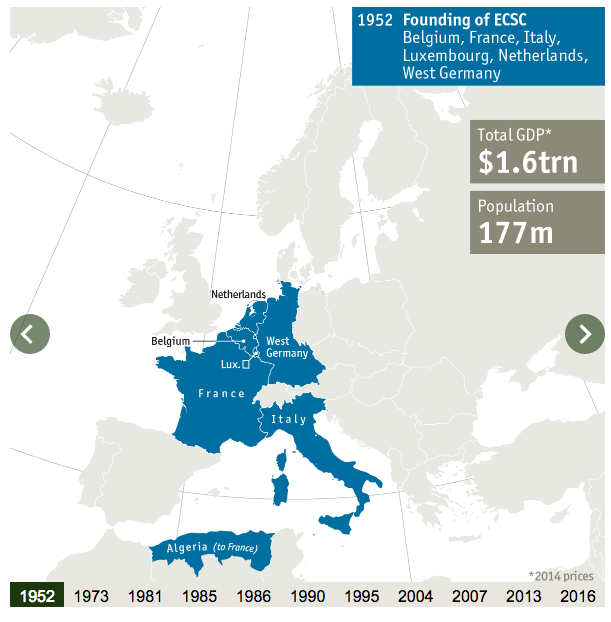

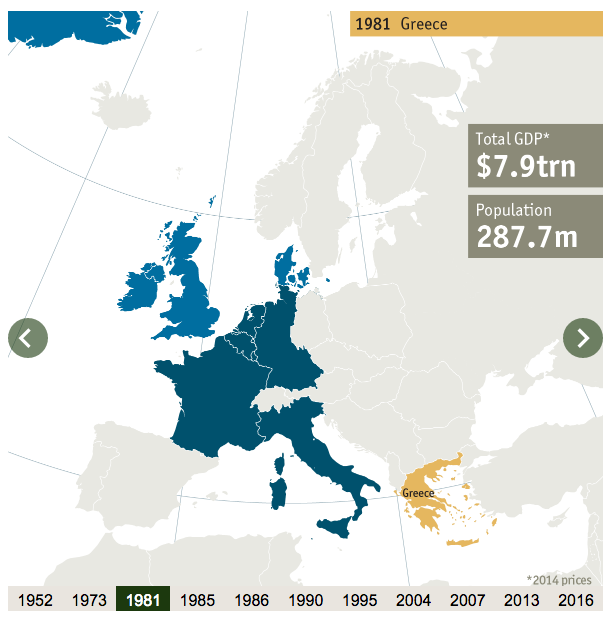

To quickly get up to speed on the EU’s history, scan through the following images from The Economist:

- a) 1952: Six countries (France, West Germany, Italy, Netherlands, Belgium, and Luxembourg) sign “The Treaty of Paris”… establishing the European Coal and Steel Community (ECSC).

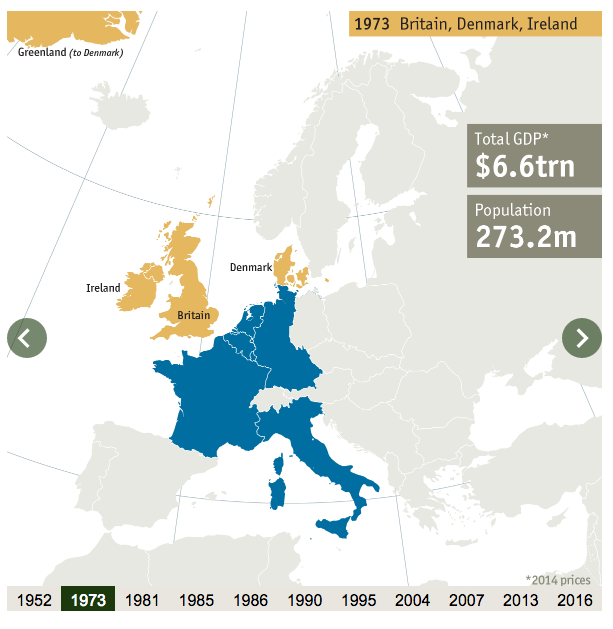

- b) By 1973, three more nations had joined:

Great Britain, Ireland, and Denmark (which at that point also included Greenland in its territory)

- c) In 1981, the die was cast regarding many financial headlines (and Market headaches) to come when Greece was allowed to join.

