Here is something a little different for you – something that I hope opens your trading mind and your strategic imagination to some helpful new insights and possibilities!

Let’s start by looking at a price chart comparing three very well known companies in the same industry. The period covers July 1, 2012 through October 31, 2013:[1]

As you proceed through this quiz, I don’t want your answers to be impacted by your existing feelings/prejudices regarding these three stocks. Therefore, let’s arbitrarily assign the letter “A” to the stock shown in blue above, while “B” is the stock represented along the red line and “C” is the stock whose price is tracked along the green line.

Which of these stocks demonstrates price action in which you would be most interested — in other words, which stock would you have been most likely to buy early in November: A, B, or C?

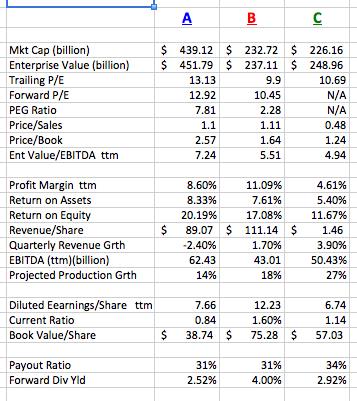

Do you think it is hard to decide without more information? That is perfectly understandable? Therefore, to help you discern value and profitability, here are some key metrics for each of the above companies as currently listed on the YahooFinance.com website:[2]

Big companies, aren’t they?

Don’t worry if you don’t know precisely what each of these metrics measure, much less what any given metric value “means”, you can take a quick look in the appendix to review as brief a definition of those metrics listed here that are least well-known.

Don’t worry if you don’t know precisely what each of these metrics measure, much less what any given metric value “means”, you can take a quick look in the appendix to review as brief a definition of those metrics listed here that are least well-known.

As you review these metrics, I think you’ll agree that there is no absolutely “best” answer … much less “correct” answer!

In fact, interpreting the price graph and these metrics might be likened to a Rorschach Test![3] As you discern which stock you’d prefer to own, much will be revealed (consciously or unconsciously) about your investment goals, risk tolerance, need or desire for investment income, and your perception of which metrics are most important within trading and/or investing!

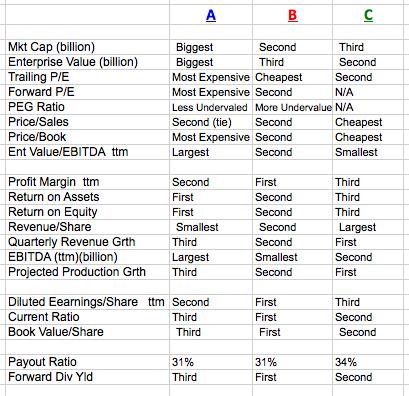

For those of you who are newer to the investment world, here is a very brief (superficial) summary of which company might be considered “tops” within each financial category:

I found it interesting that each company has a very similar “Payout Ratio” – it felt as though they were each following a “standard benchmark” (but they aren’t!). That is why there is no ranking in that category.

I found it interesting that each company has a very similar “Payout Ratio” – it felt as though they were each following a “standard benchmark” (but they aren’t!). That is why there is no ranking in that category.

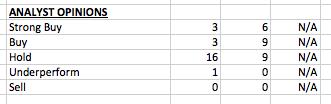

And before I pose my questions, I recall that a few of you really depend upon a review of analyst opinions. The most efficient way for me to provide this input to you is through YahooFinance.com. Unfortunately, that site does not provide any ratings on Stock C (for reasons you may deduce later).

Here is a summary of the ratings from early November 2013:

So, let’s proceed now with the “Quiz”!

1) If your rich uncle gave you enough money to buy $10,000 of one of these stocks[4] … which stock would you prefer to buy?

1) If your rich uncle gave you enough money to buy $10,000 of one of these stocks[4] … which stock would you prefer to buy?

2) Why did you make the choice you did? List all the reasons.

3) Follow-up question: which stock would be your second choice?

4) Why did you make the choice you did? List all the reasons.

I know most of you won’t do this, but I strongly suggest you write your answers down, because you may discover some revealing insights about the way you conceptualize trading (investing) and which corporate metrics are most important to you when you weigh investment alternatives.[5]

Thank you for participating, folks!

Now here is the next step in our analysis!! Guess which stock the legendary Warren Buffett purchased during the third quarter of 2013 (revealed within a Form 13F to the SEC in November)? In fact, not only did the Oracle of Omaha buy shares – he purchased 40.1 million shares, costing $3.45 billion!!