- d) This may surprise you, but there was an exit from the EU long before GREXIT and BREXIT became infamously familiar headline terms!

In 1985, Greenland exited the EU following its official independence from Denmark! [But we were spared the specter of “Greenlexit” fears because it had merely been one territory (however huge) of an EU country that remained… and (more importantly) because Greenland’s economy is miniscule [approximately 1/100th the size of Greece’s GDP; less than 1/1000th the size of Germany’s economy.]

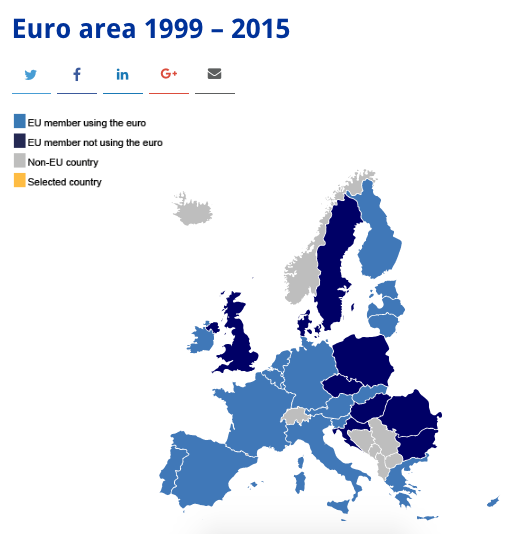

This map displays the EU as currently constituted. Following 1985, the EU grew, country by country, into the size and scope it enjoys today. Note that nine of these nations do not use the Euro!

- e) Since 1985, the following nations have joined the EU–

1986 Spain, Spain, Portugal, Azores, Madeira, Plazas de soberanía

1990 East Germany & West Berlin (upon German Unification)

1995 Austria, Finland, Sweden

2004 Malta, Cyprus, Estonia, Latvia, Lithuania, Poland, Czech Republic, Slovakia, Slovenia, Hungary, Akrotiri and Dhekelia

2007 Bulgaria, Romania

2013 Croatia

In addition there is a list of “Candidate Countries”: Albania, Macedonia, Montenegro, Serbia, Turkey.

With regard to what those who are aware that the UK still uses its time worn Pound Sterling as currency (rather than the Euro) and might suppose that the UK thereby gets special treatment, it is important to highlight that eight other EU nations do not use the Euro, either!

Based upon the above, we can see that the EU has never been a “fixed”, firmly established entity… but rather the result of over 60 years of evolution and change. So although BREXIT would indeed result in a major period of transition for the EU, its very history has been one of transition.

What is of greatest significance with regard to BREXIT is the as yet unanswered question:

How would political leaders within the EU (as well as the UK) handle the complex processes involved in any exit from the EU by the UK? To be candid, I am not optimistic that enough “statesmen/women” would emerge within either side to ensure a rational, reasonable, mutually constructive exit process.

Instead, I fear that the political environment du jour (filled with more heat than light… more rancor than reason… more invective than insight) would result in prolonged dysfunction, and do economic harm to all involved![6]

3) PRESUMED “HOT BUTTON” ISSUES FOR UK CITIZENS:

The signing of the “Magna Carta” in 1215 was a watershed event in history with regard to British sovereignty.

- “Sovereignty is Sacred” : in the minds of a substantial group of those within the UK, membership within the EU has sacrificed too much of the “sovereignty” treasured by Britons ever since the Magna Carta in 1215 A.D.[7]

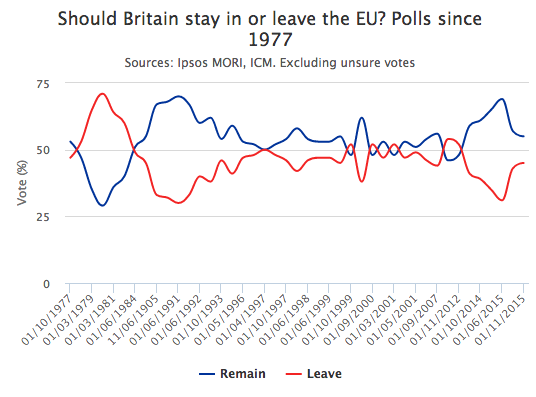

- The simple fact is that UK membership within the EU has never been a huge hit with the British populace:

- Just take a look at this graph of UK polling regarding EU Membership since 1977:

A vote to “Remain” on the 23rd may offer Markets a sigh of relief… but it will hardly be long-lived. The British people are unlikely to ever become anything more than reluctantly “resigned” to membership within the EU. And populist politicians within the UK will surely continue to use BREXIT as a rallying cry (for their own ends).

Taxation is another one of the issues regarding which many Brits look upon the EU with suspicion. At that heart of this suspicion are two fears:

That the UK does not receive adequate benefit from the tax it pays to the EU.

Prime Minister David Cameron has assured voters that the UK receives more than sufficient benefit from EU membership to justify payments to the EU.

However, opponents of UK membership within the UK has taken great pains to more than counter any/all information that PM Cameron has offered to UK voters.

Boris Johnson (MP), former Mayor of London, is one of the more outspoken critics of UK membership in the EU.

Personally, I do not recommend that any of us believe either side. Obfuscation of reality and the facts seems to have become a required skill set for 21st Century politicians!

Another fundamental concern/fear held by most of those who support the UK leaving the EU is the following:

- As the EU bureaucracy grows in size (employees) and scope (regulatory reach), UK taxpayers will suffer.

In order to get a better handle on this point, I gathered the most recent data I could find on relative government spending. The following graphs (from 2014) suggest that UK spending is roughly in line with the spending of major EU members… at least in terms of government spending per capita and as a percent of GDP.

The chart below sorts the data in order of “Government Expenditures/Person”, expressed in Euros… from highest to lowest.

| Nation | Millions of Euro | Euro/Person | % GDP | Chg 13 to 14 |

| NORWAY | 172,306 | 33,536 | 45.7 | 1.6 |

| SWEDEN | 227,679 | 23,481 | 53.0 | -.0.3 |

| FINLAND | 119,691 | 21,913 | 58.7 | 0.9 |

| FRANCE | 1,226,481 | 18,530 | 57.2 | 0.2 |

| GERMANY | 1,274,415 | 15,469 | 43.9 | -0.4 |

| UK | 986,554 | 15,293 | 44.4 | -1.1 |

| EURO AREA | 4,961,272 | 14,617 | 49.0 | -0.4 |

| ITALY | 826,262 | 13,591 | 51.1 | 0.2 |

| EU | 6,701,315 | 13,153 | 48.1 | -0.5 |

| SPAIN | 461,124 | 9,924 | 43.6 | -0.7 |

| GREECE | 88,371 | 8,039 | 49.3 | -10.7 |

| POLAND | 172,760 | 4,489 | 41.8 | -0.4 |

The chart below sorts the same data in order of “Government Expenditures as a % of GDP”… from highest to lowest.

| Nation | Millions of Euro | Euro/Person | % GDP | Chg 13 to 14 |

| FINLAND | 119,691 | 21,913 | 58.7 | 0.9 |

| FRANCE | 1,226,481 | 18,530 | 57.2 | 0.2 |

| SWEDEN | 227,679 | 23,481 | 53.0 | -.0.3 |

| ITALY | 826,262 | 13,591 | 51.1 | 0.2 |

| GREECE | 88,371 | 8,039 | 49.3 | -10.7 |

| EURO AREA | 4,961,272 | 14,617 | 49.0 | -0.4 |

| EU | 6,701,315 | 13,153 | 48.1 | -0.5 |

| NORWAY | 172,306 | 33,536 | 45.7 | 1.6 |

| UK | 986,554 | 15,293 | 44.4 | -1.1 |

| GERMANY | 1,274,415 | 15,469 | 43.9 | -0.4 |

| SPAIN | 461,124 | 9,924 | 43.6 | -0.7 |

| POLAND | 172,760 | 4,489 | 41.8 | -0.4 |

Next, Immigration has been a “Hot Button” issue for nearly every country in the world in recent years! The bombings that have taken place within Europe for which the perpetrators were (or are suspected to have been) from foreign countries – enabled by easy passage throughout the “borderless” EU to get to get to nearly any desired location – have created a strong strain of fear throughout Europe. And (as we know) such fear leads to popular calls for regulation… tightening down national borders.