Although that amounts to only 0.9% of the total stock float of that company, it now represents the seventh largest position within the stock portfolio of Berkshire Hathaway Inc. (BRK-A)!

So which stock do you think was purchased: Stock A, B, or C? And “why” do you think he chose that stock?

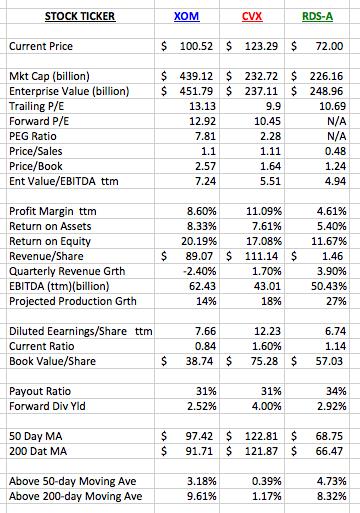

ANSWER: Mr. Buffett purchased Stock A!! Exxon-Mobil Corporation (XOM)

Does that surprise you? I imagine that all those who chose to buy Stock B are thinking: “What?! Has Buffett gone daft? Stock B is a much better value, with much better forward production growth, and a dividend yield 60% higher!! I thought Buffett was all about ‘value’! Maybe Buffett needs to be eased out as portfolio manager because he is evidently losing it!”

Does that surprise you? I imagine that all those who chose to buy Stock B are thinking: “What?! Has Buffett gone daft? Stock B is a much better value, with much better forward production growth, and a dividend yield 60% higher!! I thought Buffett was all about ‘value’! Maybe Buffett needs to be eased out as portfolio manager because he is evidently losing it!”

Well, folks, I doubt that Mr. Buffett will be at all concerned about your opinion! He is extremely secure in his position (to put it mildly!). In addition, as always, Mr. Buffett’s rationale is impeccable. The reason that his rationale for purchasing XOM is not apparent from the statistics provided at the start (and fleshed out here with the identities of the all three companies revealed … along with some additional metrics that provide current data… see the worksheet to the left) is that Mr. Buffett often looks way below the surface – to data not as frequently discussed in the financial press!

As you can see, Stock B was Chevron Corportion (CVX) while Stock C was Royal Dutch Shell plc (RDS-A).

So what exactly does Buffett see within the less visible dimensions of XOM that (in his opinion) makes it such a compelling stock that it is worthy of being his 7th largest position?

To answer that question, we have to poke around the XOM website and probe one of the most recent “Investor Presentation” PDF downloads for more data.

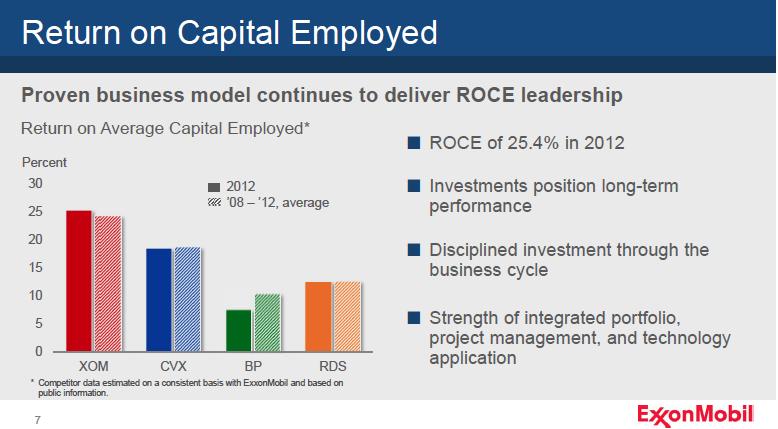

Does “ROCE” mean anything to you? It sure does to Mr. Buffett!! That acronym is short for “Return on Capital Employed” — a metric that reveals how much cash is going into a business vis-à-vis how much is coming back out! This metric is particularly telling for companies in industries that run through a lot of capital each year[6]. XOM certainly qualifies as a capital-intensive company.

So take a good look at this graph from the XOM site:

WOW! XOM blows the others[7] away! Maybe Warren Buffett knew what he was doing!

As we know, Buffett is content to sit on cash until/unless he finds a compelling opportunity that offers a favorable amount of reward (investment return) compared with the associated risk! He feels absolutely no compulsion to add investments merely to avoid carrying a high cash balance (or perhaps to “look better” in reports because he has a larger “equities” balance! Buffett exercises strict investment discipline!