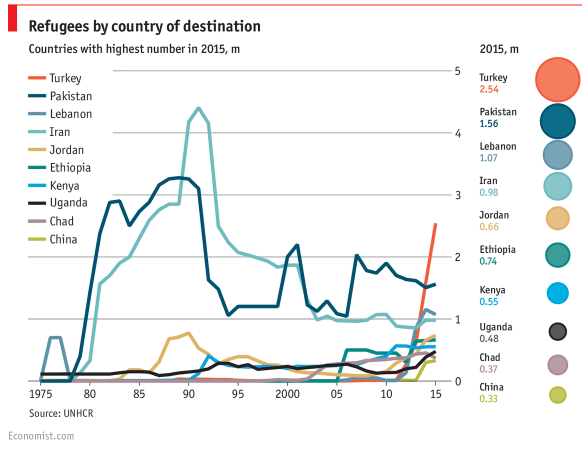

Here are key facts about immigration (drawn from The Economist):

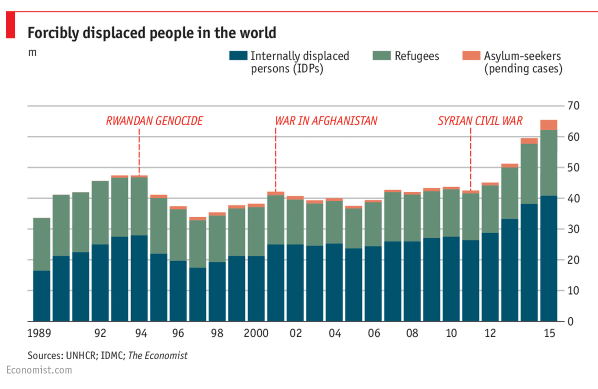

According to the UN body charged with focus upon issues related to global refugees (UNHCR), the number of people displaced from their home is now higher than ever recorded previously. Currently, almost 1% of the world’s population consists of displaced persons (65.3 million in 2015). That was an increase of six million from the prior year. Approximately one-third of those persons are refugees, while the rest are “internally displaced” or “asylum-seekers”.

As we see below, much of this growing problem is accounted for by one or another conflict (such as those in Rwanda, Afghanistan, or Syria):

This timeline shows key global conflicts since 1989 that have led to the displacement of large numbers of people!

At present, just three countries produce more than one half of the world’s refugees: Syria, Afghanistan, and Somalia.[8] As one might guess, the place to which most of those refugees flee is a neighboring country.

As can be seen in the above graph, Turkey and Pakistan currently house the largest number of refugees (Syrians in Turkey; Afghans in Pakistan).

While not meaning to imply any diminishment of the legitimacy of the immigrant issue within the EU or the UK – it is worthy of note that there is no European country in the “top ten” of the destination nations itemized above.

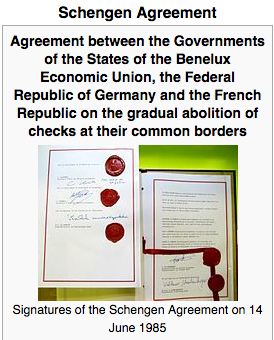

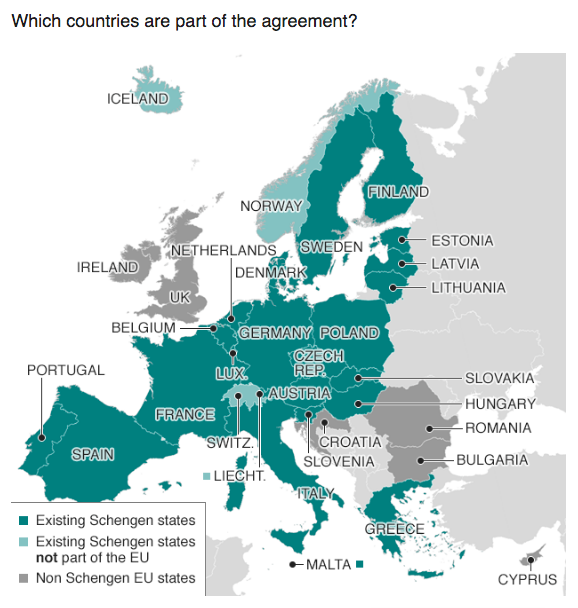

What is significant with regard to a contrast between the UK and the EU is a quick review of the Schengen Agreement. For those who are not familiar with that agreement, it was signed 31 years ago (June 1985) between Belgium, France, (W) Germany, Luxembourg, and the Netherlands… and committed each party to the gradual abolition of checkpoints as their borders.

Currently, the map below shows the nations who are a part of that agreement:

Note that the UK is not a party to this “no border” agreement. That being said, it is true that Schengen does make it (as a practical matter at least) easier to get into and out of the UK than it used to be… as does (for example) the Chunnel.

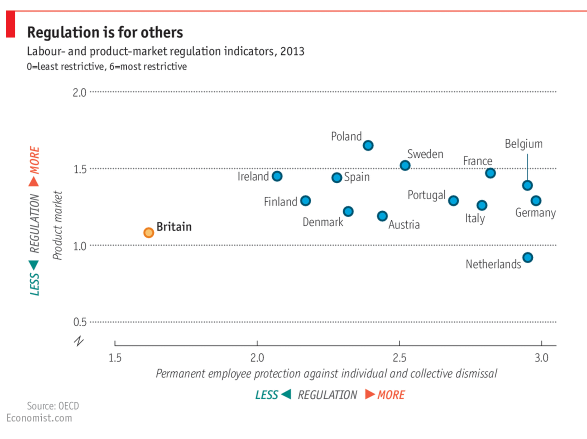

Another important issue raised by those opposed to remaining in the EU is “Business Regulation“. This is a complex issue. But I believe it is fair to point out two points:

- There is a persistent tendency for government regulation, however well-intended, to become entangled in bureaucracy – almost inevitably increasing every business’ cost of doing business, and therefore increasing the “final” cost to consumers.

- That being said, most experts agree that business in the UK is less regulated (by far) than business within the EU:

This graph illustrates that (at least according to this analysis) regulatory burdens are much lower in the UK than in the EU.

Finally, with regard to two other points I raised earlier within the “sovereignty” category [ie. presumptions that a break from the EU would enable the UK to regain its international “clout”… and presumption that the UK could negotiate more favorable trade agreements with non-EU nations… while retaining comparably favorable trade with EU members] let me emphasize that those two points are merely and only that: presumptions!

I have already outlined my estimate regarding the odds that “withdrawal” negotiations with the EU would be rational, reasonable, and efficient (very doubtful). Beyond that, the energy UK leaders would need to devote to the inevitably long, arduous “withdrawal” process would certainly distract them from international leadership anyway, making international leadership a relatively less significant issue.

INVESTOR TAKEAWAY:

In my opinion, it is nearly impossible for anyone living in the U.S. to accurately (much less insightfully) analyze the BREXIT issue from the point of view of citizens within the UK. As we have only begun to illustrate above, BREXIT is a tangled web that mixes politics, nationalism, economic growth, distaste for taxes, fear of immigrants, and a whole rash of other dynamics into what has obviously become a quite volatile “pot”.

That “pot” will be stirred vigorously up to and through June 23rd…. resulting in a decision that will be watched with great (grave) concern by millions around the world – from Janet Yellen to George Soros… from David Cameron and Barack Obama to Vladimir Putin… from the average woman on the street to the anxious trader sitting at a screen with a position likely to be pushed up or down by any/all BREXIT news.