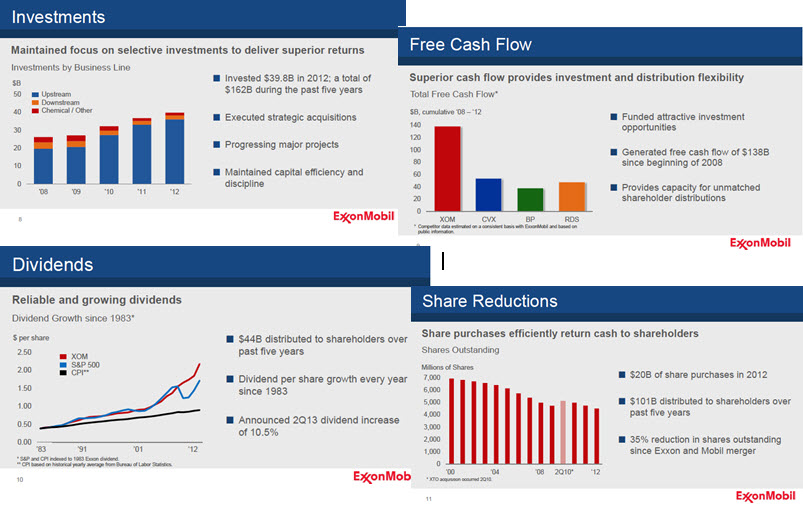

XOM management shares a very similar discipline. As the company with the world’s third largest annual revenue stream[8], XOM managers oversee more money than we can possibly imagine! And yet “cash in hand” never burns a hole in their “corporate pocket”!! They exercise great discipline in regard to capital allocation – allocating resources only to those projects that have a high potential return (vis-à-vis risk). If management cannot find enough profitable projects through which to utilize capital… they are extremely comfortable returning “excess capital” to shareholders (through dividends and stock buybacks)!

Expressed in a different manner, let me point out that XOM could ensure that it grows (in production and other metrics) as fast as other large oil companies. However, management knows that doing so would require allocating capital to projects about which they aren’t as excited as they want to be – projects that offer a return that could be lower than an investor (be it Buffett, or a fund, or you) could otherwise earn with that capital!!

Talk about responsible management! That is Buffett’s assurance that any money BRK-A invests in XOM will be extremely well utilized – much as Buffett himself might utilize it!

Other slides from this investor presentation demonstrate these same basic themes:

1) Discipline of “Selective Investment of Capital”.

2) Maximize the Allocation of Cash.

3) Return Excess Capital to shareholders.

a. Dividends

b. Share buybacks that enhance all “per share” metrics!

Let’s wrap up with observations from two industry analysts and the one more disclosure regarding BRK-A portfolio changes from the third quarter:

Oppenheimer senior oil analyst, Fadel Gheit, recently observed:

“He [Buffett] likes buying big, established global brand names, and Exxon is a good flight-to-quality stock. The stock has also lagged the market in the last three and five years. That makes a typical Warren Buffett holding.”

Pavel Molchanov is an analyst with Raymond James & Associates, echoes and embellishes those thoughts: “Buffett is a classic value investor, and Exxon has been an under loved stock in a bull market. Exxon is an amazing cash generating machine, which should generate $16 billion of free cash flow this year!”

Keeping in mind that (at least through October) XOM had underperformed CVX, it is telling that the Form 13F filing also revealed that, during the third quarter, BRK-A sold 44% of its total holding in CVX stock. That is a classic example of investing with “reversion to the mean” in mind. After all, CVX had significantly outperformed the sector’s biggest ETF fund (Energy Selector Sector SPDR (XLE)) and “lapped” XOM.

INVESTOR TAKEAWAY:

1) Each investor holds a unique mix of investment perception, preferences, and priorities, in addition to her/his risk tolerance, feelings regarding certain brands[9], and/or need for current investment income! That means that an investment coveted by one investor might be considered foolish by another investor – but neither would be “wrong” in any absolute sense!

2) Rarely are the metrics of any one company so obvious, one-sided, and compelling that a side-by-side comparison with industry competitors would make the choice of one “best stock” either obvious or inevitable.

3) At different stages of our life, the investments that would make the most sense for our portfolio would quite likely be significantly different.

4) One should absolutely not automatically run out and buy XOM because of this article!! I cannot emphasize this enough. Let’s assume most folks knew about Buffett’s “buy” on November 10th. The price action since then has reflected very positive sentiment toward XOM. (See the graph.)

It is reasonable to suggest that XOM has already filled some of the performance gap that had existed between it and CVX!

Here is a look at a weekly chart of XOM (from ThinkorSwim). It is more obvious in this graph that XOM has had a “bump up”!