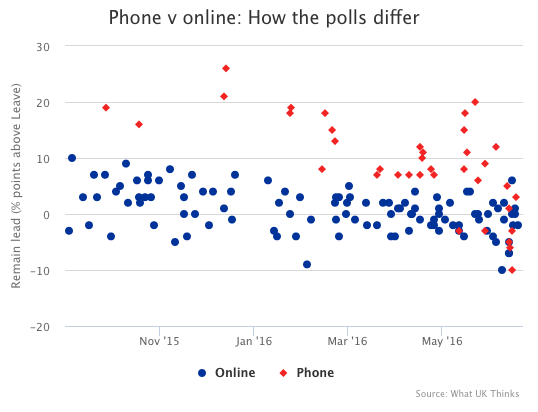

As we wait, I suggest we pay minimal attention to news reports regarding this poll or that poll. Polls are notoriously misleading…. and in my humble opinion, polls have become much more a media tool to gain viewers, ratings, and/or “clicks” than an effort to inform and enlighten.

In addition, I draw your attention to the empirically established vagaries that impact polls. For example:

This graph illustrates statistically different responses to BREXIT polls depending upon whether the poll is conducted by phone or online.

As we can see above, those who respond to phone polls (red) clearly show a greater tendency to indicate support for “Remaining” in the EU, versus those who respond to online polls. That is just one example of the lack of reliability found within polls.

Perhaps more interesting, let’s take a look at BREXIT projections from those who are true professional prognosticators – because they put their own real money on the line, and therefore they risk significant loss if they are wrong!!

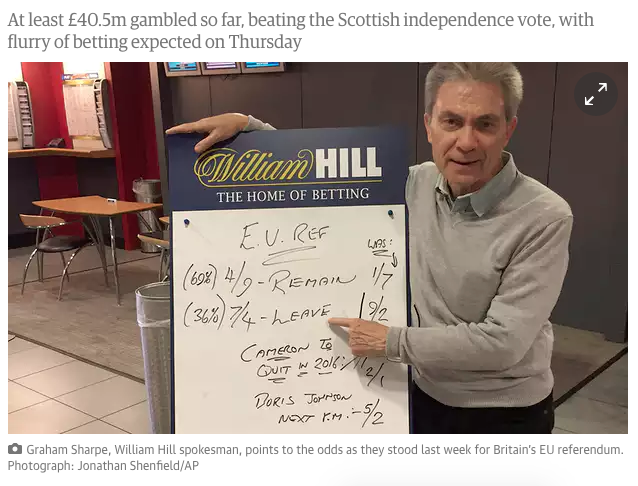

William Hill is one of the UK's “Big Three” bookmakers. It has been reported that BREXIT has become the most bet upon political event in UK history!

Yes, I refer to UK “bookies” – who within the past week indicated that the odds in favor of the “REMAIN” side are approximately 60%-40%. That sure offers a significantly different perspective on BREXIT vis-à-vis the polls that appear in the media, doesn’t it? But if you personally had to project which data source is more likely to be correct – would you choose polls or bookies?

In the interest of full disclosure, I need to add this little narrative that appeared on 6/21, reminding us all of the sheer volatility of public opinion:

On June 17th, if one wanted to bet that the UK will remain in the EU, a bet of $165 was required to win $100!

But by June 20th, those odds changed to this— to win $100, a bet of $400 was required! (If you want to bet that the UK “leaves”, a bet of just $100 would win you $250.)

In an effort to offer “equal time” (but mainly because I love the name “Paddy Power”) here is a headline from 6/20 regarding BREXIT odds.

Of course, as virtually every trading educator/expert has been counseling the “average” investor – “Be careful out there”. Reduced trade size and risk management, along with some targeted hedging of any significant long positions in one’s portfolio, are all very helpful suggestions for folks such as you and I.

Allow me to digress enough to offer one fascinating side note that speaks both to the

According to data from the U.S. Office of Management and Budget, even if the U.S, was interested in joining the EU, it would not qualify for inclusion. Why?

The EU has an official financial requirement that each member nation maintain an annual budget deficit that does not exceed 3% of its GDP and a total public debt that does not exceed 60% of its GDP!

During FY 2015, the U.S. reported a budget deficit that amounted to just 2.5% of GDP (we’d qualify for EU inclusion). However, our total public debt at the end of FY 2015 totaled fully 73.7% of GDP!!