You can’t see the detail very well in the graph, so allow me to tell you that (as of 1/10/14):

a) The 5-Week MA stood at $99.04;

b) The 20-Week MA stood at $94.32

c) The top of the Keltner Channel was at $95.85.

Therefore, if your rich uncle was being pushy and insisted that you make your stock choice quickly, you could propose that you do one of the following:

1) Sell a February 2014 $97.50/$95 Bull Put Spread for a $0.50 credit per spread (or higher). With your risk per spread $2.00 (Difference between strikes $2.50, less $0.50 credit)… your Return on Risk would be 25%.

2) Much less risky[10], and less profitable, would be — Sell a February 2014 $95/$92.50 Bull Put Spread for a $0.24 credit per spread (or higher). With your risk per spread $2.26 (Difference between strikes $2.50, less $0.24 credit)… your Return on Risk would be 10.6%.

3) Another choice using the lower short strike would be — Sell a February 2014 $95/$90 Bull Put Spread for a $0.36 credit per spread (or higher). With your risk per spread $4.64 (Difference between strikes $5.00, less $0.36 credit)… your Return on Risk would be 7.8%.

You can try other variations if you choose. [The above examples are for educational purposes only!!!! Not advice to buy or sell anything!]

DISCLOSURE: The author has owned XOM in the past. Members of his family have owned it for decades and still do. The author does not own CVX, BP, RDS-A, or XLE. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

APPENDIX: The following definitions are derived from content in Wikipedia.com and/or Investopedia.com. The author has edited a few, but cannot claim credit for the content.

The hyperlink sections are intended (by the author) to draw attention to key content.[11]

Enterprise Value/EBITDA

From Wikipedia, the free encyclopedia

EV/EBITDA (Enterprise value/EBITDA) is a popular valuation multiple used in the finance industry to measure the value of a company. It is the most widely used valuation multiple based on enterprise value and is often used in conjunction with, or as an alternative to, the P/E ratio (Price/Earnings ratio) to determine the fair market value of a company.

An advantage of this multiple is that it is capital structure-neutral, and, therefore, this multiple can be used to directly compare companies with different levels of debt.[1]

The EV/EBITDA multiple requires prudent use for companies with low profit margins; i.e. for an EBITDA estimate to be reasonably accurate, the company under evaluation must have legitimate profitability.

Often, an industry average EV/EBITDA multiple is calculated on a sample of listed companies to use for comparison to the company of interest, i.e. as a benchmark. An example of such an index is one that provides an average EV/EBITDA multiple on a wide sample of transactions on private companies in the Eurozone.

The reciprocate multiple EBITDA/EV is used as a measure of cash return on investment.

‘Earnings Before Interest, Taxes, Depreciation and Amortization – EBITDA'

An indicator of a company's financial performance which is calculated in the following EBITDA calculation:

EBITDA = REVENUE – (EXPENSES (excluding tax, interest, depreciation, and amortization))

EBITDA is essentially net income with interest, taxes, depreciation, and amortization added back to it, and can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions.

This is a non-GAAP measure that allows a greater amount of discretion as to what is (and is not) included in the calculation. This also means that companies often change the items included in their EBITDA calculation from one reporting period to the next.

Currently, EBITDA is commonly reported by many companies — especially in the tech sector. This is true even when it isn't warranted.

A common misconception is that EBITDA represents cash earnings. EBITDA is a good metric to evaluate profitability, but not cash flow. EBITDA also leaves out the cash required to fund working capital and the replacement of old equipment, which can be significant. Consequently, EBITDA is often used as an accounting gimmick to dress up a company's earnings. When using this metric, it's key that investors also focus on other performance measures to make sure the company is not trying to hide something with EBITDA

Enterprise value

From Wikipedia, the free encyclopedia

(Redirected from Enterprise Value)

Enterprise value (EV), Total enterprise value (TEV), or Firm value (FV) is an economic measure reflecting the market value of a whole business. It is a sum of claims of all claimants: creditors (secured and unsecured) and equity holders (preferred and common).

Enterprise value is one of the fundamental metrics used in business valuation, financial modeling, accounting, portfolio analysis, etc.

EV is more comprehensive than market capitalization (market cap), which only includes common equity.

EQUATION:

Enterprise value =

common equity at market value (this line item is also known as “market cap”)

+ debt at market value (here debt refers to interest-bearing liabilities, both long-term and short-term)

+ minority interest at market value, if any[2]

+ preferred equity at market value

+ unfunded pension liabilities and other debt-deemed provisions

– cash and cash equivalents

– “extra assets”, assets not required to run the business

– investments in associated companies at market value, if any

Intuitive Understanding of Enterprise Value

- A simplified way to understand the EV concept is to envision purchasing an entire business. If you settle with all the security holders, you pay EV.

- Counter-intuitively, increases or decreases in enterprise value do not necessarily correspond to “value creation” or value destruction”. Any acquisition of assets (whether paid for in cash or through share issues) will increase EV, whether or not those assets are productive. Similarly, reductions in capital intensity (for example by reducing working capital) will reduce EV.

- EV can be negative if the company, for example, holds abnormally high amounts of cash.

- Because EV is a capital structure-neutral metric, it is useful when comparing companies with diverse capital structures. Price/earnings ratios, for example, will be significantly more volatile in companies that are highly leveraged.

- Stock market investors use EV/EBITDA to compare returns between equivalent companies on a risk-adjusted basis.

They can then superimpose their own choice of debt levels.

In practice, equity investors may have difficulty accurately assessing EV if they do not have access to the market quotations of the company debt. It is not sufficient to substitute the book value of the debt because a) the market interest rates may have changed, and b) the market's perception of the risk of the loan may have changed since the debt was issued.

Remember, the point of EV is to neutralize the different risks, and costs of different capital structures.

Buyers of controlling interests in a business use EV to compare returns between businesses, as above. They also use the EV valuation (or a debt free cash free valuation) to determine how much to pay for the whole entity (not just the equity). They may want to change the capital structure once in control.

PEG RATIO:

Definition of ‘Price/Earnings To Growth – PEG Ratio'

A stock's price-to-earnings ratio divided by the growth rate of its earnings for a specified time period.

The price/earnings to growth (PEG) ratio is used to determine a stock's value while taking the company's earnings growth into account, and is considered to provide a more complete picture than the P/E ratio.

While a high P/E ratio may make a stock look like a good buy, factoring in the company's growth rate to get the stock's PEG ratio can tell a different story. The lower the PEG ratio, the more the stock may be undervalued given its earnings performance. The calculation is as follows:

P/E ratio ÷ Annual EPS Growth

‘Payout Ratio'

The amount of earnings paid out in dividends to shareholders. Investors can use the payout ratio to determine what companies are doing with their earnings.

Calculated as:

PAYOUT RATIO = (Dividends per Share)/ (Earnings per Share)

‘Current Ratio'

A liquidity ratio that measures a company's ability to pay short-term obligations.

Current Ratio = (Current Assets) / (Current Liabilities)

[Also known as the “liquidity ratio“, “cash asset ratio” and “cash ratio”.]

‘Return On Assets”

An indicator of how profitable a company is relative to its total assets. ROA gives an idea as to how efficient management is at using its assets to generate earnings. Calculated by dividing a company's annual earnings by its total assets, ROA is displayed as a percentage. Sometimes this is referred to as “return on investment”.

The formula for return on assets is:

ROA = NET INCOME / TOTAL ASSETS

[Note: Some investors add interest expense back into net income when performing this calculation because they'd like to use operating returns before the cost of borrowing.]

‘Return On Equity”

The amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation's profitability by revealing how much profit a company generates with the money shareholders have invested.

ROE is expressed as a percentage and calculated as:

ROE = NET INCOME / SHAREHOLDER’S EQUITY

Net income is for the full fiscal year (before dividends paid to common stock holders but after dividends to preferred stock.) Shareholder's equity does not include preferred shares.

[1] Graph created through YahooFinance.com.

[2] Data compiled into worksheet by Thomas R. Petty, C.F.P.

[3] This is sometimes referred to as “the Inkblot Test”. It is a method of psychological evaluation. Psychologists use this test in an attempt to examine the personality characteristics and emotional functioning of an individual.

[4] And the uncle insists that, in order to receive any money, you: 1) have to buy one of these stocks; 2) you cannot split the money between or among the choices given!

[5] Even if “the lights” don’t turn on for you regarding what this quasi-Rorschach Test reveals about your thought processes (and preferences) … your memory of today’s “Quiz” may eventually prove helpful to you!

[6] Examples: airlines, energy, semi-conductors, etc.

[7] “BP” represents British Petroleum plc

[8] According to http://en.wikipedia.org/wiki/List_of_companies_by_revenue. Second largest market capitalization.

[9] For example, many folks have such negative feelings about Microsoft (MSFT), British Petroleum (BP), etc. that an investment in the related stock might be unthinkable.

[10] Less risky because the short strike is below both the 5-Week and 20-Week moving averages.

[11] You are urged in particular to read the detail in the EBITDA definition.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Is IonQ Stock a Buy?

Is IonQ Stock a Buy?