Therefore, on that basis, the U.S. would “flunk” a key criteria for inclusion within the EU!!

Of course, it should not be a surprise that EU officials have made it a habit to let a number of EU nations fall on the wrong side of those two key financial “standards” regarding national discipline. Hence the recurring theme of “European Debt Crisis”!

Finally, please do not count upon anyone, no matter how many credentials they include in their resume or how much money they made in 2007-09 (or what fortune they made as the result of a “correct call” over 20 years ago) to accurately predict how markets will respond to the results that will ensue from the BREXIT referendum. Every human being has her/his shortcomings – including a distinct incapacity to be omniscient!!

Perhaps even more significantly, no matter what the referendum result actually turns out to be (short of a landslide one way or the other) – no one can confidently predict how long we will continue to hear about, and likely wring our hands about, BREXIT and its many related issues. As I tried to describe earlier, the sentiment within the UK regarding the EU has historically been so (at best) “lukewarm” that the shadow[9] of BREXIT will likely linger to one extent or another for quite some time.

And (of course) if the UK actually proceeds to withdraw from the EU – well I am sure the media will be provided lots of tantalizing news stories for countless months thereafter about the unpleasantness and political bickering that will follow! There is absolutely no chance of a “clean break” in this instance.[10]

Good luck to you… and to the good citizenry within the UK and the EU!

DISCLOSURE:

The author is neither a Europhile nor an Anglophile. Admittedly, he has Irish and English blood coursing through his veins… but he also has German and French blood as well… with a dash or two of Spanish blood from great, great grandfather, Don Carlos Petty…. who is reputed to have counseled investors as follows: “Nada de lo anterior pretende ser una recomendación para vender o comprar cualquier cosa . Siempre consulte con su asesor financiero antes de tomar cualquier decisión importante.”

FOOTNOTES:

[1] Sometimes it feels as though the press tries to interpret even her facial expressions

[2] I hasten to add that “politics gone off the rails” seems to have become a global phenomenon – one that has clearly infested the United States landscape as well.

[3] Too quickly, in fact… I apologize that I had to throw this together so quickly… leaving so many details out (and/or not adequately analyzed).

[4] On June 17th, news reports outlined the manner in which the International Monetary Fund’s (IMF) Director, Christine Lagarde… used the IMF report on the United Kingdom to scare the living daylights out of the British people. From the Guardian on 6/17:

“Leaving the EU would hit British living standards, stoke inflation and wipe up to 5.5% off GDP, the International Monetary Fund has warned with less than a week to go until the referendum.

The IMF used its annual report on the British economy to say Brexit would plunge the UK into recession next year and that it could see no economic advantage in leaving the EU.” [It added that Lagarde predicted a plunge in housing prices and a stock market crash.] One commentator observed that Lagarde’s comments could be likened to Don Corleone (from “The Godfather”) making someone “an offer they couldn’t refuse”.

[5] Yes, I mean no one! In recent days George Soros has gotten lots of “press” for predicting a 25% collapse in the British Pound if the UK exits the EU. He receives that coverage because he made a huge fortune (about $2 billion) by shorting the Pound back in 1992 However, last time I checked, the fact that a human was prescient (or lucky) once does not in any way ensure she/he will be correct a second time!

[6] The temptation for EU leaders to be vindictive and arbitrary may well be beyond their ability to resist… at least based on past performance.

[7] To put it entirely crudely, many Britons share the feeling that their ancestors did not sacrifice blood, sweat, tears, and millions of lives in WWII (when for a few years Britain was all that stood between the Axis Powers and total domination of Europe) only to give up their national sovereignty in the 21st Century.

[8] This particular study does not include data regarding Palestinian refugees… who come under the purview of a different UN body…. [Perhaps one of many signs of dysfunction within the UN]

[9] Or worse yet, specter…

[10] You see there, I just found myself falling into the prognostication trap! Well, you shouldn’t depend upon ME being correct anymore than you should count on anyone else to be omniscient!!!!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

You Don't Need Talent to Succeed: Lessons From Warren Buffett's Lifetime of Investing

You Don't Need Talent to Succeed: Lessons From Warren Buffett's Lifetime of Investing